- Home

- »

- Medical Devices

- »

-

Colon Screening Market Size & Share, Industry Report, 2033GVR Report cover

![Colon Screening Market Size, Share & Trends Report]()

Colon Screening Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Test, Product), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-523-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Colon Screening Market Summary

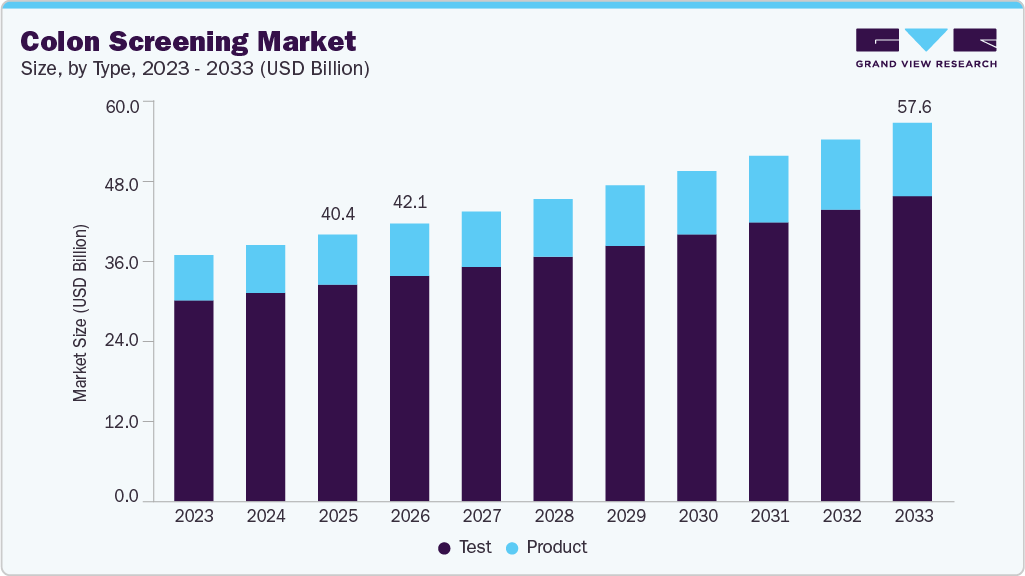

The global colon screening market size was estimated at USD 40.41 billion in 2025 and projected to reach USD 57.65 billion by 2033, growing at a CAGR of 4.60% from 2026 to 2033. The growing prevalence of colorectal cancer, increasing government initiatives to encourage cancer screening, and ongoing technological advancements in the market are major factors driving the growth of this market.

Key Market Trends & Insights

- North America colon screening market held the largest share of 53.12% of the global market in 2025.

- The colon screening industry in Canada is expected to grow at the significant rate over the forecast period.

- By type, the test segment held the highest market share of 81.24% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 40.41 Billion

- 2033 Projected Market Size: USD 57.65 Billion

- CAGR (2026-2033): 4.60%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

For instance, in December 2023, Medtronic expanded its artificial intelligence collaboration with Cosmo Pharmaceuticals, the developer of plug-in software designed to detect health issues during endoscopic examinations automatically.

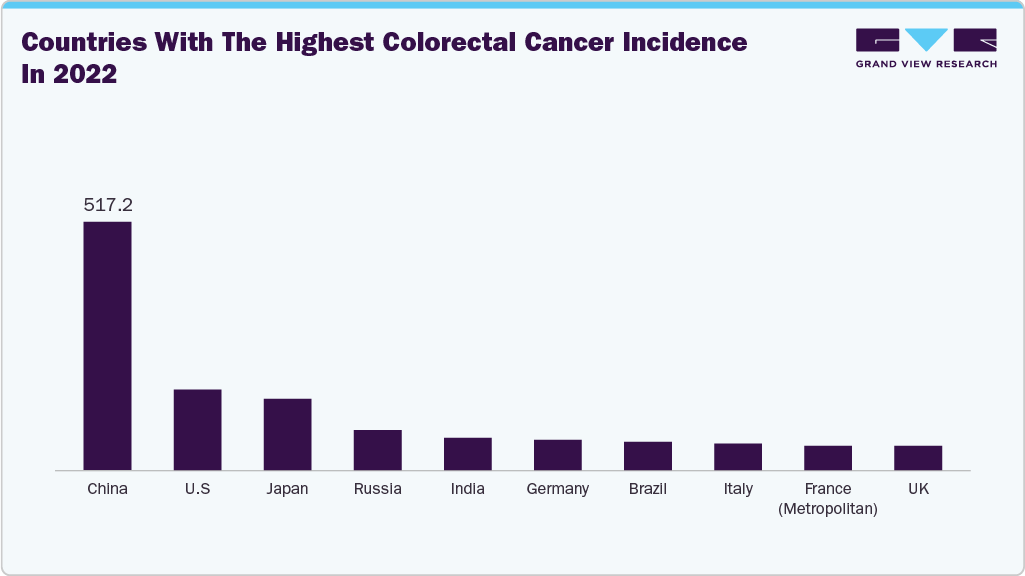

The increasing prevalence of colorectal diseases is a major driver of growth in the colon screening industry. Colorectal cancer, a severe gastrointestinal condition, ranks as the third most commonly diagnosed cancer and the second leading cause of cancer-related deaths worldwide. Its growing incidence highlights the critical need for early detection and effective screening methods. According to the International Agency for Research on Cancer (IARC), approximately 1.9 million new cases of colorectal cancer are reported annually across the globe, making it one of the most prevalent malignancies. The World Health Organization further emphasizes that regions such as Europe, Australia, and New Zealand exhibit the highest incidence rates, primarily due to lifestyle factors, diet, and aging populations.

The following figure showcases the ten countries with the highest colorectal cancer incidence rates in 2022.

The following table showcases the ten countries with the highest colorectal cancer incidence rates in males in 2022.

Country

New cases in men

ASR/100,000

World

1,069,446

22

China

307,688

24.7

U.S.

84,172

30.1

Japan

Upgrade report license to gain access to the complete analysis

India

Russia

Germany

Brazil

Italy

France (metropolitan)

UK

The following table showcases the ten countries with the highest colorectal cancer incidence rates in females in 2022.

Country

New cases in women

ASR/100,000

World

856,979

15.2

China

209,148

15.7

U.S.

76,014

24.2

Japan

Upgrade report license to gain access to the complete analysis

Russia

Brazil

Germany

India

Italy

France (metropolitan)

UK

Governments worldwide have recognized the importance of colon cancer screening in improving public health and reducing cancer-related deaths. As a result, various countries have launched initiatives focused on early detection and prevention of colorectal cancer (CRC), emphasizing education, accessibility, and affordability to encourage regular screenings. The following are some examples of colorectal cancer screening programs offered by different countries,

Country

Program

Description

U.S. (United States Preventive Services Task Force (USPSTF) and the American Cancer Society)

Colorectal Cancer Control Program (CRCCP)

The program aims to promote to increase colorectal cancer screening rates among people between 45 and 75 years of age.

Canada (Canadian Cancer Society)

Colorectal Cancer Screening

Recommended for people between the ages of 50 to 74, with a stool test after every 2 years.

UK

NHS Bowel Cancer Screening Programme

The program provides free bowel cancer screening to individuals aged 60 to 74 in the UK. It uses the Fecal Immunochemical Test (FIT), which detects blood in stool samples.

Germany

Upgrade report license to gain access to the complete analysis

France

Italy

Spain

Australia

Hong Kong

Slovenia

In addition, integrating artificial intelligence (AI) in colonoscopy procedures has accelerated market growth. Computer-assisted detection (CAD) systems equipped with AI algorithms analyze video feeds in real-time to assist gastroenterologists in detecting polyps or other abnormalities that the human eye might miss. For instance, in May 2024, FUJIFILM launched two innovative endoscopic imaging technologies: CAD EYE and SCALE EYE. CAD EYE is an AI-powered system designed to enhance the detection of colonic mucosal lesions such as polyps and adenomas during colonoscopy. On the other hand, SCALE EYE focuses on improving the speed and accuracy of lesion measurement during endoscopic procedures. These technologies are pivotal in providing precise measurements, enabling more accurate diagnosis and treatment planning.

Case Study: Expanding Access to Colorectal Cancer Screening Through At-Home Testing and Digital Engagement: The Privia Health Initiative

Overview of Privia Health Initiative: Privia Health is a physician-enablement organization operating in multiple U.S. states. This initiative increases colorectal cancer screening rates by integrating technology and aligning care teams with population health objectives.

Challenge: Before 2022, Privia relied on clinician-initiated discussions during patient visits for CRC screening. Many patients didn’t complete screenings due to missed opportunities, limited awareness, or procedural inconvenience.

Strategic Partnership & Program Structure: In 2023, Privia Health partnered with Exact Sciences, provider of Cologuard kits, and Amalgam Rx Inc., a clinical decision support platform, to implement an automated CRC screening workflow integrated with electronic health record systems.

Key Program Components:

1. EHR Integration & Patient Identification:

-

Patient records are automatically scanned to identify individuals due for screening.

-

Clinician teams review eligibility and outreach lists for accuracy and completeness.

2. Patient Engagement Automation:

-

Personalized texts and emails with educational content are sent to patients.

-

Patients who choose to participate receive Cologuard test kits by mail.

3. Simplified Ordering & Delivery:

-

Cologuard kits are shipped directly to patients, along with return labels for added convenience.

-

Test results are automatically uploaded to electronic health record systems.

4. Care Coordination & Follow-Up:

- Positive results automatically notify clinicians and initiate care coordination for colonoscopy referrals.

5. Clinician Incentives & Continuous Feedback:

-

Physicians and care teams receive incentives based on their performance in screening metrics.

-

Regular meetings support alignment and continuous improvement of workflows.

Results & Impact:

- CRC screening rates among Medicare Shared Savings Program patients rose from 79% in 2023 to 84% in 2024, surpassing national benchmarks.

- Integrating data analytics, automation, and patient engagement has significantly increased both screening uptake and completion rates.

- The non-invasive Cologuard test increased patient participation, particularly among those who were reluctant to undergo a colonoscopy.

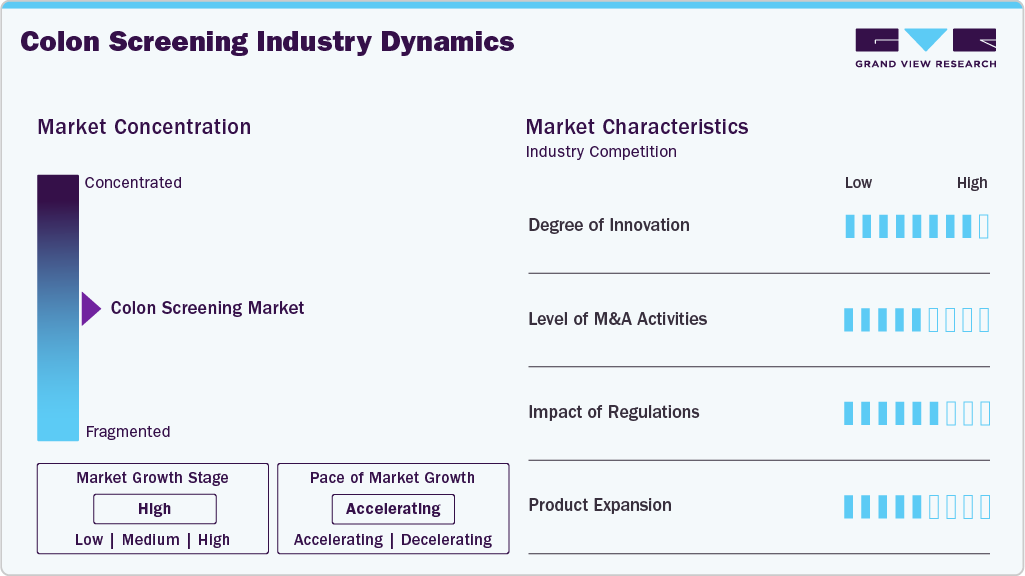

Market Concentration & Characteristics

The global industry is characterized by a high degree of innovation, owing to the development of technologically advanced products and innovations that have enhanced diagnostic accuracy, improved patient comfort, and minimized risks associated with traditional procedures. For instance, in January 2025, Panakeia introduced PANProfiler Colon, an AI-driven software that analyzes H&E-stained colon cancer tissue images to assess microsatellite instability (MSI) and mismatch repair deficiency (dMMR). This digital profiling tool enables rapid treatment decisions, enhancing personalized patient care.

The industry is characterized by medium merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for colon screening tests and products to maintain a competitive edge. For instance, in December 2021, Baxter acquired Hillrom, helping Baxter expand its product portfolio in medical technology and digital health innovations.

Colonoscopies and other screening devices must meet strict regulatory requirements to ensure high quality, safety, and effectiveness standards positively impact market growth. In Canada, the Medical Devices Directorate (MDD), under Health Canada, regulates diagnostic devices and tools. The MDD ensures that medical devices meet the safety, effectiveness, and quality standards outlined in the Food and Drugs Act and its regulations. Their responsibilities include reviewing scientific data to assess device safety and efficacy, evaluating investigational testing applications, and monitoring post-market device safety through adverse event reporting.

Several market players are expanding their business by launching new products and getting approvals from regulatory authorities to strengthen their market position and expand their product portfolio. For instance, in April 2021, FUJIFILM Medical Systems, Inc., a part of FUJIFILM Corporation, launched the G-EYE 700 series colonoscope. This product was developed using Smart Medical to assist in visualization, stabilization, and control while performing colonoscopies. The G-EYE product would be an extension of the 700-endoscope series.

Type Insights

By type, the test segment dominated the market with the largest revenue share of 81.24% in 2025. The growing demand for non-invasive and simple screening procedures is driving the growth of the test segment in the market. The increasing awareness of the significance of early cancer detection encourages patients to seek colon screening. As a result, new and advanced tests have been developed to identify abnormalities, including colon cancer. For instance, in January 2025, Geneoscopy, Inc., a St. Louis, MO-based company, was preparing to launch its FDA-approved at-home RNA colorectal cancer screening test. The Colosense test demonstrated a 94% sensitivity for detecting colorectal cancer.

The product segment is anticipated to grow at the fastest CAGR over the forecast period. The introduction of innovative products designed to enhance early detection and improve patient compliance and the rise in the launch of training courses regarding colonoscopies fuel the market's growth. For instance, in September 2024, FUJIFILM Healthcare Europe GmbH launched a standardized Basic Colonoscopy Training Course across 16 countries in the Growth Emerging Markets (GEM) region. This course strives to ensure that healthcare practitioners in various areas receive a uniform and high-quality learning experience.

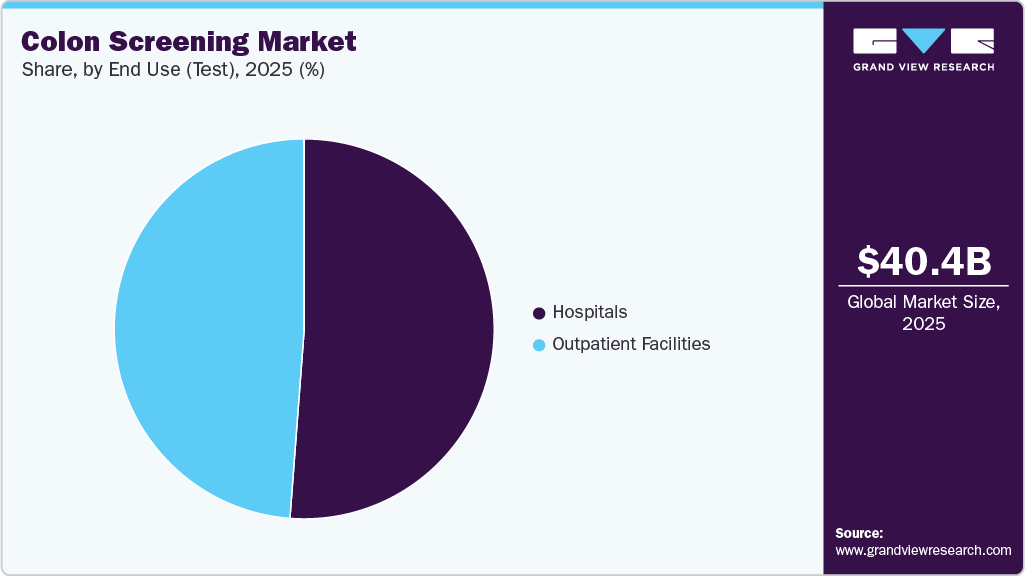

End Use (Test) Insights

By end use, the hospitals segment dominated the market with a revenue share of 51.20% in 2025. Factors such as availability and increasing adoption of advanced imaging technologies and personalized screening pathways to enhance diagnostic accuracy. For instance, in December 2024, AIG Hospitals in Hyderabad, India, introduced the PillBot, a robotic, remote-controlled endoscopy capsule developed in collaboration with U.S. Endiatx. It is equipped with advanced cameras, wireless technology, and sensors that help it navigate the gastrointestinal tract and transmit high-resolution, real-time images to physicians.

The outpatient facilities segment is expected to grow at the fastest rate during the forecast period. Factors include the increasing preference for daycare and ambulatory surgery centers in colon screenings, which fuels the market growth. Outpatient facilities offer advantages such as quick discharge, reduced waiting times, improved efficiency, and lower procedural costs. In addition, they provide patients with rapid discharge, minimal side effects, and overall cost containment.

Regional Insights

North America colon screening market dominated with a revenue share of 53.12% in 2025. A well-established regulatory framework and ongoing efforts to promote disease screenings are expected to support market growth further. For instance, the U.S. Preventive Services Task Force recommends colon cancer screenings for individuals aged 45 to 75, according to the Centers for Disease Control and Prevention (CDC). Moreover, Advanced diagnostic technologies contribute to market expansion, including colonoscopies, fecal immunochemical tests (FIT), and DNA-based stool tests such as Cologuard. In October 2024, Exact Sciences Corp. received U.S. Food and Drug Administration (FDA) approval for its Cologuard Plus test. The development and use of such tests help remove barriers to screening, broadening market accessibility.

U.S. Colon Screening Market Trends

The U.S. dominated the colon screening market in North America region in 2025. The presence of key players in the U.S. and the growing number of approvals for advanced screening solutions also contribute to market expansion. For instance, Guardant Health, Inc., a precision oncology company, announced in August 2024 the commercial availability of Shield, the first FDA-approved blood test for primary colon cancer screening. Furthermore, the presence of key players in the U.S. and the growing number of approvals for advanced screening solutions contribute to market expansion.

Europe Colon Screening Market Trends

The colon screening market in Europe is expected to grow significantly over the forecast period. Factors such as the increasing incidence of colon cancer, a growing emphasis on early detection, technological advancements, and supportive government initiatives. According to a report published by the European Commission in March 2024, the European Cancer Information System recorded approximately 361,986 cases of colon cancer in Europe in 2022, accounting for about 13% of total cancer cases in the region.

Germany colon screening industry is expected to grow significantly during the forecast period. the increasing incidence of cancer in Germany is further expected to drive the demand for advanced diagnostic solutions such as screenings in the country. For instance, according to the Robert Koch Institute, approximately one in eight incident cancers in Germany affect the colon, and about 24,650 women and 29,960 men were diagnosed with colon cancer in 2022.

Asia Pacific Colon Screening Market Trends

The colon screening industry in Asia Pacific is expected to register the fastest growth rate over the forecast period, owing to government initiatives that are pivotal in advancing CRC screening efforts throughout the Asia Pacific. For instance, Malaysia's National Strategic Plan for Colon Cancer (NSPCRC) 2021-2025 aims to enhance early detection and improve treatment outcomes for colon cancer. The plan emphasizes a phased implementation of screening programs using immunological fecal occult blood tests (iFOBT), targeting asymptomatic individuals aged 50 to 75. Such steps are anticipated to drive screening participation in the region and drive market growth.

China colon screening industry is anticipated to register considerable growth during the forecast period. The growing technological advancement in the country and the increasing investment in advanced technologies are expected to drive market growth. The health authorities are focusing on integrating these advanced technologies into existing screening protocols to improve overall effectiveness and compliance.

Latin America Colon Screening Industry Trends

The colon screening industry in Latin America is anticipated to witness considerable growth over the forecast period. The increasing advancements in screening technologies are shaping the colon screening market in Latin America. The adoption of non-invasive methods such as FIT has gained traction due to their cost-effectiveness and ease of use. In addition, increasing efforts to establish effective screening programs and an emphasis on developing healthcare infrastructure are further expected to drive market growth in the region.

Brazil colon screening market is anticipated to register considerable growth during the forecast period. Technological advancements, including non-invasive biomarker-based tests and enhanced imaging techniques, have improved screening accuracy and patient compliance. Public and private players in the market contribute to increasing awareness regarding colon cancer screening in the country, further adding to market growth.

Middle East and Africa Colon Screening Market Trends

The colon screening market in the Middle East and Africa is anticipated to witness considerable growth over the forecast period. Health ministries across the region are increasingly implementing awareness and screening programs to encourage participation, targeting high-risk populations. In addition, the availability of advanced diagnostic tools such as fecal immunochemical tests (FIT) and colonoscopy is expected to further advance healthcare infrastructures in detecting colorectal cancer at earlier stages.

South Africa colon screening market is anticipated to register considerable growth during the forecast period. Favorable government initiatives and partnerships encourage CRC screening nationwide, which boosts market growth. In April 2021, the Cancer Association of South Africa (CANSA) collaborated with the South African Colon Society (SACRS) to launch the Colon Awareness and Support Program. This initiative aimed at educating the public about colon cancer risks, symptoms, and screening options through interactive campaigns.

Key Colon Screening Company Insights:

Key players operating in the colon screening market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Colon Screening Companies:

The following are the leading companies in the colon screening market. These companies collectively hold the largest Market share and dictate industry trends.

- Olympus

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Medtronic

- Ambu A/S

- Baxter (Hillrom & Welch Allyn)

- EndoFresh (Daichuan medical)

- Bracco

- Varay Laborix

Recent Developments

-

In July 2025, Viome Life Sciences and Scripps Research announced a strategic partnership to develop and clinically validate the first at-home RNA test for detecting precancerous colon polyps. This test aims to support early prevention of colorectal cancer.

-

In April 2024, UC Davis Health launched a novel digital health program to expand colorectal cancer screening. This initiative is part of efforts to improve early detection and reduce the risk of colon cancer, which is increasing among younger individuals

-

In October 2024, GI Alliance collaborated with Medtronic to launch the GI Genius AI Technology for enhanced colon polyp detection at the Alliance’s over 400 site locations.

Colon Screening Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 42.09 billion

Revenue forecast in 2033

USD 57.65 billion

Growth rate

CAGR of 4.60% from 2026 to 2033

Actual data

2021 - 2025

Forecast data

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation; Medtronic; Ambu A/S; Baxter (Hillrom & Welch Allyn); EndoFresh; (Daichuan medical); Bracco; Varay Laborix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Colon Screening Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides the analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global colon screening market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Test

-

Colonoscopy

-

Capsule Endoscopy

-

Imaging Tests

-

Virtual Colonoscopy

-

Magnetic resonance colonography (MRC)

-

-

Others

-

End Use, By Test

-

Hospitals

-

Outpatient Facilities

-

-

-

Product

-

Colonoscopes

-

Sigmoidoscopes

-

CT Scanners

-

Magnetic Resonance Imaging (MRI)

-

End Use, By Product

-

Hospitals

-

Outpatient Facilities

-

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global colon screening market size was estimated at USD 40.41 billion in 2025 and is expected to reach USD 42.09 billion in 2026.

b. The global colon screening market is expected to grow at a compound annual growth rate of 4.60% from 2026 to 2033 to reach USD 57.65 billion by 2033.

b. North America dominated the colon screening market with a share of 53.12% in 2025. A well-established regulatory framework and ongoing efforts to promote disease screenings are expected to support market growth further.

b. Some key players operating in the colon screening market include Olympus, PENTAX Medical (Hoya Corporation), FUJIFILM Holdings Corporation, Medtronic, Ambu A/S, Baxter (Hillrom & Welch Allyn), EndoFresh, (Daichuan medical), Bracco, and Varay Laborix.

b. The growing prevalence of colorectal cancer, increasing government initiatives to encourage cancer screening, and ongoing technological advancements in the market are major factors driving the growth of the colon screening market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.