- Home

- »

- HVAC & Construction

- »

-

Compact Electric Construction Equipment Market ReportGVR Report cover

![Compact Electric Construction Equipment Market Size, Share & Trends Report]()

Compact Electric Construction Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Forklift, Loader, Excavator, AWP), By Ton (Below 5 Ton, 6 To 8 Ton, Above 8 Ton), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-967-5

- Number of Report Pages: 189

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

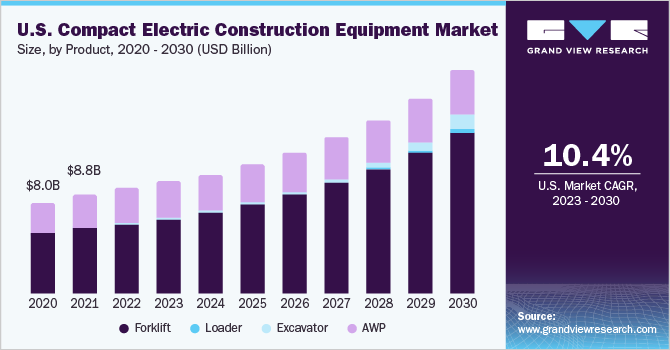

The global compact electric construction equipment market size was valued at USD 50,499.4 million in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 13.9% from 2023 to 2030. Rapid urbanization in developing countries is driving the need for better infrastructure, such as houses, schools, hospitals, stadiums, government buildings, and airports. For instance, in 2019, the government of India announced an investment of USD 1.4 trillion for infrastructure projects during the years 2019 -2023.

This signifies the rising demand for compact construction machinery in the country. Furthermore, forklifts such as pallet jacks and stand-up riders are gaining more importance among warehouse owners as they are efficiently designed to lift heavy weights and can be flexible at greater heights. Warehouse owner’s approach toward lowering operational costs and increasing transparency within the warehouse is anticipated to drive the demand for compact electric construction equipment.

The growth in demand for compact electric construction equipment can be attributed to a noticeable increase in global construction activities and stringent environmental regulations. Furthermore, governments are focused on infrastructure development to support rapid growth. Thus, an exponential increase in construction activities is boosting the demand for compact equipment that can work in narrow spaces, is easy to transport, and has less maintenance & operational costs. This aspect is expected to augment the growth of the global market for compact electric construction equipment.

Moreover, activities involving renting construction equipment are expanding rapidly. Customers often prefer to rent construction equipment to save on the costs of purchasing and maintaining the equipment. To increase their market share, many manufacturers of construction equipment, including Mitsubishi Corporation, Komatsu Ltd, and Hyundai Construction Co., Ltd, have started working with rental businesses and launching new products. As a result, the rental industry's high demand for electric excavators, loaders, and forklifts is anticipated to support industry growth.

Major players are moving towards online channels to increase their sales activity, which is anticipated to drive market growth. For instance, in March 2022, Volvo CE announced that a 2.5-ton battery-powered compact Volvo electric excavator will be available for sale in Asia. Through this, the corporation anticipates increased sales and brand value in Western markets. Rising urban infrastructure investment and a move towards adopting smart construction equipment to combat increasing pollution are likely to cause countries like India and Japan to experience rapid economic growth. This is expected to enhance the demand for smart electric excavators.

The global market expansion for compact electric construction equipment is projected to be hampered by the fluctuating price of raw materials and the high cost of goods. One of the major restraints for the industry is the high initial investment required to purchase these machines. While electric equipment can save money in the long run due to lower fuel and maintenance costs, the upfront cost can be a significant barrier for many companies, especially smaller ones.

The growing trend towards urbanization is also creating opportunities in the market. With more people moving into cities, there is a growing demand for construction equipment that can work in urban environments. Compact electric equipment is well-suited for this type of work, as it is quieter and produces fewer emissions than traditional diesel-powered equipment.

In addition, the increasing adoption of advanced technologies, such as telematics and automation, is expected to drive the demand for compact electric construction equipment. These technologies allow operators to remotely monitor and control equipment, which can increase efficiency and productivity on the job site.

Consumer Buying Behaviour Analysis

In the compact electric construction equipment market, it is especially important to understand consumer behavior since it is a relatively new and rapidly evolving industry. The primary motivation for consumers in the market is the desire to reduce their environmental impact.

Consumers are looking for sustainable and eco-friendly options, and compact electric construction equipment is an excellent alternative to traditional gas-powered equipment. Furthermore, the increasing emphasis on sustainability may also play a role in pushing consumers toward choosing compact electric construction equipment over their gas-powered counterparts.

Product Insights

The forklift segment held the largest revenue share of nearly 80.0% in 2022 and is expected to continue its dominance over the forecast period. Electric forklifts are generally cheaper to operate than their traditional counterparts. They have fewer moving parts, require less maintenance, and are more energy-efficient, resulting in lower operating costs. This makes them attractive for companies looking to reduce their operating expenses. An electric forklift is ideal for indoor, smooth floor factory applications.

The loader segment is expected to witness rapid growth over the forecast period at a CAGR of 49.7% due to the high demand for compact loaders from the construction sector. Electric loaders have lower maintenance costs, with fewer moving parts and less frequent servicing requirements than diesel engines. Additionally, the cost of electricity is generally lower than the cost of diesel fuel, which can result in significant savings for construction companies over the lifetime of the equipment.

Also, the introduction of new products from notable players is expected to support the growth of the target segment. For instance, in January 2022, Doosan Bobcat announced the prototype of T7X, an electric Bobcat T7X compact track loader. The newly launched T7X is fully electric and offers benefits such as eliminating hydraulic systems, emissions, and vibrations. Such factors are expected to drive the segment’s growth over the forecast period.

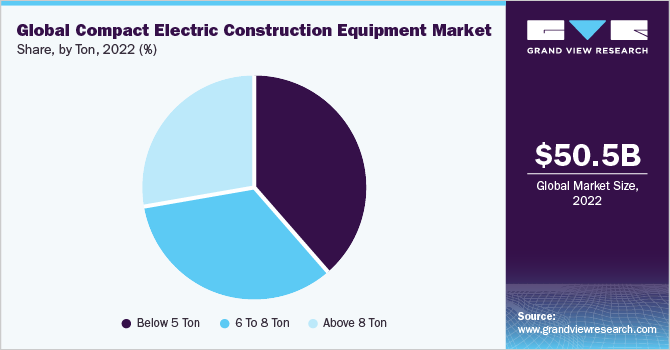

Ton Insights

The ton segment is divided into below 5 tons, 6 to 8 tons, and above 8 tons. The below 5-ton segment held the largest revenue share of over 38.0% in 2022. This can be attributed to the increasing demand for compact construction machinery to increase operational efficiency and lower the environmental impact. Lightweight excavators and loaders are electrified faster than medium and large excavators. Thus, the manufacturers’ approach toward the electrification of compact excavators is expected to gain momentum gradually over the forecast period.

The above 8 ton segment is expected to witness significant growth in the global market due to high demand from industries for compact electric excavators and loaders that have a high load-carrying capacity. Another factor driving the demand for compact electric construction equipment is the increasing emphasis on safety in the construction industry. Electric equipment operates more quietly than diesel-powered machines, reducing noise pollution and enhancing safety on construction sites.

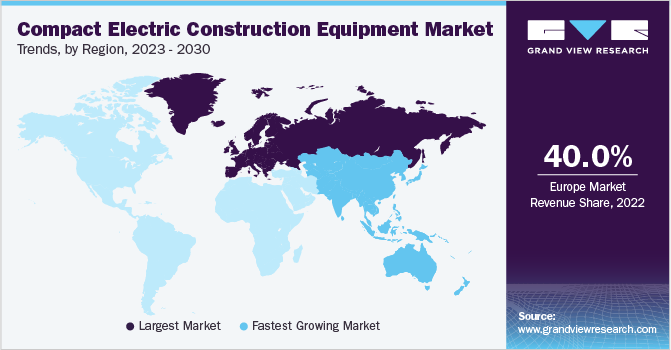

Regional Insights

Europe accounted for a revenue share of over 40.0% in 2022 and the regional market is expected to grow steadily over the forecast period. The European Union has set ambitious targets to reduce greenhouse gas emissions and combat climate change. To achieve these targets, the EU has implemented regulations to incentivize the use of electric vehicles and equipment. For instance, the EU has set a target for new cars to emit 37.5% less CO2 by 2030 compared to 2021 levels.

Additionally, regulations such as the Low Emission Zone in London have restricted the use of diesel-powered equipment in certain areas. The regional growth can be attributed to the surge in the adoption of zero-emission equipment, coupled with the increasing number of infrastructure projects in cities such as Oslo (Norway), Helsinki (Finland), London (UK), Copenhagen (Denmark), Amsterdam (Netherlands), and Stockholm, (Sweden).

Asia Pacific is expected to expand at a rapid CAGR of more than 17.0% over the forecast period, which has been attributed to rapid infrastructure development activities in the region. Governments in several Asia Pacific countries, including China, Japan, and South Korea, have introduced initiatives and policies to promote the adoption of electric vehicles and equipment. They are providing incentives and subsidies to encourage the use of eco-friendly products, including compact electric construction equipment.

For instance, the Chinese government signed the recent Regional Comprehensive Economic Partnership (RCEP) free trade agreement with Asia Pacific countries, including Japan, South Korea, Australia, and other smaller South-East Asian economies. The partnership is focused on developing the transportation infrastructure without comprising environmental regulations.

Key Companies & Market Share Insights

Manufacturers are actively involved in product development, and their approach toward the introduction of new advanced products and acquiring major market share through mergers and acquisitions is expected to intensify industry growth. For instance, in February 2022, Takeuchi Mfg. Co., Ltd., a Japanese construction equipment manufacturer, announced the launch of the TB20e, an electric compact excavator, for the North American market. The product launch is expected to help the company strengthen its position in the regional industry. Some prominent players in the global compact electric construction equipment market include:

-

Caterpillar

-

JCB

-

HAULOTTE GROUP

-

Wacker Neuson SE

-

Toyota Motor Corporation

-

Hyster-Yale Group, Inc.

-

SANY Group

-

Volvo CE

-

Hyundai CE

-

Bobcat

Compact Electric Construction Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 55,652.3 million

Revenue forecast in 2030

USD 138,748.4 million

Growth rate

CAGR of 13.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ton, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Caterpillar; JCB; HAULOTTE GROUP; Wacker Neuson SE; Toyota Motor Corporation; Hyster-Yale Group, Inc.; SANY Group; Volvo CE; Hyundai CE; Bobcat

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

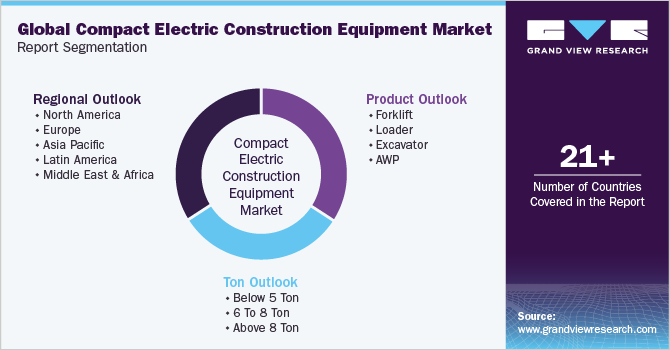

Global Compact Electric Construction Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global compact electric construction equipment market report on the basis of product, ton, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Forklift

-

Loader

-

Excavator

-

Mini

-

Midi

-

-

AWP

-

Telehandler

-

Boom

-

Scissor

-

-

-

Ton Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 5 Ton

-

6 to 8 Ton

-

8 to 10 Ton

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global compact electric construction equipment market size was estimated at USD 50,499.4 million in 2022 and is expected to reach USD 55,652.3 million in 2023.

b. The global compact electric construction equipment market is expected to grow at a compound annual growth rate of 13.9% from 2023 to 2030 to reach USD 1,38,748.4 million by 2030.

Which segment accounted for the largest global compact electric construction equipment market share?b. Europe dominated the compact electric construction equipment market with a share of nearly 40.00% in 2022. This is attributable to increasing construction and reconstruction activities in the region.

b. Some key players operating in the global compact electric construction equipment market include Caterpillar, Hitachi Construction Ltd. Deere & Company, Sany Group, and Volvo AB

b. The compact electric construction equipment sales witnessed strong demand in 2022, owing to stringent government environmental regulations, increased construction spending worldwide, and increasing demand for compact construction equipment that works in narrow spaces..

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.