- Home

- »

- Advanced Interior Materials

- »

-

Cold Plasma Technology Market Size, Industry Report, 2030GVR Report cover

![Cold Plasma Technology Market Size, Share & Trends Report]()

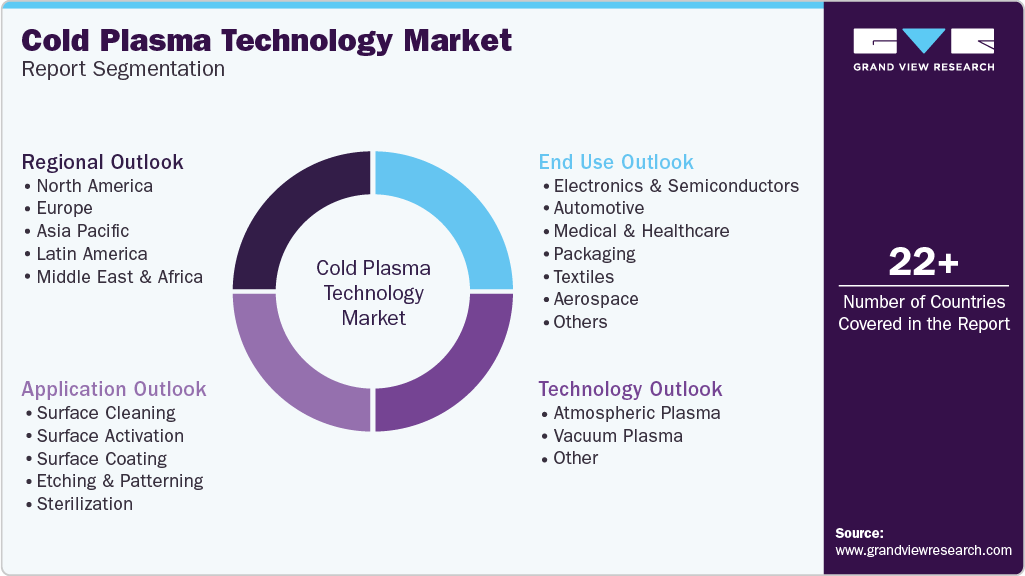

Cold Plasma Technology Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Surface Cleaning, Surface Activation, Surface Coating, Etching & Patterning, Sterilization), By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-586-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cold Plasma Technology Market Summary

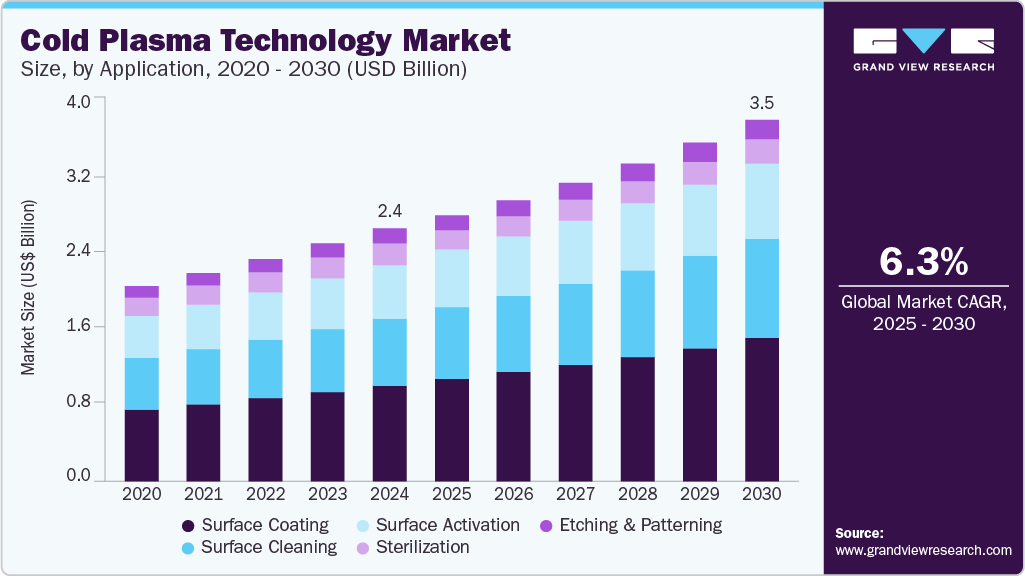

The global cold plasma technology market size was estimated at USD 2,421.8 million in 2024 and is projected to reach USD 3,466.2 million by 2030, growing at a CAGR of 6.3% over the forecast period from 2025 to 2030. Growth in this market is primarily driven by the increasing demand across diverse industries such as electronics, automotive, and healthcare, where cold plasma offers effective solutions for surface modification, sterilization, and wound healing.

Key Market Trends & Insights

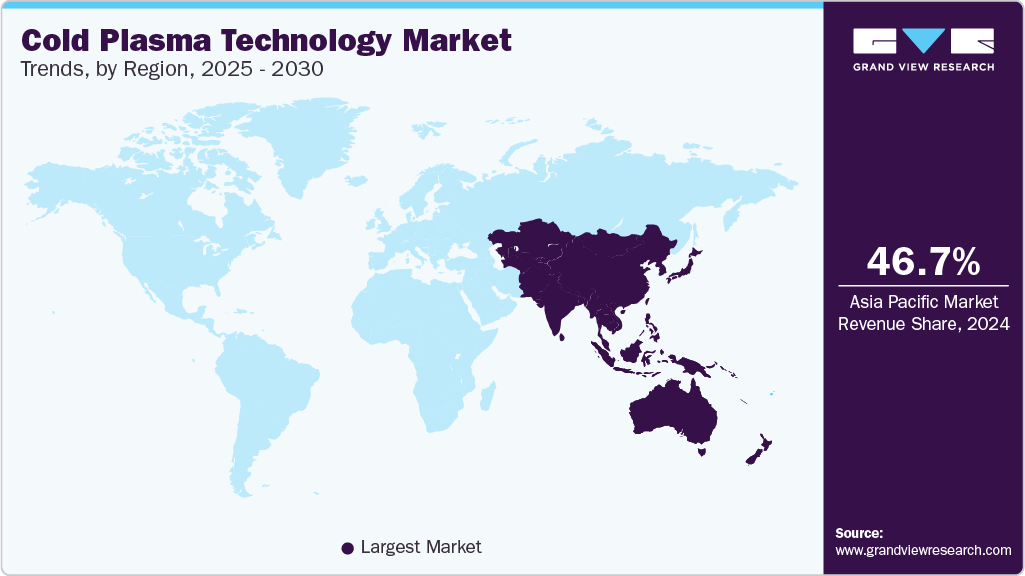

- The market in Asia Pacific dominated the global revenue share in 2024, accounting for 46.7%.

- The China cold plasma market is projected to grow at a CAGR of 7.4% over the forecast period.

- The cold plasma technology market in the U.S. is projected to expand at a CAGR of 6.7% over the forecast period.

- Based on technology, the atmospheric plasma segment dominated the market in 2024 by accounting for a share of 72.2%.

- In terms of application, the surface coating segment dominated the market in 2024 by accounting for a share of 37.8%.

Market Size & Forecast

- 2024 Market Size: USD 2,421.8 million

- 2030 Projected Market Size: USD 3,466.2 million

- CAGR (2025-2030): 6.3%

- Asia Pacific: Largest market in 2024

Its non-thermal, eco-friendly properties make it particularly attractive for applications requiring minimal heat damage and reduced chemical usage. Furthermore, ongoing technological advancements, expanding application scope, and rising awareness about the benefits of cold plasma are accelerating its adoption globally.

Additionally, advancements in cold plasma technology, such as improved generation methods, enhanced precision, and broader application techniques, are expected to drive market growth. Furthermore, scalability, efficiency, and cost-effectiveness developments make cold plasma technology more accessible, leading to its integration into various sectors, thereby expanding its commercial potential and market reach.

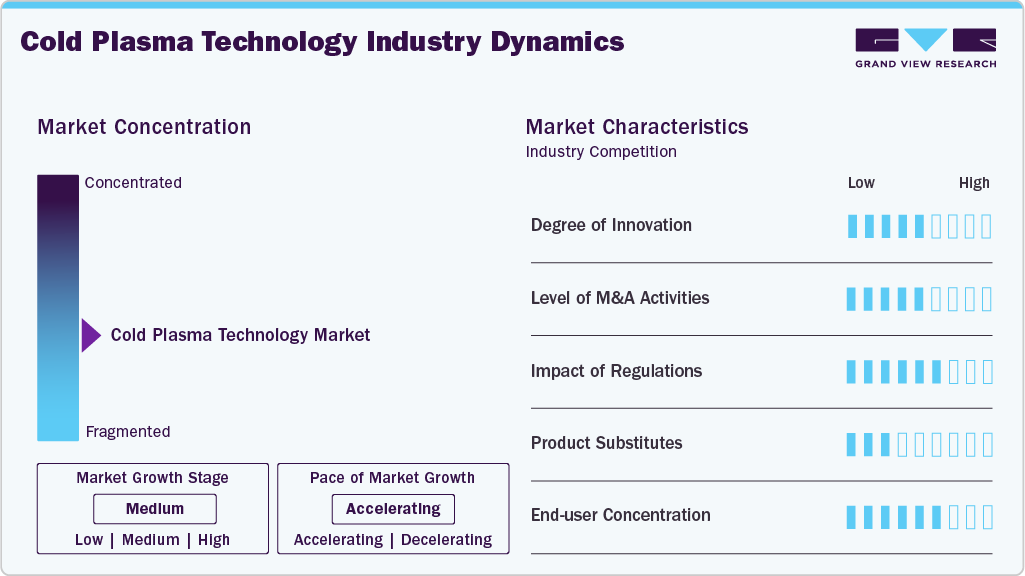

Market Concentration & Characteristics

The global cold plasma technology industry is moderately fragmented, with a mix of large multinational companies and regional players competing for market share. Key manufacturers are focusing on research and development to enhance the efficiency and versatility of technology. Companies are prioritizing collaborations with various industries to expand applications. Strategic partnerships and acquisitions are common to increase market share and innovation. Additionally, companies are investing in scaling up production and improving the cost-effectiveness of cold plasma systems. For instance, in November 2024, Neoplas Med GmbH, a medical technology company based in Greifswald, strengthened its partnership with Niterra Ventures Company. With a total investment of USD 25 million, the funding aims to expand the market for Neoplas Med’s cold plasma products and support international growth and innovation.

The market is characterized by a high degree of technical expertise, intellectual property barriers, and application-specific customization, making entry difficult for new players without strong R&D capabilities. Moreover, regional regulatory variations and the need for extensive safety and efficacy validation also define the market dynamics. Despite these complexities, the market is witnessing increased attention due to its eco-friendly, non-thermal, and chemical-free nature, aligning well with global sustainability goals and industrial modernization trends.

The market’s competitive nature is largely innovation-led rather than price-driven, especially in advanced applications such as wound healing, cancer therapy support, and advanced semiconductor manufacturing. Companies invest heavily in R&D to secure patents, improve performance, and develop proprietary cold plasma systems. Universities and research institutes also play a critical role, often partnering with private firms to bring laboratory innovations to the commercial market. As cold plasma remains an evolving field, early movers that can validate the technology through clinical trials or long-term industrial use tend to build strong reputational advantages, creating competitive moats around core application areas.

Drivers, Opportunities & Restraints

Advancements in electronics manufacturing are significantly driving the cold plasma technology industry due to the increasing need for precise, contamination-free surface treatments. In semiconductor and microelectronics production, components are extremely small and sensitive. Cold plasma offers non-thermal, highly controlled surface cleaning, activation, and etching crucial for ensuring strong adhesion, accurate patterning, and defect-free fabrication.

The high initial costs associated with cold plasma technology remain a significant barrier to its widespread adoption especially for small and medium-sized manufacturers. The equipment requires advanced materials, precision engineering, and specialized infrastructure, all contributing to high capital investment. These financial barriers can limit adoption, particularly in cost-sensitive industries or regions with limited access to funding or technical support.

The miniaturization of devices presents a significant opportunity for cold plasma technology, particularly in the automotive industry. As components shrink in size, there’s a growing demand for portable, scalable cold plasma systems that can perform on-site surface treatments. These systems enable precise, localized processing without the need for large-scale setups, improving efficiency, reducing production costs, and offering flexibility for manufacturers.

Application Insights

The surface coating segment dominated the market in 2024 by accounting for a share of 37.8%. Surface coating represents the largest application segment in the cold plasma technology industry. Cold plasma improves surface energy, enabling better bonding of paints, adhesives, and coatings. This precise, eco-friendly process benefits industries like automotive, aerospace, and electronics. As demand rises for high-performance, sustainable coatings, cold plasma is increasingly adopted for advanced surface modification.

The surface cleaning segment is expected to grow rapidly over the forecast period. Cold plasma effectively removes organic contaminants, dust, and microbes from surfaces without damaging the material. It is especially valuable in electronics, medical devices, and aerospace, where cleanliness is critical. The demand for dry, eco-friendly alternatives to chemical cleaning processes drives the adoption of cold plasma in precision surface preparation.

Technology Insights

The atmospheric plasma segment dominated the market in 2024 by accounting for a share of 72.2% due to its cost-effectiveness and ease of integration into existing production lines. Unlike vacuum-based systems, atmospheric plasma operates at ambient pressure, eliminating the need for complex vacuum chambers. This makes it ideal for continuous processes in industries like automotive, packaging, and electronics. Its versatility, low maintenance, and ability to treat large or complex surfaces drive its increasing adoption across sectors.

The vacuum plasma segment is expected to grow significantly due to its precision and ability to treat intricate and sensitive surfaces. Operating in controlled environments, vacuum plasma ensures uniform treatment, making it ideal for high-end applications in semiconductors, medical devices, and aerospace. Its effectiveness in surface activation, cleaning, and coating at the microscopic level is driving demand, especially where stringent quality and contamination control are critical.

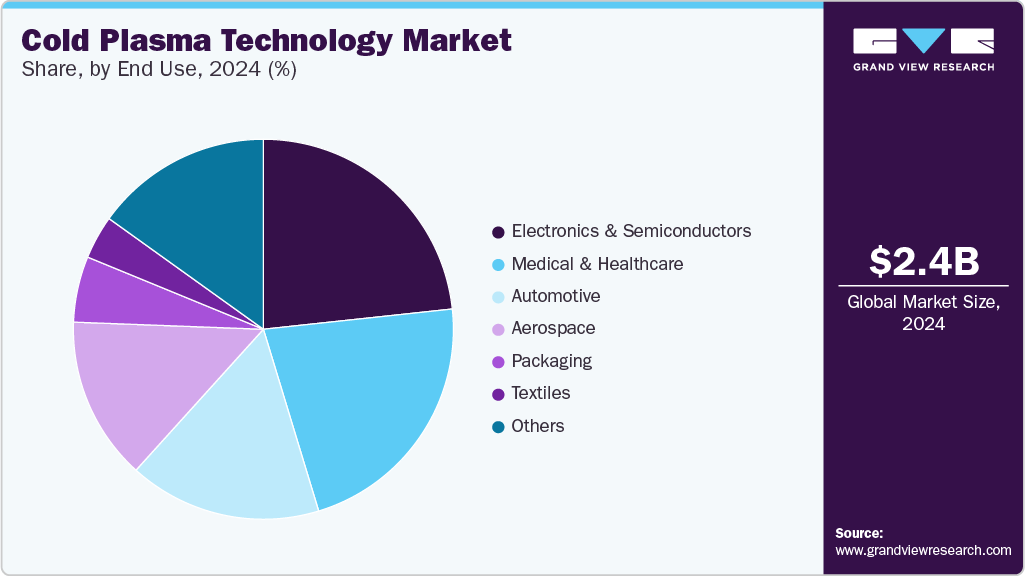

End Use Insights

The electronics and semiconductors segment dominated the market in 2024, accounting for a share of 23.3%, driven by surging demand for advanced chips in artificial intelligence (AI), data centers, and consumer electronics. Cold plasma is essential for cleaning, etching, and modifying surfaces at the micro and nano level, ensuring high-quality semiconductor fabrication. As devices become smaller and more complex, the demand for reliable, uniform processing methods increases, making cold plasma a critical technology in this fast-evolving industry.

The automotive sector sees a strong demand for cold plasma technology due to its ability to improve surface treatment processes like cleaning, activation, and functionalization. Cold plasma enhances adhesion for coatings, adhesives, and paints, boosting the performance and durability of automotive components. Its eco-friendly, low-temperature characteristics make it a preferred solution for sustainable manufacturing in the industry.

Regional Insights

The market in Asia Pacific dominated the global revenue share in 2024, accounting for 46.7%, driven by increasing adoption across key industries such as electronics, semiconductors, and automotive. The region's growth is fueled by advancements in surface treatment technologies that enhance manufacturing processes, along with a rising demand for eco-friendly solutions and improved product performance.

China Cold Plasma Technology Market Trends

The China cold plasma market is projected to grow at a CAGR of 7.4% over the forecast period. The market is rapidly advancing in the electronics and semiconductor industries, where it enhances surface cleaning, activation, and coating for improved product efficiency. Government initiatives and strong industrial growth support this trend.

The market for cold plasma technology in India is projected to grow at a CAGR of 8.2% over the forecast period. In India, the cold plasma technology industry is growing due to expanding automotive sectors, where it plays a crucial role in surface activation and coating for better adhesion and performance. Initiatives such as "Make in India" are significantly supporting the growth of the market by encouraging local manufacturing and innovation. It promotes the adoption of advanced technologies, like cold plasma, across key industries such as electronics & semiconductors, automotive, and medical & healthcare.

North America Cold Plasma Technology Market Trends

In North America, the growth of the cold plasma technology market is fueled by innovations in surface treatment and sterilization technologies. Industries like electronics, automotive, and healthcare are increasingly adopting cold plasma solutions to improve manufacturing processes, driven by demand for more sustainable and efficient production methods.

The cold plasma technology market in the U.S. is projected to expand at a CAGR of 6.7% over the forecast period, particularly in the electronics and semiconductor industries. The country's strong focus on R&D, along with a favorable regulatory environment, fosters innovation and drives the use of cold plasma in applications like surface activation, cleaning, etching, and enhancing production capabilities.

Europe Cold Plasma Technology Market Trends

In Europe, the demand for cold plasma technology is driven by advancements in surface treatment and coating applications across industries like electronics and automotive. Europe’s focus on sustainability and strict regulatory standards, such as the REACH regulation (Registration, Evaluation, Authorization, and Restriction of Chemicals), is accelerating the adoption of cold plasma for more efficient and eco-friendly production processes.

The France cold plasma technology market is expected to grow at a rapid CAGR of 7.1% over the forecast period due to its strong research efforts and public-private collaborations. France’s robust scientific community and focus on medical and industrial applications boost the market’s growth. Moreover, in 2024, France maintained its leading position in Foreign Direct Investments (FDI) in European destinations. In February 2024, according to the Ministry for Europe and Foreign Affairs, around USD 123.0 billion in investment was announced at the AI Action Summit, bolstering its position in artificial intelligence.

The Italy cold plasma technology market is expected to grow at a rapid CAGR of 6.7% over the forecast period. The application of cold plasma technology in the automotive sector is rising, focusing on surface activation and functionalization of the automotive parts, bolstered by the rising demand for electric vehicles. The country’s emphasis on sustainable manufacturing and eco-friendly practices accelerates the adoption of cold plasma to improve material properties and enhance product performance in various industries.

Latin America Cold Plasma Technology Market Trends

In Latin America, the cold plasma technology market is growing due to increasing demand in healthcare for advanced therapies and sterilization, rising industrial applications in electronics and automotive, and growing investment in research and sustainable technologies across key regional economies. For instance, in September 2024, Brazil invested approximately USD 36.6 billion in digital transformation, focusing on semiconductors, industrial robotics, and advanced technologies. This initiative aims to drive innovation, enhance industrial efficiency, and strengthen the country’s technological capabilities.

The cold plasma technology market in Argentina is projected to grow at a CAGR of 4.7% over the forecast period due to expanding sectors like healthcare, automotive, and electronics. Technology’s ability to sterilize, modify surfaces, and enhance materials without using heat or chemicals is driving its adoption. Strong collaborations between academia, government, and industry are fueling innovation and market growth.

Middle East & Africa Cold Plasma Technology Market Trends

The Middle East and Africa cold plasma technology market is growing as industries in the region adopt more sustainable and efficient solutions. Technology is gaining traction in healthcare and electronics due to its ability to improve sterilization, surface treatment, and material properties with minimal environmental impact. Countries in the region are actively focusing on investing in industries other than oil & gas, which is also expected to drive the demand for cold plasma technology market.

The market for cold plasma technology in Saudi Arabia is projected to grow at a CAGR of 6.2% over the forecast period. The country's cold plasma technology market is growing due to the expansion of the industrial sector under various government initiatives, which is driving demand for advanced technologies like plasma systems. As part of Vision 2030, Saudi Arabia also invests in R&D to further integrate such technologies into key industries, fostering growth and modernization.

Key Cold Plasma Technology Company Insights

Some of the key players operating in the market include Plasmatreat and Adtec Plasma Technology Co., Ltd., among others.

-

Plasmatreat GmbH is a leading provider of plasma surface treatment solutions. The company pioneered the Openair-Cold Plasma Technology, enabling efficient surface activation, cleaning, and coating without the need for vacuum chambers. Plasmatreat's innovative systems are utilized across various industries, including automotive, electronics, packaging, and life sciences.

-

Adtec Plasma Technology Co., Ltd. is a Japanese company specializing in the design, manufacture, and sale of RF plasma generators, matching units, and digital RF power tracers. Adtec serves industries such as semiconductors, LCD panels, and medical devices. The company is renowned for its compact, high-durability RF plasma generators and has a global presence with subsidiaries in the U.S., U.K., Vietnam, South Korea, China, and Taiwan.

Key Cold Plasma Technology Companies:

The following are the leading companies in the cold plasma technology market. These companies collectively hold the largest market share and dictate industry trends.

- Coating Plasma Innovation

- Plasmatreat GmbH

- relyon plasma GmbH

- Nordson Corporation

- Neoplas GmbH

- Bodycote

- Henniker

- Adtec Plasma Technology Co., Ltd.

- Apyx Medical

- Enercon Industries Corporation

- Europlasma N.V.

- AcXys Technologies

- Tri-Star Technologies

- Plasma Etch, Inc.

- Plasmawerk GmbH

Recent Developments

-

In December 2024, Viromed Medical AG and relyon plasma GmbH entered a strategic partnership to promote the use of cold atmospheric pressure plasma in medical applications. In this collaboration, relyon plasma will focus on developing the cold plasma technology, while Viromed will be responsible for obtaining device approvals and managing distribution.

-

In December 2022, SOCOMORE and Molecular Plasma Group (MPG) signed a partnership to commercialize MPG’s cold atmospheric plasma technology across the aerospace, defense, and railway sectors. Under this agreement, SOCOMORE became the exclusive global supplier of the functional chemicals used with MPG’s dry surface functionalization equipment, strengthening their combined offering in advanced, eco-friendly surface treatment solutions.

Cold Plasma Technology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,550.4 million

Revenue forecast in 2030

USD 3,466.2 million

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, & CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Application, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Coating Plasma Innovation; Plasmatreat GmbH; relyon plasma GmbH; Nordson Corporation; Neoplas GmbH; Bodycote; Henniker; Adtec Plasma Technology Co., Ltd.; Apyx Medical; Enercon Industries Corporation; Europlasma N.V.; AcXys Technologies; Tri-Star Technologies; Plasma Etch, Inc.; Plasmawerk GmbH.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cold Plasma Technology Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global cold plasma technology market on the basis of application, technology, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Surface Cleaning

-

Surface Activation

-

Surface Coating

-

Etching & Patterning

-

Sterilization

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Atmospheric Plasma

-

Vacuum Plasma

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronics & Semiconductors

-

Automotive

-

Medical & Healthcare

-

Packaging

-

Textiles

-

Aerospace

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors driving the cold plasma technology market include rising demand for environmentally friendly and energy-efficient technologies, growing applications in electronics, and semiconductor, automotive, and healthcare advancements in surface treatment processes, and increasing use in sterilization and decontamination.

b. The global cold plasma technology market size was estimated at USD 2,421.8 million in 2024 and is expected to reach USD 2,550.4 million in 2025.

b. The global cold plasma technology market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 3,466.2 million by 2030.

b. Electronics and semiconductor segment dominated the end use segment in 2024 accounting for 23.3% due to its precision in surface cleaning, etching, and coating. Cold plasma ensures high-quality, contamination-free processing, essential for miniaturized components and complex circuit patterns, boosting efficiency and product reliability.

b. Some of the key players operating in the market are Coating Plasma Innovation, Plasmatreat GmbH, relyon plasma GmbH, Nordson Corporation, Neoplas GmbH, Bodycote, Henniker, Adtec Plasma Technology Co., Ltd., Apyx Medical, Enercon Industries Corporation, Europlasma N.V., AcXys Technologies, Tri-Star Technologies, Plasma Etch, Inc., Plasmawerk GmbH.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.