- Home

- »

- Pharmaceuticals

- »

-

Clinical Nutrition Market Size, Share & Trends Report, 2030GVR Report cover

![Clinical Nutrition Market Size, Share & Trends Report]()

Clinical Nutrition Market Size, Share & Trends Analysis Report By Product (Parenteral, Enteral, Oral), By Application (Malabsorption/GI Disorder/Diarrhea, Cancer Care), By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-200-1

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Clinical Nutrition Market Size & Trends

The global clinical nutrition market size was estimated at USD 30.67 billion in 2023 and is projected to grow at a CAGR of 5.34% from 2024 to 2030. Rising prevalence of malnutrition is one of the major driving factors of the market growth. As per the World Health organization, in 2022, around 149 million children under 5 were estimated to be stunted, and 45 million were estimated to be wasted globally. The South Asia sub region experiences a large burden of malnutrition burden among children aged under 5 years. According to the UN, Asia’s undernourished population increased from 361.3 million in 2019 to 418.0 million in 2020, increasing the occurrence of undernourishment from 7.9% to 9.0%, respectively.

There has been a constant increase in the prevalence of chronic diseases, such as Alzheimer's disease, Attention Deficit Hyperactivity Disorder (ADHD), osteoporosis, osteoarthritis, central nervous system disorders, and other diseases, that require clinical dietary management. For instance, as per the data published by the Centers for Disease Control and Prevention (CDC) in August 2023, ADHD ranks among the most prevalent mental conditions in children, with approximately 6 million children aged 3 to 17 years having received a diagnosis at some point.

Similarly, according to an article published in the International Journal of Child Development and Mental Health in November 2022, the estimated ADHD prevalence in Thailand is around 4.2% to 8.1%, which is higher than the global average. This growing prevalence is encouraging manufacturers to develop advanced clinical nutrition products capable of fulfilling nutrient deficiency in patients with ADHD. For instance, in January 2021, SFI Health launched EQUAZEN PRO. It effectively promotes learning, concentration, and brain health in children and adolescents grappling with ADHD and related neurodiverse conditions.

Rising geriatric population is driving the demand for clinical nutrition across the globe. According to several NCBI studies, individuals aged over 65 years are at a greater risk of developing chronic illnesses such as Parkinson’s and nervous system disorders. According to the World Health Organization (WHO), the global population aged 60 years and above is expected to increase significantly from around 1 billion in 2020 to about 1.4 billion in 2030 and is further expected to almost double by 2050 to reach around 2.1 billion.

The number of elderly patients with critical illnesses has increased significantly over the past few years. The risk of malnutrition and frailty among the geriatric population with comorbidities, such as stroke, depression, and dementia, is much higher, mainly owing to various age-related changes in body composition and muscle mass.

Also, according to an NCBI article published in February 2022, the prevalence of malnutrition in hospitalized patients varies widely, ranging from 20% to 50%, depending on the specific diagnostic criteria and screening tools employed. Thus, professionals are maximizing options for clinical nutrition among the elderly, which is expected to boost the market over a forecast period.

Market Concentration & Characteristics

The market growth is moderate and the pace of growth is accelerating. The clinical nutrition market is characterized by the growing aging population, increasing prevalence of chronic diseases, focus on personalized nutrition, technological advancements, evolving government policies and regulations, patient-centered care approaches, and increasing nutritional awareness and patient & provider education.

The clinical nutrition sector is undergoing a transformation fueled by progress in medical research and technology. Key trends such as innovative formulations, personalized nutrition solutions, and the use of bioactive ingredients are emerging. Manufacturers are dedicating resources to R&D to produce products that not only fulfill fundamental nutritional requirements but also provide added health advantages. This emphasis on innovation is fostering competition among industry participants, resulting in a constant flow of new products and therapies tailored to various patient demographics.

For instance, in November 2023, FrieslandCampina Ingredients launched Nutri Whey ProHeat, a heat-stable whey protein using the latest microparticulation technology.

“Our latest ingredient innovation presents a big leap forward for medical nutrition and will enable manufacturers to provide patients with the unrivalled nutritional benefits of whey protein in an appealing, drinkable format. By using our unparalleled technological and applications expertise, we’ve been able to create a highly nutritious ingredient that will unlock new innovations in medical nutrition.”

- Vicky Davies, Global Senior Marketing Director,

Key players are implementing strategic initiatives, such as geographical expansion, innovations, collaborations, and partnerships to strengthen their market presence. For instance, in February 2023, Neslte and EraCal Therapeutics entered into a research collaboration to identify novel nutraceuticals relevant to controlling food intake. Similarly, in In May 2020, AbbVie, a global biopharmaceutical company, acquired Allergan PLC. The acquisition helped the company strengthen its existing therapeutic categories and on-market & pipeline assets.

Regulations play a crucial role in shaping the clinical nutrition market. Manufacturers of medical foods must comply with all applicable FDA requirements for foods, including the following regulations:

-

Current good manufacturing practice (21 CFR part 110)

-

Registration of food facilities (21 CFR part 1 subpart H)

-

Thermally processed low-acid foods packaged in hermetically sealed containers (21 CFR part 113)

-

Acidified foods (21 CFR part 114)

-

Emergency permit control (21 CFR part 108).

The threat of substitutes is expected to be low for clinical nutrition products as they are specifically formulated to meet the unique nutritional needs of patients with specific medical conditions, providing a level of efficacy and precision that may not be available in substitutes.

Market players are focusing on geographical expansion to capture the untapped market. The expansion is generally done through launching manufacturing facilities in new geographies or through partnering with companies at the target location. For instance, in September 2023, Nutrisens Group strengthened its position as a major independent European platform in clinical nutrition with the acquisition of Vitasyn Medical GmbH, a German specialist focusing on nephrology and oncology. With this acquisition, Nutrisens is pursuing its European expansion, setting up a subsidiary in Germany (alongside those in France, Spain, Italy, and Portugal)

Product Insights

The oral nutrition segment held the largest revenue share of 53.29% in 2023. The rising prevalence of malnutrition among the adult population and the increasing instances of obesity and chronic diseases such as cancer and diabetes are some of the major factors boosting the market growth. The market leaders and innovators are involved in novel product launches to enhance productivity, durability, and quality, and improve the nutritional value of the food products. Along with the nutritional value, the manufacturers of clinical nutrition products are working to enhance and improve the taste of the products by incorporating different flavors.

Due to this, the demand for oral clinical nutrition products is rising, thereby driving the global market. For instance, in March 2021, Kate Farms launched two products covering Medi-Cal insurance for children and adults. The products, Kate Farms Standard 1.4 Vanilla and Plain, and Kate Farms Pediatric Peptide Vanilla Flavor 1.0 are indicated to treat nutrient deficiency in patients with chronic diseases such as allergies, malnutrition in adults, cancer, and gastrointestinal disorders. Such novel product inventions are expected to drive industry growth.

The parenteral nutrition segment is expected to grow at the fastest CAGR over a forecast period. Development of technically advanced parenteral nutrition (PN) products with barcode assistance, growing preference for PN over enteral nutrition in patients, shorter hospital stays, and reduced risk of infection are some of the factors boosting the product demand, thereby driving the market growth.

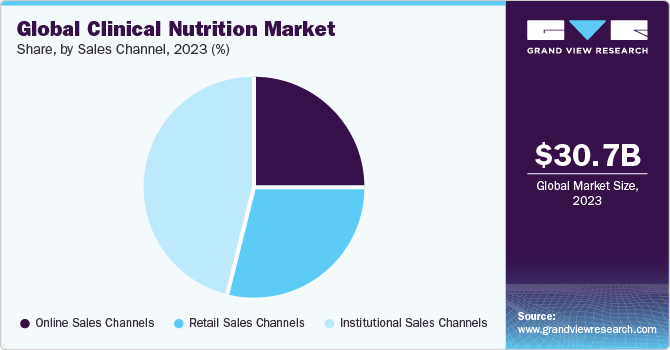

Sales Channel Insights

The institutional sales channel segment held the largest market share of 46.45% in 2023. Institutions that purchase clinical nutrition products include hospitals, long-term care centers, hospices, and disability facilities. The purchase decision of enteral or parenteral nutrition is influenced by doctors.Furthermore, the growing number of private and public institutions and the increasing chronic disease patient population across the globe are propelling the segment. An August 2021 article notes, "The majority of medical food sales are to institutions: hospitals, nursing homes, and home care settings.

As per, the report published by the Danone, reveals that medical foods for various applications are distributed through specialized distributors in hospitals, clinics, and pharmacies, resulting in the majority of sales generated through institutional channels, primarily hospitals and clinics.

The online sales channel segment is anticipated to witness the fastest growth during the forecast period.There is a shift in the trend of direct selling to customers via e-commerce platforms. The preference for online purchase of enteral feeding formula is rising owing to the convenience offered by this sales channel. Although consumed under medical surveillance, these products are intended for long-term nutrition management, resulting in growing sales through e-commerce.

As per, the report published by the Nestle in 2021, the retail sales of company was about 7.1% and e-commerce sales grew to 16.6%.

Application Insights

The cancer care segment accounted for 15.13% of global revenue in 2023. Rising prevalence of cancer is the major factor driving the segment growth. According to the Pan America Health Organization, in North America, around 4 million new individuals were diagnosed with cancer in 2020, and 1.4 million died due to the disease. Similarly, as per the statistics published by the American Cancer Society Journal in January 2023, around 609,820 people in the U.S. were anticipated to die from cancer in 2023.

In addition, by 2040, it is anticipated that the global burden of cancer is expected to surge to approximately 30 million new cases, with the most significant rises expected in low- and middle-income countries. These statistics underscore the increasing need for comprehensive strategies to address the growing cancer burden and provide support for affected populations worldwide. Furthermore, cancer weakens immunity and leads to loss of energy, which results in malnutrition in 40% to 80% of the cases. This affects the response to the treatment as well as increases treatment-related toxicity. Hence, to maintain nutrition and positive nitrogen balance, various types of clinical nutrition such as tube feeding are used.

The malabsorption/GI Disorder/Diarrhea segment is anticipated to grow at the fastest CAGR over the forecast period. Malabsorption typically means difficulty in digesting nutrients that are provided through food. Certain conditions are known to cause malabsorption, such as short bowel syndrome, cystic fibrosis, chronic pancreatitis, and Crohn’s disease. It can also lead to other illnesses if proper nutrients are unavailable in the body. In these cases, enteral nutrition via oral or tube/enteral feeding plays a vital role. It provides the body with necessary nutrients and helps in improving gut immunity. Many enteral feeds are available for malabsorption, for instance, Vital peptide 1.5 Cal by Abbott, which provides a therapeutic formulation that is useful for the treatment of malabsorption and other gastrointestinal disorders.

Regional Insights

North America dominated the global clinical nutrition market and accounted for a 32.62% revenue share in 2023. This can be attributed to the increasing geriatric population, which is more susceptible to chronic diseases, such as gastrointestinal disorders, metabolic disorders, and neurological disorders. According to the United Health Foundation, in 2022, about 17.3% of the population in the U.S. was aged 65 and above. Furthermore, around 56 million elderly people are expected to depend on clinical nutrition to fulfill their nutritional needs in the U.S. by 2030. Moreover, the growing number of premature infants in critical care is a major factor driving market growth. For instance, in 2022, CDC reported that approximately 10% of infants born in the U.S. were affected by preterm birth.

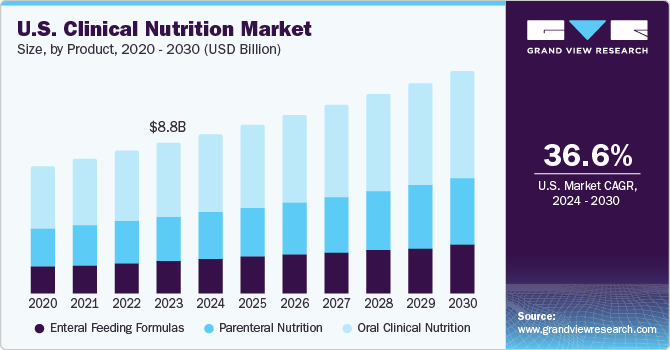

U.S. Clinical Nutrition Market Trends

The clinical nutrition market in the U.S. is expected to grow at a CAGR of 5.67% over a forecast period.The increasing prevalence of head & neck cancer across the U.S. is driving the adoption of medical foods. For instance, the American Cancer Society, in 2023, reported that approximately 54,540 new cases and 11,580 fatalities were attributed to oral cavity or oropharyngeal cancer in the U.S. Furthermore, rising demand for clinical nutrition formulas such as enteral feeding formulas by end users and the fact that enteral feeding is the safest way to help patients meet their nutritional requirements have positively influenced the market growth in this region.

The clinical nutrition market in Canada is anticipated to grow at a significant rate owing to an increase in the number of people suffering from malnutrition who require enteral nutrition support. Moreover, several initiatives are being undertaken to curb the incidence of disease-related malnutrition. The Canadian Malnutrition Task Force has developed a 2018-2023 strategic plan to develop best practices for nutrition care in Canada through collaborations and research. Such initiatives are expected to boost the market growth.

Asia Pacific Clinical Nutrition Market Trends

The clinical nutrition market in Asia Pacific is anticipated to witness significant growth over the forecast period. The region has a large patient pool and geriatric population. Lifestyle changes are leading to an increase in the prevalence of various diseases, such as cancer, diabetes, gastrointestinal disorders, and autoimmune diseases. As a result, the demand for clinical nutrition for the dietary management of chronic diseases is expected to increase.

The Japan clinical nutrition market is expected to grow at a significant rate owing to the increasing aging population in the country. As per the data published by the Ministry of Internal Affairs and Communications in October 2023, the number of people aged 65 and above as of September 15, 2023, stood at 36.2 million. Furthermore, supportive legislative changes in the country are also expected to positively impact the market. The Ministry of Health, Labour, and Welfare in Japan has established exclusive enteral and parenteral nutritional clinical guidelines for clinical nutrition. This is expected to drive the market over the forecast period.

The clinical nutrition market in China held a significant revenue share in 2023, owing to factors such as the rising geriatric population, increasing per capita healthcare expenditure, and growing prevalence of esophageal cancer. In addition, the growing incidence of preterm births and malnutrition is driving the adoption of clinical nutrition, thereby fueling the market growth. As per the data published by WHO in February 2018, China accounted for 1,172,300 preterm births.

The India clinical nutrition market is expected to grow during the forecast period. An increase in malnutrition and diabetes is expected to drive the market growth in India over the forecast period. According to the data published by the Indian Council of Medical Research - India Diabetes (ICMR INDIAB) in 2023, around 1.2 million people have diabetes.In addition, the growing prevalence of cancer due to excessive consumption of tobacco in India is likely to improve the adoption of clinical nutrition over the forecast period.

Key Clinical Nutrition Company Insights

Key players are adopting strategies such as new product developments, partnerships, and mergers & acquisitions to increase their market share. Companies such as Abbott; Pfizer Inc.; Bayer AG; Nestle S.A.; Baxter International Inc.; Otsuka Holdings Co., Ltd.; Mead Johnson & Company, LLC; and Danone dominate the market. These key players have been developing novel products to cater to different end-use applications.

For instance, in February 2023, Danone’s specialized nutrition business segment Nutricia developed its first plant-based ready-to-drink medical nutrition supplement “Fortimel”. The product is intended for people with malnourishment or those at risk of malnutrition due to medical conditions. Furthermore, key participants in the industry are embracing the strategy of M&A to strengthen their market presence.

For instance, in March 2023, Danone acquired ProMedica, a Poland-based company that specializes in providing care services for patients in their homes. This acquisition is part of Danone's lucrative specialized nutrition market expansion strategy, to strengthen its presence in Poland.

Key Clinical Nutrition Companies:

The following are the leading companies in the clinical nutrition market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Nutrition

- Pfizer Inc.

- Bayer AG

- Nestle

- Baxter International Inc.

- Otsuka Holdings Co., Ltd.

- Mead Johnson & Company, LLC

- Danone (Nutricia)

- Victus, Inc.

- Fresenius Kabi

- Meiji Holdings. Co., Ltd.

- Abbvie (Allergan)

- Baxter

- Grifols, S.A.

Recent Developments

-

In May 2024, Danone acquired Functional Formularies, a provider of whole food tube feeding solutions in the U.S., from Swander Pace Capital. This acquisition is a strategic component of Danone's Renew Strategy, enhancing the company's Medical Nutrition offerings in the U.S. market by broadening its portfolio of enteral tube feeding products.

-

In December 2023, Danone India launched new flavors of Protinex, which are free from added sugar. This move is in line with Danone's commitment to FSSAI's Eat Right Movement, to reduce sugar in its products by 20% by 2020. The HFD brand Protinex has been a trusted choice for Indian consumers for over six decades, and this new addition aims to provide healthier food options to its customers

-

In March 2022, Fresenius Kabi received FDA approval for the utilization of its SMOFlipid Lipid Injectable Emulsion in pediatric patients on parenteral nutrition.

-

In November 2020, B Braun and Grifols formed an alliance to enhance therapy safety & pharmacy production output. Grifols’ Kiro and B Braun’s Safe Infusion Systems would be combined to provide solutions for safe automated drug mixtures & delivery systems.

-

In February 2018, Fresenius Kabi AG offered a Euro 100,000 (USD 107,564) grant for supporting clinical nutrition research in Latin America. The research grant was created to aid hospitalized patients in the region who were severely malnourished.

Clinical Nutrition Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 32.32 billion

Revenue forecast in 2030

USD 44.17 billion

Growth rate

CAGR of 5.34% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway China; Japan; India; South Korea; Australia; Thailand; Brazil Mexico; Argentina; UAE; South Africa; Saudi Arabia; Kuwait

Key companies profiled

Abbott Nutrition; Pfizer Inc.; Bayer AG; Nestle; Baxter International Inc.; Otsuka Holdings Co., Ltd.; Mead Johnson & Company, LLC; Danone (Nutricia); Victus; Inc.; Fresenius Kabi; Meiji Holdings. Co., Ltd.; Abbvie (Allergan); Baxter; Grifols, S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Nutrition Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical nutrition market report based on product, application, sales channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Clinical Nutrition

-

Parenteral Nutrition

-

Carbohydrates

-

Parenteral Lipid Emulsion

-

Single Dose Amino Acid Solutions

-

Trace Elements

-

Vitamins & Minerals

-

-

Enteral Feeding Formulas

-

Standard Formula

-

Disease-specific Formulas

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer’s Disease

-

Nutrition Deficiency

-

Cancer Care

-

Diabetes

-

Chronic Kidney Diseases

-

Orphan Diseases

-

Dysphagia

-

Pain Management

-

Malabsorption/GI Disorder/Diarrhea

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Sales Channels

-

Online Sales Channels

-

Institutional Sales Channels

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical nutrition market size was estimated at USD 30.67 billion in 2023 and is expected to reach USD 32.32 billion in 2024.

b. The global clinical nutrition market is expected to grow at a compound annual growth rate of 5.34% from 2024 to 2030 to USD 44.17 billion by 2030

b. North America dominated the global clinical nutrition market and accounted for 32.62% share in 2023. Growth in the market can be attributed to the increasing geriatric population, which is more susceptible to chronic diseases, such as gastrointestinal disorders, metabolic disorders, and neurological disorders. Moreover, the growing number of premature infants is a major factor driving market growth.

b. Some of the key player operating in the market includes Abbott Nutrition, Pfizer Inc., Bayer AG, Nestle, Baxter International Inc., Otsuka Holdings Co., Ltd., Mead Johnson & Company, LLC, Danone (Nutricia), Victus, Inc., Fresenius Kabi , Meiji Holdings. Co., Ltd., Abbvie (Allergan), Baxter, Grifols, S.A.

b. Key factors driving the clinical nutrition market includes growing aging population, increasing prevalence of chronic diseases, focus on personalized nutrition, technological advancements, evolving government policies and regulations, patient-centered care approaches, and increasing nutritional awareness and patient & provider education.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."