- Home

- »

- Medical Devices

- »

-

Clinical Trial Equipment & Ancillary Solutions Market Report 2030GVR Report cover

![Clinical Trial Equipment & Ancillary Solutions Market Size, Share & Trends Report]()

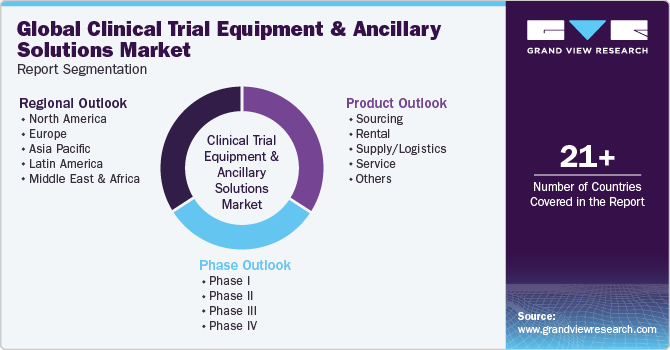

Clinical Trial Equipment & Ancillary Solutions Market Size, Share & Trends Analysis Report By Product (Sourcing, Supply/Logistics, Service, Others), By Phase (Phase I, II, III, IV), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-533-5

- Number of Report Pages: 131

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global clinical trial equipment & ancillary solutions market size was valued at USD 2.96 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. The global market has witnessed critical growth due to increasing R&D investments, the growing need for clinical trials, and the rapid growth of pharmaceutical and medical industries.

The COVID-19 outbreak temporarily hindered the process of clinical trials in 2020 due to lockdowns enforced by governments, which impacted the market negatively. However, rising demand for effective COVID-19 treatments and other disorders led to a growth in the number of trials. Companies and government authorities are launching clinical trial initiatives for COVID-19. For instance, in July 2023, the National Institutes of Health introduced the RECOVER Initiative, targeting long-COVID clinical trials. Thus, the demand for equipment and ancillary solutions is expected to increase significantly with rising number of initiatives.

As the number of clinical trials increases, more resources are needed for conducting those trails, including equipment, ancillary supplies, and drugs. Ancillary supplies comprise all objects essential to conduct a study, such as surgical knives, syringes, swabs, gloves, and any other entities that patients and medical personnel require to administer medications and examine the efficacy and safety parameters under investigation.

Sourcing instruments & ancillary objects for clinical trials involve more than just procurement. It requires an in-depth knowledge of the study’s design and prerequisites, as well as relentless & proactive planning to ensure that the most pertinent tools and supplies are purchased at the proper time and an appropriate price. A combination of internal knowledge and external help is suggested in managing intricacies of equipment and ancillary supply, logistics, restocking, and expiry management.

Additionally, increased investments in R&D and the adoption of virtual clinical trials due to the COVID-19 pandemic have boosted industry growth. Furthermore, there is a tremendous upsurge in the number of studies undertaken for COVID-19, which is anticipated to enhance industry growth. For instance, according to an article by the U.S. Department of Health & Human Services in September 2023, the Strategies and Treatments for Respiratory Infections and Viral Emergencies (STRIVE), part of the global clinical trials consortium, would register about 1,500 individuals at research locations globally to test immune modulation method for hospitalized COVID-19 patients. Such trials and a growing interest of industry participants in clinical studies are expected to boost growth in the coming years.

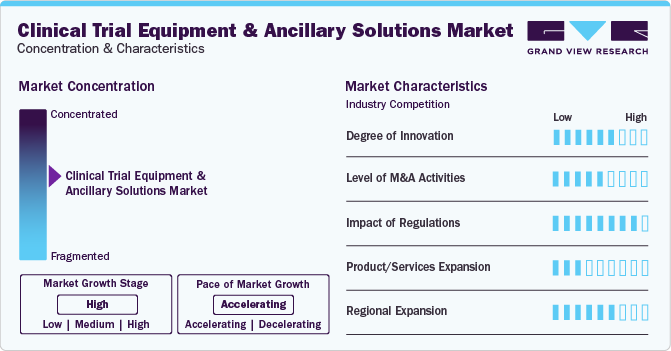

Market Concentration & Characteristics

Market growth stage is high, and the pace of the market growth is accelerating. The clinical trial equipment & ancillary solutions industry is characterized by a moderate degree of innovation due to rapid technological advancements, such as adoption of machine learning and AI in clinical trial platforms. Companies are entering the market and bringing novel technologies and platforms, which is expected to drive industrial innovations.

For instance, in November 2023, pharmaceutical giant AstraZeneca introduced the health technology business Evinova to enhance clinical trial processes. It offers digital technology tools to streamline clinical trial design and delivery to decrease time and costs in medicine development. This business would utilize artificial intelligence and machine learning to help clinical teams craft optimal studies. Furthermore, in October 2023, H1 introduced GenosAI, a new generative AI tool implanted into Trial Landscape, the compnay’s clinical trial intelligence platform, to scrutinize and respond to complicated queries.

The market is characterized by a moderate level of merger and acquisition (M&A) activities among leading players. This is due to several factors, including the desire to gain a competitive advantage in this industry and the need to consolidate in a rapidly growing market. Major industry participants are acquiring firms providing advanced services and solutions for clinical studies.

For instance, in October 2022, Myonex, a major clinical trial supply organization, acquired the clinical trial and packaging business of the Germany-based organization, Hubertus Apotheke. This acquisition is expected to support the capabilities and resources for both sourcing and packaging, including decentralized trials. Such acquisitions are expected to propel industry growth in the coming years.

Furthermore, industry participants are focusing on increasing their presence in several regions and improving access to instruments needed during clinical studies globally. For instance, in December 2022, Catalent announced the completion of the expansion of its clinical supply facility in Shanghai, China. With this expansion, the company increased the facility by about 30,000 sq. ft., adding refrigerated and deep-frozen storage and extended secondary packaging capacities. Thus, regional expansions by the major players are expected to improve access to these products.

Product Insights

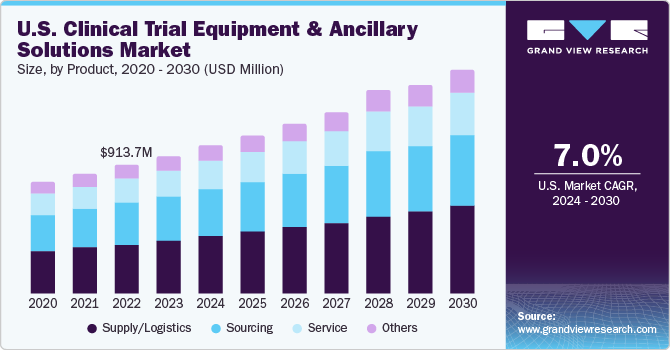

The supply/logistics segment accounted for a dominant revenue share of 38.95% in 2023. As clinical trials have become more global and diverse, they require a proper cold-chain logistics system to maintain the integrity of temperature-sensitive drugs. Fluctuation in rules & regulations in emerging markets is expected to boost the need for supply/logistic services during the forecast period. Furthermore, presence of companies such as AKESA PTY LTD, Movianto, Parexel International (MA) Corporation., and Oximio offering supply and logistics solutions is expected to propel segment growth in the coming years.

The sourcing segment is anticipated to witness strong growth through 2030. Owing to the rising intricacy of clinical trials, the quantity of tools and ancillary supplies needed, as well as the number of suppliers required has risen substantially. The challenge of ensuring that supplies reach sites in a cost-effective manner for worldwide research has increased. With sourcing and distribution expertise, there is a single point of contact to supply and transport equipment and ancillary supplies worldwide. This streamlined and coordinated procedure removes the strain on teams conducting trials and facilities.

Phase Insights

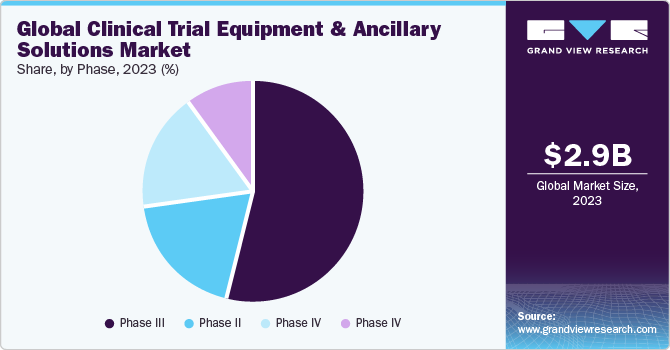

The phase III segment dominated the market in 2023 and is expected to maintain its dominance through 2030. Investigations in phase III are more complex than those in earlier phases. Even though the number of medications in this phase is relatively minimal, intricacies associated with this stage are immense. In addition, failure rates are also more as the research design and sample size require accurate dosing at an ideal level. This leads to human and economic damage, and most failures are generated by non-compliance with safety provisions. Such a scenario is likely to boost the demand for effective supply chain and logistics, which is projected to boost market growth over the coming years.

On the other hand, the phase I segment is projected to witness the highest growth rate over the forecast period due to the increasing number of pharmaceutical companies that are focusing on the development of novel therapeutics for rare diseases. Growth in the number of CROs globally is another factor supporting the adoption of phase I clinical trials to boost the rapid development of drugs.

Regional Insights

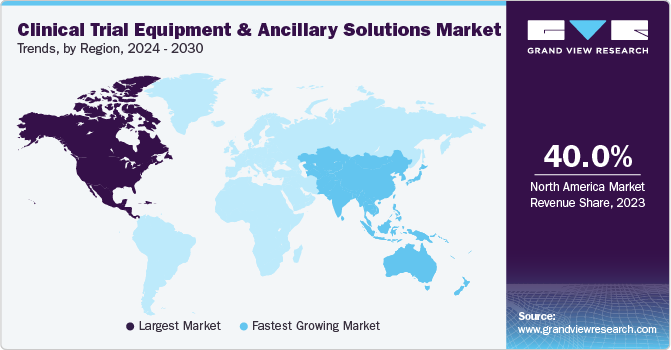

North America dominated the clinical trial equipment & ancillary solutions market with a 40.05% revenue share in 2023. This dominance is attributed to the fact that most pharmaceutical businesses are located in the U.S. and perform most of their business in this region. Favorable regulatory policies, the introduction of technologically advanced products by market players, and increasing investments by pharmaceutical firms are expected to drive regional market growth during the forecast period. Companies operating in this industry are expanding their presence in the U.S. For instance, in March 2023, Almac Group invested USD 65 million to expand its supply-chain services for clinical trials in Montgomery County, Pennsylvania. Such expansions are expected to boost regional growth.

Asia Pacific is anticipated to witness fastest growth in the clinical trial equipment and ancillary solutions market. Asia Pacific has become a hotspot for performing clinical trials on account of inexpensive study costs, ease of regulatory compliance, an increasing patient population in this region, and the increasing presence of elite clinical institutions that are functioning as sites.

Key Clinical Trial Equipment & Ancillary Solutions Company Insights

Some key players operating in the global market for clinical trial equipment & ancillary solutions include Imperial CRS, Inc.; Woodley Equipment Company Ltd., Thermo Fisher Scientific, Inc.;Parexel International (MA) Corporation;Emsere (Medicapital Rent); Marken; Yourway; and Myonex.

-

Myonex is a major clinical trial solutions provider. The company has been operating in the industry for more than 30 years and provides various services and products like clinical trial drug sourcing, packaging & distribution, and equipment & supplies. It operates in numerous countries, such as the UK, Denmark, Germany and the U.S.

-

Parexel International (MA) Corporation is among the largest clinical research organizations , offering a wide range of Phase I to IV clinical development solutions. It operates across numerous regions including North America, Europe, Latin America, Middle East & Africa and Asia Pacific.

Ancillare LP, Quipment SAS, and IRM are some notable emerging market participants in the clinical trial equipment & ancillary solution market.

-

Ancillare LP is an emerging ancillary supply partner for life science companies. The company was founded in 2006 and it has a vast depot network and subject-matter professionals in procurement, research, logistics, operations, and regulatory matters to construct tailored ancillary equipment and supply programs for Phase I-IV clinical research.

-

IRM is a clinical trial service organization that works with major industry stakeholders, like CROs, sponsors, and sites, to deliver a successful clinical trial. The company's portfolio includes equipment and ancillary material sourcing, research and pharmaceutical consulting, and trial referral networks. The company has been operating in the industry since 2016.

Key Clinical Trial Equipment & Ancillary Solutions Companies:

The following are the leading companies in the clinical trial equipment & ancillary solutions market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these clinical trial equipment & ancillary solutions companies are analyzed to map the supply network.

- Ancillare, LP

- Imperial CRS, Inc.

- Woodley Equipment Company Ltd.

- Thermo Fisher Scientific, Inc.

- Parexel International (MA) Corporation

- Emsere (formerly MediCapital Rent)

- Quipment SAS

- IRM

- Marken

- Myonex

- Yourway

Recent Developments

-

In August 2023, Parexel, a major industry player, partnered with Partex to leverage artificial intelligence (AI)-powered solutions to understand the probability of clinical success of assets in its portfolio. Under this collaboration, clinical trial execution by Partex will be handled by Parexel

-

In July 2023, SanaClis, a major supply chain solutions provider for clinical trials, introduced its advanced Clinical Trial Supply Chain Depot in Ventura in the state of California, U.S.

-

In June 2023, Curavit Clinical Research introduced its Inclusivity, Diversity, and Equity in Action (IDEA) toolkit. It is a clinical trial support and planning service developed to help clinical trial sponsors while designing and implementing diversity action plans

Clinical Trial Equipment & Ancillary Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.20 billion

Revenue forecast in 2030

USD 5.10 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, phase, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Ancillare, LP; Imperial CRS, Inc.; Woodley Equipment Company Ltd.; Thermo Fisher Scientific, Inc.; Parexel International (MA) Corporation; Emsere (MediCapital Rent); Quipment SAS; IRM; Marken; Myonex; Yourway

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Equipment & Ancillary Solutions Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clinical trial equipment & ancillary solutions market report based on product, phase, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Sourcing

-

Procurement

-

Equipment

-

Ancillaries

-

-

Rental

-

Equipment

-

Ancillaries

-

-

-

Supply/Logistics

-

Transportation

-

Packaging

-

Others

-

-

Service

-

Calibrations

-

Equipment Servicing

-

Others

-

-

Others

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial equipment & ancillary solutions market size was estimated at USD 2.96 billion in 2023 and is expected to reach USD 3.2 billion in 2024.

b. The global clinical trial equipment & ancillary solutions market is expected to grow at a compound annual growth rate of 8.1% from 2024 to 2030 to reach USD 5.1 billion by 2030.

Which segment accounted for the largest clinical trial equipment & ancillary solutions market share?b. North America dominated the clinical trial equipment & ancillary solutions market with a share of 40.1% in 2023. This is attributable to the high R&D investments, the strong presence of global players, and their efforts to come up with newer patents.

b. Some key players operating in the clinical trial equipment & ancillary solutions market include Ancillare LP, Imperial Clinical Research Services, Woodley Equipment Company LTD, Thermo Fisher Scientific Inc., PAREXEL International Corp., etc.

b. Key factors that are driving the clinical trial equipment & ancillary solutions market growth include rising R&D investments, the evolving need for clinical trials, and the increase in the growth of pharmaceutical and medical industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."