- Home

- »

- Digital Media

- »

-

Cloud Advertising Market Size, Share & Growth Report, 2030GVR Report cover

![Cloud Advertising Market Size, Share & Trends Report]()

Cloud Advertising Market (2023 - 2030) Size, Share & Trends Analysis Report By Service, By Channel, By Deployment, By Enterprise Size, By Application, By End-use Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-132-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Advertising Market Summary

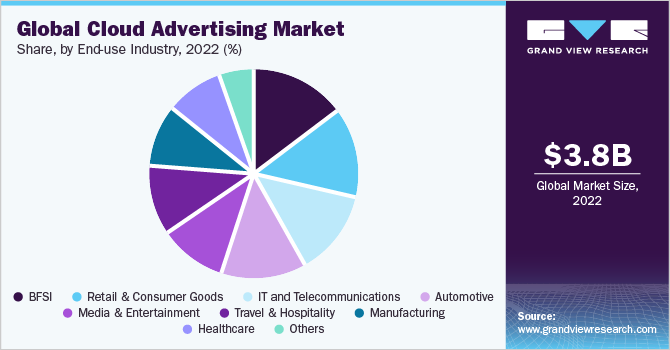

The global cloud advertising market size was valued at USD 3.84 billion in 2022 and is projected to reach USD 14.31 billion by 2030, growing at a CAGR of 18.1% from 2023 to 2030, owing to increasing demand for programmatic advertising. Cloud advertising services provide the infrastructure and capabilities needed for programmatic advertising, enabling advertisers to target specific audiences efficiently, optimize ad placements, and allocate budgets effectively.

Key Market Trends & Insights

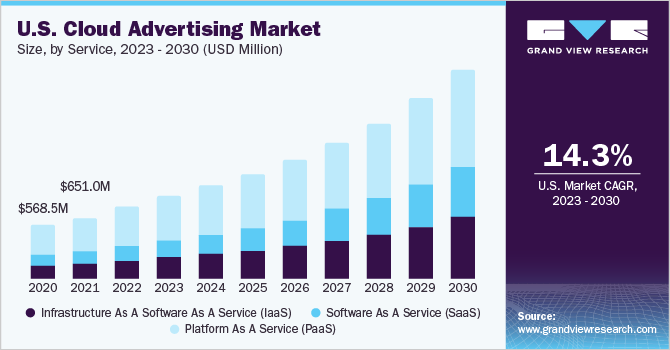

- North America dominated the market with a share of 33.1% in 2022 and is anticipated to dominate over the forecast period.

- Asia Pacific is anticipated to grow at the highest CAGR of 22.5% during the forecast period.

- Based on service, the platform as a service (PaaS) segment accounted for the largest revenue share of 53.2% in 2022 and is expected to continue to dominate the market over the forecast period.

- Based on enterprise size, the large-size enterprise segment held the largest revenue share of 56.8% in 2022 and is expected to maintain its position over the forecast period.

- Based on deployment, the hybrid segment held the largest revenue share of 43.3% in 2022 over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 3.84 Billion

- 2030 Projected Market Size: USD 14.31 Billion

- CAGR (2023-2030): 18.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The scalability and agility cloud services offer make them an ideal choice for programmatic advertising, leading to widespread adoption. Furthermore, the growing adoption of cloud technology across various sectors led to an increased reliance on cloud-based advertising solutions. Businesses increasingly leverage cloud services’ scalability, flexibility, and cost-effectiveness to deliver targeted and personalized advertisements to their target audience.

The Covid-19 pandemic accelerated the digital transformation efforts of businesses across industries. Organizations realized the importance of establishing a robust online presence and enhancing their digital marketing capabilities. Cloud advertising played a crucial role in this transformation, enabling businesses to quickly pivot their advertising strategies and tap into the expanding digital market. Advertisers leveraged the capabilities of cloud services to implement agile and data-driven campaigns, reaching their target audience effectively in a rapidly evolving digital landscape.

Service Insights

In terms of service, the market is further segmented into infrastructure as a software as a service (IaaS), software as a service (SaaS), and platform as a service (PaaS). The platform as a service (PaaS) segment accounted for the largest revenue share of 53.2% in 2022 and is expected to continue to dominate the market over the forecast period. Integrating emerging technologies such as artificial intelligence (AI) and machine learning (ML) is driving the growth of IaaS in the market for cloud advertising. IaaS providers leverage AI and ML algorithms to analyze vast data, identify patterns, and deliver highly personalized and targeted advertisements. PaaS services enable advertisers to optimize their ad targeting, increase relevancy, and improve overall campaign performance by harnessing the computational power and scalability of the cloud infrastructure.

The software as a service (SaaS) segment is anticipated to witness the highest growth rate of 21.6% during the forecast period. Growing demand for targeted and personalized advertising experiences drives the demand for cloud advertising within the SaaS segment. SaaS services gather extensive user data, including preferences, behaviors, and demographics, allowing advertisers to deliver highly relevant and tailored ads to their target audience. By leveraging the data-driven capabilities of SaaS services, advertisers optimize their ad campaigns, improve customer engagement, and achieve higher conversion rates.

Channel Insights

Based on the channel, the global market is sub-segmented into email marketing, in-app, social media marketing, company website, and others. The proliferation of mobile devices and the increasing popularity of mobile applications have led to a surge in in-app usage among consumers. People spend a substantial amount of time within mobile apps for various activities, such as social networking, gaming, shopping, and content consumption. This shift in user behavior has created a lucrative opportunity for advertisers to target and engage with their audience within these applications directly.

The social media marketing segment is anticipated to witness the highest growth rate of 20.5% during the forecast period. Integrating advanced targeting techniques, such as remarketing and lookalike audiences, is driving the adoption of cloud advertising in social media marketing. Cloud advertising platforms provide the infrastructure and capabilities to implement these targeting strategies, expanding the reach and effectiveness of social media marketing campaigns.

Deployment Insights

Based on the deployment, the global market is sub-segmented into public, private, and hybrid. The hybrid segment held the largest revenue share of 43.3% in 2022 over the forecast period. Hybrid cloud adoption in cloud advertising is driven by the growing complexity of advertising campaigns and the requirement for smooth integration. Advertisers often use multiple advertising services, data sources, and technologies to execute their campaigns effectively. The hybrid cloud enables seamless integration and orchestration of these various services, providing a unified infrastructure that streamlines advertising workflows and enhances campaign performance. This integration capability is crucial for advertisers managing large-scale, multi-channel campaigns with complex data processing and analytics requirements.

On the other hand, the private cloud segment is expected to witness the highest CAGR rate of 20.4% during the forecast period. Strict regulatory compliance requirements drive private cloud adoption in the cloud advertising industry. Advertisers operating in heavily regulated industries, including finance, healthcare, or government, often face strict compliance standards and data governance policies. Private cloud environments provide a controlled and auditable infrastructure that helps advertisers meet these regulatory obligations. Advertisers ensure that their advertising activities comply with industry-specific regulations, data protection laws, and privacy frameworks, enhancing trust and mitigating compliance risks.

Enterprise Size Insights

The global market for cloud advertising is segmented into small and medium-sized enterprises (SMEs) and large size enterprises based on enterprise size. The large-size enterprise segment held the largest revenue share of 56.8% in 2022 and is expected to maintain its position over the forecast period. The growing adoption of digital channels and the rise of mobile devices within the large enterprise segment drive the demand for cloud advertising. These organizations recognize the importance of reaching customers through multiple touchpoints, such as websites, social media, mobile apps, and streaming services. Cloud advertising allows large enterprises to effectively deliver their campaigns across these channels, ensuring maximum visibility and engagement with their target audience. For instance, large-sized organizations like Amazon, Adobe, Audi, and many others use cloud advertising to promote their brands.

On the other hand, the small and medium-sized enterprises segment is anticipated to witness the highest CAGR rate of 19.7% during the forecast period. The increased need for seamless integration and omnichannel marketing drives SMEs' adoption of cloud advertising. Cloud advertising services offer the integration capabilities to seamlessly connect different advertising channels, such as social media, search engines, websites, and mobile apps. This integration enables SMEs to execute omnichannel marketing strategies, ensuring a cohesive brand presence and delivering personalized experiences to their target audience.

Application Insights

Based on the application, the global market is segmented into campaign management, customer management, experience management, analytics and insights, and real-time engagement. The campaign management segment held the largest revenue share of 28.9% in 2022 and is expected to maintain its position over the forecast period. The need for real-time campaign monitoring and agility drives the adoption of cloud-based campaign management services. Advertisers require the ability to monitor campaign performance, track key metrics, and make data-driven decisions in real time. Cloud advertising services offer real-time reporting and analytics capabilities, empowering advertisers to respond quickly to changing market dynamics, optimize campaigns on the fly, and maximize their advertising impact.

On the other hand, the real-time engagement segment is anticipated to witness the highest CAGR rate of 22.6% during the forecast period. Cloud advertising services leverage real-time data analytics and advanced targeting capabilities to deliver ads tailored to individual users' needs. By providing real-time engagement, advertisers capture users' attention at the right moment and deliver more meaningful and impactful ads, leading to higher engagement rates and improved campaign performance.

End-use Industry Insights

Based on the end-use industry, the global cloud advertising market is segmented into IT & telecommunications, BFSI, healthcare, travel and hospitality, manufacturing, automotive, retail & consumer goods, media & entertainment, and others. The BFSI segment held the largest revenue share of 14.8% in 2022 and is expected to maintain its position over the forecast period. The increasing competition in the BFSI sector has driven organizations to differentiate themselves through personalized customer experiences. Cloud advertising facilitates the delivery of personalized advertisements based on individual customer profiles, helping financial institutions build stronger relationships with their customers. By leveraging cloud platforms, BFSI advertisers can effectively tailor their ads to specific customer segments, addressing their unique needs and preferences.

The healthcare segment is anticipated to witness the highest growth rate of 19.9% during the forecast period. With the growing adoption of electronic health records (EHRs), telemedicine, and other digital health platforms, a wealth of data is available within the healthcare ecosystem. Cloud advertising enables healthcare providers, pharmaceutical companies, and stakeholders to leverage this data to deliver targeted, personalized advertisements to relevant audiences. Using cloud-based platforms, advertisers can optimize their campaigns based on real-time data insights, ensuring their messages reach patients, healthcare professionals, or other relevant parties.

Regional Insights

North America dominated the market with a share of 33.1% in 2022 and is anticipated to dominate over the forecast period. The widespread adoption of cloud computing technology in North America laid a strong foundation for expanding cloud advertising. With a highly developed cloud infrastructure, businesses in the region embrace cloud-based solutions, including advertising services, to leverage their scalability, flexibility, and cost-effectiveness. Moreover, the increasing digitalization of various industries in North America propelled the demand for cloud advertising. Cloud advertising enables advertisers to deliver targeted and personalized ads across multiple digital services, optimizing their marketing efforts and enhancing customer engagement in the competitive North American market. Organizations in the region are launching the latest updates to their cloud database solutions to gain a competitive edge over their competitors. For instance, in July 2021, Salesforce announced Advertising Sales Management for Media Cloud, an industry-specific solution to streamline cross-channel advertising sales. This innovative application integrates cross-channel planning, execution, automated client reporting, and campaign optimization into a unified service, empowering publishers to boost revenue effectively.

Asia Pacific is anticipated to grow at the highest CAGR of 22.5% during the forecast period. The increasing adoption of e-commerce and the rise of digital marketplaces drive the demand for cloud advertising in Asia Pacific. Online retail services and e-commerce marketplaces are expanding rapidly in countries like China, India, and Southeast Asian nations. Advertisers leverage cloud advertising to promote their products and services on these services, effectively reaching a large base of online shoppers. The scalability and data-driven nature of cloud advertising allows advertisers to target specific customer segments, personalize their ads, and measure the impact of their campaigns on e-commerce services.

Key Companies & Market Share Insights

The market has a fragmented competitive landscape featuring various global and regional players. Leading industry players are undertaking strategies such as product launches, collaborations, and partnerships to survive the highly competitive environment and expand their business footprints.

For instance, in October 2021, Google introduced the GNI Advertising Lab program for India as part of the Google News Initiative's dedication to fostering the success of journalism in the digital era. This initiative aims to assist small and mid-sized news organizations that create original news content for local and regional communities. Its main objective is to enhance the digital infrastructure and help boost digital advertising revenue. The company achieves this by offering customized training and diagnostic sessions conducted by expert consultants. Additionally, Google provides hands-on technical support to optimize its online assets and implement the recommended strategies effectively. Some of the prominent players operating in the global cloud advertising market are:

-

Google LLC

-

Oracle

-

IBM Corporation

-

Amazon Web Services, Inc.

-

Adobe

-

Salesforce, Inc.

-

Wipro

-

The Nielsen Company (US), LLC.

-

Viant Technology LLC

-

Cavai

-

Kubient

-

Imagine Communications

Cloud Advertising Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.47 billion

Revenue forecast in 2030

USD 14.31 billion

Growth Rate

CAGR of 18.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, channel, deployment, enterprise size, application, end-use industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Netherlands; China; India; Japan; Australia; Singapore; Brazil; Mexico; Chile; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Google LLC; Oracle; IBM Corporation; Amazon Web Services, Inc.; Adobe, Salesforce, Inc.; Wipro; The Nielsen Company (US), LLC.; Viant Technology LLC; Cavai; Kubient; Imagine Communications

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud advertising market report based on service, channel, deployment, enterprise size, application, end-use industry, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrastructure As A Software As A Service (IaaS)

-

Software As A Service (SaaS)

-

Platform As A Service (PaaS)

-

-

Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Email Marketing

-

In-App

-

Social Media Marketing

-

Company Website

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Size Enterprises

-

Small and Medium Sized Enterprises (SMEs)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Campaign Management

-

Customer Management

-

Experience Management

-

Analytic and Insights

-

Real-Time Engagement

-

-

End-use Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

IT and Telecommunications

-

BFSI

-

Healthcare

-

Manufacturing

-

Retail and Consumer Goods

-

Automotive

-

Media and Entertainment

-

Travel and Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Chile

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud advertising market size was estimated at USD 3.84 billion in 2022 and is expected to reach USD 4.47 billion in 2023

b. The global cloud advertising market is expected to grow at a compound annual growth rate of 18.1% from 2023 to 2030 to reach USD 14.31 billion by 2030

b. North America dominated the cloud advertising market with a market share of 33.1% in 2022. This is attributed to the rising demand for data-driven advertising in the region.

b. Some key players operating in the Cloud advertising market include Google LLC, Nutanix, Oracle, Google LLC, Oracle, IBM Corporation, Amazon Web Services, Inc., Adobe, Salesforce, Inc., Wipro, The Nielsen Company (US), LLC., Viant Technology LLC, Cavai, Kubient, Imagine Communications

b. Key factors driving the market growth include rise in adoption of cloud services and emergence of personalized marketing

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.