- Home

- »

- Plastics, Polymers & Resins

- »

-

Compostable & Biodegradable Refuse Bags Market Report, 2030GVR Report cover

![Compostable & Biodegradable Refuse Bags Market Size, Share & Trends Report]()

Compostable & Biodegradable Refuse Bags Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (PLA, PHA, PBAT, PBS), By Capacity, By Application (Retail & Consumer, Industrial, Institutional), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-472-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Compostable & Biodegradable Refuse Bags Market Summary

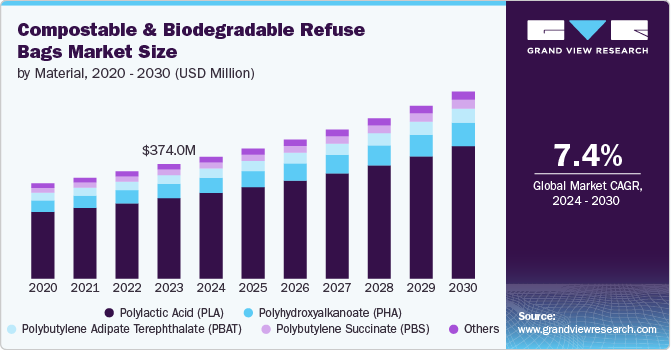

The global compostable & biodegradable refuse bags market size was estimated at USD 374.01 million in 2023 and is projected to reach USD 610.48 million by 2030, growing at a CAGR of 7.4% from 2024 to 2030. The market growth is driven by a combination of environmental concerns, regulatory frameworks, consumer preferences, and advancements in material science.

Key Market Trends & Insights

- Europe dominated the compostable & biodegradable refuse bags market, with a revenue share of 43.04% in 2023.

- The compostable & biodegradable refuse bags market in North America is expected to grow at the fastest CAGR from 2024 to 2030.

- By material, the polylactic acid (PLA) segment led the market, with the largest revenue share of 70.31% in 2023.

- By capacity, the 30 to 40 gallons segment led the market with the largest revenue share in 2023.

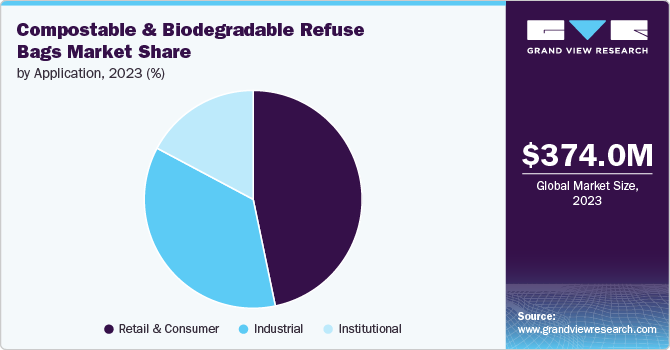

- By application, the retail & consumer segment led the market, with the largest revenue share of 46.80% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 374.01 Million

- 2030 Projected Market Size: USD 610.48 Million

- CAGR (2024-2030): 7.4%

- Europe: Largest market in 2023

One key factor is the growing global awareness of environmental sustainability, with consumers and businesses increasingly seeking alternatives to conventional plastic bags. Traditional plastic refuse bags contribute significantly to pollution, as they take hundreds of years to decompose. In contrast, compostable and biodegradable refuse bags are designed to break down naturally within a much shorter time frame, reducing environmental impact. This shift is evident in regions such as Europe and North America, where bans or taxes on single-use plastics have accelerated the adoption of eco-friendly alternatives.

The regulatory push from governments and international organizations is positively influencing the market growth. Many governments have introduced legislation that promotes the use of compostable and biodegradable refuse bags. The European Union's Single-Use Plastics Directive is an example of a regulatory initiative that has propelled the demand for biodegradable alternatives. Similarly, in the U.S., certain states, such as California and New York, have passed laws banning or limiting the use of single-use plastic bags, encouraging the shift towards biodegradable refuse bags.

Consumer behavior and preferences also play a significant role in driving this market. As people become more environmentally conscious, there is a growing preference for sustainable products, including biodegradable refuse bags. Many consumers are willing to pay a premium for products that align with their values of environmental responsibility. Major retailers and brands have responded to this demand by offering eco-friendly bag options. For example, companies such as BioBag and EcoSafe provide a range of compostable bags that cater to both individual consumers and businesses, further accelerating the adoption of such products.

Material Insights

Based on material, the global market has been segmented into polylactic acid (PLA), polybutylene succinate (PBS), polybutylene adipate terephthalate (PBAT), polyhydroxyalkanoate (PHA), and others. The polylactic acid (PLA) segment led the market with the largest revenue market share of 70.31% in 2023 and is expected to witness at a robust CAGR of 7.5% over the forecast period. It a biopolymer derived from renewable resources such as corn starch or sugarcane. PLA is widely used in compostable and biodegradable refuse bags due to its ease of processing and relatively low cost. PLA offers good mechanical properties and is transparent, making it versatile for different applications.

Polybutylene succinate (PBS) is a biodegradable aliphatic polyester with good thermal and mechanical properties. It is often used in combination with other biodegradable materials, such as PLA or PBAT, to enhance flexibility and strength in refuse bags. PBS is recognized for its high biodegradability and ability to degrade in both soil and water environments, making it suitable for various ecological applications.

Capacity Insights

Based on capacity, the global market has been segmented into 7 to 20 gallons, 20 to 30 gallons, 30 to 40 gallons, 40 to 55 gallons, and above 55 gallons. The 30 to 40 gallons segment led the market with the largest revenue market share of 33.09% in 2023. The 30 to 40-gallon compostable refuse bags are widely used in both residential and commercial settings, particularly for managing larger volumes of organic waste. This segment is often associated with garden and yard waste disposal as well as larger kitchens and food service operations that require greater capacity for organic refuse.

Bags with capacities above 55 gallons are designed for industrial-scale waste management and large public events where substantial amounts of compostable materials are generated. These bags are durable and capable of holding large volumes of waste, making them suitable for municipal waste programs and agricultural or industrial applications.

The 7 to 20-gallon segment in the global market primarily caters to small-scale applications such as household kitchens, office spaces, and bathrooms. These bags are widely used for managing daily waste, particularly organic or compostable materials. Their compact size makes them suitable for indoor bins and convenient for homes with minimal waste output, promoting easy waste separation and disposal.

Application Insights

Based on the application, the market is segmented into retail & consumer, industrial, and institutional. The retail & consumer segment led the market with the largest revenue share of 46.80% in 2023. In the retail & consumer segment, compostable and biodegradable refuse bags are primarily used by households for waste management, including food scraps and general household waste.

The industrial segment focuses on large-scale waste management needs in sectors such as manufacturing, construction, and agriculture. Industries generating substantial organic waste prefer compostable and biodegradable bags to align with sustainability initiatives and reduce their environmental footprint. The shift toward circular economy models and corporate sustainability commitments are key driving factors in this segment. In addition, regulatory requirements mandating the use of eco-friendly materials for waste disposal in industries further drive demand.

The institutional segment includes the use of compostable and biodegradable refuse bags in settings such as hospitals, schools, hotels, and restaurants. These institutions often produce significant amounts of organic waste and seek sustainable waste management solutions to comply with environmental standards. The push for green certification and increasing consumer expectations for eco-friendly practices in the hospitality, education, and healthcare sectors drive the adoption of compostable refuse bags. Furthermore, government incentives and stricter waste disposal policies in institutions promote the use of biodegradable options.

Regional Insights

The compostable & biodegradable refuse bags market in North America is anticipated to grow at the fastest CAGR during the forecast period. The region's well-established waste management infrastructure and growing emphasis on composting programs have also contributed to market growth. Cities such as San Francisco, Seattle, and Portland have implemented mandatory composting laws, requiring residents and businesses to separate organic waste. This has led to an increased demand for compostable bags that can be used to collect and dispose of organic waste without contaminating the composting process. In addition, many grocery stores, restaurants, and other businesses in North America are voluntarily adopting compostable bags as part of their sustainability initiatives, further driving market expansion.

U.S. Compostable & Biodegradable Refuse Bags Market Trends

The compostable & biodegradable refuse bags market in the U.S. is growing due to the increasing environmental awareness and concern about plastic pollution in the country. Many U.S. cities and states have implemented bans or restrictions on single-use plastic bags, creating a demand for alternative solutions. For example, California banned single-use plastic bags statewide, while cities such as New York and Chicago have followed suit. This legislative push has encouraged consumers and businesses to seek out more eco-friendly options, including compostable and biodegradable refuse bags.

Europe Compostable & Biodegradable Refuse Bags Market Trends

Europe dominated the compostable & biodegradable refuse bags market with the largest revenue share of 43.04% in 2023. Europe has emerged as a leader in driving market growth due to a combination of stringent environmental regulations, growing consumer awareness, and government initiatives. The European Union has implemented several directives aimed at reducing plastic waste and promoting sustainable alternatives. For instance, the EU Plastics Strategy, adopted in 2018, sets targets for all plastic packaging to be recyclable or reusable by 2030. This has created a strong incentive for businesses and consumers to switch to more environmentally friendly options like compostable and biodegradable bags.

The compostable & biodegradable refuse bags market in UK is primarily driven due to the stringent regulations aimed at reducing plastic waste and promoting sustainable alternatives. For instance, the UK Plastics Pact, launched in 2018, set ambitious targets for eliminating problematic plastics and increasing the use of recyclable, reusable, or compostable packaging. This regulatory push has incentivized manufacturers and retailers to invest in compostable and biodegradable refuse bag options. Major supermarket chains like Tesco and Sainsbury's have begun offering compostable bags for fruit and vegetables, setting a precedent for wider adoption in the refuse bag sector.

Asia Pacific Compostable & Biodegradable Refuse Bags Market Trends

The compostable & biodegradable refuse bags market in Asia Pacific is expected to grow at a significant CAGR during the forecast period. The region's rapid urbanization and growing middle class are contributing to higher waste generation rates, particularly in countries like Indonesia, Vietnam, and the Philippines. This has led to a greater need for effective waste management solutions, including biodegradable refuse bags. For example, Jakarta, Indonesia's capital, produces around 7,000 tons of waste daily, creating a significant market opportunity for eco-friendly waste disposal products.

The China compostable & biodegradable refuse bags market is anticipated to grow at a substantial CAGR during the forecast period. Increasing environmental awareness and stricter regulations across the country are driving the market growth. As the world’s largest consumer of plastics, China has been under pressure to manage its waste effectively. In recent years, the Chinese government has implemented strict regulations and policies aimed at reducing single-use plastics, including bans on non-degradable plastic bags in major cities. The 2020 nationwide ban on non-degradable plastic bags for all major urban areas, including shopping malls and restaurants, created a significant demand for alternative, eco-friendly materials, including compostable and biodegradable refuse bags.

Key Compostable & Biodegradable Refuse Bags Company Insights

The competitive environment of the market is shaped by a growing emphasis on sustainability, driving innovation among both established and emerging players. Key companies lead the market with advanced biodegradable materials and a strong focus on R&D. Smaller, and niche manufacturers are also entering the space, leveraging regional demand for eco-friendly alternatives. The market is highly fragmented, with players differentiating through product certifications, material sourcing, and composability standards. Intense competition is driven by consumer preference for environmentally friendly products and increasing government regulations encouraging sustainable waste management solutions.

Key Compostable & Biodegradable Refuse Bags Companies:

The following are the leading companies in the compostable & biodegradable refuse bags market. These companies collectively hold the largest market share and dictate industry trends.

- Mondi

- Sphere Group

- Vegware Global

- VICTOR Güthoff & Partner GmbH

- Cedo Ltd.

- BioBag International AS

- PLAST-UP

- Polybags Ltd

- Clondalkin Group Holdings B.V.

- Plastiroll Oy Ltd

- The Biodegradable Bag Company Ltd

- QuickPack Haushalt + Hygiene GmbH

- The Compost Bag Company

- SIMPAC

- TERDEX GmbH

Recent Developments

-

In September 2023, Coles introduced certified compostable bags for fresh produce across all its stores in South Australia as part of its commitment to sustainability. This initiative aims to replace single-use plastic bags, with the expectation of eliminating 28.0 million plastic produce bags annually from circulation

-

In September 2022, BIOLO launched the first home compostable bags made from a revolutionary plant-based plastic alternative known as polyhydroxyalkanoate (PHA), which is TÜV certified for biodegradation in soil, freshwater, and marine environments. BIOLO's bags break down in various bioactive settings without leaving harmful residues or micro plastics. This innovation aims to address the growing plastic waste crisis by providing sustainable packaging solutions that perform comparably to traditional plastics while supporting businesses in their sustainability goals across multiple industries, including e-commerce and food service

Compostable & Biodegradable Refuse Bags Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 397.78 million

Revenue forecast in 2030

USD 610.48 million

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030

Report coverage

Volume Forecast, Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, capacity, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Mondi; Sphere Group; Vegware Global; VICTOR Güthoff & Partner GmbH; Cedo Ltd.; BioBag International AS; PLAST-UP; Polybags Ltd; Clondalkin Group Holdings B.V.; Plastiroll Oy Ltd; The Biodegradable Bag Company Ltd; QuickPack Haushalt + Hygiene GmbH; The Compost Bag Company; SIMPAC; TERDEX GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Compostable & Biodegradable Refuse Bags Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global compostable & biodegradable refuse bags market report based on the material, capacity, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polylactic Acid (PLA)

-

Polybutylene Succinate (PBS)

-

Polybutylene Adipate Terephthalate (PBAT)

-

Polyhydroxyalkanoate (PHA)

-

Others

-

-

Capacity Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

7 to 20 Gallons

-

20 to 30 Gallons

-

30 to 40 Gallons

-

40 to 55 Gallons

-

Above 55 Gallons

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Retail & Consumer

-

Industrial

-

Institutional

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global compostable & biodegradable refuse bags market was estimated at USD 374.01 million in 2023 and is expected to reach USD 397.78 million in 2024.

b. The global compostable & biodegradable refuse bags market is expected to grow at a compound annual growth rate of 7.4% from 2024 to 2030, reaching around USD 610.48 million by 2030.

b. Polylactic acid (PLA) dominated the overall market with a revenue market share of over 70.0% in 2023. It is a biopolymer derived from renewable resources such as corn starch or sugarcane. PLA is widely used in compostable and biodegradable refuse bags due to its ease of processing and relatively low cost. PLA offers good mechanical properties and is transparent, making it versatile for different applications.

b. Some of the key players in compostable and biodegradable refuse bags include Mondi, Sphere Group, Vegware Global, VICTOR Güthoff & Partner GmbH, Cedo Ltd., BioBag International AS, PLAST-UP, Polybags Ltd, Clondalkin Group Holdings B.V., Plastiroll Oy Ltd, The Biodegradable Bag Company Ltd, QuickPack Haushalt + Hygiene GmbH, The Compost Bag Company, SIMPAC, and TERDEX GmbH.

b. The market for compostable and biodegradable refuse bags is driven by a combination of environmental concerns, regulatory frameworks, consumer preferences, and advancements in material science.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.