Cloud Data Warehouse Market Size & Trends

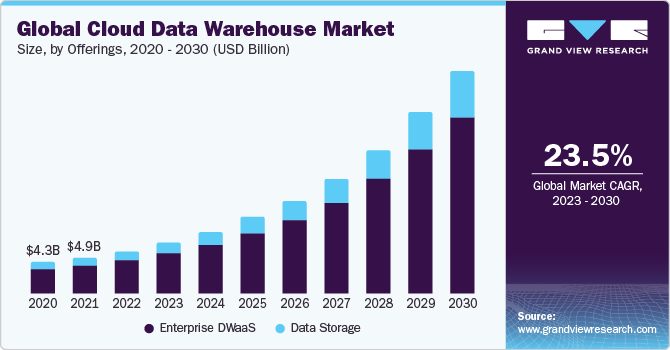

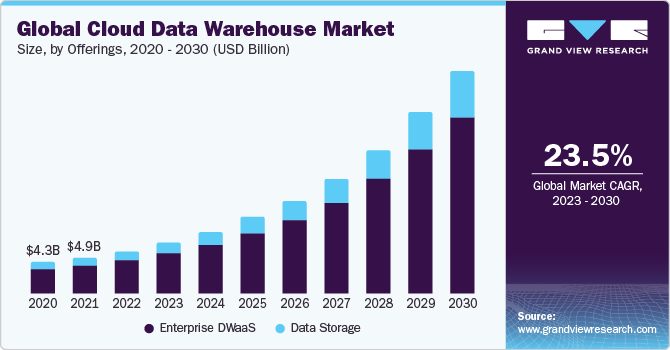

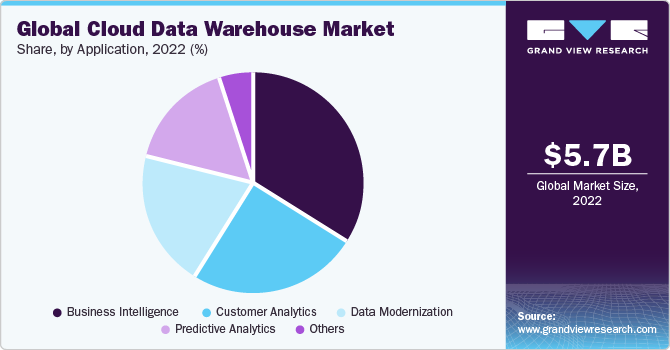

The global cloud data warehouse market size was valued at USD 5.68 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 23.5% from 2023 to 2030. The increasing importance of business intelligence and analytics across different verticals is a major factor driving the market growth. For analytics and business intelligence processes, cloud data warehouses act as a backbone for storing large amounts of data. Moreover, the emergence of cloud services has also accelerated the adoption of business intelligence and analytic practices as they aid organizations in deriving actionable insights. The shift towards the implementation of Artificial Intelligence (AI) and Machine Learning (ML) across different industries is further expected to create new growth opportunities for the market growth.

The COVID-19 outbreak has been advantageous for the demand of the cloud data warehouse market. The pandemic of COVID-19 and the development of remote work situations generated new complicated challenges for organizations to overcome. The economic downturn caused by COVID-19 highlighted the necessity for alternative business methods. Businesses are increasingly embracing cloud computing and migrating to cloud data warehouses. This is expected to assist firms in maintaining a steady business state in the short term while aiming for long-term growth and expansion.

With the generation of large amounts of data, the need to collect, store, and analyze large data sets has grown exponentially. Cloud data warehousing enables organizations, regardless of their size, to meet this need with considerable agility, effectiveness, and speed. Businesses must connect ERP, CRM, social media, support, and marketing data while retaining speed and performance in order to make data-driven choices. Cloud data warehouses are quick and can handle many data streams at different speeds. Cloud data warehouses typically include multiple servers that may balance the data load and boost processing rates. Cloud data warehouses with many servers can service multiple sectors of the business in different geographies at the same time. Cloud data warehouses can rapidly and efficiently integrate with additional data sources as needed and then deploy the revised solution to production.

Offering Insights

Based on the offering, the cloud data warehouse market is segmented into enterprise DWaaS and data storage. The enterprise DWaaS segment held the largest market share in 2022. With the increasing data volume across different industries, organizations are turning to focus on business functioning. The organization is leveraging data from across different functionalities in the organization to make a strategic decision. To access a large amount of data produced, the end users are turning towards Enterprise Data Warehouse as a Service (DWaaS) solutions, as they store data from multiple sources and applications while being centrally available across the enterprise. However, the low installation cost and flexibility to manage the scalability of the cloud data warehouse also provide organizations with easy availability.

Organization Size Insights

Based on the organization size, the cloud data warehouse market is segmented into SMEs and large enterprises. The large enterprises segment held the largest market share in 2022. Large enterprises deal with a large amount of data, storing historical data in a data warehouse, with serves to increase the operational cost of the company. On the other hand, the cloud data warehouse platform does not require any physical services and is easily accessible owing to its centralized repository, thereby driving segmental growth.

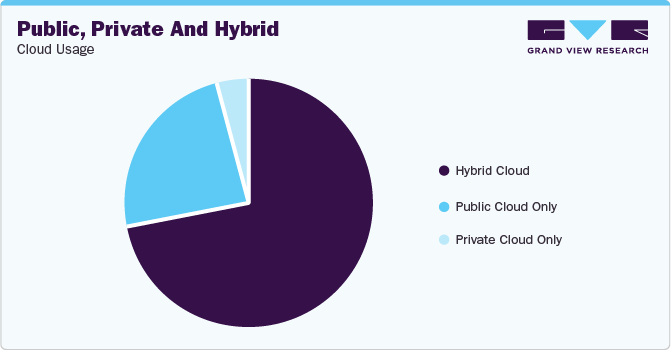

Deployment Type Insights

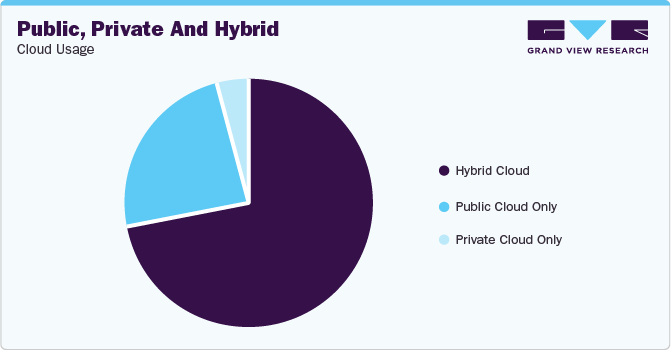

Based on the deployment type, the cloud data warehouse market is segmented into public cloud and private cloud. The public cloud deployment segment held the largest market share in 2022. To lower operational costs, small to large-scale organizations resort to public cloud deployment.

Moreover, the public cloud also provides advantages such as higher reliability, no maintenance, and almost unlimited scalability for the data warehouse. Moreover, the increasing investment in collaboration, mobility, and other remote working technologies is further expected to drive the segmental growth.

Vertical Insights

Based on the Vertical, the cloud data warehouse market is segmented into telecom & ITES, government, BFSI, retail & consumer, healthcare, manufacturing & automotive, and others. The healthcare segment held the largest market share in 2022. The healthcare industry is undergoing significant changes, as the industry is embracing advanced technologies such as analytics based on AI, ML, and IoT. The information quality and an interest in efficient pharmaceutical administrations have become increasingly important. Initially, the implementation of cloud data warehouse solutions in the healthcare vertical was comparably delayed due to data complexities along with a wider range of medical data. However, in recent years, the increased use of Cloud Data Warehouse solutions has proven to be useful in administrative and clinical settings. The historical data is applied in a wide range of applications, from improving the health of patients to medicinal testing.

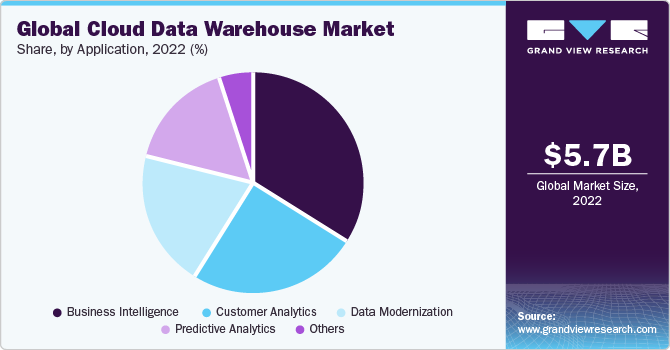

Application Insights

Based on the application, the cloud data warehouse market is segmented into customer analytics, data modernization, business intelligence, predictive analytics, and others. The business intelligence segment held the largest market share in 2022. Data warehouse storage plays a pivotal part in business intelligence operations.

The growing traction of cloud-based services has culminated in increased dependency on business intelligence operations. A business intelligence solution's main functionalities are dashboards, visualization of data, and providing analytical insights. Business intelligence tools are often used to assist firms in improving data classifications and reporting. As a result, the increased use of business intelligence technologies is fueling market demand for data warehouse services.

Regional Insights

North America dominated the market in 2022. The advent of the big data trend in organizations across the U.S. is fueling increased demand for analytics, which is expected to boost market growth. The regional market demand is anticipated to be driven by the rising need for analytics and minimal latency, as well as the expanding role of BI in company management. The emerging cloud warehouse facilities enable flexibility while also incorporating the most recent information and sources to solve difficulties such as complexity, diversity, volume, and velocity.

Key Companies & Market Share Insights

Key players operating in the market are Amazon Web Services, Inc., International Business Machines Corp. (IBM), Microsoft Corporation, Google LLC, Oracle Corporation, SAP SE, Snowflake Inc., Yellowbrick Data, Teradata Corporation, and Cloudera, Inc. The market players typically resort to strategic initiatives such as launch new technologies and research and development activities. The following are some instances of such initiatives.

-

In October 2023, mParticle, Inc. announced the launch of ComposeID, an identity resolution service compatible with cloud data warehousing environments. ComposeID is based on IDSync. IDSync is intended to assist teams in supporting any identity strategy on any data architecture.

-

In July 2023, International Business Machines Corp. (IBM) announced new updates in the IBM Db2 Warehouse. The next generation of the warehouse can add cloud object storage with the support of advanced caching, which delivers four times faster query response while cutting storage costs by 34%.