- Home

- »

- Communication Services

- »

-

C-RAN Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![C-RAN Market Size, Share & Trends Report]()

C-RAN Market (2025 - 2030) Size, Share & Trends Analysis Report By Component, By Network Type, By Architecture Type (Centralized - RAN, Virtualized/Cloud RAN), By Deployment Model, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-282-2

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

C-RAN Market Size & Trends

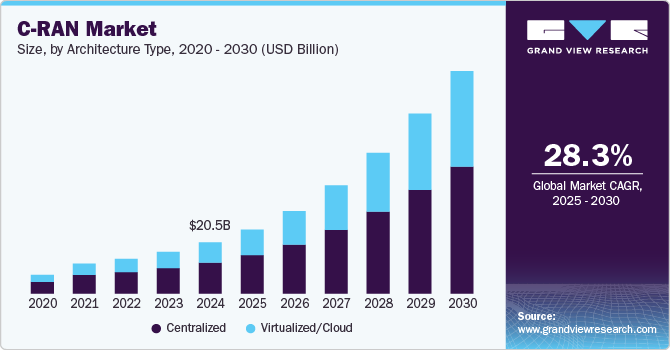

The global C-RAN market size was estimated at USD 20.5 billion in 2024 and is projected to grow at a CAGR of 28.3% from 2025 to 2030. The increasing demand for high-speed data services, coupled with the rapid growth of 5G networks, is a major driver for the market. C-RAN allows for the centralization of baseband processing, which improves network efficiency and reduces operational costs. Additionally, the proliferation of smart devices and the Internet of Things (IoT) has spurred the need for better mobile connectivity, further driving C-RAN adoption to handle the growing network traffic.

Advancements in virtualization, cloud computing, and software-defined networking (SDN) are revolutionizing the C-RAN market. These technologies enable the disaggregation of hardware and software functions, making network deployment more flexible and cost-efficient. Enhanced C-RAN architectures, such as virtualized and open RAN, are becoming more prevalent, facilitating easier integration with emerging technologies and allowing for more scalable and efficient network operations.

Governments worldwide are launching initiatives to promote deploying advanced telecommunications infrastructure, including C-RAN, to support 5G rollouts and bridge the digital divide. Regulatory bodies offer financial incentives, subsidies, and streamlined approval processes for telecom operators and vendors adopting C-RAN technologies. In regions like Asia-Pacific and Europe, governments are also focusing on strengthening digital infrastructure, further boosting the demand for C-RAN solutions.

Manufacturers in the C-RAN market are focusing on partnerships, collaborations, and mergers to strengthen their product portfolios and expand their market presence. Companies are investing heavily in research and development to innovate and provide advanced C-RAN solutions that meet the growing demand for efficient and scalable networks. Moreover, manufacturers are actively engaging in strategic alliances with telecom operators to facilitate faster deployment of C-RAN infrastructure across regions.

The shift toward 5G technology presents significant opportunities for the C-RAN market, as telecom operators seek to enhance network capacity and reduce latency. The adoption of edge computing and AI in network management is also creating opportunities for more intelligent, automated C-RAN solutions. Additionally, the expansion of IoT ecosystems, smart cities, and connected industries opens up vast potential for C-RAN to support the massive data throughput required for these applications, making it a key enabler for future digital infrastructure.

Architecture Type Insights

The centralized segment held the highest share of over 60% in 2024 due to its ability to improve network efficiency and reduce operational costs. Centralized C-RAN architecture enables better management of radio resources by consolidating baseband processing in a central location. This centralization allows operators to optimize spectrum usage and improve network performance, which is especially crucial in densely populated urban areas. Furthermore, centralized C-RAN supports the seamless deployment of advanced wireless technologies such as 5G, contributing to its dominant revenue share.

The virtualized/cloud-based segment is expected to grow at the highest CAGR of over 30% from 2025 to 2030, due to the increasing demand for flexible, scalable, and cost-efficient network solutions. Virtualization decouples hardware from software, allowing network functions to be run on general-purpose hardware and reducing dependency on proprietary systems. This shift to cloud-based solutions enhances the agility and scalability of the network, allowing operators to dynamically allocate resources based on real-time demand. With the ongoing evolution toward 5G networks, the demand for virtualized/cloud C-RAN solutions is expected to surge, driving remarkable growth in this segment.

Network Type Insights

The LTE and 5G segments dominated the market in 2024, due to the increasing global adoption of high-speed mobile broadband technologies. Both LTE and 5G require high network capacity, low latency, and extensive coverage, all of which can be efficiently achieved through C-RAN architectures. With the expansion of 5G deployments, which require enhanced network flexibility and scalability, the demand for C-RAN solutions is rapidly increasing. The LTE and 5G technologies, therefore, hold the largest share of the market, as they benefit the most from C-RAN's ability to optimize network resources and improve performance.

Despite the widespread adoption of LTE and 5G, the 3G segment is expected to experience considerable growth from 2025 to 2030, especially in regions where 3G networks remain the primary mode of mobile communication. In developing markets, 3G networks still serve a large user base, and operators are leveraging C-RAN technology to improve network performance and reduce costs. The ability of C-RAN to support multi-generation networks is helping operators extend the life of their 3G infrastructure while preparing for future upgrades, thus contributing to the sustained growth of the 3G segment.

Deployment Model Insights

The outdoor segment held the highest share in 2024 due to the extensive deployment of outdoor macro cells in urban, suburban, and rural environments. Outdoor C-RAN deployments are essential for providing wide-area coverage, especially in densely populated cities where mobile traffic is high. By centralizing baseband processing, outdoor C-RAN solutions enable telecom operators to enhance network capacity and coverage while reducing the number of physical cell sites required. This cost-efficient approach is one of the main reasons for the high adoption of outdoor C-RAN solutions, particularly in markets with heavy mobile data traffic.

The indoor segment is anticipated to grow at the fastest CACR from 2025 to 2030, driven by the increasing demand for reliable indoor coverage in commercial buildings, shopping malls, airports, and stadiums. As more people rely on high-speed mobile data services in indoor environments, telecom operators are deploying C-RAN solutions to ensure consistent and high-quality connectivity. Indoor C-RAN solutions, such as small cells, help address the challenges of poor indoor signal reception and network congestion. The rise of smart buildings and IoT applications further fuels the demand for robust indoor networks, contributing to the rapid expansion of the indoor C-RAN market.

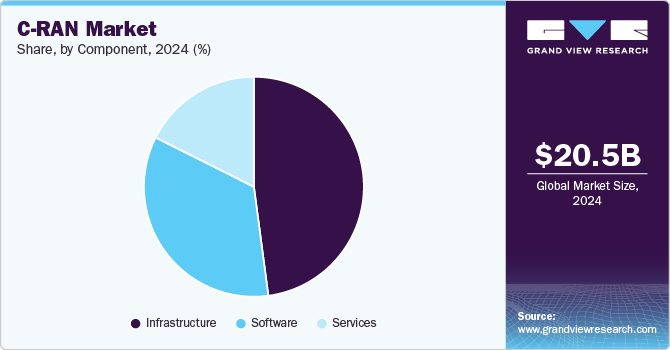

Component Insights

The infrastructure segment held highest share in 2024, primarily because of the extensive deployment of hardware components like remote radio heads (RRHs), baseband units (BBUs), and fronthaul solutions. These components form the backbone of the C-RAN architecture, facilitating efficient signal processing and communication between the network's central units and end-users. As telecom operators expand their networks to support advanced wireless technologies like LTE and 5G, the demand for robust and scalable infrastructure continues to grow, further consolidating the infrastructure segment's dominant position in the C-RAN market.

The service segment is expected to witness the highest growth from 2025 to 2030, driven by the increasing demand for installation, maintenance, optimization, and consulting services. As telecom operators transition to C-RAN architecture, they require expert services to ensure the seamless integration of new technologies with their existing networks. Moreover, with the growing complexity of modern wireless networks, operators are increasingly relying on managed services to maintain network performance and reliability. This rising dependency on specialized services, along with the proliferation of 5G networks, is contributing to the strong growth of the service segment in the C-RAN market.

Regional Insights

The North America C-RAN market held a significant share globally, driven by rapid technological advancements and large-scale deployment of 5G infrastructure. Key players in the region are focusing on network densification to accommodate the growing data demands. Moreover, telecom operators are extensively adopting C-RAN to reduce operational costs and improve network performance. This shift is propelled by the region's strong digital ecosystem, high internet penetration, and increasing mobile traffic, with large telecom companies investing heavily in upgrading to centralized networks.

U.S. C-RAN Market Trends

The C-RAN market in the U.S. is witnessing robust growth due to the accelerated rollout of 5G technology and increased demand for efficient network architecture. Factors like the rise in mobile data consumption, edge computing, and the integration of artificial intelligence (AI) in network management are propelling the market forward. The U.S. is home to some of the largest telecom providers, which are significantly investing in modernizing their existing network infrastructure with C-RAN solutions to support high-capacity, low-latency networks. The federal government’s initiatives to enhance communication networks, especially in rural areas, further contribute to this growth.

Europe C-RAN Market Trends

The Europe C-RAN market is growing steadily, supported by the increased focus on energy-efficient, scalable network solutions and the expansion of 5G infrastructure across the region. Telecom operators are adopting C-RAN to improve network performance and reduce operational complexities in urban and suburban areas. Key European countries such as Germany, France, and the UK are leading the charge in deploying centralized radio access networks to address the rising demand for high-speed data and enhanced mobile coverage. Moreover, European Union policies promoting digital connectivity and innovation are fostering a favorable environment for the growth of C-RAN technology.

Asia Pacific C-RAN Market Trends

The C-RAN market in the Asia Pacific is experiencing high growth in the global market due to the rapid expansion of telecom networks and the increasing demand for high-speed connectivity across densely populated urban areas. Countries like China, Japan, South Korea, and India are at the forefront of 5G deployment, with C-RAN playing a crucial role in supporting the infrastructure needed for seamless data transmission. Governments and private telecom operators are investing heavily in modern network solutions to accommodate the surge in mobile users and the need for faster, more reliable services. The region's booming smartphone penetration and growing IoT applications are also contributing to this market's expansion

Japan C-RAN market has established itself as a key player in the Asia Pacific market, driven by its early adoption of 5G networks and the country’s ongoing focus on technology innovation. Japanese telecom operators have been proactive in deploying C-RAN to improve network efficiency and accommodate the country's high mobile data consumption. The densely populated urban areas in Japan present a unique challenge for network providers, making C-RAN an ideal solution to enhance coverage and support the growing number of connected devices. Moreover, Japan’s strong emphasis on advanced communication technologies is expected to further drive the growth of C-RAN in the future.

The C-RAN market in China is experiencing rapid growth in the market, due to its aggressive 5G rollout and large-scale investments in telecommunications infrastructure. The country’s massive population, coupled with its fast-growing urbanization and industrialization, has led to a surge in mobile data traffic. To manage this, Chinese telecom operators are extensively adopting C-RAN to optimize network resources and provide seamless connectivity. The Chinese government’s supportive policies, such as its push for smart city initiatives and the expansion of its digital economy, are also playing a crucial role in the expansion of the C-RAN market in the country.

Key C-RAN Company Insights

Some of the key companies in the market include Avaya LLC, Oracle, Cisco Systems, Inc. and others. Organizations are focusing on increasing the customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Cisco Systems is a global leader in networking and telecommunications technology, with a strong presence in cloud-based solutions. In the context of the C-RAN market, Cisco leverages its expertise in IP networking and virtualization to offer advanced solutions that enhance the efficiency and scalability of mobile networks. By integrating cloud technologies with radio access networks, Cisco enables telecom operators to reduce operational costs and improve network flexibility.

-

Samsung Electronics, a global leader in consumer electronics and telecommunications equipment, is also making significant strides in the C-RAN market. With its comprehensive portfolio of 5G solutions, including radio units and core networks, Samsung provides end-to-end solutions for mobile operators seeking to modernize their infrastructure.

Key C-RAN Companies:

The following are the leading companies in the C-RAN market. These companies collectively hold the largest market share and dictate industry trends.

- Altiostar Networks

- ASOCS Ltd.

- Cisco Systems, Inc.

- Telefonaktiebolaget LM Ericsson

- Fujitsu Limtied

- Huawei Technologies Co., Ltd.

- Intel Corporation

- HRMavenir Systems, Inc

- NEC Corporation

- Samsung Electronics Co., Ltd.

Recent Developments

-

In February 2024, O2 Telefónica will start deploying Ericsson Cloud RAN for 5G Standalone (SA) in Offenbach, Germany, during the first half of 2024. This advanced Cloud RAN solution utilizes the latest in virtualization and cloud technology to enhance flexibility, accelerate service delivery, and improve network scalability.

-

In February 2024, AT&T and Ericsson completed VRAN with AT&T now handling commercial traffic on Cloud RAN sites. This transition allows AT&T to deliver and secure data cost-effectively while fostering an open environment for developers to create new apps and services.

-

In July 2023, Telstra and Ericsson announced the deployment of Ericsson’s Cloud RAN infrastructure on Telstra’s 5G commercial network, already operational at several sites. This marks the first Cloud RAN deployment in Australia and a significant step in Telstra's ability to provide next-generation 5G services nationwide.

C-RAN Market Report Scope

Report Attribute

Details

Market size in 2025

USD 25.64 billion

Revenue forecast in 2030

USD 89.29 billion

Growth rate

CAGR of 28.3% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Architecture Type, component, network type, deployment type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; South Korea; Brazil; Saudi Arabia; Argentina; South Africa

Key companies profiled

Altiostar Networks; ASOCS Ltd.; Cisco Systems, Inc;

Telefonaktiebolaget LM Ericsson.; Fujitsu Limtied; Huawei Technologies Co., Ltd.; Intel Corporation; HRMavenir Systems, Inc; NEC Corporation; Samsung Electronics Co., Ltd

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global C-RAN Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global C-RAN market report based on architecture type, component, network type, deployment model, and region.

-

Architecture Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Centralized - RAN

-

Virtualized/Cloud RAN

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Infrastructure

-

Remote Radio Units

-

Baseband Units

-

Fronthaul

-

-

Software

-

Services

-

Consulting

-

Design and Architecture Type

-

Maintenance and Support

-

Others

-

-

-

Network Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

3G

-

LTE & 5G

-

-

Deployment Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Indoor

-

Outdoor

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global C-RAN Market is expected to grow at a compound annual growth rate of 28.3% from 2025 to 2030 to reach USD 89.29 billion by 2030.

b. The centralized segment holds the highest share of over 60% in the C-RAN market due to its ability to improve network efficiency and reduce operational costs. Centralized C-RAN architecture enables better management of radio resources by consolidating baseband processing in a central location. This centralization allows operators to optimize spectrum usage and improve network performance, which is especially crucial in densely populated urban areas. Furthermore, centralized C-RAN supports the seamless deployment of advanced wireless technologies such as 5G, contributing to its dominant market share

b. Some of the key players operating in the C-RAN Market include Altiostar Networks, ASOCS Ltd., Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson., Fujitsu Limtied, Huawei Technologies Co., Ltd., Intel Corporation, HRMavenir Systems, Inc, NEC Corporation, and Samsung Electronics Co., Ltd

b. The increasing demand for high-speed data services, coupled with the rapid growth of 5G networks, is a major driver for the C-RAN (Centralized Radio Access Network) market. C-RAN allows for the centralization of baseband processing, which improves network efficiency and reduces operational costs. Additionally, the proliferation of smart devices and the Internet of Things (IoT) has spurred the need for better mobile connectivity, further driving C-RAN adoption to handle the growing network traffic.

b. The global C-RAN Market size was estimated at USD 20.5 billion in 2024 and is expected to reach USD 25.64 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.