- Home

- »

- IT Services & Applications

- »

-

Cloud Data Security Market Size, Industry Report, 2030GVR Report cover

![Cloud Data Security Market Size, Share & Trends Report]()

Cloud Data Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment (Public Cloud, Private Cloud), By Type, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-517-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Data Security Market Summary

The global cloud data security market size was estimated at USD 4.75 billion in 2024 and is projected to reach USD 11.62 billion by 2030, growing at a CAGR of 16.4% from 2025 to 2030. The growing frequency and sophistication of cyber threats are driving the growth of the cloud data security industry.

Key Market Trends & Insights

- North America cloud data security industryheld a significant global share of around 36.0% in 2024.

- The U.S. dominated the cloud data security industry in 2024.

- Based on type, the fully managed segment dominated the industry with a revenue share of 59.1% in 2024.

- Based on enterprise size, the large enterprises segment dominated the market with a revenue share of 71.2% in 2024.

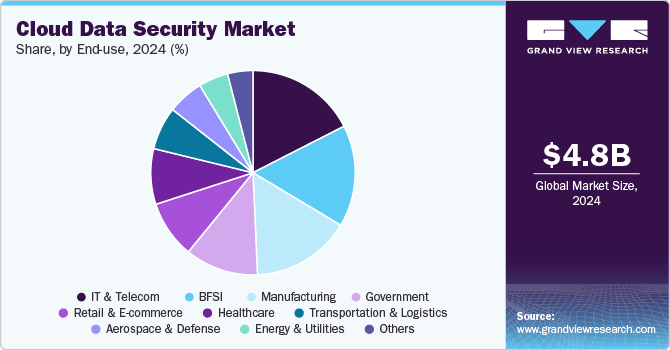

- Based on end use, the IT & telecommunication segment dominated the market and held a 17.5% share of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.75 Billion

- 2030 Projected Market Size: USD 11.62 Billion

- CAGR (2025-2030): 16.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Hackers are using increasingly advanced techniques such as ransomware, phishing, and malware attacks to exploit vulnerabilities in cloud infrastructures. Recent high-profile data breaches have highlighted the urgent need for encryption, identity access management (IAM), and real-time threat detection to prevent unauthorized access.According to Cloud Security Alliance, encryption adoption remains low despite the crucial role of data security. Fewer than 10% of enterprises encrypt at least 80% of their cloud data, and using multiple key management systems adds further complexity to the security landscape. This slow adoption of encryption poses significant risks, especially as the volume of sensitive data in the cloud expands. As cybercriminals continue to evolve their attack strategies, businesses are investing in artificial intelligence (AI) driven security tools that can analyze data patterns, detect anomalies, and respond to threats in real time. This trend is expected to drive the demand for automated security solutions in cloud environments.

The expanding adoption of cloud-native applications and IoT (Internet of Things) devices is driving the need for enhanced cloud security measures. Organizations leverage cloud computing for scalability and flexibility, but the proliferation of IoT-connected devices increases the risk of cyber threats. Cloud security solutions that offer real-time monitoring, advanced encryption, and secure API management are becoming essential in protecting data in transit and at rest. As businesses continue to deploy IoT-enabled solutions, the demand for cloud security tools with AI-driven threat detection and predictive analytics will surge.

In addition, the rise of remote work and digital transformation also significantly boost the cloud data security industry. With more employees accessing corporate networks remotely, organizations face greater risks of unauthorized access, data leaks, and insider threats. Companies are adopting zero-trust security frameworks, which require continuous authentication and verification of users, devices, and applications before granting access to cloud resources. In addition, the integration of secure access component edge (SASE) solutions, which combine network security functions with cloud-native capabilities, is helping businesses protect data in a highly distributed work environment. The demand for cloud security solutions with endpoint protection, secure VPNs, and multi-factor authentication (MFA) is expected to grow as remote work remains a long-term trend.

Furthermore, the rise of software-defined networking (SDN) and network function virtualization (NFV) also fuels the demand for advanced cloud security solutions. As enterprises transition from traditional hardware-based network infrastructure to software-defined and virtualized environments, the risk of cyber threats increases due to the dynamic nature of software-defined networks. Organizations are adopting cloud security solutions that provide real-time traffic analysis, automated security policy enforcement, and micro-segmentation to protect their cloud workloads. These technologies help reduce attack surfaces and prevent lateral movement of cyber threats within cloud environments, driving the demand for next-generation cloud security solutions.

Component Insights

Based on component, the market is segmented into solution and services. The solution segment is experiencing significant growth due to the rising adoption of cloud-based workloads across industries. As organizations increasingly migrate sensitive data to the cloud, concerns regarding data breaches, unauthorized access, and regulatory compliance are driving demand for comprehensive security solutions. Cloud security solutions, such as data encryption, identity and access management (IAM), cloud security posture management (CSPM), and data loss prevention (DLP), are becoming essential for enterprises seeking to protect critical business assets. These solutions help organizations monitor, detect, and mitigate security threats while ensuring seamless access control and compliance with industry standards.

The services segment is anticipated to grow significantly at a CAGR of 17.6% over the forecast period. The rising adoption of hybrid and multi-cloud environments is a major factor fueling the growth of the cloud data security industry. Organizations increasingly utilize multiple cloud service providers (CSPs) such as AWS, Microsoft Azure, and Google Cloud to optimize costs and performance. However, securing multi-cloud architecture presents unique challenges, as cloud platforms have varying security protocols and policies. This has led to a surge in demand for cloud security services that provide centralized threat detection, policy enforcement, and risk management across multiple cloud environments. Security service providers offer cloud access security broker (CASB) solutions, managed detection and response (MDR), and continuous security monitoring to ensure seamless protection across all cloud platforms.

Type Insights

Based on type, the market is segmented into fully managed and co-managed. The fully managed segment dominated the industry with a revenue share of 59.1% in 2024. The increasing number and sophistication of cyberattacks drive the demand for fully managed cloud security solutions. Cyber threats such as ransomware, DDoS (Distributed Denial of Service) attacks, advanced persistent threats (APTs), and insider threats are becoming more targeted and complex, often requiring expertise and proactive security strategies to mitigate. Fully managed services offer a comprehensive suite of tools, including real-time threat detection, vulnerability assessments, patch management, and incident response, to defend against these growing threats. By leveraging a managed service provider, businesses can access state-of-the-art cybersecurity technologies and expertise that would otherwise be difficult or costly to develop in-house.

The co-managed segment is expected to grow at a CAGR of 17.4% over the forecast period. As organizations increasingly migrate to cloud environments, the complexity of managing security has grown significantly. This complexity arises from integrating multiple cloud services, handling vast amounts of data, complying with regulatory requirements, and protecting against evolving cyber threats. Many organizations, particularly small and medium-sized businesses (SMBs), find it challenging to manage all these aspects internally. By partnering with external security experts, companies can benefit from specialized knowledge and advanced tools without overburdening their internal IT teams. The co-managed approach allows businesses to retain some control over their security operations while leveraging third-party providers' expertise to handle more specialized tasks, such as threat detection, incident response, and regulatory compliance.

Deployment Insights

Based on deployment, the market is segmented into public, private, and hybrid. The private cloud segment dominated the industry with a revenue share of 44.9% in 2024. The increasing demand for enhanced data control and privacy drives segment growth. Organizations dealing with highly sensitive or confidential data are often concerned about the risks of storing their information in a shared environment, such as the public cloud. With private cloud solutions, businesses have full control over their infrastructure, enabling them to implement tailored security protocols and data governance policies. This autonomy in managing security settings helps ensure compliance with stringent data protection regulations like GDPR, HIPAA, and industry-specific standards. Private cloud solutions offer dedicated resources and private networks, reducing the risk of data breaches, unauthorized access, or other security vulnerabilities associated with multi-tenant public cloud environments. As regulations become more stringent and companies strive to maintain their reputation and customer trust, the demand for private cloud security solutions continues to rise.

The hybrid cloud segment is anticipated to grow significantly at a CAGR of 17.9% over the forecast period. The growing use of artificial intelligence (AI) and machine learning (ML) in hybrid cloud security contributes to market growth. AI and ML technologies are increasingly integrated into cloud data security solutions to enhance threat detection, automate responses, and identify real-time anomalies. These technologies are especially useful in hybrid cloud environments, where the complexity of managing security across multiple platforms can overwhelm traditional security measures. AI and ML algorithms can analyze large volumes of data, learn from previous behavior patterns, and detect emerging threats more efficiently than conventional methods. As organizations embrace AI and ML in their security strategies, the demand for hybrid cloud security solutions powered by these technologies will continue to rise.

Enterprise Size Insights

Based on enterprise size, the market is segmented into large enterprises and SMEs. The large enterprises segment dominated the market with a revenue share of 71.2% in 2024. The growing demand for integrated security solutions drives growth among large enterprises in the cloud data security industry. As organizations increasingly operate in multi-cloud and hybrid environments, managing security across multiple platforms and providers becomes complex. Large enterprises need integrated cloud security solutions to unify security policies, provide centralized visibility, and streamline threat detection across diverse environments. By integrating various security tools, such as firewalls, intrusion detection systems (IDS), and identity management platforms, organizations can ensure comprehensive protection for their cloud native. This integration reduces the complexity of managing disparate security tools and enhances the overall efficiency of threat prevention and mitigation efforts. As the multi-cloud strategy continues to gain popularity, the need for integrated, end-to-end security solutions for large enterprises becomes more pressing.

The small and medium enterprises (SMEs) segment is expected to grow significantly, with a CAGR of over 17.8% over the forecast period. The growing regulatory pressure surrounding data privacy and protection is a critical driver for the cloud data security market among SMEs. As data privacy regulations become more stringent globally, such as the GDPR in the European Union and CCPA in California, SMEs are under increasing pressure to ensure they comply with these rules. Non-compliance can result in hefty fines and legal repercussions, devastating for smaller businesses. Cloud security providers are responding by offering solutions that help SMEs comply with data protection regulations by providing tools like data encryption, secure data storage, access control, and audit trails. These features help SMEs safeguard customer data, demonstrate regulatory compliance, and avoid penalties.

End Use Insights

The IT & telecommunication segment dominated the market and held a 17.5% share of the global revenue in 2024. The shift to cloud environments and the rapid expansion of 5G networks means that telecom and IT companies are managing an ever-increasing amount of data across diverse networks. Cloud data security solutions are crucial to ensuring this data's confidentiality, integrity, and availability as it travels across various platforms. Telecom and IT companies must ensure that sensitive information is encrypted, networks are protected against data breaches, and compliance requirements related to data protection laws such as the GDPR, HIPAA, or industry-specific regulations are met. With cyberattacks becoming more sophisticated, cloud data security solutions such as threat detection, continuous monitoring, and intrusion prevention systems are essential for these industries to stay ahead of potential risks and safeguard client data.

The shift to omnichannel retailing contributes to the demand for cloud data security solutions in retail and e-commerce. As retailers expand their operations across multiple channels, including physical stores, websites, mobile apps, and social media platforms, the complexity of managing customer data and ensuring its security grows. With customers interacting across various touchpoints, businesses need cloud-based security solutions to monitor and secure data from all channels. For example, customer interactions on mobile apps or e-commerce websites may need to be safeguarded from data breaches or unauthorized access. Cloud security solutions enable retailers to secure data across all customer interactions, regardless of the channel, ensuring the entire customer journey is protected. The omnichannel approach has thus driven the need for integrated cloud data security solutions that provide consistent and comprehensive protection across all customer-facing platforms.

Regional Insights

North America cloud data security industryheld a significant global share of around 36.0% in 2024. The growing use of cloud-based services for sensitive data storage in sectors such as healthcare, finance, and government further drive the growth in the North American market. These industries store sensitive data, including personal health records, financial information, and government data, which are highly attractive targets for cybercriminals. Ensuring this sensitive data is protected in the cloud is a top priority. With a growing reliance on cloud computing to store and manage critical information, businesses in these sectors are increasingly adopting data security solutions designed to provide robust protection and ensure compliance with industry regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) for healthcare and Sarbanes-Oxley Act (SOX) for financial data.

U.S. Cloud Data Security Market Trends

The U.S. dominated the cloud data security industry in 2024. The growth of data sovereignty and localization requirements is also driving demand for cloud data security solutions. Many U.S. businesses, especially those operating in the European Union or other regions with stringent data protection laws, face increasing pressure to store and process data within specific geographic boundaries. This concept, known as data sovereignty, refers to the idea that data must be subject to the laws and regulations of the country where it is stored. Organizations are investing in cloud data security solutions to meet these requirements that can facilitate secure data storage, encryption, and transfer while complying with local laws and regulations. As businesses expand globally and the regulatory landscape becomes more complex, organizations must ensure that their cloud data security strategies can support data sovereignty mandates and prevent unauthorized access to data stored across borders.

Europe Cloud Data Security Market Trends

The cloud data security industry in Europe is anticipated to register considerable growth from 2025 to 2030. The rise of digital banking and fintech companies in Europe drives the demand for cloud data security solutions. As more consumers and businesses transition to online banking and financial services, the security of personal financial data and transactions becomes a top priority. Many fintech companies leverage cloud platforms to deliver innovative services like mobile banking apps, digital wallets, and peer-to-peer lending. Still, these platforms require advanced cloud data security measures to protect against fraud, unauthorized access, and financial crimes. With the increasing volume of economic data being stored and processed in the cloud, fintech companies seek solutions that offer end-to-end encryption, multi-factor authentication, and fraud detection systems to secure their cloud-based operations and ensure compliance with financial regulations.

The Germany cloud data security industry held a substantial market share in the European region in 2024. The growing demand for secure cloud migration services drives market growth in Germany. As businesses migrate their IT infrastructure, applications, and data to the cloud, the need for safe and seamless cloud migration services has surged. Many organizations seek cloud migration solutions, prioritizing security at every stage of the migration process, from data transfer to post-migration operations. This includes securing data during transit, ensuring the integrity of applications once they are in the cloud, and implementing security measures for cloud-based storage. As a result, cloud service providers offer more secure migration services, including encryption, data sanitization, and secure authentication methods to reduce the risk of data breaches during migration. This is driving the demand for cloud data security solutions specifically tailored to the needs of businesses transitioning to the cloud.

The France cloud data security industry is expected to grow rapidly during the forecast period. The growing adoption of cloud computing across French industries drives market growth. Cloud services, including Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS), are becoming increasingly popular among businesses in sectors such as finance, healthcare, retail, and manufacturing. These sectors rely heavily on cloud computing to improve operational efficiency, reduce costs, and enable remote work and collaboration. However, as organizations move more critical data and applications to the cloud, the need for robust security measures to protect this data becomes paramount. France’s large and small organizations are increasingly seeking cloud data security solutions, such as encryption, identity management, and threat intelligence, to safeguard their cloud-hosted data and ensure business continuity in the event of a breach or cyberattack.

Asia Pacific Cloud Data Security Market Trends

Asia Pacific cloud data securityindustry is anticipated to achieve the fastest CAGR of 19.6% over the forecast period. The rapid expansion of digital transformation initiatives across industries in APAC is an important factor driving the cloud data security market. As governments, businesses, and organizations in finance, healthcare, manufacturing, and retail embrace digital transformation, they increasingly rely on cloud-based solutions to enable innovation, improve operational efficiency, and enhance customer experiences. However, digital transformation efforts often involve migrating sensitive data and critical applications to the cloud, heightening the risk of exposure to security vulnerabilities. As a result, organizations in APAC are investing in cloud data security solutions to protect their assets while driving digital initiatives forward. Technologies such as secure cloud access, encryption, and secure data sharing are in demand to ensure data safety during digital transitions.

The China cloud data security industry held a substantial market share in 2024. The growing demand for secure cloud collaboration tools in China drives the growth of the cloud data security market. As remote work and online collaboration become more prevalent nationwide, businesses increasingly rely on cloud-based platforms for communication, file-sharing, and collaborative project management. However, the widespread use of these platforms exposes organizations to new security risks, such as unauthorized access to sensitive files and data leakage. To address these concerns, Chinese businesses are investing in cloud data security solutions that can protect the integrity and confidentiality of shared information through cloud collaboration tools. The demand for secure collaboration features, such as encryption, multi-factor authentication, and granular access controls, is growing as companies look to safeguard sensitive data while enhancing productivity and innovation in a remote or hybrid work environment.

The India cloud data security industry is expected to grow rapidly during the forecast period. The increasing cybersecurity threats in India are critical drivers of the cloud data security industry. As the digital landscape in India continues to evolve, cybercriminals are becoming more sophisticated in their methods, targeting businesses, governments, and individuals. The rising frequency of cyberattacks such as ransomware, data breaches, and phishing attacks has heightened the need for businesses to adopt comprehensive cloud security solutions. Indian companies are increasingly aware of the vulnerabilities of storing sensitive data on cloud platforms. Therefore, they prioritize cloud security to protect their intellectual property, customer data, and financial information. The growing threat landscape in India is leading organizations to invest in advanced security technologies, such as encryption, access management, and real-time threat detection, to ensure the safety and integrity of their data stored in the cloud.

Key Cloud Data Security Company Insights

Some of the key players operating in the market include Palo Alto Networks, Inc., IBM, and Microsoft, among others.

-

Palo Alto Networks is a global cybersecurity company. It provides comprehensive security solutions to protect enterprises, service providers, and governments against cyber threats. Through its advanced technology and a robust portfolio of cybersecurity products, Palo Alto Networks addresses this need through its comprehensive cloud security solutions, particularly within its Prisma Cloud platform, designed to secure data, applications, and workloads in the cloud. Prisma Cloud provides real-time visibility and threat protection for data stored in public and private cloud environments, such as AWS, Microsoft Azure, and Google Cloud. The platform helps organizations identify vulnerabilities, monitor compliance, and safeguard sensitive data, ensuring companies can use the cloud without compromising security.

Lookout, Inc. and Forcepointare some of the emerging market participants in the target market.

-

Lookout, Inc., is a cybersecurity company specializing in mobile security and cloud data protection. Lookout’s cloud data security solutions are designed to protect enterprise data across mobile, endpoint, and cloud environments. Lookout offers Lookout Cloud Security Platform, which integrates mobile, endpoint, and cloud security to provide comprehensive protection. The platform uses AI-powered threat detection to monitor, assess, and mitigate real-time risks, helping organizations secure data across various cloud services, such as Microsoft 365, Google Workspace, and Box.

Key Cloud Data Security Companies:

The following are the leading companies in the cloud data security market. These companies collectively hold the largest market share and dictate industry trends.

- Palo Alto Networks

- IBM

- Microsoft

- Amazon Web Services, Inc.

- Alibaba Group

- Netskope

- Check Point Software Technologies Ltd.

- Zscaler, Inc.

- Lookout, Inc.

- Orca Security

- SentinelOne

- Forcepoint

Recent Developments

-

In September 2023, IBM announced the expansion of its IBM Cloud Security and Compliance Center, an updated solution designed to assist enterprises in reducing risk and safeguarding data across hybrid, multi-cloud environments and workloads. As businesses seek to tackle emerging threats in the supply chain and navigate evolving global regulations, this suite of solutions aims to enhance resiliency, performance, security, and compliance while minimizing operational costs.

-

In February 2023, Orca Security launched new Data Security Posture Management (DSPM) capabilities as an extension of the Orca Cloud Security Platform. This latest offering builds on Orca's comprehensive cloud security approach and significantly enhances its existing features. It offers advanced data discovery and management tools, allowing organizations to identify, prioritize, and address sensitive data risks across multi-cloud environments, including shadow and misplaced data that organizations may not have previously detected.

Cloud Data Security Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 5.43 billion

Revenue Forecast in 2030

USD 11.62 billion

Growth Rate

CAGR of 16.4% from 2025 to 2030

Actual Data

2018 - 2023

Forecast Period

2025 - 2030

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Component, type, deployment, enterprise size, end use, region

Regional Scope

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

Palo Alto Networks, IBM, Microsoft, Amazon Web Services, Inc., Alibaba Group, Netskope, Check Point Software Technologies Ltd., Zscaler, Inc., Lookout, Inc., Orca Security, SentinelOne, Forcepoint

Customization Scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Data Security Market Report Segmentation

This report forecasts revenue growth at global, regional, as well as at country levels and offers qualitative and quantitative analysis of the market trends for each of the segment and sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud data security market report based on component, type, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fully Managed

-

Co-Managed

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

Hybrid

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

SMEs

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

IT & Telecom

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Government

-

Transportation & Logistics

-

Manufacturing

-

Aerospace & Defense

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The cloud data security market size was estimated at USD 4.75 billion in 2024 and is expected to reach USD 5.43 million in 2025

b. The cloud data security market is expected to grow at a compound annual growth rate of 16.4% from 2025 to 2030 to reach USD 11.62 million by 2030

b. The fully managed segment dominated the industry with a revenue share of 59.1% in 2024. The increasing number and sophistication of cyberattacks drive the demand for fully managed cloud security solutions.

b. Some key players operating in the market include Palo Alto Networks, IBM, Microsoft, Amazon Web Services, Inc., Alibaba Group, Netskope, Check Point Software Technologies Ltd., Zscaler, Inc., Lookout, Inc., Orca Security, SentinelOne, Forcepoint.

b. Factors such as the growing frequency and sophistication of cyber threats and the expanding adoption of cloud-native applications and IoT (Internet of Things) devices are driving the cloud data security market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.