- Home

- »

- Electronic Devices

- »

-

Commercial Kitchen Appliances Market Size Report, 2027GVR Report cover

![Commercial Kitchen Appliances Market Size, Share & Trends Report]()

Commercial Kitchen Appliances Market Size, Share & Trends Analysis Report By Product (Refrigerator, Cooking Appliance, Dishwasher, Other Specialized Appliance), By End-use, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-1-68038-664-6

- Number of Pages: 171

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Semiconductors & Electronics

Report Overview

The global commercial kitchen appliances market size was valued at USD 79.72 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2020 to 2027. The market is poised to witness substantial growth in the coming years owing to the growth of the travel and tourism industry and the rising attractiveness of Quick Service Restaurants (QSRs) among millennials. Increasing demand for drive-through meals, fast-paced life in metros and cosmopolitan cities, a surge in the number of working women and nuclear families, and rise in disposable income of individuals are some of the other factors driving the market for commercial kitchen appliances.

Changing the lifestyle of the youth population and shift towards a low-calorie and a healthy diet are expected to positively impact the demand for nutritious food chains and thereby commercial kitchen equipment associated with them. Additionally, rising consumer spending on tourism and the hospitality sector is encouraging restaurant owners to upgrade their infrastructure and offer enhanced services. Thus, increasing demand for deployment of upgraded kitchen equipment at commercial spaces is expected to favorably contribute to the market growth.

Growing use of smart kitchen equipment by the foodservice industry is expected to boost the demand for commercial kitchen appliances. These smart commercial kitchen equipment are designed with advanced connectivity features and equipped with sensors, which can connect to handheld devices, such as smartphones and tablets or other household devices.

End-use industries are now favoring commercial kitchen equipment inbuilt with digital transformation technologies, such as the Internet of Things (IoT) and Artificial Intelligence (AI), which are helping them cater to their customers with perpetual operations. For instance, Elanpro, an India-based commercial refrigerator manufacturer, launched IOT-enabled connected refrigerator with intuitive alert and temperature management features for the HoReCa industry.

Furthermore, rising awareness amongst the end-use industries regarding the utilization of energy-efficient commercial kitchen equipment is likely to lead to a notable increase in demand for kitchen appliances in the commercial sector. In addition, supportive government regulations promoting energy-efficient commercial kitchen equipment are expected to escalate the sales of commercial kitchen appliances, thus curbing energy consumption. For instance, the U.S. Environment Protection Agency (EPA) proposes the foodservice industries to utilize refrigerator certified with R-290 (refrigerant grade propane) as it is natural, non-toxic, and free from ozone-damaging properties and reduces the overall energy costs by around 28.0%.

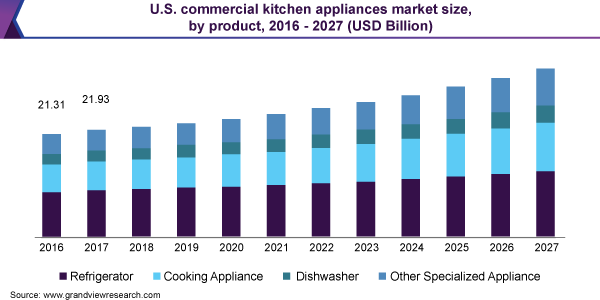

Product Insights

The commercial kitchen appliances market is segregated by product into refrigerator, cooking appliance, dishwasher, and other specialized appliance. The cooking appliance segment is further segmented into cooktop and cooking range, oven, and other cooking appliance. In 2019, the refrigerator segment accounted for the largest revenue share of over 40.0% and is expected to witness substantial growth over the forecast period.

Growing need for food preservation owing to changing climatic conditions is contemplating the end customers to deploy refrigerator with state-of-the-art technologies. Thus, the growing emphasis on advancements in refrigeration technologies is expected to boost the demand for refrigerators during the forecast period. For instance, Liebherr launched commercial food service refrigerators and freezers with elite cooling components for the restaurant and foodservice industry in North America.

The cooking appliance segment is anticipated to expand at a CAGR of 7.6% over the forecast period on account of increased demand for combination oven and induction cooktop and cooking range. The induction cooking range comprises an induction cooktop and convection oven that uses convection technology to distribute the heat evenly for faster cooking. Demand for the induction cooking range is expected to increase over the forecast period owing to growing fuel and electricity prices and awareness about the conservation of energy.

In the oven segment, a combination oven, which is a built-in oven with a microwave function, is expected to expand at the highest CAGR of 9.2% during the forecast period. These ovens can be used to prepare different food items inside the same unit with convection, microwave, and combination mode. Moreover, this commercial kitchen equipment offers numerous benefits such as fast and multi-level cooking and advanced humidity and air movement control. Furthermore, the combination oven improves production capacity, which results in increased profitability and efficiency of the end-use industries.

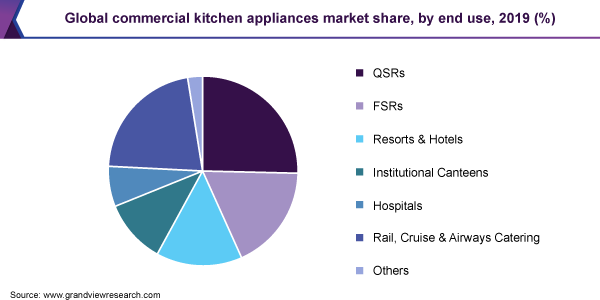

End-use Insights

By end use, the market for commercial kitchen appliances has been segmented into quick service restaurants, full service restaurants, resorts and hotels, institutional canteens, hospitals, rail, cruise and airways catering, and others. In 2019, the QSR segment accounted for the largest revenue share of over 20.0%. The segment is projected to positively impact the market growth over the forecast period owing to the growing trend of international and local QSR outlets and the opening of new QSR brands. Regional QSR brands are expected to expand with casual dining brand outlets entering new geographies.

Global as well as local fast food chains are deploying technologically updated kitchen appliances owing to rising need for innovative and most efficient kitchen appliances among the end-use industries. Increasing demand from QSRs for innovation in the equipment space is expected to drive the demand for advanced appliances with digital solutions. Furthermore, with QSRs emphasizing on menu innovation, convenience, and competitive pricing, there is a need for more mechanized commercial equipment in kitchens, thereby driving the market for commercial kitchen appliances.

Rail, cruise and airways catering is expected to expand at the highest CAGR of 8.1% over the forecast period. Substantial growth in the tourism industry is expected to drive the demand for commercial kitchen appliances for catering in railways, airways, and cruise. For instance, according to the Cruise Lines International Association (CLIA), a world-renowned cruise industry trade organization, cruise tourism has grown at almost 7.0% from 2017 to 2018 globally, totaling up to 28.5 million passengers. The transportation system is overburdened by immense demand and there is an increased need to flourish the associated facilities worldwide. With countries including India, China, and Japan increasing the number of trains each year, the railway dining segment and the associated kitchen appliance industry are projected to witness significant growth.

The hospitals segment is envisioned to witness significant growth from 2020 to 2027. One of the key factors responsible for the higher deployment of these appliances in hospitals is the need to prepare food in the hospital’s vicinity to maintain the nutritional requirements of the patients. The ability to offer diverse food items to long-term residents while maintaining hygiene standards is anticipated to offer lucrative opportunities for the commercial kitchen appliances industry participants in the hospital sector.

Regional Insights

In 2019, North America accounted for the largest revenue share of over 30.0%. An increasing number of restaurants, hotels, and food businesses in this region is likely to aid industry growth. Furthermore, increasing usage of different types of kitchen appliances at commercial spaces and early adoption of technologically advanced equipment is driving the market for commercial kitchen appliances in this region. Moreover, improving the macro-economic condition of North America is driving the regional market for commercial kitchen appliances.

MEA is projected to register the highest CAGR of 9.0% over the forecast period. With the growing tourism, the fast food franchises in this region are adopting variation in the restaurant menu by including a diverse range of food items belonging to local culture as well as other parts of the world. Furthermore, the ferry and cruise and canteens are adopting a menu that is suited to other local cultures and ethnic foods from various countries, which, in turn, is anticipated to boost the demand for commercial kitchen appliances in the region.

The quick service restaurants segment in the Asia Pacific is expected to grow at a substantial rate as a large number of international chains and local players are venturing their businesses in the region. There is a growing trend of the foreign QSR chains trying to adapt to local tastes. Similarly, Indian restaurants are incorporating multi-cuisine food preparations, such as Italian, Mexican, and Continental, in their food menu, owing to an increasing number of customers experimenting with new food and developing a taste for different cuisines.

Key Companies & Market Share Insights

Key market participants include Bakers Pride, G.S. Blodgett Corporation, Garland Group, Vulcan, Bonnet International, Ali Group, and True Manufacturing. These players are focused on the development of advanced appliances to strengthen their market reach and expand its product portfolio. For instance, in February 2020, Blodgett Corporation launched its freestanding ventless convection oven that is integrated with easy-to-use touchscreen controls for hospital cafeterias, institutional kitchens, fast-casual restaurants, and other foodservice facilities. With the launch of this commercial kitchen equipment, the company is focusing on expanding its product portfolio in the energy-efficient appliances segment as ventless cooking consumes lower energy and has a lower maintenance and installation cost.

The commercial kitchen equipment industry’s lucrativeness is contemplating the market players from household appliances to invest in adjacent product categories. For instance, Whirlpool Corporation, one of the prominent players in the household kitchen appliance industry, launched its commercial oven, dishwasher, and ice maker. With this foray into the commercial domain, the company is aiming to expand its product portfolio further, currently boasting of a 5.0% revenue share in the overall market for commercial kitchen appliances.

Furthermore, a large number of cooking appliance manufacturing companies are focusing on strategic partnerships and mergers & acquisitions to gain a competitive advantage over their customers and expand their end-customer reach. For instance, Parts Town, a U.S.-based distributor of commercial foodservice equipment, acquired the PartsXpress, which is the supplier of foodservice and commercial appliance parts for Smart Care Equipment Solutions. With this acquisition, Parts Town will become the primary supplier of genuine OEM parts to Smart Care Equipment Solutions. Some of the prominent players in the commercial kitchen appliances market include:

-

Bakers Pride

-

G.S. Blodgett Corporation

-

Garland Group

-

Vulcan

-

Bonnet International

-

Ali Group

-

True Manufacturing

Commercial Kitchen Appliances Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 83.83 billion

Revenue forecast in 2027

USD 131.77 billion

Growth Rate

CAGR of 6.7% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; India; China; Japan; Brazil; Mexico

Key companies profiled

Bakers Pride; G.S. Blodgett Corporation; Garland Group; Vulcan; Bonnet International; Ali Group; True Manufacturing

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global commercial kitchen appliances market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Billion, 2016 - 2027)

-

Refrigerator

-

Cooking Appliance

-

Cooktop & Cooking Range

-

Induction

-

Gas

-

Electric

-

-

Oven

-

Convection

-

Microwave

-

Combination

-

-

Other Cooking Appliance

-

-

Dishwasher

-

Other Specialized Appliance

-

-

End-use Outlook (Revenue, USD Billion, 2016 - 2027)

-

Quick Service Restaurants (QSRs)

-

Full Service Restaurants (FSRs)

-

Resorts & Hotels

-

Institutional Canteens

-

Hospitals

-

Rail, Cruise & Airways Catering

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global commercial kitchen appliances market size was estimated at USD 79.72 billion in 2019 and is expected to reach USD 83.83 billion by 2020.

b. The global commercial kitchen appliances market is expected to grow at a compound annual growth rate of 6.7% from 2020 to 2027 to reach USD 131.77 billion by 2027.

b. Refrigerator segment dominated the commercial kitchen appliances market with a share of 42.16% in 2019. This is attributable to the increasing need for food preservation owing to changing climatic conditions contemplating the end customers to deploy refrigerators with state-of-the-art technologies.

b. Some key players operating in the commercial kitchen appliances market include Bakers Pride; G.S. Blodgett Corporation; Garland Group; Vulcan; Bonnet International; Ali Group; and True Manufacturing.

b. Key factors that are driving the market growth include expanding tourism and the development of railways, growing popularity of Quick Service Restaurants (QSRs) among the youth, and increased working population worldwide.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."