- Home

- »

- Healthcare IT

- »

-

Clinical Data Analytics Solutions Market Size Report, 2030GVR Report cover

![Clinical Data Analytics Solutions Market Size, Share & Trends Report]()

Clinical Data Analytics Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud-based, On-premise), By Application (Clinical Decision Support, Clinical Trials, Regulatory Compliance), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-197-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

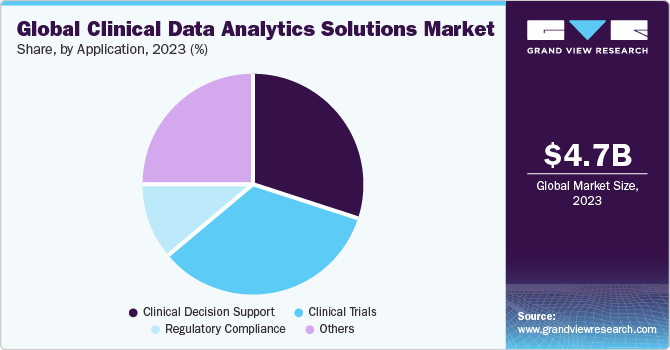

The global clinical data analytics solutions market size was valued at USD 4.69 billion in 2023 and is estimated to expand at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. The market growth is attributed to the increasing need for advanced technologies such as AI in healthcare organizations, growing number of clinical trials, and the rising prevalence of chronic diseases. Moreover, increasing focus on population health management and personalized patient care is anticipated to drive the market over the forecast period.

Rising demand for new diagnostic tests and medical treatments tailored to diverse patient requirements has led to a surge in clinical trials. These trials generate vast volumes of data that necessitate advanced clinical data analytics solutions for extracting valuable insights. Consequently, the growing number of clinical trials fuels the demand for advanced clinical trial solutions. In August 2023, Lokavant introduced a study planning solution that empowers contract research organizations and clinical trial sponsors to optimize study performance by identifying the ideal locations, site mix, and site numbers.

Increasing emphasis on population health management is also a significant driver of market growth. Clinical data analytics play a pivotal role in identifying patient data trends and patterns, enabling healthcare organizations to address health issues and allocate resources effectively and proactively. These solutions also facilitate risk stratification by identifying high-risk individuals, enabling targeted interventions and personalized care plans. This results in reduced hospital admissions lowered healthcare costs, and enhanced patient satisfaction.

COVID-19 highlighted the importance of healthcare data analytics in tracking and responding to the virus's spread. Healthcare organizations and governments relied on data analytics for pandemic monitoring, resource allocation, and informed decision-making. For instance, an article in Forbes from July 2021 highlighted using clinical data analytics solutions to analyze critical details like available hospital bed counts, COVID-19 case numbers, and personal protective equipment kit statuses.

The pandemic accelerated the demand for clinical data analytics in drug development and vaccine research. Pharmaceutical companies and research institutions leveraged data analytics to streamline clinical trials, analyze extensive datasets, and expedite the development of COVID-19 treatments and vaccines. An article from Sartorius AG in June 2020 emphasized the critical role of data analytics solutions in accelerating vaccine production through rapid-scale rollout processes and efficient Design of Experiments (DOE).

Market Concentration & Characteristics

The global clinical data analytics solutions market is characterized by a high degree of innovation, with new technologies being developed and introduced at regular intervals. Key players in the market are investing in research and development of solutions capable of catering to the rising demand for clinical data analytics.

Several market players such as UnitedHealth Group, SAS Institute Inc., and IQVIA are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Stringent regulations enhance data security, driving demand for compliant clinical data analytics solutions. Companies face challenges in ensuring adherence to privacy and transparency requirements. The compliance costs are expected to rise; however, the emphasis on regulatory alignment increases trust and innovation.

Prominent players invest in product expansion to cater to the rising market demand. In September 2023, SAS launched SAS Health, an end-to-end solution for data automation and analytics capable of simplifying healthcare data management, accelerating patient insights, and enhancing data governance.

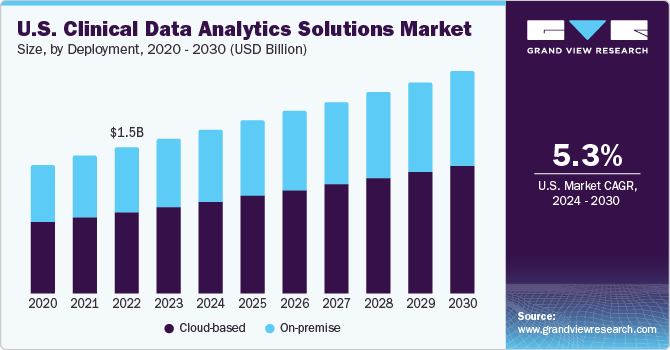

Deployment Insights

Based on deployment, the market is segmented into cloud-based and on-premise. The cloud-based segment dominated the market with a revenue market share of 55.58% in 2023 and is anticipated to exhibit the fastest growth throughout the forecast period. This growth can be attributed to the scalability advantages it offers to healthcare organizations, enabling them to adjust their analytics infrastructure as per evolving data demands.

This adaptability is particularly valuable in an industry characterized by fluctuating data volumes. In addition, adopting cloud-based analytics eliminates the need for on-premises hardware and maintenance expenses, allowing organizations to allocate resources more efficiently. They can opt for pay-as-you-go models, reducing initial capital investments.

Moreover, cloud-based solutions offer remote accessibility, fostering collaboration among healthcare professionals, researchers, and stakeholders, irrespective of their geographical locations. This accessibility streamlines decision-making and patient care timelines.Furthermore, cloud platforms facilitate the integration of advanced analytics and machine learning algorithms, augmenting the depth and accuracy of clinical data insights. This capability is pivotal for predictive analytics, personalized medicine, and clinical research. The growing awareness of these advantages is expected to propel market growth during the forecast period.

Application Insights

The market is segmented by application, encompassing clinical decision support (CDS), clinical trials, regulatory compliance, and others. In 2023, the clinical trials segment held the largest market share, driven by increasing awareness of the advantages of employing clinical data analytics solutions in this context. The growing number of clinical trials, propelled by the demand for technologically advanced and cost-effective medical treatments, is a key driver. According to a study by the WHO in February 2023, the total number of clinical trials increased from 51,451 in 2017 to 54,954 in 2022.

Conversely, the clinical decision support segment is poised for the most rapid growth during the forecast period. This is fueled by the rising adoption of clinical decision support systems for customizing recommendations and treatment plans to individual patient profiles. Clinical data analytics solutions play a pivotal role in enhancing CDS by offering patient-specific insights to clinicians and facilitating tailored and effective treatments. Furthermore, these solutions integrate artificial intelligence (AI) and machine learning into CDS applications, enabling predictive insights for early diagnosis and treatment planning. These factors are expected to drive growth in this segment over the forecast period.

Regional Insights

In 2023, North America dominated the market with a revenue share of 43.66%, owing to the region's well-established healthcare infrastructure and widespread integration of advanced technologies. A rising incidence of chronic diseases and aging population are compelling healthcare institutions in the region to adopt analytics solutions. Furthermore, the presence of major industry players drives market growth.

Europe is anticipated to experience the highest growth during the forecast period. This growth is propelled by interoperability initiatives, crucial in a region where healthcare systems are diverse and often fragmented. Healthcare sector in Europe is enthusiastically embracing AI and ML technologies, especially in fields like radiology and pathology, to efficiently analyze extensive datasets. Governments are also investing in digital health infrastructure and incentivizing the uptake of clinical data analytics solutions, with the aim of enhancing healthcare access, cost reduction, and improved patient outcomes.

Key Clinical Data Analytics Solutions Company Insights

-

IQVIA; Optum, inc.; (UnitedHealth Group); SAS Institute Inc.; and Dassault Systems are the dominant players in the clinical data analytics solutions industry.

-

IQVIA has a global presence and operates in more than 100 countries.

-

SAS Institute Inc. operates in several facilities located across North America, Asia Pacific, Europe, and MEA.

-

Health Catalyst; eClinical Solutions LLC; JMP Statistical Discovery LLC.; OSP; OpenClinica, LLC, and Cytel are some of the emerging players functioning in the clinical data analytics solutions industry.

-

eClinical Solutions LLC offers services in clinical data acquisitions, data conversion and standardization, clinical data management, and elluminate implementation among others.

-

JMP Statistical Discovery LLC is headquartered in the U.S. and operates across North America, Europe, and Asia.

Key Clinical Data Analytics Solutions Companies:

The following are the leading companies in the clinical data analytics solutions market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these clinical data analytics solutions companies are analyzed to map the supply network.

- Optum, inc. (UnitedHealth Group)

- SAS Institute Inc.

- IQVIA

- Health Catalyst

- eClinical Solutions LLC

- JMP Statistical Discovery LLC.

- OSP

- BD

- Dassault Systems

- Cognizant

Recent Developments

-

In August 2023, PurpleLab, a healthcare analytics company, launched Comprehensive Layout for Exploration, Analysis, & Research (CLEAR). The solutions facilitate analysis and reduce the data required for generating insights.

-

In January 2023, IQVIA announced a co llaboration with Alibaba Cloud. This collaboration is anticipated to strengthen IQVIA’s geographical presence in China by better serving its customers.

-

In November 2022, Hartford HealthCare and Google Cloud announced a long-term partnership to enhance data analytics, advance digital transformation, and improve access and care delivery.

Clinical Data Analytics Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.0 billion

Revenue forecast in 2030

USD 7.5 billion

Growth rate

CAGR of 6.8% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Deployment, application, region

Regional Scope

North America ; Europe ; Asia Pacific ; Latin America ; Middle East & Africa

Country Scope

U.S.; Canada; Germany; U.K; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Optum, inc. (UnitedHealth Group); SAS Institute Inc.; IQVIA; Health Catalyst; eClinical Solutions LLC; JMP Statistical Discovery LLC.; OSP; BD; Dassault Systems; Cognizant

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Data Analytics Solutions Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical data analytics solutions market report based on deployment, application, and region:

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Cloud-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Decision Support

-

Clinical Trials

-

Regulatory Compliance

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical data analytics solutions market size was estimated at USD 4.69 billion in 2023 and is expected to reach USD 5.03 billion in 2024

b. The global clinical data analytics solutions market is expected to grow at a compound annual growth rate of 6.8% from 2024 to 2030 to reach USD 7.48 billion by 2030

b. The cloud-based segment dominated the market with a revenue market share of 55.58% in 2023. This growth can be attributed to its scalability advantages to healthcare organizations, enabling them to adjust their analytics infrastructure to evolving data demands.

b. Some of the key players operating in the global clinical data analytics market include Optum, inc. (UnitedHealth Group), SAS Institute Inc., IQVIA, Health Catalyst, eClinical Solutions LLC, JMP Statistical Discovery LLC., OSP, BD, Dassault Systems, Cognizant.

b. Key factors driving the market growth include the increasing need for advanced technologies such as AI in healthcare organizations, the growing number of clinical trials, and the rising prevalence of chronic diseases. Moreover, increasing focus on population health management and personalized patient care is anticipated to drive the market over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.