- Home

- »

- Consumer F&B

- »

-

Coconut Products Market Size, Share & Trends Report, 2030GVR Report cover

![Coconut Products Market Size, Share & Trends Report]()

Coconut Products Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Coconut Oil, Coconut Milk/Cream, Coconut Water), By Application (Cosmetics, F&B), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-896-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2025

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Coconut Products Market Summary

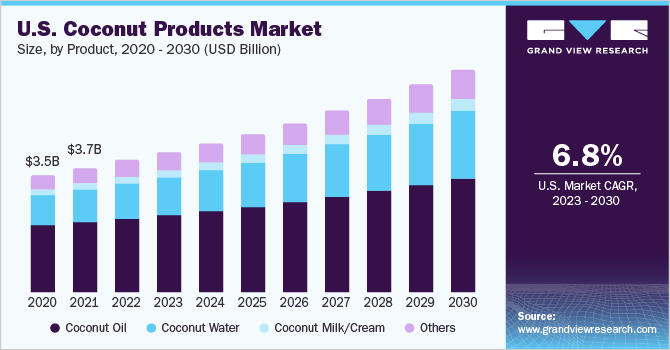

The global coconut products market size was valued at USD 20.24 billion in 2022 and is projected to reach USD 38.58 billion by 2030, growing at a CAGR of 8.4% from 2023 to 2030. Increased awareness about the benefits of coconuts coupled with the growing demand for coconut-based products in major developed countries is expected to drive the demand for these products over the forecast period.

Key Market Trends & Insights

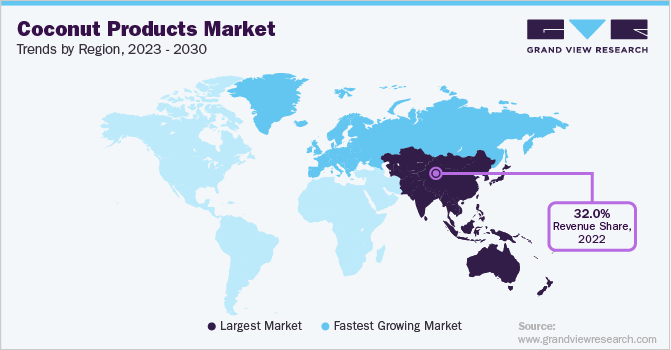

- Asia Pacific region accounted for the largest market share of over 32% in 2022.

- Europe region is expected to witness the fastest growth at a CAGR of 10.5%.

- By product, Coconut oil accounted for the largest revenue share of around 55.1% in 2022.

- By application, The cosmetics application segment accounted for the largest market share, accounting for approximately 62.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 20.24 Billion

- 2030 Projected Market Size: USD 38.58 Billion

- CAGR (2023-2030): 8.4%

- Asia Pacific: Largest market in 2022

In the post-COVID pandemic era, consumers across the globe have become increasingly conscious about the type of food they consume. This has resulted in the rising demand for a plant-based diet. The trend is expected to result in rising demand for coconut products across the globe, offering key manufacturers and food processing companies an opportunity to expand their product portfolio and enhance their consumer outreach.According to a report published by Plant Based Foods Association in 2023, 68% of the surveyed consumers from the age group 35-44 stated that excessive additives and additive ingredients in the food supply are some of the major issues related to food globally. Currently, a large consumer base continues to turn toward plant-based diets as awareness about the issue rises.

The demand for coconut and coconut-derived products is anticipated to increase in the coming years as a result of rising consumer concerns about the use of conventional dairy-based beverages and food products. The adoption of vegan diets is also on the rise due to increased health awareness, especially among millennials. The demand for foods and beverages made with components obtained or produced organically has grown as the organic industry continues to expand. Food products manufactured from organic coconut have a much higher nutritious value than conventional agricultural food products due to the presence of genetically modified elements. Coconut oil, desiccated coconut, cream, milk, and water from organic coconut are also witnessing strong demand in various application areas including food and beverages, cosmetics, and pharmaceuticals.

The increased variety of coconut products coupled with their health benefits has positively affected the market. Increasing applications of major coconut derivatives like coconut oil and milk are positively impacting product demand. Global manufacturers of food & beverages and cosmetic products are investing in research & development to extract the complete benefits of coconuts to enhance their product offering.

For instance, in February 2022, with the introduction of goods based on coconut milk, No Apologies, a flagship brand of Niam International Private Limited, expanded the scope of its product line. The company launched coconut milk shampoo, conditioner, and hair masks that offer antimicrobial & restorative care for the scalp and hair. Such initiatives by leading players that incorporate the use of coconut-based products such as milk and oil are expected to make constructive addition to the market growth over the forecast period.

This is pushing consumers to shift from the conventional utilization of coconut oil as a food ingredient to its use as a personal care or beauty product. Similarly, as an alternative to coconut milk, dairy milk continues to gain popularity among people who strictly follow vegan diets. The rising demand for lactose-free food among consumers along with the ever-growing demand for natural ingredients in food, bakery, and the confectionery market is expected to offer lucrative growth opportunities for key market players.

For instance, in January 2022, Agro Tech Foods Ltd. launched a coconut-centered product line named Sundrop Duo. The company entered the chocolate confectionary segment with the launch of Sundrop Duo. Such initiatives are expected to elevate the demand for coconut products in the coming years.

Coconut water is gaining popularity as an energy drink due to its natural hydrating property. Other coconut products like coir, coconut sugar, coconut chips and cookies, desiccated coconut, etc. are increasing the market demand due to their various applications. For instance, coir is used to make geotextiles due to its impressive durability and absorbent characteristics.

Product Insights

Coconut oil accounted for the largest revenue share of around 55.1% in 2022. Coconut oil has a high content of healthy saturated fats that can boost fat burning and replenish energy levels in the body. It also raises the good cholesterol in the body, which is beneficial in reducing the risk of heart disease. This product is also used as an excellent hair care oil that promotes healthy and shiny growth. Due to its anti-aging, antibacterial, antioxidant, and anti-inflammatory properties, this product finds its utilization in skin care as well. Moreover, coconut oil is used in cooking in major developing countries like India and China. However, due to its high saturated fat content, this product is facing stiff competition from other substitutes like almond and soy milk.

Coconut water is anticipated to be the fastest-growing segment with a CAGR of 9.4% over the forecast period. The consumption of coconut water continues to gain ground in Europe due to increased awareness of its health benefits. Coconut water is rich in electrolytes and does not contain sugar. This makes it a perfect alternative to traditional sports drinks. It can also be used as a refreshment drink as it contains many antioxidants that help neutralize stress. Key manufacturers are focused on offering attractively packaged coconut water in regions like North America and Europe where demand is high. This is expected to increase product demand and drive the growth of the market.

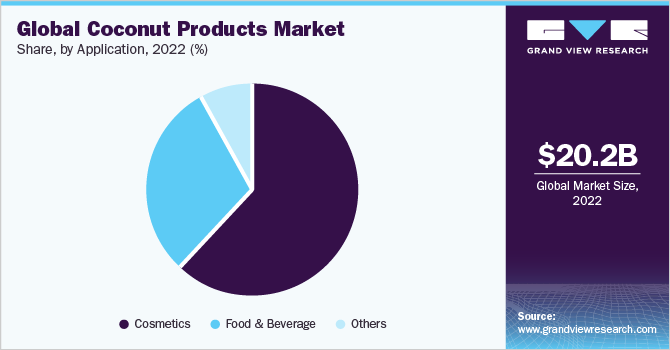

Application Insights

The cosmetics application segment accounted for the largest market share, accounting for approximately 62.6% in 2022. Various skin and hair care products use coconut oil or coconut milk as one of the base ingredients. The antioxidant properties of these products are beneficial in anti-aging creams. These products are also used directly in homemade hair and skin packs. This is expected to fuel market growth. Due to the increase in the cosmetic market due to its highly competitive nature, manufacturers are using coconut derivatives to introduce new and innovative cosmetic products. This is contributing to the accelerated growth of this segment.

The food & beverage application segment is expected to witness the fastest CAGR of 9.2% over the forecast period. The demand for coconut products is anticipated to increase as a result of rising consumer concerns about the use of conventional dairy-based food and beverage products as well as the adoption of vegan diets due to increased health awareness.

The demand for foods and beverages made with components obtained or produced organically has grown as the organic industry continues to expand. Food products created from organic coconut have a much higher nutritious value than conventional agricultural food products as they don't contain any genetically modified elements, likely favoring the growth of the segment.

Regional Insights

The Asia Pacific region accounted for the largest market share of over 32% in 2022. The region contributes significantly to consumption as the major plantations of coconut are found in countries like Indonesia, Philippines, India, Brazil, Sri Lanka, and Vietnam. These countries are also the major suppliers to the North America and European markets. The Philippines and Indonesia are the major exporters of coconuts and coconut oil in the world.

The Europe region is expected to witness the fastest growth at a CAGR of 10.5% owing to an increase in the adoption of coconut water and coconut milk. Coconut milk is already being used as a non-dairy alternative in many European countries. However, due increase in the awareness of coconut water benefits, there has been a huge increase in the demand for these products. The Netherlands is the largest importer of coconut oil in Europe after China and the United States.

Key Companies & Market Share Insights

The market for coconut products is highly competitive, with a range of companies offering various products and solutions for pet anxiety and stress. Many big players are increasing their focus toward new product launches, partnerships, and expansion into new markets to compete effectively.

-

For instance, in July 2021, Vita Coco debuted as Public Benefit Corporation (PBC) to strengthen its commitment to better products. The business was established to improve procurement by using this PBC structure to support economic growth and help coconut producers with difficulties in sustainable development. As a result, Vita Coco's adoption of this structure resulted in a lucrative business in terms of generating attention from the general public and raising shareholder profits.

-

For instance, in October 2021, McCormick & Company Inc., has revealed plans to build a brand-new, cutting-edge, multipurpose headquarters in Mentone. Early in 2022, the project is anticipated to increase production in Melbourne, Australia. Also, this will create a hub where consumers and employees can concentrate on innovation and productive cooperation, opening the door for the creation of 500 new construction-related employment.

Some prominent players in the global coconut products market include:

-

Vita Coco

-

Pepsico

-

Coca-Cola (Zico)

-

Eco Biscuits

-

Dutch Plantin

-

Coconut Dream

-

Koh Coconut

-

PECU

-

UFC Coconut Water

-

Taste Nirvana

Coconut Products Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 21.79 billion

Revenue forecast in 2030

USD 38.58 billion

Growth rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Netherlands; China; India; Japan; Brazil; South Africa

Key companies profiled

Vita Coco; Pepsico; Coca-Cola (Zico); Eco Biscuits; Dutch Plantin; Coconut Dream; Koh Coconut; PECU; UFC Coconut Water; Taste Nirvana

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coconut Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global coconut products market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Coconut Oil

-

Coconut Water

-

Coconut Milk/Cream

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Cosmetics

-

Food & Beverage

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global coconut products market was estimated at USD 20.24 billion in 2022 and is expected to reach USD 21.79 billion in 2023.

b. The global coconut products market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 38.58 billion by 2030.

b. Asia Pacific dominated the coconut products market with a share of over 32%% in 2022. The growth of the regional market is driven on account of the presence major coconut exporters.

b. Some of the key players operating in the coconut products market include Vita Coco; Pepsico; Coca-Cola (Zico); Eco Biscuits; Dutch Plantin; Coconut Dream; Koh Coconut; PECU; UFC Coconut Water; and Taste Nirvana.

b. Key factors that are driving the coconut products market growth include the increasing consumer spending on healthy and nutritional food products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.