- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Condensed Whey Market Size & Share, Industry Report, 2019-2025GVR Report cover

![Condensed Whey Market Size, Share & Trends Report]()

Condensed Whey Market (2019 - 2025) Size, Share & Trends Analysis Report By Product (Plain, Sweetened, Acid), By Application (Food & Beverage, Animal Feed), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-101-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2015 - 2017

- Forecast Period: 2019 - 2025

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global condensed whey market size was estimated at USD 2.54 billion in 2018 and is anticipated to register a CAGR of 8.4% during the forecast period. Rising awareness regarding physical appearance and the nutritional importance of whey to improve muscle strength among sports enthusiasts is expected to drive the growth. Additionally, rising disposable income among middle-class income groups of developing countries including China, India, and Brazil is projected to promote the adoption of the products as functional foods in the near future.

Whey product forms are believed to support immune systems due to the presence of immunoglobulin, which maintains blood pressure. Over the past few years, condensed whey is increasingly used as a functional ingredient in various applications, such as bakery products, jams and jellies, and confectionery which comprises rich Branched Chain Amino Acid (BCAA). This factor is projected to drive the product demand in the forthcoming years.

Condensed whey is considered a protein ingredient with a high concentration of amino acids which prompts its consumption among sports athletes and health-conscious people. Furthermore, the product also acts as a key tool for women to lose fat, gain muscle, and improve athletic strength. For instance, moderate consumption of condensed whey reduces the content of ghrelin - an appetite-stimulating hormone - and thus, results in reduced hunger along with enhanced weight loss.

The product also finds application in the formulation of infant food formula to meet their nutritional requirements. Significant spending on infant care among working-class professionals in developed countries including Germany, France, and the U.K. as a result of extensive brand campaigns for child health by regulatory bodies is projected to open new avenues in near future. Over the past few years, companies including Optimum Premium and IdealLean have launched condensed whey products, especially for women that are capable of providing weight loss and helping build lean and toned muscles.

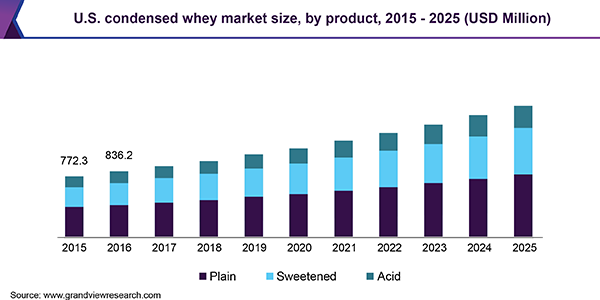

Product Insights

The market for plain condensed products registered a revenue of USD 1.22 billion in 2018. Plain whey is pasteurized and is used as a dietary ingredient in various types of products including meat products, beverages, and dairy goods. This product is rich in amino acid content required to promote muscle growth along with helping muscle tissue repair. The product also contains high levels of leucine which promotes the synthesis of muscle protein, muscle growth, and loss of fat tissues.

Sweetened whey is considered a healthier functional ingredient as compared to sugar along with excellent flavor properties and enhanced taste characteristics. The market for these product forms is projected to reach a value of USD 1.63 billion by 2025. Acid whey products are expected to account for exceeding 15% of the global market share in terms of revenue by 2025. This product form provides superior delivery of amino acid content which helps in building stamina and giving extra energy during workout sessions.

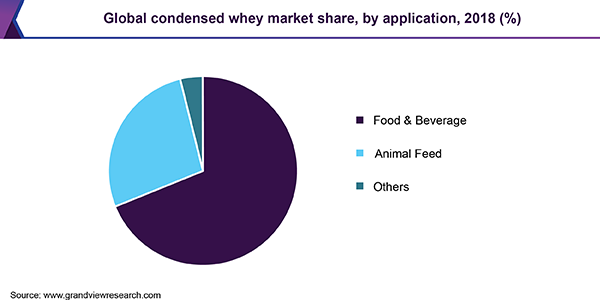

Application Insights

Food and beverage generated a revenue of more than USD 1.74 billion in 2018. This segment is expected to witness growth on account of the increasing utility of condensed whey in the formulation of baked goods which improved characteristics including viscosity, foam formation, emulsification, and dough strengthening. Furthermore, this product form can improve texture properties and induce low hygroscopicity in baked products as well as confectioneries.

Animal feed is expected to witness a CAGR of 8.0% from 2019 to 2025. This product finds utility as an animal feed additive, particularly among ruminants for providing benefits including, increased weight gains, improving feed efficiency and protein, and fat digestibility. Furthermore, regular consumption of condensed product forms among animals also results in improving mineral absorption and retention characteristics.

Regional Insights

In 2018, North America led the condensed whey market, accounting for more than 45% of the total share. High demand for plain, sweetened, and acid whey products is anticipated to push the regional growth forward over the forthcoming years. The USA Dairy Company and Optimum Nutrition (ON) are the leading manufacturers in the U.S. High consumer awareness regarding muscle building, especially among youths from U.S. and Canada has played a crucial role in promoting the utility of condensed whey forms.

Europe generated a revenue of more than USD 800 million in 2018. Key markets in this region include France, Germany, the U.K., Italy, Spain, and Poland. The high concentration of dairy processing facilities in countries including the U.K., Ireland, and France is projected to attract the food and beverage companies to establish their tie-ups and enter the value chain of the condensed whey industry in near future.

Asia Pacific is expected to witness the fastest CAGR of 9.1% from 2019 to 2025. The rapidly growing middle-class population in countries such as China, Japan, Indonesia, South Korea, Malaysia, and India is expected to open new growth avenues. Furthermore, supportive investment-friendly policies in domestic food processing sectors by the governments of emerging economies such as China and India are projected to further fuel the growth.

Key Companies & Market Share Insights

The major market players include Agri-Mark Inc.; Dairy Farmers of America; Associated Milk Producers Inc.; Leprino Foods Company.; and Optimum Nutrition. The establishment of strategic partnerships with distributors and new product launches are expected to remain the crucial success factors. Rising concerns over the availability of cattle feedstock for dairy product processing on account of fluctuating climate patterns and reducing cattle yield in prominent countries including New Zealand, China, and India is projected to remain a crucial challenge to the industry participants in the near future.

Condensed Whey Market Report Scope

Report Attribute

Details

Market size value in 2019

USD 2.8 billion

Revenue forecast in 2025

USD 4.5 billion

Growth Rate

CAGR of 8.4% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion and CAGR from 2019 to 2025

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Germany, China, India, Brazil, Japan

Key companies profiled

Agri-Mark Inc.; Dairy Farmers of America; Associated Milk Producers Inc.; Leprino Foods Company.; and Optimum Nutrition.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For this study, Grand View Research has segmented the global condensed whey market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2015 - 2025)

-

Plain

-

Sweetened

-

Acid

-

-

Application Outlook (Revenue, USD Million, 2015 - 2025)

-

Food & Beverage

-

Dairy Products

-

Bakery Products & Confectionery

-

Sauces, Soups, and Dressings

-

Jams and Jellies

-

Meat Products

-

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

-

Asia Pacific

-

China

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global condensed whey market size was estimated at USD 2.8 billion in 2019 and is expected to reach USD 3 billion in 2020.

b. The global condensed whey market is expected to grow at a compound annual growth rate of 8.4% from 2019 to 2025 to reach USD 4.5 billion by 2025.

b. North America dominated the condensed whey market with a share of 45.2% in 2019. This is attributable to high demand for plain, sweetened, and acid whey products.

b. Some key players operating in the condensed whey market include Agri-Mark Inc.; Dairy Farmers of America; Associated Milk Producers Inc.; Leprino Foods Company.; and Optimum Nutrition.

b. Key factors that are driving the market growth include rising awareness regarding physical appearance and the nutritional importance of whey to improve muscle strength among sports enthusiasts.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.