- Home

- »

- Consumer F&B

- »

-

Coffee Roaster Market Size, Share & Growth Report, 2030GVR Report cover

![Coffee Roaster Market Size, Share & Trends Report]()

Coffee Roaster Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Direct Fire, Hot Air), By Batch Size, By Application (Industrial, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-939-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Coffee Roaster Market Summary

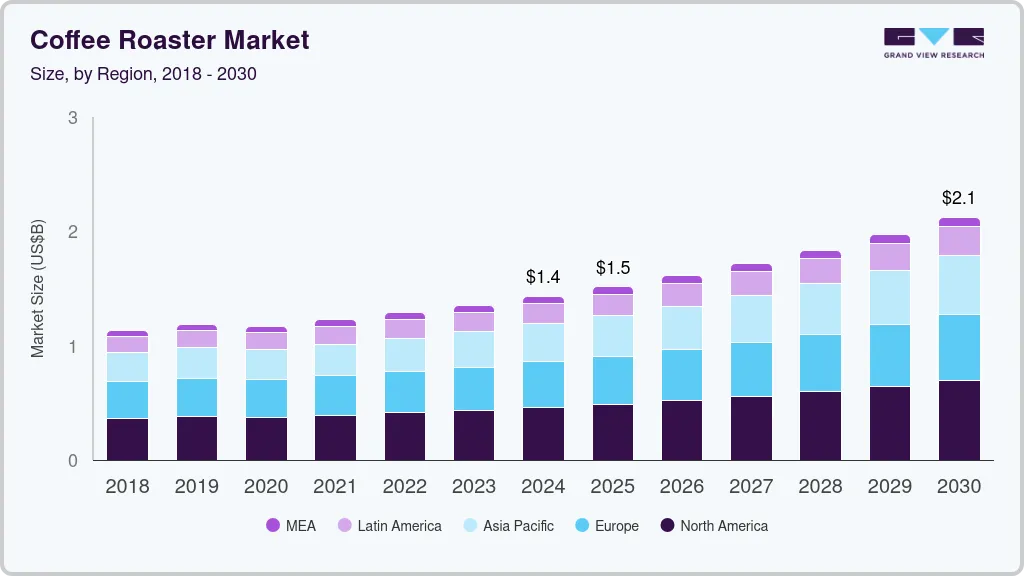

The global coffee roaster market size was estimated at USD 1,286.2 million in 2022 and is projected to reach USD 2.13 billion by 2030, growing at a CAGR of 6.5% from 2023 to 2030. The rising demand and inclination of consumers towards the consumption of coffee across the globe is a primary factor driving the market growth.

Key Market Trends & Insights

- North America held the largest share of the market accounting for 32.1% in 2022.

- Asia Pacific is expected to grow with the fastest CAGR of 7.3% over the forecast period from 2023 to 2030.

- By type, the hot air segment dominated the market with a share of over 42.5% in 2022.

- By batch size, the small batch size roaster segment is expected to grow with the fastest CAGR of 9.3%.

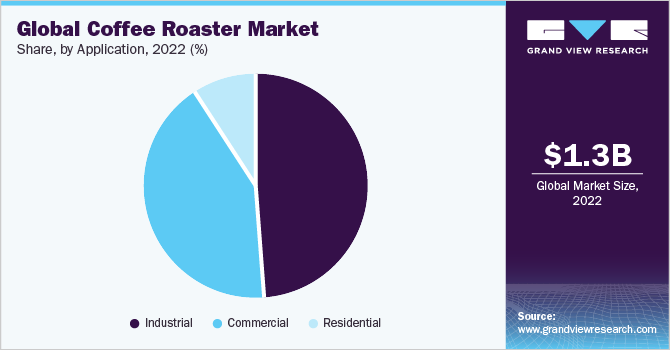

- By application, the industrial sector led the market and held a share of more than 48.6% in 2022 and is anticipated to grow at a CAGR of 6.4% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 1,286.2 Million

- 2030 Projected Market Size: USD 2.13 Billion

- CAGR (2023-2030): 6.5%

- North America: Largest market in 2022

Moreover, consumers from the Asia Pacific region play a major role in the increasing consumption of coffee. In addition, the rising demand for fresh coffee is expected to fuel market growth in the coming years. As per the International Coffee Council, the preference of consumers in East and South Asia has been shifting towards fresh coffee consumption.The COVID-19 pandemic negatively impacted various industries including the food & beverage industry. A fall in the coffee roaster industry has been observed during this period owing to a reduction in the consumption of coffee among consumers. The reduction in the consumption of coffee through the food service industry occurred due to various measures taken by the government such as the shutdown of cafes and restaurants along with maintaining social distancing due to the implementation of the lockdown. However, due to such factors, the sales of home roasters grew due to the preference of consumers to stay at home and roast their coffee. In addition, the online sale of coffee roasters also grew due to the pandemic.

The increasing number of coffee shop chains coupled with the rising trend of the culture of visiting cafés are other key factors anticipated to propel the market growth in the coming years. In addition to the rising consumption of coffee, the production of coffee has also been growing. For instance, as per the International Coffee Organization, the production of coffee across the globe has increased by 6.3% from 2019 to 2020. Furthermore, development in retail sections is also anticipated to drive the growth of coffee rosters in the residential segment.

The solubility of green coffee beans increases when it is roasted. This method also enhances the aroma and flavor of the coffee. Coffee, when roasted at the right temperature for a dedicated amount of time, provides perfect solubility that helps in achieving the right extraction of coffee. An interest in quality coffee among numerous consumers has been prompted by roasted coffee. Brewing coffee through innovative ways and experimenting with it has been made easy by coffee roasters. This has also been made more convenient to consumers by the availability of brewing and coffee machines and remains widely accessible on domestic as well as commercial platforms. Thus, the aforementioned factors are expected to boost market growth worldwide.

The growth of the global market is also attributed to the launch of new and innovative products by the key players operating in the market. The launches of products with better characteristics by manufacturers have been increasing resulting in attracting more consumers thus fueling the market growth over the forecast period. For instance, in January 2021, a new coffee roaster IKAWA Pro100 was introduced by IKAWA Ltd. The coffee roaster is easy to use, consistent, and has a capacity of 120 grams. Moreover, in May 2020 Revelation F5, a new solution for heat-circulating was launched by U.S. Roasters Corp.

The coffee roasters produce high heat and cause an intense working environment which pushes commercial coffee shops to avoid keeping coffee roasters in their places which are anticipated to challenge the market growth over the forecast period. However, investing in the development of rosters in compact sizes equipped with advanced technology is expected to offer lucrative opportunities in the market. Moreover, establishing the presence of the company in countries with roasters in both commercial and residential applications, especially in thriving coffee-consuming regions such as Asia Pacific is estimated to provide further key opportunities to the manufacturers.

Type Insights

The hot air segment dominated the market with a share of over 42.5% in 2022. Hot air coffee roasters do not generate smoke and roast the coffee beans efficiently and evenly as it has a hot air circulation system. The coffee beans are roasted at perfect temperature due to the automatic constant temperature system of hot air coffee roasters. Moreover, various features are associated with residential hot air coffee roasters such as manual adjustment of the roasting time of coffee along with dual function for roasting and cooling coffee beans. Due to such factors, hot air coffee roasters are highly used thus contributing to the higher share of the segment.

The half hot air coffee roasters are estimated to grow with the fastest CAGR of 7.3% over the forecast period. The roasting time of coffee in half hot air roasters is shorter as the heat inside such roasters are fully utilized by circulating the heat internally. Such roasters are majorly used for both residential and commercial purposes. The consumption of coffee is significantly increasing with increasing commercial offices which is propelling the segment growth over the forecast period. In addition, the trend for consuming coffee by roasting coffee at home is growing which is further driving the growth of the segment.

Batch Size Insights

With a market share of 47.3%, industrial batch size roasters dominate the coffee roaster market in 2022. Industrial-scale roasters are used by large coffee production facilities, including major coffee brands and commercial suppliers. They are designed to handle massive volumes of coffee beans efficiently and consistently. Industrial roasters often feature advanced technologies like precise temperature control, programmable roast profiles, and sophisticated data analysis systems. These roasters have custom-built configurations to fit specific production needs, enabling high-speed and high-volume processing, while maintaining quality.

The small batch size roaster segment is expected to grow with the fastest CAGR of 9.3%. Small roasters have features such as temperature logging to record roast parameters and evaluate and analyze the type of beans used. These roasters are crucial for coffee buyers, importers, and quality control professionals to assess the potential of different coffee beans and make informed purchasing decisions. Some of the popular roasters in this batch size are the ROEST sample roaster, Ikawa Pro50 and Pro100, and Aillio Bullet R1. Digital micro-sample roasters with integrated mobile applications are gaining popularity in the market.

Application Insights

Application of coffee roasters in the industrial sector led the market and held a share of more than 48.6% in 2022 and is anticipated to grow at a CAGR of 6.4% over the forecast period. The rising awareness among consumers regarding the benefits of consumption of coffee-derived products and coffee coupled with its growing consumption in various emerging economies due to rapid urbanization is contributing to the segment growth. Moreover, coffee roasters used at the industrial level majorly benefitted from the rising demand for roasted coffee in the commercial and residential segments in various forms such as beans and powdered form.

The commercial segment is estimated to grow with the highest CAGR of 6.8% over the forecast period from 2023 to 2030. The increasing number of cafes or coffee shops and outlets across the globe is surging the adoption of commercial coffee roasters. Additionally, manufacturers operating in the market are launching coffee roasters suitable especially for commercial use. For instance, in February 2022 Bellwether Coffee, a manufacturer of commercial coffee roasters launched Series 2 Bellwether Automated Roasting System, the second generation of foundational machine and technology.

Regional Insights

North America held the largest share of the market accounting for 32.1% in 2022 and is anticipated to remain the leading region over the forecast period. The market in the region is significantly driven by the high consumption and rising popularity of roasted coffee among consumers. For instance, as per the statistics provided by the International Coffee Organization, per day approximately 1.4 billion cups of coffee are consumed and approximately 45% are consumed by U.S. consumers alone. This number totals more than 400 million cups of coffee per day. Moreover, coffee chains such as Starbucks provide roasted coffee to customers as per their preferences which is further driving the market growth in the region.

Asia Pacific is expected to grow with the fastest CAGR of 7.3% over the forecast period from 2023 to 2030. The growth of the market in the region is attributed to the increasing consumption of coffee by consumers in the region. As per the International Coffee Organization, as of 2022, coffee consumption in Asia has increased by 1.5% in the past five years. Moreover, the high consumption of roasted coffee in various countries in the Asia Pacific such as China and Japan is also contributing to the growth of the market in the region. According to an article published by Monin, as of 2022, the country in the Asia Pacific with the highest roasted coffee consumption is Japan followed by China.

Key Companies & Market Share Insights

Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, development & launch of new products, global expansion, and others. Some of the initiatives include:

-

In January 2023, PROBAT AG launched the P12e electric coffee roaster, an addition to its P series of roasters that uses electrical hot air technology. The P12e has a roasting capacity of 40kg/h and offers consistent and reproducible roasting results.

-

In March 2022, Scolari Engineering S.p.A. introduced the e-Roaster, an industrial coffee roasting system that reduces gas usage by 25% and curbs carbon emissions at roasteries. The roaster has a heat recovery system, which can divert the recovered heat to other applications such as HVAC or refrigeration units.

-

In January 2022, Diedrich Manufacturing Inc launched a new roaster machine, Diedrich DR-3, replacing the older IR-1 and IR-2.5. The DR-3 has a capacity range of 1-3kg and is designed to fulfill all the functions of the older IR machines.

Some prominent players in the global coffee roaster market include:

-

Nestlé

-

Bühler Group

-

PROBAT AG

-

Scolari Engineering S.p.A.

-

Genio Roasters

-

Cia. Lilla de Máquinas Ind. e Com

-

COFFEE HOLDING

-

Diedrich Manufacturing Inc.

-

Giesen Coffee Roasters B.V.

-

Toper

Coffee Roaster Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,354.4 million

Revenue forecast in 2030

USD 2.13 billion

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, batch size, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; Italy; France; China; India; Japan; Brazil; Saudi Arabia

Key companies profiled

Nestlé; Bühler Group; PROBAT AG; Scolari Engineering S.p.A.; Genio Roasters; Cia. Lilla de Máquinas Ind. e Com; COFFEE HOLDING; Diedrich Manufacturing Inc.; Giesen Coffee Roasters B.V.; Toper

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coffee Roaster Market Report Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global coffee roaster market report based on type, application, batch size, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Direct Fire

-

Half Hot Air

-

Hot Air

-

Others

-

-

Batch Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Small (100 grams to 1 kg)

-

Medium (2 kg to 5 kg)

-

Large (10 kg to 30 kg)

-

Industrial (More than 50 kg)

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Industrial

-

Commercial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global coffee roaster market size was estimated at USD 1,286.2 million in 2022 and is expected to reach USD 1,354.4 million in 2023.

b. The global coffee roaster market is expected to grow at a compound annual growth rate of 6.5% from 2023 to 2030 to reach USD 2.13 billion by 2030.

b. North America dominated the coffee roaster market with a share of 32.06% in 2022. This can be credited to the high consumption of coffee and the growing popularity of roasted coffee in the region.

b. Some key players operating in the coffee roaster market include Nestlé, Bühler Group, PROBAT AG, Scolari Engineering S.p.A., Genio Roasters, Cia. Lilla de Máquinas Ind. e Com, COFFEE HOLDING, Diedrich Manufacturing Inc., Giesen Coffee Roasters B.V., and Toper.

b. The increasing demand for fresh coffee coupled with the increasing number of coffee shop chains are the key factors driving the coffee roaster market across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.