- Home

- »

- Medical Devices

- »

-

Clinical Trial Supply & Logistics Market Size Report, 2030GVR Report cover

![Clinical Trial Supply & Logistics Market Size, Share & Trends Report]()

Clinical Trial Supply & Logistics Market Size, Share & Trends Analysis Report By Service (Logistics & Distribution, Storage & Retention), By Phase, By Therapeutic Area, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-356-0

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

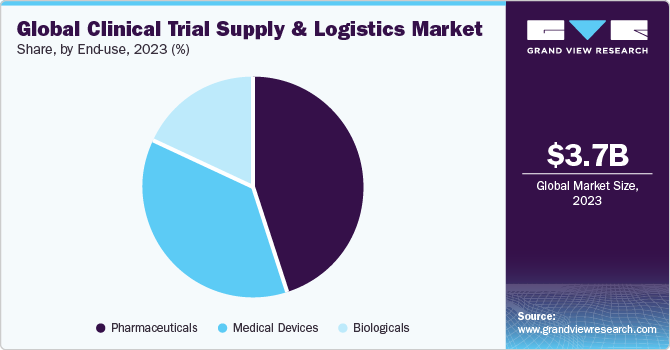

The global clinical trial supply & logistics market size was valued at USD 3.7 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.6% from 2024 to 2030. Major drivers include the rising number of clinical trials and harmonization of regulations, increasing R&D expenditure by pharmaceutical and biotechnology firms, and technological advancements in the supply chain. Also, there is a rise in outsourcing of these services due to a rise in the cost of clinical trials.

Clinical trial market logistical hurdles were brought on by the COVID-19 pandemic, and sponsors faced many difficulties during the pandemic. The quick and broad adoption of the remote trial strategy has resulted in major modifications to the traditional supply chain. The different logistical challenges of distant studies were handled using direct-to-patient strategies. Decentralized trials make it simpler for sponsors to reach a worldwide audience. Although the pandemic has increased the acceptance of such trials, there will still be a considerable need for them long after COVID-19.

Developing digital technologies has led to overcoming the trial challenges that were encountered during the pandemic and will be required to overcome these challenges for future trials. Some of the digital services are cloud-enabled digital core, blockchain-based product tracking, usage of the internet of things, etc., is likely to transform biopharmaceutical companies’ approach towards medical supplies management by incorporating valuable insights from multiple sources of data, improve patient experience, enhance trial productivity, and improve the quality of data collected in trials. For instance, in June 2020, Almac Clinical Technologies, a part of the Almac Group, introduced Simplify, a next-generation IRT solution. It is enabled with a standard array of configurable functionality designed to accelerate the study startup process.

Also, there is a rise in R&D investment and expansion in facilities by pharmaceutical and biotechnology firms for approval and launch of new drugs in the market. High investments in R&D and adequate supply and logistical facilities are likely to increase the possibility of successful drug/medicine. For instance, in July 2022, DHL Freight expanded its network in Germany with the purchase of a new terminal in Mettmann, close to Düsseldorf, Germany. This initiative was undertaken after a new facility was recently opened in Erlensee, close to Frankfurt, Germany, and a site was acquired from the logistics firm Leupold in Gochsheim, close to Würzburg, Germany.

However, the complex regulations in the trial process from application to approval of new drugs are acting as major barriers for biopharmaceuticals to invest in the new drug development phase. Biopharmaceutical companies file applications in different countries for the approval of specific drugs including authorization for supply chain, storage, and logistics.

Market Concentration & Characteristics

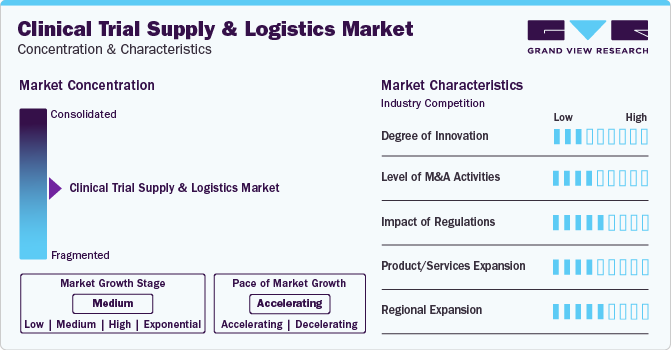

The market experienced, notable innovations include advanced technologies like blockchain for enhanced traceability artificial intelligence for predictive forecasting, and decentralized trial models which improves overall efficiency in managing and distributing clinical trial supplies.

Several market players such as Catalent Inc, Parexel International (MA) Corporation, and DHL, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories.

Regulations significantly impact the market by ensuring stringent compliance standards for product safety, quality, and documentation. While promoting patient welfare, these regulations also necessitate rigorous tracking, reporting, and adherence to good clinical practice (GCP)

Potential substitutes in the market include digital platforms for virtual trials, automated systems for inventory management, and alternative logistics providers.

Regional expansion involves establishing strategic distribution hubs and partnerships to efficiently navigate diverse regulatory landscapes. This expansion allows companies to optimize supply chain logistics, adhere to local regulations, and cater to the specific needs of clinical trials in different geographic regions.

Service Insights

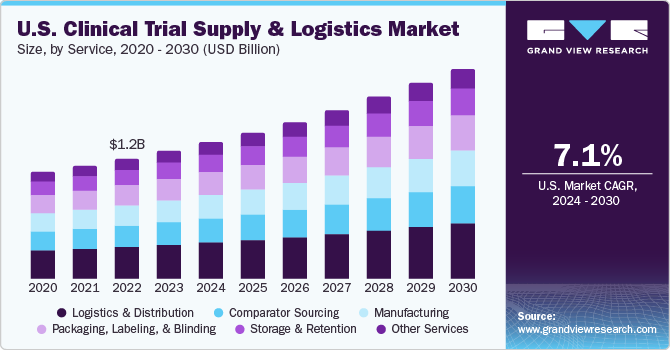

The logistics & distribution segment held the largest share of over 25.33% in 2023. The services segment is segmented into logistics & distribution, storage & retention, packaging, labeling, and blinding, manufacturing, comparator sourcing, and others. This is due to the rise in the global biologics pipeline, highly regulated structure of the market, and an increase in the usage of temperature-sensitive drugs are driving the market growth.

The manufacturing segment is expected to show lucrative growth during the forecast period. This is due to the increasing demand for biologics and complex molecules, expansion in manufacturing facilities, rise in medical trials has resulted in rise in material supply, and rise in demand for quality manufacturing of drugs. For instance, in May 2020, Catalent acquired a clinical packaging facility in Minakuchi, located in the Shiga prefecture of Japan, from Teva-Takeda Pharmaceuticals. This purchase was expected to help establish a new clinical GMP manufacturing and distribution hub to support clinical studies.

Phase Insights

The phase III segment accounted for the largest revenue share in 2023. Based on phase market is segmented into Phase I, Phase II, Phase III, Phase IV. This is due to the rise in number of patients, high complexity and cost associated with this phase, and a high failure rate in this phase that leads to loss in terms of both financial as well as human life. The major reason for this failure is the non-compliance of the product with the safety and efficacy guidelines.

The phase II segment is estimated to register the fastest CAGR over the forecast period.This rise is anticipated due to the rise in outsourcing activity in this phase, increasing investments by industry and non-industry sponsors. The increasing number of drugs in phase II is expected to generate higher complexities in logistics and supply chain, which is further expected to boost the demand for effective logistics and supply chain, thereby contributing to the growth of the industry.

Therapeutics Area Insights

The cardiovascular diseases segment dominated the market in 2023. The therapeutic area market is segmented into oncology, cardiovascular diseases, respiratory diseases, CNS and mental disorders, and others. The rise in disease burden, a large number of companies focus on bringing novel and innovative medicines to treat heart diseases, and strategies to reduce the prevalence of heart attacks and stroke. According to the Center for Disease Control and Prevention, in the U.S., 695,000 people died due to heart disease in 2021 And 805,000 people encounter heart attacks every year in the U.S.

The oncology segment has been anticipated to show lucrative growth over the forecast period. This is due to the highly complex clinical techniques, trials & the need for supportive services which are always changing. Oncology trials are designed to diagnose, manage, and treat cancer & associated symptoms. Clinical trial supplies in oncology include primary and secondary packaging. The primary objective of packaging is to improve patient compliance.

End-use Insights

The pharmaceutical segment dominated the market in 2023. Based on end-user, the market is segmented into pharmaceuticals, biologicals, and medical devices. The globalization of clinical trials, increase R&D by the pharmaceutical companies, and a large number of trials studies conducted by them are the driving factor that drives the segment growth. For instance, according to the ClinicalTrials.gov, as of December 18, 2023, about 38,891 number of studies were registered during 2023.

The biologicals segment has been anticipated to show lucrative growth over the forecast period. The main driver of the market is the rising demand for biologics products such as vaccines, cell and gene therapies, and an increase in investment for product manufacturing and development. Also, there is a rise in demand for global vaccination to prevent the COVID-19 pandemic.

Regional Insights

North America dominated the market with a share of 38.0% in 2023. The regional market accounts for the highest number of clinical trials conducted among all regions, which is a major driver for the growth of the clinical trial supply and logistics market. The significant increase in investments in clinical trials and the rise in the number of players in the clinical trial supply and logistics market are expected to contribute to growth.

The U.S. accounted for the largest share of the market in North America region in 2023. The U.S. is the hub for operation of major players in supply and logistics market such as Labcorp Drug Development, PAREXEL International Cooperation, Thermo Fisher Scientific, Inc., and Marken. Moreover, it has a strong infrastructure, availability of necessary funds, and the ability to adapt to advanced technology. In the past few years, a trend has been observed of shifting clinical trials site outside the U.S., which significantly reduces the cost.

The Asia Pacific region is expected to grow at the fastest rate during the forecast period.Significant growth in clinical research is expected to drive growth of the market in the region, thereby contributing to growth of global clinical trial supply and logistics market. According to a survey by Pharma IQ, 60.0% of the respondents consider China and India as potential regions for clinical research in the next five years. Entry of Almac Group, a global clinical research and manufacturing organization, in Asia Pacific region is a clear indication of growth of clinical trial supply and logistics market in this region.

China accounted for the largest share of the clinical trial supply & logistics market in the Asia Pacific region in 2023. China is one of the lucrative markets for clinical trial supplies players owing to its diverse pool of patients and growing pharmaceutical market. Logistics and supply chain is a major challenge in the country, which is discouraging major biopharmaceutical companies from conducting trials in China. The country accounted for 27.7% of global clinical trials conducted as of 2022 and exhibited lucrative growth in the past 3 years. The trend is driving the entry of major players such as Catalent Pharma Solutions in China, which is expected to contribute to market growth in the country.

Key Companies & Market Share Insights

Some of the key players operating in the market include Catalent, Inc, Parexel International (MA) Corporation, and DHL

-

Catalent, Inc clinical supply services provides reliable service and deep expertise in global supply chain and clinical supply management. Their full-service capabilities and worldwide footprint enable them to be your end-to-end clinical regional and global studies.

-

Parexel International (MA) Corporation provides end-to-end clinical trial supply chain management, including import-export compliance, quality assurance using leading-edge technologies to monitor the drug throughout its life cycle.

FedEx and Piramal Pharma Solutions are some of the emerging market players in the clinical trial supply & logistics market.

-

FedEx provides tailored transportation services and solutions to ship sensitive biological samples, clinical trial test drugs, and laboratory supplies.

Key Clinical Trial Supply & Logistics Companies:

- Thermo Fisher Scientific (Patheon)

- Catalent, Inc.

- Parexel International (MA) Corporation

- Almac Group

- Marken

- Piramal Pharma Solutions

- UDG Healthcare

- DHL

- FedEx

- Movianto

- Packaging Coordinators Inc

Recent Developments

-

In January 2023, Cryoport has disclosed a collaboration with Syneos Health to propel the progress of cell and gene therapies. This partnership aims to deliver an integrated solution for the cell and gene industry, incorporating Cryoport's IntegriCell platform and supply chain services provided by Syneos Health.

-

In June 2023, SkyCell, a pioneering manufacturer of temperature-controlled hybrid containers for the pharmaceutical sector, has joined forces with Marken to deliver advanced shipping solutions for pharmaceutical products in clinical trials. This partnership entails Marken utilizing SkyCell containers to transport critical and temperature-sensitive drugs.

-

In October 2023 , Parexel International (MA) Corporation and Partex established a preferred strategic alliance to utilize artificial intelligence (AI) for accelerating global drug discovery and development. This collaboration addresses challenges in investigational therapies by prioritizing assets with the greatest probability of clinical success. This enables biopharmaceutical customers to optimize their focus and resources on areas that bring the most benefit to patients.

-

In June 2022 , Catalent, Inc announced that it would expand its primary packaging abilities by installing an elevated blister packaging line to enhance its already automated bottling line at its clinical supply facility in Shiga, Japan.

-

In July 2021 , the company announced that it would open a new clinical trial supplies depot in China to support prompt access to medications and supplies for patients & clinical sites.

Clinical Trial Supply & Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.03 billion

Revenue forecast in 2030

USD 6.25 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, phase, therapeutic area, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific (Patheon); Catalent, Inc.; Parexel International (MA) Corporation; Almac Group; Marken; Piramal Pharma Solutions; UDG Healthcare; DHL; FedEx; Movianto; Packaging Coordinators Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clinical Trial Supply & Logistics Market Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global clinical trial supply & logistics market report on the basis of service, phase, therapeutic area, end-use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Logistics & Distribution

-

Storage & Retention

-

Packaging, Labeling, And Blinding

-

Manufacturing

-

Comparator Sourcing

-

Other Services

-

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Diseases

-

Respiratory Diseases

-

CNS And Mental Disorders

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Biologicals

-

Medical Devices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global clinical trial supply & logistics market size was estimated at USD 3.7 billion in 2023 and is expected to reach USD 4.03 billion in 2024.

b. The global clinical trial supply and logistics market is expected to grow at a compound annual growth rate of 7.6% from 2024 to 2030 to reach USD 6.25 billion by 2030.

b. North America dominated the clinical trial supply & logistics market with a share of 38.0% in 2023. This is attributable to a huge number of clinical trials, high investment in healthcare R&D, and the presence of dominant market players in the region.

b. Some key players operating in the clinical trial supply and logistics market include Thermo Fisher Scientific, Patheon, Catalent, Inc., Marken, Piramal Pharma Solutions, and DHL.

b. Key factors that are driving the clinical trial supply & logistics market growth include the rising number of clinical trials coupled with a robust drug pipeline across the globe.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."