- Home

- »

- Biotechnology

- »

-

Circulating Tumor Cells Market Size & Share Report, 2030GVR Report cover

![Circulating Tumor Cells Market Size, Share & Trends Report]()

Circulating Tumor Cells Market Size, Share & Trends Analysis Report By Application (Clinical/Liquid Biopsy, Research), By Specimen (Bone Marrow, Blood), By Product, By Technology, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-287-7

- Number of Pages: 120

- Format: Electronic (PDF)

- Historical Range: 2018 - 2023

- Industry: Healthcare

Circulating Tumor Cells Market Size & Trends

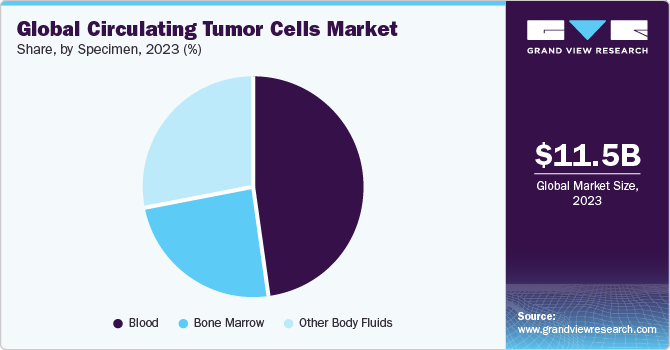

The global circulating tumor cells market size was estimated at USD 11.47 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 13.62% from 2024 to 2030. Owing to the non-invasiveness and advantages offered by circulating tumor cells (CTC), it is considered a promising tool in cancer diagnosis. This is anticipated to contribute to the market’s growth. Technological advancements in chip technology is another key factor driving the growth.

The ongoing advancements in chip technology have positively impacted market growth. Cluster chip technology plays a key role in capturing the exceptionally rare group of cells, such as CTCs. Isolation of CTCs is a cumbersome process and requires high accuracy. The chip technology not only helps perform precise CTC isolation but also helps overcome the challenges associated with isolation devices developed by key companies. The challenges include lower sensitivity, the inability to capture CTCs of all sizes & types, high manufacturing costs, and difficulty in retrieving captured CTCs from the devices for further laboratory analysis. Moreover, the white blood cells that contaminate trapped CTCs, which are similar in size, can be mistakenly regarded as CTCs; this is a limitation associated with these devices.

Increasing global prevalence of cancer is one of the major drivers for growth of the CTC market. In 2023, the Pan American Health Organization reported around 20 million newly diagnosed cancer cases and 10 million cancer-related deaths. Projections indicate a probable 60% surge in cancer burden over the next two decades, posing additional challenges to healthcare systems, individuals, and communities. It is anticipated that the global incidence of new cancer cases expected rise to approximately 30 million by the year 2040.

In addition, circulating tumor cells in breast cancer diagnosis are released in the bloodstream by cancerous tumors. As per the Breast Cancer Statistics and Resources, it is anticipated that in 2023, around 297,790 women might be diagnosed of breast cancer in the U.S., solidifying its status as the most prevalent cancer among American women. The rising burden of cancer also attracts increased investment in research and development for new cancer therapies & technologies. CTCs that actively participate in clinical trials and adopt innovative treatment options can attract patients seeking access to cutting-edge care, further boosting their market position.

Since the last several decades, extensive translational and clinical cancer research programs in the field of CTCs are being conducted. The ongoing research on circulating tumor cells technology by several government bodies, such as the American Association of Cancer Research and the American Society of Clinical Oncology, to utilize it as a surrogate marker for the determination of cancer progression is expected to aid the growth of the market.

Furthermore, rising adoption of biomarker tests enables minimally invasive screening of tumors before opting for complex surgical procedures, such as radiotherapy, chemotherapy, and surgical removal of tumors. Therefore, the high demand for noninvasive procedures due to their simpler nature is anticipated to have a considerable impact on the CTC market over the forecast period.

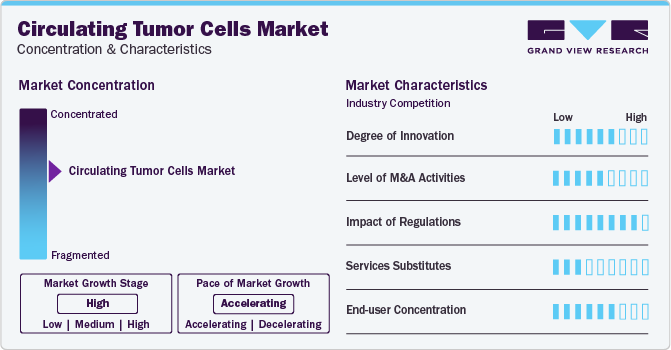

Market Concentration & Characteristics

The circulating tumor cells market has seen significant innovation in recent years. Some of the recent innovations include the development of microfluidic chips for CTC capture, the use of imaging techniques for circulating tumor cells detection, and the implementation of machine learning algorithms for CTC analysis. These advances have the potential to revolutionize cancer care by providing more accurate and reliable information about a patient's disease status.

The CTC market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. M&A drives companies to focus on specific applications of CTC technology, such as early cancer detection, treatment monitoring, or personalized medicine. This could lead to the development of more targeted and effective circulating tumor cells tests and therapies.

Regulation can have a significant impact on the CTC market. Regulatory bodies such as the FDA play a crucial role in determining the safety and efficacy of CTC products and services. Stringent regulations can lead to delays in the approval of new CTC products, which can slow down innovation and limit the options available to patients and healthcare providers.

In this market, substitute services refer to alternative products or solutions that can replace or supplement the use of CTC technologies. Some examples of substitute services in the CTC market include traditional diagnostic methods such as biopsies, blood tests, and imaging technologies. While CTC technologies offer many benefits, including noninvasive testing and early detection of cancer, substitute services still be necessary in certain situations.

End-user concentration in the CTC market is relatively high, with the majority of tests being performed in hospitals, diagnostic laboratories, and research institutions. However, there is also a growing trend towards point-of-care testing, which allows for faster and more convenient testing in a variety of settings, including clinics and physician offices.

Technology Insights

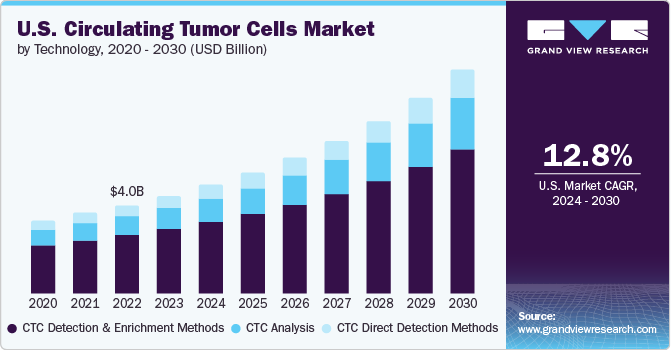

In 2023, the CTC detection and enrichment methods segment accounted for the largest revenue share of 66.21%. The availability of different methods for the enrichment of circulating tumor cells in cancer detection is expected to significantly impact segment growth over the forecast period. Moreover, positive or negative enrichment of CTCs based on biological properties is expected to hold significant potential for market growth. An effective enrichment process helps in the enhancement of sensitivity, selectivity, and yield, thereby ensuring successful clinical translation of this field. Different techniques for CTC detection include magnetic beads-based centrifugal force, enrichment, filtration, and other physical properties such as density, deformity, size, & electric charges.

The CTC analysis segment is expected to register the fastest CAGR from 2024 to 2030. Understanding subclonal intratumor heterogeneity using CTC detection can help clinicians in determining the underlying reasons for unresponsive patients subjected to targeted therapy, eventually leading to enhanced cancer therapies. Hence, CTC analysis is a minimally invasive method in repetitive analysis and validated technology for tumor study & clinical decision making. Technological advancements such as immunofluorescence, Next-Generation Sequencing (NGS), Fluorescence In Situ Hybridization (FISH), and quantitative PCR (qPCR) are anticipated to improve CTC analyses. Hence, due to the presence of fundamental principle of amplification in qPCR, the detection of CTCs in a large blood sample becomes efficient and accurate.

Application Insights

The research segment dominated the market and captured the largest revenue share in 2023. CTCs are regarded as a substrate of cancer metastasis. Currently, the enumeration of CTCs represents an effective predictive and prognostic biomarker capable of monitoring the efficacy of adjuvant therapies, identifying early development of metastases, and evaluating therapeutic responses better than conventional imaging methods. In addition, CTC enumeration remains largely a research tool.

Recently, the focus has shifted toward CTC characterization and isolation, which can provide significant opportunities in predictive testing research. For instance, in April 2021, Bio-Techne Corporation acquired Asuragen, Inc. for USD 215 million. Asuragen’s expertise in productizing lab-developed tests and commercializing innovative molecular products allowed Bio-Techne to offer advanced solutions to researchers and clinicians.

Clinical/ liquid biopsy is expected to register a significant CAGR from 2024 to 2030. In a liquid biopsy, the analysis CTCs in a cancer patient’s bloodstream has received significant attention for their potential clinical utility. The number of CTCs in a patient’s blood can differ based on cancer type, stage, and treatment. The number of CTCs found in the patient’s bloodstream indicates the state of the disease. Patients in the later stages of cancer show a higher number of CTCs than patients in early stages of cancer.

Product Insights

The kits & reagents segment dominated the market and accounted for the largest revenue share of 2023. This can be attributed to frequent purchases and high usage rates. For instance, CellSearch Circulating Tumour Cell Kit authorized by the U.S. FDA, is one the most popular products produced in the U.S. Additionally, the availability of a robust product portfolio coupled with advancements in microfluidics technology is expected to propel the market growth.

The devices or systems segment is expected to showcase significant CAGR during the forecast period. The introduction of fabricated glass microchips to overcome the challenges and to increase technical completeness for mass production is expected to propel the segment growth. The development of automated instruments that eliminate the use of additional blood collection tubes reduces the cost of blood collection tubes.

The reduction in costs is also observed as the transportation is free of the additional laboratory consumables and transfer tubes when the reagent-equipped tubes are used. On the other hand, kits and reagents have also contributed significantly to the segment’s revenue.

End-use Insights

The research and academic institutes segment accounted for the largest revenue share of 2023. This can be attributed to the increasing focus on research and development activities for cancer diagnosis and treatment. These institutes are investing heavily in advanced technologies and equipment to enhance the accuracy and efficiency of circulating tumor cell detection and analysis.

The diagnostic centers segment is expected to register a significant CAGR from 2024 to 2030. This is due to their advanced technology and expertise in detecting and analyzing CTCs. They have access to advanced equipment and trained professionals who can perform accurate and reliable tests. Additionally, diagnostic centers have partnerships with hospitals and healthcare providers, which gives them a larger customer base and more opportunities to expand their services. These factors have contributed to their success in the CTC market.

Specimen Insights

The blood specimen segment dominated the market and accounted for the largest revenue share in 2023. A large concentration of these cells in blood samples as compared with other biospecimens is responsible for the largest penetration of this specimen type. Approaches for tumor cell identification in blood samples are considered important in current cancer research, as it aids in the prediction of prognosis and determination of the response to systemic chemotherapy. However, the use of whole blood as a specimen poses a challenge when combined with microfluidic technology.

The bone marrow segment is expected to register a significant CAGR during the forecast period. Bone marrow samples, when analyzed for CTCs, play a vital role in cancer research and clinical trials. Researchers use these samples to study the biology of circulating tumor cells, understand the mechanisms of metastasis, and develop novel therapeutic approaches. These factors are expected to support segment growth in the forecast years.

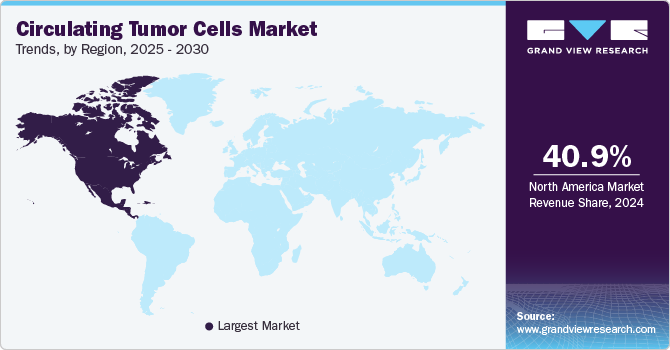

Regional Insights

North America captured the largest revenue share of 42.33% in 2023. Aviva Biosciences; Apocell, Inc.; Advanced Cell Diagnostics; Biocept, Inc.; Biofluidica, Inc.; and CellTraffix, Inc. are the key players operating in the region. These players are undertaking various strategies to enhance their market hold, which is a key factor responsible for the high share of the U.S. market for circulating tumor cells.

The U.S. is anticipated to significantly contribute to the regional market's growth due to factors including the rising incidence of cancer, product approvals, and increased R&D efforts. For instance, the American Cancer Society projects that there approximately 127,070 lung cancer fatalities nationwide and about 238,340 new instances of lung cancer diagnosis in 2023. Furthermore, the presence of a population with high susceptibility to cancer, an increase in market penetration rates, and technologically advanced cancer care infrastructure are supporting the region’s growth.

Asia Pacific is projected to grow at a lucrative CAGR during the forecast period, due to high unmet diagnostic needs coupled with rapidly growing awareness with regard to early detection of cancer and risk assessment. China is a major country that drives the regional market growth. The economy of China developed its infrastructure with academic and research institutes that provide knowledge and create interest in the emerging fields of diagnostics, biotechnology, & genetics. It also created facilities to support their development by adopting the latest technologies. The competitive nature of the government, leading to high investments in emerging fields of research, is anticipated to boost revenue generation over the forecast period.

Key Circulating Tumor Cells Company Insights

Partnerships, acquisitions, and expansions are some of the most adopted strategies by the key players. Companies such as Bio-Techne have acquired smaller companies with advanced technologies to expand their market reach globally.

Key Circulating Tumor Cells Companies:

The following are the leading companies in the circulating tumor cells market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these CTC companies are analyzed to map the supply network.

- QIAGEN

- Bio-Techne Corporation

- Precision for Medicine

- AVIVA Biosciences

- BIOCEPT, Inc.

- BioCEP Ltd.

- Fluxion Biosciences, Inc.

- Greiner Bio-One International GmbH

- Ikonisys, Inc.

- Miltenyi Biotec

- IVDiagnostics, Inc.

- BioFluidica

- Canopus Bioscience Ltd.

- Biolidics Limited

- Creativ MicroTech, Inc.

- LungLife AI, Inc.

- Epic Sciences

- Rarecells Diagnostics

- ScreenCell

- Menarini Silicon Biosystems

- LineaRx, Inc. (Vitatex, Inc.)

- Sysmex Corporation

- STEMCELL Technologies, Inc.

Recent Developments

-

In August 2023, Cell Microsystems acquired Fluxion Biosciences, Inc. This acquisition enabled precise measurement of electrical currents across cell membranes, providing insights into ion channel activity and cell signaling.

-

In June 2023, Bio-Techne announced the acquisition of LunaPhore, a Swiss company developing advanced technologies for tissue imaging and analysis. By integrating LunaPhore's expertise into its existing portfolio, Bio-Techne aimed to create a comprehensive, end-to-end workflow for researchers studying tissues. The acquisition is expected to close in the first quarter of 2024.

-

In May 2023, Menarini Silicon Biosystems partnered with Alivio Health to provide access to its CELLSEARCH liquid biopsy tests for Alivio Health's clients and members. CELLSEARCH tests provide noninvasive analysis of CTCs to help in clinical decision-making, potentially leading to earlier diagnosis and more effective treatment strategies.

-

In March 2023, Miltenyi Biotec acquired Lino Biotech AG. This acquisition of Lino Biotech's innovative biosensor technology was expected to help in the development of new & improved assays and quality control processes in the field.

Circulating Tumor Cells Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.81 billion

Revenue forecast in 2030

USD 27.55 billion

Growth rate

CAGR of 13.62% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, product, specimen, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; Kuwait; UAE; South Africa

Key companies profiled

QIAGEN; Bio-Techne Corp.; Precision for Medicine; AVIVA Biosciences; BIOCEPT, Inc.; BioCEP Ltd.; Fluxion Biosciences, Inc.; Greiner Bio-One International GmbH; Ikonisys, Inc.; Miltenyi Biotec; IVDiagnostics; BioFluidica; Canopus Bioscience Ltd.; Biolidics Limited; Creativ MicroTech, Inc.; LungLife AI, Inc.; Epic Sciences; Rarecells Diagnostics; ScreenCell; Menarini Silicon Biosystems; LineaRx, Inc. (Vitatex, Inc.); Sysmex Corporation; STEMCELL Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Circulating Tumor Cells Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global circulating tumor cells market report based on technology, application, product, specimen, end-use, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

CTC Detection & Enrichment Methods

-

Immunocapture (Label-based)

-

Positive Selection

-

Negative Selection

-

-

Size-based Separation (Label-free)

-

Membrane-based

-

Microfluidic-based

-

-

Density-based Separation (Label-free)

-

Combined Methods

-

-

CTC Direct Detection Methods

-

SERS

-

Microscopy

-

Others

-

-

CTC Analysis

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical/ Liquid Biopsy

-

Risk Assessment

-

Screening and Monitoring

-

-

Research

-

Cancer Stem Cell & Tumorogenesis Research

-

Drug/Therapy Development

-

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Kits & Reagents

-

Blood Collection Tubes

-

Devices or Systems

-

-

Specimen Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blood

-

Bone Marrow

-

Other Body Fluids

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Research and Academic Institutes

-

Hospital and Clinics

-

Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global circulating tumor cells market size was estimated at USD 11.47 billion in 2023 and is expected to reach USD 27.55 billion in 2023.

b. The global circulating tumor cells market is expected to grow at a compound annual growth rate of 13.62% from 2024 to 2030 to reach USD 27.55 billion by 2030.

b. CTC detection & enrichment methods dominated the CTC market with a share of 66.21% in 2023. This is attributable to the availability of different methods for the enrichment of circulating tumor cells in cancer detection.

b. Some key players operating in the CTCs market include QIAGEN, Bio-Techne Corporation, BIOCEPT, Inc., Greiner Bio One International GmbH, Miltenyi Biotec, Biolidics Limited, Creatv MicroTech, Inc. and among others.

b. Key factors that are driving the circulating tumor cells market growth include rising cancer prevalence, increasing preference for non-invasive cancer diagnosis, and technological advancements in CTC isolation and analysis.

Table of Contents

Chapter 1. Circulating Tumor Cells Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Segment Definitions

1.2.1. Technology

1.2.2. Application

1.2.3. Product

1.2.4. Specimen

1.2.5. End-use

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased database

1.4.2. GVR’s internal database

1.4.3. Secondary sources

1.4.4. Primary research

1.4.5. Details of primary research

1.5. Information or Data Analysis

1.5.1. Data analysis models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity flow analysis (Model 1)

1.7.2. Approach 1: Commodity flow approach

1.7.3. Volume price analysis (Model 2)

1.7.4. Approach 2: Volume price analysis

1.8. List of Secondary Sources

1.9. List of Primary Sources

1.10. Objectives

Chapter 2. Circulating Tumor Cells Market: Executive Summary

2.1. Market Outlook

2.2. Segment Snapshot

2.3. Competitive Insights

Chapter 3. Circulating Tumor Cells Market: Variables, Trends & Scope

3.1. Market Lineage Outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Advancements in chip technology

3.2.1.2. Expanding applications of CTCs

3.2.1.3. Growing demand for early and rapid cancer diagnosis

3.2.1.4. Growing incidence of cancer

3.2.2. Market restraint analysis

3.2.2.1. Consistency-related challenges in CTC detection and enrichment

3.2.2.2. Higher preference for Point-of-Care (POC) testing and nonavailability of POC adaptable CTC tests

3.2.2.3. Lower applicability of CTCs in rare cancers

3.3. Circulating Tumor Cells Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

Chapter 4. Circulating Tumor Cells Market: Technology Estimates & Trend Analysis

4.1. Technology Market Share, 2023 & 2030

4.2. Global Circulating Tumor Cells Market by Technology Outlook

4.3. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.3.1. CTC Detection & Enrichment Methods

4.3.1.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.1.2. Immunocapture (Label-based)

4.3.1.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.1.2.2. Positive Selection

4.3.1.2.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.1.2.3. Negative Selection

4.3.1.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.1.3. Size-based Separation (Label-free)

4.3.1.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.1.3.2. Membrane-based

4.3.1.3.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.1.3.3. Microfluidic-based

4.3.1.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.1.4. Density-based Separation (Label-free)

4.3.1.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.1.5. Combined Methods

4.3.1.5.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2. CTC Direct Detection Methods

4.3.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.2. SERS

4.3.2.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.3. Microscopy

4.3.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.4. Others

4.3.2.4.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.3. CTC Analysis

4.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5. Circulating Tumor Cells Market: Application Estimates & Trend Analysis

5.1. Application Market Share, 2023 & 2030

5.2. Global Circulating Tumor Cells Market by Application Outlook

5.3. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.3.1. Clinical/ Liquid Biopsy

5.3.1.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.3.1.2. Risk Assessment

5.3.1.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.3.1.3. Screening and Monitoring

5.3.1.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.3.2. Research

5.3.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.3.2.2. Cancer Stem Cell & Tumorogenesis Research

5.3.2.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

5.3.2.3. Drug/Therapy Development

5.3.2.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 6. Circulating Tumor Cells Market: Product Estimates & Trend Analysis

6.1. Product Market Share, 2023 & 2030

6.2. Global Circulating Tumor Cells Market by Product Outlook

6.3. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

6.3.1. Kits & reagents

6.3.1.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.3.2. Blood collection tubes

6.3.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

6.3.3. Devices or systems

6.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 7. Circulating Tumor Cells Market: Specimen Estimates & Trend Analysis

7.1. Specimen Market Share, 2023 & 2030

7.2. Global Circulating Tumor Cells Market by Specimen Outlook

7.3. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

7.3.1. Blood

7.3.1.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.3.2. Bone marrow

7.3.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

7.3.3. Other body fluids

7.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 8. Circulating Tumor Cells Market: End-use Estimates & Trend Analysis

8.1. End-use Market Share, 2023 & 2030

8.2. Global Circulating Tumor Cells Market by End-use Outlook

8.3. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

8.3.1. Research and academic institutes

8.3.1.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.2. Hospital and clinics

8.3.2.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

8.3.3. Diagnostic centers

8.3.3.1. Market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 9. Circulating Tumor Cells Market: Regional Estimates & Trend Analysis

9.1. Regional Market Share Analysis, 2023 & 2030

9.2. North America

9.2.1. North America market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.2. U.S.

9.2.2.1. Key country dynamics

9.2.2.2. Regulatory framework

9.2.2.3. Competitive scenario

9.2.2.4. U.S. market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.2.5. Target disease prevalence

9.2.3. Canada

9.2.3.1. Key country dynamics

9.2.3.2. Regulatory framework

9.2.3.3. Competitive scenario

9.2.3.4. Canada market estimates and forecasts, 2018 - 2030 (USD Million)

9.2.3.5. Target disease prevalence

9.3. Europe

9.3.1. Europe market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.2. UK

9.3.2.1. Key country dynamics

9.3.2.2. Regulatory framework

9.3.2.3. Competitive scenario

9.3.2.4. UK market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.2.5. Target disease prevalence

9.3.3. Germany

9.3.3.1. Key country dynamics

9.3.3.2. Regulatory framework

9.3.3.3. Competitive scenario

9.3.3.4. Germany market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.3.5. Target disease prevalence

9.3.4. France

9.3.4.1. Key country dynamics

9.3.4.2. Regulatory framework

9.3.4.3. Competitive scenario

9.3.4.4. France market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.4.5. Target disease prevalence

9.3.5. Italy

9.3.5.1. Key country dynamics

9.3.5.2. Regulatory framework

9.3.5.3. Competitive scenario

9.3.5.4. Italy market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.5.5. Target disease prevalence

9.3.6. Spain

9.3.6.1. Key country dynamics

9.3.6.2. Regulatory framework

9.3.6.3. Competitive scenario

9.3.6.4. Spain market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.6.5. Target disease prevalence

9.3.7. Norway

9.3.7.1. Key country dynamics

9.3.7.2. Regulatory framework

9.3.7.3. Competitive scenario

9.3.7.4. Norway market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.7.5. Target disease prevalence

9.3.8. Sweden

9.3.8.1. Key country dynamics

9.3.8.2. Regulatory framework

9.3.8.3. Competitive scenario

9.3.8.4. Sweden market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.8.5. Target disease prevalence

9.3.9. Denmark

9.3.9.1. Key country dynamics

9.3.9.2. Regulatory framework

9.3.9.3. Competitive scenario

9.3.9.4. Denmark market estimates and forecasts, 2018 - 2030 (USD Million)

9.3.9.5. Target disease prevalence

9.4. Asia Pacific

9.4.1. Asia Pacific market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.2. Japan

9.4.2.1. Key country dynamics

9.4.2.2. Regulatory framework

9.4.2.3. Competitive scenario

9.4.2.4. Japan market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.2.5. Target disease prevalence

9.4.3. China

9.4.3.1. Key country dynamics

9.4.3.2. Regulatory framework

9.4.3.3. Competitive scenario

9.4.3.4. China market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.3.5. Target disease prevalence

9.4.4. India

9.4.4.1. Key country dynamics

9.4.4.2. Regulatory framework

9.4.4.3. Competitive scenario

9.4.4.4. India market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.4.5. Target disease prevalence

9.4.5. Australia

9.4.5.1. Key country dynamics

9.4.5.2. Regulatory framework

9.4.5.3. Competitive scenario

9.4.5.4. Australia market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.5.5. Target disease prevalence

9.4.6. South Korea

9.4.6.1. Key country dynamics

9.4.6.2. Regulatory framework

9.4.6.3. Competitive scenario

9.4.6.4. South Korea market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.6.5. Target disease prevalence

9.4.7. Thailand

9.4.7.1. Key country dynamics

9.4.7.2. Regulatory framework

9.4.7.3. Competitive scenario

9.4.7.4. Thailand market estimates and forecasts, 2018 - 2030 (USD Million)

9.4.7.5. Target disease prevalence

9.5. Latin America

9.5.1. Latin America market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.2. Brazil

9.5.2.1. Key country dynamics

9.5.2.2. Regulatory framework

9.5.2.3. Competitive scenario

9.5.2.4. Brazil market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.2.5. Target disease prevalence

9.5.3. Mexico

9.5.3.1. Key country dynamics

9.5.3.2. Regulatory framework

9.5.3.3. Competitive scenario

9.5.3.4. Mexico market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.3.5. Target disease prevalence

9.5.4. Argentina

9.5.4.1. Key country dynamics

9.5.4.2. Regulatory framework

9.5.4.3. Competitive scenario

9.5.4.4. Argentina market estimates and forecasts, 2018 - 2030 (USD Million)

9.5.4.5. Target disease prevalence

9.6. MEA

9.6.1. MEA market estimates and forecasts, 2018 - 2030 (USD Million)

9.6.2. South Africa

9.6.2.1. Key country dynamics

9.6.2.2. Regulatory framework

9.6.2.3. Competitive scenario

9.6.2.4. South Africa market estimates and forecasts, 2018 - 2030 (USD Million)

9.6.2.5. Target disease prevalence

9.6.3. Saudi Arabia

9.6.3.1. Key country dynamics

9.6.3.2. Regulatory framework

9.6.3.3. Competitive scenario

9.6.3.4. Saudi Arabia market estimates and forecasts, 2018 - 2030 (USD Million)

9.6.3.5. Target disease prevalence

9.6.4. UAE

9.6.4.1. Key country dynamics

9.6.4.2. Regulatory framework

9.6.4.3. Competitive scenario

9.6.4.4. UAE market estimates and forecasts, 2018 - 2030 (USD Million)

9.6.4.5. Target disease prevalence

9.6.5. Kuwait

9.6.5.1. Key country dynamics

9.6.5.2. Regulatory framework

9.6.5.3. Competitive scenario

9.6.5.4. Kuwait market estimates and forecasts, 2018 - 2030 (USD Million)

9.6.5.5. Target disease prevalence

Chapter 10. Competitive Landscape

10.1. Recent Developments & Impact Analysis, By Key Market Participants

10.2. Company/Competition Categorization

10.3. Vendor Landscape

10.3.1. List of key distributors and channel partners

10.3.2. Key customers

10.3.3. Key company position analysis, 2023

10.4. Company Profiles

10.4.1. QIAGEN

10.4.1.1. Company overview

10.4.1.2. Financial performance

10.4.1.3. Product benchmarking

10.4.1.4. Strategic initiatives

10.4.2. Bio-Techne Corp.

10.4.2.1. Company overview

10.4.2.2. Financial performance

10.4.2.3. Product benchmarking

10.4.2.4. Strategic initiatives

10.4.3. Precision for Medicine

10.4.3.1. Company overview

10.4.3.2. Financial performance

10.4.3.3. Product benchmarking

10.4.3.4. Strategic initiatives

10.4.4. AVIVA Biosciences

10.4.4.1. Company overview

10.4.4.2. Financial performance

10.4.4.3. Product benchmarking

10.4.4.4. Strategic initiatives

10.4.5. BIOCEPT, Inc.

10.4.5.1. Company overview

10.4.5.2. Financial performance

10.4.5.3. Product benchmarking

10.4.5.4. Strategic initiatives

10.4.6. BioCEP Ltd.

10.4.6.1. Company overview

10.4.6.2. Financial performance

10.4.6.3. Product benchmarking

10.4.6.4. Strategic initiatives

10.4.7. Fluxion Biosciences, Inc.

10.4.7.1. Company overview

10.4.7.2. Financial performance

10.4.7.3. Product benchmarking

10.4.7.4. Strategic initiatives

10.4.8. Greiner Bio-One International GmbH

10.4.8.1. Company overview

10.4.8.2. Financial performance

10.4.8.3. Product benchmarking

10.4.8.4. Strategic initiatives

10.4.9. Ikonisys, Inc.

10.4.9.1. Company overview

10.4.9.2. Financial performance

10.4.9.3. Product benchmarking

10.4.9.4. Strategic initiatives

10.4.10. Miltenyi Biotec

10.4.10.1. Company overview

10.4.10.2. Financial performance

10.4.10.3. Product benchmarking

10.4.10.4. Strategic initiatives

10.4.11. IVDiagnostics

10.4.11.1. Company overview

10.4.11.2. Financial performance

10.4.11.3. Product benchmarking

10.4.11.4. Strategic initiatives

10.4.12. BioFluidica

10.4.12.1. Company overview

10.4.12.2. Financial performance

10.4.12.3. Product benchmarking

10.4.12.4. Strategic initiatives

10.4.13. Canopus Bioscience Ltd.

10.4.13.1. Company overview

10.4.13.2. Financial performance

10.4.13.3. Product benchmarking

10.4.13.4. Strategic initiatives

10.4.14. Biolidics Limited

10.4.14.1. Company overview

10.4.14.2. Financial performance

10.4.14.3. Product benchmarking

10.4.14.4. Strategic initiatives

10.4.15. Creativ MicroTech , Inc.

10.4.15.1. Company overview

10.4.15.2. Financial performance

10.4.15.3. Product benchmarking

10.4.15.4. Strategic initiatives

10.4.16. LungLife AI

10.4.16.1. Company overview

10.4.16.2. Financial performance

10.4.16.3. Product benchmarking

10.4.16.4. Strategic initiatives

10.4.17. Epic Sciences

10.4.17.1. Company overview

10.4.17.2. Financial performance

10.4.17.3. Product benchmarking

10.4.17.4. Strategic initiatives

10.4.18. Rarecells Diagnostics

10.4.18.1. Company overview

10.4.18.2. Financial performance

10.4.18.3. Product benchmarking

10.4.18.4. Strategic initiatives

10.4.19. ScreenCell

10.4.19.1. Company overview

10.4.19.2. Financial performance

10.4.19.3. Product benchmarking

10.4.19.4. Strategic initiatives

10.4.20. Menarini Silicon Biosystems

10.4.20.1. Company overview

10.4.20.2. Financial performance

10.4.20.3. Product benchmarking

10.4.20.4. Strategic initiatives

10.4.21. LineaRx, Inc. (Vitatex, Inc.)

10.4.21.1. Company overview

10.4.21.2. Financial performance

10.4.21.3. Product benchmarking

10.4.21.4. Strategic initiatives

10.4.22. Sysmex Corporation

10.4.22.1. Company overview

10.4.22.2. Financial performance

10.4.22.3. Product benchmarking

10.4.22.4. Strategic initiatives

10.4.23. STEMCELL Technologies, Inc.

10.4.23.1. Company overview

10.4.23.2. Financial performance

10.4.23.3. Product benchmarking

10.4.23.4. Strategic initiatives

List of Tables

Table 1 List of abbreviation

Table 2 North America circulating tumor cells market, by region, 2018 - 2030 (USD Million)

Table 3 North America circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 4 North America circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 5 North America circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 6 North America circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 7 North America circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 8 U.S. circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 9 U.S. circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 10 U.S. circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 11 U.S. circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 12 U.S. circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 13 Canada circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 14 Canada circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 15 Canada circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 16 Canada circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 17 Canada circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 18 Europe circulating tumor cells market, by region, 2018 - 2030 (USD Million)

Table 19 Europe circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 20 Europe circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 21 Europe circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 22 Europe circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 23 Europe circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 24 UK circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 25 UK circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 26 UK circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 27 UK circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 28 UK circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 29 Germany circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 30 Germany circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 31 Germany circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 32 Germany circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 33 Germany circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 34 Italy circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 35 Italy circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 36 Italy circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 37 Italy circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 38 Italy circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 39 France circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 40 France circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 41 France circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 42 France circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 43 France circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 44 Spain circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 45 Spain circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 46 Spain circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 47 Spain circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 48 Spain circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 49 Sweden circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 50 Sweden circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 51 Sweden circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 52 Sweden circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 53 Sweden circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 54 Denmark circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 55 Denmark circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 56 Denmark circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 57 Denmark circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 58 Denmark circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 59 Norway circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 60 Norway circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 61 Norway circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 62 Norway circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 63 Norway circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 64 Asia Pacific circulating tumor cells market, by region, 2018 - 2030 (USD Million)

Table 65 Asia Pacific circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 66 Asia Pacific circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 67 Asia Pacific circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 68 Asia Pacific circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 69 Asia Pacific circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 70 China circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 71 China circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 72 China circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 73 China circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 74 China circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 75 Japan circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 76 Japan circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 77 Japan circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 78 Japan circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 79 Japan circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 80 India circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 81 India circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 82 India circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 83 India circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 84 India circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 85 South Korea circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 86 South Korea circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 87 South Korea circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 88 South Korea circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 89 South Korea circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 90 Australia circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 91 Australia circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 92 Australia circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 93 Australia circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 94 Australia circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 95 Thailand circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 96 Thailand circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 97 Thailand circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 98 Thailand circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 99 Thailand circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 100 Latin America circulating tumor cells market, by region, 2018 - 2030 (USD Million)

Table 101 Latin America circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 102 Latin America circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 103 Latin America circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 104 Latin America circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 105 Latin America circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 106 Brazil circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 107 Brazil circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 108 Brazill circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 109 Brazil circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 110 Brazil circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 111 Mexico circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 112 Mexico circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 113 Mexico circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 114 Mexico circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 115 Mexico circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 116 Argentina circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 117 Argentina circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 118 Argentina circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 119 Argentina circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 120 Argentina circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 121 Middle East & Africa circulating tumor cells market, by region, 2018 - 2030 (USD Million)

Table 122 Middle East & Africa circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 123 Middle East & Africa circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 124 Middle East & Africa circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 125 Middle East & Africa circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 126 Middle East & Africa circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 127 South Africa circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 128 South Africa circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 129 South Africa circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 130 South Africa circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 131 South Africa circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 132 Saudi Arabia circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 133 Saudi Arabia circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 134 Saudi Arabia circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 135 Saudi Arabia circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 136 Saudi Arabia circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 137 UAE circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 138 UAE circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 139 UAE circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 140 UAE circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 141 UAE circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

Table 142 Kuwait circulating tumor cells market, by technology, 2018 - 2030 (USD Million)

Table 143 Kuwait circulating tumor cells market, by application, 2018 - 2030 (USD Million)

Table 144 Kuwait circulating tumor cells market, by product, 2018 - 2030 (USD Million)

Table 145 Kuwait circulating tumor cells market, by specimen, 2018 - 2030 (USD Million)

Table 146 Kuwait circulating tumor cells market, by end-use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 QFD modeling for market share assessment

Fig. 7 Market formulation & validation

Fig. 8 Circulating tumor cells market: market outlook

Fig. 9 Circulating tumor cells competitive insights

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Penetration and growth prospect mapping

Fig. 13 Industry value chain analysis

Fig. 14 Circulating tumor cells market driver impact

Fig. 15 Circulating tumor cells market restraint impact

Fig. 16 Circulating tumor cells market strategic initiatives analysis

Fig. 17 Circulating tumor cells market: Technology movement analysis

Fig. 18 Circulating tumor cells market: Technology outlook and key takeaways

Fig. 19 CTC detection & enrichment methods market estimates and forecast, 2018 - 2030

Fig. 20 Immunocapture (label-based) estimates and forecast, 2018 - 2030

Fig. 21 Positive selection market estimates and forecast, 2018 - 2030

Fig. 22 Negative selection estimates and forecast, 2018 - 2030

Fig. 23 Size-based separation (label-free) market estimates and forecast, 2018 - 2030

Fig. 24 Membrane-based estimates and forecast, 2018 - 2030

Fig. 25 Microfluidic-based estimates and forecast, 2018 - 2030

Fig. 26 Density-based Separation (Label-free) estimates and forecast, 2018 - 2030

Fig. 27 Combined Methods estimates and forecast, 2018 - 2030

Fig. 28 CTC direct detection methods estimates and forecast, 2018 - 2030

Fig. 29 SERS estimates and forecast, 2018 - 2030

Fig. 30 Microscopy estimates and forecast, 2018 - 2030

Fig. 31 Others estimates and forecast, 2018 - 2030

Fig. 32 CTC Analysis estimates and forecast, 2018 - 2030

Fig. 33 Circulating tumor cells Market: Application movement Analysis

Fig. 34 Circulating tumor cells market: Application outlook and key takeaways

Fig. 35 Clinical/ Liquid Biopsy market estimates and forecasts, 2018 - 2030

Fig. 36 Risk Assessment market estimates and forecasts, 2018 - 2030

Fig. 37 Screening and Monitoring market estimates and forecasts, 2018 - 2030

Fig. 38 Research market estimates and forecasts, 2018 - 2030

Fig. 39 Cancer Stem Cell & Tumorogenesis Research market estimates and forecasts, 2018 - 2030

Fig. 40 Drug/Therapy Development market estimates and forecasts, 2018 - 2030

Fig. 41 Circulating tumor cells Market: Product movement Analysis

Fig. 42 Circulating tumor cells market: Product outlook and key takeaways

Fig. 43 Kits & reagents market estimates and forecasts, 2018 - 2030

Fig. 44 Blood collection tubes market estimates and forecasts, 2018 - 2030

Fig. 45 Devices or Systems market estimates and forecasts, 2018 - 2030

Fig. 46 Circulating tumor cells Market: Specimen movement Analysis

Fig. 47 Circulating tumor cells market: Specimen outlook and key takeaways

Fig. 48 Blood market estimates and forecasts, 2018 - 2030

Fig. 49 Bone marrow market estimates and forecasts, 2018 - 2030

Fig. 50 Other body fluids market estimates and forecasts, 2018 - 2030

Fig. 51 Circulating tumor cells Market: End-use movement Analysis

Fig. 52 Circulating tumor cells market: End-use outlook and key takeaways

Fig. 53 Research and academic institutes market estimates and forecasts, 2018 - 2030

Fig. 54 Hospital and clinics market estimates and forecasts, 2018 - 2030

Fig. 55 Diagnostic centers market estimates and forecasts, 2018 - 2030

Fig. 56 Global circulating tumor cells market: Regional movement analysis

Fig. 57 Global circulating tumor cells market: Regional outlook and key takeaways

Fig. 58 North America, by country

Fig. 59 North America

Fig. 60 North America market estimates and forecasts, 2018 - 2030

Fig. 61 U.S.

Fig. 62 U.S. market estimates and forecasts, 2018 - 2030

Fig. 63 Canada

Fig. 64 Canada market estimates and forecasts, 2018 - 2030

Fig. 65 Europe

Fig. 66 Europe market estimates and forecasts, 2018 - 2030

Fig. 67 UK

Fig. 68 UK market estimates and forecasts, 2018 - 2030

Fig. 69 Germany

Fig. 70 Germany market estimates and forecasts, 2018 - 2030

Fig. 71 France

Fig. 72 France market estimates and forecasts, 2018 - 2030

Fig. 73 Italy

Fig. 74 Italy market estimates and forecasts, 2018 - 2030

Fig. 75 Spain

Fig. 76 Spain market estimates and forecasts, 2018 - 2030

Fig. 77 Denmark

Fig. 78 Denmark market estimates and forecasts, 2018 - 2030

Fig. 79 Sweden

Fig. 80 Sweden market estimates and forecasts, 2018 - 2030

Fig. 81 Norway

Fig. 82 Norway market estimates and forecasts, 2018 - 2030

Fig. 83 Asia Pacific

Fig. 84 Asia Pacific market estimates and forecasts, 2018 - 2030

Fig. 85 China

Fig. 86 China market estimates and forecasts, 2018 - 2030

Fig. 87 Japan

Fig. 88 Japan market estimates and forecasts, 2018 - 2030

Fig. 89 India

Fig. 90 India market estimates and forecasts, 2018 - 2030

Fig. 91 Thailand

Fig. 92 Thailand market estimates and forecasts, 2018 - 2030

Fig. 93 South Korea

Fig. 94 South Korea market estimates and forecasts, 2018 - 2030

Fig. 95 Australia

Fig. 96 Australia market estimates and forecasts, 2018 - 2030

Fig. 97 Latin America

Fig. 98 Latin America market estimates and forecasts, 2018 - 2030

Fig. 99 Brazil

Fig. 100 Brazil market estimates and forecasts, 2018 - 2030

Fig. 101 Mexico

Fig. 102 Mexico market estimates and forecasts, 2018 - 2030

Fig. 103 Argentina

Fig. 104 Argentina market estimates and forecasts, 2018 - 2030

Fig. 105 Middle East and Africa

Fig. 106 Middle East and Africa market estimates and forecasts, 2018 - 2030

Fig. 107 South Africa

Fig. 108 South Africa market estimates and forecasts, 2018 - 2030

Fig. 109 Saudi Arabia

Fig. 110 Saudi Arabia market estimates and forecasts, 2018 - 2030

Fig. 111 UAE

Fig. 112 UAE market estimates and forecasts, 2018 - 2030

Fig. 113 Kuwait

Fig. 114 Kuwait market estimates and forecasts, 2018 - 2030

Fig. 115 Market position of key market players - Circulating tumor cells marketWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Circulating Tumor Cells Technology Outlook (Revenue in USD Million, 2018 - 2030)

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC Direct Detection Methods

- SERS

- Microscopy

- Others

- CTC Analysis

- CTC detection & enrichment methods

- Circulating Tumor Cells Application Outlook (Revenue in USD Million, 2018 - 2030)

- Clinical/ Liquid Biopsy

- Risk Assessment

- Screening and Monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ Liquid Biopsy

- Circulating Tumor Cells Product Outlook (Revenue in USD Million; 2018 - 2030)

- Kits & Reagents

- Blood Collection Tubes

- Devices or Systems

- Circulating Tumor Cells Specimen Outlook (Revenue in USD Million; 2018 - 2030)

- Blood

- Bone Marrow

- Other Body Fluids

- Circulating Tumor Cells End-use Outlook (Revenue in USD Million; 2018 - 2030)

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Circulating Tumor Cells Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- North America Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- North America Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- North America Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- North America Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- North America Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- U.S.

- U.S Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- U.S Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- U.S. Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- U.S Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- U.S Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- U.S Circulating Tumor Cells Market, by Technology

- Canada

- Canada Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Canada Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Canada Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Canada Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Canada Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Canada Circulating Tumor Cells Market, by Technology

- North America Circulating Tumor Cells Market, by Technology

- Europe

- Europe Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Europe Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Europe Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Europe Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Europe Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Germany

- Germany Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Germany Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Germany Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Germany Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Germany Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Germany Circulating Tumor Cells Market, by Technology

- UK

- UK Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- UK Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- UK Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- UK Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- UK Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- UK Circulating Tumor Cells Market, by Technology

- France

- France Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- France Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- France Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- France Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- France Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- France Circulating Tumor Cells Market, by Technology

- Italy

- Italy Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Italy Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Italy Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Italy Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Italy Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Italy Circulating Tumor Cells Market, by Technology

- Spain

- Spain Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Spain Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Spain Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Spain Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Spain Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Spain Circulating Tumor Cells Market, by Technology

- Sweden

- Sweden Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Sweden Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Sweden Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Sweden Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Sweden Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Sweden Circulating Tumor Cells Market, by Technology

- Denmark

- Denmark Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Denmark Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Denmark Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Denmark Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Denmark Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Denmark Circulating Tumor Cells Market, by Technology

- Norway

- Norway Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Norway Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Norway Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Norway Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Norway Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- Norway Circulating Tumor Cells Market, by Technology

- Europe Circulating Tumor Cells Market, by Technology

- Asia Pacific

- Asia Pacific Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- Asia Pacific Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment

- Screening and monitoring

- Research

- Cancer stem cell & tumorogenesis research

- Drug/therapy development

- Clinical/ liquid biopsy

- Asia Pacific Circulating Tumor Cells Market, by Product

- Kits & reagents

- Blood collection tubes

- Devices or systems

- Asia Pacific Circulating Tumor Cells Market, by Specimen

- Blood

- Bone marrow

- Other body fluids

- Asia Pacific Circulating Tumor Cells Market, by Specimen

- Research and academic institutes

- Hospital and clinics

- Diagnostic centers

- China

- China Circulating Tumor Cells Market, by Technology

- CTC detection & enrichment methods

- Immunocapture (label-based)

- Positive selection

- Negative selection

- Size-based separation (label-free)

- Membrane-based

- Microfluidic-based

- Density-based separation (label-free)

- Combined methods

- Immunocapture (label-based)

- CTC direct detection methods

- SERS

- Microscopy

- Other

- CTC analysis

- CTC detection & enrichment methods

- China Circulating Tumor Cells Market, by Application

- Clinical/ liquid biopsy

- Risk assessment