- Home

- »

- IT Services & Applications

- »

-

Cloud Workflow Market Size, Share & Growth Report, 2030GVR Report cover

![Cloud Workflow Market Size, Share & Trends Report]()

Cloud Workflow Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Type, By Application (Human Resource, Sales And Marketing, Accounting And Finance), By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-443-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cloud Workflow Market Size & Trends

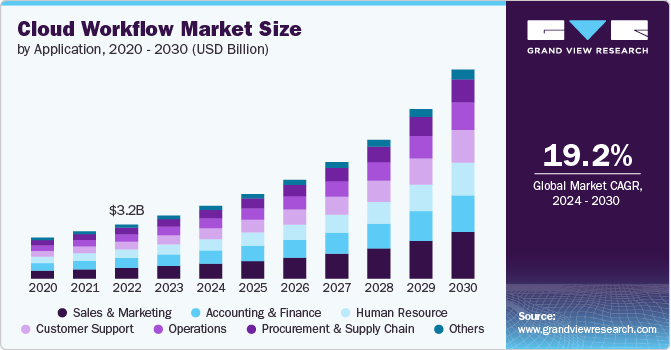

The global cloud workflow market size was valued at USD 3.76 billion in 2023 and is expected to grow at a CAGR of 19.2% from 2024 to 2030. The increasing demand for automation and streamlined operations across various industries is among the key factors driving the market growth. As enterprises move toward digital transformation, the need for efficient workflow management solutions that can operate in a cloud environment has surged. These solutions enable organizations to optimize their processes, reduce manual intervention, and improve collaboration across geographically dispersed teams, thus enhancing overall productivity.

The market is expected to witness significant growth during the forecast period owing to the rising adoption of cloud-based technologies, which offer scalability, flexibility, and cost-effectiveness. The ability to deploy workflow management systems on cloud platforms allows businesses to scale their operations without the need for substantial capital investments in infrastructure. Additionally, the integration capabilities of cloud workflow solutions with existing enterprise systems, such as ERP and CRM, are further propelling their adoption. The rise of remote work due to the COVID-19 pandemic has also accelerated the shift toward cloud workflows as businesses seek to maintain operational continuity in a decentralized working environment.

The market is poised for significant advancements in AI and machine learning integration. These technologies are expected to enhance workflow automation by enabling predictive analytics, intelligent decision-making, and more personalized workflows. The growth of microservices architecture and the increasing adoption of containerization will also play a crucial role in shaping the future of cloud workflows, allowing for more modular, agile, and scalable solutions. Moreover, the increasing emphasis on data security and compliance, particularly in regulated industries like healthcare and finance, will drive the demand for cloud workflow solutions that offer robust security features and compliance management.

Further, emerging markets in Asia Pacific, MEA, and Latin America present a significant growth potential for cloud workflow providers. The rapid digitalization in these regions, coupled with the growing awareness of the benefits of cloud-based solutions, is creating fertile ground for market expansion. Additionally, small and medium-sized enterprises (SMEs) are increasingly adopting cloud workflows as they seek to compete with larger organizations by leveraging technology to enhance their operational efficiency.

Regulatory compliance is a key consideration in the adoption of cloud workflow solutions. As governments and regulatory bodies around the world tighten data protection and privacy laws, organizations must ensure that their cloud-based workflows adhere to these standards. For instance, the General Data Protection Regulation in Europe and the California Consumer Privacy Act (CCPA) in the U.S. have set stringent requirements for how personal data is processed and stored.

Cloud workflow providers are responding to these regulatory challenges by offering solutions that include built-in compliance features, such as data encryption, audit trails, and role-based access controls. These features help organizations maintain compliance with data protection regulations while benefiting from the efficiency of cloud-based workflows.

Type Insights

The platform segment accounted for the largest market share of over 62% in 2023. The growth of the segment is being driven by the increasing need for businesses to streamline complex processes and automate routine tasks. Organizations are increasingly adopting cloud-based workflow platforms to enhance efficiency, reduce operational costs, and ensure seamless integration across various departments. The rise of remote work and digital transformation initiatives has further accelerated the demand for robust workflow solutions that can operate in a cloud environment, enabling real-time collaboration and accessibility from anywhere. Moreover, the scalability and flexibility offered by cloud platforms allow companies to adapt their workflows quickly to changing business needs, a critical factor in today's fast-paced market environment.

The services segment is expected to grow at a significant rate during the forecast period. The growth of the segment is driven by the increasing demand for implementation, consulting, and managed services. As businesses transition to cloud-based workflows, they often require expert guidance to ensure a smooth migration and integration with existing systems. This has led to a surge in demand for professional services that assist organizations in designing, deploying, and optimizing their workflow processes in the cloud. Moreover, the complexity of integrating diverse systems and ensuring data security in a cloud environment has made managed services an essential component, offering continuous monitoring, management, and support to maintain the efficiency and security of workflows.

Applications Insights

The sales and marketing segment accounted for the largest market share of over 20% in 2023. The segment is experiencing significant growth driven by the increasing need for businesses to enhance customer engagement and streamline lead management. As companies shift toward digital-first strategies, the integration of cloud workflows has become essential for automating complex marketing campaigns, managing customer data, and personalizing interactions at scale. The rise of AI and machine learning within cloud platforms enables more precise targeting and predictive analytics, helping organizations optimize their marketing efforts. Furthermore, the demand for real-time collaboration across geographically dispersed teams has fueled the adoption of cloud workflows, enabling seamless communication and faster decision-making processes.

The customer support segment is expected to grow at a significant rate during the forecast period. In the customer support segment, the adoption of cloud workflows is being driven by the need for businesses to improve response times, enhance customer satisfaction, and reduce operational costs. With the increasing complexity of customer interactions across multiple channels such as social media, email, and chat cloud-based workflows enable support teams to manage these interactions more efficiently. The ability to automate routine tasks, such as ticketing and case management, allows support agents to focus on more complex issues, leading to faster resolution times and a better customer experience. Moreover, the integration of AI-powered chatbots within cloud workflows provides instant support to customers, further reducing the burden on human agents and improving service levels.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of over 58% in 2023. In large enterprises, the adoption of cloud workflow solutions is driven by the need to manage complex, multi-departmental processes and enhance overall operational efficiency. These organizations often deal with vast amounts of data and require robust workflow management systems that can integrate seamlessly across various business units. A key trend in this segment is the shift toward hybrid cloud environments, where enterprises are leveraging both public and private clouds to optimize their workflows while ensuring data security and compliance. The ability to automate and standardize processes at a scale while maintaining flexibility and control is a significant driver for the adoption of cloud workflows in large enterprises.

The SME segment is expected to grow at a significant rate during the forecast period. The need for scalability, cost efficiency, and agility in business operations is driving the adoption of cloud workflow solutions among SMEs. SMEs often face challenges related to limited IT resources and budgets, making cloud-based solutions an attractive option due to their lower upfront costs and the ability to pay on a subscription basis. A key trend in this segment is the increasing demand for integrated workflow solutions that can automate routine tasks, streamline processes, and improve collaboration across teams, especially as remote work becomes more prevalent. The flexibility and ease of deployment offered by cloud workflow solutions enable SMEs to adapt to changing market conditions, enhancing their competitiveness quickly.

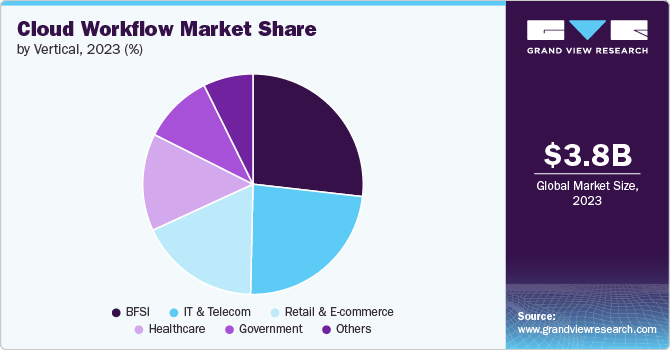

Vertical Insights

The BFSI segment accounted for the largest market share of over 26.80% in 2023. The growth of the BFSI segment is driven by the sector's demand for enhanced operational efficiency, compliance, and customer experience. Financial institutions are leveraging cloud-based workflows to streamline complex processes like loan approvals, fraud detection, and regulatory reporting. The ability to automate and integrate these processes within a cloud environment reduces operational costs, improves accuracy, and ensures compliance with stringent regulatory requirements. Furthermore, the need for real-time data processing and analytics to support decision-making in areas such as risk management and customer personalization is pushing financial institutions to adopt cloud workflows at an accelerated pace.

The healthcare segment is expected to grow at a significant rate during the forecast period. The segment is witnessing rapid adoption of cloud workflows, primarily driven by the industry's need to manage vast amounts of patient data, ensure compliance with regulatory standards, and improve patient outcomes. Cloud-based workflows enable healthcare providers to automate and streamline administrative tasks such as billing, patient registration, and claims processing, freeing up resources to focus on patient care. Additionally, the integration of electronic health records (EHR) with cloud workflows allows for seamless data sharing across different healthcare systems, improving care coordination and enabling personalized treatment plans. The increasing emphasis on value-based care models, which require efficient data management and process automation, is further propelling the adoption of cloud workflows in healthcare.

Regional Insights

North Americacloud workflow market held a share of over 35% in 2023. In North America, the market is being driven by the region's robust adoption of digital transformation initiatives across various industries, including finance, healthcare, and retail. Organizations are increasingly migrating their workflows to the cloud to enhance agility, scalability, and competitiveness in a fast-evolving digital landscape. The region's advanced IT infrastructure and high levels of cloud adoption provide fertile ground for the expansion of cloud workflow solutions. Additionally, the strong regulatory focus on data security and compliance, especially in sectors like healthcare and finance, is pushing companies to adopt cloud workflows that ensure secure and compliant operations.

U.S. Cloud Workflow Market Trends

The cloud workflow market in the U.S. is expected to grow significantly at a CAGR of 15.7% from 2024 to 2030. The cloud workflow market in the U.S. is being propelled by the rapid growth of cloud-native businesses and the tech industry's continuous innovation. The country's leading position in technology and innovation has fostered an environment where cloud workflows are integral to business operations across various sectors. Further, the market is also driven by the increasing integration of advanced technologies such as AI and big data analytics into cloud workflows, which enhances decision-making and operational agility.

Asia Pacific Cloud Workflow Market Trends

The cloud workflow market in Asia Pacific is expected to grow significantly at a CAGR of 22.4% from 2024 to 2030. The market is experiencing significant growth, driven by rapid digitalization across emerging economies and the increasing adoption of cloud technologies by SMEs. Countries like China, India, and Japan are leading the charge, with enterprises looking to cloud workflows to improve business agility, reduce costs, and compete in a digital-first economy. Further, the region's burgeoning e-commerce and fintech sectors are also major contributors, as they rely heavily on cloud workflows to manage complex, high-volume transactions and customer interactions.

Europe Cloud Workflow Market Trends

The cloud workflow market in Europe is expected to grow significantly at a CAGR of 18.9% from 2024 to 2030. The market in Europe is growing rapidly due to the region's focus on data privacy and stringent regulatory requirements, such as GDPR. European companies are adopting cloud workflows to streamline processes while ensuring compliance with data protection laws. The push toward sustainability and digitalization, particularly within the manufacturing and energy sectors, is also a significant driver as companies look to optimize operations and reduce carbon footprints through cloud-based solutions. Opportunities in Europe are being shaped by the increasing demand for hybrid cloud models that allow for both public and private cloud integration, catering to the diverse needs of European enterprises, particularly in highly regulated industries.

Key Cloud Workflow Company Insights

Some of the key players operating in the market include TALOS Workforce Solutions; Verint Systems Inc.; MPEX Solutions; Ascentis Corporation; Synel; SAP SE; WorkForce Software, LLC; The Hackett Group, Inc.; IBM Corporation; and Workday, Inc., among others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2024, CenTrak announced the launch of WorkflowRT, a scalable, cloud-based platform designed to automate workflows and communications in clinical settings, reducing manual documentation. The platform's integrated reporting tools help monitor patient flow metrics, identify bottlenecks, and enhance process improvements.

-

In April 2024, IBM Corporation announced the acquisition of HashiCorp Inc., a leading provider of multi-cloud infrastructure automation with robust Infrastructure Lifecycle Management and Security Lifecycle Management solutions. This strategic move aims to integrate IBM's cloud solution portfolio and expertise with HashiCorp's advanced capabilities and skilled talent. This initiative aligns with IBM Corporation's focus on advancing hybrid cloud and AI technologies, addressing the growing complexity of multi-cloud environments, and enhancing cloud workflow automation.

Key Cloud Workflow Companies:

The following are the leading companies in the cloud workflow market. These companies collectively hold the largest market share and dictate industry trends.

- TALOS Workforce Solutions

- Verint Systems Inc.

- MPEX Solutions

- Ascentis Corporation

- Synel

- SAP SE

- WorkForce Software, LLC

- The Hackett Group, Inc

- IBM Corporation

- Workday, Inc.

Cloud Workflow Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.34 billion

Revenue forecast in 2030

USD 12.48 billion

Growth Rate

CAGR of 19.2% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, application, enterprise size, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Australia, Brazil, Saudi Arabia, UAE, and South Africa.

Key companies profiled

TALOS Workforce Solutions; Verint Systems Inc.; MPEX Solutions; Ascentis Corporation; Synel; SAP SE; WorkForce Software, LLC; The Hackett Group, Inc; IBM Corporation; and Workday, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cloud Workflow Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cloud workflow market report based on type, application, enterprise size, vertical, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Platform

-

Services

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Human Resource

-

Sales & Marketing

-

Accounting & Finance

-

Customer Support

-

Procurement & Supply Chain

-

Operations

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Retail & E-commerce

-

Healthcare

-

Government

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global cloud workflow market was valued at USD 3.76 billion in 2023 and is expected to reach USD 4.34 billion in 2024.

b. The global cloud workflow market is expected to grow at a compound annual growth rate of 19.2% from 2024 to 2030 to reach USD 12.48 billion by 2030.

b. The platform segment accounted for the largest market share of over 62% in 2023. The growth of the cloud workflow solution platform segment is being driven by the increasing need for businesses to streamline complex processes and automate routine tasks. Organizations are increasingly adopting cloud-based workflow platforms to enhance efficiency, reduce operational costs, and ensure seamless integration across various departments.

b. Key players in the cloud workflow market include TALOS Workforce Solutions, Verint Systems Inc., MPEX Solutions, Ascentis Corporation, Synel, SAP SE, WorkForce Software, LLC, The Hackett Group, Inc., IBM Corporation, and Workday, Inc.

b. The market is expected to witness significant growth during the forecast period owing to the rising adoption of cloud-based technologies, which offer scalability, flexibility, and cost-effectiveness. The ability to deploy workflow management systems on cloud platforms allows businesses to scale their operations without the need for substantial capital investments in infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.