- Home

- »

- Advanced Interior Materials

- »

-

Coated Steel Market Size & Share, Industry Report, 2030GVR Report cover

![Coated Steel Market Size, Share & Trend Report]()

Coated Steel Market (2025 - 2030) Size, Share & Trend Analysis Report By Product (Galvanized, Pre-painted), By End Use (Automotive, Building & Construction), By Region (North America, Europe, Asia Pacific), And Segment Forecasts

- Report ID: GVR-4-68040-516-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Coated Steel Market Summary

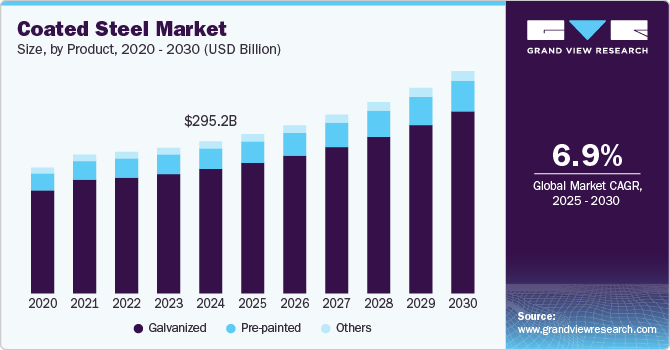

The global coated steel market size was valued at USD 295.16 billion in 2024 and is projected to reach USD 431.96 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. Coated steel is widely used in the construction of buildings, roofs, and facades due to its ability to withstand harsh weather conditions, prevent rusting, and maintain aesthetic appeal over time.

Key Market Trends & Insights

- The North America coated steel industry dominated the global market with revenue share of 66.8% in 2024.

- Based on product, the pre-painted segment is anticipated to register the fastest CAGR over the forecast period.

- Based on end use, the appliances segment is anticipated to register the fastest CAGR over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 295.16 Billion

- 2030 Projected Market Size: USD 431.96 Billion

- CAGR (2025-2030): 6.9%

- North America: Largest market in 2024

As urbanization continues to rise globally, there is a growing need for sustainable and reliable materials in construction, propelling the coated steel industry forward.Coated steel is crucial in automotive manufacturing, especially in producing body panels, structural components, and chassis. Steel's protective coatings improve the material's resistance to corrosion and scratches, which is essential in extending the lifespan of vehicles. The coatings also offer design flexibility and better fuel economy due to reduced weight. As consumer demand for more fuel-efficient and longer-lasting vehicles increases, the demand for coated steel in the automotive sector continues to rise.

In addition to construction and automotive, the growing demand for energy-efficient appliances and electronics fuels the coated steel industry. Products such as refrigerators, washing machines, air conditioners, and other household appliances require durable and aesthetically appealing materials. Coated steel, with its ability to resist corrosion and maintain visual appeal, is increasingly used in producing these products. As consumers seek energy-efficient and long-lasting household items, manufacturers turn to coated steel to meet these demands, driving market growth.

Technological advancements in coating processes also play a significant role in expanding the coated steel industry. Innovations in coating technologies, such as advanced galvanizing, polymer coatings, and nanotechnology, have led to the development of higher-performance coated steels that offer enhanced corrosion resistance, better mechanical properties, and improved aesthetic finishes. These advancements cater to the demands of traditional industries and open up new applications for coated steel in specialized sectors, including electronics, medical devices, and the renewable energy industry, further boosting market growth.

Furthermore, the growing awareness of environmental sustainability and energy efficiency has contributed to the demand for coated steel, particularly in the renewable energy sector. Coated steel is increasingly used in producing solar panels, wind turbine components, and energy-efficient infrastructure, where durability and corrosion resistance are essential. With governments and industries focusing on green energy initiatives and reducing carbon footprints, coated steel's role in building sustainable infrastructure is becoming more prominent, driving its demand across various sectors and contributing to the market's overall growth.

Drivers, Opportunities & Restraints

The coated steel industry is largely driven by the increasing demand across various industries, particularly in construction, automotive, and appliances. Coated steel offers enhanced durability, corrosion resistance, and aesthetic appeal, making it a popular choice for manufacturers. In construction, for example, it is used in roofing, siding, and structural components where long-term performance is crucial. The automotive industry also benefits from coated steel for vehicle body parts, where protection against environmental factors and long-lasting finishes are vital. The rising urbanization and industrialization globally also create an expanding demand for coated steel, further boosting its consumption.

The growing emphasis on energy efficiency and eco-friendly products opens new avenues for coated steel, especially in green building practices where materials that contribute to energy savings and lower carbon footprints are in demand. The use of coated steel in solar panel frames and energy-efficient construction applications highlights its role in supporting sustainable infrastructure. Moreover, advances in coating technologies, such as nano-coatings and eco-friendly alternatives, offer manufacturers the potential to meet stringent environmental regulations while expanding product offerings in markets focused on sustainability.

Coating processes, especially with advanced technologies, can add significant costs to production, making them less attractive in price-sensitive markets. In addition, the volatility of raw material prices, such as steel and chemicals used for coatings, can impact manufacturers' cost structure and profitability. Another challenge is the increasing competition from alternative materials, such as aluminum and plastic composites, which offer similar benefits but may be lighter or more cost-effective in some applications.

Product Insights

Galvanization, the process of coating steel with a layer of zinc, offers improved durability and resistance to rust and corrosion. This makes galvanized steel a preferred material in industries such as automotive, construction, and infrastructure, where the longevity and reliability of materials are critical.

Pre-painted is anticipated to register the fastest CAGR over the forecast period. Pre-painted steel, especially those coated with high-performance paints, offers excellent thermal insulation, which helps reduce energy consumption in buildings. Furthermore, eco-friendly coatings and the ability to recycle steel contribute to the growing preference for this material.

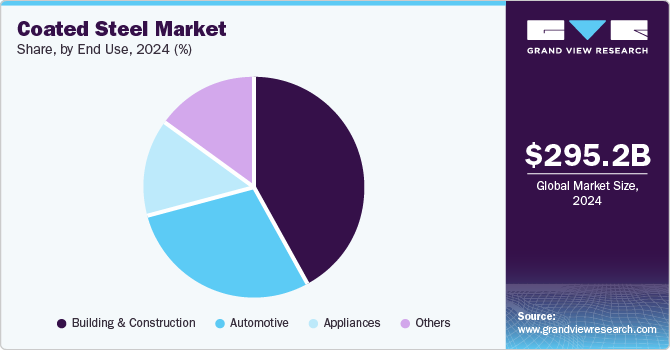

End Use Insights

Coated steel offers exceptional corrosion resistance, especially when coated with materials such as zinc or polymer, making it highly suited for roofing, siding, and other architectural applications. Its longevity makes it a desired alternative for residential and commercial buildings, as it reduces maintenance costs and enhances the overall lifespan of structures.

Appliances is anticipated to register the fastest CAGR over the forecast period. The need for durable and aesthetically pleasing materials is rising with the increasing adoption of modern household appliances, such as refrigerators, washing machines, microwaves, and dishwashers. As global urbanization and disposable incomes increase, consumers upgrade their appliances, further boosting demand for coated steel in this sector.

Regional Insights

The North America coated steel industry is anticipated to grow significantly over the forecast period. The rise of EVs in North America has further expanded the use of coated steel in automotive production. In 2024, the U.S. and Canada achieved around 9.0% growth in EV sales, with 1.8 million units sold. EVs require durable materials for their bodies, chassis, and other critical components to withstand electric powertrains' unique demands. Coated steel, with its corrosion resistance and ability to handle the stresses of electrical systems, is becoming increasingly important in EV manufacturing.

Asia Pacific Coated Steel Market Trends

The Asia Pacific coated steel industry is anticipated to grow over the forecast period. The growth is largely driven by economic expansion, particularly in countries such as China, India, and Southeast Asian nations. As these countries continue to develop rapidly, there is an increasing demand for coated steel in the construction, automotive, and consumer electronics industries.

The growing urban infrastructure projects, including residential and commercial buildings, transportation networks, dams, and bridges, require durable, corrosion-resistant materials, and coated steel is ideal for these applications. For instance, in December 2024, China officially approved the construction of the world's largest dam on the Brahmaputra River, known as the Yarlung Zangbo, in Tibet, with an estimated cost of USD 137 billion.

Europe Coated Steel Market Trends

Europe coated steel industry held a significant market share in 2024. The rise in housing projects, commercial developments, and industrial infrastructure across European countries is contributing to the market's expansion. These regions are experiencing rapid urbanization, with construction projects demanding reliable, cost-effective, and long-lasting materials like coated steel for new buildings and renovations.

Central & South America Coated Steel Market

The coated steel industry in Central & South America is driven by the energy sector, particularly oil, gas, and renewable energy. The rise of wind and solar energy projects requires durable materials that can withstand the harsh conditions typical of these environments. Coated steel, particularly galvanized and aluminized steel, is commonly used in constructing wind turbines, solar panel frames, and energy transmission towers due to its excellent corrosion resistance and ability to handle extreme weather.

Middle East & Africa Coated Steel Market Trends

The Middle East & Africa coated steel industry growth is driven by the oil & gas industry, a cornerstone of many Middle Eastern economies. Oil refineries, pipelines, offshore platforms, and storage tanks are all critical components of the sector and require highly resistant materials to cope with extreme conditions. Coated steel, with its corrosion-resistant properties, is widely used in these applications to enhance the longevity and reliability of equipment exposed to chemicals, moisture, and fluctuating temperatures.

Key Coated Steel Company Insights

Some of the key players operating in the market include ArcelorMittal, Kobe Steel, and others.

-

ArcelorMittal is one of the world’s leading steel and mining companies. It is strongly committed to innovation and sustainability and focuses on producing high-quality steel products, including coated steel solutions essential for various applications. Among its offerings, ArcelorMittal provides galvanized products known for their corrosion resistance and superior non-flaking properties, making them suitable for severe forming operations without compromising quality.

-

Kobe Steel is a prominent Japanese steel manufacturer that operates through various segments, including iron and steel, aluminum and copper, machinery, construction machinery, and welding. The company’s coated steel products are characterized by their superior strength, durability, and resistance to wear and corrosion.

Key Coated Steel Companies:

The following are the leading companies in the coated steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Baosteel Group

- ChinaSteel

- Essar Steel

- JFE Steel Corporation

- JSW

- Kobe Steel Ltd.

- Nippon Steel Corporation

- Nucor

- OJSC Novolipetsk Steel

- POSCO

- Severstal

- SSAB AB

- Tata Steel

- voestalpine AG

Recent Developments

-

In September 2024, U.S. Steel officially launched ZMAG, a groundbreaking coated steel product designed to endure the most challenging environments. The carbon flat-rolled steel features a unique zinc-aluminum-magnesium coating, providing up to five times the corrosion resistance compared to traditional galvanized steel.

-

In May 2024, JSW Steel launched an indigenous coated steel product named JSW Magsure, a Zinc-Magnesium-Aluminium alloy designed to enhance corrosion resistance. This launch is a strategic move to reduce India's reliance on imported coated steel, as the domestic market for this type of steel has expanded significantly, growing from approximately 15,000 tons to 120,000 tons in recent years.

Coated Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 309.46 billion

Revenue forecast in 2030

USD 431.96 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative Units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Russia; China; India; Japan; Indonesia; Brazil; Saudi Arabia

Key companies profiled

ArcelorMittal; Baosteel Group; ChinaSteel; Essar Steel; JFE Steel Corporation; JSW; Kobe Steel Ltd.; Nippon Steel Corporation; Nucor; OJSC Novolipetsk Steel; POSCO; Severstal; SSAB AB; Tata Steel; voestalpine AG

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coated Steel Market Report Segmentation

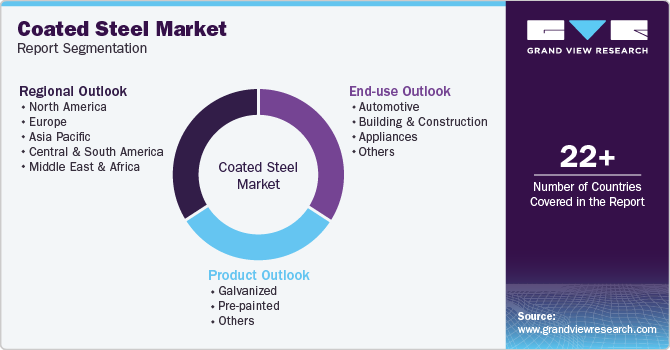

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coated steel market report based on product, end use, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Galvanized

-

Pre-painted

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Appliances

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

-

Central & South America

-

Brazil

-

-

Middle East

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global coated steel market size was estimated at USD 295.16 billion in 2024 and is expected to reach USD 309.46 million in 2025.

b. The global coated steel market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 431.96 billion by 2030.

b. The galvanized segment dominated the market with a revenue share of over 81.0% in 2024.

b. Some of the key vendors of the global coated steel market are Tata Steel, Nippon Steel Corporation, ArcelorMittal, Nucor, voestalpine AG, and others.

b. The key factor that is driving the growth of the global coated steel market is growing demand from the automotive sector for manufacturing body parts and the rapid urbanization, particularly in developing countries, is driving the need for coated steel in construction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.