- Home

- »

- Next Generation Technologies

- »

-

Cloud Computing Market Size, Share & Growth Report, 2030GVR Report cover

![Cloud Computing Market Size, Share & Trends Report]()

Cloud Computing Market Size, Share & Trends Analysis Report By Service (Infrastructure as a Service, Platform as a Service), By Deployment, By Workload, By Enterprise Size, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-210-5

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Cloud Computing Market Size & Trends

The global cloud computing market size was estimated at USD 602.31 billion in 2023 and is expected to grow at a CAGR of 21.2% from 2024 to 2030. The market is on a fast track to expansion, fueled by a confluence of factors. Large enterprises are realizing the transformative power of cloud computing. By migrating to the cloud, they can streamline operations, improve agility, and unlock new levels of efficiency. This translates to significant performance gains across the organization.

The rise of hybrid and multi-cloud solutions is providing businesses with the flexibility and control they crave. Companies can now leverage the strengths of different cloud providers, creating a customized infrastructure solution that perfectly aligns with their specific needs. Furthermore, pay-as-you-go pricing models eliminate the upfront costs associated with traditional IT infrastructure, making cloud computing an attractive proposition for businesses of all sizes. This is particularly true in developing countries, where businesses are actively seeking ways to enhance their digital capabilities and compete on a global scale.

Governments around the world are also playing a crucial role in propelling cloud adoption forward. By implementing robust data security regulations and fostering trust in the cloud ecosystem, they are creating a more secure environment for businesses to operate in. The unprecedented shift towards remote work due to the COVID-19 pandemic further accelerated cloud adoption. As organizations scrambled to adapt to the new normal, cloud-based solutions offered the scalability and accessibility needed to support a geographically dispersed workforce. However, the path to cloud dominance has its challenges. Data privacy and security concerns remain a significant hurdle. Businesses are understandably apprehensive about entrusting their sensitive data to a third-party provider. The potential for data breaches and unauthorized access poses a risk to continued market growth. Addressing these concerns and prioritizing robust security measures will be paramount to building trust and ensuring the long-term success of the market.

The market is experiencing a surge in growth, fueled by a wave of adoption from both small and medium-sized organizations (SMOs) and governments in developing nations. Several key factors drive this expansion. Firstly, SMEs are increasingly recognizing the benefits of cloud-based systems. Unlike traditional on-premise IT infrastructure, cloud solutions offer a more cost-effective and scalable model. SMOs can access enterprise-grade computing power without the burden of hefty upfront investments or the need to manage complex hardware and software. Additionally, cloud computing streamlines operations and boosts agility, allowing SMEs to adapt quickly to changing market conditions and compete more effectively.

This trend is evident in initiatives like the AWS Connected Community launched by the United Arab Emirates' Ministry of Economy (MoE) in partnership with Amazon Web Services. This program exemplifies how governments in developing nations are actively promoting cloud adoption. By providing SMEs with access to cloud resources, training, and support, such initiatives empower them to embrace digital transformation, expand their reach, and contribute to the overall growth of the national economy.

Beyond its economic benefits, cloud computing offers a transformative power that extends across industries. It fosters faster and more efficient business operations, streamlining the entire process of technology adoption and enabling the creation of highly engaging customer experiences. Cloud technology has fundamentally altered how businesses operate by enabling them to navigate technological limitations and find creative solutions. Trends in the market directly influence a company's investment strategies, digital decision-making processes, and the selection of vendors and technologies.

Rapid digitization has further accelerated cloud adoption as organizations seek to modernize their infrastructure and applications. Cloud solutions offer a cost-effective and agile alternative, allowing businesses to move workloads to the cloud and avoid network latency issues. Major vendors are constantly innovating and launching new cloud solutions and services to address businesses' evolving needs. For example, the partnership between Airtel India and Vultr offers businesses access to a wide range of cloud solutions, including Cloud GPUs, fractionalized GPUs, and optimized cloud computing options.

However, data security and privacy remain a primary concern for organizations transitioning to the cloud. Ensuring the secure storage, use, and transmission of information is paramount. Fortunately, cloud vendors offer a comprehensive suite of security services like data encryption, access control, and monitoring & auditing. Additionally, leading providers like Google, Microsoft, and Amazon guarantee exceptional uptime, relieving businesses from the burden of maintaining redundant infrastructure and backup systems. By addressing these concerns and continuously enhancing security protocols, cloud computing can solidify its position as the driving force behind a more efficient, innovative, and secure future for businesses around the world.

Market Concentration & Characteristics

The major players in the market are engaged in a fierce battle for dominance. Leading the charge are the "hyperscalers" - Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP). These giants boast massive infrastructure, comprehensive service offerings, and constant innovation. Their growth strategies are multifaceted. Firstly, they are all aggressively expanding their global reach, establishing new data centers across the world to cater to a wider customer base. Secondly, they are continuously adding new features and functionalities to their cloud platforms, encompassing everything from artificial intelligence and machine learning tools to advanced analytics and security solutions. This diversification allows them to cater to the specific needs of a broader range of industries.

Beyond the hyperscalers, a vibrant ecosystem of smaller cloud providers is also flourishing. These companies often specialize in niche areas, such as high-performance computing or cloud solutions for specific industries. Their growth strategies typically involve forging strategic partnerships with larger players or focusing on providing exceptional customer service and domain expertise to carve out a loyal customer base. Additionally, many regional cloud providers are emerging in different parts of the world, catering to the specific data privacy regulations and latency requirements of their local markets. This dynamic mix of established giants, innovative niche players, and regional specialists ensures a healthy and competitive cloud computing landscape, driving constant advancements and cost-effective solutions for businesses of all sizes.

The competitive landscape in cloud computing extends beyond just the technology providers. Telecommunication companies are also recognizing the potential of cloud services and are actively entering the fray. They leverage their existing network infrastructure and customer base to offer integrated cloud solutions. For example, Airtel India's partnership with Vultr is a prime illustration of this trend. By combining their expertise, these companies can provide businesses with a one-stop shop for both connectivity and cloud services, simplifying the adoption process and potentially lowering costs.

Another significant trend is the rise of multi-cloud and hybrid cloud deployments. Businesses are no longer tethered to a single cloud provider. Instead, they are strategically adopting a multi-cloud approach, leveraging the strengths of different platforms to optimize their IT infrastructure. This allows them to benefit from the best-in-class features and pricing models offered by various vendors.

The market is poised for continued exponential growth. As businesses increasingly embrace digital transformation initiatives, the demand for cloud-based solutions will only intensify. The focus of competition will likely shift towards providing industry-specific solutions, advanced security features, and seamless integration capabilities. Cloud providers that can effectively address these evolving needs and build strong relationships with their customers will be well-positioned to thrive in this dynamic and ever-evolving market.

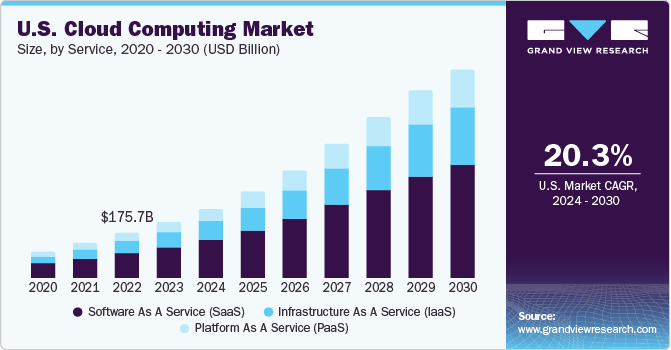

Service Insights

The SaaS segment dominated the market and accounted for around 54% of the revenue share in 2023. SaaS applications offer unparalleled ease of use and deployment. Businesses can access these applications on demand, eliminating the need for complex installations or ongoing maintenance. This user-friendly approach makes SaaS solutions highly attractive to companies of all sizes, from established enterprises to fledgling startups. Additionally, SaaS applications are typically priced on a subscription basis, offering a predictable and cost-effective way for businesses to access the software they need. Furthermore, SaaS vendors are constantly releasing updates and new features, ensuring that customers always have access to the latest functionalities. All the factors mentioned above have resulted in the increased growth of the SaaS segment in the market.

The IaaS segment is expected to grow at the fastest CAGR of around 22% over the forecast period. The Infrastructure-as-a-Service (IaaS) segment is another key driver of cloud computing's expansion, fueled by its ability to offer businesses flexibility, scalability, and cost-efficiency. Unlike traditional on-premise infrastructure, IaaS eliminates the need for companies to invest in expensive hardware and software upfront. Instead, they can pay for the computing resources they need on a per-user basis, scaling their infrastructure up or down as their demands fluctuate. This flexibility is particularly attractive for startups and businesses with unpredictable resource needs. Additionally, IaaS providers handle the management and maintenance of the underlying infrastructure, freeing IT teams to focus on higher-level tasks and strategic initiatives.

Deployment Insights

The private segment dominated the market with the largest revenue share in 2023. Private clouds offer several advantages over public clouds. Firstly, they provide a higher level of control and customization. Businesses can tailor their cloud infrastructure to meet their specific security and compliance requirements. Additionally, private clouds offer predictable performance, as resources aren't shared with other users, which is critical for businesses that run mission-critical applications. However, private clouds also come with challenges. They require a significant upfront investment in hardware and software, and ongoing maintenance can be resource intensive. To address these limitations, managed private cloud services are gaining traction.

The hybrid cloud segment is expected to grow at a significant growth rate during the forecast period as hybrid cloud allows businesses to maintain control over sensitive data that might require stricter regulations or on-premise storage for compliance reasons. Secondly, existing on-premise investments can be leveraged and integrated with the scalability and cost-effectiveness of the public cloud. Additionally, hybrid cloud deployments offer greater flexibility in disaster recovery strategies. Businesses can replicate critical data and applications in the public cloud, ensuring seamless continuity of operations in the event of an outage.

Workload Insights

The resource management segment dominated the market with the largest revenue share in 2023. Cloud environments are becoming increasingly complex as businesses adopt hybrid and multi-cloud strategies. Managing resources across various cloud providers and on-premise infrastructure becomes a significant challenge. Resource management tools automate tasks like provisioning, scaling, and optimizing resource allocation, leading to increased efficiency and cost savings.

The application development & testing segment is expected to have a high growth rate over the forecast period. The application development and testing (AppDev & Testing) workload is poised for explosive growth in the market. This surge is fueled by a confluence of factors: the cloud's on-demand resources accelerating development cycles, its inherent scalability perfectly matching project demands, and built-in collaboration tools fostering seamless teamwork across locations. Additionally, the cloud's pay-as-you-go model slashes costs associated with traditional on-premise infrastructure while offering access to cutting-edge development tools without upfront investment.

Enterprise Size Insights

The large enterprise segment dominated the market with the largest revenue share in 2023. Cloud computing empowers large businesses to automate routine tasks, enabling faster completion times and improved efficiency, which translates to significant cost savings. Additionally, cloud-based solutions offer greater flexibility by eliminating the need for on-premise infrastructure and associated maintenance. Large businesses can easily scale their cloud resources up or down to meet fluctuating demands. Furthermore, cloud computing fosters enhanced teamwork by facilitating seamless collaboration among geographically dispersed teams.

The small & medium enterprises segment is projected to have the highest growth rate over the forecast period. Cloud computing is flourishing in SMEs due to its affordability and scalability. Unlike large enterprises, SMEs no longer need substantial upfront investments in IT infrastructure. Cloud-based solutions allow them to pay only for the resources they use, making it a budget-friendly option. Additionally, cloud computing offers unmatched scalability. SMEs can easily adjust their storage and processing power as their business grows, eliminating the limitations of fixed on-premise IT systems.

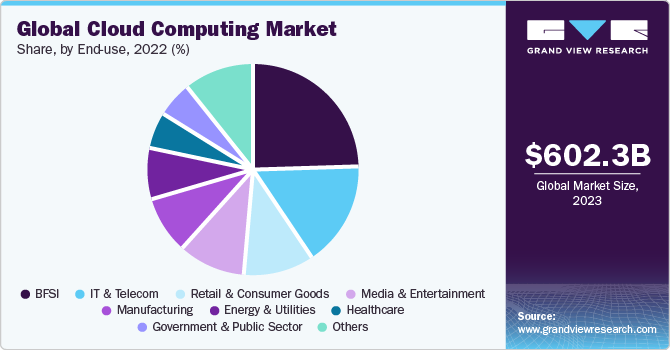

End-use Insights

The BFSI segment dominated the market with the largest revenue share in 2023. Cloud technology offers significant cost savings by reducing the need for expensive on-premise infrastructure and IT staff. Financial institutions are leveraging the cloud's scalability to handle surges in data processing and transactions while also benefiting from improved agility to launch new financial products and services faster. Moreover, cloud-based analytics unlock valuable insights from vast troves of customer data, empowering BFSI firms to personalize offerings and enhance customer experiences.

The manufacturing segment is projected to witness the highest growth rate over the forecast period. By offering scalable, on-demand resources, cloud solutions enable manufacturers to streamline operations, optimize production processes, and foster better collaboration across the supply chain. This translates to significant cost savings through reduced IT infrastructure needs and the ability to automate routine tasks. Additionally, cloud computing empowers manufacturers to leverage data analytics for real-time insights, leading to improved decision-making and faster time-to-market for new products.

Regional Insights

North America held the major share of around 40% of the global cloud computing market in 2023. North America remains a dominant force in the cloud computing market, driven by the presence of major technology hubs and a mature IT infrastructure. The widespread adoption of cloud solutions across various industries, coupled with strong government initiatives promoting digital transformation, is fueling further growth.

U.S. Cloud Computing Market Trends

The cloud computing market in the U.S. held the largest market share of above 90% in 2023. The United States, as the economic leader of North America, holds the largest share of the regional cloud computing market. The presence of leading cloud service providers like AWS, Microsoft Azure, and Google Cloud Platform (GCP) fosters innovation and attracts businesses seeking advanced cloud solutions.

Europe Cloud Computing Market Trends

The cloud computing market in Europe is expected to grow significantly at a CAGR of 20.8% from 2024 to 2030. Europe's cloud computing market is experiencing significant growth, driven by increasing digitalization efforts and growing awareness of the benefits of cloud-based solutions. The European Union's focus on data privacy regulations is also shaping the market, with a growing demand for secure and compliant cloud services.

The UK cloud computing market is expected to grow significantly at a CAGR of 19.7% from 2024 to 2030. The UK is a mature market within Europe, with a strong focus on cloud adoption across various sectors, such as finance, healthcare, and public services. Government initiatives promoting cloud adoption and fostering a competitive cloud service provider landscape are further accelerating growth.

The cloud computing market in Germany is expected to grow significantly at a CAGR of 22.3% from 2024 to 2030. Germany is a major player in the European cloud computing market, driven by its strong industrial base and growing adoption of Industry 4.0 initiatives. The need for secure and reliable cloud solutions for data-intensive manufacturing processes is fueling the demand for cloud services in Germany.

Asia Pacific Cloud Computing Market Trends

The cloud computing market in Asia Pacific is expected to grow significantly at a CAGR of 24.0% from 2024 to 2030. The Asia Pacific region is witnessing the fastest growth in the global cloud computing market, fueled by rapid economic development, increasing internet penetration, and a growing tech-savvy population. This region presents a significant market potential for cloud service providers.

China cloud computing market is expected to grow significantly at a CAGR of 24.0% from 2024 to 2030. China's cloud computing market is the second largest globally, driven by government initiatives promoting cloud adoption and a vast domestic market with a growing demand for digital services. The presence of domestic cloud giants like Alibaba Cloud and Tencent Cloud is further propelling market growth.

The cloud computing market in Japan is expected to grow significantly at a CAGR of 23.2% from 2024 to 2030. Rapid digitalization in Japan across industries, from healthcare and finance to manufacturing and critical infrastructure, is creating a vast surface for cybercriminals. Further, the country faces a significant shortage of qualified cybersecurity professionals, which necessitates upskilling and reskilling initiatives through cybersecurity training courses.

India cloud computing market is expected to grow significantly at a CAGR of 26.7% from 2024 to 2030. India's cloud computing market is experiencing significant growth due to a young population, increasing internet penetration, and government initiatives promoting digitalization. The affordability and scalability of cloud solutions are particularly attractive for India's growing startup ecosystem.

Middle East & Africa Cloud Computing Trends

The cloud computing market in the Middle East & Africa is expected to grow significantly at a CAGR of 18.3% from 2024 to 2030. The Middle East & Africa (MEA) cloud computing market is at a nascent stage but is experiencing rapid growth. Increasing government investments in digital transformation initiatives and growing internet infrastructure are key drivers. The region presents significant potential for cloud service providers offering solutions tailored to the specific needs of the MEA market.

Key Cloud Computing Company Insights

Some of the key companies operating in the market include Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), and Alibaba Cloud among others are some of the leading participants in the cloud computing market.

-

Amazon Web Services (AWS) is one of the most extensive and popular cloud platforms globally, providing a broad range of on-demand cloud computing services and APIs to meet the requirements of individuals, businesses, and governments of any size. With an extensive global network of data centers and a convenient "pay-as-you-go" pricing structure, AWS remains the preferred choice for many who seek trustworthy and adaptable cloud solutions.

-

Microsoft Azure has established itself as a leading platform for developer solutions. It is popular among developers who build cloud-based applications due to its excellent integration with Microsoft's products and developer tools. Furthermore, Azure's security features are robust, and it offers hybrid cloud solutions that meet the needs of enterprises, making it a strong contender in the market.

GroundCloud, and Coastal Cloud are some of the emerging market participants in the cloud computing market.

-

GroundCloud prioritizes renewable energy sources to power their data centers, making them an appealing option for environmentally conscious businesses seeking sustainable cloud solutions.

-

Coastal Cloud is a specialist provider of cloud solutions tailored to handle large media files, ensuring efficient content production, storage, and delivery for the media and entertainment industry.

Key Cloud Computing Companies:

The following are the leading companies in the cloud computing market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Amazon Web Services, Inc.

- CloudHesive

- Coastal Cloud

- DigitalOcean

- GroundCloud

- IBM

- Microsoft Azure

- Oracle Cloud

- Rackspace Technology, Inc.

- Salesforce, Inc.

- Tencent

- The Descartes Systems Group Inc.

- VMware LLC

Recent Developments

-

In April 2024, Google unveiled a custom-designed Arm-based server chip named Axion. This chip aims to revolutionize cloud computing by making it more affordable. This moves positions Google alongside competitors like Amazon and Microsoft who have already embraced similar strategies. With the launch expected later in 2024, Google plans to utilize Axion for its YouTube ad workloads. The news has generated excitement, with customer Snap expressing early interest in this innovative technology.

-

In January 2024, American Tower and IBM Join Forces to Empower Businesses with Cutting-Edge Cloud Solutions. This collaboration aims to revolutionize how businesses approach innovation and customer experiences. American Tower will integrate IBM's hybrid cloud technology and Red Hat OpenShift into its existing Access Edge Data Center network. This combined offering will provide enterprises with powerful tools to leverage the potential of technologies like IoT, 5G, AI, and network automation. By working together, American Tower and IBM will empower businesses to meet the ever-evolving demands of their customers in the age of digital transformation.

-

In January 2024, Eviden and Microsoft joined forces for a five-year strategic partnership. This collaboration expands on their existing relationship by bringing innovative Microsoft Cloud and AI solutions to diverse industries, which aligns with Eviden's broader alliance strategy of solidifying existing partnerships and building new ones to strengthen its global network.

Cloud Computing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 752.44 billion

Revenue forecast in 2030

USD 2,390.18 billion

Growth Rate

CAGR of 21.2% from 2024 to 2030

Base Year

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Service, Deployment, Workload, Enterprise Size, End-use, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Alibaba Cloud; Amazon Web Services, Inc. ; CloudHesive; Coastal Cloud; DigitalOcean; Google; GroundCloud; IBM; Microsoft Azure; Oracle Cloud; Rackspace Technology, Inc.; Salesforce, Inc.; Tencent; The Descartes Systems Group Inc.; and VMware LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Computing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud computing market report based on service, deployment, workload, enterprise size, end-use, and region

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infrastructure as a Service (IaaS)

-

Platform as a Service (PaaS)

-

Software as a Service (SaaS)

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Workload Outlook (Revenue, USD Billion, 2018 - 2030)

-

Application Development & Testing

-

Data Storage & Backup

-

Resource Management

-

Orchestration Services

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Media & Entertainment

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion,2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

United Arab Emirates (UAE)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud computing market size was estimated at USD 602.31 billion in 2023 and is expected to reach USD 752.44 billion in 2024.

b. The global cloud computing market is expected to witness a compound annual growth rate of 21.2% from 2024 to 2030 to reach USD 2,390.18 billion by 2030.

b. The North American cloud computing market accounted for the largest revenue share of over 40.0% in 2023. The presence of numerous cloud computing vendors in the region and the higher propensity to adopt new technologies is expected to help the regional market maintain its positions in the market.

b. Adobe Inc., Alibaba Group Holding Limited, Amazon.com Inc., Google LLC, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Salesforce.com Inc., SAP SE, and Workday, Inc., are some of the prominent players present in the cloud computing market.

b. The global cloud computing market report scope covers segmentation by service, workload, enterprise size, deployment, end-use, and region.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."