- Home

- »

- Specialty Glass, Ceramic & Fiber

- »

-

Construction Fabrics Market Size, Industry Report, 2030GVR Report cover

![Construction Fabrics Market Size, Share & Trends Report]()

Construction Fabrics Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (PVC, PTFE, ETFE), End Use (Residential, Non-residential), By Region (North America, Europe, Asia Pacific, Central & South America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-4-68040-559-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Fabrics Market Size & Trends

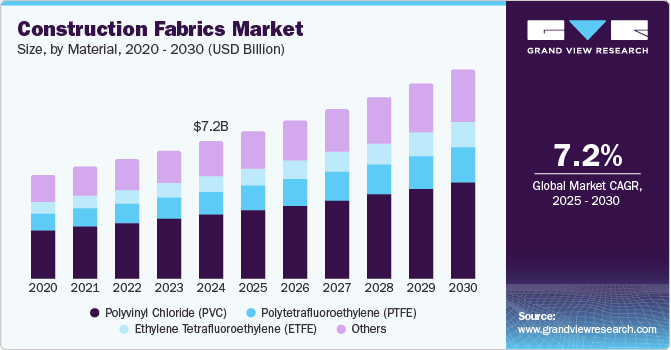

The global construction fabrics market size was estimated at USD 7.21 billion in 2024 and is expected to expand at a CAGR of 7.2% from 2025 to 2030. This growth is driven by rapid urbanization, infrastructural development, and increased environmental awareness. As cities expand and modern architectural designs gain traction, there is a growing preference for lightweight, durable, and aesthetically appealing materials like construction fabrics. These fabrics are increasingly used in residential and non-residential projects due to their energy efficiency and cost-effectiveness.

Government initiatives promoting green buildings and sustainable construction practices further contribute to market growth. Moreover, the rising popularity of temporary structures such as event tents, canopies, and modular buildings is boosting demand. Construction fabrics also offer benefits like UV resistance, flexibility, and low maintenance, making them an attractive choice across regions.

Technological innovation is playing a pivotal role in transforming the market. Advances in coating technologies, such as nanotechnology and polymer science, have significantly enhanced the strength, longevity, and weather resistance of fabrics like PVC, PTFE, and ETFE. ETFE, for example, is now being engineered for greater transparency and self-cleaning properties, making it ideal for modern architectural marvels like stadiums and airports. In addition, digital printing on fabrics allows for customizable and dynamic designs, adding to their aesthetic value. Innovations in tensioning systems and modular installation techniques are also making it easier and faster to deploy construction fabrics in diverse environments. As smart materials and sensor integration become more common, the future holds promise for intelligent, responsive fabric structures.

Among the numerous drivers, energy efficiency and durability stand out as crucial. Construction fabrics offer excellent thermal insulation properties, which help reduce energy consumption in buildings. ETFE, for instance, allows natural light penetration while minimizing heat gain, contributing to lower HVAC costs. This makes it a sustainable alternative to traditional glass. Another major factor is that fabrics like PVC are designed to withstand harsh environmental conditions such as wind, rain, and UV exposure without significant wear and tear. These properties ensure longevity and reduce overall lifecycle costs, making them highly appealing for residential and non-residential construction projects.

The increasing demand for construction fabrics is closely tied to the global shift toward sustainable and lightweight architectural solutions. As building regulations tighten and awareness around carbon footprints rises, construction stakeholders seek alternatives to traditional materials like concrete and steel. Fabric structures, which require fewer raw materials and generate less construction waste, are becoming a preferred choice. Their lightweight nature reduces transportation and installation costs, while their recyclability supports green building certifications such as LEED. This trend is particularly prominent in emerging economies, where rapid urban development must align with environmental goals, making construction fabrics a strategic solution for balancing progress and sustainability.

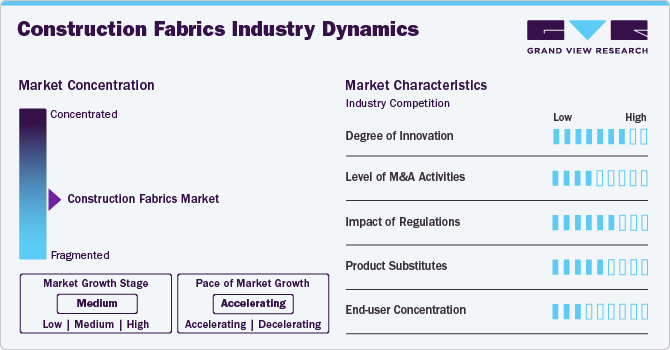

Market Concentration & Characteristics

The global market demonstrates a moderate to high degree of innovation fueled by a blend of environmental responsibility, performance enhancement, and design flexibility. Rising demand for energy-efficient buildings has encouraged the development of smart fabrics with thermal regulation, light diffusion, and self-cleaning properties, especially in materials like ETFE and PTFE. Manufacturers also explore biodegradable coatings and solvent-free production processes to reduce environmental impact. Another key area of innovation lies in digital fabrication and 3D modeling, which enable precise customization and quicker prototyping. The push for visually iconic yet functional architecture, particularly in non-residential sectors like sports arenas and airports, continues to expand the boundaries of what these fabrics can achieve, making this one of the most dynamic niches in construction technology today.

Leading companies in the market are actively focusing on strategic collaborations, R&D investments, and product diversification to gain a competitive edge. For materials, firms are expanding their offerings in high-performance segments like PTFE and ETFE to cater to premium construction needs. In terms of end use, some players are aligning their portfolios toward the fast-growing non-residential segment, including commercial buildings and public infrastructure. Companies also adopt eco-friendly production methods and promote recyclable fabric solutions to meet evolving consumer preferences. This multifaceted approach is essential to stay relevant in a dynamic and highly competitive market landscape.

Material Insights

The Polyvinyl Chloride (PVC) segment led the market and accounted for the largest revenue share of 46.4% in 2024, driven by its exceptional balance of performance, cost-effectiveness, and versatility. PVC-coated fabrics are widely used in a range of applications including tensile structures, awnings, roofing membranes, and temporary pavilions. Their popularity stems from attributes such as excellent durability, water resistance, UV protection, and ease of fabrication. Moreover, PVC fabrics are relatively inexpensive to produce and install, making them a preferred choice for budget-conscious construction projects, particularly in developing regions. The material’s long lifecycle and minimal maintenance requirements enhance its appeal for large-scale infrastructure projects and industrial applications. As global infrastructure spending increases and awareness of resource efficiency grows, PVC remains the go-to material for projects demanding performance and affordability.

Ethylene Tetrafluoroethylene (ETFE) is experiencing the fastest market growth, driven by its cutting-edge properties that align with modern architectural and sustainability goals. ETFE is an ultra-lightweight, highly transparent, and self-cleaning material that offers superior resistance to UV radiation, weathering, and chemical exposure. It allows up to 95% light transmission while providing excellent thermal insulation, making it ideal for energy-efficient structures such as stadiums, airports, and greenhouses. Furthermore, advancements in multilayer cushion systems and smart surface technologies enhance their functionality, supporting dynamic shading and temperature control. As architects and developers seek innovative solutions for iconic and sustainable structures, ETFE is rapidly emerging as the future material.

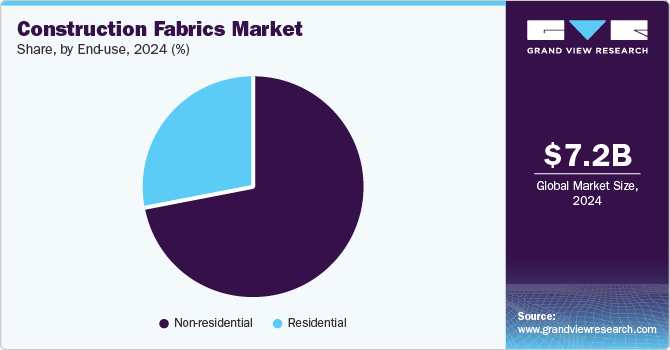

End Use Insights

The non-residential segment dominated the market and accounted for the largest revenue share of 72.2% in 2024. This demand comes from commercial complexes, public infrastructure, sports facilities, and transportation hubs. A key driver is the appeal of large, flexible, and architecturally striking fabric structures in spaces like airports, stadiums, and exhibition centers. These materials allow expansive, column-free interiors and natural light penetration, enhancing functionality and visual impact. Governments and private entities also invest heavily in sustainable infrastructure, leading to a preference for energy-efficient and low-maintenance materials like ETFE and PTFE. Moreover, the ease and speed of installation make fabric-based construction ideal for temporary or semi-permanent non-residential projects, such as emergency shelters or event pavilions.

The demand for residential segment is also growing. The growing trend toward modern, space-efficient, and eco-conscious living drives this demand. Urban housing developments increasingly incorporate fabric structures for awnings, carports, garden coverings, and tensile roofs due to their cost-effectiveness and aesthetic appeal. In addition, homeowners are seeking solutions that provide shade and insulation while enhancing the exterior design of homes. The shift toward sustainable materials and energy-efficient homes is further fueling the adoption of fabrics like PTFE and PVC, which offer thermal benefits and durability. Rapid population growth and rising disposable incomes, especially in developing nations, also contribute to the increased use of construction fabrics in residential settings.

Regional Insights

Asia Pacific dominated the market and accounted for the largest revenue share of 42.2% in 2024. Asia Pacific is witnessing explosive growth in construction fabric demand due to urban expansion, booming construction activities, and increasing residential and non-residential infrastructure investments. Countries like India, China, and Southeast Asia are rapidly urbanizing, which is prompting the need for innovative, space-efficient, and cost-effective building materials. Construction fabrics are particularly valued in this region for their quick installation, ability to withstand diverse weather conditions, and minimal maintenance. The region’s proactive push toward sustainable urban development and smart cities has created a favorable environment for modern construction technologies, including advanced fabric-based structures offering functionality and aesthetic appeal.

China Construction Fabrics Market Trends

The construction fabrics market in China dominated the Asia Pacific market in terms of revenue share in 2024. China is rapidly expanding its use of construction fabrics as part of its ambitious urban development and modernization strategies. The country’s drive toward green building solutions and futuristic architecture is pushing builders to adopt sustainable, efficient, and visually impactful materials. Fabric structures are being integrated into large-scale infrastructure projects, commercial hubs, and public facilities due to their lightweight, energy-saving capabilities and ability to create vast, open interiors. China's emphasis on smart cities and digital design integration also aligns well with the growing innovation in fabric materials, making them an integral part of contemporary architectural expressions and infrastructure planning.

Europe Construction Fabrics Market Trends

The construction fabrics market in Europe is expected to grow significantly over the forecast period. Europe stands at the forefront of the global shift toward sustainable and eco-conscious construction, which significantly drives the demand for construction fabrics across the continent. Strict building regulations, climate change policies, and the widespread acceptance of green certifications have pushed architects and developers to embrace materials that reduce environmental impact. Construction fabrics, particularly PTFE and ETFE, are favored for their recyclability, energy efficiency, and compatibility with modern minimalist design trends. In addition, Europe’s well-established culture of innovation in engineering and materials science promotes the continuous development and use of advanced fabric solutions in high-profile projects ranging from museums and commercial centers to airports and stadiums.

Germany construction fabrics market is being propelled by its strong focus on environmental sustainability, precision engineering, and architectural innovation. The country’s building sector has long embraced energy-efficient materials, and using high-performance fabrics like PTFE and ETFE is a natural extension of this mindset. These fabrics are used for their functionality, such as insulation and durability, and their ability to support cutting-edge design in residential and non-residential settings. With a deep-rooted culture of research and development, Germany continues to lead in pioneering advanced material technologies that support the country's sustainable construction goals and ambitious architectural visions.

North America Construction Fabrics Market Trends

The construction fabrics market in North America is poised for steady growth, driven by the region’s focus on sustainable building practices, modernization of aging infrastructure, and a strong inclination toward innovative architecture. The versatility of construction fabrics makes them ideal for a wide range of applications, from outdoor canopies and sports arenas to retail spaces and transportation hubs. As consumers and developers prioritize energy efficiency, fabric structures that offer thermal insulation, UV resistance, and natural light diffusion are gaining popularity. Furthermore, growing investments in smart cities and urban redevelopment projects encourage the use of lightweight, adaptable materials that align with green construction goals and accelerated project timelines.

The U.S. construction fabrics market is experiencing a growing demand as the country embraces a shift toward modular, sustainable, and aesthetically flexible construction techniques. Fabric materials are increasingly used in commercial spaces, sports complexes, educational institutions, and public infrastructure due to their rapid installation, structural efficiency, and visual impact. As developers and city planners seek cost-effective and environmentally responsible alternatives to traditional building materials, construction fabrics offer an attractive solution. The expanding trend of outdoor spaces such as open-air retail areas, event venues, and transit shelters also contributes to their popularity, supported by rising public and private investments in infrastructure renewal and urban revitalization.

Latin America Construction Fabrics Market Trends

The construction fabrics market in Latin America is gaining ground due to the growing need for versatile and low-cost construction methods that can adapt to a wide range of environments and community needs. The region’s emphasis on improving public infrastructure, housing, and tourism amenities creates a fertile ground for fabric-based solutions that are durable, quick to install, and require minimal upkeep. For shading systems in urban parks or temporary shelters in remote or disaster-prone areas, fabric structures blend practicality and design potential. With increasing attention to resilience and resource efficiency, construction fabrics are becoming a valuable tool in Latin America's evolving architectural and infrastructural landscape.

Middle East & Africa Construction Fabrics Market Trends

The construction fabrics market in the Middle East and Africa is emerging significantly due to their unique architectural ambitions and climatic demands. In the Middle East, the extreme temperatures and intense solar radiation have led to the widespread use of fabric materials that provide shade and thermal regulation in public spaces, transit hubs, and cultural landmarks. Iconic projects and mega events also encourage using innovative materials that blend design elegance with functional performance. In Africa, the demand is growing for low-cost, easy-to-install construction solutions to support rapid urbanization, disaster recovery, and basic infrastructure needs. The scalability and efficiency of fabric structures make them highly suitable for the region’s diverse economic and environmental conditions.

Key Construction Fabrics Companies Insights

Some of the key players operating in the market include Seaman Corporation and Sioen Industries NV.

-

Seaman Corporation is a U.S.-based manufacturer that has become a leader in high-performance coated fabrics for architectural and industrial use. In the construction sector, the company is recognized for its FiberTite roofing systems and architectural fabrics used in tensile structures and environmental enclosures. Seaman emphasizes longevity, UV resistance, and superior weather performance in its fabric solutions, catering to a wide array of demanding construction applications across the globe.

-

Established in 1960, Sioen Industries NV is a Belgian multinational renowned for its expertise in technical textiles, including high-performance construction fabrics. The company produces coated technical textiles used in architectural applications such as tensile structures, façades, and roofing systems. Sioen is known for its innovation in PVC-coated fabrics, offering solutions combining strength, flexibility, and long-term durability for temporary and permanent structures.

Sattler AG and HIRAOKA & Co., Ltd. are emerging market participants.

-

Sattler AG is an Austria-based company with a long-standing tradition in producing high-quality textiles. In the construction fabrics segment, Sattler is well-regarded for its architectural membrane solutions, particularly in the areas of awnings, canopies, and tensile architecture. The company focuses on delivering UV-resistant, flame-retardant, and weatherproof materials and has built a strong reputation for blending functionality with visual elegance in outdoor fabric applications.

-

HIRAOKA & Co., Ltd., established in 1902 in Japan, specializes in developing and manufacturing functional films and coated fabrics for a wide range of industries, including construction. The company provides advanced fabric materials used in roofing, facades, domes, and shelters, emphasizing performance, safety, and sustainability. HIRAOKA is known for leveraging cutting-edge coating technologies to produce durable, lightweight, and adaptable materials to meet challenging architectural demands.

Key Construction Fabrics Companies:

The following are the leading companies in the construction fabrics market. These companies collectively hold the largest market share and dictate industry trends.

- Sioen Industries NV

- Sattler AG

- TAIYO KOGYO CORPORATION

- SERGE FERRARI

- Saint-Gobain

- HIRAOKA & Co., Ltd.

- ENDUTEX COATED TECHNICAL TEXTILES

- Verseidag-Indutex GmbH

- Hightex Maintenance GmbH

- EREZ Thermoplastic Products

- Seaman Corporation

Construction Fabrics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.73 billion

Revenue forecast in 2030

USD 10.94 billion

Growth rate

CAGR of 7.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Sioen Industries NV; Sattler AG; TAIYO KOGYO CORPORATION; SERGE FERRARI; Saint-Gobain; HIRAOKA & Co., Ltd.; ENDUTEX COATED TECHNICAL TEXTILES; Verseidag-Indutex GmbH; Hightex Maintenance GmbH; EREZ Thermoplastic Products; Seaman Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

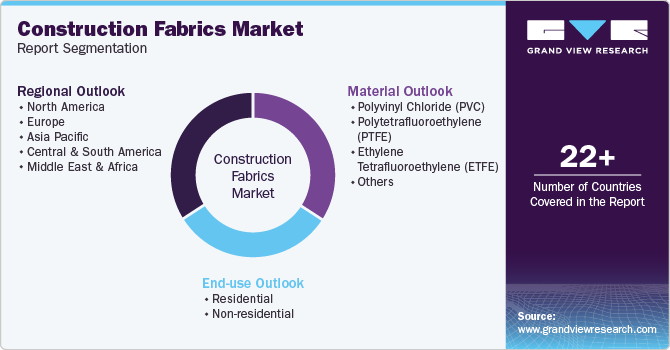

Global Construction Fabrics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction fabrics market report based on material, end use, and region:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyvinyl Chloride (PVC)

-

Polytetrafluoroethylene (PTFE)

-

Ethylene Tetrafluoroethylene (ETFE)

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global construction fabrics market size was estimated at USD 7.21 billion in 2024 and is expected to reach USD 7.73 billion in 2025.

b. The global construction fabrics Market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2030 to reach USD 10.94 billion by 2030.

b. The polyvinyl chloride (PVC) segment led the market and accounted for the largest revenue share of 46.4% in 2024, due to its cost-effectiveness, durability, and wide applicability across diverse construction projects.

b. Some of the key players operating in the Construction Fabrics Market include Sioen Industries NV, Sattler AG, TAIYO KOGYO CORPORATION, SERGE FERRARI, Saint-Gobain, HIRAOKA & Co., Ltd., ENDUTEX COATED TECHNICAL TEXTILES, Verseidag-Indutex GmbH, Hightex Maintenance GmbH, EREZ Thermoplastic Products, Seaman Corporation.

b. The key factors driving demand for construction fabrics include the growing emphasis on sustainable building practices, rapid urbanization, lightweight architecture, and the need for cost-effective, durable, and aesthetically flexible materials.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.