- Home

- »

- Conventional Energy

- »

-

Compressed Natural Gas Market Size & Share Report, 2030GVR Report cover

![Compressed Natural Gas Market Size, Share & Trends Report]()

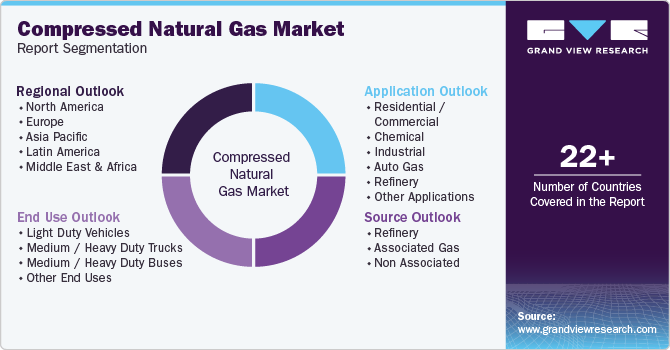

Compressed Natural Gas Market (2024 - 2030) Size, Share & Trends Analysis Report By Source (Refinery, Associated Gas, Non Associated Gas), By Application (Chemical), By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-290-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Compressed Natural Gas Market Summary

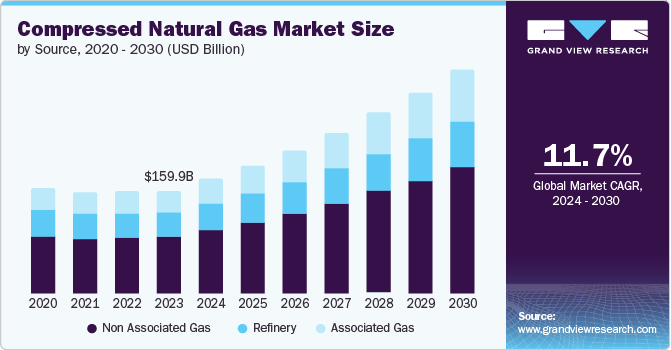

The global compressed natural gas market was estimated at USD 159,865.81 million in 2023 and is projected to reach USD 344,595.7 million by 2030, growing at a CAGR of 11.8% from 2025 to 2030. Market growth is driven by the rising need for cleaner energy options, government programs advocating for sustainable methods, and the expanding use of CNG as a fuel for transportation.

Key Market Trends & Insights

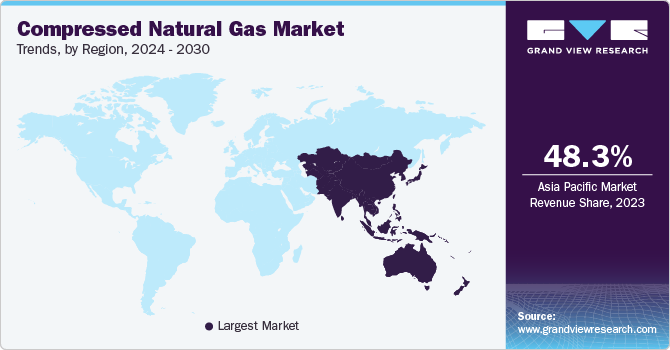

- In terms of region, Asia Pacific was the largest revenue generating market in 2023.

- Country-wise, Australia is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, non associated gas accounted for a revenue of USD 106,560.9 million in 2023.

- Refinery is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 159,865.81 million

- 2030 Projected Market Size: USD 344,595.7 million

- CAGR (2024-2030): 11.8%

- Asia Pacific: Largest market in 2023

The increase in fossil fuel costs, such as gasoline and diesel, and the growing carbon emissions from these fuels have been the main factors behind the increasing need for CNG in recent years.

The industry is witnessing robust growth worldwide, driven primarily by the proliferation of CNG-powered natural gas vehicles that are used as a clean and efficient transportation fuel in both light-duty and heavy-duty vehicles. The lower emissions of CNG compared to traditional fuels like gasoline and diesel make it an attractive option for environmentally conscious consumers and fleet operators.

The rise in popularity of non-associated gas as a source for CNG production is another crucial driver of the market. Non-associated gas is expected to account for the largest share of global CNG production during the forecast period, as the decline in crude oil production and depletion of oil wells have led to an increased reliance on non-associated gas. Moreover, advancements in CNG storage technology are creating new opportunities for the market. The growth of the CNG market also depends on the growth of natural gas supply, increasing energy demand driving enhancements in CNG storage tanks, and technological progress in the market.

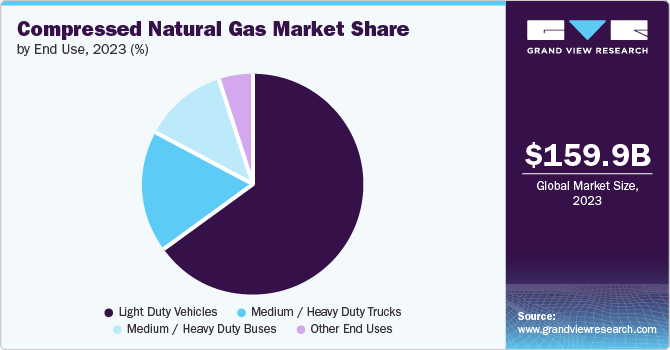

Government guidelines promoting green fuels due to increasing pollution and environmental awareness are driving the CNG fuel market growth. In India, the Council for Air Quality Management (CAQM) released a strategy outlining specific plans to decrease air pollution in the next five years. The increasing number of light-duty vehicles worldwide is also driving the CNG market, with factors such as increased disposable income, rapid urbanization, and the expansion of the automotive industry contributing to the rising demand for light-duty vehicles. The light-duty vehicle segment is particularly lucrative, offering the greatest investment opportunity in the CNG market, especially in emerging economies where CNG is being used to combat air pollution from traditional fossil fuels.

Source Insights & Trends

Non-associated gas accounted for the largest market revenue share of 55.0% in 2023. CG and natural gas are derived from the same source. The decline in global crude oil production and depletion of oil wells have led to a shift towards non-associated gas as a primary source of compressed natural gas. Unconventional and non-associated gas are expected to dominate CNG production in the future. Notably, significant amounts of CNG are already being produced from non-associated gas reserves in the Middle East and Russia.

Associated gas is expected to register the fastest CAGR of 12.5% over the forecast period. Associated gas is generated during oil extraction and is often found alongside hydrocarbons. Non-conventional sources, such as shale gas, tight gas, and coalbed methane, are becoming increasingly significant in the CNG industry. These unconventional sources require techniques like horizontal drilling and hydraulic fracturing to extract natural gas from geological formations with shale gas reserves

Application Insights & Trends

The refinery segment led the market with a share of 33.1% of the total revenue in 2023. Refineries are increasingly utilizing CNG by capturing and converting the significant amounts of natural gas typically flared or wasted during the refining process. This reduces emissions, generates additional revenue, and contributes to the overall CNG supply as a transportation fuel.

The chemical segment is expected to grow at the fastest CAGR of 13.7% over the forecast period due to fewer harmful emissions when burned compared to petrol or oil (such as unburned hydrocarbons, carbon monoxide, nitrogen oxides, sulfur oxides, and particulate matter). One example is when a vehicle travels 100 km using gasoline, it releases 22 kilograms of CO2, whereas the same distance covered with CNG results in only 16.3 kilograms of CO2 being emitted.

End Use Insights & Trends

Light duty vehicles accounted for the largest market revenue share of 64.5% in 2023. The increasing demand for light-duty cars is driven by rising disposable income, urbanization, and auto industry growth. This demand also fuels the adoption of CNG as a fuel for light-duty vehicles. Global players like Royal Dutch Shell and Total Energies are developing CNG products to gain a competitive edge. CNG’s cost-effectiveness, environmental benefits, and government incentives are driving its popularity in urban areas, making it an attractive option for consumers and fleet operators.

Medium / Heavy duty trucks is expected to register the fastest CAGR of 13.0% over the forecast period. Heavy-duty trucks converted to run on CNG produce fewer pollutants, such as carbon monoxide, nitrogen oxides, and particulate matter, compared to diesel. Segment growth is primarily driven by the significant reduction in greenhouse gas emissions and air pollution. CNG-powered trucks offer lower operating costs, reduced emissions, and improved fuel efficiency, making them an attractive option for fleet operators. Government incentives and regulations have boosted adoption in the medium and heavy-duty segments, driving growth as companies seek to reduce their environmental impact.

Regional Insights & Trends

North America compressed natural gas market is poised to grow significantly in the global compressed natural gas market, driven by abundant and cost-effective domestic natural gas resources, particularly shale gas in the U.S. Favorable government incentives, such as tax credits and emissions targets, promote adoption. A well-developed refueling infrastructure and rising demand for cleaner transportation solutions further boost the market’s popularity, making it an attractive option for fleet operators and consumers.

U.S. Compressed Natural Gas Insights & Trends

The compressed natural gas market in the U.S. is expected to grow rapidly in 2023 due to its size and the extent of its development, the natural gas industry in the U.S. is highly competitive and has a diverse group of producers. This could lead to more funds being allocated to research and development, potentially leading to advancements in the region’s CNG tank design technology.

Europe Compressed Natural Gas Insights & Trends

Europe compressed natural gas is expected to experience significant growth as governments implement policies to increase the number of CNG stations, promoting a reduction in carbon emissions. For instance, in Germany, strict environmental regulations in urban areas have led to restricted mobility access, driving companies and utilities to adopt CNG fleets. This growth is anticipated to boost the CNG industry and support the adoption of cleaner transportation solutions.

The compressed natural gas market in Germany is growing due to its commitment to reducing greenhouse gas emissions and transitioning to cleaner energy. Abundant North Sea resources, well-developed infrastructure, and government incentives support the market. Moreover, the increasing demand for CNG-powered light-duty vehicles is driven by lower emissions and cost savings compared to traditional fuels.

Asia Pacific Compressed Natural Gas Insights & Trends

Asia Pacific compressed natural gas market dominated the global compressed natural gas market in 2023, generating 48.3% of the total revenue share. Market growth in the region is driven by the widespread adoption of CNG vehicles in countries like India, China, and Japan, particularly in the light-duty and commercial segments. Rising carbon emissions have prompted governments to implement stricter regulations, with India, for example, investing in infrastructure projects to ensure widespread access to CNG.

The compressed natural gas market in China dominated the Asia Pacific region with a share of 32.7% in 2023, fueled by rising middle-class disposable income and growing product consumption. The majority of China’s public transportation fleet is being converted to CNG fuel systems. Companies like Sino-Energy are expanding CNG filling stations in medium-sized cities. China’s commitment to reducing carbon emissions and transitioning to cleaner energy sources fuels the market’s growth. The country’s large and rapidly growing light-duty vehicle fleet, along with government incentives and infrastructure development, accelerate CNG adoption. Abundant natural gas resources, including shale gas, also support the market’s expansion.

Key Compressed Natural Gas Company Insights

Some of the key companies in the compressed natural gas market include ExxonMobil Corporation; BP plc; TotalEnergies SE; Chevron Corporation; Eni S.p.A.; Equinor ASA; and ConocoPhillips Company. Key market participants are actively pursuing strategies to expand their customer base, including mergers and acquisitions, as well as partnerships with major companies.

-

ExxonMobil Corporation is involved in the CNG market through production, distribution, and marketing. The company’s expertise and technological advancements in compression and storage systems contribute to market growth. Partnerships with local distributors and national gas companies enhance infrastructure development and accessibility.

-

Shell plc Shell, a global energy company, has a significant presence in the CNG market. It is expanding its business by investing in infrastructure development and partnering with others to increase CNG adoption. Shell prioritizes CNG growth as part of its commitment to sustainability and reducing carbon emissions, aligning with the shift towards cleaner energy sources.

Key Compressed Natural Gas Companies:

The following are the leading companies in the compressed natural gas market. These companies collectively hold the largest market share and dictate industry trends.

- ExxonMobil Corporation

- BP plc

- TotalEnergies SE

- Chevron Corporation

- Eni S.p.A.

- Equinor ASA

- ConocoPhillips Company

- Cabot Oil & Gas LLC

- Gazprom PAO

- Shell plc

- Occidental Petroleum Corporation

- JW Power Company

Recent Developments

-

In June 2024, TotalEnergies has agreed with EIG, a global energy sector investor, to purchase all of West Burton Energy’s shares for 450 million Euros as part of its evolution as an integrated electricity company.

-

In May 2024, The Gazprom Management Committee acknowledged the updates on the gas supply and infrastructure expansion programs in Russian Federation regions in 2024. This program is scheduled for the period between 2021 and 2025 to cover 72 Russian regions.

Compressed Natural Gas Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 177.8 billion

Revenue forecast in 2030

USD 345.3 billion

Growth rate

CAGR of 11.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD billion, volume in million tons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Netherlands, Norway, China, India, Japan, Australia, South Korea, Indonesia, Malaysia Brazil, Argentina, Venezuela, South Africa, Saudi Arabia, UAE, Qatar, Kuwait

Key companies profiled

National Iranian Gas Company; Chevron Corporation; Indraprastha Gas Limited; Total Energies; Phillips 66 Company; Gazprom; Exxon Mobil Corporation; Royal Dutch Shell Plc .com; Occidental Petroleum Corporation; JW Power Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Compressed Natural Gas Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global compressed natural gas market report based on source, application, end use, and region.

-

Source Outlook (Revenue, USD Billion, 2018 - 2030, Volume in Million Tons)

-

Refinery

-

Associated Gas

-

Non Associated

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030, Volume in Million Tons)

-

Residential / Commercial

-

Chemical

-

Industrial

-

Auto Gas

-

Refinery

-

Other Applications

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030, Volume in Million Tons)

-

Light Duty Vehicles

-

Medium / Heavy Duty Trucks

-

Medium / Heavy Duty Buses

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030, Volume in Million Tons)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Qatar

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.