- Home

- »

- Medical Devices

- »

-

Congestive Heart Failure Treatment Devices Market, 2030GVR Report cover

![Congestive Heart Failure Treatment Devices Market Size, Share & Trends Report]()

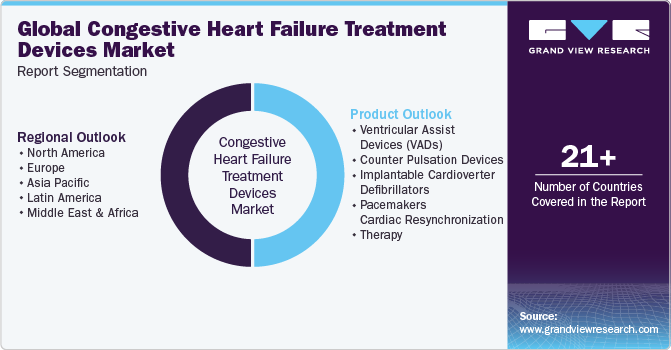

Congestive Heart Failure Treatment Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ventricular Assist Devices, Implantable Cardioverter Defibrillators, Counter Pulsation Devices, Pacemakers), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-292-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Congestive Heart Failure Treatment Devices Market Summary

The global congestive heart failure treatment devices market size was estimated at USD 5.6 billion in 2024 and is projected to reach USD 8.2 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. Technological advancements in heart failure treatment, including ventricular assist devices (VADs) and artificial heart pumps, drive market growth by improving patient outcomes and quality of life.

Key Market Trends & Insights

- North America congestive heart failure treatment devices market dominated the global market with a 45.6% share in 2024.

- Asia Pacific is experiencing significant growth driven by the rising burden of cardiovascular diseases, particularly in countries like China, Japan, and India.

- Based on product, the implantable cardioverter defibrillators (ICDs) segment held highest revenue share of 34.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.6 Billion

- 2030 Projected Market Size: USD 8.2 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

The increasing prevalence of cardiovascular diseases, particularly heart failure, is further fueling demand for these devices, with an aging population contributing to the rise. In April 2024, The Journal of Heart and Lung Transplantation (JHLT) reported on the CH-VAD, a left ventricular assist device used in China since 2017. A study of 50 patients showed high survival rates (96% at 6 months, 88.6% at 3 years) with low complications, demonstrating its safety and efficacy for end-stage heart failure.

Continuous innovation in heart failure treatment devices, including ventricular assist devices (VADs), artificial heart pumps, and minimally invasive options, is a significant driver in the industry. These advancements have improved treatment outcomes and patient quality of life. Ongoing research into new materials and technologies further supports the market's growth. In September 2024, Astellas Pharma announced the FDA listing of DIGITIVA, a non-invasive digital health solution for heart failure management, classified as Class I Software as a Medical Device. DIGITIVA empowers patients to actively manage their health through a digital stethoscope, a smartphone app, and educational content from the American Heart Association (AHA). At the same time, a dedicated clinical team monitors patient data to notify physicians about potential interventions.

The global rise in cardiovascular diseases, particularly heart failure, significantly fuels the demand for treatment devices. In October 2024, the CDC reported that heart disease is the primary cause of death for men, women, and individuals from nearly all racial and ethnic backgrounds in the U.S. Every 33 seconds, someone loses their life due to cardiovascular disease. As the prevalence of heart failure increases, the need for advanced medical devices like VADs and heart pumps grows. This trend is expected to continue with the aging population, which is more prone to heart conditions. The rising incidence of these diseases contributes to industry expansion. Early detection and improved management also drive the adoption of these life-saving devices.

The increasing prevalence of heart failure has led to significant advancements in treatment strategies, particularly in early intervention and proactive care. A major driver of the congestive heart failure (CHF) treatment device industry is the growing emphasis on identifying and addressing the condition in its early stages. In October 2024, Abbott launched the TEAM-HF trial to enhance outcomes for patients with worsening heart failure. The trial aims to enroll up to 850 patients globally, utilizing the CardioMEMS HF System to identify those who could benefit from earlier intervention with the HeartMate 3 left ventricular assist device. This initiative responds to the growing prevalence of heart failure in the U.S., currently affecting 6.7 million individuals.

Market Concentration & Characteristics

The degree of innovation in the industry is currently high, with continuous advancements in ventricular assist devices (VADs), artificial heart pumps, and minimally invasive technologies. Ongoing research enhances device efficiency and patient outcomes, driving market progress. In March 2024, Analog Devices, Inc. announced FDA 510(k) clearance and the launch of its Sensinel Cardiopulmonary Management System. This compact wearable device is designed for non-invasive, remote monitoring of cardiopulmonary measurements, particularly aiding chronic disease management like heart failure.

The level of merger and acquisition activities in the industry is considered medium. Companies consolidate to strengthen portfolios, acquire new technologies, and improve operations, enhancing overall patient care. In August 2024, Johnson & Johnson announced its acquisition of V-Wave Ltd., a company dedicated to heart failure treatments, for an initial payment of USD 600 million. The deal includes potential milestone payments totaling up to USD 1.1 billion. V-Wave will become part of Johnson & Johnson MedTech following the acquisition.

The impact of regulations on the industry is rated high. Regulatory bodies such as FDA and EMA ensures device safety and efficacy. While stringent regulations may slow product launches, they guarantee high-quality, safe treatments. Regulatory approvals also instill trust in healthcare providers and patients, promoting widespread adoption of new devices. Evolving regulatory standards for advanced devices will encourage further innovation.

Product expansion within the industry is evaluated as a medium. Companies are diversifying offerings, introducing new heart pumps, artificial hearts, and minimally invasive solutions to meet increasing patient demand. This expansion includes continuous updates to technology, ensuring devices are aligned with evolving patient needs. The trend also emphasizes creating more compact and efficient devices for better patient comfort.

The regional expansion is high in industry, especially in North America, Europe, and emerging Asia-Pacific markets. Companies are expanding due to rising cardiovascular disease rates and enhanced healthcare infrastructure. In addition, governments' focus on improving healthcare access has created new opportunities in these regions. Expanding into these regions allows quicker adoption of advanced devices due to increased healthcare investments.

Product Insights

The implantable cardioverter defibrillators (ICDs) segment held highest revenue share of 34.3% in 2024. Implantable Cardioverter Defibrillators (ICDs) dominate the cardiac device market due to their critical role in preventing sudden cardiac arrest in patients with arrhythmias. As heart disease prevalence rises globally, ICDs are increasingly sought after for their life-saving capabilities, especially in high-risk populations with conditions like heart failure or previous myocardial infarction. In October 2023, Medtronic gained FDA approval for the Aurora EV-ICD MRI SureScan, a cutting-edge extravascular implantable cardioverter-defibrillator designed to treat dangerously fast heartbeats. This state-of-the-art device features a lead beneath the breastbone, outside the heart and blood vessels, and offers defibrillation and pacing treatments that match those of conventional transvenous ICDs.

The ventricular assist devices segment is anticipated to grow at the fastest CAGR from 2025 to 2030 due to the increasing number of elderly individuals worldwide afflicted with chronic conditions such as diabetes, stroke, heart disease, neurological disorders, and hypertension. Moreover, the rising incidence of cardiovascular disorders, the increasing risk of organ failure, shortage of organ donors, and postponements in organ transplantation procedures are likely to contribute to the growth of this segment. In November 2024, BrioHealth Solutions revealed that it has begun enrolling its initial patients in the INNOVATE Trial for the BrioVAD System, a device aimed at assisting patients with severe heart failure. The trial aims to assess the safety and efficacy of this innovative device, intending to enhance the available treatment alternatives for those suffering from advanced heart failure.

Regional Insights

North America congestive heart failure treatment devices market dominated the global market with a 45.6% share in 2024, driven by an aging population, a high prevalence of heart disease, and advanced healthcare infrastructure. The growing adoption of innovative treatment devices, such as ventricular assist devices (VADs) and heart pumps, is further supported by ongoing research and technological advancements in the medical field. In July 2024, the FDA awarded a breakthrough device designation to Restore Medical’s ContraBand system to treat heart failure patients with reduced ejection fraction (HFrEF) who have persistent symptoms despite optimal medical therapy. This designation was based on promising study results demonstrating the device's safety and effectiveness, including reduced left ventricle size and improved heart function and physical ability in patients.

U.S. Congestive Heart Failure Treatment Devices Market Trends

The congestive heart failure treatment devices market in the U.S. is expanding due to the increasing number of heart failure patients, enhanced healthcare access, and rising healthcare expenditure. Technological innovations and reimbursement policies supporting advanced heart failure treatments drive market growth. In October 2023, Walgreens teamed up with the Cardiovascular Research Foundation (CRF) to launch the PREVUE-VALVE study, which aims to evaluate how common valvular heart disease (VHD) is among older adults in the U.S. This collaboration seeks to improve the early detection and treatment of VHD, ultimately leading to better health outcomes for patients.

Europe Congestive Heart Failure Treatment Devices Market Trends

The Europe congestive heart failure treatment devices market is experiencing significant growth driven by an increasing incidence of cardiovascular diseases, aging populations, and improvements in healthcare systems. Advancements in device technology and increased adoption of minimally invasive treatments drive market expansion. In January 2024, Bayer and Asklepios BioPharmaceutical launched the Phase II GenePHIT trial for AB-1002, a gene therapy for congestive heart failure (CHF). This double-blind, placebo-controlled study will assess its safety and efficacy in adults with non-ischemic cardiomyopathy (NYHA Class III) who have been stable for four weeks and have a left ventricle ejection fraction of 15% to 35%.

The rising incidence of heart failure, aging demographics, and greater access to cutting-edge heart failure treatment devices drive the congestive heart failure treatment devices market in the UK. The National Health Service (NHS) plays a critical role in adopting advanced medical technologies, which supports the market's growth.

France congestive heart failure treatment devices market benefits from a strong healthcare infrastructure and a growing number of cardiovascular diseases. Government investments in healthcare and the increasing use of advanced heart failure management devices, like artificial heart pumps, contribute to market growth.

Asia Pacific Congestive Heart Failure Treatment Devices Market Trends

The congestive heart failure treatment devices market in the Asia Pacific is experiencing significant growth driven by the rising burden of cardiovascular diseases, particularly in countries like China, Japan, and India. Healthcare access improvements, awareness of heart failure treatments, and government initiatives contribute to market growth. In January 2024, an article published in the Journal of Cardiovascular Development and Disease discusses the advancements in heart transplantation and the challenges posed by the shortage of donor hearts. It highlighted the progress in mechanical circulatory support (MCS), particularly on ventricular assist devices (VADs), which offer various therapeutic options. The article emphasizes developing and applying durable VADs (dVADs) and explores their research progress, particularly in China.

Japan congestive heart failure treatment devices market is experiencing significant growth driven by the aging population and high prevalence of heart diseases. The country’s advanced healthcare system and the increasing adoption of innovative heart failure treatment technologies support market expansion.

The congestive heart failure treatment devices market in India is witnessing robust growth due to the growing prevalence of cardiovascular diseases, healthcare access improvements, and awareness of advanced treatment options. The adoption of advanced heart failure treatment devices is increasing as the healthcare infrastructure develops

Latin America Congestive Heart Failure Treatment Devices Market Trends

The Latin America congestive heart failure treatment devices market is growing due to the rising burden of heart diseases, aging populations, and improvements in healthcare services. Countries like Brazil are seeing increased adoption of heart failure devices as part of efforts to improve cardiovascular care. Regional healthcare policies and rising awareness of heart failure management are driving market expansion. As healthcare infrastructure improves, access to advanced devices is expected to increase, further supporting growth in the market.

The congestive heart failure treatment devices market in Brazil is characterized by high cardiovascular disease prevalence, improving healthcare systems, and a growing demand for advanced medical technologies. In February 2024, data from Cardiovascular Statistics - Brazil revealed that in Brazil 72% of deaths are attributed to non-communicable diseases (NCDs), with 30% of those deaths resulting from cardiovascular diseases (CVD) and 16% from cancers. The country’s healthcare reforms and investment in medical infrastructure are driving market expansion.

Middle East & Africa Congestive Heart Failure Treatment Devices Market Trends

The Middle East and Africa congestive heart failure treatment devices market is growing rapidly due to increasing cardiovascular disease rates and improving healthcare infrastructure. In November 2024, an article in Diagnostics highlighted the role of left ventricular assist devices (LVADs) in managing advanced heart failure when transplantation isn't feasible. It reviewed LVAD effectiveness, survival rates, quality of life improvements, and complications while also discussing recent technological advancements and future directions in treatment.

Investments in healthcare technology and government initiatives to improve access to advanced treatments propel market growth. In May 2024, the Journal of Mechatronics and Artificial Intelligence in Engineering discussed advancements in Mechanical Circulatory Support (MCS) for end-stage congestive heart failure (CHF). MCS devices like LVADs, ECMO, and artificial hearts provide circulatory support but face challenges in device selection, complications, and integration of AI for treatment optimization. Research is focused on reducing device size, improving blood compatibility, and enhancing durability.

The congestive heart failure treatment devices market in Saudi Arabia is witnessing robust growth fueled by a rising incidence of heart disease, improvements in healthcare infrastructure, and government initiatives to provide advanced medical treatments. The adoption of heart pumps and other advanced treatment devices is increasing.

Key Congestive Heart Failure Treatment Devices Company Insights

Key companies in the industry actively pursue various strategic initiatives to enhance their market presence. These initiatives include investing in research and development to innovate and improve the properties of congestive heart failure treatment devices, which aims to achieve better clinical outcomes and enhance patient comfort. To meet the global market's diverse needs, these players focus on product diversification, offering various types of products suitable for congestive heart failure treatment.

Key Congestive Heart Failure Treatment Devices Companies:

The following are the leading companies in the congestive heart failure treatment devices market. These companies collectively hold the largest market share and dictate industry trends.

- Jarvik Heart Inc.

- ReliantHeart, Inc.

- Biotronik SE & Co. KG

- Berlin Heart GmbH

- Medtronic

- Boston Scientific Corp.

- Biotronik SE & Co. KG

- Abbott

Recent Developments

-

In December 2024, Johnson & Johnson MedTech announced the FDA's expansion of indications for the Impella 5.5 with SmartAssist and Impella CP with SmartAssist heart pumps. This premarket approval allows their use in certain pediatric patients suffering from symptomatic acute decompensated heart failure and cardiogenic shock, marking a significant advancement in treatment options for critically ill children.

-

In September 2024, Boston Scientific Corporation gained FDA approval to broaden the application of its INGEVITY+ Pacing Leads for conduction system pacing and monitoring of the left bundle branch area with single- or dual-chamber pacemakers. This method serves as an alternative to standard right ventricular pacing for managing symptomatic bradycardia, potentially enhancing ventricular synchrony and minimizing the long-term risk of heart failure.

-

In August 2024, Abbott announced that the FDA approved a label change for the HeartMate 3 left ventricular assist device, allowing patients to manage without routine aspirin use. This update, which aims to enhance clinical outcomes, has also been approved by regulatory agencies in Canada and the EU. The decision was informed by the ARIES-HM3 study, assessing the need for aspirin in the blood thinning regimen for HeartMate 3 patients.

-

In May 2024, Centra in Virginia performed the state's first congestive heart failure treatment using the Integra D Impulse Dynamics device. This breakthrough procedure was highlighted with the treatment of a woman, referred to as "patient zero." The device aims to improve heart function in patients with advanced heart failure, marking a significant step forward in heart failure care.

Congestive Heart Failure Treatment Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.9 billion

Revenue forecast in 2030

USD 8.2 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Jarvik Heart Inc.; ReliantHeart, Inc.; Biotronik SE & Co. KG; Berlin Heart GmbH; Medtronic; Boston Scientific Corporation; Biotronik SE & Co. KG; Abbott;

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Congestive Heart Failure Treatment Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global congestive heart failure treatment devices market report based on product and region.

- Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ventricular Assist Devices (VADs)

-

LVAD

-

RVAD

-

BiVAD

-

-

Counter Pulsation Devices

-

Implantable Cardioverter Defibrillators

-

Transvenous ICD

-

Subcutaneous ICD

-

-

Pacemakers

-

Implantable

-

External

-

-

Cardiac Resynchronization therapy

-

Cardiac Resynchronization Therapy-Defibrillators (CRT-D)

-

Cardiac Resynchronization Therapy-Pacemakers (CRT-P)

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Latin America

-

Brazil

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global congestive heart failure treatment devices market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030, reaching USD 8.2 billion by 2030.

b. Implantable cardioverter defibrillators dominated the congestive heart failure treatment device market with a share of 34.3% in 2024. The rising prevalence of cardiovascular diseases, particularly arrhythmias, served as a primary catalyst, amplifying the demand for ICDs as a critical intervention for life-threatening conditions.

b. Some key players operating in the congestive heart failure treatment devices market include Medtronic Plc; Boston Scientific Corporation; Biotronik SE & Co., KG; and St. Jude Medical

b. Key factors that are driving the market growth include rising burden of Cardiovascular Diseases (CVDs), sedentary lifestyles, mental stress, junk food consumption, and favorable reimbursement policies.

b. The global congestive heart failure treatment device market was estimated at USD 5.6 billion in 2024 and is expected to reach USD 5.9 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.