- Home

- »

- Advanced Interior Materials

- »

-

Construction Bolts Market Size, Share & Growth Report 2030GVR Report cover

![Construction Bolts Market Size, Share & Trends Report]()

Construction Bolts Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Residential, Non-Residential), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-167-0

- Number of Report Pages: 49

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Bolts Market Size & Trends

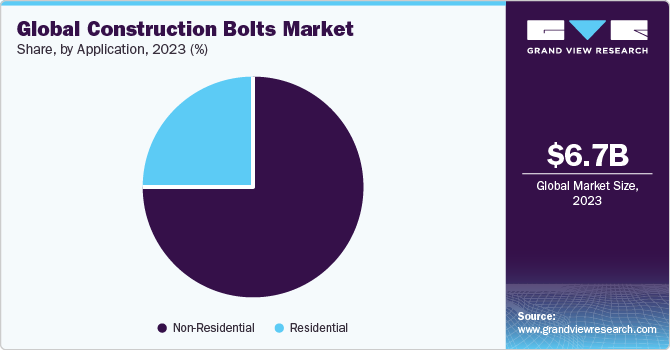

The global construction bolts market size was estimated at USD 6.65 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030. Demand for bolts in the construction industry is influenced by several factors, including the integral role that bolts play in enhancing structural integrity and safety of buildings and infrastructure. As urbanization and population continues to grow globally, there is a rapidly increasing demand for new infrastructure and buildings. This has led to a surge in construction activities, driving the need for a variety of fasteners, including bolts, to assemble and secure structural components.

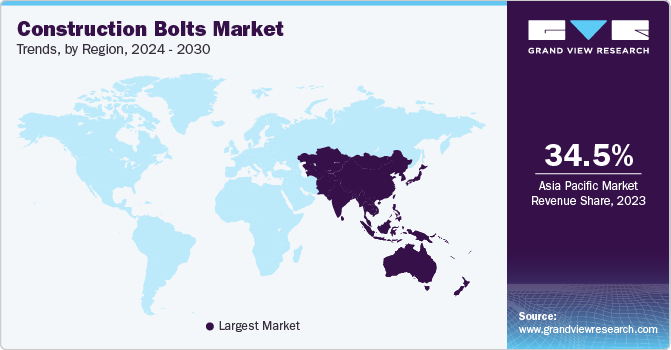

Demand for bolts in the construction sector is directly influenced by the growth of industry and growing product usage in the market. The growth in construction industry in Asia-Pacific is expected to be driven by factors such as rising population and high investments in countries such as India, China, South Korea, and Indonesia. This is expected to further propel the growth of market.

Market Dynamics

Bolts made of stainless steel, carbon steel, aluminum, brass, silicon bronze, and mild steel are utilized in several applications in construction sector such as in joining of structural elements and installation of materials on surfaces. They are widely used for building structures such as bridges, tunnels, highways, piers, and railings. High strength and load-bearing capacity are required in majority of construction industry, which results in low demand for plastic bolts. Metal bolts are the preferred choice in the construction industry as they are durable, safe, and help minimize the risk of accidents.

The rapid growth of construction projects in Asia, strong economic development, and expanding population are factors that favor the growth of market by contributing to product demand in residential and infrastructure constructions. In addition, increasing population and rapid urbanization are expected to emerge as major factors fueling a rise in residential construction spending.

However, the introduction of laser welding techniques in heavy machine equipment has led to an increase in welding market share. Welding is a cost-effective option in steel-intensive construction and is also a preferred choice as it ensures reliability and durability. Rising consumption of welds and rivets for various types of bridge and metal construction is anticipated to boost the welding market in infrastructural projects, thereby posing a threat to bolts market share.

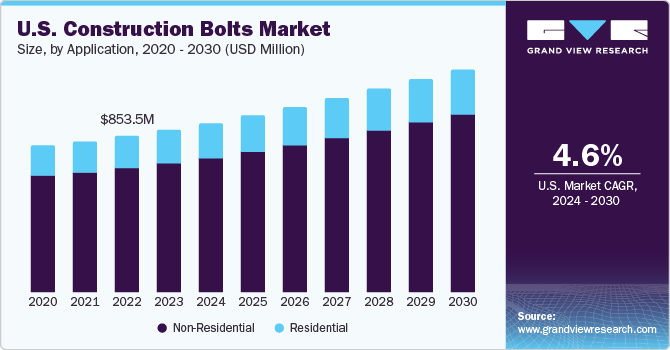

The U.S. economy is on a slow recovery path owing to the lessening impact of fiscal policies and strengthening of the housing industry, despite recent hikes in mortgage prices. The construction industry in the U.S. is expected to stabilize following the adverse effects of recession owing to large-scale investments in private construction. Factors such as strained relationships with neighboring countries due to economic & political instability are expected to contribute to the overall moderate growth in the country.

The construction industry in the U.S. has witnessed significant growth over the past few years in lodging, office, commercial (retail), healthcare, education, religious, public safety, amusement & recreation, transportation, communication, and manufacturing sectors. Primary factors driving the construction industry in the country include population growth, increase in government spending, and private investments.

Application Insights

Based on application, the non-residential segment led the market with largest revenue share of 74.7% in 2023 and is forecasted to grow with the highest CAGR of 5.6% from 2024 to 2030. Non-residential construction frequently involves heavy-duty applications and large-scale projects such as industrial plants, warehouses, and commercial complexes. Such projects demand robust and reliable fastening solutions to withstand heavy loads and provide structural integrity. Bolts play a crucial role in connecting prefabricated elements, providing a quick and efficient means of assembly. This contributes to the growing demand for bolts in non-residential projects. In addition, several non-residential structures rely heavily on steel framing and components. Bolts are critical for connecting steel beams, columns, and other elements in these structures, making them indispensable in the non-residential construction sector.

The residential application segment held a significant revenue share in 2023 and is forecasted to grow rapidly over the coming decade. In residential construction, especially in single-family homes and low-rise multi-family buildings, wooden and light-frame construction methods are preferred. Bolts play a vital role in connecting wooden framing elements, such as studs, beams, and trusses, ensuring the sturdiness and durability of the building structure. Growth in residential construction, particularly in suburban areas, contributes to the increased demand for bolts.

Residential development often focuses on a significant emphasis on aesthetics and design. Bolts, while primarily functional, also contribute to the overall appearance of buildings. The demand for aesthetically pleasing bolts, such as those with coated finishes or concealed fastening systems, is on the rise as homeowners and builders seek to balance design preferences with structural integrity.

Regional Insights

Based on region, Asia Pacific dominated the market with the largest revenue share of 34.5% in 2023 and is forecasted to grow at the fastest CAGR of 6.8% from 2024 to 2030. Economic growth in India, China, and Southeast Asian countries has augmented the need for better public infrastructure including roadways, harbors, airports, and rail transport systems.

In addition, a large number of airport building & development projects including building of new airfields and refurbishing of existing airports, have been undertaken to cater to the growing demand, thereby driving the construction industry growth. This is further expected to fuel the demand for bolts in the construction industry in Asia Pacific.

Growing geriatric population in economies such as China, India, and Bangladesh is expected to drive the need for expansion of transportation infrastructure. Moreover, ongoing development of railway infrastructure in India including metro rails and bullet trains is expected to drive the demand for building materials including bolts. These trends are projected to drive the market demand as it is widely used in building rail and roadway infrastructure.

Europe held a significant revenue share in 2023 and is expected to grow rapidly over the coming years. Europe is continuously investing in infrastructure development, including transportation, energy, and public facilities. Large-scale projects such as bridges, tunnels, and rail networks require a significant quantity of bolts for various applications, ranging from connecting steel components to securing critical infrastructure. The growth in infrastructure projects contributes to the rising demand for bolts.

Key Companies & Market Share Insights

The market is characterized by the presence of a large number of manufacturers catering to the global demand. Some companies undergo mergers and collaborations to expand their reach to increase their market share. Companies adopt merger and acquisition strategies for various reasons such as product portfolio expansions, distribution network expansions, promotion of key product brands, and new market entries. For instance, in June 2020, Fabory was acquired by Torqx Capital Partners, a Dutch private equity company. With this acquisition, Fabory aimed to grow from the strong technical distribution business of Torqx.

Key Construction Bolts Companies:

- Fabory, Fastenal Company

- REYHER

- KD FASTENERS, INC.

- AALL AMERICAN Fasteners

- Acument Intellectual Properties, LLC

- Haydon Bolts

- Caliber Enterprise.

- Ningbo Yi Pian Hong Fastener Co., Ltd.

- Bhansali Fasteners

- Baseline Bolts Industries LLC

Construction Bolts Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.99 billion

Revenue forecast in 2030

USD 9.65 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Central & South America

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; China; India; Japan; South Korea; Brazil

Key companies profiled

Fabory, Fastenal Company; REYHER; KD FASTENERS, INC.; AALL AMERICAN Fasteners; Acument Intellectual Properties, LLC; Haydon Bolts; Caliber Enterprise.; Ningbo Yi Pian Hong Fastener Co., Ltd.; Bhansali Fasteners; Baseline Bolts Industries LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Bolts Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction bolts market based on application and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-Residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global construction bolts market size was estimated at USD 6.65 billion in 2023 and is expected to reach USD 6.99 billion in 2024.

b. The global construction bolts market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 9.65 billion by 2030.

b. The non-residential application segment of the market accounted for the largest revenue share of 74.7% in 2023 owing to growing demand for bolt in commercial buildings & infrastructural development activities

b. Some of the key players operating in the construction bolts market include Fabory, Fastenal Company, REYHER, KD FASTENERS, INC., AALL AMERICAN Fasteners, and Acument Intellectual Properties, LLC

b. The key factors that are driving the construction bolts market is the growing infrastructural development activities in the developing countries in the Asia Pacific region

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.