- Home

- »

- Clinical Diagnostics

- »

-

Laboratory Developed Tests Market Size, Share Report, 2030GVR Report cover

![Laboratory Developed Tests Market Size, Share & Trends Report]()

Laboratory Developed Tests Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Immunoassay, Molecular Diagnostics), By Application (Oncology, Nutritional & Metabolic Disease), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-010-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Laboratory Developed Tests Market Summary

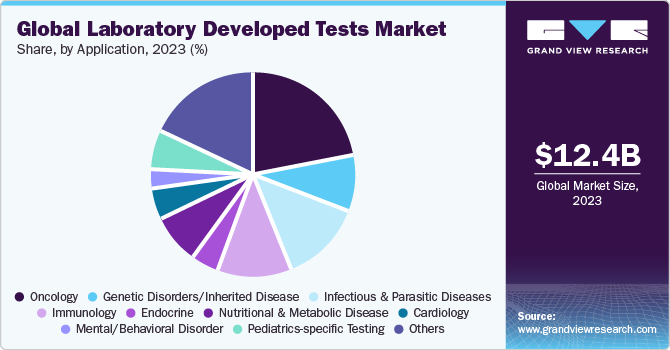

The global laboratory developed tests market size was estimated at USD 12.36 billion in 2023 and is projected to grow at a CAGR of 7.05% from 2024 to 2030. The market growth is attributed to the rising prevalence of cancer and genetic disorders, aided by the rising number of product launches.

Key Market Trends & Insights

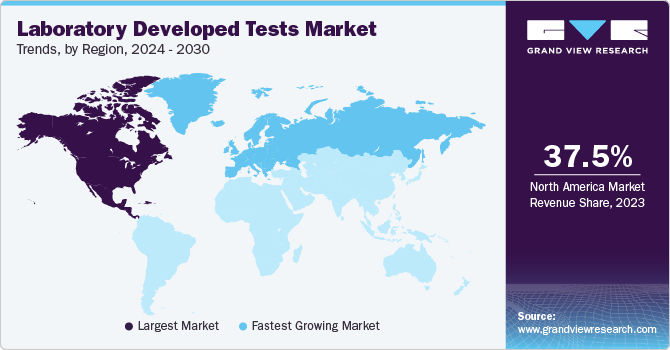

- North America dominates the laboratory developed tests market with a revenue share of 37.53% in 2023.

- By technology, the molecular diagnostics segment led the market with the largest revenue share of 25.73% in 2023.

- By application, the oncology segment led the market with the largest revenue share of 22.15% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 12.36 Billion

- 2030 Projected Market Size: USD 19.85 Billion

- CAGR (2024-2030): 7.05%

- North America: Largest market in 2023

As per the National Cancer Institute, incidence of cancer is expected to increase to 23.6 million by 2030.

Laboratory developed test (LDT) regulations are important for advancements in precision oncology because various tests are used for selection of therapy and to determine risk. Moreover, the increase in adoption of personalized medicines is further anticipated to fuel market growth.

Genetic testing has been made widely available for direct consumer purchase for complex and common diseases. It is usually available through online channels, without the involvement of a healthcare professional. In 2017, FDA authorized the first DTC genetic test developed by 23andMe-PGS Genetic Health Risk test. This test would provide information about the risk of developing genetic diseases.

LDTs are important tools to rapidly incorporate new information and decide which drug to utilize for personalized therapy. They enable treatments to shift from a “one drug fits all” approach to a much more personalized approach based on the unique genetics of each person and their disease. Tests developed in the laboratory are critical in public health defense by allowing the identification of Severe Acute Respiratory Syndrome (SARS) or avian flu. Individualized laboratories perform and develop these tests, offering reliable and early diagnosis for several rare and complex diseases.

Furthermore, a significant number of product launches by key players have contributed to the market growth. Several LDTs, such as Invitae's Personalized Cancer Monitoring (PCM) test, which is accessible since June 2022 under an early-access program, have been made available in 2022. Although PCM is useful for tracking the development of lung cancer, the company plans to broaden its use as a pan-cancer monitoring test. Furthermore, in September 2021, Journey Biosciences announced the launch of NaviDKD diagnostic screening technology, which would help manage and prevent the risk of kidney complications related to diabetes.

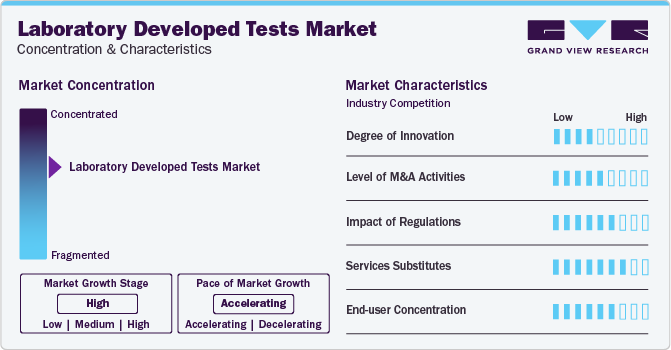

Market Concentration & Characteristics

Market growth stage is high, and pace of the growth is accelerating. The market is characterized by a high degree of innovation owing to the rising adoption of personalized medicine. LDTs are developed in-house out of necessity. Previously, lab-developed tests could be rapidly launched and developed as deployment does not require prior authorization or approval by a government agency. This makes LDTs efficient and responsive in situations where rapid adoption is required to adapt to changing circumstances or when the biomarkers that need to be measured have not yet been identified or standardized.

The market is also characterized by a high level of partnership and collaboration activity by the leading players. It is one of the most adopted strategies by players to enhance early commercialization of their products and improve the availability of products.

In November 2021, Human Health Services announced the withdrawal of an administration policy that directed the FDA to not include LDTs for premarket review, a category most adopted during the pandemic. According to the new legislation, the LDTs would require traditional marketing or emergency use authorization before commercialization. The shift in regulatory standards is expected to increase the reliability & accuracy of COVID-19 tests and enhance access to at-home diagnostics

LDT products with molecular diagnostic capabilities deliver effective results. Moreover, these tests allow early detection of diseases, maintaining a low threat of substitutes, whereas high prices of these tests are anticipated to encourage patients to shift to externally available substitutes. In addition, for detection of newer infections like SARS-CoV-2, the rate of internal substitution is high, which fuels the competitive rivalry, resulting in a moderate threat of substitutes.

End-user concentration is a significant factor in the global market. Diagnostics laboratories are preferred for care due to availability of various services under one roof. Molecular laboratories are dependent on robust molecular diagnostic techniques to integrate RNA/DNA sequences for detection of sequence variants linked with a particular prognosis, diagnosis, or therapeutic response. These tests are widely accepted by laboratories to keep abreast with new molecular discoveries and bring new discoveries to clinical practice.

Technology Insights

Based on technology, the molecular diagnostics segment led the market with the largest revenue share of 25.73% in 2023, attributed to the high adoption of molecular diagnostics tests for detection of all major parasitic, bacterial, and viral infections. Drawbacks of traditional molecular testing, such as complexity in growing organisms in manually equipped culture media, long turnaround time, absence of sensitivity, and poor in vitro kinetics have been addressed in advanced technologies, such as in situ hybridization and PCR. Some of the key pathogens usually diagnosed using multiplex PCR are Leishmania spp (leishmaniasis); C. parvum (diarrheal diseases); HSV-2 (meningitis & encephalitis); and HIV-1 & H. influenza.

The immunoassays segment is anticipated to grow at the fastest CAGR over the forecast period. The growth of the segment is attributed to the rising applications associated with immunoassays. Key applications of immunology are detection of infectious microbes, such as fungi, bacteria, and viruses, by detecting presence of their toxins.Moreover, key players are focusing on R&D about development of new immunological diagnostic instruments for assessment of individuals suspected of immune deficiency. For instance, in January 2023, Quanterix expanded its laboratory developed test portfolio with introduction of neurofilament light chain tests. This novel blood test increases crucial brain health biomarkers that help provide optimum clinical care and advance research.

Application Insights

Based on application, the oncology segment led the market with the largest revenue share of 22.15% in 2023. This is attributable to the increasing prevalence of cancer which further propels the demand for IVD.According to WCRF International, in 2020, there were an estimated 18.1 million new cases globally, out of which, 8.8 million were women and 9.3 million were men. Cancer is estimated to be the second most common cause of death in the U.S. Genomic and genetic variation molecular tests have become a crucial part of managing breast cancer. These tests can help predict breast cancer in patients with a family history of the condition. Moreover, growing awareness about the need for early diagnosis is expected to impel demand for oncology related LDTs.

The nutritional and metabolic disease segment is projected to witness at the fastest CAGR over the forecast period. Modern metabolomics is primarily defined by the use of mass spectrometry-based techniques in conjunction with bioinformatics data processing, which enables quick and complex study of metabolites with a high diagnostic accuracy of 90%-95%. Metabolomics fingerprinting and metabolomics profiling are the two most popular techniques used for studying metabolites.FDA and clinically approved complex metabolic diagnostic tests are not yet available. Only two relevant publications were found when searching for “metabolomics and laboratory test” in PubMed on March 25, 2021, which is a requirement for the development of the first comprehensive metabolomics test intended to identify Parkinson's disease in its early stages.

Regional Insights

North America dominates the laboratory developed tests market with a revenue share of 37.53% in 2023. This high share is owing to increasing healthcare expenditure, prevalence of chronic diseases, geriatric population, and government funding. Moreover, the outbreak of coronavirus positively impacted growth. The number of tests increased due to the outbreak of COVID-19 in response to increased demand for quick on-site screening.Furthermore, with the increasing prevalence of cancer and the rapid development of diagnosis, the market is undergoing significant growth. For instance, in June 2022, Neogenomics announced data on its LDT RaDaR assay for the detection of minimal residual disease (MRD) by its subsidiary Inivata Ltd.

U.S. Laboratory Developed Tests Market Trends

The laboratory developed tests market in the U.S. is expected to grow at the fastest CAGR over the forecast period. Several key market players operating in the LDT market are introducing new products and entering into several strategic alliances, which is contributing to the country’s market growth.

Europe Laboratory Developed Tests Market Trends

The laboratory developed tests market in Europe was identified as a lucrative region in this industry. Several initiatives are taken by various companies in Europe to develop and commercialize LDTs. These initiatives demonstrate the growing importance of LDTs in the European diagnostic market and the significant investment being made by companies to develop & commercialize new diagnostic solutions.

The UK laboratory developed tests market is expected to grow at the fastest CAGR over the forecast period, due to presence of several key companies in the diagnostic industry, including Roche, Illumina, and Thermo Fisher Scientific, as well as smaller companies that focus on niche areas of diagnostics.

The laboratory developed tests market in France is expected to grow at the fastest CAGR over the forecast period. There have been several advancements in the field of LDTs in France. The healthcare system emphasizes the use of innovative technologies to improve patient outcomes, which has boosted the demand for LDTs in the country.

The Germany laboratory developed tests market is expected to grow at the fastest CAGR over the forecast period, due to strong presence of several companies in Germany, such as Roche Diagnostics, QIAGEN, bioMérieux, Siemens Healthineers, and Agilent Technologies, is involved in the development of LDTs, which focus on the development of innovative solutions for the healthcare industry.

Asia Pacific Laboratory Developed Tests Market Trends

The laboratory developed tests market in Asia Pacific growth is attributed to the rising initiatives being taken in the region to develop & commercialize LDTs which includes collaboration among academic institutions and research centers to develop new LDTs and validate their performance. This allows them to access the latest research and scientific knowledge, as well as benefit from the expertise of academic researchers. There is growing importance of LDTs in the European diagnostic market and the significant investment being made by companies to develop & commercialize new diagnostic solutions which fuel the market growth in the region.

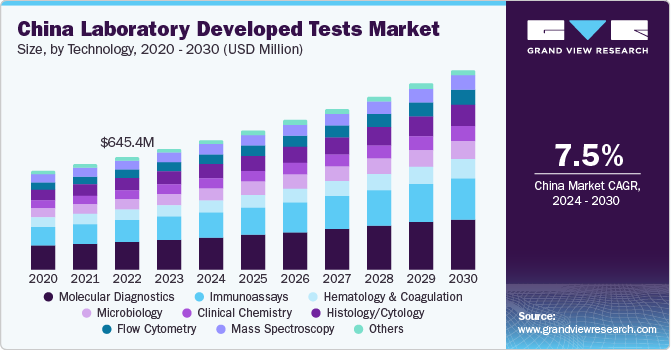

The China laboratory developed tests market is expected to grow at the fastest CAGR over the forecast period. This is due to various initiatives undertaken by government, such as free cervical cancer screening campaigns for women of all ages and collaborations with nonprofit organizations to improve the accessibility of the tests.

The laboratory developed tests market in Japan is expected to grow at the fastest CAGR over the forecast period, owing to high government investment to reduce cancer prevalence. Many initiatives, such as government grants to various research institutes and companies, can help develop practical solutions to battle cancer.

Latin America Laboratory Developed Tests Market Trends

The laboratory developed tests market in Latin America was identified as a lucrative region in this industry. Increasing government expenditure on R&D, presence of skilled healthcare professionals, rising focus of multinational pharmaceutical companies in the clinical diagnostics sector, and increase in patient awareness levels are expected to drive market growth over the forecast period.

The Brazil laboratory developed tests market is expected to grow at the fastest CAGR over the forecast period, due to the rising prevalence of chronic diseases in the country due to the moderate standards of living, further increasing the need for advanced diagnostic and treatment options.

MEA Laboratory Developed Tests Market Trends

The laboratory developed tests market in MEA was identified as a lucrative region in this industry. The increasing prevalence of chronic diseases created a significant need for enhanced diagnostic tools and therapeutic alternatives in the country.

The Saudi Arabia laboratory developed tests market is expected to grow at the fastest CAGR over the forecast period, owing to the rapid launch of new products in the region and increasing number of government initiatives.

Key Laboratory Developed Tests Company Insights

Some of the key players operating in the global market include Illumina, Inc., QIAGEN, F. Hoffmann-La Roche Ltd., and Guardant Health.These players are involved in the development of novel NGS platforms and services that offer portability as well as efficiency of sequencing. Ambry Genetics,Epic Sciences, HelixDiagnostics are some of the emerging market participants in the global market. These companies are focusing on continually expanding the understanding of biology and human genome behind genetic diseases to develop novel platforms.

Key Laboratory Developed Tests Companies:

The following are the leading companies in the laboratory developed tests market. These companies collectively hold the largest market share and dictate industry trends.

- Quest Diagnostics Incorporated.

- 23andMe, Inc.

- Abbott

- Guardant Health

- NeoGenomics Laboratories.

- Siemens Healthineers AG

- QIAGEN

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

Recent Developments

-

In January 2023, QIAGEN entered into a partnership with Helix to advance NGS companion diagnostics in hereditary disorders. The partnership would apply QIAGEN's global regulatory experience, NGS capabilities, and relationships with biopharma companies to power the Helix Laboratory Platform

-

In January 2023, Quanterix expanded its LDT portfolio with introduction of neurofilament light chain tests. This novel blood test increases crucial brain health biomarkers that help provide optimum clinical care and advance research

-

In January 2023, QIAGEN introduced the EZ2 Connect MDx platform for automated sample processing in diagnostic labs. This initiative was expected to help clinical labs perform consistent and effective nucleic acid purification

Laboratory Developed Tests Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.19 billion

Revenue forecast in 2030

USD 19.85 billion

Growth rate

CAGR of 7.05% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Quest Diagnostics Incorporated.; 23andMe, Inc.; Abbott; Guardant Health; NeoGenomics Laboratories.; Siemens Healthineers AG; QIAGEN; Illumina; Inc. F. Hoffmann-La Roche Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Laboratory Developed Tests Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global laboratory developed tests market report based on technology, application, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Immunoassays

-

Hematology & Coagulation

-

Molecular Diagnostics

-

Microbiology

-

Clinical Chemistry

-

Histology/Cytology

-

Flow Cytometry

-

Mass Spectroscopy

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Companion Diagnostics

-

Genomics Sequencing & Other

-

-

Genetic Disorders/Inherited Disease

-

Infectious & Parasitic Diseases

-

Immunology

-

Endocrine

-

Nutritional & Metabolic Disease

-

Cardiology

-

Mental/Behavioral Disorder

-

Pediatrics-specific Testing

-

Hematology/General Blood Testing

-

Bodily Fluid Analysis

-

Toxicology

-

Other Diseases

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global laboratory developed test market size was estimated at USD 12.36 billion in 2023 and is expected to reach USD 13.19 billion in 2024.

b. The global laboratory developed test market is expected to grow at a compound annual growth rate of 7.05% from 2024 to 2030 to reach USD 19.85 billion by 2030.

b. North America dominated the laboratory developed test market with a share of 37.53% in 2023. This is attributable to rising healthcare expenditure, increasing prevalence of chronic diseases, growing geriatric population, and an increasing government funding.

b. Some key players operating in the TDTs market include Quest Diagnostics Incorporated., 23andMe, Inc., Abbott, Guardant Health, NeoGenomics Laboratories., Siemens Healthineers AG, QIAGEN, Illumina, Inc., F. Hoffmann-La Roche Ltd.

b. Key factors that are driving the market growth include increasing demand for in vitro diagnostic tests that are currently unavailable in the market, increasing demand for the development of personalized medicine, and the fact that these tests do not require any regulatory approval. Moreover, these tests are available at lower cost and can aid in developing a wide range of diagnostic tools for various health conditions. Which further drives the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.