- Home

- »

- Renewable Energy

- »

-

Concentrated Photovoltaic Market Size, Industry Report 2030GVR Report cover

![Concentrated Photovoltaic Market Size, Share & Trends Report]()

Concentrated Photovoltaic Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (High Concentrated Photovoltaic (HCPV), Low Concentrated Photovoltaic (LCPV)), By Application (Utility, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-061-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Concentrated Photovoltaic Market Trends

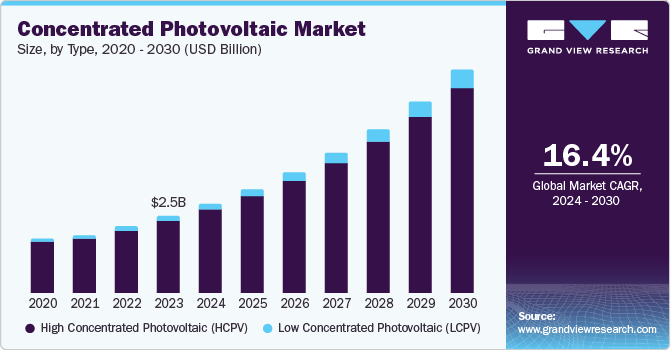

The global concentrated photovoltaic market size was valued at USD 2.45 billion in 2023 and is anticipated to grow at a CAGR of 16.4% from 2024 to 2030. The increasing demand for efficient and sustainable energy solutions drives this growth. Advancements in concentrated photovoltaic (CPV) technology, such as improved cell designs and dual-axis tracking systems, enhance energy yields and reliability, making CPV more attractive for various applications.

Growing environmental awareness and the need to reduce carbon emissions are also propelling the market, as CPV technology is seen as a viable solution for clean energy production. Furthermore, the versatility and scalability of CPV systems, suitable for utility-scale power plants and residential and commercial installations, contribute to their increased adoption.

Government regulations and policies promote renewable energy sources, incentivizing the deployment of CPV systems. For example, the European Union's Renewable Energy Directive requires member states to increase their use of renewable energy sources, driving the development of CPV technology. In the U.S., initiatives such as the Investment Tax Credit (ITC) have spurred investment in solar technologies, including CPV systems, by allowing investors to deduct a significant percentage of their investment costs.

Moreover, countries such as India have set ambitious solar energy targets under the National Solar Mission, which encourages the adoption of advanced solar technologies through financial incentives and subsidies. These regulatory frameworks enhance market stability and attract investment, fostering innovation and competition within the CPV sector globally.

Type Insights

The high-concentrated photovoltaic (HCPV) segment accounted for 93.5% of the market revenue in 2023, attributed to its advanced technology and exceptional efficiency. Their high efficiency makes them ideal for regions with high direct normal irradiance (DNI), such as deserts and sun-rich areas. Moreover, the capability of HCPV systems to minimize the amount of semiconductor material required for solar cells further amplifies their cost-effectiveness, rendering them a compelling choice for large-scale solar power projects.

The Low Concentrated Photovoltaic (LCPV) segment is expected to grow at a CAGR of 19.7% from 2024 to 2030. The lower concentration level of LCPV systems simplifies their design and installation, expanding their suitability for a wide range of applications, including residential and commercial installations. The expected growth in the LCPV segment is attributed to the rising demand for cost-effective and efficient solar energy solutions, particularly in regions with moderate sunlight conditions.

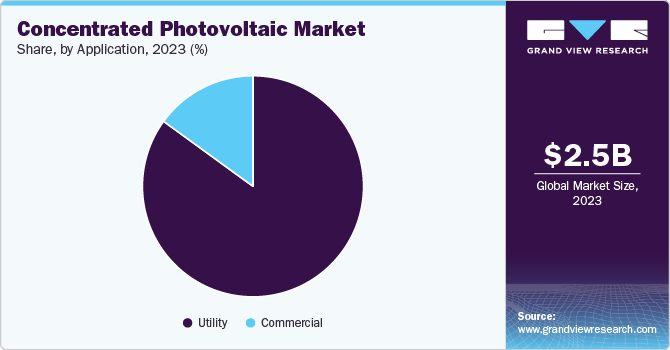

Application Insights

The utility segment dominated the market in 2023. Utility-scale CPV installation benefits from the high efficiency and scalability, making it particularly attractive for utility companies looking to meet increasing energy demands while reducing carbon emissions. The high concentration levels achieved by CPV systems enable them to produce more power per unit area than traditional photovoltaic systems, making them ideal for large solar farms in regions with high direct normal irradiance (DNI). In addition, integrating advanced tracking systems in utility-scale CPV installations enhances their performance by ensuring that the solar cells are always optimally aligned with the sun.

The commercial segment is expected to grow the fastest over the forecast period from 2024 to 2030 attributed to the increasing adoption of CPV systems by commercial entities seeking to reduce their energy costs and carbon footprint. Commercial CPV installations are typically smaller in scale compared to utility projects but offer significant energy efficiency and cost savings benefits. Businesses in the manufacturing, retail, and hospitality sectors increasingly turn to CPV technology to power their operations, driven by the rising cost of conventional energy sources and the growing emphasis on sustainability. The commercial segment’s growth is also driven by advancements in CPV technology that have made these systems more affordable and easier to install.

Regional Insights

North America accounted for a significant market share of the global concentrated photovoltaic market revenue in 2023 driven by the region’s strong focus on renewable energy and supportive government policies. The U.S., in particular, has been a major contributor to this market, with various federal and state-level incentives such as the Investment Tax Credit (ITC) encouraging investments in CPV technology. The presence of advanced technological infrastructure and a high level of research and development activities further bolster the CPV market in North America.

U.S. Concentrated Photovoltaic Market Trends

The U.S. held a substantial revenue share of the North American concentrated photovoltaic market in 2023 attributed to the country’s robust policy framework supporting renewable energy adoption, including tax incentives, grants, and subsidies. The U.S. market has seen significant investments in CPV technology, driven by the need to diversify energy sources and reduce carbon emissions. The country’s vast land area with high direct normal irradiance (DNI) makes it an ideal location for CPV installations. Moreover, the increasing focus on energy independence and security has led to the development of large-scale CPV projects, particularly in states including California, Texas, and Arizona, which have favorable solar conditions.

Asia Pacific Concentrated Photovoltaic Market Trends

The Asia Pacific region held the largest revenue share of 47.7% in the global concentrated photovoltaic market in 2023 due to the rapid industrialization and urbanization in countries such as China and India, which are leading to increased energy demand. Governments in Asia Pacific are actively promoting renewable energy through various policies and incentives, aiming to reduce reliance on fossil fuels and curb greenhouse gas emissions.

China accounted for the largest share of concentrated photovoltaic market driven by its aggressive renewable energy policies and substantial investments in solar technology. China’s government has set ambitious targets for solar energy capacity, and CPV technology is a key component of its strategy to achieve these goals. The country’s vast land area with high solar irradiance, particularly in regions such as Inner Mongolia and Xinjiang, provides ideal conditions for CPV installations. In addition, China’s strong manufacturing capabilities and focus on technological innovation have enabled it to produce CPV systems at a lower cost, making them more accessible and attractive for large-scale deployment.

Europe Concentrated Photovoltaic Market Trends

The European concentrated photovoltaic market is expected to grow at a CAGR of 16.3% from 2024 to 2030 driven by the European Union’s stringent renewable energy targets and supportive policies aimed at reducing carbon emissions. Countries such as Spain, Italy, and Germany are leading the adoption of CPV technology, leveraging their favorable solar conditions and advanced technological infrastructure. The region’s focus on sustainability and energy efficiency is also contributing to the growth of the CPV market.

The concentrated photovoltaic market in the UK is expected to grow steadily. The UK’s commitment to reducing carbon emissions and increasing the share of renewable energy in its energy mix is driving the adoption of CPV technology. The government has implemented several specific incentives and subsidies to promote renewable energy, including the Contracts for Difference (CfD) scheme, which provides long-term contracts to renewable energy projects, and the Green Industries Growth Accelerator, which includes a USD 1.28 billion investment to boost manufacturing capacity in net-zero sectors. In addition, USD 352 million in renewable energy subsidies has been allocated to support the development and installation of new solar panel systems.

Key Concentrated Photovoltaic Company Insights

The global concentrated photovoltaic market is driven by several key companies, including Amonix, Arzon Solar, China Sunergy, Cool Earth Solar, Emcore, and ES-SYSTEM, among others.

-

Amonix has been developing solar power generators for over 20 years, focusing on low-cost utility-scale deployment. The company utilizes the highest efficiency solar cells, similar to those used in space, combined with lenses to concentrate sunlight and minimize the use of expensive solar cell material.

-

Arzon Solar specializes in the design and manufacture of commercial solar power systems. The company is known for its dual-axis tracking systems, which enhance the efficiency and flexibility of CPV installations.

Key Concentrated Photovoltaic Companies:

The following are the leading companies in the concentrated photovoltaic market. These companies collectively hold the largest market share and dictate industry trends.

- Amonix

- Arzon Solar

- China Sunergy

- Cool Earth Solar

- Emcore

- ES-SYSTEM

- Everphoton Energy Corporation

- Focal Point Energy

- Greenfield Solar

- Guascor Foton

- ISOFOTON

- Morgan Solar

- Pramac

Recent Developments

-

In July 2024, Soltec announced a strategic partnership with the Fraunhofer Institute for Solar Energy Systems ISE to co-develop an innovative two-axis tracker specifically designed for CPV applications. The joint project, led by Fraunhofer ISE, seeks to leverage Soltec's advanced solar tracker technology and adapt it to meet the unique requirements of a new generation of micro-CPV modules capable of operating at nearly 1,000 sun concentrations.

-

In April 2024, RayGen Resources has secured USD 51 million in Series D funding. This investment will support the company's expansion of manufacturing and engineering capabilities in Victoria and strengthen its domestic and international growth. The company's system combines concentrated photovoltaic solar modules with a thermal water-based storage system.

Concentrated Photovoltaic Market Scope

Report Attribute

Details

Market size value in 2024

USD 2.83 billion

Revenue forecast in 2030

USD 7.04 billion

Growth rate

CAGR of 16.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Key companies profiled

Amonix, Arzon Solar, China Sunergy, Cool Earth Solar, Emcore, ES-SYSTEM, Everphoton Energy Corporation, Focal Point Energy, Greenfield Solar, Guascor Foton, ISOFOTON, Morgan Solar, Pramac

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Concentrated Photovoltaic Market Report Segmentation

This report forecasts revenue & volume growth of the concentrated photovoltaic market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global concentrated photovoltaic market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

High Concentrated Photovoltaic (HCPV)

-

Low Concentrated Photovoltaic (LCPV)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Russia

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.