- Home

- »

- Automotive & Transportation

- »

-

Connected Rail Market Size & Share, Industry Report, 2030GVR Report cover

![Connected Rail Market Size, Share & Trends Report]()

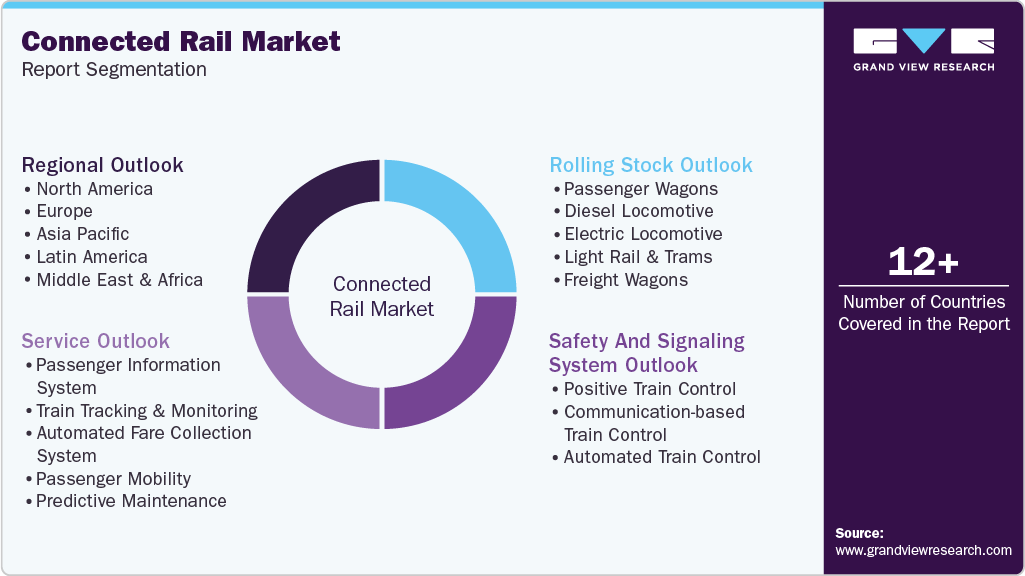

Connected Rail Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Passenger Information System, Predictive Maintenance, Train Tracking & Monitoring), By Rolling Stock, By Safety & Signaling System, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-596-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Connected Rail Market Summary

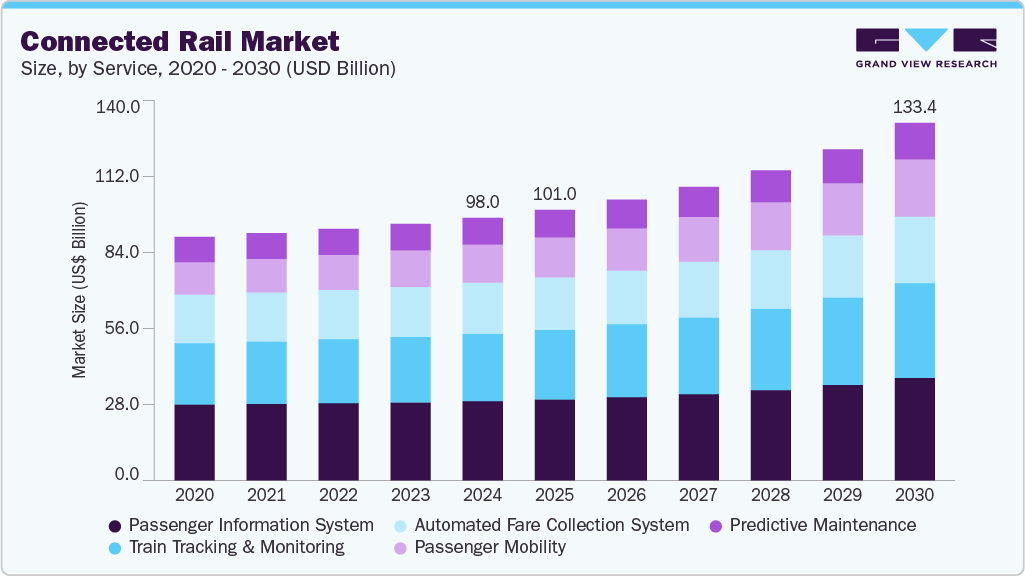

The global connected rail market size valued at USD 98.04 billion in 2024 and projected to reach USD 133.45 billion by 2030, growing at a CAGR of 5.7% from 2025 to 2030. The connected rail industry growth is propelled by rising urbanization, demand for efficient mass transit systems, and the need for enhanced passenger safety and operational reliability.

Key Market Trends & Insights

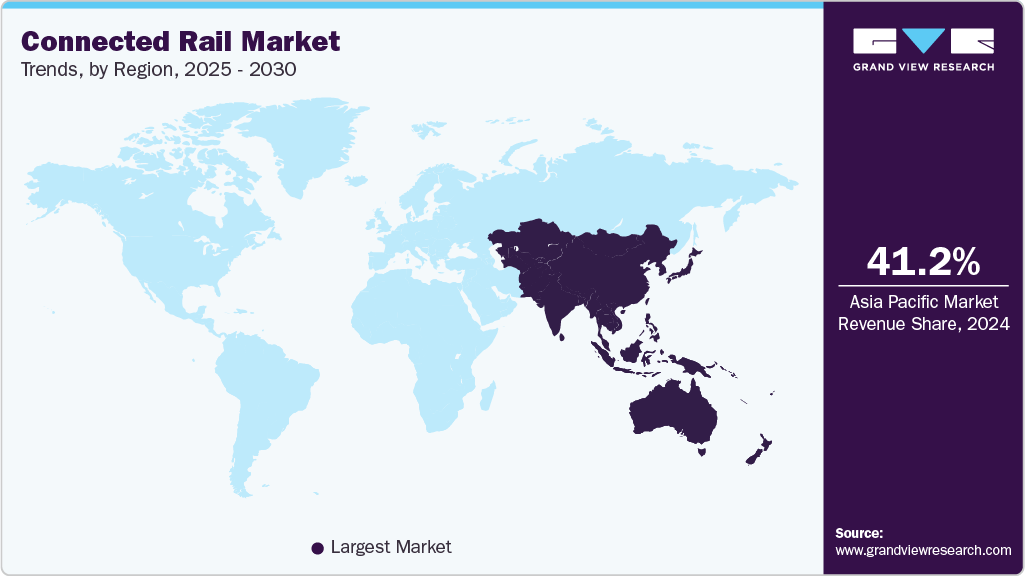

- Asia Pacific captured the largest revenue share of 41.2% in 2024.

- The Japan connected rail market is expected to grow rapidly in the coming years.

- In terms of service segment, the passenger information system segment accounted for the largest market share of 30.2% in 2024.

- In terms of rolling stock segment, the passenger wagons segment held the largest market share of 29.7% in 2024.

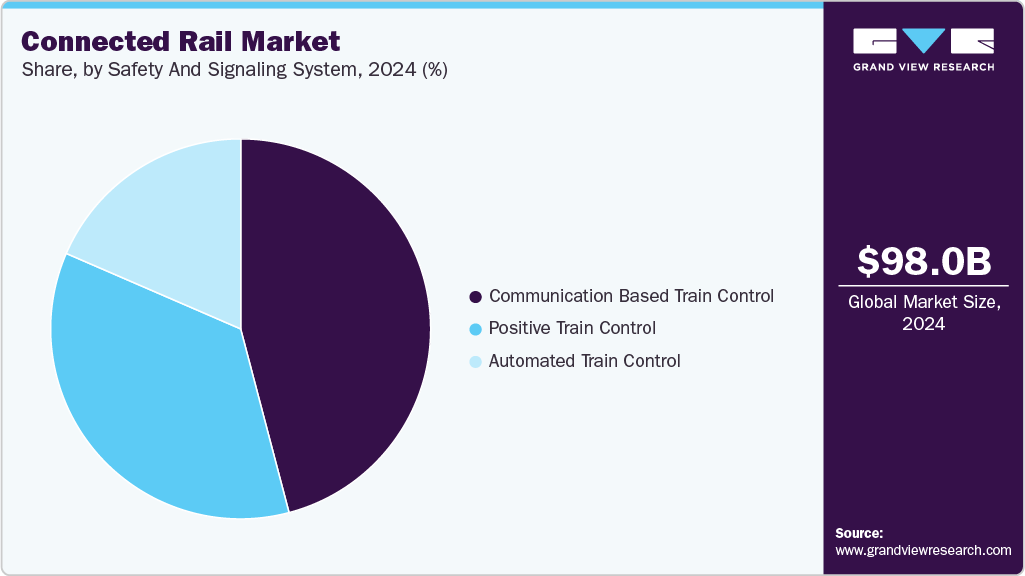

- In terms of safety and signaling system segment, the communication-based train control segment dominated the connected rail market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 98.04 Billion

- 2030 Projected Market Size: USD 133.45 Billion

- CAGR (2025-2030): 5.7%

- Asia-Pacific: Largest market in 2024

- Middle East & Africa: Fastest growing market

As cities expand and congestion intensifies, rail networks have been positioned as critical infrastructure, necessitating modernization and digital integration. In addition, heightened environmental concerns have driven preference toward rail over road and air transport due to its lower carbon footprint, thereby supporting the broader adoption of connected rail solutions globally. Significant technological advancements have been observed in areas such as predictive maintenance, communication-based train control (CBTC), and automated fare collection systems. Real-time data analytics, artificial intelligence, and Internet of Things (IoT) technologies have been integrated to optimize train scheduling, track monitoring, and passenger information systems. Connectivity across rolling stock and infrastructure has been enhanced through 5G and edge computing, enabling seamless communication and decision-making. These innovations have enabled rail operators to reduce costs, improve punctuality, and deliver better service quality.

Both public and private sectors have committed substantial investments to modernize railway infrastructure and deploy intelligent transportation systems. Government-led smart city initiatives and stimulus packages have been leveraged to accelerate the adoption of connected rail technologies, particularly in Asia-Pacific and Europe. Private players have also been engaged through public-private partnerships (PPPs) and infrastructure funds, enabling the scaling of advanced rail systems. The electrification of rail networks and the deployment of automated systems have been prioritized within long-term strategic transportation plans.

The regulatory landscape has been increasingly shaped by mandates focused on safety, interoperability, and environmental sustainability. Standards such as Positive Train Control (PTC) in the U.S. and European Rail Traffic Management System (ERTMS) in the EU have been enforced to ensure system harmonization and operational safety. Government regulations have also emphasized emissions reduction, thereby encouraging investment in electric locomotives and energy-efficient signaling technologies. Additionally, cybersecurity compliance requirements have been introduced to protect critical rail infrastructure from potential threats.

Despite its promising growth, the connected rail market has been constrained by high capital expenditure requirements, long project timelines, and integration complexities with legacy systems. Budget constraints among public authorities and limited digital infrastructure in developing regions have further slowed adoption. Operational disruptions during technology upgrades and the need for skilled labor to manage sophisticated systems have also been cited as barriers. Moreover, data privacy concerns and the risk of cyberattacks have necessitated greater vigilance, adding to implementation challenges.

Service Insights

The passenger information system segment accounted for the largest market share of 30.2% in 2024. Rising passenger expectations for real-time updates drive the growth of the connected rail industry. Today’s passengers demand real-time, accurate, and accessible travel information, such as train arrival/departure times, platform changes, delays, and emergency notifications. The increasing use of smartphones and digital interfaces has set a new standard for passenger services. To meet these expectations, rail operators are investing in advanced PIS technologies that can deliver consistent updates across mobile apps, onboard displays, station kiosks, and public address systems. This enhances customer satisfaction, improves passenger flow, and minimizes confusion in high-traffic areas.

The predictive maintenance segment is expected to grow at a significant CAGR during the forecast period. Reduction in downtime and service disruptions drives the growth of the market. Traditional preventive maintenance methods often lead to over-maintenance or missed failures, which can result in train delays or breakdowns. Predictive maintenance, on the other hand, uses real-time data and analytics to detect anomalies and predict component failures before they occur. This enables rail operators to schedule maintenance activities more effectively, reducing service interruptions and improving overall fleet availability.

Rolling Stock Insights

The passenger wagons segment held the largest market share of 29.7% in 2024. Rising demand for urban and intercity public transportation fuels the segment's growth. Passenger wagons are central to commuter and intercity rail systems, offering a sustainable alternative to congested roadways and carbon-intensive air travel. As more people rely on trains for daily commuting and long-distance travel, governments and transit authorities are investing in expanding and modernizing passenger rail fleets. This expansion directly boosts demand for connected technologies embedded in passenger wagons to ensure comfort, reliability, and real-time communication.

The electric locomotives segment is expected to register the fastest CAGR of 6.8% during the forecast period. Operational efficiency and lower lifecycle costs drive the growth of the segment. Electric locomotives offer greater energy efficiency and lower operating costs compared to diesel alternatives. Their ability to regenerate energy during braking and the lower cost of electricity versus diesel fuel contribute to substantial savings over time. In addition, electric locomotives typically require less maintenance because they have fewer moving parts and simpler mechanical systems. Connected technologies enable real-time monitoring of locomotive health and performance, further optimizing maintenance schedules and reducing downtime. This combination of energy efficiency and predictive maintenance capabilities makes electric locomotives an attractive option for rail operators seeking cost-effective solutions.

Safety And Signaling System Insights

The communication-based train control segment dominated the connected rail market in 2024. Modernization of legacy signaling systems drives the segment’s growth. Many rail networks worldwide are transitioning from outdated legacy signaling systems, such as fixed-block or manual signaling, to more sophisticated digital solutions, such as CBTC. Legacy systems often suffer from limited capacity, high maintenance costs, and reduced reliability. CBTC offers a modern, scalable alternative that integrates seamlessly with digital infrastructure, enabling easier upgrades, remote diagnostics, and predictive maintenance.

The automated train control segment is projected to grow at a significant CAGR of 6.4% over the forecast period. Increasing adoption of driverless and unattended train operations fuels the market growth. There is a rising trend towards driverless train systems and unattended train operations (UTO), particularly in metro and light rail networks worldwide. Cities such as Singapore, Paris, and Dubai have implemented fully automated trains that rely on ATC for safe and efficient functioning. The push for automation stems from the desire to improve service frequency, reduce headways, and offer 24/7 operations without constraints related to driver availability.

Regional Insights

The North America connected rail market held the largest market share in 2024. The connected rail industry is witnessing steady growth driven by increased investments in rail infrastructure modernization and the adoption of intelligent transportation systems. Rail operators across the region are focusing on enhancing operational efficiency and passenger safety through advanced technologies such as automated train control, predictive maintenance, and passenger information systems.

U.S. Connected Rail Market Trends

The U.S. connected rail industry held a dominant position in 2024 due to the federal mandates and funding aimed at improving railway safety and reducing operational risks. The implementation of Positive Train Control (PTC) has become a central element of the U.S. rail safety strategy, boosting demand for communication and automation technologies.

Europe Connected Rail Industry Trends

The Europe connected rail industry was identified as a lucrative region in 2024. High adoption rates of intelligent signaling systems and extensive government support for cross-border rail interoperability characterize the growth. The European Union’s investment in the Trans-European Transport Network (TEN-T) and the deployment of the European Rail Traffic Management System (ERTMS) are key drivers in modernizing regional rail networks.

The UK connected rail market is expected to grow rapidly in the coming years. The UK is advancing its connected rail capabilities through the Digital Railway program, which aims to modernize signaling infrastructure and increase network capacity. Rail operators are actively adopting technologies such as Communication-Based Train Control (CBTC) and real-time passenger information systems to improve service delivery and customer experience.

The connected rail market in Germany held a substantial market share in 2024. A robust rail manufacturing base and strong government backing for digital mobility drive the growth. The country is deploying CBTC and automated train control technologies across regional and long-distance networks to enhance operational efficiency. Deutsche Bahn, the national rail operator, is investing heavily in predictive maintenance and real-time data analytics to streamline operations and minimize downtime.

Asia Pacific Connected Rail Market Trends

Asia Pacific captured the largest revenue share of 41.2% in 2024. The Asia Pacific connected rail industry is anticipated to grow at a CAGR of 6.4% during the forecast period. The Asia Pacific region is experiencing rapid growth in the connected rail market, fueled by large-scale infrastructure investments and the expansion of urban rail systems. Countries across the region are embracing digital rail technologies to address rising transportation demands, urban congestion, and safety challenges. Advanced signaling systems, automated fare collection, and predictive maintenance are being increasingly deployed to improve service reliability and reduce operational disruptions.

The Japan connected rail market is expected to grow rapidly in the coming years, driven by its long-standing commitment to technological innovation and precision in rail operations. The country’s advanced high-speed rail systems, such as the Shinkansen, already incorporate sophisticated automation and real-time control technologies. Japan continues to invest in next-generation rail systems that integrate AI and IoT for predictive maintenance and enhanced passenger services.

The connected rail market in China held a substantial revenue share in 2024, supported by massive investments in high-speed rail and urban metro networks. The government’s “New Infrastructure” initiative has accelerated the adoption of smart technologies such as CBTC, ATC, and integrated passenger information systems. Chinese rail operators are leveraging big data and cloud computing to enhance asset performance and ensure seamless network management.

Key Connected Rail Company Insights

Some of the key companies in the connected rail market include Trimble Inc.; Siemens Mobility; Hitachi Rail Limited; and Huawei Technologies Co., Ltd. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Trimble Inc. is a technology company specializing in positioning, modeling, connectivity, and data analytics solutions. The company operates across diverse sectors, including construction, agriculture, geospatial, transportation, and rail. In the connected rail market, Trimble offers advanced technologies that support real-time train tracking, asset management, predictive maintenance, and driver assistance systems. The company is known for integrating GPS, laser, optical, and inertial technologies with application-specific software to improve productivity, safety, and operational efficiency.

-

Hitachi Rail Limited offers integrated solutions that encompass rolling stock, signaling systems, digital technologies, and turnkey services. As a wholly owned subsidiary of Hitachi, Ltd., the company is committed to advancing sustainable mobility and enhancing the efficiency of rail transportation worldwide. The company's product portfolio includes high-speed trains, such as the renowned A-train series, metro and commuter trains, freight locomotives, and advanced signaling systems. Hitachi Rail Limited's expertise extends to digital asset management, predictive maintenance, and traffic management systems, enabling operators to optimize performance and reduce operational costs.

Key Connected Rail Companies:

The following are the leading companies in the connected rail market. These companies collectively hold the largest market share and dictate industry trends.

- Trimble Inc.

- Siemens Mobility

- Robert Bosch GmbH

- Alstom SA

- Nokia

- Hitachi Rail Limited

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Wabtec Corporation

- Cisco Systems, Inc.

Recent Developments

-

In May 2025, Rail Forum and UKTram established a strategic partnership to enhance collaboration between the UK’s rail and light rail industries. The alliance is intended to create greater value for the members of both organizations through joint initiatives, reciprocal support, and coordinated goals. This new agreement builds upon their existing cooperation, which earlier in the year included UKTram Chair Steve Edwards participating in a Light Rail roundtable alongside Mike Hill, Deputy Director for Rail and Maritime at the Department for Business & Trade.

Connected Rail Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 101.02 billion

Revenue forecast in 2030

USD 133.45 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report rolling stock

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, rolling stock, safety and signaling system, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Trimble Inc.; Siemens Mobility; Robert Bosch GmbH; Alstom SA; Nokia; Hitachi Rail Limited; Huawei Technologies Co., Ltd.; International Business Machines Corporation; Wabtec Corporation; Cisco Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Connected Rail Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global connected rail market report based on service, rolling stock, safety and signaling system, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Information System

-

Train Tracking and Monitoring

-

Automated Fare Collection System

-

Passenger Mobility

-

Predictive Maintenance

-

-

Rolling Stock Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Wagons

-

Diesel Locomotive

-

Electric Locomotive

-

Light Rail and Trams

-

Freight Wagons

-

-

Safety And Signaling System Outlook (Revenue, USD Million, 2018 - 2030)

-

Positive Train Control

-

Communication-based Train Control

-

Automated Train Control

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global connected rail market size was estimated at USD 98.04 billion in 2024 and is expected to reach USD 101.02 billion in 2025.

b. The global connected rail market is expected to grow at a compound annual growth rate of 5.7% from 2025 to 2030 to reach USD 133.45 billion by 2030.

b. The passenger information system segment accounted for the largest share of 30.2% in 2024. Rising passenger expectations for real-time updates drive growth of the market.

b. Some key players operating in the connected rail market include Trimble Inc.; Siemens Mobility; Robert Bosch GmbH; Alstom SA; Nokia; Hitachi Rail Limited; Huawei Technologies Co., Ltd.; International Business Machines Corporation; Wabtec Corporation; Cisco Systems, Inc.

b. The connected rail market has been propelled by increasing urbanization, rising demand for efficient mass transit systems, and the growing need for enhanced passenger safety and operational reliability.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.