- Home

- »

- Next Generation Technologies

- »

-

Cloud Gaming Market Size, Share & Growth Report, 2030GVR Report cover

![Cloud Gaming Market Size, Share & Trends Report]()

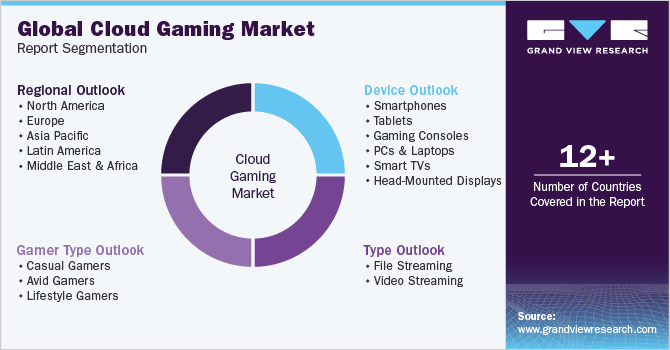

Cloud Gaming Market Size, Share & Trends Analysis Report By Type (File Streaming, Video Streaming), By Gamer Type (Casual Gamers, Avid Gamers), By Device, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-847-3

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

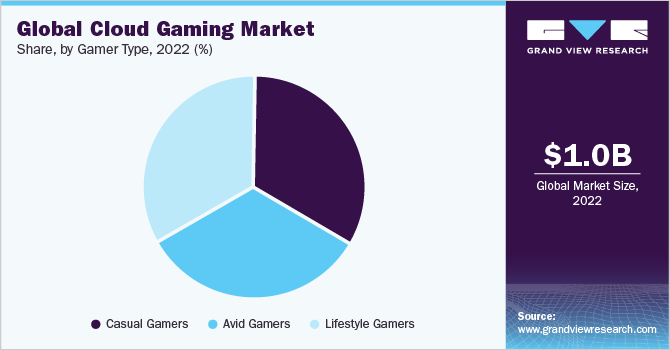

The global cloud gaming market size was estimated at USD 1.02 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 45.5% from 2023 to 2030. The growing popularity and demand for gaming across multiple devices such as smartphones, and consoles, among others are anticipated to drive the expansion of the market. Similarly, the increase in the trend of digital gaming is expected to push gamers to cloud gaming because of quick downloads and updates of new video game titles. For instance, Sony Group Corporation launched its PlayStation 5 console with a digital-only variant.

In addition, the trend of companies focusing on the expansion of cloud data centers offering an enhanced gaming experience is expected to drive market growth. For instance, Amazon Web Services, Inc. invested USD 35 billion in its cloud data centers in Virginia between 2011 and 2020. Cloud data centers enable companies to offer a seamless and low-latency gaming experience to their customers. Similarly, the market players are also focusing on developing advanced cloud gaming products and services to attract a larger customer base, which is positively influencing the overall market of cloud gaming.

Furthermore, the advent of 5G and high-speed broadband is expected to accelerate market growth. Gaming companies are also partnering with networking enterprises to offer modern and efficient cloud connectivity. For instance, in August 2022, Verizon Communications, Inc. partnered with Hi-Rez Studios to offer game developers efficient mobile gaming tools over its millimeter wave (mmWave) and C-band 5G network. This, in turn, is expected to generate new opportunities in the cloud gaming industry.

In addition, it has been observed that gamers are turning towards cloud gaming due to the storage size and updates of modern games. For instance, Activision Publishing, Inc.’s Call of Duty Modern Warfare 2 video game that launched in November 2022 accounted for approximately 36.2 GB of storage size on the PlayStation 5 console. Furthermore, gamers are also adopting cloud services for saving game progress as they can continue from the same save point on any compatible console with the only prerequisite of being logged in to the account associated with the purchase of the game.

Moreover, cloud gaming experienced an uptick during the COVID-19 pandemic as people turned towards gaming for leisure during the government-issued lockdowns. As people were restricted from gathering in public spaces due to social distancing norms, there was an increase in the popularity of multiplayer video games such as Among Us, Fortnite, and Minecraft, where the cloud services allowed seamless gaming between several players. Similarly, cloud gaming services enabled mobile game developers to create open-world games that grew in popularity during the pandemic. Thus, the market of cloud gaming gained prominence during the pandemic and is expected to grow further over the forecast period.

Type Insights

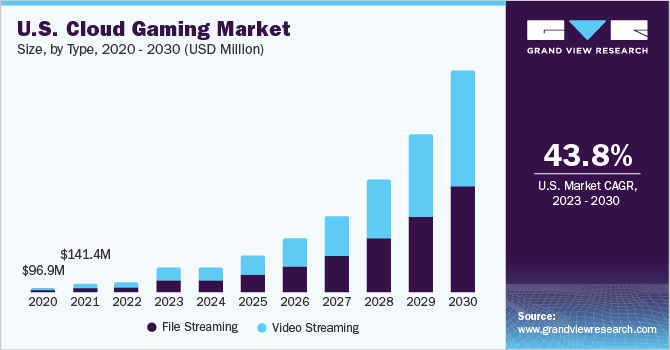

The video streaming segment accounted for the highest market share of around 55% in 2022. The segment’s dominance can be attributed to the convenience it offers to gamers to play any game regardless of hardware requirements. As the gaming graphics are processed on the cloud and not on local devices, gamers require a stable and high-speed internet connection to run the games. This, in turn, is expected to add to the segment’s dominance over the forecast period.

The file streaming segment is anticipated to grow at the fastest CAGR of more than 45% during the forecast period from 2023 to 2030. This segment growth is attributed to the economic factors it provides to game developers. File streaming enables gamers to run the game immediately after a certain percentage of files are downloaded due to the sequential file downloading feature. Thus, it is anticipated that game developers and gamers will positively turn towards file streaming thereby adding to the segment growth.

Device Insights

The gaming consoles segment accounted for the largest market share of over 50% in 2022. The segment’s dominance is attributed to growing disposable income and certain game titles available exclusively on specific consoles. For instance, the popular Forza Horizon racing game is available solely on Microsoft Xbox consoles, which in turn attracts new users to purchase the Xbox console if they wish to play the game. In addition, the 4K resolution output at 120-hertz capabilities of modern consoles is anticipated to attract lifestyle gamers for an immersive gaming experience.

The smartphone segment is anticipated to grow at the fastest CAGR over the forecast period from 2023 to 2030. This growth can be attributed to the growing availability of freemium games that include optional in-app purchases and subscriptions. Similarly, companies involved in the cloud gaming market targeted mobile gaming due to the high smartphone penetration around the world. In addition, the 5G and Wi-Fi 6 capabilities of modern smartphones are anticipated to satisfy the technical barrier for cloud gaming and are helping the segment grow positively.

Gamer Type Insights

Based on gamer type, the cloud gaming market is segmented into casual gamers, avid gamers, and lifestyle gamers. The casual gamers segment accounted for the largest market share of over 50% in 2022. The segment revenue can be attributed to the growing popularity of casual games under the freemium model. In addition, the trend of recreational and spontaneous gaming is expected to drive the segment.

The avid gamers segment is expected to grow at a significant CAGR of more than 45% over the forecast period from 2023 to 2030. This is attributed to the increasing number of people who are turning to gaming for purposes other than only as a hobby. It is also observed that avid gamers are more likely to complete in-app purchases and subscribe to gaming platforms over casual gamers. Similarly, the low-entry barrier to cloud gaming in terms of devices such as smartphones and budget PCs is anticipated to drive the segment.

Regional Insights

The Asia Pacific region accounted for the largest market share of more than 45% in 2022. The regional dominance can be attributed to the combination of multiple demographics and a large gamer population in the region. For instance, China and India are the highest populated countries in the world that also have a large gaming base. Finally, the availability of affordable high-speed internet combined with high smartphone penetration is another factor for their regional dominance.

The North America region is projected to grow at a CAGR of approximately 44% over the forecast period. The regional growth is attributed to the presence of legacy cloud gaming companies such as NVIDIA Corporation, Microsoft Corporation, and Intel Corporation in the region. Moreover, the large-scale technological development in the region is expected to propel regional market growth. The availability of 5G and high-speed internet is another driver for regional growth.

Key Companies & Market Share Insights

The key players in the market are adopting strategies, such as partnerships, acquisitions, ventures, innovations, R&D, and geographical expansions, to solidify their industry position. Companies for staying competitive are also focusing on improving their product offerings to better suit the changing needs of users. For instance, in May 2023, Microsoft Corporation entered into a multi-year agreement with Nware, a cloud gaming platform, and added it to its game streaming offering. The partnership was consistent with Microsoft Corporation’s plan to outperform competitors and develop a significant cloud gaming service. Some prominent players in the cloud gaming market are:

-

Amazon.com, Inc.

-

Apple Inc.

-

Electronic Arts, Inc.

-

Google LLC

-

Intel Corporation

-

International Business Machines Corporation (IBM Corporation)

-

Microsoft Corporation

-

NVIDIA Corporation

-

Sony Interactive Entertainment

-

Ubitus Inc.

-

Tencent Holdings Ltd.

Cloud Gaming Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.52 billion

Revenue forecast in 2030

USD 20.93 billion

Growth Rate

CAGR of 45.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

The device, gamer type, type

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Mexico; Saudi Arabia; South Africa

Key companies profiled

Amazon.com, Inc.; Apple Inc.; Electronic Arts, Inc.; Google LLC; Intel Corporation; IBM Corporation; Microsoft Corporation; NVIDIA Corporation; Sony Interactive Entertainment; Ubitus Inc.; Tencent Holdings Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Gaming Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cloud gamingmarket report based on type, device, gamer type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

File Streaming

-

Video Streaming

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Smartphones

-

Tablets

-

Gaming Consoles

-

PCs & Laptops

-

Smart TVs

-

Head-mounted Displays

-

-

Gamer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Casual Gamers

-

Avid Gamers

-

Lifestyle Gamers

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global cloud gaming market size was estimated at USD 1.02 billion in 2022 and is expected to reach USD 1.52 billion in 2023.

b. The global cloud gaming market is expected to grow at a compound annual growth rate of 45.5% from 2023 to 2030 to reach USD 20.93 billion by 2030.

b. Asia Pacific dominated the cloud gaming market with a share of 45.1% in 2022. This is attributable to the cost-effective nature of the cloud gaming platforms promoting its usage across various new customer classes that vary in investing in gaming systems due to its cost.

b. Some key players operating in the cloud gaming market include Amazon Web Services Inc.; Apple, Inc.; Electronic Arts, Inc.; Google Inc.; Intel Corporation; International Business Machines Corporation; Microsoft Corporation; NVIDIA Corporation; Sony Interactive Entertainment LLC; and Ubitus Inc.

b. Key factors driving the cloud gaming market growth include growing penetration of high-speed internet, rising adoption of smart devices, increasing utilization of gaming as a service, and digital transformation in the media & entertainment industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."