- Home

- »

- Plastics, Polymers & Resins

- »

-

Composite Packaging Market Size, Industry Report, 2030GVR Report cover

![Composite Packaging Market Size, Share & Trends Report]()

Composite Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Paper & Paperboard), By Application (Food & Beverages, Pharmaceuticals, Household Products), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-515-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Composite Packaging Market Size & Trends

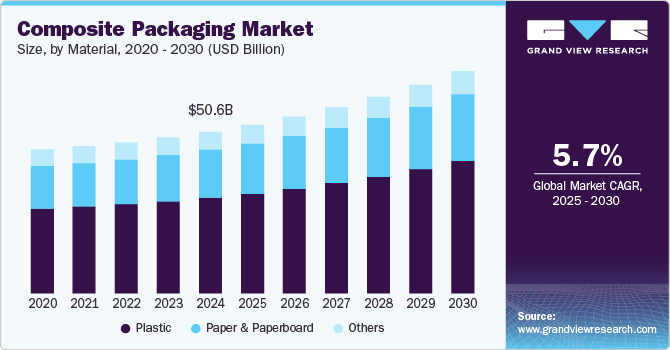

The global composite packaging market size was valued at USD 50.56 billion in 2024 and is expected to grow at a CAGR of 5.7% from 2025 to 2030. Increasing consumer demand and regulatory pressure for sustainable, recyclable, and reduced environmental-impact packaging solutions are propelling the composite packaging market's growth.

The growing need to extend the shelf life of perishable products is a key driver of the composite packaging market. By combining materials such as plastic, aluminum, and paperboard, composite packaging creates multi-layered structures that offer superior barrier protection against moisture, oxygen, and contaminants. This is especially important in the food & beverage industry, where maintaining product freshness is essential. For instance, aseptic composite cartons for milk, juices, and soups help prevent spoilage without refrigeration, reducing food waste and lowering costs for both manufacturers and consumers.

Sustainability concerns have led to a shift toward recyclable and biodegradable composite packaging solutions. Companies are investing in the development of eco-friendly materials that reduce plastic content and incorporate renewable resources. For example, manufacturers are increasingly using fiber-based composite packaging with minimal plastic layers to enhance recyclability. Tetra Pak, a prominent player in composite packaging, has introduced paper-based cartons with plant-based polymers to reduce carbon emissions and dependency on fossil fuels. As consumer awareness of environmental issues grows, brands are prioritizing sustainable packaging solutions to align with regulatory requirements and consumer expectations.

The rapid expansion of e-commerce has significantly influenced the growth of the composite packaging market. Online retailers require durable, lightweight, and protective packaging to ensure safe product delivery. Composite packaging provides excellent structural integrity and tamper resistance, making it ideal for shipping fragile items such as electronics, cosmetics, and pharmaceuticals. Additionally, the rise of omnichannel retailing has increased the demand for innovative packaging formats, including flexible pouches and composite cartons, which offer convenience and branding opportunities through high-quality printing and customization.

Material Insights

The plastic material segment recorded the largest revenue share of over 59.0% in 2024. The growing demand for convenient, lightweight, and durable packaging solutions is a major driver for plastic-based composite packaging. Advancements in multi-layer plastic films have improved the protective qualities of packaging, making them ideal for perishable goods. Additionally, the increasing adoption of flexible packaging, particularly in the food sector, is propelling market growth.

The paper & paperboard material segment is projected to grow at the fastest CAGR of 5.8% during the forecast period. Paper & paperboard are widely used in composite packaging due to their eco-friendly nature and excellent printability. They are often combined with plastic or aluminum to enhance strength and moisture resistance. This material is commonly used in beverage cartons, tetra packs, and snack packaging, providing a balance between sustainability and functionality. The rising preference for sustainable and biodegradable packaging solutions is a key driver for paper & paperboard composite packaging.

Application Insights

The food & beverage segment recorded the largest revenue share of over 33.0% in 2024. Composite packaging is widely used in the food & beverage industry due to its ability to offer excellent barrier properties against moisture, oxygen, and contaminants. Products like snack foods, dairy items, confectionery, and beverages often utilize composite packaging to enhance shelf life and maintain freshness. Aseptic cartons, laminated pouches, and composite cans are commonly used for packaging perishable and processed foods. Growing demand for extended shelf-life packaging to reduce food waste is driving the growth of the segment.

The household products segment is expected to grow at the highest CAGR of 6.6% during the forecast period. Household products such as cleaning agents, detergents, and air fresheners use composite packaging for improved durability, chemical resistance, and spill-proof storage. Common packaging formats include laminated pouches, aerosol containers, and stand-up pouches.

Composite packaging plays a critical role in the pharmaceutical industry. It offers tamper-proof, moisture-resistant, and sterile packaging for medicines, tablets, and liquid drugs. It ensures product integrity and compliance with stringent regulations. Blister packs, strip packs, and laminated tubes are commonly used in pharmaceutical applications.

Region Insights

North America composite packaging market is primarily driven by the region's robust consumer goods sector and advanced retail infrastructure. The U.S. and Canada have witnessed a significant shift in consumer preferences toward sustainable and lightweight packaging solutions, particularly in the food and beverage industry. For example, major beverage companies such as Coca-Cola and PepsiCo have increasingly adopted composite materials for their packaging needs, combining materials like paperboard with thin plastic barriers to create more environmentally friendly yet durable containers.

The composite packaging market in the U.S. is growing due to its robust manufacturing sector and high consumer demand across multiple industries. Major companies such as International Paper, WestRock Company, and Berry Global Inc. have invested heavily in developing innovative composite packaging solutions, particularly for the food and beverage, healthcare, and personal care sectors.

Asia Pacific Composite Packaging Market Trends

The composite packaging market in Asia Pacific dominated the global industry and accounted for the largest revenue share of over 40.0% in 2024 and is anticipated to grow at the fastest CAGR of 5.9% over the forecast period. The region's dominance in the composite packaging market is primarily driven by rapid industrialization and urbanization, particularly in countries such as China, India, Vietnam, and Indonesia. These nations are experiencing a significant rise in disposable income and changing consumer lifestyles, leading to increased demand for packaged food, beverages, and personal care products. Additionally, its robust manufacturing sector, particularly in electronics and automotive components, has also fueled the demand for composite packaging. Countries such as South Korea, Japan, and Taiwan have extensive electronics manufacturing facilities that require specialized protective packaging.

China composite packaging market is primarily driven by driven by its massive manufacturing ecosystem and rapid industrialization. The country's robust supply chain infrastructure, combined with lower production costs and a skilled labor force, has made it a global hub for composite packaging production. Moreover, the surge in domestic consumption and e-commerce has further accelerated China's composite packaging market growth. Chinese e-commerce giants such as Alibaba and JD.com have created unprecedented demand for innovative packaging solutions, thus driving market growth in the country.

Europe Composite Packaging Market Trends

The composite packaging market in Europe is primarily driven by stringent environmental regulations and sustainability initiatives. The European Union's Circular Economy Action Plan and the European Green Deal have pushed manufacturers to adopt more environmentally friendly packaging solutions. Besides, the region's robust food and beverage industry, coupled with advanced manufacturing capabilities, further strengthens its position in the composite packaging market. Major food companies such as Nestlé (Switzerland) and Danone (France) have been early adopters of innovative composite packaging solutions.

Germany composite packaging market is primarily driven by its robust manufacturing sector, particularly in automotive and industrial applications. The country's strong emphasis on sustainability aligns perfectly with composite packaging solutions, which often offer reduced material usage and improved recyclability compared to traditional packaging.

Key Composite Packaging Company Insights

The competitive environment of the composite packaging market is characterized by the presence of several global and regional players striving for market share through innovation, sustainability, and cost efficiency. Major companies focus on developing high-performance, multi-layered packaging solutions that enhance product shelf life while meeting evolving consumer preferences for eco-friendly materials. Additionally, stringent regulations on plastic usage and sustainability goals have intensified competition, with players investing in R&D to develop more sustainable and lightweight composite packaging solutions. Strategic collaborations, mergers, and acquisitions are prevalent, as companies seek to expand their market presence and technological capabilities.

-

In May 2024, saperatec GmbH inaugurated a new facility in Dessau, Saxony-Anhalt, Germany, dedicated to recycling plastic and aluminum from composite packaging waste. The facility focuses on the industrial-scale recycling of plastic/aluminum composite films found in beverage cartons and other composite packaging.

-

In May 2023, SIG opened a new production plant for aseptic carton packaging in Queretaro, Mexico, with a USD 75.77 million investment. The plant aims to capitalize on SIG's growth potential in North America. It was expected to initially focus on producing mid-sized and large carton packs, with plans to add small formats in the second phase.

Key Composite Packaging Companies:

The following are the leading companies in the composite packaging market. These companies collectively hold the largest market share and dictate industry trends.

- International Paper Co.

- WestRock Company

- GWP Packaging

- Bansal Papertube Industries (P) Ltd.

- Cosmo Films

- Moti Packaging

- Volmar Packaging srl

- TOPPAN Inc.

- SUPERPACKS

- Fibre Foils

- Smurfit Kappa

- Zipform Packaging

- YANTAI SHENHAI PACKAGING CO. LTD.

Global Composite Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 52.77 billion

Revenue forecast in 2030

USD 69.53 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific,; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

International Paper Co.; WestRock Company; GWP Packaging; Bansal Papertube Industries (P) Ltd.; Cosmo Films; Moti Packaging; Volmar Packaging srl; TOPPAN Inc.; SUPERPACKS; Fibre Foils; Smurfit Kappa; Zipform Packaging; YANTAI SHENHAI PACKAGING CO.,LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Composite Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global composite packaging market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Plastic

-

Paper & Paperboard

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Household Products

-

Industrial Packaging

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. Some of the key players operating in the global composite packaging market include International Paper Co.; WestRock Company; GWP Packaging; Bansal Papertube Industries (P) Ltd.; Cosmo Films; Moti Packaging; Volmar Packaging srl; TOPPAN Inc.; SUPERPACKS; Fibre Foils; Smurfit Kappa; Zipform Packaging; YANTAI SHENHAI PACKAGING CO.,LTD.

b. Increasing consumer demand and regulatory pressure for sustainable, recyclable, and reduced environmental-impact packaging solutions are propelling the composite packaging market's growth.

b. The global composite packaging market size was estimated at USD 50.56 billion in 2024 and is expected to reach USD 52.77 billion in 2025.

b. The global composite packaging market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 69.53 billion by 2030.

b. Based on application, the food & beverage segment recorded the largest market share of over 33.0% in 2024. Composite packaging is widely used in the food & beverage industry due to its ability to offer excellent barrier properties against moisture, oxygen, and contaminants.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.