- Home

- »

- Clinical Diagnostics

- »

-

Clinical Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Clinical Diagnostics Market Size, Share & Trends Report]()

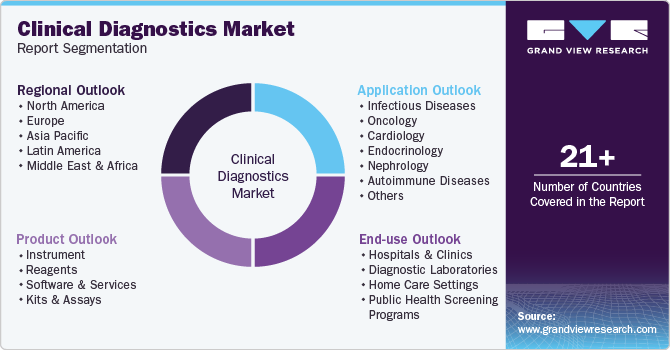

Clinical Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instrument, Reagent), By Application (Infectious Disease, Oncology), By End Use (Hospitals & Clinics, Diagnostic Laboratory, Home Care Settings), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-495-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Clinical Diagnostics Market Summary

The global clinical diagnostics market size was estimated at USD 115.51 billion in 2024 and is anticipated to reach USD 169.23 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. The global clinical diagnostics industry is anticipated to witness growth over the forecast period, driven by the development of specialized tests for early disease detection and disease management and increasing demand for lab automation.

Key Market Trends & Insights

- The North America clinical diagnostics industry dominated with a revenue share of 47.5% in 2023.

- Europe clinical diagnostics industry was identified as a lucrative region in this industry.

- By product, the instruments segment dominates the clinical diagnostics industry and contributed to 46.6% of the market share in 2023.

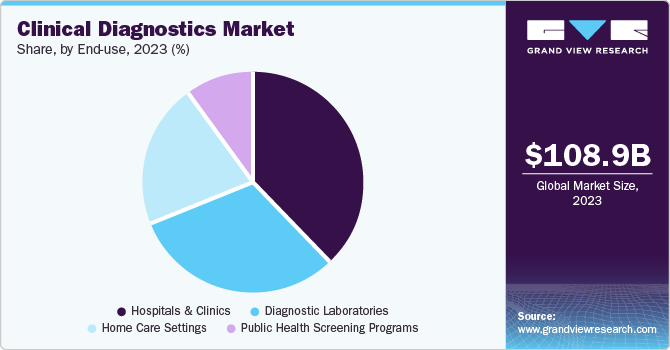

- By end use, the hospital segment dominated the end use segments with a market share of 38.3% in 2023.

- By application, the infectious dominated the market and accounted for a share of 29.5% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 115.51 Billion

- 2030 Projected Market Size: USD 169.23 Billion

- CAGR (2025-2030): 6.6%

- North America: Largest market in 2023

Furthermore, the rapidly rising use of point of care diagnostic products also has introduced a decentralization trend in the healthcare industry. Other key factors driving the market are the growing rate of chronic diseases such as diabetes, heart failure, and colon cancer, increasing demand for personalized medicine expanding geriatric population base, and growing patient awareness towards disease diagnosis.

The clinical diagnostics market is experiencing a growing demand for lab automation. Automated laboratory systems offer several advantages, including increased efficiency, reduced human errors, and improved turnaround times for test results. As healthcare providers strive to deliver faster and more accurate diagnoses, the integration of automated systems has become increasingly important. Lab automation streamlines processes, enhances productivity, and enables more extensive testing capabilities. This trend towards lab automation is driving the market for clinical diagnostics.

In 2024, AI-powered diagnostic tools will revolutionize the interpretation of medical images with exceptional accuracy. These advanced tools, utilizing cutting-edge machine learning algorithms, have gained extensive recognition and secured numerous FDA approvals, particularly in the field of radiology. The capability of AI to analyze both structured and unstructured data has significantly transformed healthcare, establishing it as an essential resource in the industry. For instance, in May 2024, iHridAI introduced its premier product, HarmonyCVI, designed for precise and thorough cardiovascular evaluations. HarmonyCVI is an advanced diagnostic and insights tool utilizing artificial intelligence (AI) and machine learning to support cardiologists and radiologists in the detailed analysis of cardiac MRI scans.

The integration of AI in diagnostics has profound implications, not just in improving disease diagnosis but in transforming patient care as a whole. AI enables medical professionals to create more personalized and effective treatment plans, thereby enhancing the overall healthcare experience for patients. In 2024, numerous real-world examples demonstrate the success of AI-driven treatment plans in improving patient care. In oncology, for instance, AI models that combine clinical data, pathology, imaging, and genetics have enabled more accurate prognoses and personalized cancer treatments. These advancements represent a significant leap forward in precision medicine, offering hope for more effective and targeted therapies.

Drivers, Opportunities & Restraints

The rising cases of chronic diseases such as cancer, cardiovascular diseases, diabetes, and respiratory diseases are significantly driving the demand for clinical diagnostic services. Early and accurate diagnosis plays a crucial role in managing these conditions effectively. As the global population ages and lifestyle factors contribute to the increased incidence of chronic illnesses, healthcare systems are witnessing a surge in the need for diagnostic tests to detect, monitor, and guide treatment strategies. For instance, a February 2022 report by the World Health Organization revealed that around 400,000 children and adolescents between the ages of 0 and 19 are diagnosed with cancer annually. The report further highlighted that the most prevalent forms of childhood cancers include leukemias, brain cancers, lymphomas, and solid tumors.

As per the Centers for Disease Control and Prevention (CDC), in the U.S., four in ten adults have two or more chronic diseases, and six in ten adults have a chronic disease. Chronic diseases such as cancer, respiratory diseases, and diabetes. In another instance, there were approximately 20 million new cases of cancer globally, and nearly 10 million deaths were attributed to cancer. According to International Agency on Cancer research (IARC) demographic-based projections indicated that the annual number of new cancer cases would escalate to 35 million by 2050, representing a 77% increase from the year 2022. Lung cancer was the most commonly diagnosed cancer type in 2022, accounting for nearly 2.5 million new cases or one in eight cancers worldwide 12.4% of all cancers globally. Thus, the rising prevalence of various diseases is fueling market growth.

An article published by the World Health Organization (WHO) in September 2023 highlights, 17 million individuals lose their lives to non-communicable diseases (NCDs) before the age of 70, with a staggering 86% of these premature deaths occurring in low- and middle-income nations. Overall, 77% of all NCD-related fatalities take place in low- and middle-income countries. Cardiovascular diseases claim the highest number of lives each year, causing 17.9 million deaths, followed by cancer at 9.3 million deaths, chronic respiratory disorders at 4.1 million deaths, and diabetes along with diabetes-induced kidney disease accounting for 2.0 million deaths. As the prevalence of these diseases continues to rise, the need for accurate and timely diagnosis has become increasingly crucial, driving a higher demand for clinical diagnostic tests and equipment to facilitate early detection and proper disease management.

Point-of-care (POC) diagnostic products have revolutionized the clinical diagnostics market by enabling rapid and convenient testing at the patient's bedside or in remote locations. These products are designed to provide immediate results, allowing for faster decision-making and treatment initiation. The availability of user-friendly point-of-care (POC) hematological tests offers a twofold benefit. Firstly, it reduces the necessity for extensive user training, making it easier for healthcare professionals to operate these diagnostic tools effectively. Secondly, POC tests enable remote testing, allowing medical assessments to be conducted beyond traditional clinical settings. For instance, in January 2023, Seamaty highlighted the success of their SD1 Auto Dry Chemistry Analyzer in the market, this POC instrument excels at providing precise medical diagnoses. Notably, the streamlined tests significantly decrease the turnaround time, enhancing efficiency in patient care.

The ongoing technological advancements are aimed at delivering safer diagnosis with the less turnaround times and maximum efficiency. For instance, in July 2023, Beckman Coulter launched the DxI 9000 Access Immunoassay Analyzer, designed to address demands for speed, reliability, reproducibility, quality, and menu expansion. The analyzer can run up to 215 tests per hour per square meter and features ZeroDaily Maintenance and PrecisionVision Technology for improved performance and data integrity. Such advancements are anticipated to drive clinical diagnostics market growth.

Several laboratories are adopting automation to improve efficiency and standardize the process. For instance, in May 2023, Siemens Healthineers launched next-generation hematology analyzers, the Atellica HEMA 570 and Atellica HEMA 580, designed to streamline workflow and accelerate patient results. These analyzers offer advanced automation and intelligence to break down barriers that hinder efficiency and speed in hematology testing. This is anticipated to contribute to a heightened demand for automation, which would help the market drive market growth.

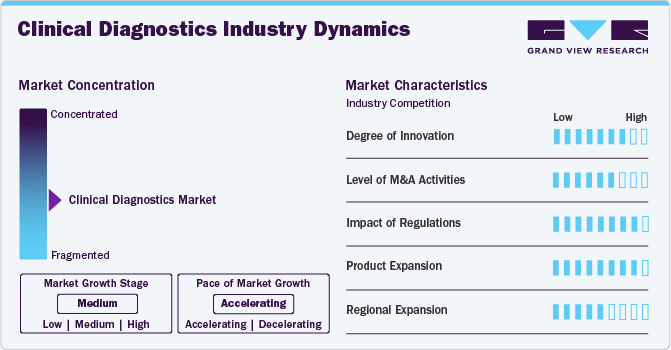

Market Concentration & Characteristics

The market is characterized by high levels of innovation, including the frequent development and introduction of novel products and diagnostic technologies like handheld analyzers, fluorescent probes, and nanoparticle-based reagents, which define the global clinical diagnostics industry. Key players are investing in innovative methods and technologies to meet the global demand of the market.

The market is characterized by the leading players with moderate levels of product launches and merger and acquisition (M&A) activity. Market players like Siemens, Healthineers, and Abbott are involved in new product launches and merger and acquisition activities. Such strategic activities as M&A, partnership, and collaboration are only serving to increase companies competitiveness, and expand their geographic reach, and help to enter new territories.

Regulatory factors, including medical device regulations, patient safety standards, documentation requirements, and hygiene standards, have a high impact on the clinical diagnostics market. Stringent regulatory requirements ensure that diagnostic instruments and reagents meet strict safety and efficacy standards, protecting patients from potential harm or inaccurate results. Regulations mandate rigorous quality control measures, including validation studies, manufacturing controls, and post-market surveillance, ensuring the consistent performance and reliability of diagnostic products.

Clinical diagnostics products have experienced significant product expansion driven by standardization and design advancements. This means developing new and improved things to help doctors and nurses care for patients' better health during medical procedures. For instance, liquid biopsies, which analyze circulating tumor cells, cell-free DNA, or other biomarkers present in blood or other bodily fluids, are gaining traction as a less invasive alternative to traditional tissue biopsies. These techniques could potentially replace or complement certain diagnostic procedures, particularly in cancer diagnostics and monitoring.

The end user concentration factor is crucial for any manufacturer in the market space. Hospitals highly utilize clinical diagnostics products. These facilities use imaging modalities for monitoring illness and chronic disease and rare conditions in prognosis of different patient populations, interventional procedures, and diagnostic purposes.

Product Insights & Trends

The instruments segment dominates the clinical diagnostics industry and contributed to 46.6% of the market share in 2023. Advanced diagnostic instruments, such as automated analyzers and molecular diagnostic tools, offer high precision, speed, and reliability in detecting diseases, leading to their widespread adoption in clinical laboratories. Continuous technological advancements in instrumentation, including integration of artificial intelligence and machine learning, enhance diagnostic capabilities, making them indispensable for accurate and efficient patient care. Moreover, the growing prevalence of chronic diseases and the rising demand for early and precise diagnosis drive the need for sophisticated diagnostic instruments. Additionally, the expansion of healthcare infrastructure, particularly in developing regions, fuels the demand for advanced diagnostic equipment. Lastly, the increasing focus on personalized medicine and the growing trend towards automation in laboratories further bolster the dominance of the instruments segment of the market.

The software services are expected to witness the fastest growth with a CAGR of 7.2% during the forecast period. As the software solutions are revolutionizing the way laboratories and healthcare facilities manage and analyse diagnostic data, enabling more efficient and accurate testing processes. Services such as Laboratory Information Management Systems (LIMS) are comprehensive software platforms designed to streamline and automate various laboratory processes, including sample tracking, data management, workflow optimization, and reporting. Further the software solutions are driving significant advancements in image acquisition, processing, and interpretation. These software tools are essential for various imaging modalities, including image acquisition and processing and seamless integration with electronic health records and other.

End Use Insights & Trends

The hospital segment dominated the end use segments with a market share of 38.3% in 2023. This is attributable to growing clinical diagnostics demand in hospital based medical labs for disease diagnosis, blood cell counts, detecting illegal drug use, protein analysis, blood typing and monitoring therapeutic drug levels along with detecting the presence of antibodies. The growing demand for emergency facilities and the increasing incidence of emergency situations requiring immediate attention, such as road accidents and sudden cardiovascular events. Furthermore, with the increasing number of patients suffering from lifestyle and chronic diseases, specialized outpatient clinics are registering significant growth. These clinics offer targeted care for specific conditions, allowing for more personalized treatment plans and improved outcomes.

The home care settings segment is anticipated to expand at a rapid pace over the forecast period. The segment is driven by several key factors including the rise of chronic diseases, aging population, technological advancements, and the desire for more convenient and accessible healthcare options. This market is poised to expand substantially over the next few years, offering innovative solutions that allow patients to manage their health conditions at home, thereby reducing the need for frequent hospital visits and lowering healthcare costs. I addition, innovations in home healthcare, including the integration of AI into home diagnostic devices, offer advanced features such as real-time analysis of results, personalized recommendations, and early disease detection capabilities.

Application Insights & Trends

The infectious dominated the market and accounted for a share of 29.5% in 2023. The diseases such as HIV, HPV, Hepatitis B and C, influenza, and flu which are forms of STDs are increasing, therefore leading to the rise in demand for clinical diagnostics. Furthermore, advances in the disease identification such as metagenomic NGS is being used in clinical settings to identify pathogens in plasma cell-free DNA, demonstrating its potential for diagnosing infectious diseases. Furthermore, manufacturers are involved in gaining product approvals. For instance, in December 2022, bioMérieux announced the CE marking approval for its VIDAS Kube immunoassay platform, which is used to run a variety of immunoassays, including assays for the detection of antibodies to infectious diseases. This innovation is aimed at improving clinical labs by helping to speed up patient care diagnostics.

The oncology segment is expected to register the fastest CAGR of 8.3% during the forecast period. The increasing prevalence of cancer across the globe, with a staggering 1.9 million new cases and 609,000 cancer-related deaths projected to occur in the U.S. alone in 2023 is likely to fuel the segment growth. According to the American Cancer Society, one in nine people are likely to develop cancer at some point in their lifetime. Early detection is crucial in the fight cancer. However, current screening methods, such as low dose computed tomography (LDCT) scans, have limitations in terms of accuracy, accessibility, and cost-effectiveness. Manufacturers are working on developing and introducing non-invasive and potentially more accessible approach to cancer screening. For instance, in October 2023, Delfi Diagnostics launched FirstLook Lung, a blood-based test designed to enhance lung cancer screening through a routine blood test. The test uses machine learning and whole-genome sequencing to analyze DNA fragment patterns in the blood, which can help identify individuals who are likely to have lung cancer.

Regional Insights & Trends

The North America clinical diagnostics industry dominated with a revenue share of 47.5% in 2023. This high share is attributable to increasing prevalence of cancer; for instance, the global number of cancer sufferers is predicted to rise with cancer being one of the largest cause of cancer death worldwide, with an estimated cancer cases in the U.S. reaching 1.9 million in 2022. The rising incidence of chronic diseases such as anemia, hemophilia, leukemia, sickle-cell anemia, lymphomas, and several infections has contributed to the emerging demand for clinical diagnosis. For instance, according to National Association of Chronic Disease Directors, approximately 60% of the U.S. population, equating to 150 million Americans, suffered from at least one chronic disease as of 2022. Thus, these factors are poised to bring need for clinical diagnostics in the forecast period.

U.S. Clinical Diagnostics Market Trends

The clinical diagnostics industry’s growth in the U.S. is primarily driven by the rise of patient centered treatment assays and personalized diagnostics, and the emergence of blood related disorders. The growing burden of VCXhealthcare cost for treating chronic diseases amongst the population, for instance, a recent study found that the treatment of the seven most prevalent chronic diseases, combined with lost productivity, is projected to incur a significant economic burden of USD 2.00 trillion, USD 8,600 per person annually on the U.S. by 2030. Thus, the market is driven by demographic changes, disease prevalence, and technological advancements. The market's expansion reflects the increasing importance of early disease detection and management in modern healthcare.

Europe Clinical Diagnostics Market Trends

Europe clinical diagnostics industry was identified as a lucrative region in this industry. Driven by the increasing awareness of point-of-care testing, high sensitivity and specificity of in vitro diagnostic tests, and growing adoption of clinical diagnostics. Market player such as Abbott Laboratories, BD, bioMérieux SA, Bio-Rad Laboratories, Inc., Danaher Corporation, Siemens AG are driving the market in the region by undertaking various strategic initiatives and investing heavily in advanced diagnostics technologies and offering a broad portfolio.

The UK clinical diagnostics market is anticipated to witness significant growth over the forecast period due to the presence of several small and medium-sized companies that significantly contribute to the economy. The government in the region is working on introducing various diseases diagnosis frameworks in the region. For instance, NHS England’s the Faster Diagnosis Standard (FDS) is a program aimed at ensuring that patients referred for suspected cancer are diagnosed or have cancer ruled out within 28 days. The East of England Cancer Alliance is supporting the implementation of this standard to improve patient outcomes and reduce unwarranted variation in cancer diagnosis. The program further aimed to achieve 75% FDS performance by March 2024, with a focus on improving patient experience, reducing unwarranted variation, and increasing early diagnosis. Such interventions are creating awareness for early diagnosis thus driving the market in the region.

The clinical diagnostics market in Germany is expected to grow over the forecast period. With the ongoing developments in the regions and the country's strong healthcare infrastructure, focus on innovation, and increasing investment in the healthcare sector. The market's expansion reflects the growing importance of early disease detection and management in modern healthcare. Global players such as F. Hoffmann-La Roche Ltd., Danaher, and Abbott are consistently involved in carrying out strategic mergers and collaborations in the regions, which is anticipated to create lucrative opportunities in Germany.

Asia Pacific Clinical Diagnostics Market Trends

Asia Pacific clinical diagnostics industry is anticipated to witness significant growth during the forecast period. The rising prevalence of chronic diseases in the Asia-Pacific region is significant, with cardiovascular diseases (CVD), diabetes, cancer, and chronic respiratory diseases being the most common non-communicable diseases (NCDs). According to World Heart Federation, CVD is the leading cause of death in the Asia-Pacific region, accounting for approximately 40% of all deaths. In August 2022, EU-ASEAN business council, published document titled "Transforming Diagnostics Access" focusing on the challenges and opportunities in improving access to diagnostics, particularly in low- and middle-income countries (LMICs). It emphasizes the critical role of diagnostics in healthcare, highlighting the need for equitable access to ensure better health outcomes. Further the effective partnerships between governments, private sector entities, donors, and civil society organizations are addressing the multifaceted challenges of improving diagnostics access in the region. In addition, the rising adoption of devices with new advanced features in emerging countries such as China, Japan, and India is anticipated to drive the market growth over the forecast period.

The clinical diagnostics market in China is expected to grow over the forecast period due to rise in per capita income leading to increased adoption of diagnostic and therapy products coupled with government initiatives to improve healthcare infrastructure are expected to fuel the regional market growth. For instance, in May 2022, Berry Oncology, a prominent Chinese firm specializing in genetic testing and early tumor screening, announced plans to introduce an early cancer screening product capable of detecting six prevalent tumor types simultaneously within the year. This advancement is part of the company's ongoing efforts to enhance screening performance and optimize its proprietary HIFI technology, aiming to identify more than 20 tumor types through a single blood draw in the future. Furthermore, China's rapidly evolving healthcare landscape and patient needs played a significant role in driving the market growth.

The Japan clinical diagnostics market is expected to grow over the forecast period due the presence of some major companies, such as Sysmex Corporation, Sekisui medical Co., Ltd, Morimoto pharma offering molecular and clinical diagnostics kits. For instance, in Japan, in June 2022, Japanese company Sysmex introduced its XR-series in June 2022, a flagship model that integrates sample sorting, sample archiving, and automated quality transportation capabilities into one device, enhancing the efficiency and smoothness of diagnostic procedures. This innovative product has developed interest from government organizations, academic institutions, and research centers. As a result, major players in the market are employing strategies such as mergers and acquisitions, partnerships, and collaborations to remain competitive in the industry.

Latin America Clinical Diagnostics Market Trends

The clinical diagnostics market in Latin America is expected to grow substantially over the forecast period. The increasing demand for Point-of-care diagnostic tests in the developing countries like Brazil and Argentina due to their ease of use, rapid results. The high prevalence of infectious diseases such as dengue and HIV is also driving factor for the rise in number of people opting for specialized test kits in order to diagnose disease earlier.

The clinical diagnostics market in Brazil is expected to grow substantially over the forecast period. The Brazilian healthcare landscape is witnessing a surge in the development and adoption of specialized diagnostic tests aimed at enabling early disease management. Driven by the growing burden of chronic and infectious diseases, as well as the recognition of the importance of preventive care, Brazil has become a hub for innovative diagnostic solutions. Domestic and international companies are actively investing in research and development efforts to create highly sensitive and specific tests that can detect diseases at their earliest stages.

MEA Clinical Diagnostics Market Trends

The MEA clinical diagnostics industry is estimated to grow at a significant CAGR owing to adoption of technologically advanced products in countries such as UAE and rest of GCC. The market in MEA is shifting towards higher adoption of personalized medicine and the growing use of AI in laboratories for the diagnostics and management of disease treatment.

The UAE clinical diagnostics market has recently witnessed a surge in investment in cutting-edge diagnostic technologies, such as next-generation sequencing (NGS), liquid biopsy, and biomarker analysis. These innovative technologies offer improved accuracy, sensitivity, and specificity in disease detection, enabling more effective treatment strategies and better patient outcomes. In January 2023, Sheikh Shakhbout Medical City (SSMC) in the UAE formed a joint venture with Abu Dhabi Health Services Company (SEHA) and Mayo Clinic to launch a public awareness campaign highlighting the significance of screening and prevention during colorectal cancer awareness month. This initiative underscores the importance of timely detection and diagnosis, which in turn drives the demand for IVD (In Vitro Diagnostic) solutions for cancer diagnosis, thereby fueling the growth of the segment over the forecast period.

Key Clinical Diagnostics Company Insights

Some of the key players operating in the market include Abbott; Beckman Coulter, Inc.; Siemens Healthineers; Mindray Medical International Limited; F. Hoffmann-La Roche Ltd; Sysmex Corporation; Bio-Rad Laboratories; and Quest Diagnostics Incorporated. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New product developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

-

F. Hoffmann-La Roche Ltd. develops and manufactures diagnostic & pharmaceutical products. It has 26 manufacturing sites globally with two business segments: pharmaceuticals and diagnostics. The pharmaceutical segment manufactures drugs for infectious diseases, cardiovascular, respiratory, & metabolic disorders, cancer, and central nervous system & autoimmune diseases. Roche Diagnostics is involved in various fields ranging from patient self-monitoring to clinical laboratory systems. Roche Professional Diagnostics (RPD) is the company’s largest business segment and provides solutions, tests, & instrument systems to enable reliable & cost-effective delivery of results. Ventana Medical Systems, a member of Roche Group, is involved in developing assays & kits for in situ hybridization. It has operations in several regions, including North America, South America, Europe, Africa, Asia, and Oceania.

-

QIAGEN is a biotechnology company operating in over 20 countries globally. Key business areas of the company include assay technologies for molecular diagnostics, pharmaceutical, academic, and applied testing. Furthermore, molecular technologies developed by the company are being utilized by forensic technicians, and the company is also involved in the isolation of genetic material from biological samples.

-

Danaher designs, manufactures, and commercializes products as well as services catering to medical, professional, and commercial applications. The company operates through four segments: diagnostics, life sciences, environmental & applied solutions, and dental solutions. Danaher’s diagnostics segment offers reagents, analytical instruments, software, consumables, and services for physicians’ offices, hospitals, reference laboratories, and other critical care settings to diagnose various diseases.

-

bioMérieux is a multinational biotechnology company that specializes in the field of IVD for medical and industrial sectors. The company designs, develops, and produces diagnostic systems and provides diagnostic solutions such as reagents, instruments, and software. Its products are widely used for diagnosing infectious diseases, testing for cardiovascular disorders, and screening & monitoring cancer. Currently, it has operations in more than 150 countries through its distribution network and 42 subsidiaries.

QuidelOrtho Corporation, Trinity Biotech, Sekisui Diagnostics, OraSure Technologies Inc., Spectral Medical, Inc. are some of the emerging companies in the clinical diagnostics market.

-

QuidelOrtho Corporation develops and distributes POC diagnostic solutions for diseases such as group A streptococcus & influenza. It offers molecular diagnostic products & immunoassays for hospital-acquired infections, lesions, respiratory disorders, women's health, STDs, bone health, colorectal cancer, and gastrointestinal disorders. It delivers products in the U.S. through local distributors. It operates in various regions, including North America and Europe.

-

Trinity Biotech is involved in developing, manufacturing, and distributing medical and POC diagnostic device. It offers diagnostic tests and instrumentation for infectious diseases, hemoglobin assays, and molecular assay kits. In addition, the company provides reagents for detection of liver and kidney dysfunction. The company’s Uni-Gold HIV test is widely used for the detection of HIV antibodies. The company also sells raw materials to companies engaged in life sciences research. It has a large distribution network worldwide. Its client base includes hospitals, reference laboratories, and healthcare practitioners. The company operates in several countries, including Ireland, the U.S., and Canada.

-

Sekisui Diagnostics focuses on developing & manufacturing research and diagnostic products for coagulation, thrombosis, hemostasis, and oncology. The company was formerly known as Genzyme Diagnostics, Inc., which was changed to Sekisui Diagnostics in February 2011. At The company currently operates in various regions, including North America, Europe, and Asia Pacific.

Key Clinical Diagnostics Companies:

The following are the leading companies in the clinical diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- bioMérieux SA

- QuidelOrtho Corporation

- Siemens Healthineers AG

- Bio-Rad Laboratories, Inc.

- Qiagen

- Sysmex Corporation

- Charles River Laboratories

- Quest Diagnostics Incorporated

- Agilent Technologies, Inc.

- Danaher Corporation

- BD

- F. Hoffmann-La Roche Ltd.

Recent Development

-

In June 2024, Qiagen confirmed the plan of regulatory submission of a new panel for syndromic diagnosis of meningitis in the U.S. in 2024. Additionally, new mini panels are also expected to be submitted for U.S. approval in 2024

-

In May 2024, Danaher collaborated with John Hopkins University to develop new methods to diagnose Traumatic Brain Injury. The scientists at the John Hopkins University would focus on evaluating new blood-based biomarkers leveraging highly sensitive technology from Beckmann Coulter.

-

In December 2023, Sysmex expanded its sales in Europe, which consisted of the reagents used in blood testing for identification of the Amyloid Beta, and Sysmex corporation developed concentrated reagents for hematology analyzers.

-

In July 2023, SEKISUI Diagnostics, introduced the OSOM COVID-19 Antigen Home Test, a lateral flow immunoassay for diagnosis of SARS-CoV-2 virus.

-

In May 2023, Siemens Healthineers launched next-gen hematology analyzers products. The products include Atellica HEMA 580 and 570 analyzers. The analyzer provides intuitive interfaces & multi-analyzer automation connectivity to remove workflow roadblocks supporting faster results.

-

In March 2023, Quidel Corporation received a De Novo authorization from the U.S. Food and Drug Administration (FDA) to commercialize its innovative Sofia 2 SARS Antigen+ FIA test. This groundbreaking test is the first rapid antigen test to be approved by the FDA for COVID-19 diagnosis and is designed for use only in point-of-care settings, where a prescription is required.

-

In March 2022, Mindray launched a revolutionary hematology analyzer series new BC-700 Series, incorporating both erythrocyte sedimentation rate (ESR) tests and complete blood count (CBC).

Clinical Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 122.63 billion

Revenue forecast in 2030

USD 169.23 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; bioMérieux SA; QuidelOrtho Corporation; Siemens Healthineers AG; Bio-Rad Laboratories, Inc.; Qiagen; Sysmex Corporation; Charles River Laboratories; Quest Diagnostics Incorporated; Agilent Technologies, Inc.; Danaher Corporation; BD; F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Diagnostics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global clinical diagnostics market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instrument

-

Blood Gas Analyzers

-

Hematology Analyzers

-

Clinical Chemistry Analyzers

-

Immunoassay Analyzers

-

Urine Analyzers

-

Coagulation Analyzers

-

Microscopes

-

Flow Cytometers

-

PCR

-

Sequencing Instruments

-

Elisa

-

Mass Spectrometers

-

Automated Plate Readers

-

Spectrophotometers

-

Centrifuges

-

Electrophoresis Equipment

-

Point-of-Care Testing (POCT) Devices

-

Ultrasound Machines

-

CT (Computed Tomography) Scanners

-

MRI

-

X-ray Machines

-

Others

-

-

Reagents

-

Taq Polymerase

-

MMLV RT

-

HIV RT

-

Hot Start Taq Polymerase

-

UNG

-

RNAse Inhibitors

-

BST Polymerase

-

PCR Master Mix

-

Lyophilized Polymerase

-

T7 RNA Polymerase

-

Cas9 Enzyme

-

Acid Phosphatase

-

Alanine Aminotransferase

-

Amylase

-

Angiotensin Converting Enzyme

-

Aspartate Aminotransferase

-

Cholinesterase

-

Creatinine Kinase

-

Gamma Glutamyl Transferase

-

Lactate Dehydrogenase

-

Renin

-

Glucose Oxidase/Glucose Dehydrogenase

-

Urease

-

Lactate Oxidase

-

Horseradish Peroxide

-

Glutamate Oxidase

-

Others

-

-

Software and services

-

Laboratory Information Management Systems

-

Diagnostic Imaging Software

-

Data Analysis Software

-

In Vitro Diagnostics Quality Control

-

-

Kits and assays

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

HIV

-

Clostridium Difficile

-

HBV

-

Pneumonia or Streptococcus Associated Infections

-

Respiratory Syncytial Virus (RSV)

-

HPV

-

Influenza/Flu

-

HCV

-

MRSA

-

TB and Drug-resistant TB

-

HSV

-

COVID-19

-

Other Infectious Diseases

-

-

Oncology

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Lung Cancer

-

Prostate Cancer

-

Skin Cancer

-

Blood Cancer

-

Kidney Cancer

-

Liver Cancer

-

Pancreatic Cancer

-

Ovarian Cancer

-

Others

-

-

Cardiology

-

Endocrinology

-

Nephrology

-

Autoimmune Diseases

-

Hematology

-

Toxicology

-

Neurology

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Inpatient and Outpatient

-

Emergency Rooms

-

-

Diagnostic Laboratories

-

Independent Laboratories

-

Reference Laboratories

-

-

Home Care Settings

-

At-home Testing Kits

-

Point-of-Care Devices

-

-

Public Health Screening Programs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical diagnostics market size was estimated at USD 108.98 billion in 2023 and is expected to reach USD 115.52 billion in 2024.

b. The global clinical diagnostics market is expected to grow at a compound annual growth rate of 6.6% from 2024 to 2030 to reach USD 169.23 billion by 2030.

b. North America dominated the clinical diagnostics market, with a share of 47.56% in 2023. This is attributable to rising healthcare awareness, a target population, and constant research and development initiatives.

b. Some key players operating in the clinical diagnostics market include Abbott, bioMérieux SA, QuidelOrtho Corporation, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Qiagen, Sysmex Corporation, Quest Diagnostics Incorporated, Agilent Technologies, Inc., Danaher Corporation, BD, F. Hoffmann-La Roche Ltd.

b. Key factors that are driving the market growth include technological advancements across various instruments and a rising number of emerging companies coming up with new technologies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.