- Home

- »

- Medical Devices

- »

-

Clip Applicator Market Size & Share, Industry Report, 2030GVR Report cover

![Clip Applicator Market Size, Share & Trends Report]()

Clip Applicator Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Laparoscopic Appliers, Endoscopic Appliers, Open Surgery Appliers), By End Use (Hospitals & Clinics, ASCs), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-205-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Clip Applicator Market Size & Trends

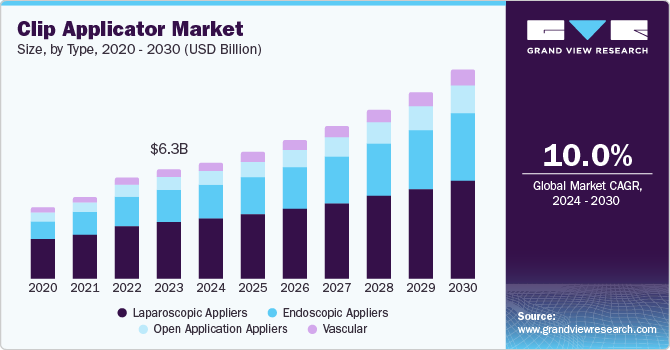

The global clip applicator market size was valued at USD 6.33 billion in 2023 and is projected to grow at a CAGR of 10.0% from 2024 to 2030. Increasing demand for minimally invasive surgeries (MIS), rising laparoscopy applications, and an aging population pose as primary drivers for market growth. In addition, the growing incidence of chronic diseases requiring surgical intervention contributes to the market’s growth.

The increasing adoption of MIS and laparoscopic procedures is a significant driver of the market, as these procedures offer benefits such as reduced pain, shorter recovery times, and lower risk of complications compared to traditional open surgeries. This trend is expected to continue, driven by the growing demand for minimally invasive procedures and the increasing procedural volumes in these areas.

Another key driver of the market is technological advancements in clip applicator devices. The development of more precise and efficient surgical ligation systems has enabled clinicians to perform surgeries with greater accuracy and speed. Moreover, the shift to digital business models and increasing digitalization has driven the adoption of advanced clip applicator tools, which offer improved ergonomics, precision engineering, and compatibility with different surgical techniques. These advancements have enhanced both surgical results and the overall effectiveness of healthcare systems.

The market is also being propelled by demographic trends, including increasing urbanization and population growth. As the global population grows, so does the demand for surgical devices like clip applicators. Furthermore, collaborative efforts between medical device makers and healthcare providers have resulted in increased adoption rates and market presence through training and education partnerships.

Type Insights

Endoscopic appliers dominated the market and accounted for a share of 52.5% in 2023 due to lower invasiveness and faster recovery times, is driving the adoption of clip applicators. These devices enable clinicians to perform a high volume of endoscopic interventions with increased effectiveness and reduced error. Advancements in endoscopic technology and expanding use in GI and urological procedures are fueling the growth of this market segment.

Laparoscopic appliers are expected to register the fastest CAGR of 12.7% during the forecast period due to their non-invasive nature and precise surgical outcomes. Their use in laparoscopic procedures enables surgeons to maintain precise control and grip, resulting in optimal results. The growing incidence of conditions requiring laparoscopic surgeries, such as appendicitis and gallstones, is fueling demand for these devices further.

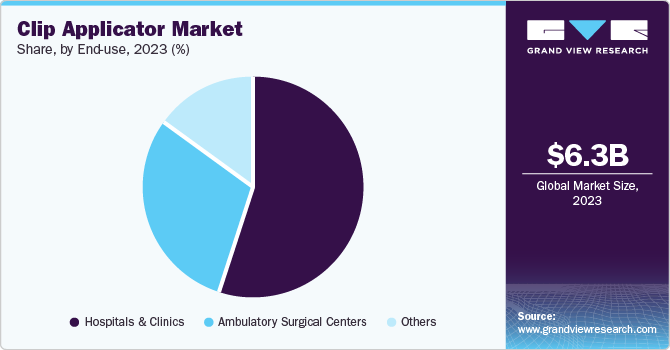

End Use Insights

Hospitals & clinics accounted for the largest revenue share of 55.1% in 2023. Minimally invasive surgeries, facilitated by clip applicators, offer significant benefits, including reduced hospitalization time, accelerated patient recovery, and decreased risks of blood loss, infection, and pain. As the aging population grows, with increased prevalence of conditions requiring surgery, hospitals and clinics are investing in cutting-edge technologies like clip applicators to meet the evolving needs of this expanding patient base.

Ambulatory surgical centers (ASCs) are projected to grow significantly with a CAGR of 9.7% over the forecast period. ASCs offer a cost-effective alternative to hospitals, appealing to patients and insurers alike. Procedures are often performed on an outpatient basis, enabling quicker recovery times and return to normal life. With a focus on patient-centric care, ambulatory centers are gaining popularity, driving demand for specialized equipment like clip applicators.

Regional Insights

North America clip applicator market dominated the global clip applicator market in 2023, generating a revenue share of 45.3%. The region is experiencing growth driven by advancements in healthcare technology and the increasing adoption of minimally invasive surgical methods. A strong healthcare infrastructure, investments in medical R&D, and the rising incidence of chronic diseases have contributed to the market’s expansion, fueling demand for clip applicators.

U.S. Clip Applicator Market Trends

Clip applicator market in the U.S. dominated the North America clip applicator market with a share of 79.5% in 2023. The U.S. is a prominent medical technology market, driving innovation and adoption of advanced clip applicators. Hospitals and ambulatory surgical centers in the country are receptive to new technologies, including clip applicators. The growing demand for minimally invasive surgeries, fueled by rising rates of cancer, gastrointestinal, and cardiovascular diseases, underscores the need for clip applicators.

Europe Clip Applicator Market Trends

Europe clip applicator market was a lucrative region in 2023, driven by the growing trend towards minimally invasive surgeries and the aging population. The region’s stringent regulatory environment ensured the quality and safety of medical devices, fostering consumer and healthcare provider confidence. Improving healthcare systems and recognition of minimally invasive techniques’ benefits also contributed to market growth.

Clip applicator market in the UK is poised for rapid growth, driven by an aging population and increasing demand for surgical interventions. Clip applicators are crucial tools in elderly procedures, boosting demand. Patient preference for minimally invasive surgeries, due to faster recovery and reduced pain, is further fueling market expansion. The NHS supports this trend to reduce costs and improve outcomes.

Asia Pacific Clip Applicator Market Trends

Asia Pacific clip applicator market is anticipated to witness the fastest CAGR of 10.5% in the global clip applicator market over the forecast period. The region witnessed significant market growth due to population density and urbanization. Advances in healthcare facilities and the emergence of medical tourism drove demand. Increased healthcare spending and adoption of hi-tech medical equipment fueled growth. Government initiatives to improve affordable healthcare services further accelerated market expansion.

The clip applicator market in China held a substantial share of the Asia Pacific clip applicator market in 2023. The government’s initiatives to promote the domestic medical device industry have boosted development, with funding support for research. The prevalence of diseases such as diabetes, obesity, and cardiovascular disease, which require surgical treatment, drives demand for clip applicators, further fueling market growth.

Key Clip Applicator Company Insights

Some key companies in the clip applicator market include unimax medical systems inc.; Betatech Medical; Zhejiang Geyi Medical Instrument Co.,Ltd; and Elcam Medical; among others. Key players are expanding in high-growth regions such as Asia Pacific and Latin America. Companies are engaging in mergers and acquisitions, pricing strategies, and regulatory approvals to strengthen their presence and offerings.

-

Millennium Surgical is a supplier of surgical instruments, catering to diverse medical specialties. The company sources and distributes high-quality instruments for orthopedics, neurology, and general surgery. Focused on customer service, Millennium Surgical offers a user-friendly online catalog and collaborates with healthcare providers to streamline procurement and enhance surgical outcomes.

-

CONMED Corporation is provides surgical devices and equipment, focusing on advancing minimally invasive procedures. Offering a comprehensive portfolio of products, including clip applicators along with a strong global presence, CONMED Corporation serves hospitals and surgical centers, enhancing patient outcomes through its latest technologies.

Key Clip Applicator Companies:

The following are the leading companies in the clip applicator market. These companies collectively hold the largest market share and dictate industry trends.

- unimax medical systems inc.

- Betatech Medical

- Zhejiang Geyi Medical Instrument Co.,Ltd

- Elcam Medical

- Teleflex Incorporated

- CONMED Corporation

- Millennium Surgical

- Johnson & Johnson Services, Inc.

- B. Braun Medical Inc.

- Surtex Instruments Limited

Recent Developments

-

In January 2024, B. Braun Medical Inc. appointed Rob Albert as CEO, succeeding Jean-Claude Dubacher. Albert joined the company in 1984 and held various roles, including Senior Vice President & Chief Marketing Officer.

Clip Applicator Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.81 billion

Revenue forecast in 2030

USD 12.05 billion

Growth rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

unimax medical systems inc.; Betatech Medical; Zhejiang Geyi Medical Instrument Co.,Ltd; Elcam Medical; Teleflex Incorporated; CONMED Corporation; Millennium Surgical; Johnson & Johnson Services, Inc.; B. Braun Medical Inc.; Surtex Instruments Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Clip Applicator Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global clip applicator market report based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Laparoscopic Appliers

-

Endoscopic Appliers

-

Open Application Appliers

-

Vascular

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.