- Home

- »

- Animal Health

- »

-

Companion Animal Ear Infection Treatment Market, 2030GVR Report cover

![Companion Animal Ear Infection Treatment Market Size, Share & Trends Report]()

Companion Animal Ear Infection Treatment Market Size, Share & Trends Analysis Report By Disease Type (Otitis Externa, Otitis Media), By Product, By Mode of Administration, By Animal Type, By Sales Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-277-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

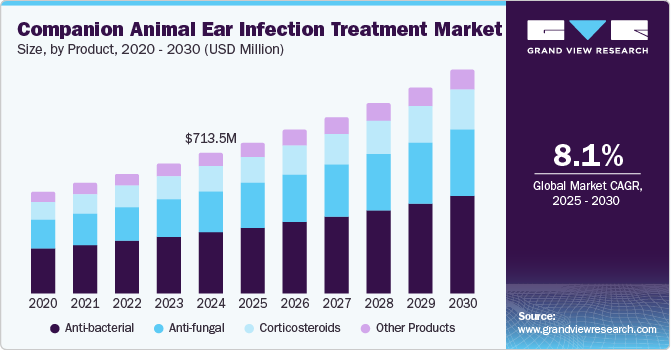

The global companion animal ear infection treatment market size was valued at USD 713.52 million in 2024 and is anticipated to grow at a CAGR of 8.11% from 2025 to 2030. The industry is expected to grow due to the increased prevalence of otitis externa in small animals. Otitis externa is a condition characterized by the inflammation of the external ear canal. Its signs include pain, head shaking, erythema, malodor, swelling, and ulceration. It is one of the most common ear infections in companion animals. According to Dechra Pharmaceuticals, otitis or ear infection is the final diagnosis in 2% of all feline and 5% of all canine consultations.

According to the study published in the International Journal of Advanced Biochemistry Research in June 2024, among 651 suspected dogs with visible symptoms, 92 dogs were found positive for otitis externa, comprising 14.13% of the total dogs under study. The highest occurrence of this condition was reported in dogs within the age group of 3-6 years, mainly during monsoon season. The same study also mentioned that bilateral and unilateral otitis externa were 61.04% and 38.06%, respectively. This is expected to increase the adoption of various treatment alternatives for this condition. It is also likely to increase the establishment of reference laboratories to improve animal health in the coming years.

The WHO is involved in various cross-sectoral activities to address health threats at the human-animal-ecosystem interface. Some major health threats are food-borne zoonosis, antimicrobial resistance, infectious conditions, and emerging zoonosis. Various efforts are being undertaken at regional and international levels by many departments within the WHO, and it works closely with multiple partners, including the Food and Agriculture Organization (FAO), the World Bank, the World Organization for Animal Health (OIE), national ministries of health, and United Nations System Influenza Coordination (UNSIC). The National Center for Emerging and Zoonotic Infectious Diseases (NCEZID) is constantly engaged in preventing, tracking, detecting, and responding to outbreaks of infectious diseases across the U.S. and other countries.

In addition, growth in the pet population is expected to increase the demand for veterinary healthcare services and boost the overall expenditure on pets. According to the American Veterinary Medical Association, the canine population in the U.S. has steadily increased from 52.9 million in 1996 to 89.7 million in 2024. At the same time, the cat population grew from 59.8 million in 1996 to 73.8 million in 2024. This continuous surge in the pet population in several regions has significantly propelled the market growth in recent years. Furthermore, government organizations are increasingly involved in issuing guidelines to promote veterinary services globally, which is expected to contribute to market growth over the forecast period. For instance, the OIE International Standards, a part of the WTO framework, establishes standards to improve animal health and promote international animal products trade. Such measures facilitate early detection, control, and reporting of pathogenic agents and prevent their transmission by rejecting products that do not adhere to the standards. Thus, there will be a significant improvement in the overall penetration rate of animal health products, which is anticipated to fuel the market demand and boost revenue.

Product Insights

The antibacterial segment dominated the market with a share of 44.04% in 2024. Ear infection is relatively common among these companion animals, and it can significantly affect the pet’s quality of life. Common ear diseases in pets are otitis externa, otitis media, and otitis interna. Various organizations are researching and developing novel methods to treat bacterial otic infections in companion animals. For instance, according to the news published in July 2024, research was conducted recently at the University of Nottingham and the University of Birmingham to find that specific frequencies of blue light can kill 99% of bacteria associated with ear infections in dogs. Many strains in such bacteria are antibiotic-resistant, and blue light can effectively treat otic infections. The contribution of such research initiatives fuels the entrance of new antibacterial treatments for ear infections and drives industry growth.

The anti-fungal segment is projected to grow with the fastest CAGR of 8.42% during the forecast period. Yeast infection is the most common type of ear infection in dogs. Otitis externa is the second-most common reason dog owners take their pets to a veterinarian. This condition often causes pain and itching in the affected dog. Malassezia pachydermatis is one of the most frequently isolated yeasts in canines. Frequent research is ongoing to find better treatments, followed by their launch, fostering the segment’s growth in the coming years. For instance, in March 2024, the FDA approved DuOtic (terbinafine and betamethasone acetate otic gel) for treating Malassezia pachydermatis-associated Otitis externa. It is the first FDA-approved drug for treating yeast-only otitis externa in dogs and the first otic drug without any antibiotic to treat the condition. The factors above are anticipated to drive the market growth significantly.

Mode of Administration Insights

The topical segment dominated the market in 2024 with a share of 53.46%. This dominance can be attributed to several factors such as ease of application, ease of withdrawal in case of allergy, unlike oral or otic formulations, lack of significant resistance by the body, etc. Most topical ear medications contain a combination of antibiotics, anti-fungal drugs, and glucocorticoids. Also, topical antibiotics are the most common method of treating middle ear infections in dogs. According to Merck & Co., Inc., Yeast otitis typically responds well to topical therapy that includes an anti-fungal and steroid to help reduce inflammation. Moreover, several developments in the segment fuel the market growth. For instance, in November 2023, Elanco extended the shelf life of Zorbium (a topical product for cats) from 18 months to 24 months to improve the stability and benefit veterinarians and pet owners.

The organic segment is expected to grow with the fastest CAGR during the forecast period. Otic suspensions can deliver rapid, sustained treatment for otitis. It is formulated to treat bacterial, inflammation, and fungal infections associated with otitis. Hence, end users will likely prefer products from this segment over others. Numerous otic products are available in the market. EASOTIC Otic Suspension by Virbac delivers relief to dogs as a fast-acting, easy-to-use treatment. SYNOPTIC Otic Solution by Zoetis is specified to relieve inflammation and pruritus associated with acute & chronic otitis in canines. Dechra's MalAcetic Otic and Cleanser is a patented formula for dogs and cats.

Animal Type Insights

The dog segment dominated the market in 2024 with a share of 44.68% owing to their popularity as companion animals. Canines share a good bond with their owners and are usually considered a part of the family. Pet owners are worried about their canines and invest heavily in their healthcare. An increase in the incidence of ear infections in canines also supports the segment's growth to a large extent. According to the article published in March 2023, ear infections are found in 7% to 16% of dogs in private veterinary practice. These factors are expected to provide significant opportunities for segment growth during the forecast period.

The cat segment is expected to grow with the fastest CAGR of 8.36% during the forecast time. Cats are the second most popular pet choice. Increased concern regarding the health and hygiene of cats is likely to drive the segment. Younger demographics, especially millennials, have become very careful when caring for their pet cats. Cats tend to be good groomers; however, it is still not easy for them to clean the inside of their ears. This can cause excess earwax, debris, and dirt to build up inside the ear, elevating the risk of ear infections.

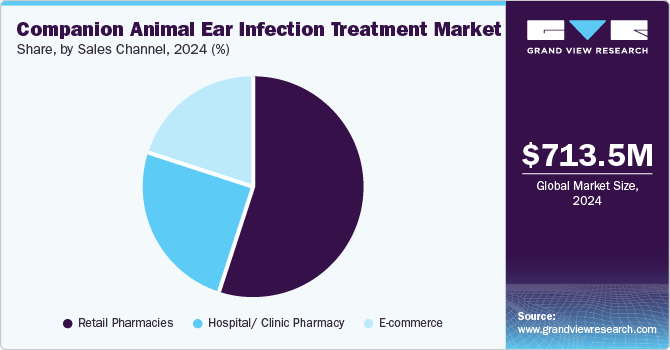

Sales Channel Insights

Retail pharmacies dominated the market with the largest share of over 55% in 2024 due to their widespread availability, ease of access, and trust among pet owners. Retail pharmacies, including veterinary-focused outlets and general drugstores, provide a reliable source for purchasing over-the-counter and prescription ear infection treatments. Their physical presence allows pet owners to quickly acquire medications, often with pharmacist guidance, making them a preferred choice for urgent or routine needs.

The e-commerce segment is expected to grow at a CAGR of 10.24% over the forecast period. Even after substantial growth in veterinary pharmacies, there is a considerable drift in the availability and demand of veterinarians. The segment is driven by the convenience and accessibility it offers to pet owners. The shift in consumer behavior toward online shopping has made platforms like Amazon, Chewy, and specialized veterinary e-commerce sites popular for purchasing otic products for ear infections in pets.

Disease Type Insights

Otitis externa dominated the disease-type segment in 2024 with a share of around 65%. It is an external ear canal inflammation, one of the most common reasons for small animal visits to the veterinarian. It is a recurrent problem in numerous dogs and cats and supports segment growth. Various innovative ear solution products are available for animals and provide anti-fungal, anti-inflammatory, and antibacterial activity. For instance, Neptra ear solution offers anti-fungal, anti-inflammatory, & antibacterial activity and is available on prescription for canine otitis externa.

Otitis media is anticipated to grow with the fastest CAGR of 8.20% over the forecast period. The condition affects the middle part of the ear canal and is typically a secondary development in up to 50% of chronic otitis externa cases. It is common and has a stated incidence of 50% to 88.9%. It is present in more than half of the canines with long-term recurrent external ear inflammation. In dogs with recurrent ear infections, up to 89% may have concurrent otitis media. The disease was also observed when the tympanic membrane was intact. Such a high prevalence of this disease among animals is driving the market. Surgery may be required to drain and resolve the infection in long-term cases.

Regional Insights

North America companion animal ear infection treatment market dominated the global industry and accounted for 49.52% of revenue share in 2024, attributed to the local presence of significant animal healthcare companies. Moreover, introducing veterinary health information systems in the region enabled real-time diagnosis. This is anticipated to facilitate R&D activities and increase new product development. Furthermore, the region's increased number of veterinary clinics and veterinarians is further boosting market growth. For instance, according to the data published by the American Veterinary Medical Association, as of December 2023, there were over 127,131 veterinarians in the U.S.

U.S. Companion Animal Ear Infection Treatment Market Trends

The U.S. companion animal ear infection treatment market held a significant share of the North American market in 2024. Increasing number of pet owners and rising awareness about animal health & hygiene are expected to accelerate market growth. According to a survey conducted by the APPA National Pet Owners Survey, in 2024, 82 million U.S. families own a pet. An increase in the pet population is expected to boost the demand for veterinary healthcare services and increase the overall pet expenditure. Hence, rising pet ownership and improvements in R&D activities regarding animal healthcare are expected to fuel the market.

Europe Companion Animal Ear Infection Treatment Market Trends

The Europe companion animal ear infection treatment market is driven by the strong presence of several major players such as Ceva Santé Animale, Dechra Pharmaceuticals, Merial Animal Health, Virbac, Vetoquinol S.A., Zoetis, & Elanco, rapid acceptance of advanced veterinary devices, and the large number of pet owners. According to the European Pet Food Industry Federation, over 129 million European households own cats, and 106 million have dogs as pets. Around 166 million people have one or more pets, comprising of Europe's 50% pet population. Europe’s companion animal ear infection treatment market includes the UK, Germany, France, Italy, and Spain, among other countries.

The UK companion animal ear infection treatment market is expected to show significant growth driven by the presence of potential suppliers of veterinary products in the region. Moreover, the country's substantial population of veterinary professionals contributes to the market growth. According to the data published by SynergyVets in February 2024, there are around 27,000 registered veterinarians in the country.

The companion animal ear infection treatment market in Germany is experiencing significant growth, primarily due to rising disposable income and a proportionate increase in interest in farm & companion animals. Additionally, the rise in government initiatives, the growing risk of emerging zoonotic diseases, and leading innovations in veterinary healthcare are significant factors likely to drive the market over the forecast period.

Asia Pacific Companion Animal Ear Infection Treatment Market Trends

The companion animal ear infection treatment market in Asia Pacific is expected to grow at the fastest CAGR of 10.17% over the forecast period. Asia Pacific's market is anticipated to grow fastest over the forecast period. Rising adoption of pet animals, increasing prevalence of pet diseases, and growing health concerns about pet animals are vital drivers likely to boost the market in Asia Pacific. Moreover, increasing veterinary services and animal health expenditure contributes to regional market growth. The growing prevalence of otitis externa in pets is a major factor accelerating the companion animal ear infection treatment market. Furthermore, increasing pet and animal healthcare services is expected to drive the market in several Asia Pacific countries. Awareness about animal health and hygiene will likely create opportunities for players in this market.

China companion animal ear infection treatment market is growing at a lucrative rate and will hold a significant share in 2024. The increasing prevalence of zoonotic and food-borne diseases in China has driven companies to develop successful veterinary medicines & products for animals & pets. According to the study published in November 2023, the highest prevalence of ear diseases in canines was observed from June to October in the Xi'an Teaching Hospital. The increase in demand for veterinary products is supported by growing spending on animal healthcare and favorable regulatory scenarios for animal product approval in China. Launch of products, acquisitions, and R&D activities are key strategies adopted by players in the market. In January 2022, Elanco's Zorbium, a topical cat application, received U.S. approval. The company also expanded its pain management offerings while addressing the unmet needs of veterinary practices.

Latin America Companion Animal Ear Infection Treatment Market Trends

The companion animal ear infection treatment market in Latin Americaexhibits high growth potential in the forecast period. The increasing prevalence of otitis externa in pets, the growing overall pet population, and the rising demand for veterinary healthcare services are key factors expected to drive the market in Latin America. Despite economic and political problems, the pet industry has remained consistent over the recent past. The Latin American companion animal ear infection market is highly competitive due to the local presence of several large- and small-scale players. Most companies focus on R&D partnerships, acquisitions, product approvals, and mergers to gain market share. For instance, in August 2024, Virbac launched Cortotic, a non-antimicrobial canine otitis externa treatment for dogs.

Brazil companion animal ear infection treatment market exhibits high growth potential, driven by the country's large pet population, the growing trend of pet humanization, and increasing awareness of pet health. Brazil's humid climate and the popularity of breeds prone to ear infections contribute to a high prevalence of conditions like otitis externa, fueling demand for effective treatments. Expanding veterinary services, advancements in otic medications, and a focus on preventive care further support market growth.

Middle East and Africa Companion Animal Ear Infection Treatment Market Trends

The companion animal ear infection treatment market in the Middle East and Africa is fueled by an increasing number of government animal healthcare organizations and rising awareness about veterinary health. In addition, the growing trend of pet humanization and the willingness of owners to spend on pet animals is likely to drive the market. The impact of pet owners treating their pets as family members has reflected the high spending pattern of owners, especially in this region.

South Africa companion animal ear infection treatment market growth is attributed to the increasing number of veterinary hospitals, laboratories, & clinics and the local presence of large veterinary hospitals with modern facilities. The availability of hospital facilities for treatment & diagnosis of diseases, such as ear infections, and funding from the South African Veterinary Association. For example, Ashburne Veterinary Hospital in South Africa offers quality veterinary diagnostics, treatment, care, and hospitalization for all family pets. The hospital provides a complete range of premium pet care products, such as dog & cat food, to suit the nutritional needs of every animal. The hospital offers various facilities, including an isolation unit, in-house laboratories, and diagnostic equipment. The Florida Veterinary Hospital in South Africa also provides high-quality veterinary care to clients in the greater West Rand area.

Key Companion Animal Ear Infection Treatment Company Insights

The industry is highly competitive due to several strategic initiatives, such as new product launches, mergers and acquisitions, and regional expansion, undertaken by key market players to increase their global footprints. Companies are diversifying their product portfolios to address a broader range of applications.

Key Companion Animal Ear Infection Treatment Companies:

The following are the leading companies in the companion animal ear infection treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Zoetis

- Elanco

- Dechra Pharmaceuticals Plc.

- Merck & Co

- Boehringer Ingelheim

- OurPetsLife

- Vetoquinol

- Virbac

- Ceva

- Vedco Inc. (Covetrus)

- Penn Veterinary Supply

View a comprehensive list of companies in the Companion Animal Ear Infection Treatment Market

Recent Developments

-

In October 2024, Zomedica Corp. launched an Ear Cytology Quick Scan protocol to assist veterinary professionals in diagnosing and treating companion animals faster and more efficiently. This would reduce the time needed to diagnose ear conditions such as otitis in companion animals.

-

In August 2023, Dechra launched a series of Lifelong Ear Partnership resources to educate and support veterinarians and pet owners and achieve better results for dogs experiencing otitis externa.

Companion Animal Ear Infection Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 768.43 million

Revenue forecast for 2030

USD 1.13 billion

Growth rate

CAGR of 8.11% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Product, mode of administration, animal type, disease type, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Japan; China; India; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Zoetis, Elanco, Dechra Pharmaceuticals Plc., Merck & Co, Boehringer Ingelheim, OurPetsLife, Vetoquinol, Virbac, Ceva, Vedco Inc. (Covetrus), Penn Veterinary Supply

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Companion Animal Ear Infection Treatment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global companion animal ear infection treatment market report on the basis of product, mode of administration, animal type, disease type, sales channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Antibacterial

-

Aminoglycosides

-

Fluoroquinolones

-

Others Antibacterial Products

-

-

Anti-fungal

-

Corticosteroids

-

Other Products

-

-

Mode of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Oral

-

Otic

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Otitis Externa

-

Otitis Media

-

Otitis Interna

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital/ Clinic Pharmacy

-

Retail Pharmacies

-

E-commerce

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Rest of Asia-Pacific

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of LA

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global companion animal ear infection treatment market size was estimated at USD 713.52 million in 2024 and is expected to reach USD 768.43 million in 2025.

b. The global companion animal ear infection market is expected to grow at a compound annual growth rate of 8.11% from 2025 to 2030 to reach USD 1.13 billion by 2030.

b. By Disease, Otitis externa dominated the disease-type segment in 2024 with a share of 65.69%. It is an external ear canal inflammation, one of the most common reasons for small animal visits to the veterinarian. It is a recurrent problem in numerous dogs and cats and supports segment growth. Various innovative ear solution products are available for animals and provide anti-fungal, anti-inflammatory, and antibacterial activity.

b. Some key players operating in the companion animal ear infection market include Zoetis, Elanco, Dechra Pharmaceuticals Plc., Merck & Co, Boehringer Ingelheim, OurPetsLife, Vetoquinol, Virbac, Ceva, Vedco Inc. (Covetrus) and Penn Veterinary Supply

b. Key factors that are driving the companion animal ear infection market growth include increased prevalence of otitis externa in small animals, increasing adoption of pet animals, growing health concerns about animals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."