- Home

- »

- Next Generation Technologies

- »

-

Coding And Marking Equipment Market Size Report, 2030GVR Report cover

![Coding And Marking Equipment Market Size, Share & Trends Report]()

Coding And Marking Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Continuous Inkjet Printer, Thermal Inkjet Printer, Piezo Inkjet Printer Laser Printer), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-818-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Coding And Marking Equipment Market Summary

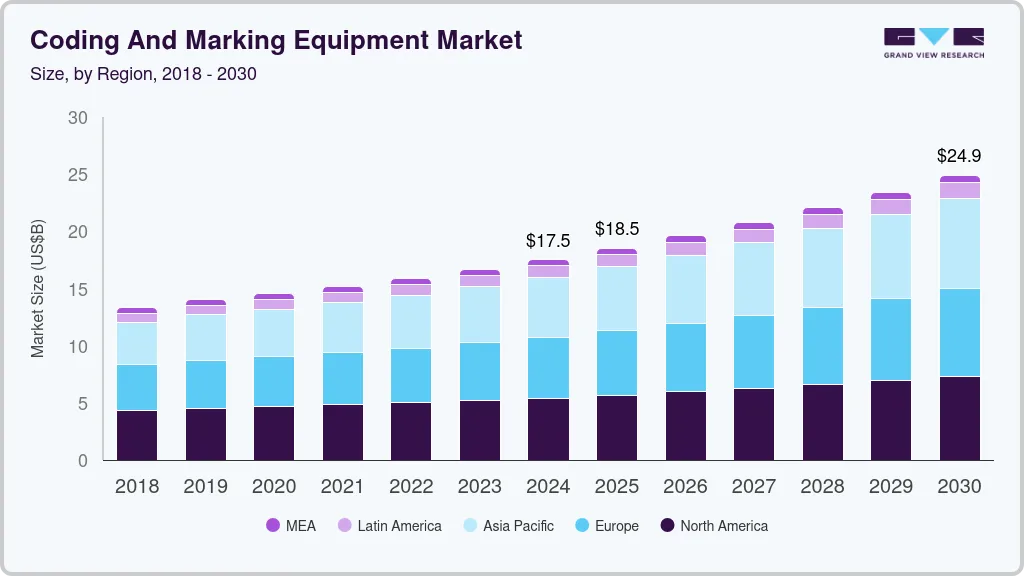

The global coding and marking equipment market size was estimated at USD 17,528.4 million in 2024 and is projected to reach USD 24,927.0 million by 2030, growing at a CAGR of 6% from 2025 to 2030. Market growth is primarily driven by rising demand for product traceability across key industries, including food and beverage, pharmaceuticals, cosmetics, and electronics.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Mexico is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, continuous inkjet (cij) printer accounted for a revenue of USD 5,670.2 million in 2024.

- Thermal Inkjet (TIJ) Printer is the most lucrative grade segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 17,528.4 million

- 2030 Projected Market Size: USD 24,927.0 million

- CAGR (2025-2030): 6.0%

- North America: Largest market in 2024

Furthermore, stringent regulations around product labeling and safety standards are accelerating the adoption of advanced coding and marking systems. Some significant factors contributing to this trend are innovations in coding technologies, such as laser and Thermal Inkjet (TIJ) solutions, and the growing automation of manufacturing and packaging processes.

Advancements in coding and marking technologies have empowered companies across diverse industries to enhance operational performance and achieve cost-efficiency through innovative systems. Modern coding and marking equipment with high-precision capabilities, such as laser technology, TIJ, Continuous Inkjet (CIJ), and thermal transfer, are critical for accurately and efficiently labeling various materials. This technology is essential in food and beverage, pharmaceuticals, cosmetics, electronics, automotive, logistics, and packaging industries. Coding and marking equipment is widely used for product identification, traceability, regulatory compliance labeling, date coding, and batch numbering, as it meets stringent standards for safety, quality control, and anti-counterfeiting. Leading companies are adopting these solutions to improve efficiency, minimize errors, and optimize production and supply chain processes.

For example, in September 2024, Domino Printing Sciences, a prominent player in the coding and marking industry, launched a high-speed laser coder for the packaging sector. This advanced system offers precise coding on various substrates while reducing operational costs, enabling companies in highly regulated sectors to maintain compliance and productivity.

In addition, an increase in investment by government bodies and private organizations across regions like North America, Europe, and Asia Pacific is accelerating R&D in coding and marking technology. Funding initiatives such as the U.S. National Innovation Strategy and Germany’s Industry 4.0 programs favor technological advancements that drive market growth. As coding and marking technology continues to evolve, companies benefit from enhanced traceability, regulatory compliance, and product authenticity, supporting the broader expansion of the industry.

Product Insights

The Continuous Inkjet (CIJ) printer segment led the coding and marking equipment industry in 2024, accounting for 32.3% of the revenue. Known for their non-contact, high-speed coding capabilities, CIJ printers support versatile, reliable marking across high-volume production lines. The wide availability of CIJ printers and inks further strengthens this segment, prompting manufacturers to innovate and defend their market shares.

The Thermal Inkjet (TIJ) printer segment is expected to grow at the highest CAGR over the forecast period, driven by their cost-effectiveness, high speed, high-quality output, and ease of use across multiple materials, including plastics, paper, cartons, and metals. TIJ printers require minimal operator training and are instantly ready to use, making them an appealing option for businesses seeking efficient, user-friendly printing solutions.

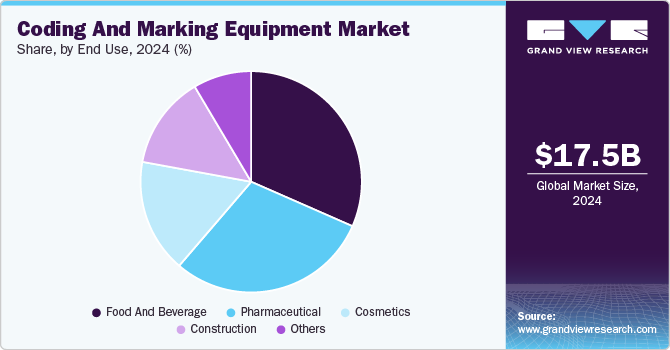

End Use Insights

In 2024, the food and beverage sector dominated the coding and marking equipment market, driven by stringent safety standards required for online and retail channels. Reliable coding systems facilitate clear labeling of expiration dates, batch numbers, and traceability, which is essential for brand protection and differentiation. Growing consumer demand for traceability tags and certifications further boosts this sector’s reliance on advanced coding solutions.

The pharmaceutical sector is expected to grow at the highest CAGR during the forecast period, with precise coding supporting compliance, serialization, and product authenticity under strict regulatory mandates. The COVID-19 pandemic has further intensified the need for accurate labeling of essential health products, further driving demand for robust coding systems in the sector.

Regional Insights

North America led the global coding and marking equipment market in 2024 with a revenue share of 30.9%, driven by continuous R&D, a growing manufacturing base, and the presence of established coding technology providers. Stringent regulatory standards in pharmaceuticals, food & beverage, and automotive industries fuel the demand for precise, reliable coding solutions in the region.

U.S. Coding And Marking Equipment Market Trends

Within North America, the U.S. dominated the regional coding and marking equipment industry, supported by high demand from the pharmaceutical and food & beverage sectors for compliance, adoption by automotive and electronics manufacturers, and a strong innovation ecosystem. The increasing demand for efficient supply chain management tools across sectors further boosts the U.S. market.

Europe Coding And Marking Equipment Market Trends

Europe remains a promising region in the coding and marking equipment market, driven by rapid digital transformation across pharmaceuticals, personal care, and automotive sectors. Government support for traceability and anti-counterfeiting measures and strong compliance awareness amplify demand for advanced coding technologies.

Germany leads the European market, benefiting from a robust manufacturing sector, increasing use of high-precision coding for quality assurance, and a focus on R&D. The rise of collaborative and sophisticated marking solutions strengthens Germany’s regional role.

Asia Pacific Coding And Marking Equipment Market Trends

Asia Pacific captured a significant share of the global coding and marking equipment market in 2024, driven by large-scale manufacturing, stringent regulatory requirements, and high adoption of advanced coding solutions across key industries. The region’s significant use of coding in food & beverage, pharmaceuticals, and automotive sectors further enhances its market position.

China spearheaded growth in Asia Pacific, supported by high coding demand from large manufacturers, strong R&D in industrial automation, and government support for innovation. China’s manufacturing scale and emphasis on product traceability make it a critical market for coding and marking equipment.

Key Coding And Marking Equipment Company Insights

Some key companies in the coding and marking equipment industry are Danaher Corporation, Hitachi Ltd., and ProMach Inc. Major market participants are adopting strategies such as innovation, enhanced focus on R&D activities, expansions, portfolio enhancements, partnerships, and collaborations to address growing competition and rising technology adoption.

-

Danaher Corporation offers a comprehensive range of precision coding and marking solutions through subsidiaries like Videojet and Linx, targeting various industries, such as pharmaceuticals, food & beverage, and manufacturing. Known for high-performance inkjet, laser, and thermal transfer technologies, Danaher’s solutions support compliance, traceability, and product authentication with advanced data integration features.

-

Hitachi Ltd. delivers reliable coding and marking systems, including continuous inkjet and laser solutions tailored for high-speed production in the automotive, electronics, and consumer goods sectors. With a strong focus on innovation, Hitachi integrates IoT-enabled and automation features to enhance traceability and operational efficiency in large-scale manufacturing.

Key Coding And Marking Equipment Companies:

The following are the leading companies in the coding and marking equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher Corporation

- Domino Printing Sciences plc

- Comp3

- Hitachi Ltd.

- Markem-Imaje Group

- Matthews International Corporation

- Leibinger Group

- REA Elektronik GmbH

- ProMach Inc.

- Koenig & Bauer Coding GmbH

- HSA Systems A/S

Recent Developments

-

In September 2024, Domino Printing Sciences launched the K300, a compact monochrome inkjet printer, at Labelexpo Americas. Designed for high-speed variable data printing, it integrates easily into existing lines, enabling label customization with QR codes and batch information. The K300 will be featured alongside a code verification solution from Lake Image Systems, meeting the rising demand for 2D codes in packaging.

-

In April 2024, Markem-Imaje launched the MW2160P, a versatile opaque white ink for extruded products like PVC and rubber, compatible with its 9750+ CIJ printers. This durable ink offers strong visibility and adhesion, resisting bending and water exposure, making it ideal for demanding industrial applications. Nicknamed the “Swiss Army Knife” of CIJ inks, it ensures reliable print quality across various substrates.

Coding And Marking Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 18.52 billion

Revenue forecast in 2030

USD 24.93 billion

Growth Rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Kingdom of Saudi Arabia, and South Africa

Key companies profiled

Danaher Corporation.; Domino Printing Sciences Plc; Hitachi Ltd.; Markem-Imaje Group; Matthews International Corporation; Leibinger Group; REA Elektronik GmbH; ProMach Inc.; Koenig & Bauer Coding GmbH; HSA Systems A/S

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coding And Marking Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coding and marking equipment industry report based on product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Continuous Inkjet (CIJ) Printer

-

Thermal Inkjet (TIJ) Printer

-

Piezo Inkjet Printer

-

Laser Printer

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food and Beverage

-

Pharmaceutical

-

Construction

-

Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.