- Home

- »

- Communications Infrastructure

- »

-

Fiber Optics Market Size & Share, Industry Report, 2033GVR Report cover

![Fiber Optics Market Size, Share & Trend Report]()

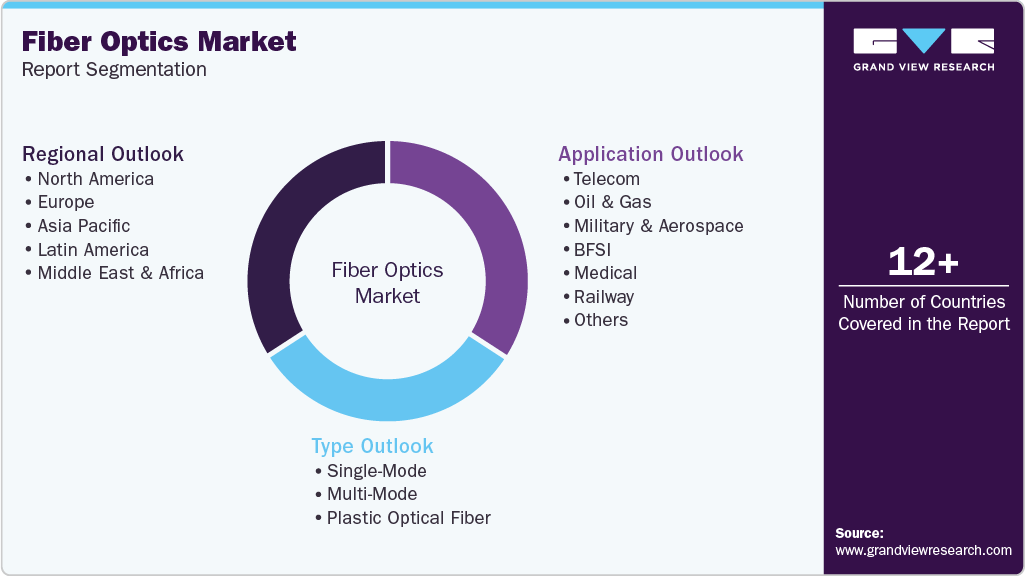

Fiber Optics Market (2026 - 2033) Size, Share & Trend Analysis Report By Type (Single Mode, Multi-mode, Plastic Optical Fiber (POF)), By Application (Telecom, Oil & Gas, BFSI, Military & Aerospace, Medical, Railway, Others), By Region (North America, Asia Pacific, Europe, Latin America), And Segment Forecasts

- Report ID: GVR-1-68038-860-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Fiber Optics Market Summary

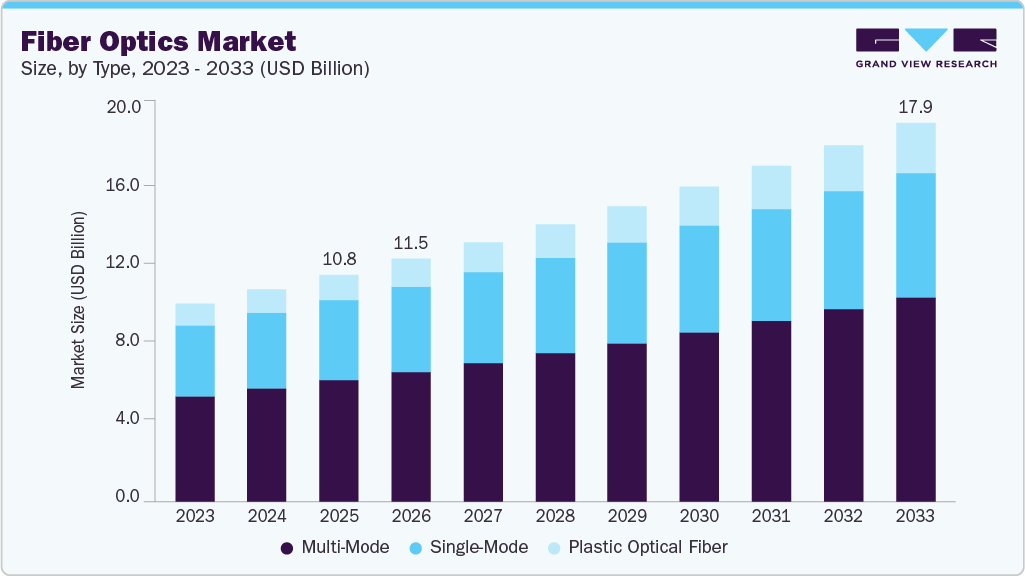

The global fiber optics market size was estimated at USD 10.76 billion in 2025 and is projected to reach USD 17.95 billion by 2033, growing at a CAGR of 6.6% from 2026 to 2033. The rapid advancement of high-speed communication networks is driving widespread fiber deployment, rising data traffic from cloud computing and video streaming is boosting demand for optical connectivity, growing adoption of fiber in smart city and IoT infrastructure is accelerating market expansion, and continuous innovations in fiber materials and transmission technologies are enhancing performance and supporting long-term market scalability.

Key Market Trends & Insights

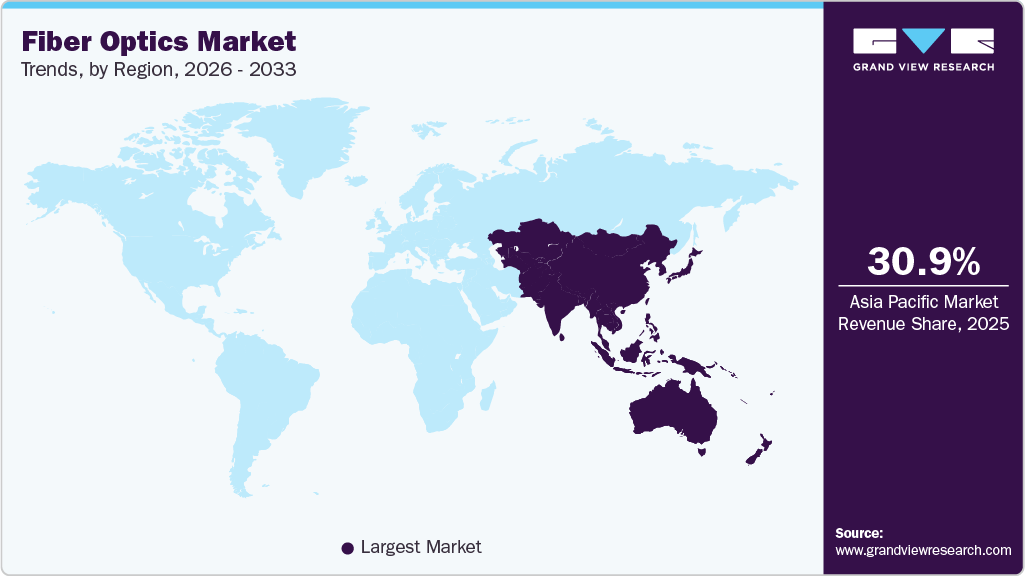

- Asia Pacific dominated the global fiber optics industry with the largest revenue share of 30.9% in 2025.

- The fiber optics market in the U.S. led the North America market and held the largest revenue share in 2025.

- By type, multi-mode segment held the largest revenue share of over 53% in 2025.

- By application, medical segment is expected to grow at the fastest CAGR of 8.2% from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 10.76 Billion

- 2033 Projected Market Size: USD 17.95 Billion

- CAGR (2026-2033): 6.6%

- Asia Pacific: Largest Market in 2025

The global push for high-speed connectivity is driving large-scale deployments of fiber networks across urban and rural regions. Governments and private operators are accelerating fiber-to-the-home (FTTH) rollouts to support next-generation digital services. Rising internet consumption, fueled by remote work and cloud adoption, is further boosting demand for high-capacity fiber infrastructure. Network operators are prioritizing fiber upgrades to replace aging copper systems and enhance service reliability. Overall, broadband modernization remains a core driver of fiber optics market expansion.Energy and utility operators are rapidly integrating fiber to strengthen real-time control and monitoring capabilities. Smart grid initiatives rely on high-speed fiber to coordinate distributed energy resources and precision demand management. Fiber connectivity is dramatically improving fault detection and enabling faster outage response across grid networks. Renewable energy facilities are also leveraging fiber links to support seamless communication between field assets and control centers. As digital substations evolve, fiber is becoming the preferred medium for secure and interference-free data flow. The modernization of the energy sector is positioning fiber as a critical driver of future grid resilience.

Innovations in photonics are actively pushing fiber network efficiency to new performance thresholds. Companies are rolling out advanced WDM systems and high-speed transceivers to expand bandwidth capacity. Newer fiber types, including bend-insensitive and ultra-low-loss variants, are enabling more flexible deployment in dense environments. Enhanced optical amplifiers and connector technologies are improving long-distance signal strength and reducing transmission loss. Integrated photonics chips redefine optical processing speeds and creating new industry benchmarks. Collectively, these technological leaps are driving stronger adoption of next-generation fiber infrastructure.

Type Insights

The multi-mode segment led the market, accounting for over 53% of the global revenue in 2025, driven by its cost-efficient deployment and strong bandwidth performance for short-to-medium distance applications. Enterprises increasingly adopted multi-mode fiber to support high-density connectivity for cloud workloads and internal communication systems. Its lower transceiver costs and easy installation made it a preferred option for modernizing data centers and campus networks. The segment also gained momentum due to rising demand for scalable LAN infrastructure across commercial and institutional environments. Overall, multi-mode fiber maintained a dominant market position by offering a compelling balance of performance, scalability, and cost efficiency.

The plastic optical fiber segment is predicted to experience significant growth in the forecast period, owing to its low-cost installation, high flexibility, and suitability for short-distance communication applications. Its ease of handling and resistance to bending make it highly attractive for consumer electronics, automotive systems, and home networking solutions. The growing adoption of in-vehicle infotainment, advanced driver-assistance systems, and smart home devices is further accelerating demand for plastic optical fiber. Manufacturers are also leveraging its lightweight design to support compact, space-efficient system architectures. As a result, the segment is positioned to capture strong growth as industries increasingly prioritize affordable and adaptable optical connectivity solutions.

Application Insights

The telecom segment is expected to hold the highest market share of the global revenue in 2025, primarily driven by accelerating investments in fiber-based broadband expansion and large-scale 5G rollout initiatives. Operators are rapidly upgrading legacy copper networks to fiber to support higher bandwidth, lower latency, and improved service reliability. The surge in mobile data consumption, cloud adoption, and video streaming is further pushing telecom providers to strengthen their fiber backbone infrastructure. Additionally, rising deployment of fiber for small-cell densification and next-generation network architectures is reinforcing market leadership for the telecom sector.

The medical segment is projected to achieve substantial growth over the forecast period. Rising adoption of fiber optic technology in medical imaging, endoscopy, and minimally invasive procedures is driving strong demand. Healthcare providers are increasingly deploying fiber-based solutions to enhance imaging resolution, patient monitoring, and diagnostic accuracy. Continuous advancements in fiber optic sensors and wearable medical devices are further accelerating market penetration. As a result, the segment is well-positioned for sustained expansion, driven by the healthcare industry’s focus on precision, efficiency, and reliable data transmission.

Regional Insights

North America fiber optics market is expected to hold a significant share of over 23% in 2025. The region’s leadership is driven by robust investments in high-speed broadband infrastructure and large-scale 5G deployment. Strong adoption of cloud computing, data centers, and enterprise networking solutions continues to fuel demand for advanced fiber technologies. Government initiatives and private sector commitments to upgrade legacy networks further reinforce the market’s growth trajectory.

U.S. Fiber Optics Market Trends

The U.S. fiber optics market maintains a strong position owing to rapid network modernization and digital transformation initiatives. Telecom operators are investing heavily in fiber-to-the-home (FTTH) and fiber-to-the-premises (FTTP) projects to meet growing bandwidth needs. Increasing deployment of smart city projects and enterprise connectivity solutions further drives adoption. The market benefits from a well-established technology ecosystem, high-capacity infrastructure, and supportive regulatory frameworks.

Europe Fiber Optics Market Trends

Europe fiber optics market is expanding steadily, supported by extensive broadband rollout programs and 5G network expansion. Government-backed initiatives to enhance digital infrastructure across both urban and rural areas are key growth drivers. Demand is rising from data centers, industrial automation, and enterprise networks requiring high-capacity and reliable fiber solutions. The region’s focus on sustainable and energy-efficient network deployments further strengthens fiber adoption.

Asia Pacific Fiber Optics Market Trends

Asia Pacific is expected to record the fastest CAGR over the forecast period, driven by rapid urbanization, large-scale 5G deployment, and increasing demand for high-speed broadband connectivity. Telecom operators and government initiatives are accelerating fiber network expansion to support growing internet penetration and enterprise digitalization.

The surge in data center construction, cloud adoption, and smart city projects is further fueling fiber optics demand. Combined with supportive policies and industrial automation trends, these factors are positioning the region as the fastest-growing market for fiber solutions.

Key Fiber Optics Company Insights

Some key companies in the fiber optics industry are Corning Incorporated, Prysmian Group, Sterlite Technologies Limited, Yangtze Optical Fiber and Cable Joint Stock Limited Company (YOFC), AFL

-

Corning is a prominent player in optical fiber and cable solutions, specializing in high-performance fiber for telecommunications, data centers, and enterprise networks. The company develops and manufactures optical fiber, cable, and related connectivity solutions that support high-speed data transmission. Its innovations include bend-insensitive fiber and advanced glass technologies that enhance network reliability and performance. Corning serves a wide range of industries, including telecom, cloud services, and industrial automation, maintaining a strong presence in the fiber optics market.

-

Prysmian Group is a manufacturer of optical fibers, cables, and systems for telecom, energy, and industrial applications. The company offers solutions for high-capacity long-distance networks, including submarine and terrestrial fiber optic infrastructure. Prysmian invests heavily in R&D to develop next-generation fiber technologies, such as ultra-low-loss and bend-insensitive fibers. Its global footprint and comprehensive product portfolio make it a key player in enabling digital transformation and network modernization worldwide.

Key Fiber Optics Companies:

The following are the leading companies in the fiber optics market. These companies collectively hold the largest Market share and dictate industry trends.

- AFL

- Birla Furukawa Fiber Optics Limited

- Corning Incorporated

- Finolex Cables Limited

- Molex, LLC

- OFS Fitel, LLC

- Optical Cable Corporation (OCC)

- Prysmian Group

- Sterlite Technologies Limited

- Yangtze Optical Fiber and Cable Joint Stock Limited Company (YOFC)

Recent Developments

-

In November 2025, Crown Fiber Optics announced it had secured over USD 100 million in multi-year fiber infrastructure contracts. These agreements cover major broadband projects in New Mexico and the Seattle area, each contributing significant annual revenue. Additional rural broadband contracts in Oregon, including RUS-funded initiatives, further increased the company’s backlog. This achievement demonstrates strong demand for fiber-optic infrastructure and reinforces Crown Fiber’s commitment to providing high-quality broadband solutions in both urban and rural markets.

-

In October 2025, Fraunhofer IIS launched SpikeHERO, an initiative to develop an AI chip that combines optical and electrical spiking neural network processing for fiber-optic networks. The project seeks to improve signal quality and increase data transmission rates by integrating brain-inspired SNN technology into fiber infrastructure. SpikeHERO is expected to reduce latency, enhance energy efficiency, and support next-generation digital networks. This initiative demonstrates the increasing convergence of advanced AI hardware and fiber-optic communications to address the demand for high-speed, efficient data transmission.

-

In September 2025, Relativity Networks partnered with Network Planning Solutions (NPS) to accelerate the deployment of its hollow-core fiber (HCF) infrastructure. NPS, as the first “Trusted Installation Partner,” manages planning, pre-staging, installation, and ongoing support for HCF rollouts. This collaboration streamlines large-scale deployment, enabling faster and more efficient implementation of next-generation fiber networks. Clients in AI, cloud computing, and high-performance networking benefit from lower latency and higher data throughput compared to conventional fiber solutions.

-

In September 2025, VCTI launched VCTI‑RoBERTa‑Fiber, an open-source AI encoder model tailored for the optical communications and photonics industry. Trained on fiber-optic datasets, the model understands technical language and industry requirements. It supports semantic search, intelligent chatbots, predictive maintenance, and automated network fault detection. By releasing the model openly, VCTI seeks to accelerate innovation, shorten product development cycles, and promote collaboration within the optical communications ecosystem.

Fiber Optics Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 11.51 billion

Revenue forecast in 2033

USD 17.95 billion

Growth rate

CAGR of 6.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

AFL; Birla Furukawa Fiber Optics Limited; Corning Incorporated; Finolex Cables Limited; OFS Fitel, LLC; Optical Cable Corporation (OCC); Prysmian Group; Sterlite Technologies Limited; Yangtze Optical Fiber; Cable Joint Stock Limited Company(YOFC)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Fiber Optics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global fiber optics market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Single-Mode

-

Multi-Mode

-

Plastic Optical Fiber

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Telecom

-

Oil & Gas

-

Military & Aerospace

-

BFSI

-

Medical

-

Railway

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global fiber optics market is projected to grow at a compound annual growth rate (CAGR) of 6.6% from 2026 to 2033, reaching USD 17.95 billion by 2033.

b. The Asia Pacific dominated the fiber optics market, accounting for over 30% of the share in 2025, driven by aggressive 5G rollouts, expanding broadband penetration, and sustained government-backed investments in digital infrastructure.

b. Key factors driving the growth of the fiber optics market include the rising demand for high-speed broadband and 5G network deployment, increasing data center expansion and cloud computing adoption, growing investments in smart cities and digital infrastructure, and the strong uptake of fiber-to-the-home solutions across residential and enterprise networks.

b. The global fiber optics market size was estimated at USD 10.76 billion in 2025 and is expected to reach USD 11.51 billion in 2026.

b. Some key players operating in the fiber optics market include Corning Incorporated; Optical Cable Corporation (OCC); Sterlite Technologies Limited; OFS Fitel, LLC; Prysmian Group; AFL; Birla Furukawa Fiber Optics Limited; and Finolex Cables Limited.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.