- Home

- »

- Clinical Diagnostics

- »

-

Comprehensive Metabolic Panel Testing Market Report, 2030GVR Report cover

![Comprehensive Metabolic Panel Testing Market Size, Share & Trends Report]()

Comprehensive Metabolic Panel Testing Market (2025 - 2030) Size, Share & Trends Analysis Report By Analytes (K+, Na+, Cl-, CO2), By Disease (Kidney Disease, Diabetes), By End-use (Laboratory, PoC), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-747-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

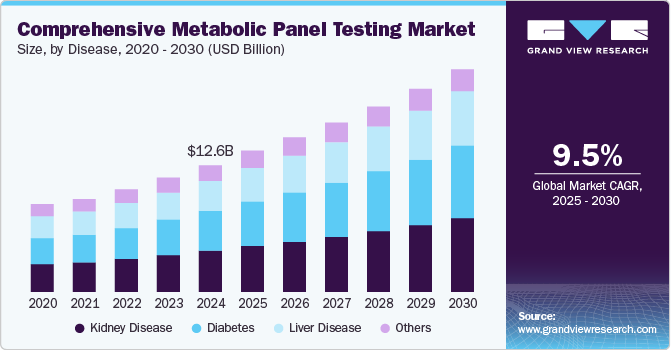

The global comprehensive metabolic panel testing market size was valued at USD 12.58 billion in 2024 and is expected to grow at a CAGR of 9.5% from 2025 to 2030. Factors such as the rising prevalence of chronic diseases and emphasis on early diagnosis and treatment are expected to drive the demand for comprehensive metabolic panel (CMP) testing. The high prevalence of lifestyle-associated diseases, such as obesity, smoking, unhealthy eating habits, and lack of physical activity, is among the factors responsible for increasing the incidence of chronic diseases. The growth in the geriatric population is driving the market as they are more prone to diabetes and cardiovascular diseases. According to the World Health Organization (WHO), over 1 billion people are over 60 years and are estimated to reach 1.4 billion by 2030.

Diabetes is one of the fastest-growing diseases in the world, widening the patient pool for point-of-care (PoC) CMP testing. The increasing prevalence of diabetes, cardiovascular diseases, and other target diseases is anticipated to boost the demand for CMP testing over the forecast period. Cardiovascular diseases are fatal and are considered the leading cause of death worldwide. According to the WHO, cardiovascular diseases (CVDs) cause 17.9 million deaths annually.

The healthcare industry largely depends on regulatory frameworks established by organizations such as the U.S. Food and Drugs Administration (FDA) and the European Medicines Agency (EMA). Regulatory bodies such as the Clinical Laboratory Improvement Amendments (CLIA) regulate the approval of these tests, and government bodies set the fee waiver and the reimbursement for Medicare and Medicaid. The FDA has control over the Laboratory-Developed Tests (LDTs), which refer to in-house clinical laboratories developing tests, delivering efficient and rapid results. For instance, in 2020, the EU4Health program was initiated, and health is considered an investment. The EU4Health program, with a budget of over USD 5.8 billion for 2021-27, is a significant financial support from the EU in the health sector. This program reflects the EU's commitment to prioritizing public health and plays a crucial role in moving toward establishing a European Health Union.

Reimbursement and regulatory bodies in Europe impose stringent laws. Most European manufacturers set their pricing based on the Return on Investment (RoI) and follow value-based pricing. There is an oversupply of redundant testing products and many products with similar indications. However, this has led to lower pricing, faster processing time, and wider availability of the products.

The introduction of innovative solutions for enhancing efficiency and minimizing errors is expected to boost the CMP testing market growth over the forecast period. Integrated workflow management systems and database management tools are gaining importance, with companies processing several thousand samples per year. Development and execution of various bioinformatics and data management solutions, coupled with the emergence of automated laboratory systems, indicate a prosperous future for the market.

Analytes Insights

The glucose segment led the market and accounted for the largest revenue share of 11.0% in 2024. Blood sugar is another name for glucose. Blood glucose may be measured with a CMP. A form of sugar called glucose gives your body and brain energy. A high fasting blood glucose level is frequently an indication of Type 2 diabetes. According to the International Diabetes Federation (IDF), over 540 million people are suffering from diabetes worldwide, and by 2045, the numbers are expected to cross the 780 million mark.

The K+ segment is expected to grow at the fastest CAGR of 10.0% over the forecast period. The CMP test helps physicians detect or monitor renal illness, the most common cause of excessive potassium levels. It also offers information on the body's fluid balance, electrolytes such as potassium levels, and how well the liver and kidneys are functioning. When a patient exhibits symptoms of high blood pressure or cardiac issues, these tests are prescribed. In the U.S., chronic kidney disease (CKD) has developed into a public health issue.

Disease Insights

The kidney diseases dominated the global comprehensive metabolic panel testing market and accounted for the largest revenue share of 32.4% in 2024, driven by a high disease prevalence and maximum utilization of analytes. Renal anomalies could arise from other comorbidities, such as diabetes and high blood pressure. Nearly 50% of patients had a history of cardiovascular disease or diabetes. Lack of early symptoms poses a challenge to the early diagnosis of the disease.

The diabetes segment is expected to grow at the fastest CAGR of 10.3% over the forecast period. Nearly 50% of diabetics remain undiagnosed, presenting a lucrative opportunity for growth for the comprehensive metabolic panel testing market. Abbott partnered with important health tech companies BeatO, PharmEasy, GOQii, and Sugar.fit, 1MG, Zyla Health, Fitterfly, and HealthifyMe in February 2022 to usher in a new era of comprehensive diabetes management treatment. With the help of these partnerships, Abbott hopes to cure 8 million diabetics.

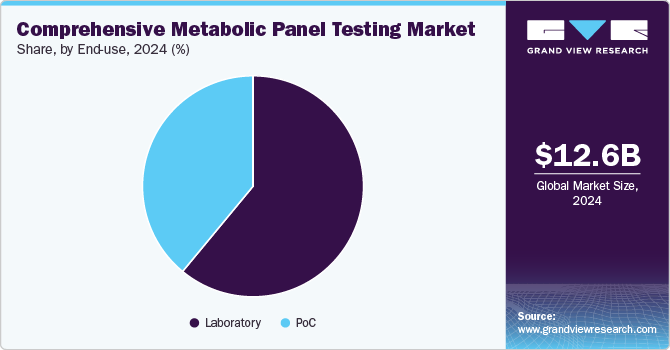

End Use Insights

The laboratories segment held the dominant position in the market with the largest revenue share of 60.5% in 2024, driven by easy availability, high market penetration, increased usage, and clinically significant results. Some laboratories may be in/and affiliated with hospitals, blood banks, and specialized diagnostic centers. Among laboratories, the emergency department held the largest revenue share in 2024. Furthermore, the extensive presence of ancillary support, in terms of manpower and infrastructure, is a key propeller for market growth.

The PoC segment is expected to grow at the fastest CAGR of 10.3% from 2025 to 2030. The PoC CMP tests are driven by their ease of operation, portability, speed of results, and lower requirements for the sample. Among PoC, telemedicine is expected to grow at a fastest CAGR of 10.6% owing to digitization and ease of availability. Abbott has provided Henry Schein Medical with two complete diagnostic solutions that comply with Clinical Laboratory Improvement Amendments (CLIA) and allow for testing, diagnosing, and treating patients in the same visit.

Regional Insights

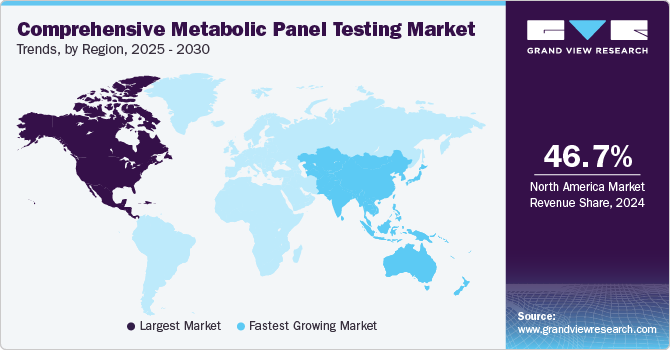

North America comprehensive metabolic panel testing market dominated the global market and accounted for the largest revenue share of 46.7% in 2024, owing to strong commercial performances of CMP diagnostics in the U.S. High disease burden, rising consumer awareness, technological advancements, proactive government measures, and improvements in healthcare infrastructure are some of the major contributors of market growth. Furthermore, the presence of key players is projected to bode well for the demand for CMP testing.

U.S. Comprehensive Metabolic Panel Testing Market Trends

The comprehensive metabolic panel testing market in the U.S. dominated the North American market and held the largest revenue share in 2024, fueled by the high prevalence of chronic diseases such as diabetes and kidney disorders. Advanced healthcare infrastructure supports widespread diagnostic services, while proactive government measures and insurance coverage encourage routine screenings. In addition, technological developments, including point-of-care testing and AI-assisted diagnostics, enhance accuracy and accessibility, driving adoption. Furthermore, the increasing popularity of direct-to-consumer testing platforms enables individuals to manage their health proactively, boosting market expansion.

Asia Pacific Comprehensive Metabolic Panel (CMP) Testing Market Trends

Asia Pacific comprehensive metabolic panel testing market is expected to grow at the fastest CAGR of 12.4% over the forecast period, driven by improvements in healthcare infrastructure, a rise in the number of older people, who are more susceptible to chronic illnesses, growth in consumer awareness, a rise in disposable income, and overall economic development. According to the Asian Development Bank, in Asia and the Pacific, one in four persons will be older than 60 by 2050. Between 2010 and 2050, the region's elderly population is projected to quadruple. The market in emerging countries such as China, India, and South Korea is expected to witness rapid growth in demand for CMP testing during the forecast period.

The comprehensive metabolic panel testing market in Japan led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by its rapidly aging population, which necessitates regular health screenings for chronic conditions like diabetes and cardiovascular diseases. Furthermore, the country's focus on preventive healthcare aligns with rising awareness of lifestyle-related diseases. Innovations such as automated analyzers and point-of-care testing streamline diagnostics, addressing the needs of elderly patients. Moreover, government initiatives to improve healthcare access and promote early disease detection further accelerate demand for CMP tests in Japan's healthcare system.

Europe Comprehensive Metabolic Panel (CMP) Testing Market Trends

The European comprehensive metabolic panel testing market is expected to grow significantly over the forecast period, owing to a strong emphasis on preventive healthcare and early diagnosis of chronic conditions. In addition, rising cases of lifestyle-related diseases, coupled with advancements in diagnostic technologies, fuel market growth. Furthermore, the integration of AI and machine learning enhances diagnostic accuracy and efficiency across laboratories. Moreover, increasing investments in healthcare infrastructure and accessibility to point-of-care testing contribute to the expansion of CMP testing services across European nations.

Key Comprehensive Metabolic Panel Testing Company Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and grow their global reach. The following are some of the major participants in the comprehensive metabolic panel testing market:

-

Quest Diagnostics manufactures and delivers a wide range of laboratory tests, including biomarker panels for diabetes, kidney function, and cardiovascular risk assessment. Operating in the clinical diagnostics segment, Quest Diagnostics focuses on offering advanced testing solutions through its laboratories and digital platforms, enabling healthcare providers and individuals to access accurate and timely health insights.

-

Sonic Healthcare provides diagnostic solutions that assess metabolic functions, organ health, and chronic disease risks. It operates in the medical diagnostics segment, offering services through its network of laboratories and healthcare facilities. The company emphasizes precision diagnostics by integrating advanced technologies to support the early detection and management of diseases, catering to both healthcare providers and patients worldwide.

Key Comprehensive Metabolic Panel Testing Companies:

The following are the leading companies in the comprehensive metabolic panel testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Quest Diagnostics

- Laboratory Corporation of America Holdings Limited

- Sonic Healthcare

- Unipath

- SYNLAB International GmbH

- ARUP Laboratories

- Genoptix Inc.

- Nova Medical

Recent Developments

-

In May 2024, Nova Biomedical received FDA clearance for its Stat Profile Prime Plus analyzer, enhancing critical care diagnostic testing. This analyzer now supports micro-capillary sample mode, requiring only 90 microliters of capillary blood for an 11-test panel or 135 microliters for a 22-test profile.

Comprehensive Metabolic Panel Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.02 billion

Revenue forecast in 2030

USD 22.07 billion

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

April 2025

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Analytes, disease, end use, and region.

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; and Kuwait

Key companies profiled

Abbott; Quest Diagnostics; Laboratory Corporation of America Holdings Limited; Sonic Healthcare; Unipath; SYNLAB International GmbH; ARUP Laboratories; Genoptix Inc.; Nova Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Comprehensive Metabolic Panel Testing Market Report Segmentation

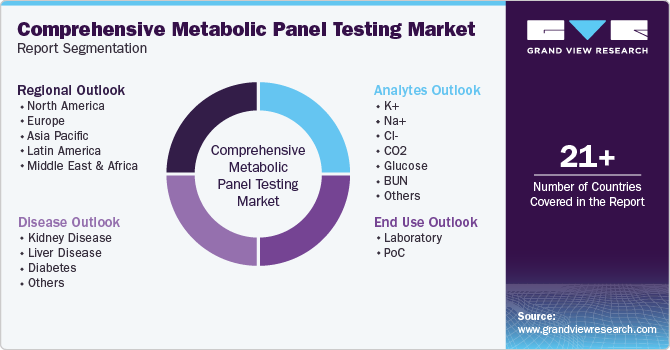

This report forecasts revenue growth at global, regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global comprehensive metabolic panel testing market report based on analytes, disease, end use, and region:

-

Analytes Outlook (Revenue, USD Million, 2018 - 2030)

-

K+

-

Na+

-

Cl-

-

CO2

-

Glucose

-

BUN

-

Creatinine

-

Ca++

-

Albumin

-

Total protein

-

ALP

-

ALT

-

AST

-

Total bilirubin

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Kidney Disease

-

Liver Disease

-

Diabetes

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory

-

Emergency dept.

-

Hospital wards

-

Primary care

-

Pharmacy

-

Telemedicine

-

-

PoC

-

Emergency dept.

-

Hospital wards

-

Primary care

-

Pharmacy

-

Telemedicine

-

-

PoC (Instruments)

-

Piccolo Xpress

-

Skyla-HB1

-

DRI-CHEM NX500

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.