Industry Insights

The global coated paper market size was estimated at USD 27.3 billion in 2018. Rising demand for advertising and packaging in different industries will boost product demand over the forecast period. Product demand is also fueled by the rising impact of advertisements in media such as newsprints, magazines, brochures, and catalogs. Furthermore, inclination toward innovative and environment-friendly packaging has resulted in the emergence of bio-degradable packaging solutions, which act as a key driver for the market.

Coated papers have a layer of clay or polymer applied on either or both sides. Such sheets result in brighter and sharper images in printing and also provide better reflectivity compared to uncoated variants. The layer also adds a glossy and shining texture to the paper, giving it a professional touch to be used in magazines and other publications. In addition, these papers ensure sharp images as the ink does not seep through. These products are dust resistant and require less ink owing to better ink holdout. This makes them suitable for different finishing techniques such as spot varnish.

The application of coated papers also includes printing invitations as well as for decoration purposes, which provides various growth opportunities to players. The soaring popularity of online and digital platforms has driven the e-commerce industry, which has resulted in a surge in-home delivery services. This has fueled the need for packaging and labeling solutions, thereby driving product demand.

However, widespread digitalization across industries is a major challenge impeding coated papersmarket growth. Companies have been replacing brochures, catalogs, and manuals with digital alternatives such as videos and tutorials, thereby discouraging the use of paper. This trend is primarily brought on by rising deforestation and the release of carbon emissions during product manufacturing, which harms the environment. Nevertheless, players have been turning to technological advancements and innovations in product manufacturing to overcome these hurdles.

Product Insights

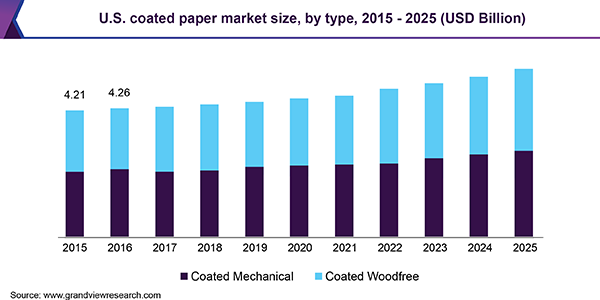

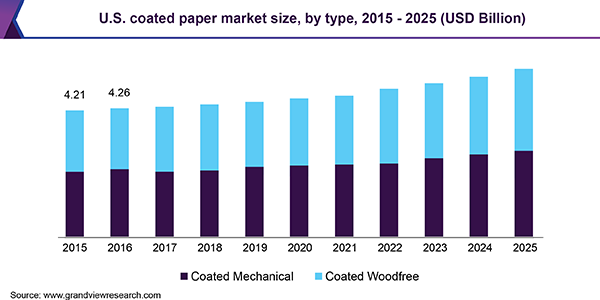

Coated mechanical emerged as the largest category by-product, accounting for 50.6% of the market revenue in 2018. These products constitute the majorly of mechanical wood pulp and are produced from base sheets. It is coated with chemical pulp and minerals in order to form a smooth and bright surface. They have the ability to enhance the ink holdout feature, which reduces ink usage and produces better prints and images. These are also known as lightweight coated papers used in magazines, catalogs, inserts, and decorative pages. These can be printed through the offset printing process.

Coated woodfree is projected to exhibit a revenue-based CAGR of 3.6% from 2019 to 2025 owing to the increasing adoption of agro- and fiber-based papers. These papers are produced by chemical processing of wood pulp rather than mechanical processes. The chemical content of wood pulp is expected to be at least 90% in coated woodfree papers. These sheets are used for general writing, printing, stationery, copying, and magazine applications.

Application Insights

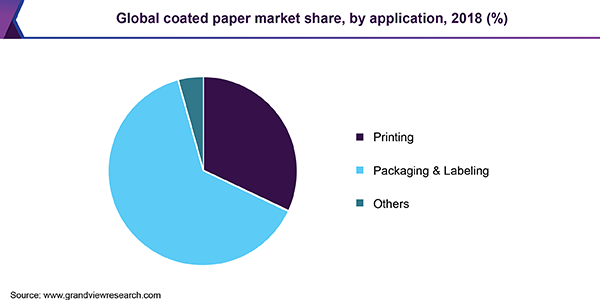

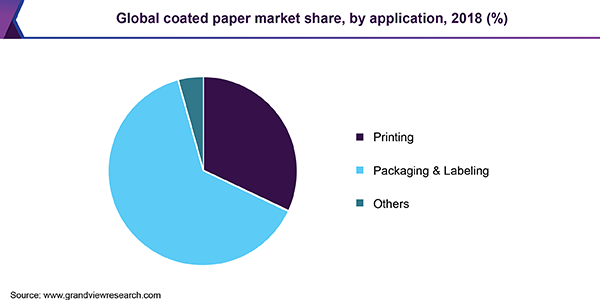

Packaging and labeling held a considerable revenue share of 63.7% in 2018 in the global market. The increasing application of flexible paper packaging solutions compared to flexible plastics has emerged as an important constituent in the packaging industry worldwide, making room for coated paper. The FMCG industry is one of the leading end-users of this product, for packaging flour, sugar, medical items, processed meats, frozen foods, cigarette bundles, and other retail products.

The rapid growth of the e-commerce industry has paved the way for decorative and premium packaging, which has widened the scope of the coated paper market. The rising preference for home delivery services on the heels of the strengthening presence of online retailers has increased the consumption of coated paper in packaging activities. Businesses have been investing in brand promotion through various forms of advertisements, which also act as a key driver for the segment.

The printing application held a share of 32.1% in the market in 2018 owing to its wide area of application across various industries. However, widespread digitalization has had an adverse impact on this application, threatening to make it saturated. Nevertheless, the use of coated paper in currency, security documents, and check books is anticipated to ensure stable growth of the segment over the forecast period. Moreover, steady usage of this product as brochures and product manuals for smartphones, computers, and other electronic gadgets will keep demand steady.

Regional Insights

North America held the largest share in terms of volume in 2018, accounting for 35.8% that year, and the market is primarily driven by a high rate of production in the U.S. The region is also home to several leading manufacturers, which has resulted in the large-scale production of coated paper. By revenue, North America is expected to register a CAGR of 3.5% from 2019 to 2025. Corporate profit is a major contributor to the U.S. economy, therefore businesses rely heavily on paper products, which poses a significant opportunity for growth.

Asia Pacific is expected to exhibit a revenue-based CAGR of 3.7% from 2019 to 2025 on account of the increasing production and consumption of coated paper in the global market. The region is home to some of the largest paper-consuming countries such as India and China, which has increased the scope for the product across industries. Furthermore, a booming e-commerce sector in the region has spurred product demand for the printing and packaging of goods. Product usage in advertising and print media also presents room for growth.

Coated Paper Market Share Insights

Key product manufacturers include Oji Holdings Corporation; Asia Pulp & Paper Co. Limited; Stora Enso Oyj; Nippon Paper Industries Co.; NewPage Corporation; Michelman, Inc.; BASF SE; Imersys; Arjowiggins SAS; and Penford Corporation. Leading players have been focusing on product innovation and new product development, thereby helping them gain a greater market share at a global level and retain consumer interest. Increasing preference for bio-based papers in the majority of the regions is a lucrative opportunity for players.

Report Scope

|

Attribute

|

Details

|

|

Base year for estimation

|

2018

|

|

Actual estimates/Historical data

|

2015 - 2017

|

|

Forecast period

|

2019 - 2025

|

|

Market representation

|

Revenue in USD Billion, Volume Million Tons & CAGR from 2019 to 2025

|

|

Regional scope

|

North America, Europe, Asia Pacific, Central & South America, & MEA

|

|

Country scope

|

U.S., U.K., Germany, China, India, Brazil

|

|

Report coverage

|

Revenue forecast, company share, competitive landscape, growth factors and trends

|

|

15% free customization scope (equivalent to 5 analyst working days)

|

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

|

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the coated paper market report on the basis of type, application, and region:

-

Type Outlook (Volume, Million Tons; Revenue, USD Billion, 2015 - 2025)

-

Application Outlook (Volume, Million Tons; Revenue, USD Billion, 2015 - 2025)

-

Printing

-

Packaging & Labeling

-

Others

-

Regional Outlook (Volume, Million Tons; Revenue, USD Billion, 2015 - 2025)