- Home

- »

- Automotive & Transportation

- »

-

Construction Equipment Finance Market Size Report, 2033GVR Report cover

![Construction Equipment Finance Market Size, Share & Trends Report]()

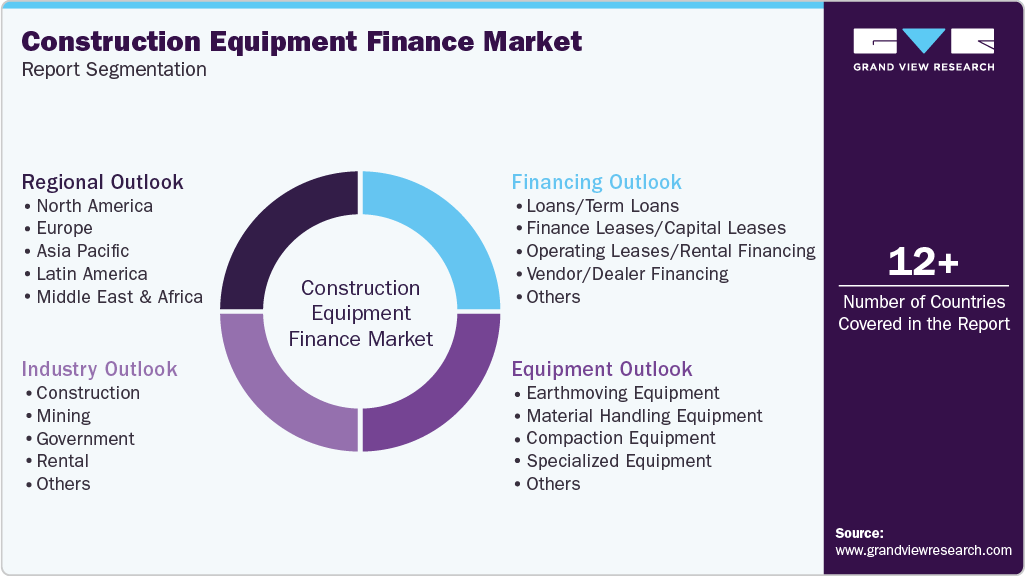

Construction Equipment Finance Market (2025 - 2033) Size, Share & Trends Analysis Report By Financing (Loans/Term Loans, Finance Leases/Capital Leases), By Equipment, By Industry (Construction, Mining, Government), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-772-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Equipment Finance Market Summary

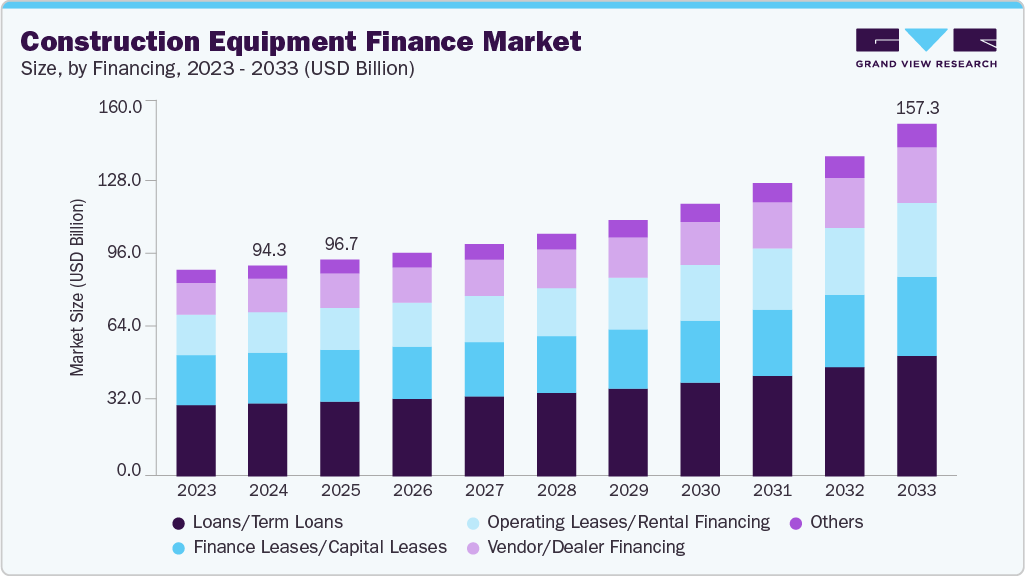

The global construction equipment finance market size was estimated at USD 94.27 billion in 2024, and is projected to reach USD 157.26 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033.The growth of the market is driven by the accelerating pace of global infrastructure development, rapid urbanization, and the growing demand for cost-efficient financing solutions among contractors.

Key Market Trends & Insights

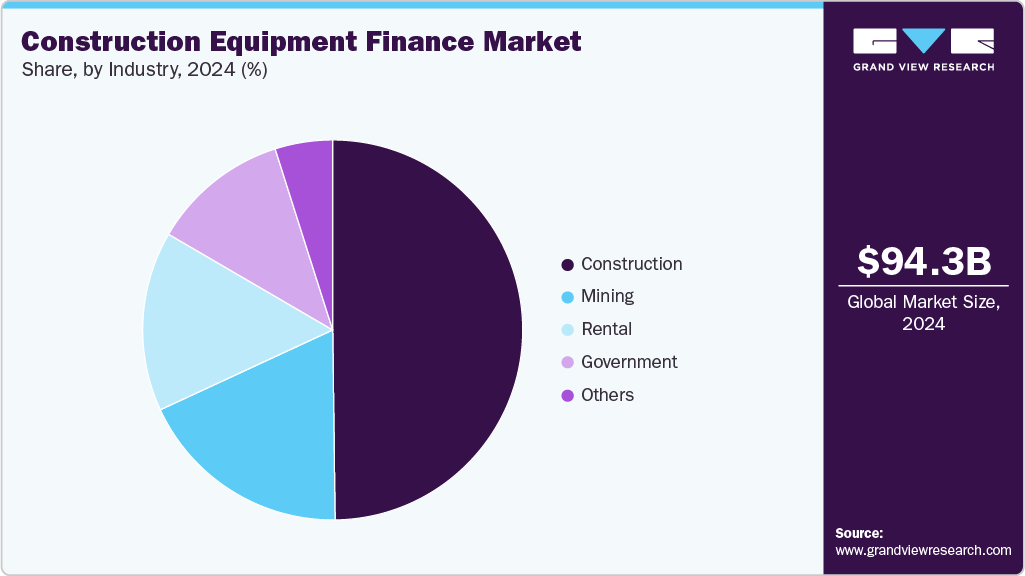

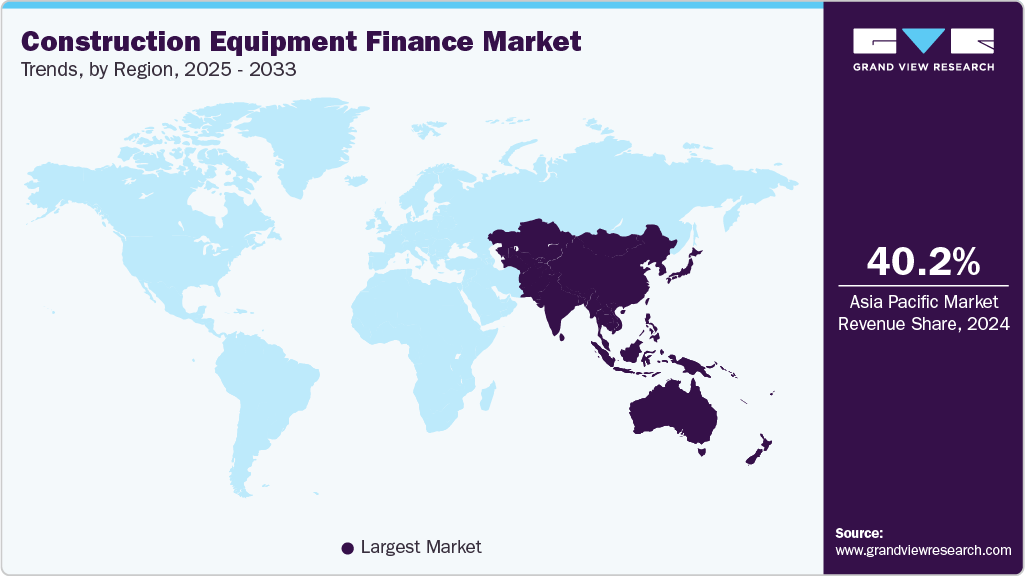

- Asia Pacific construction equipment finance industry accounted for a 40.2% share of the overall market in 2024.

- The construction equipment finance industry in the China held a dominant position in 2024.

- By financing, the loans/term loans segment accounted for the largest share of 34.7% in 2024.

- By equipment, the earthmoving equipment segment held the largest market share in 2024.

- By industry, the construction segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 94.27 Billion

- 2033 Projected Market Size: USD 157.26 Billion

- CAGR (2025-2033): 6.3%

- Asia Pacific: Largest market in 2024

Governments across emerging economies are investing heavily in transportation, housing, and energy projects, fueling demand for high-value equipment such as excavators, loaders, and cranes. Small and medium-sized contractors increasingly rely on financing and leasing options to manage cash flow and reduce upfront capital expenditure. Technological innovation is transforming construction equipment financing by enhancing asset management, risk assessment, and customer experience. The integration of IoT-enabled telematics allows financiers to track equipment usage, monitor asset performance, and assess residual value with greater accuracy. Artificial intelligence (AI) and machine learning (ML) are increasingly being used for credit risk modeling and predictive maintenance, while digital financing platforms streamline loan approvals and disbursements.Investments in the construction equipment finance industry are rising as banks, captive finance arms of OEMs, and independent leasing companies expand their portfolios to capitalize on strong demand. Equipment manufacturers such as Caterpillar Financial, Volvo Financial Services, and Komatsu Financial are increasingly partnering with fintech firms to provide flexible, customer-centric solutions. Venture capital and private equity investors are also showing interest in financing startups that specialize in equipment-as-a-service (EaaS) models, asset tracking, and digital financing platforms. Asia Pacific, in particular, is witnessing a surge in investments as local financial institutions develop tailored loan and lease products to support national infrastructure programs.

The regulatory environment surrounding construction equipment finance is evolving to promote transparency, asset safety, and fair lending practices. Governments and financial regulators are implementing stricter compliance frameworks for asset-backed lending, anti-money laundering (AML), and non-performing loan (NPL) management. In mature markets such as North America and Europe, equipment financing regulations align with banking and leasing standards, ensuring consumer protection and operational transparency. Emerging economies, meanwhile, are improving collateral registration systems and digitizing documentation processes to facilitate cross-border leasing and mitigate default risks.

Despite strong growth prospects, the market faces several challenges. High interest rates and inflationary pressures in certain regions can limit the affordability of financed equipment, particularly for small contractors. Volatile construction activity and cyclical demand fluctuations may also impact repayment capacities. In developing markets, inadequate credit assessment frameworks and weak collateral management systems pose additional risks for lenders. Moreover, the rising cost of raw materials and supply chain disruptions has inflated equipment prices, making financing more complex and expensive.

Financing Insights

The loans/term loans segment accounted for the largest share of 34.7% in 2024. The rising cost of advanced machinery and the need for flexible capital management among contractors drive the growth of the segment. As modern construction projects increasingly rely on high-performance, fuel-efficient, and technologically integrated equipment, the initial purchase cost has surged, making traditional cash purchases less viable. Long-term loan structures allow contractors and fleet owners to spread out repayments over several years, reducing immediate financial strain while enabling them to access premium machinery.

The operating leases/rental financing segment is expected to grow at the fastest CAGR during the forecast period. The operating lease and rental financing segment is witnessing rapid growth as construction firms increasingly favor asset-light business models. With project cycles becoming shorter and more diverse, many contractors prefer renting or leasing equipment rather than owning it outright. Operating leases offer significant flexibility, allowing companies to use equipment only for the duration of a project and return it afterward, thereby avoiding depreciation and maintenance liabilities. This model minimizes capital expenditure (CAPEX) and enhances operational efficiency, especially for small and mid-sized enterprises (SMEs) that may lack large cash reserves.

Equipment Insights

The earthmoving equipment segment held the largest market share of 38.3% in 2024. The financing of earthmoving equipment, including excavators, loaders, bulldozers, and backhoe loaders, is expanding rapidly due to sustained demand from global infrastructure and urban development projects. Governments and private developers are investing heavily in road construction, housing, and industrial expansion, creating a strong pipeline of projects that require heavy-duty earthmoving machinery. Since these machines represent significant capital expenditures, contractors increasingly rely on loans, leases, and OEM financing programs to acquire them. The growing preference for long-term financing structures aligns with the high utilization and long service life of earthmoving equipment, making it financially viable for both lenders and borrowers.

The specialized equipment segment is expected to grow at the fastest CAGR during the forecast period. The specialized equipment category, which includes Pile Drivers, Concrete Pumps, Asphalt Pavers, and Welding Machines, is experiencing strong growth in financing demand due to the increasing complexity and scale of modern infrastructure projects. Specialized machines are typically high-value, project-specific assets that require significant upfront investment, leading contractors and project developers to depend heavily on structured financing and leasing solutions. The surge in large-scale projects such as metro rail systems, airports, smart cities, renewable energy infrastructure, and oil & gas facilities has created sustained financing opportunities for such specialized assets. Financial institutions and OEM captive lenders are responding by designing project-based finance structures with flexible repayment linked to project milestones.

Industry Insights

The construction segment dominated the market in 2024. The adoption of construction equipment finance in the construction industry is primarily driven by the need to manage high equipment acquisition costs and maintain liquidity for ongoing projects. Modern construction projects, spanning residential, commercial, and infrastructure development, require advanced machinery such as excavators, cranes, and loaders, which come with significant capital outlays. Financing solutions such as long-term loans, equipment leases, and vendor financing allow contractors to reduce upfront costs while maintaining access to the latest equipment.

The rental segment is projected to grow at the fastest CAGR of 7.5% over the forecast period. In the rental industry, the adoption of construction equipment finance is being propelled by the shift toward asset-light business models and increasing demand for short-term project-based equipment usage. Rental companies are expanding their fleets to meet diverse project requirements without making full upfront capital investments. Equipment finance solutions, particularly operating leases and fleet-based loans, enable rental operators to scale their inventory efficiently while preserving cash flow.

Regional Insights

The North America construction equipment finance industry held a significant share in 2024. The market in North America is mature and well-established, supported by a robust network of banks, captive finance companies, and independent leasing firms. Growth in the region is driven by large-scale infrastructure modernization, commercial construction, and renewable energy projects.

U.S. Construction Equipment Finance Market Trends

The U.S. construction equipment finance industry held a dominant position in North American region in 2024 due to the strong public investment in transportation, energy, and housing infrastructure. Federal initiatives such as the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act stimulate equipment demand, prompting contractors to utilize financing solutions to manage capital efficiently.

Europe Construction Equipment Finance Market Trends

The Europe construction equipment finance industry was identified as a lucrative region in 2024. The growth in the region is driven by sustainability-oriented infrastructure projects and the transition toward eco-efficient equipment. The region has a high penetration of leasing and vendor-based financing, particularly in Western Europe, where companies prefer asset-light business models to manage equipment lifecycle costs.

The UK construction equipment finance industry is expected to grow rapidly in the coming years. The market in the region is evolving in response to renewed government spending on transport, housing, and renewable energy infrastructure. Contractors and plant hire firms are increasingly turning to leasing and long-term loan solutions to fund equipment upgrades and fleet expansion.

The Germany construction equipment finance industry held a substantial market share in 2024. The country’s focus on smart infrastructure, sustainable construction, and digitization is prompting contractors to adopt technologically advanced equipment, often financed through leases and vendor programs.

Asia Pacific Construction Equipment Finance Market Trends

The Asia Pacific construction equipment finance industry is anticipated to grow at a CAGR of 7.3% during the forecast period. The market is expanding rapidly, driven by large-scale infrastructure investments, urbanization, and industrialization across developing economies. Rising equipment prices and the growing participation of small and mid-sized contractors have increased reliance on equipment loans and leases.

The India construction equipment finance industry is expected to grow rapidly in the coming years, fueled by national infrastructure programs such as Bharatmala, Smart Cities Mission, and Gati Shakti. High capital intensity and increasing adoption of advanced equipment have led contractors to rely on loans and lease-based financing solutions.

The China construction equipment finance market held a substantial market share in 2024. The growth of the market in the region is supported by massive infrastructure development and urban renewal projects under initiatives such as the Belt and Road Initiative (BRI). The market is dominated by domestic OEMs and financial institutions offering low-interest loans and flexible leasing programs to contractors and state-owned enterprises.

Key Construction Equipment Finance Company Insights

Some of the key companies in the construction equipment finance industry include Caterpillar, Deere & Company, Komatsu, AB Volvo, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Caterpillar Inc. is a construction and mining equipment provides, also offering comprehensive construction finance solutions through its wholly owned subsidiary, Cat Financial. Cat Financial provides retail and wholesale financing, leasing, and equipment protection services tailored to Caterpillar customers and dealers worldwide. This captive finance company supports the acquisition and lifecycle management of capital-intensive machinery by offering flexible payment options that help customers overcome financing barriers.

-

Deere & Company, a manufacturer of agricultural, construction, and forestry machinery, operates a financial services segment that supports its core equipment business. Its financial services division, John Deere Financial, provides tailored construction finance solutions, including retail and wholesale equipment financing, leasing, and related credit products to customers and dealers globally. It plays a critical role in enabling customers to acquire and manage expensive construction machinery through flexible payment options, facilitating infrastructure and construction projects worldwide.

Key Construction Equipment Finance Companies:

The following are the leading companies in the construction equipment finance market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar

- Deere & Company

- Komatsu

- AB Volvo

- CNH Industrial Capital Private Limited

- DLL

- Siemens Financial Services GmbH

- BNP Paribas Leasing Solutions

- Mitsubishi HC Capital America

- Sumitomo Mitsui Finance and Leasing Co., Ltd

Recent Developments

-

In September 2025, Gordon Brothers, an asset management firm, formed a USD 1.5 billion joint venture with Davidson Kempner Capital Management and obtained a lender finance facility from Wells Fargo Capital Finance to strengthen and expand its commercial equipment financing capabilities. This expanded capital base enables Gordon Brothers to offer flexible, customized financing solutions to large corporate and middle-market clients in key sectors such as manufacturing, construction, and loans. It provides a comprehensive range of equipment financing options, including capital leases, loans, and specialized lease structures such as Fair Market Value (FMV) and Terminal Rental Adjustment Clause (TRAC) leases.

-

In February 2024, Mahindra Construction Equipment (MCE) entered into a strategic partnership with Bank of Maharashtra through a Memorandum of Understanding (MoU) to provide tailored financing solutions for its range of construction equipment. This collaboration aims to offer customers hassle-free and adequate credit options for purchasing Mahindra’s upcoming and current BSV range of construction machinery, including products such as the EarthMaster backhoe loader and Earthmoving EquipmentMaster motor grader.

Construction Equipment Finance Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 96.73 billion

Revenue forecast in 2033

USD 157.26 billion

Growth Rate

CAGR of 6.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report equipment

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Financing, equipment, industry, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Caterpillar; Deere & Company; Komatsu; AB Volvo ; CNH Industrial Capital Private Limited; DLL; Siemens Financial Services GmbH; BNP Paribas Leasing Solutions; Mitsubishi HC Capital America; Sumitomo Mitsui Finance and Leasing Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Equipment Finance Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global construction equipment finance market report based on financing, equipment, industry, and region.

-

Financing Outlook (Revenue, USD Million, 2021 - 2033)

-

Loans/Term Loans

-

Finance Leases/Capital Leases

-

Operating Leases/Rental Financing

-

Vendor/Dealer Financing

-

Others

-

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Earthmoving Equipment

-

Material Handling Equipment

-

Compaction Equipment

-

Specialized Equipment

-

Others

-

-

Industry Outlook (Revenue, USD Million, 2021 - 2033)

-

Construction

-

Mining

-

Government

-

Rental

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global construction equipment finance market size was estimated at USD 94.27 billion in 2024 and is expected to reach USD 96.73 billion in 2025.

b. The global construction equipment finance market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 157.26 billion by 2033.

b. Asia Pacific led the construction equipment finance gaining a market share of 40.2%. The market is expanding rapidly, driven by large-scale infrastructure investments, urbanization, and industrialization across developing economies.

b. Some key players operating in the construction equipment finance market include Caterpillar; Deere & Company; Komatsu; AB Volvo ; CNH Industrial Capital Private Limited; DLL; Siemens Financial Services GmbH; BNP Paribas Leasing Solutions; Mitsubishi HC Capital America; Sumitomo Mitsui Finance and Leasing Co., Ltd

b. The growth of the market is driven by the accelerating pace of global infrastructure development, rapid urbanization, and the growing demand for cost-efficient financing solutions among contractors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.