- Home

- »

- Petrochemicals

- »

-

Clear Brine Fluids Market Size, Industry Analysis Report, 2020 - 2025GVR Report cover

![Clear Brine Fluids Market Size, Share & Trends Report]()

Clear Brine Fluids Market (2020 - 2025) Size, Share & Trends Analysis Report By Product (Zinc Calcium Bromide, Cesium Formate, Potassium Chloride, Calcium Chloride, Sodium Bromide), And Segment Forecasts

- Report ID: 978-1-68038-308-9

- Number of Report Pages: 124

- Format: PDF

- Historical Range: 2014 - 2018

- Forecast Period: 2020 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Industry Insights

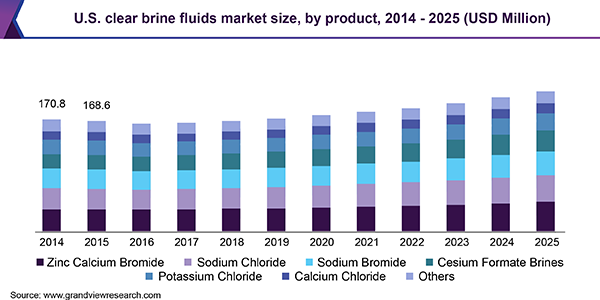

The global clear brine fluids market size was valued at USD 820 million in 2018. It is projected to expand at a CAGR of 3.3% during the forecast period. Demand for energy has been increasing year-on-year, which, in turn, is driving the need for oil and gas production as fossil fuels are the primary source of energy.

The gradual increase in crude oil prices in 2017 following their slump from 2014 to 2016 has led to moderate growth in drilling operations across different geographies. The number of rig counts increased from 1,620 in October 2016 to 2,298 as of January 2019 globally, depicting a rise in drilling activities. Drilling operations are expected to increase further over the forecast period, thereby propelling the demand for clear brine fluids.

Clear brine fluids generate the required density without the need of maintaining viscosity for carrying weight-material particulates as all weight-material is dissolved completely. These solutions are primarily used in the good completion stage. They act as a direct alternative to water-based formulations, which can be used only once and need to be disposed of after that. These fluids are environment-friendly and also help in rock formations. Unlike water-based mud, brine solutions reduce the chances of mud swelling.

The primary advantage of saline solutions is that they increase the rate of penetration along with an increase in run life. However, this specific characteristic largely depends on the management of temperature levels, thermal capacity, and connectivity. With the right execution, these fluids can be reliable free systems that help achieve the required density.

Moreover, these formulations have the least adverse effects on the environment and they do not cause any damage to the drilling equipment either. The aforementioned superior advantages of the saline solutions over other drilling fluids are anticipated to drive their demand over the forecast period.

Despite the global economic depression in late 2008 and during the first quarter of 2009, oilfield service companies witnessed a significant improvement in their profit margins. Oil prices started declining in the last quarter of 2014 until 2016; however, the prices did not drop any further in the first and second quarter of 2017.

The overall production of crude oil has not gone down despite the decline in its prices, which, in turn, is anticipated to ensure continuity in the demand for completion fluids. Moreover, the increasing complexity of drilling operations and decreasing productivity from the existing wells are some of the factors that have propelled the need to achieve an optimum level of operational efficiency.

A majority of the investors in clear brine fluids market are focusing on penetrating the emerging markets such as Central and South America, Eastern Europe, and the Asia Pacific. Leading multinational players intend to expand their presence in lucrative regions such as the Asia Pacific and exploit some of the advantages of these geographies such as low cost of land and labor and the comparatively lenient governing norms.

Optimizing the production process becomes imperative with the increasing complexities in drilling operations, which is likely to boost the product demand soon as they offer several functional benefits. The market is becoming highly competitive with the increasing number of players. A rise in the presence of small as well as large players has been crucial in altering the market dynamics in terms of product pricing.

The depletion of the proven hydrocarbon reserves and increasing complexity in the production of oil and gas have led to the deployment of several tertiary processes such as enhanced oil recovery. Increasing EOR activities globally is yet another crucial factor boosting the drilling operations, thereby leading to a greater requirement for the application of clear brine fluids as completion and workover chemicals. The aforementioned technological and functional advantages coupled with the yearly rise in oil and gas production are expected to be the major market drivers.

Clear Brine Fluids Market Trends

With a majority of the world’s oil fields on the verge of drying up and the level of peak oil expected to witness a decline, major players are now attempting to extract the trapped oil and gas in deeper basins. The increase in exploration & production activities for developing deep reserves is expected to maintain the product demand. Clear brine fluids are used in almost all stages of oil and gas production completion and are expected to register a steady growth owing to the increasing global energy demand. Clear brine fluids exhibit high solubility, high density, and high saturation properties that add a compatibility factor when used with the completion fluids. Clear brine fluids formulation is capable of stabilizing shale formations, protecting polymers at high temperatures, and offering excellent lubricity.

Growing petroleum exploration & production activities in the U.S., Venezuela, Indonesia, China, Canada, and Nigeria, has been a major factor contributing to the increasing requirements of clear brine fluid solutions over the past few years. In addition, there has been increasing production in oil & gas reserves globally. Moreover, different reservoirs have distinct rock strata, which require different drill bits. Furthermore, drilling activities in tight/shale reserves require frequent change of bits to achieve efficiency, which is anticipated to boost the demand for clear brine fluids over the forecast period.

The shift in trend toward developing unconventional resources has contributed to the growth of clear brine fluids. As the global energy demand is escalating, the conventional sources of oil & gas are depleting at the expense of future energy demands. Swift growth in the production of hydrocarbons from unconventional sources in the past few years has driven the demand for overall specialty oilfield chemicals such as brine solutions and associated products. The combination of cementing and stimulation products, completion and brine fluids, drilling fluids, and oil production chemicals is essential for the effective extraction of oil from such sources.

The growth in offshore production across many regions of the world has contributed to an increased demand for brine solutions. Brine solutions have successfully replaced heavy drilling muds years ago in areas such as Oklahoma due to the pressure encountered in Deep Anadarko Basin. Many companies have been using brine fluids in offshore drilling for years due to their various advantages over heavy drilling mud. In 2015, Africa accounted for over 15% of the overall share of offshore capital expenditure, mostly with the developments in offshore Angola. In the West African region, investments are projected to increase in the offshore fields of Congo and Ghana within the next five to seven years.

Clear brine fuels are subjected to stringent regulations as most of these except formates and chlorides have a serious environmental impact and also include costs of disposal. In 1992, the American Petroleum Institute (API) surveyed the U.S. oil & gas industry to identify how waste was disposed of, how much does the disposal costs, and what was the volume of oilfield chemicals that require disposal. The results of which indicated that the disposal costs greatly varied depending on the number of drums to be disposed of and the disposal method selected.

The oil prices dropped drastically in 2014 & 2015 and quickly led to the reductions in planned CapEx and implementation of cost-cutting actions by oil companies across the globe. Defensive strategies implemented by oil companies had a direct impact on the oilfield service industry as this industry relies on oil-producing companies for business. The impact has been quick and increasing with the continuous dip in the crude oil prices. Many industries depending directly on the oil & gas market have witnessed serious reductions in cash flow. However, with the increase in production of oil & gas despite the low crude price era, the upstream operations have suffered operational losses during the past three years.

Product Insights

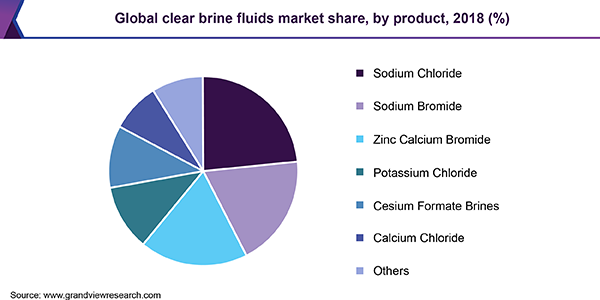

Zinc calcium bromide was the largest product segment in 2018 in terms of revenue and is expected to continue the dominance over the forecast period. Zinc calcium bromide is a multi-salt fluid blend of zinc bromide/calcium bromide/calcium chloride. Multi-salt formulations are used as completion and workover fluids in the oil and gas industry to operate at higher densities at comparatively lesser costs compared to other counterparts.

Zinc calcium bromide solution is used in oil and gas well completion and workover operations with a density of approximately 19.2 lb/US gallon. This brine fluid is toxic to aquatic life with long-lasting effects, however, the product category holds a significant market share due to its high efficiency.

The product possesses highly efficient characteristics and the blend can be formulated to cater to the high-density requirements. These high-density fluids show compatibility with completion and formation fluids.

Sodium chloride is the cheapest of all the products and is a widely available economical brine product used for inhibition and density. The product is generally used for low-pressure wells and can also be used to adjust the density of other unsaturated brines such as potassium chloride, ammonium chloride, and seawater. It also reduces salt dissolution when drilling halite salt sections and freezing point of water-based solutions.

Regional Insights

The Middle East led with over 30% of market share in 2018 in terms of revenue. Growing energy demand in tandem with the supportive government initiatives to lessen dependency on oil imports is anticipated to drive onshore and offshore oil drilling operations. However, severe policies regarding oil pollution are also likely to affect the demand for efficient hydrocarbon exploration and production formulations in near future.

The Middle East and Africa are one of the most prominent regions in the global oil and gas industry. Drillers from this region can now proficiently drill and complete separate, multiple, pressure-isolated, and accessible laterals from any single original wellbore. Thus, delivering broader growth prospects for the completion and drilling fluids sector.

Nigeria, Angola, Kenya, and Mozambique are the key contributing nations to the African oil and gas sector. However, Africa has witnessed a downward trend in the oil and gas industry with players shifting towards geologies offering promising returns with attractive fiscal terms.

Saudi Arabia is an oil based economy with strong government controls over major economic activities. Despite the lower prices, the country is one of the leading oil and gas producers and holds approximately 17 % of the world proven oil reserves. Saudi Aramco, a major player in the market operated 220 rings even during the latest oil crisis. The company has capitalized on low production costs to increase funding for the ongoing investments from its own resources.

North America witnessed a surge in crude oil and natural gas production from 2013 to 2014. This surge in drilling operations has majorly triggered the demand for clear brine fluids in North America. Increasing oil and natural gas production in the region coupled with significant oilfield development especially in the U.S. and Canada tight oil reserves may be attributed to high oilfield chemicals industry penetration. Numerous parameters such as shale boom, increase in offshore drilling operations in the Gulf of Mexico, and need for exploring possible untapped oil & gas reserves are anticipated to drive the market growth of clear brine fluids over the forecast period.

Significant oilfield development in Texas, Gulf of Mexico, and North Dakota along with the supportive governmental regulations for unconventional hydrocarbon resource development is further expected to boost industry expansion. As the clear drawing Fluids play a significant role in the modern drilling technologies, the market for brine solutions has witnessed a steady growth in the U.S. drilling operations and basins. Moreover the beneficial merger such as Newpark Drilling Fluids and Alliance Drilling Fluids in 2013 has combined the capacity and services of the companies in the Permian basin.

The Asia Pacific is expected to be the fastest-growing region in terms of consumption volume over the estimated period. China, India, and Indonesia lead almost every aspect of the regional petroleum industry. Also, several upcoming advancements are anticipated to have significant strategic and commercial implications on the E&P activities, products, and equipment market.

Various technological advancements for increasing productivity and reducing production cost are projected to play a vital role in regional growth and is further projected to witness rapid pace over the forecast period.

Most of the oil production in China comes from large mature oil fields which are situated in the northern part of the country. One of the China’s largest oil-producing oilfield, PetroChina’s Daqing field is located in the northeastern part of China. Other major oilfield in the country include Sinopec’s Shengli field and PetroChina’s Changqing field. China’s gas fields are situated in the inland provinces of northern central northwestern part of China. Sichuan Basin is considered as one of the other key gas-producing region in the country, which mainly constitutes of large non-associated gas fields. PetroChina’s Changqing Sulige gas field is the main gas- field in China. These oilfields activities are expected to support the China clear brine fluids market.

Key Companies & Market Share Insights

The market is competitive in terms of product offerings and drilling technologies. New product developments, partnerships, collaborations, and joint ventures are some of the strategies adopted by industry players to increase market penetration. Some of the key competitive factors include product quality, brand, modest pricing, and efficient distribution network.

Top players have implemented sustainable solutions considering the long-term benefits and easy availability of raw materials. Companies are focusing on a strategy of locating plants in the proximity of raw material sources or chemical hubs and processes certified with authenticity for inbound raw materials. Some of the prominent vendors include ICL, Cabot Corp., LANXESS, Albemarle Corporation, EMEC, Schlumberger, and Tetra Technologies.

Clear Brine Fluids Market Report Scope

Report Attribute

Details

Market size value in 2020

-

Revenue forecast in 2025

-

Growth rate

CAGR of %from 2020 to 2025

Base year for estimation

2019

Historical data

2014 - 2018

Forecast period

2020 - 2025

Quantitative units

Revenue in USD Million, Volume in Units & CAGR from 2020 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Middle East and Africa; Central and South America

Country scope

U.S.; Canada; Mexico; U.K.; Russia; Norway; China; Japan; India; Indonesia; Malaysia; Singapore; UAE; Saudi Arabia; Qatar; Iran; Iraq; Brazil; Argentina

Key companies profiled

Albemarle Corporation; LANXESS; Schlumberger Limited; Zirax Limited; Solent Chemicals; Cabot Corporation; Clements Fluids; EMEC; GEO Drilling Fluids, Inc.; ICL; Halliburton; Tetra Technologies, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts volume and revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For this study, Grand View Research has segmented the global clear brine fluids market based on product and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

Zinc Calcium Bromide

-

Cesium Formate Brines

-

Potassium Chloride

-

Calcium Chloride

-

Sodium Chloride

-

Sodium Bromide

-

Others

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Russia

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Indonesia

-

Malaysia

-

Singapore

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

Qatar

-

Iran

-

Iraq

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.