- Home

- »

- Electronic & Electrical

- »

-

Combi Ovens Market Size & Trends, Industry Report, 2030GVR Report cover

![Combi Ovens Market Size, Share & Trends Report]()

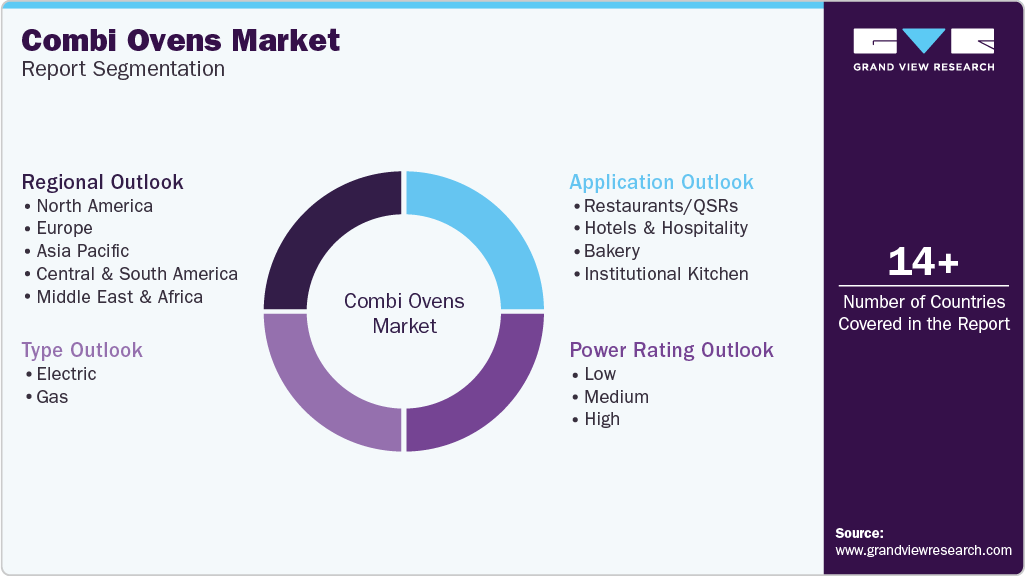

Combi Ovens Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Electrical, Gas), By Power Rating (Low, Medium, High), By Application (Restaurants/QSRs, Hotels & Hospitality, Bakery), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-587-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Combi Ovens Market Summary

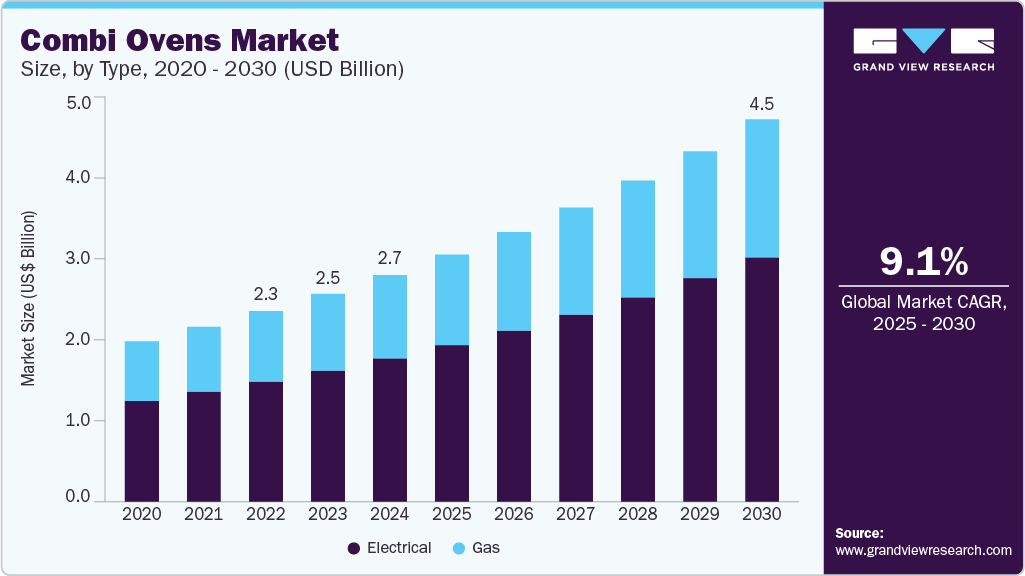

The global combi ovens market size was estimated at USD 2,675.0 million in 2024 and is projected to reach USD 4,514.9 million by 2030, growing at a CAGR of 9.1% from 2025 to 2030. The market is experiencing significant growth, driven by a convergence of technological, economic, and consumer trends.

Key Market Trends & Insights

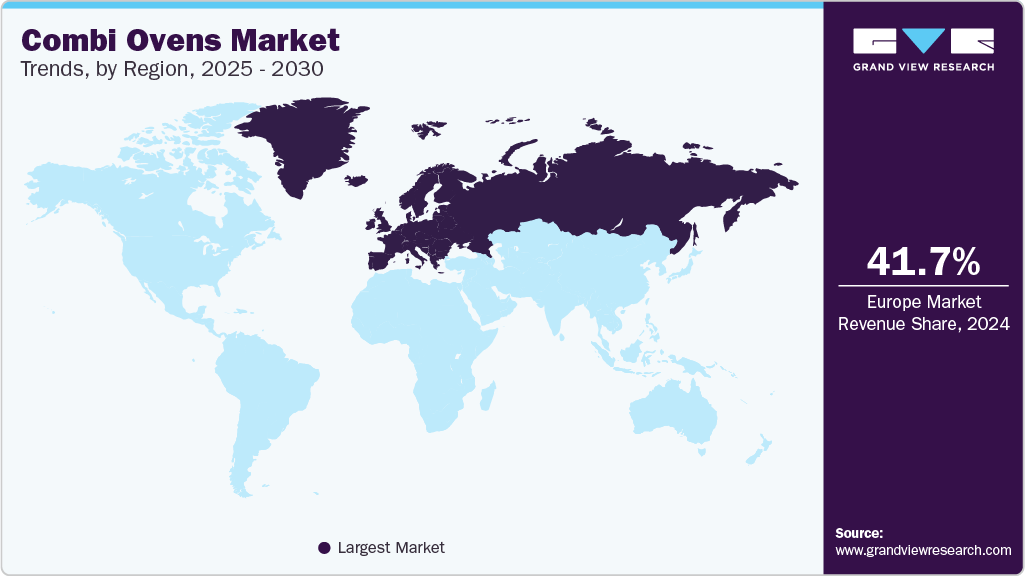

- The combi oven market in Europe accounted for a share of 41.66% of the global revenue in 2024.

- U.S. is expected to exceed USD 1 billion by 2030 and grow at a CAGR of 8.7% from 2025 to 2030.

- By type, the electric segment was valued at USD 1691.7 million in 2024.

- By application, the restaurant sector segment is expected to grow at a CAGR of 9.3% from 2025 to 2030.

- By power ratings, the low-capacity segment is expected to exceed USD 1.1 billion by 2030.

Market Size & Forecast

- 2024 Market Size: USD 2,675.0 Million

- 2030 Projected Market Size: USD 4,514.9 Million

- CAGR (2025-2030): 9.1%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

One of the foremost reasons is the increasing demand for versatile, energy-efficient, and multi-functional cooking appliances in commercial kitchens. Combi ovens, which combine convection, steam, and hybrid cooking modes, offer superior flexibility and efficiency compared to traditional ovens.This versatility allows foodservice operators to prepare a wide range of dishes consistently, streamlining operations and reducing the need for multiple appliances. Another major driver is the rapid expansion of the quick-service restaurant (QSR) sector and the broader hospitality industry. As urbanization accelerates and lifestyles become busier, consumers opt for ready-to-eat and fast-casual dining options. Combi ovens enable QSRs, hotels, and catering businesses to meet these demands by delivering high-quality food quickly and efficiently, even during peak periods. Their ability to maintain food texture and moisture is particularly valued in bakeries and catering services, further fueling adoption.

Technological advancements have also played a pivotal role in market growth. Integrating smart features such as digital touchscreens, programmable cooking modes, IoT connectivity, and AI-assisted automation has made combi ovens more user-friendly and efficient. These innovations enhance cooking precision and consistency and support remote monitoring and predictive maintenance, reducing downtime and operational costs in commercial kitchens.

Sustainability and regulatory pressures are increasingly shaping purchasing decisions in the foodservice industry. Governments and industry bodies are promoting energy-efficient appliances and sustainability initiatives, especially in regions like Europe and North America. Combi ovens, particularly electric models, are favored for their lower energy consumption and reduced emissions. This aligns with the broader push toward eco-friendly and low-emission kitchen equipment, making combi ovens an attractive investment for businesses aiming to meet regulatory standards and corporate sustainability goals.

The rise of cloud kitchens, ghost kitchens, and meal-prep companies has further accelerated the adoption of combi ovens. These business models prioritize operational efficiency, space-saving equipment, and the ability to consistently produce diverse menu items. Combi ovens, with their compact design and programmable features, are ideally suited to these modern kitchen environments, supporting the growth of delivery-focused and multi-brand food service operations.

The global expansion of the hospitality and foodservice sectors, particularly in emerging markets across Asia Pacific, contributes to robust market growth. Urbanization, rising disposable incomes, and increased restaurant and hotel infrastructure investment drive demand for advanced kitchen equipment. Government incentives for energy-efficient appliances and the growing presence of international food chains also encourage the adoption of combi ovens in these regions, ensuring sustained market expansion in the coming decade.

Type Insights

The electric segment was valued at USD 1691.7 million in 2024. Electric combi ovens are experiencing robust growth, primarily due to their superior energy efficiency, precise temperature control, and alignment with global sustainability initiatives. These ovens are easier to install and require less complex ventilation, making them particularly suitable for urban kitchens, quick-service restaurants (QSRs), and cloud kitchens where space and infrastructure may be limited. Furthermore, electric combi ovens are at the forefront of technological innovation, with features such as digital touchscreens, programmable cooking modes, IoT connectivity, and remote monitoring becoming increasingly standard. These advancements enhance operational efficiency and support automation and consistency, which are highly valued in modern foodservice operations. Regulatory pressures and incentives promoting energy-efficient appliances, especially in regions like North America and Europe, further accelerate the adoption of electric combi ovens.

Gas combi ovens remain in a strong position in the market, particularly in high-volume, large-scale commercial kitchens such as those found in hotels, catering services, and institutional settings. The primary appeal of gas ovens lies in their powerful heating capabilities and rapid temperature recovery, essential for continuous, high-output cooking. In regions where natural gas is more affordable than electricity, gas combi ovens offer significant operational cost savings, making them a preferred choice for many businesses. Their reliability and ability to maintain high temperatures over extended periods are especially valued in traditional, heavy-duty kitchen environments. While gas ovens also see technological improvements, such as enhanced efficiency and better control systems, innovation is generally slower than their electric counterparts.

Electric combi ovens are rapidly gaining traction in developed, urban, and eco-conscious markets, driven by regulatory mandates and the integration of innovative technologies. New foodservice formats increasingly favor these ovens, including ghost kitchens and multi-brand delivery hubs, where automation and sustainability are key priorities. On the other hand, gas combi ovens remain popular in regions with established gas infrastructure and lower gas prices, as well as in settings where large-scale, high-volume cooking is the norm. Both types of ovens are evolving to meet the diverse needs of the foodservice industry, but electric models are expected to lead market growth in the coming years due to their adaptability to emerging trends and regulatory requirements.

Application Insights

The restaurant sector is the most prominent application for combi ovens and is expected to grow at a CAGR of 9.3% from 2025 to 2030. The restaurant sector holds the largest share of combi oven usage, benefiting from the equipment’s ability to deliver consistent quality, streamline cooking processes, and support a diverse menu. Restaurants are expected to account for a significant portion of the market, as investments in the food and beverage sector increase alongside global population growth and demand for ready-to-eat meals. The multifunctionality of combi ovens, capable of baking, roasting, broiling, and steaming, makes them indispensable in modern restaurant kitchens, especially as consumer preferences shift toward healthier and more varied cuisines. Cloud kitchens and quick-service restaurants (QSRs) are emerging as fast-growing application segments, with combi ovens playing a central role in supporting their business models. These operations prioritize speed, consistency, and space-saving equipment, all provided by modern combi ovens. The rise of food delivery platforms, meal-prep companies, and ghost kitchens is accelerating demand for high-performance, programmable ovens that can handle diverse menus with minimal staff intervention.

Hotels and hospitality venues represent another major application, leveraging combi ovens to efficiently serve large volumes of guests while maintaining high standards of food quality. The sector’s growth is propelled by the expansion of the global hospitality industry and the rising demand for energy-efficient, high-performance kitchen equipment. Hotels value combi ovens for their ability to prepare a wide range of dishes quickly and precisely, which is crucial for buffet service, banquets, and room service operations. This application is further supported by the trend toward automation and smart kitchen technology, which enhances operational efficiency and consistency.

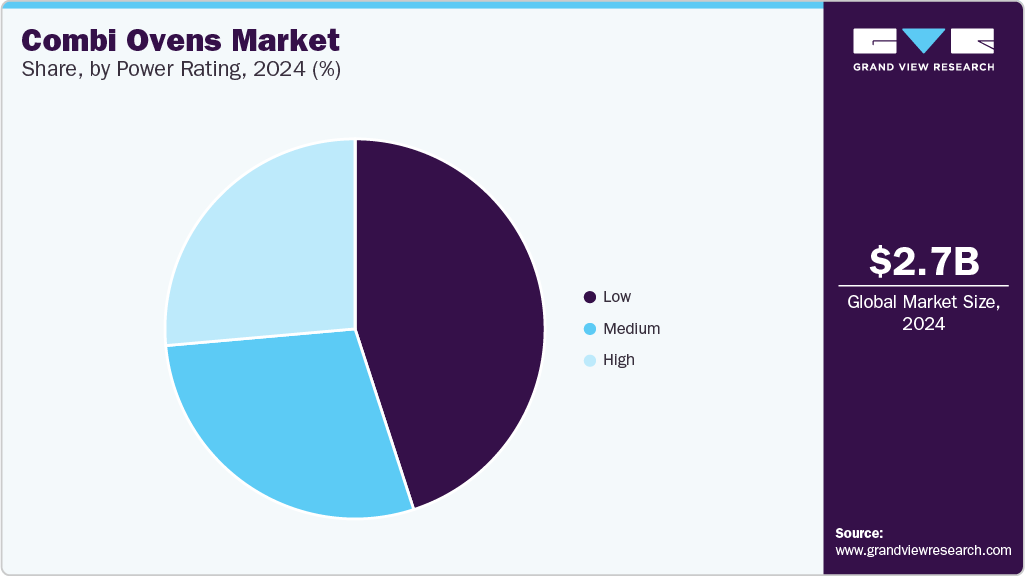

Power Rating Insights

The low-capacity segment is expected to exceed USD 1.1 billion by 2030. Low-capacity combi ovens are particularly popular in densely populated urban areas where kitchen space is limited and the volume of food preparation is modest. These compact models are ideal for individuals, small families, or boutique cafés, offering practicality and efficiency for limited cooking needs. The growth of this segment is fueled by the increasing number of small households and the trend toward compact living spaces in cities, where maximizing kitchen utility without sacrificing performance is a top priority.

The medium segment is expected to grow at a CAGR of 9.3% from 2025 to 2030. Medium-capacity combi ovens are witnessing significant growth due to their versatility and balanced size, making them suitable for both professional and semi-professional settings. These ovens are widely adopted in supermarkets, hotels, cafés, and restaurants because they offer enough cooking space to handle various menu items without occupying excessive kitchen real estate. Their adaptability allows for the efficient preparation of ready-to-eat meals, baked goods, and diverse dishes, making them indispensable for establishments with moderate to high customer turnover. The segment's growth is also supported by its cost-effectiveness; medium-capacity ovens provide high functionality at a more accessible price point than larger models, appealing to businesses seeking value without compromising performance.

High-capacity combi ovens are essential for large-scale foodservice operations such as institutional kitchens, catering services, and high-traffic restaurants. These ovens are designed to meet the demands of establishments with high customer volumes and the need for continuous, large-batch food production. The primary driver for growth in this segment is the operational efficiency these ovens provide, enabling businesses to maintain service speed and consistency during peak hours. As the hospitality and catering sectors expand globally, particularly in regions with growing tourism and institutional food programs, the demand for high-capacity ovens continues to rise.

Regional Insights

The North America combi ovens market was estimated at approximately USD 750 million in 2024. In North America, the market is driven by a robust foodservice sector, especially in the U.S. and Canada, where operational efficiency and automation are top priorities. The surge in ghost kitchens, quick-service restaurants (QSRs), and meal-prep companies is fueling demand for high-performance, space-saving, and versatile cooking equipment. In addition, government regulations promoting energy-efficient kitchen appliances and sustainability initiatives in the hospitality sector are accelerating the adoption of advanced combi ovens. Integrating smart technologies, such as AI-assisted cooking and remote monitoring, has become increasingly important, allowing operators to enhance consistency and reduce labor costs. These factors, combined with a strong culture of innovation and investment in foodservice technology, position North America as a leading market for combi ovens.

U.S. Combi Ovens Market Trends

The combi ovens market in the U.S. is expected to exceed USD 1 billion by 2030 and grow at a CAGR of 8.7% from 2025 to 2030. The expansion of QSRs and cloud kitchens, along with a focus on automation and sustainability, are key trends. Adopting IoT-enabled features, such as automated recipe programming and real-time monitoring, makes kitchens more efficient and responsive to consumer demands. The U.S. market also benefits from a high level of investment in innovative kitchen technologies and a strong regulatory push for lower energy consumption and reduced environmental impact, making it a hotspot for next-generation combi oven adoption.

Europe Combi Ovens Market Trends

The combi oven market in Europe accounted for a share of 41.66% of the global revenue in 2024, driven by increasing demand for energy-efficient and multifunctional kitchen equipment across commercial and institutional foodservice sectors. The growing popularity of combi ovens in restaurants, hotels, and catering services stems from their ability to combine steam, convection, and combination cooking, leading to faster preparation times and consistent food quality. Rising labor costs and a shortage of skilled kitchen staff are also pushing foodservice operators to adopt automated and programmable cooking technologies.

Asia Pacific Combi Ovens Market Trends

The combi ovens market in Asia Pacific is expected to grow at a CAGR of 10% from 2025 to 2030. The market is experiencing the fastest growth in Asia Pacific, driven by rapid urbanization, a booming foodservice industry, and rising disposable incomes. Countries like China, Japan, India, and South Korea are seeing increased demand for modern, versatile kitchen equipment to support the expansion of fast-casual eateries, street food chains, and hotels. Government initiatives encouraging the use of energy-efficient appliances and the adoption of innovative kitchen technology are further accelerating market penetration. The region’s diverse culinary landscape and the rise of cloud kitchens and international food chains create robust opportunities for combi oven manufacturers. While high initial investment and limited awareness in some emerging markets remain challenges, the trend toward automation, AI-based cooking, and compact, high-efficiency equipment is expected to drive sustained growth throughout Asia Pacific.

Key Combi Ovens Company Insights

The competitive landscape of the global market is marked by several well-established multinational companies alongside emerging regional players. Leading companies such as Alto-Shaam Inc., Electrolux AB, Fujimak Corporation, Giorik SpA, The Middleby Corporation, Rational, Convotherm, Houno, Unox, Merrychef, and Lainox dominate the market by leveraging innovation, customer-centric solutions, and sustainability initiatives. These companies invest heavily in research and development to introduce advanced features like innovative control systems, IoT connectivity, AI-assisted cooking, and self-diagnostic capabilities, which enhance operational efficiency and consistency in commercial kitchens. In addition, many players focus on providing tailored solutions and robust after-sales support to build customer loyalty and differentiate themselves in a crowded marketplace.

Key Combi Ovens Companies:

The following are the leading companies in the combi ovens market. These companies collectively hold the largest market share and dictate industry trends.

- Rational AG

- Electrolux Professional

- Convotherm

- Unox

- Alto-Shaam, Inc.

- The Middleby Corporation

- Vulcan Equipment

- G.S. Blodgett

- Lincat Catering Equipment

- Henny Penny Corporation

- Retigo Ltd.

- Falcon Foodservice Equipment

- Turbofan

- Carbolite Gero

- Merrychef

Combi Ovens Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2,918.4 million

Revenue forecast in 2030

USD 4,514.9 million

Growth rate

CAGR of 9.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, power rating, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil,; UAE

Key companies profiled

Rational AG; Electrolux Professional; Convotherm; Unox; Alto-Shaam, Inc.; The Middleby Corporation; Vulcan Equipment; G.S. Blodgett; Lincat Catering Equipment; Henny Penny Corporation; Retigo Ltd.; Falcon Foodservice Equipment; Turbofan; Carbolite Gero; Merrychef

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Combi Ovens Market Report Segmentation

This report forecasts revenue growth globally, regionally, and country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global combi ovens market report based on type, power rating, application, and region:

- Power Rating Outlook (Revenue, USD Million, 2018 - 2030)

-

Low

-

Medium

-

High

-

- Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electric

-

Gas

-

- Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Restaurants/QSRs

-

Hotels & Hospitality

-

Bakery

-

Institutional Kitchen

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global combi ovens market was valued at USD 2,675 million in 2024.

b. The global combi ovens market is expected to grow at a CAGR of 9.1% from 2025 to 2030.

b. The electric combi ovens market was valued at USD 1691.7 million in 2024. Electric combi ovens are experiencing robust growth, primarily due to their superior energy efficiency, precise temperature control, and alignment with global sustainability initiatives. These ovens are easier to install and require less complex ventilation, making them particularly suitable for urban kitchens, quick-service restaurants (QSRs), and cloud kitchens where space and infrastructure may be limited. Furthermore, electric combi ovens are at the forefront of technological innovation, with features such as digital touchscreens, programmable cooking modes, IoT connectivity, and remote monitoring becoming increasingly standard. These advancements enhance operational efficiency and support automation and consistency, which are highly valued in modern foodservice operations. Regulatory pressures and incentives promoting energy-efficient appliances, especially in regions like North America and Europe, further accelerate the adoption of electric combi ovens.

b. Some of the key players operating in the market include Rational AG; Electrolux Professional; Convotherm; Unox; Alto-Shaam, Inc.; The Middleby Corporation; Vulcan Equipment; G.S. Blodgett; Lincat Catering Equipment; Henny Penny Corporation; Retigo Ltd.; Falcon Foodservice Equipment; Turbofan; Carbolite Gero; Merrychef

b. The combi oven market is experiencing significant growth, driven by a convergence of technological, economic, and consumer trends. One of the foremost reasons is the increasing demand for versatile, energy-efficient, and multi-functional cooking appliances in commercial kitchens. Combi ovens, which combine convection, steam, and hybrid cooking modes, offer superior flexibility and efficiency compared to traditional ovens. This versatility allows foodservice operators to prepare a wide range of dishes consistently, streamlining operations and reducing the need for multiple appliances.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.