- Home

- »

- Healthcare IT

- »

-

Clinical Decision Support Systems Market Size Report, 2033GVR Report cover

![Clinical Decision Support Systems Market Size, Share & Trends Report]()

Clinical Decision Support Systems Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Standalone CDSS, Integrated EHR with CDSS), By Application (Drug-Drug Interactions), By Delivery Mode, By Component, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-339-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Decision Support Systems Market Summary

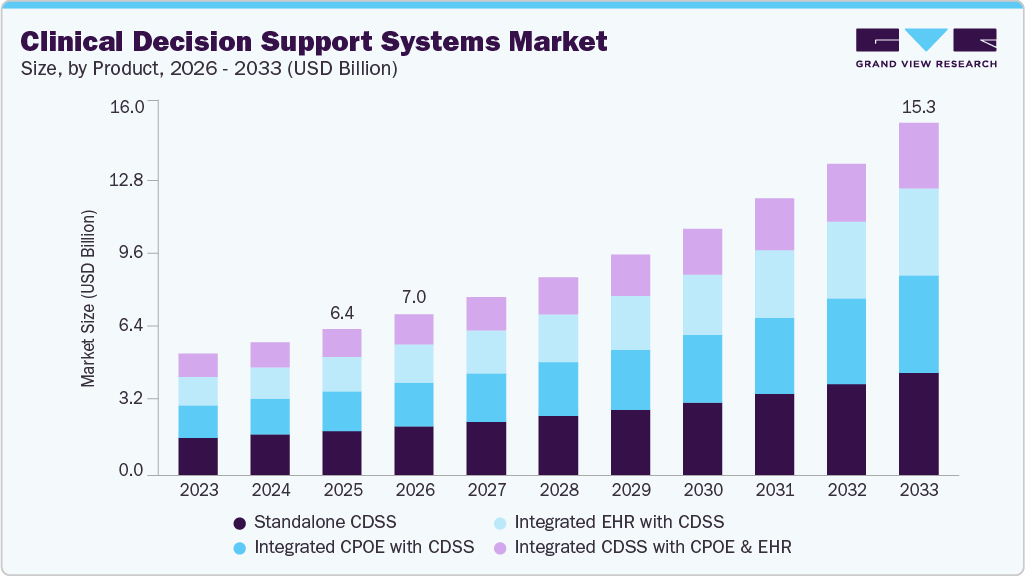

The global clinical decision support systems market size was estimated at USD 6.36 billion in 2025 and is estimated to reach USD 15.32 billion by 2033, growing at a CAGR of 11.8% from 2026 to 2033. Clinical decision support systems have experienced significant advancement in recent decades, providing clinicians with vital tools to make informed decisions in patient care.

Key Market Trends & Insights

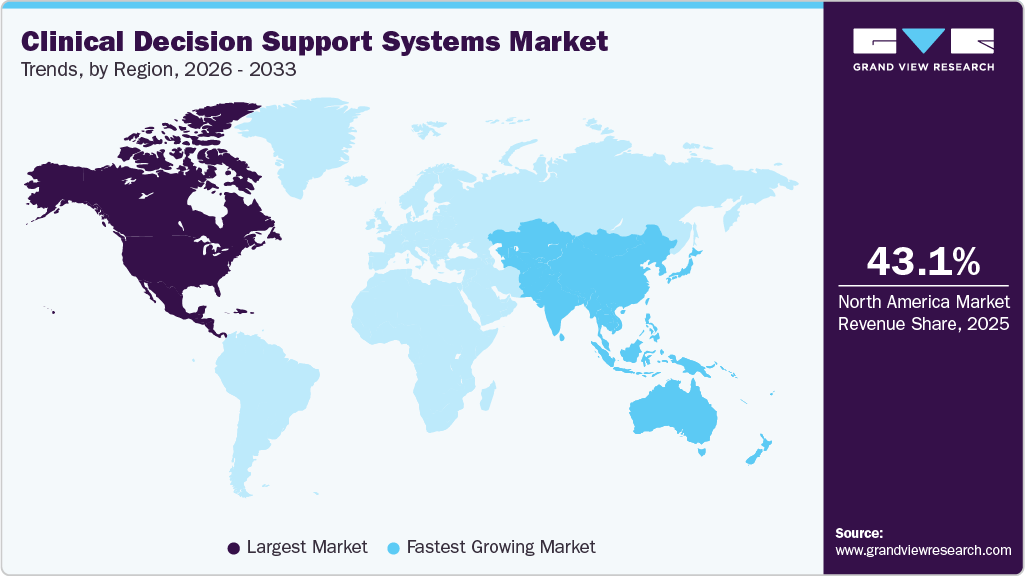

- North America clinical decision support systems market dominated the global market with over 45.13% revenue share in 2025. CDSS market in the U.S. held the largest market share in 2025.

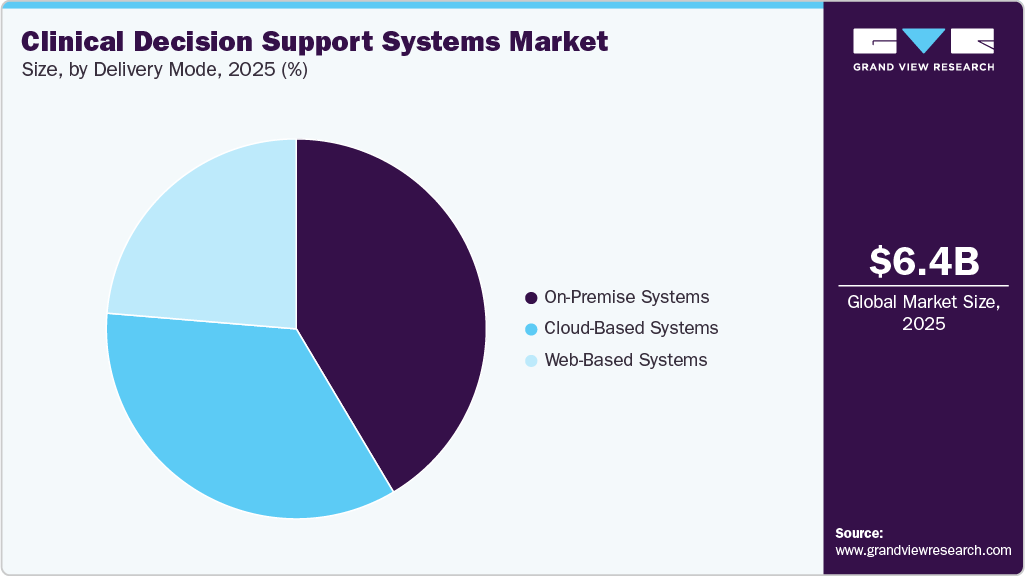

- By delivery mode, on-premise segment in delivery mode dominated the market with the largest share of 41.45% in 2025.

- By component, CDSS services segment held the largest market share in 2025.

- By product, standalone CDSS segment held the largest market share of 30.51% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 6.36 Billion

- 2033 Projected Market Size: USD 15.32 Billion

- CAGR (2026-2033): 11.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

These systems have emerged as a promising means to improve patient outcomes and reduce overall healthcare costs. The growing need to reduce medical errors and enhance patient safety is driving the growth of clinical decision support systems market, as healthcare providers increasingly rely on technology to support accurate and consistent clinical decision making. CDSS solutions help minimize diagnostic, medication, and treatment errors by providing real-time alerts, evidence-based recommendations, drug-drug and drug allergy interaction checks, and standardized clinical guidelines at the point of care. By supporting clinicians with timely and context-specific insights, CDSS improves adherence to best practices, reduces adverse events, and enhances overall care quality. As patient safety has become a core quality metric for hospitals and payers particularly under value-based care and accreditation requirements healthcare organizations are accelerating CDSS adoption to improve outcomes, reduce liability risks, and ensure safer clinical workflows.

The adoption of personalized medicine is increasing, with CDSSs playing a crucial role. These systems analyze patient data, including genetic profiles and medical histories, to customize treatment plans for individuals. By providing tailored recommendations, CDSSs enhance treatment effectiveness and reduce the risk of adverse reactions, driving market growth.

Governments worldwide are implementing regulations and incentives to promote CDSS and other healthcare IT solutions. These regulations focus on enhancing patient safety, interoperability, and care quality, prompting healthcare organizations to invest in CDSS to comply with regulatory requirements and qualify for incentives.

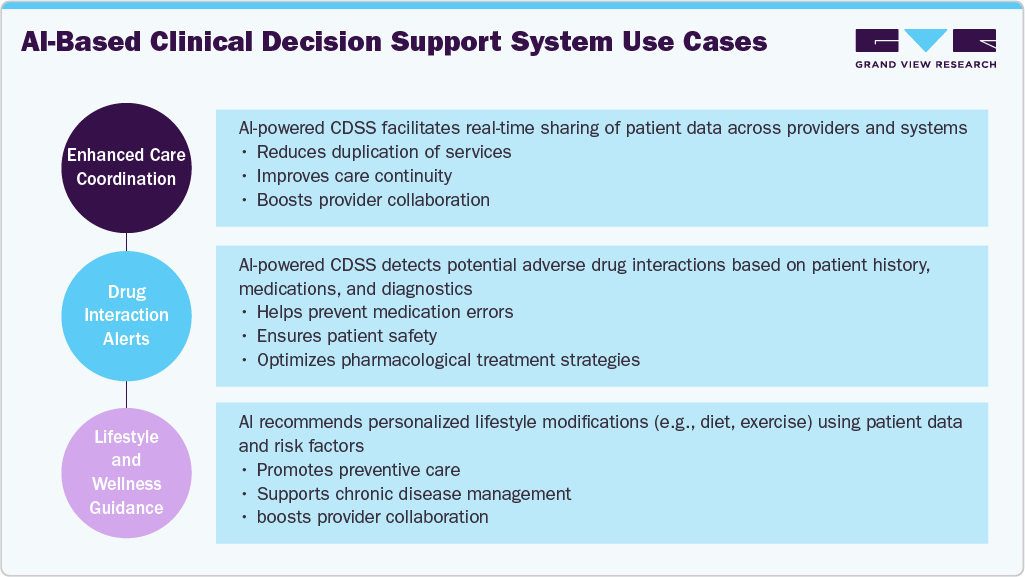

AI-Driven Clinical Decision Support Systems Market

Researchers are integrating AI into Clinical Decision Support Systems to process vast data to recommend treatment strategies, highlight potential issues, streamline operations, and support healthcare professionals. Hence, researchers are integrating CDSS with AI. For instance, in December 2022, the University of Texas at Austin’s Dell Medical School researchers designed an AI-based CDSS to assist clinicians in discussing nutrition and sharing decision-making with patients about diet improvements.

By utilizing patient health data, including information from electronic health records (EHRs), AI-enabled clinical decision support systems enhance the accuracy of diagnoses, treatments, and prognoses for specific medical conditions. These systems predict medical outcomes or assess disease risks based on biomedical imaging data. AI CDSS can analyze historical, current, and new patient data to identify safety concerns, errors, or opportunities for enhancing care pathways. Their precise predictive capabilities open up innovative avenues for optimizing patient care.

Case Study and Survey Insights

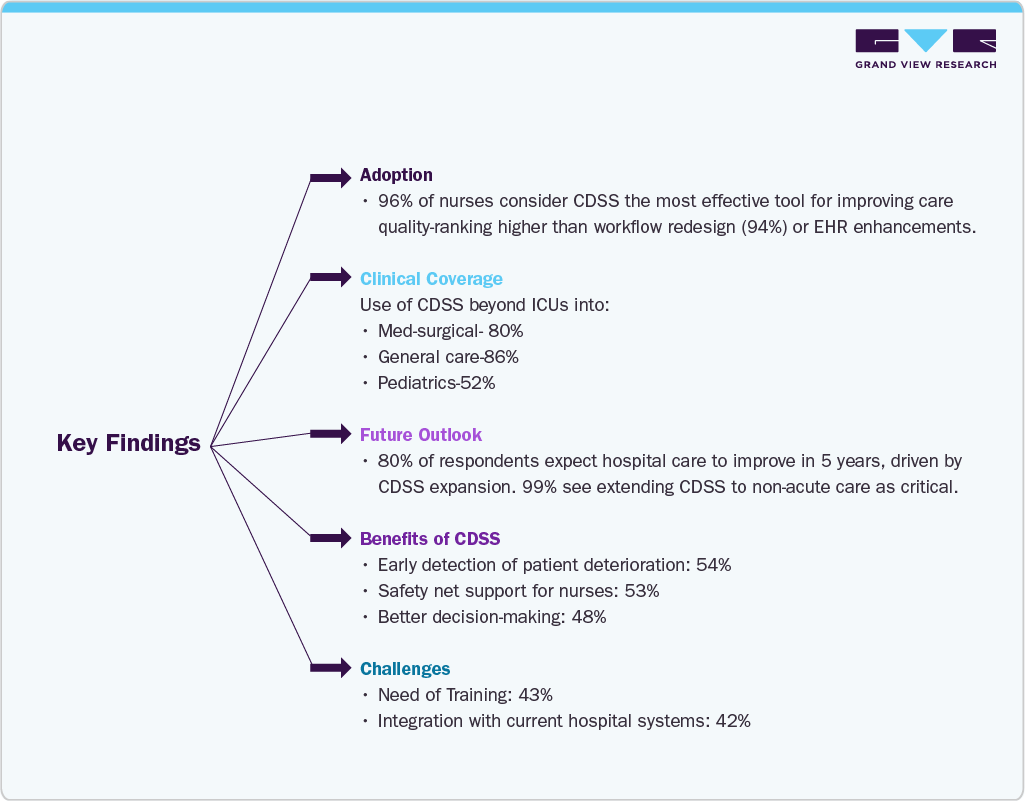

The Rising Role of CDSS in U.S. Healthcare

In June 2023, Ascom conducted a nationwide survey (via OnePoll) with 950 U.S. nurses across general care and ICU settings to assess the usage, impact, and perception of Clinical Decision Support Systems (CDSS).

“Analyst Takeaways: The Ascom CDSS Report 2023 highlights growing confidence in clinical decision support systems, with 96% of nurses ranking it as the top tool for improving care. Its expanding use beyond ICUs shows market maturity, but challenges like integration and training remain. The shift toward real-time, mobile “push” alerts reflects a broader move to intelligent, proactive care creating clear opportunities for agile, user-friendly CDSS platforms.”

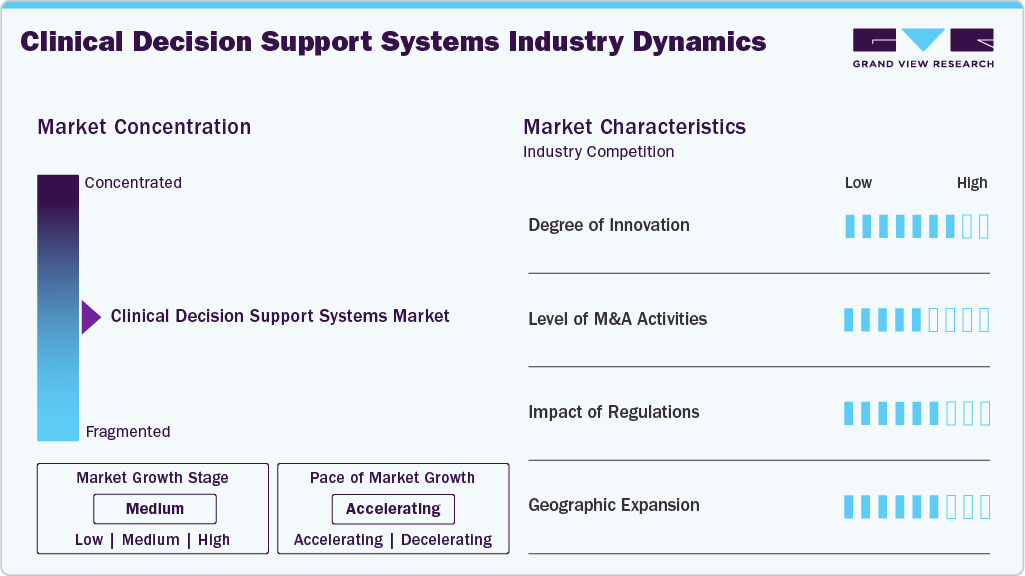

Market Concentration & Characteristics

-

Degree of Innovation: The degree of innovation in the clinical decision support systems industry is high. This innovation encompasses the integration of advanced technologies like artificial intelligence (AI) and machine learning (ML), along with frequent updates to features aimed at enhancing operational efficiency. For instance, in July 2025, GuidelineX showcased its next‑generation AI‑powered Clinical Decision Support System (AI‑CDSS) at HIMSS APAC 2025 in Kuala Lumpur, highlighting integration with hospital systems to provide personalized diagnostics, treatment guidance, and risk management.

-

Level of M&A Activities: The level of M&A activities is high in the market. The market players undertake several initiatives such as mergers & acquisitions, partnerships, and product launches to strengthen their product portfolio, ultimately contributing to the market growth. For instance, in October 2022, Beckman Coulter Diagnostics acquired StoCastic, LLC., a company that offers decision support based on evidence to hospital emergency departments (ED). The acquisition is expected to strengthen Beckman Coulter Diagnostics' CDSS portfolio.

-

Impact of Regulations: Regulatory bodies, such as the FDA, regulate the CDSS industry. For instance, in September 2022, the U.S. FDA released finalized and revised guidance documents, such as Final CDS Guidance, addressing clinical decision support software, along with various digital health subjects.

-

Geographical Expansion: Major players are focusing on geographical expansion to capture new geographical CDSS industries. The expansion is generally done by launching manufacturing facilities or R&D centers in new locations or mergers and acquisitions of companies based in different countries.

Product Insights

Standalone CDSS held the largest market share of over 30.51% in 2025, because it is widely adopted for its low cost and simplicity. They don't require standardization or extensive clinical expertise and can operate without real patient data. Their user-friendly nature contributes to dominance in hospitals and clinical settings.

The integrated EHR with CDSS segment is expected to grow at the fastest CAGR during the forecast period, driven by increasing EHR adoption in multi-specialty healthcare facilities. Integrated systems provide CDSSs access to patient databases and medical histories, automating clinical workflows. In April 2023, the U.S. government proposed a rule granting providers more comprehensive access to information within their EHR systems to evaluate CDSS algorithms and outcomes. Integration of CDSSs with EHRs standardizes workflows and leverages existing datasets. In addition, more CDSS functions are built into EHR systems, supporting segment growth.

Application Insights

Drug allergy alerts accounted for the largest market share of over 25.5% in 2025. Several people have allergies to specific drugs, so it is important to have systems that provide allergy alerts, because it is widely utilized in clinical decision support systems (CDSSs) to enhance patient safety and prevent adverse drug reactions (ADRs). CDSSs allow customization of alerts based on individual patient profiles and specific allergy information. Healthcare providers can tailor alert thresholds and preferences to ensure relevance and actionability for each patient. The rising burden of drug allergies is driving CDSS adoption, fueling segment growth. For instance, according to a September 2022 CDC study, approximately 10% of the U.S. population is allergic to penicillin.

The clinical guidelines segment is expected to grow at the fastest CAGR during the forecast period. Clinical Decision Support (CDS) systems provide guidelines for diagnosis and treatment, delivering essential real-time information primarily at the point of care. These systems automate routine tasks, alert clinical teams to potential issues, and provide recommendations for assessing healthcare professionals and patients. For instance, the American Medical Informatics Association (AMIA) defines Clinical Decision Support as a mechanism to enhance health-related decision-making and actions, empowering clinicians, patients, and stakeholders to refine clinical decision-making processes and improve healthcare service quality and patient outcomes.

Component Insights

CDSS services held the largest market share in 2025, offering implementation, training, support, customization, and consulting services to help healthcare organizations maximize CDSS software value and optimize clinical decision-making. This segment dominated the market as continuous technical support ensures CDSS functionality and performance. In addition, healthcare professionals require training to effectively utilize CDSS, further propelling segment growth.

CDSS software segment is anticipated to grow at the fastest CAGR during the forecast period. The CDSS software, when integrated with software for CPOE and EHRs, provides enhanced decision support by making customized and specific results for the particular patient. Novel innovations for technical support, interoperability of the software, and efficient outcomes are anticipated to drive the market growth. For instance, in July 2022, QIAGEN announced that its CDS software platform, QIAGEN Clinical Insights (QCI), was utilized to analyze over three million patient molecular profiles for oncological and hereditary diseases.

Delivery Mode Insights

On-premise segment in delivery mode dominated the market with the largest share of 41.45% in 2025. On-premise CDSS solutions offer flexibility for customization and integration with existing healthcare systems and workflows, catering to specific organizational needs. Multispecialty hospitals and large healthcare organizations prefer this system for greater data control within their infrastructure. Integration with existing systems like EHRs enables smoother data flow and interoperability, enhancing decision support efficiency.

Cloud-based systems are expected to grow at the fastest CAGR over the forecast period. Representing a significant IT advancement, they offer reliability and cost-effectiveness. Enhanced accessibility via mobile platforms and robust data protection mechanisms drives their adoption. Unlike web-based systems, cloud solutions are not dependent on web browsers, enhancing security and usability.

Regional Insights

Clinical decision support systems market in the North American region dominated the global with over 43.13% revenue share in 2025. This dominance is fueled by the rising demand for IT solutions in healthcare and the emphasis on delivering quality healthcare services. Rapid technological advancements further drive market growth. Initiatives promoting CDSS adoption. For instance, in December 2023, EBSCO Information Services launched Dyna Innovation Center in the U.S. to promote innovation in clinical decisions. Such initiatives from the market players are expected to contribute to the region's CDSS market growth.

U.S. Clinical Decision Support Systems Market Trends

Clinical decision support systems market in the U.S. held the largest market share in 2025. The growth is driven by widespread EHR adoption supported by federal initiatives such as the HITECH Act, along with increasing emphasis on reducing preventable medical errors and improving patient safety. In addition, value-based reimbursement models, CMS quality reporting requirements, and early adoption of AI-enabled clinical decision support tools across hospitals and large healthcare networks are accelerating CDSS deployment nationwide.

Europe Clinical Decision Support Systems Market Trends

Clinical decision support systems market in Europe is expected to maintain a substantial market share over the forecast period. The growth is due to the presence of key market players, increasing adoption of CDSS, and supporting frameworks. For instance, in February 2024, the European Commission released a document to emphasize and promote the usage of clinical decision support tools.

Clinical decision support systems market in the UK is expected to growth significantly, increasing adoption of advanced healthcare IT solutions, due to well-collaborations strategies between healthcare and IT industries in the UK and government initiatives, is expected to propel the country’s market. For instance, in June 2023, the UK government announced approximately USD 28.2 million in funding to deploy AI-based decision support tools for early diagnosis of strokes, cancers, and heart conditions.

Asia Pacific Clinical Decision Support Systems Market Trends

Clinical decision support systems market in Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The growth can be attributed to the increasing healthcare sector investments in countries such as China, Japan, India, and Australia. Asia Pacific’s market is showing high potential due to growing R&D expenses by governments of key regional economies for improving information technology penetration in the healthcare sector.

Growth of clinical decision support systems market in Australia is majorly driven by increasing government and healthcare provider investments in digital health and AI‑driven clinical tools aimed at improving diagnostic accuracy and workflow efficiency. For instance, in April 2022, Northern Territory Health upgraded to Alcidion’s Miya Precision platform to enhance patient flow, bed management, and care coordination. Thus, country’s focus on optimizing hospital operations and enhancing patient care through advanced clinical decision support solutions is contributing to the markets growth.

Clinical decision support systems market in China is expected to grow at a significant CAGR owing to numerous business initiatives undertaken by the market players. For instance, in June 2023, AffaMed Therapeutics launched Headache CDSS in partner with the International Headache Center of the Chinese PLA General Hospital at the 16th Annual Meeting of Neurologists of the Chinese Medical Association.

Latin America Clinical Decision Support Systems Market Trends

Latin America Clinical Decision Support Systems market is growing steadily, supported by the gradual modernization of healthcare delivery, rising demand for standardized clinical workflows across hospitals and diagnostic centers, and improving data availability.

Middle East and Africa Clinical Decision Support Systems Market Trends

Middle East and Africa clinical decision support systems market is witnessing steady growth, driven by increasing investments in healthcare digitization, expansion of hospital infrastructure, and growing adoption of EHR and HIS platforms, in GCC countries and South Africa. In addition, government-led health IT initiatives, rising burden of chronic diseases, and the need to improve clinical efficiency and reduce diagnostic errors are contributing to adoption of CDSS.

Key Clinical Decision Support Systems Company Insights

The global clinical decision support systems market is fairly competitive. The most notable participants in the market are McKesson Corporation; Koninklijke Philips N.V.; Wolters Kluwer NU; Oracle; Siemens Healthineers, along with other providers of clinical decision support systems. These players are involved in new product launches, product innovations, acquisitions, and partnerships to gain a competitive edge over each other.

Key Clinical Decision Support Systems Companies:

The following key companies have been profiled for this study on the clinical decision support systems market.

- McKesson Corporation

- Oracle

- Siemens Healthineers AG

- Allscripts Healthcare, LLC

- athenahealth, Inc.

- NextGen Healthcare Inc.

- Koninklijke Philips N.V.

- IBM

- Agfa-Gevaert Group

- Wolters Kluwer N.V.

- Becton, Dickinson and Company

- Cabot Technology Solutions

- GE HealthCare

- Nordic

- BeeKeeperAI

- BSCO Industries, Inc.

- Epic Systems Corporation

Recent Developments

-

In December 2025, The Ministry of Health and Family Welfare announced steps to expand the use of AI‑based diagnostic tools in India, including establishing AI Centres of Excellence and deploying solutions for diabetic retinopathy, chest X‑ray classification, and tuberculosis screening. The national telemedicine platform eSanjeevani has integrated an AI‑enabled Clinical Decision Support System to improve tele‑consultation quality and standardized care

-

In April 2025, Becton, Dickinson and Company launched next-generation HemoSphereAdvanced Monitoring Platform, integrating AI-driven clinical decision support to enhance real-time hemodynamic monitoring.

“Research over the past two decades has demonstrated the wide variability of the lower limit of cerebral blood flow autoregulation between individuals, as well as the risk for patient morbidity and mortality when blood pressure is maintained below this threshold.”

- Dr. Charles Hogue, chairman of the Department of Anesthesiology at Northwestern University Feinberg School of Medicine in Chicago

-

In December 2023, EBSCO Information Services launched the Dyna Innovation Center in the U.S. to promote advancements like the integration of AI, in clinical decisions.

-

In October 2023, Wolters Kluwer Health launched AI Labs, a collective resource to integrate generative AI with UpToDate, its CDS solution, enabling medical professionals to make better-informed decisions.

“Our goal for UpToDate is to continuously improve how we present and deliver content to best support informed decision-making at the point of care. “

- Greg Samios, President and CEO of Clinical Effectiveness, Wolters Kluwer Health.

-

In August 2023, GE HealthCare launched CardioVisio for Atrial Fibrillation, a patient-centric, digital CDS tool to allow precision care.

“Existing diagnosis and treatment care models for AFib have been shown to be complex, time consuming and disconnected with disparate guidelines and poor guideline adherence.”

-Eigil Samset, PhD, general manager, Cardiology Solutions, GE HealthCare

-

In February 2023, EBSCO Information Services launched new features in DynaMedex Mobile App to improve clinical decision support. These enhancements improve the mobile experience for users by enabling clinicians to deliver evidence-based patient care efficiently.

“With these updates, users can be confident that they are accessing the latest content updates while using their mobile device.”

-EBSCO Vice President of Product Management, Clinical Decisions, Julia Colpitts

Clinical Decision Support Systems MarketReport Scope

Report Attribute

Details

Market size value in 2026

USD 7.00 billion

Revenue forecast in 2033

USD 15.32 billion

Growth rate

CAGR 11.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, delivery mode, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MiddleEast and Africa

Country scope

U.S.; Canada, Mexico; Germany; UK; France; Italy; Spain; Norway, Sweden, Denmark, Japan; India; China; Australia; Thailand; South Korea; Brazil; Argentina, South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

McKesson Corporation; Cerner Corporation; Siemens Healthineers GmbH; Allscripts Healthcare, LLC; athenahealth, Inc.; NextGen Healthcare Inc.; Koninklijke Philips N.V. (Royal Philips); IBM Corporation; Agfa-Gevaert Group; Wolters Kluwer N.V., Becton, Dickinson and Company, Cabot Technology Solutions, GE HealthCare, Nordic, BeeKeeperAI, BSCO Industries, Inc., Epic Systems Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Clinical Decision Support Systems Market Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global clinical decision support systems market report on the basis of product, application, delivery mode, component, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Standalone CDSS

-

Integrated CPOE with CDSS

-

Integrated EHR with CDSS

-

Integrated CDSS with CPOE & EHR

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug-drug interactions

-

Drug allergy alerts

-

Clinical reminders

-

Clinical guidelines

-

Drug dosing support

-

Others

-

-

Delivery Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Web-based Systems

-

Cloud-based Systems

-

On -premise Systems

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Software

-

Services

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the clinical decision support systems market growth include rising demand for quality care and integrated reliable technical solutions. Increasing adoption of information systems by hospitals and healthcare institutes and favorable initiatives taken by several governments worldwide are also stimulating the growth of the market.

b. The global clinical decision support systems market size was estimated at USD 6.36 billion in 2025 and is expected to reach USD 7.0 billion in 2026.

b. The global clinical decision support systems market is expected to grow at a compound annual growth rate of 11.8% from 2026 to 2033 to reach USD 15.32 billion by 2033.

b. North America dominated the clinical decision support systems market with a share of 43.13% in 2025. This dominance is fueled by the rising demand for IT solutions in healthcare and the emphasis on delivering quality healthcare services. Rapid technological advancements further drive market growth. Initiatives promoting CDSS adoption, like EBSCO Information Services' Dyna Innovation Center launch in December 2023, contribute to regional market expansion.

b. Some key players operating in the clinical decision support systems market include McKesson Corporation; Cerner Corporation; Siemens Healthineers GmbH; Allscripts Healthcare, LLC; athenahealth, Inc.; NextGen Healthcare Inc.; Koninklijke Philips N.V. (Royal Philips); IBM Corporation; Agfa-Gevaert Group; Wolters Kluwer N.V., Becton, Dickinson and Company, Cabot Technology Solutions, GE HealthCare, Nordic, BeeKeeperAI, BSCO Industries, Inc., and Epic Systems Corporation

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.