- Home

- »

- Next Generation Technologies

- »

-

Computer Vision In Healthcare Market Size Report, 2030GVR Report cover

![Computer Vision In Healthcare Market Size, Share & Trends Report]()

Computer Vision In Healthcare Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Product, By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-134-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Computer Vision In Healthcare Market Summary

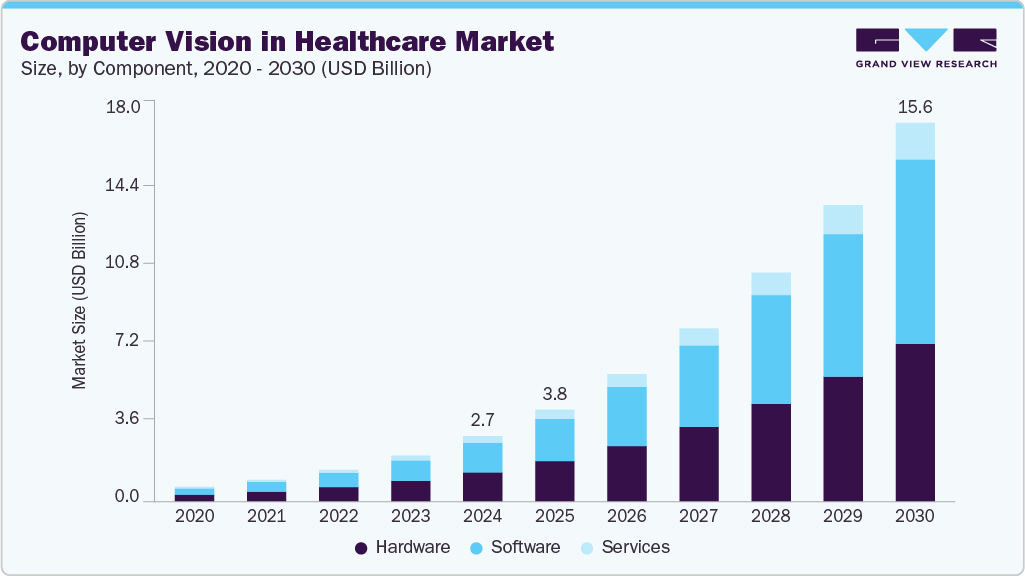

The global computer vision in healthcare market size was estimated at USD 2,692.5 million in 2024 and is expected to reach USD 15,600.8 million by 2030, growing at a CAGR of 32.7% from 2025 to 2030. The continuous development of machine learning models, especially in computer vision, is set to transform healthcare significantly, resulting in a more efficient diagnostic and treatment system, enhancing patient care outcomes.

Key Market Trends & Insights

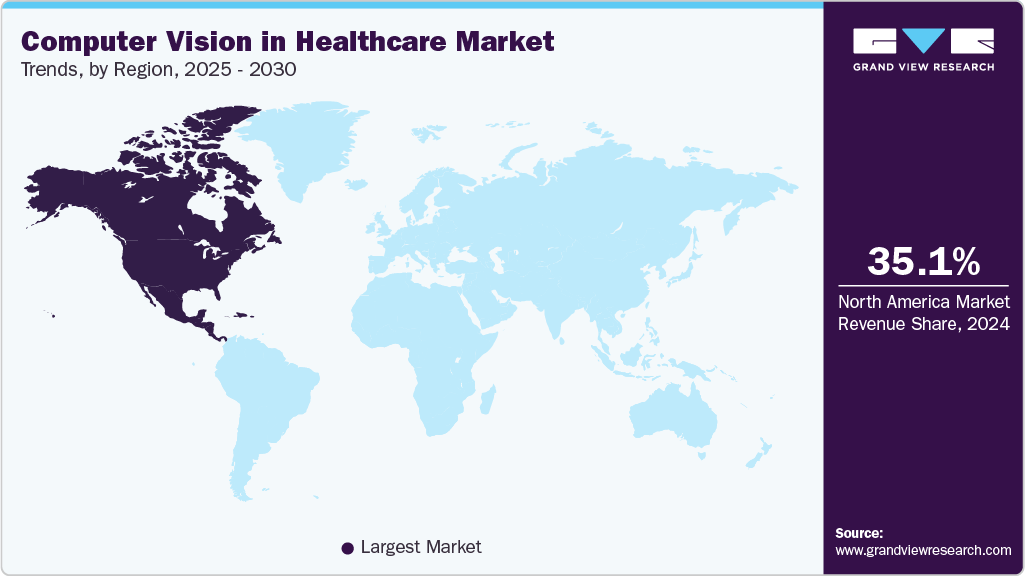

- North America dominated the global computer vision in healthcare market with the largest revenue share of 35.1% in 2024.

- The computer vision in healthcare market in the U.S. led the North America market and held the largest revenue share in 2024.

- By component, software led the market and held the largest revenue share of 45.3% in 2024.

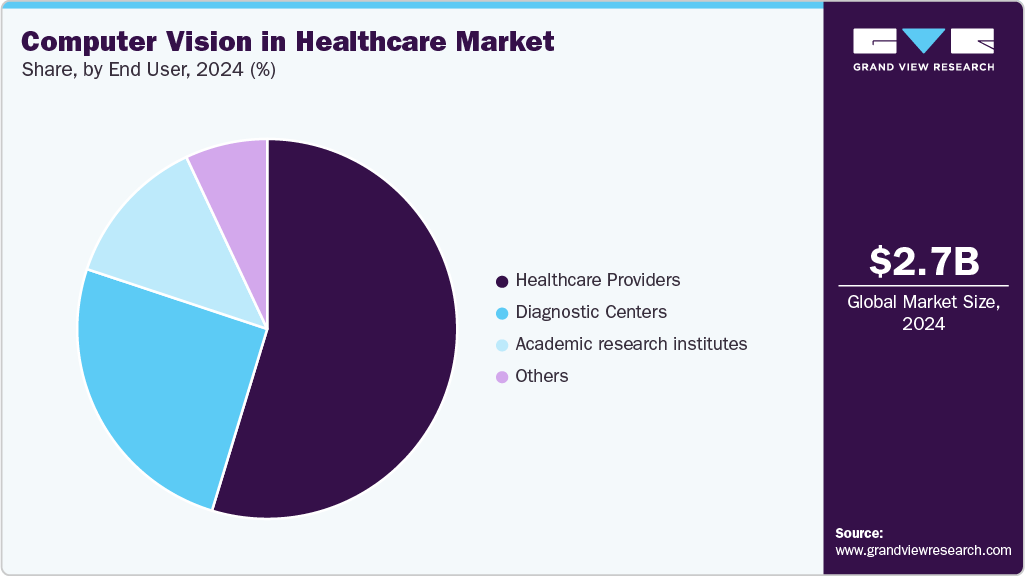

- By end use, healthcare providers segment held the dominant position in the market and accounted for the leading revenue share of 54.7% in 2024.

- By end use, the diagnostic centers segment is expected to grow at the fastest CAGR of 35.3% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 2,692.5 Million

- 2030 Projected Market Size: USD 15,600.8 Million

- CAGR (2025-2030): 32.7%

- North America: Largest market in 2024

The market growth is due to the rising need for computer vision systems in the healthcare sector, government efforts to boost the adoption of AI-based technologies, big data integration in healthcare practices, and computer vision applications in precision medicine. These collectively contribute to the anticipated expansion of the market. Artificial intelligence (AI) is revolutionizing various domains, reshaping commerce, social interactions, and healthcare. It is advancing diagnostic techniques and enhancing the treatment of patients globally.Computer vision systems bring precision to medical diagnoses that help minimize false positives, potentially reducing the need for redundant surgical procedures and costly therapies. Leveraging sophisticated algorithms trained on extensive datasets, computer vision can identify even subtle indications of a medical condition that human doctors might overlook due to inherent sensory limitations. The application of computer vision in healthcare diagnosis can provide remarkably high levels of accuracy, with advancements suggesting the possibility of achieving nearly 100% precision.

Healthcare professionals analyze health and fitness metrics through computer vision technology, empowering patients to make quicker and more informed medical decisions. In contemporary healthcare settings, computer vision measures blood loss during surgeries, particularly in C-sections. This capability is crucial for prompt intervention in emergencies when the volume of blood lost reaches critical levels. Moreover, computer vision's versatility extends to measuring body fat percentage, utilizing images captured by standard cameras. This multifaceted application of technology showcases its potential to enhance medical decision-making processes and contribute to comprehensive healthcare assessments.

Component Insights

The software segment accounted for the highest revenue share of 45.3% in 2024. The dominance of software solutions is a key factor in the digitalization of healthcare. These software solutions are often integrated with artificial intelligence, providing healthcare providers with a strategic advantage, particularly in challenges such as understaffing and the rising volume of imaging scans. Integrating artificial intelligence into healthcare software addresses operational challenges and enhances the competitive edge for healthcare providers, fostering significant market growth.

The services segment registered a CAGR of 32.1% from 2025 to 2030. The services segment in the global market is expanding due to the growing complexity of implementing and managing advanced computer vision systems in medical environments. This has led to increased demand for specialized services like deployment, maintenance, training, and ongoing support to ensure these AI-driven solutions are used effectively. Healthcare organizations also require consulting and customization services to adapt computer vision technologies to their unique clinical and operational requirements. As the use of computer vision grows in areas such as diagnostics, patient monitoring, and personalized treatment, a strong service infrastructure becomes crucial, driving further growth in this segment.

Product Insights

The smart camera-based computer vision system segment accounted for the largest market revenue share in 2024. Smart camera-based vision systems are built with open-embedded processing technology that suppresses the requirement of peripheral devices, such as an external computer or a frame-capture card. This growth is attributed to cost-effectiveness, compact dimensions, and simple, smart camera-based computer vision system integration. Also, smart cameras are built with open-embedded processing technology that suppresses the requirement of peripheral devices, such as an external computer or a frame-capture card.

The PC-based computer vision systems are projected to grow significantly over the forecast period. A PC-based vision system is generally dedicated to image processing, and it needs several peripheral devices for other tasks, such as data transfer, frame grabbing, storage, and lighting. The high share is attributed to its low cost, upgradability, and ability to be swapped to provide relative ease. These systems are commonly used in the medical sector for diagnosis with the technological advancement of imaging. For instance, in March 2024, NVIDIA introduced the new generative AI microservices designed specifically for the healthcare sector, helping organizations around the globe speed up drug development, medical imaging, and digital health innovations.

Application Insights

The medical imaging and diagnostics segment accounted for the largest market revenue share in 2024. The integration of computer vision, along with artificial intelligence (AI) algorithms, has significantly enhanced medical imaging and diagnostics. AI-powered tools analyze medical images with a high level of accuracy, aiding healthcare professionals in the detection and diagnosis of various conditions. Furthermore, computer vision applications in medical imaging contribute to improved diagnostic accuracy. These systems identify patterns and anomalies in medical images that may not be easily discernible by human eyes, leading to early detection and more precise diagnoses. Such benefits provided by computer vision in medical imaging and diagnostics contribute to the segment's growth.

The surgeries segment is projected to grow significantly over the forecast period. Computer vision technologies are particularly valuable in complex surgeries requiring precise navigation and visualization. As surgeons undertake more complex and intricate procedures, the demand for computer vision applications to assist in these surgeries will likely increase. Furthermore, the field of robot-assisted surgery has witnessed significant growth. Computer vision plays a crucial role in enhancing the capabilities of robotic surgical systems, allowing for more precise movements, improved agility, and enhanced visualization during minimally invasive procedures.

End User Insights

The healthcare providers segment accounted for the largest market revenue share in 2024. Healthcare providers, including hospitals and clinics, adopt computer vision technologies to integrate with their existing healthcare systems. This integration enhances diagnostic processes, improves patient care, and improves workflow efficiency. Healthcare providers extensively use computer vision for diagnostic imaging and pathology. Computer vision algorithms assist in interpreting medical images, pathology slides, and other diagnostic tests, aiding healthcare professionals in making more accurate and timely diagnoses. In addition, computer vision technologies improve patient care by providing healthcare providers with tools for early detection, personalized treatment planning, and patient health monitoring. This can lead to better outcomes and a more proactive approach to healthcare.

The diagnostic centers segment is projected to grow significantly over the forecast period. Diagnostic centers use imaging technologies like X-rays, CT scans, MRI, and ultrasound. Integrating computer vision in diagnostic imaging improves accuracy and efficiency in interpreting medical images, driving the demand for computer vision solutions in diagnostic centers. The application of computer vision in diagnostics can enhance the detection of various diseases and conditions, including cancer, cardiovascular disorders, and neurological abnormalities. This contributes to early diagnosis and improved patient outcomes, aligning with the objectives of diagnostic centers.

Regional Insights

North America dominated the market and accounted for a 35.1% share in 2024. North America demonstrates a heightened tendency for cutting-edge digital technologies, marked by its robust healthcare, IT, and telecommunications infrastructure, which has notably fueled market expansion. Moreover, the region benefits from favorable government policies that actively promote the integration of digital and innovative technologies, including artificial intelligence, within the healthcare sector. The region is home to a substantial patient base suffering from one or more chronic diseases. This prevalence has led to an upsurge in hospital admissions, necessitating the storage and management of patients' health data in digital formats to comply with government regulations. This regulatory imperative is a significant driver behind the rising demand for computer vision in the healthcare market.

U.S. Computer Vision in Healthcare Market Trends

The computer vision in healthcare market in the U.S. is rising, driving demand in the region. This country's market is driven by the surge in medical imaging data that demands efficient analysis and the growing need for AI-powered tools that improve diagnostic precision and treatment planning. Supportive regulatory frameworks, such as FDA guidelines for AI-enabled medical devices, along with major investments in healthcare infrastructure and AI development, are also driving market growth.

Europe Computer Vision in Healthcare Market Trends

The computer vision in healthcare market in Europe is experiencing growth due to the region’s advancing healthcare digitization and strong government support for AI integration. The rising need for personalized medicine and precision diagnostics improves diagnostic accuracy and treatment effectiveness, particularly in medical imaging. Moreover, an aging population and increasing rates of chronic illnesses are driving demand for AI-based remote patient monitoring and chronic disease management. Continued investment in digital health infrastructure and AI research is also significantly accelerating market expansion throughout the region.

Asia Pacific Computer Vision in Healthcare Market Trends

The computer vision in healthcare market in Asia Pacific is expected to grow significantly over the forecast period. Many countries in the Asia Pacific region are investing in developing and upgrading their healthcare infrastructure. Building new hospitals, clinics, and diagnostic centers provides opportunities for integrating computer vision technologies to enhance healthcare services. Asia Pacific is home to a significant portion of the global population, and the prevalence of chronic diseases is rising. The increasing healthcare needs and the large patient population demand innovative technologies, including computer vision, to support diagnostics, treatment, and patient management.

Key Computer Vision in Healthcare Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry.

-

NVIDIA is accelerating in computing and artificial intelligence, providing advanced GPUs and AI platforms that power breakthroughs in computer vision in healthcare. The company’s technologies enable faster and more accurate medical imaging analysis, disease detection, and drug discovery. Through its dedicated healthcare AI solutions and collaborations with medical institutions, NVIDIA drives innovation in diagnostic tools and patient care, accelerating the adoption of computer vision across the healthcare sector.

-

Intel is in computing innovation, providing advanced processors and AI technologies that power computer vision in healthcare solutions. The company’s hardware and software platforms enable efficient processing and analysis of complex medical images, supporting faster and more accurate diagnostics. Through strategic collaborations and continuous innovation, Intel helps healthcare organizations harness the potential of computer vision to improve patient outcomes and operational efficiency.

Key Computer Vision in Healthcare Companies:

The following are the leading companies in the computer vision in healthcare market. These companies collectively hold the largest market share and dictate industry trends.

- NVIDIA Corporation

- Microsoft

- Intel Corporation

- IBM Corporation

- Goggle LLC

- Basler AG

- Tempus AI, Inc.

- AiCure

- iCAD, Inc.

- SenseTime

Recent Developments

-

In April 2025, Tempus AI, Inc. introduced Tempus Loop. This AI-driven oncology platform streamlines target discovery and validation by combining real-world patient data with advanced biological models and CRISPR screening. This cutting-edge solution is designed to quickly uncover and confirm new drug targets, aiming to close the gap between preclinical research and impactful patient therapies.

-

In February 2025, iCAD, Inc. and Koios Medical formed a strategic partnership to offer an integrated AI-powered solution for breast cancer detection, combining iCAD’s ProFound AI for mammography with Koios SmartUltrasound. Launched at ECR 2025, this collaboration is designed to improve diagnostic precision and streamline radiology workflows by delivering a comprehensive, multi-modality AI platform for breast cancer screening and diagnosis.

-

In September 2024, AiCure introduced its cutting-edge patient engagement platform, H.Code, at the 14th Annual DPHARM conference. H. Code is designed to improve clinical trial monitoring and participant adherence by leveraging AI, computer vision, and predictive analytics. CEO Ed Ikeguchi discussed how the platform streamlines participation by embedding trial protocols into patients’ daily routines, minimizing the reliance on multiple technologies. The platform aims to revolutionize clinical trials by enhancing patient experience and advancing precision medicine.

Computer Vision In Healthcare Market Report Scope

Report Attribute

Details

Market size in 2025

USD 3,788.4 million

Revenue forecast in 2030

USD 15,600.8 million

Growth rate

CAGR of 32.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, product, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

NVIDIA Corporation; Microsoft; Intel Corporation; IBM Corporation; Google LLC; Basler AG; Tempus AI, Inc.; AiCure; iCAD, Inc.; SenseTime

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Computer Vision In Healthcare Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global computer vision in healthcare market report based on component, product, application, end user, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Smart Cameras-Based Computer Vision Systems

-

PC-Based Computer Vision Systems

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical Imaging & Diagnostics

-

Surgeries

-

Patient Management & Research

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Healthcare Providers

-

Diagnostic Centres

-

Academic research institutes

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Kingdom of Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global healthcare computer vision market size was estimated at USD 1.31 billion in 2022 and is expected to reach USD 1.89 billion in 2023.

b. The global healthcare computer vision market is expected to grow at a compound annual growth rate of 35.2% from 2023 to 2030 to reach USD 15.60 billion by 2030.

b. North America dominated the healthcare computer vision market with a share of 36.1% in 2022. North America demonstrates a heightened tendency for cutting-edge digital technologies, marked by its robust healthcare, IT, and telecommunications infrastructure, which has notably fueled the expansion of computer vision in healthcare market.

b. Some key players operating in the healthcare computer vision market include NVIDIA Corporation; Microsoft; Intel Corporation; IBM Corporation; Google LLC; Basler AG; Arterys Inc.; AiCure; iCAD, Inc.; SenseTime.

b. Key factors that are driving the healthcare computer vision market growth include the rising need for computer vision systems in the healthcare sector, government efforts to boost the adoption of AI-based technologies, integration of big data in healthcare practices, and application of computer vision in precision medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.