- Home

- »

- Plastics, Polymers & Resins

- »

-

Construction Films Market Size, Share, Industry Report 2030GVR Report cover

![Construction Films Market Size, Share & Trends Report]()

Construction Films Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vapor Barrier Films), By Resin Type, By Application, By Function, By End Use, By Distribution Channel, Region, And Segment Forecasts

- Report ID: GVR-3-68038-056-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Construction Films Market Summary

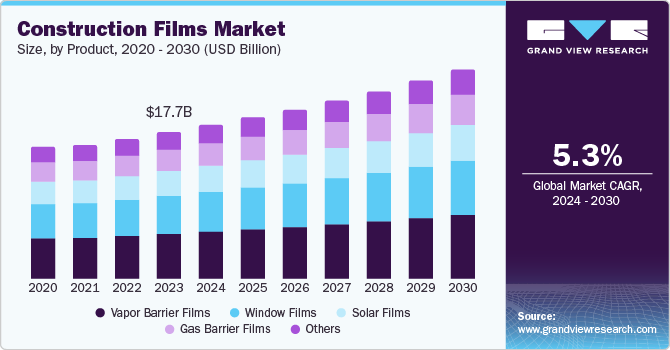

The global construction films market size was valued at USD 17.7 billion in 2023 and is projected to reach USD 25.3 billion by 2030, growing at a CAGR of 5.3% from 2024 to 2030. Construction films are generally used for various applications comprising all types of masking works in construction and protecting buildings from water infiltration in the construction process.

Key Market Trends & Insights

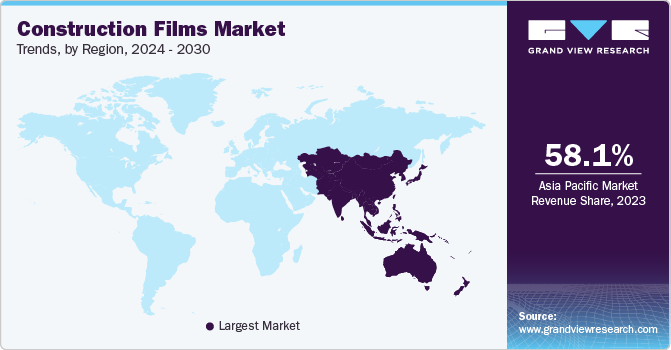

- Asia Pacific dominated the global market and accounted for the largest revenue share of 58.1% in 2023.

- China dominated the Asia Pacific market and accounted for the largest revenue share of 41.4% in 2023.

- By product, vapor barrier films dominated the market and accounted for the largest revenue share of 31.5% in 2023.

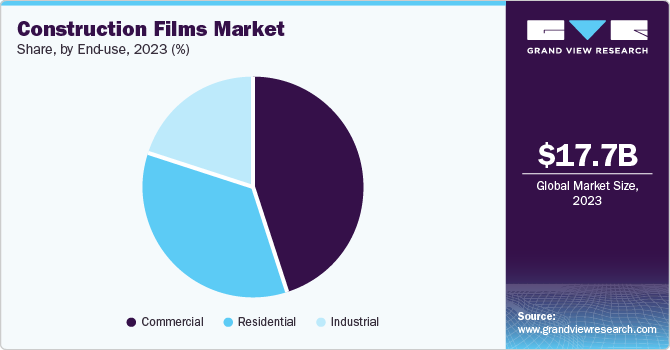

- By end-use, commercial use dominated the market and accounted for the largest revenue share of 45.2% in 2023.

- By distribution channel, the direct distribution channel segment dominated the market with a market share of 80.2% in 2023

Market Size & Forecast

- 2023 Market Size: USD 17.7 Billion

- 2030 Projected Market Size: USD 25.3 Billion

- CAGR (2024-2030): 5.3%

- Asia Pacific: Largest market in 2023

The construction & building sector is estimated to rise rapidly due to industrialization, urbanization, and increasing population worldwide in many countries promoting the use of the construction films market, as the demand from constructors and leading companies is rising. Moreover, the rising utilization of more advanced and sustainable products to meet the increasing requirements of construction projects in the world propels market growth.

In addition, the construction and building sector is implementing nature-friendly films that could be recycled and films that affect the environment with less impact. These films are available in a variety of surface designs and characteristics, such as matte, translucent, UV-resistant, smooth, transparent, colored opaque, and many others. Furthermore, rising demand from developing countries results in the expansion of capacity by major manufacturers to produce construction films, fueling the growth of the construction films market.

The wide range adoption of construction film in the curing procedure of concrete due to their capability to maintain hydration levels and prevent moisture is leading to an increasing demand for construction films. Moreover, with a growing focus on green construction practices and sustainability shaping construction films, there is a rising demand for less environment-impacting and recyclable construction films. Green building construction is experiencing huge demand, with the government emphasizing green construction, further providing a wider opportunity for the market in the forecast period.

Product Insights

Vapor barrier films dominated the market and accounted for the largest revenue share of 31.5% in 2023 as they are being utilized to control the diffusion of water vapors within the building envelope, protecting against moisture-associated problems such as mold or mildew. It works as a preventive measure against moisture by stopping its movement and preventing it from entering attics, wall cavities, and building spaces. The films support maintaining structural integrity, increasing the lifespan of construction & building materials, and lowering the risk of internal air quality by reducing moisture intrusion. Furthermore, these films assist in sealing the inside roof structure against moisture or wind, safeguarding reliable insulation from heat loss, resulting in increasing demand from various parts of the world.

Solar films are expected to grow at a CAGR of 5.7% over the forecast period. The solar films function by reflection, absorption, and transmission mechanisms. The solar film reflects an extensive part of the radiation from the sun, minimizing heat and glare in the building, providing long-term protection, absorbing UV light, relieving visual comfort, and monitoring temperature. Moreover, some solar films for buildings are designed to optimize the thermal relief of indoor spaces and offer an efficient solution for reducing excessive heat while maintaining natural light. Such films thus create some more pleasant and energy-efficient surroundings, influencing demand from developed and developing economies.

Resin Type Insights

Polyolefin films led the market and accounted for the largest revenue share of 26.3% in 2023. Polyolefin is widely used in construction due to its durability, versatility, and cost-effectiveness, making it ideal for applications such as vapor barriers and temporary protection. This robust and versatile plastic is extensively utilized in films, exhibiting characteristics such as chemical and corrosion resistance, which lower maintenance costs and extend the service life of buildings. Premium-quality shrink films made from polyolefin offer greater clarity and appearance, further enhancing their use in the building and construction sector. In addition, the low cost and eco-friendly nature of polyolefin have increased their demand. The growing need for sheets and films in construction is expected to drive market expansion.

Ethylene vinyl alcohol is expected to grow at a CAGR of 5.9% over the forecast period. Ethylene vinyl alcohol (EVOH) films are known for their exceptional barrier properties against gases and liquids and are increasingly applied in construction films. These films are specifically valued for their ability to provide high levels of protection from moisture and air, thereby enhancing the longevity and integrity of buildings. Moreover, the demand for EVOH films is driven by their superior gas barrier resistance, antistatic properties, luster, transparency, and resistance to oil and organic solvents. These characteristics make them ideal for various applications in the construction sector, including roofing, flooring, and wall and ceiling applications. The global construction industry, especially in developing regions, is experiencing significant growth, which propels the demand for the EVOH film market and is expected to grow in the upcoming years.

Application Insights

Roofing applications dominated the market and accounted for the largest revenue share of 22.2% in 2023 primarily driven by rapid urbanization and increased infrastructure development, which boost demand for advanced roofing materials. Innovations in eco-friendly materials and advancements in plastic recycling, as well as the shift towards high-performance materials such as single-ply membranes, which offer superior durability and ease of installation, help to minimize moisture infiltration between the layers of walls and ceilings, which prevents dirt or bacteria from causing cracks. Their high strength helps avoid cracks.

Building and enveloping are anticipated to grow at a CAGR of 5.5% during the forecast period. Construction films offer numerous benefits and applications for building and enveloping, such as enhanced energy efficiency, improved durability, and increased protection. The use of films creates a barrier that separates the internal environment of a building from the external environment, protecting against weather, pests, noise, and dirt while controlling sunlight penetration and enhancing privacy and comfort. The global demand for construction films is boosted by the need for increased durability, energy efficiency, and cost-effectiveness in the construction sector, with significant growth expected due to rising green building initiatives and rapid urbanization, particularly in emerging economies.

Function Insights

The protection function led the market and accounted for the largest revenue share 2023. The superior moisture barrier film protects against moisture, dust, and dirt throughout the logistical journey of building elements. It possesses durability and withstands extreme weather conditions, making it ideal for covering scaffolding and offering weather protection during facade and roof renovations. Furthermore, the growing trend towards environmentally friendly and sustainable protective films depicts increasing consumer and industry awareness of the environmental impact of packaging materials. In addition, the rise in construction and manufacturing activities worldwide drives the demand for protective films in applications such as building surfaces, appliances, and industrial equipment.

Glazing is expected to grow at a CAGR of 5.5% during the forecast period. The window film, primarily composed of polyethylene terephthalate (PET), is a retrofit solution designed to enhance glass performance in residential, commercial, and vehicular applications. Applied to the interior surface of windows, these films feature a scratch-resistant coating for durability. The multiple functions reduce visible light transmission, block solar heat, mitigate glare, and enhance climate control by minimizing solar heat gain in buildings, thereby maintaining internal temperatures and eliminating bright light in extreme hot spots. Further, the demand for such films in the construction industry is fueled by their ability to improve energy efficiency, enhance occupant comfort, and provide cost-effective solutions for upgrading existing glazing systems.

End Use Insights

Commercial use dominated the market and accounted for the largest revenue share of 45.2% in 2023. The demand for construction films in the commercial sector is primarily led by the increasing construction & building activities worldwide, in developed and developing regions, with the growing need for energy-efficient building systems. Furthermore, its key drivers include the ever-increasing green building projects, strict regulations intended to reduce carbon and greenhouse gas emissions, robust industrialization, and urbanization. In addition, the emphasis on durability, cost advantages, and the availability of application-specific construction films boosts the market growth.

The residential use is expected to witness the fastest CAGR of 5.9% during the forecast period. The demand for construction films in the residential sector is fueled by several key factors, such as the increasing number of housing projects, increasing population and urbanization, and the growing emphasis on energy-efficient and sustainable building practices. In the global landscape, the rise in residential construction activities, particularly in emerging economies, augmented with supportive government policies and initiatives for green buildings, with the advancements in film technology that enhance durability and provide cost-effective solutions further propel the demand for construction films in residential construction end uses.

Distribution Insights

The direct distribution channel segment dominated the market with a market share of 80.2% in 2023 driven by the desire for efficient supply chains and stronger connection networks between manufacturers and customers. Furthermore, direct distribution provides improved quality control, customized customer service, and typically faster responses to market needs. Manufacturers are expected to continue emphasizing efficient, reliable delivery and customer relationships, so the direct channel's prominence will remain high for various types of construction films in upcoming years.

Third-party distribution channels are expected to grow significantly over the forecast period. These intermediaries, such as distributors and retailers, offer important services such as wider market reach, localized assistance, and extra value-added services. For manufacturers, utilizing third-party channels can simplify the management of extensive distribution networks, particularly in geographically diverse markets. As the construction sector becomes more robust and demanding globally, the need for various construction materials increases and third-party distributors play a crucial role in the distribution channel of construction films.

Regional Insights

Asia Pacific construction films market dominated the global market and accounted for the largest revenue share of 58.1% in 2023. The market is augmented by the wide growth of the construction sector in the developed regions, along with the presence of major construction film manufacturers in China and India. The regional market is anticipated to be driven in the next years by several government initiatives and a sizeable foreign investment in construction & building developments.

China Construction Films Market Trends

The construction films market in China dominated the Asia Pacific market and accounted for the largest revenue share of 41.4% in 2023. The construction film market in China is on the way to robust growth, driven by the rapid expansion of the construction industry, generally in residential, commercial, and industrial sectors. The growth factors are rising urbanization, government initiatives to develop infrastructure, and the demand for sustainable solutions for construction films. In addition, developments in polymer technology have led to the development of high-performance films with enhanced durability, UV resistance, and acoustic properties, further boosting market growth.

India Construction Films Market Trends

The India construction films market is expected to experience lucrative growth, fueled by robust urbanization, a rising population influencing commercial and residential construction buildings, increasing disposable incomes, and substantial government investments in infrastructure development. The growth factors include the increasing demand for energy-efficient and sustainable building construction film materials, advancements and improvements in polymer technology, and the growing emphasis on green construction practices.

Latin America Construction Films Market Trends

The construction film market in Latin America is expected to grow at a CAGR of 5.6% over the forecast period. This growth is primarily driven by rapid urbanization and an expanding middle class, which increases demand for residential and commercial construction. Additionally, government initiatives aimed at infrastructure development and energy efficiency are significant contributors. The region's focus on sustainable building practices and rising disposable income further stimulate market growth. However, challenges such as limited access to financing and a shortage of skilled labor may hinder progress in some areas.

North America Construction Films Market Trends

The North America construction film market is expected to grow substantially over the forecast period. Significant construction activities led to this growth in the residential and commercial sectors. The demand for various films is backed by the need for protective and barrier films, advancements in film technology, and stringent regulations promoting energy-efficient building practices. Moreover, rising investments in industrial and commercial projects and new power plants are factors for expanding the construction film market.

U.S. Construction Films Market Trends

The construction film market in the U.S. is a significant market for construction films. The region has a strong and well-established construction sector, and the use of construction films in applications by increased construction activities in residential, commercial, and industrial sectors. Further, the demand is strengthened by the need for energy-efficient building materials, advancements in film technology, and stringent environmental regulations promoting sustainable construction practices. The rising infrastructure development projects and the influence of greener construction materials are significant factors contributing to the market expansion of construction films.

Europe Construction Films Market Trends

Europe construction films market is expected to witness substantial growth. The market is well-established and continuously evolving, led by advancements such as portion retention coatings, UV and fade protection, dirt protection film, condo glass coating, and window tinting, which positively impact market growth. Stringent building regulations and the increasing implementation of smart construction technology systems fuel the demand for construction films.

UK Construction Films Market Trends

The growth of the construction films market in the UK is driven by the demand for durable and high-performance films in various construction applications such as roofing, insulation, and vapor barriers. Other factors include the rising focus on energy-efficient buildings, advancements in polymer technology, and the growing adoption of sustainable construction practices. Government initiatives aimed at infrastructure development and renovation further propel market expansion. The market is also benefiting from heightened awareness regarding the environmental impact of construction materials, leading to a preference for recyclable and eco-friendly films.

Key Construction Films Company Insights

Some key construction film companies include Raven Industries, Berry Global, Inc., Saint-Gobain, DuPont, Eastman Chemical Company, Polyplex, and RKW Group, focusing on development & to gain a competitive edge in the industry. These players are adopting various strategies to enhance their market presence, including expanding production capacities to meet rising demand and investing in research and development to create innovative products. Strategic partnerships and collaborations are being formed to strengthen their positions while targeting emerging markets such as India and China for growth.

-

Raven Industries specializes in producing high-performance plastic films for the construction industry. Their offerings include durable string-reinforced poly, vapor retarders, gas barriers, wet curing blankets, and liquid containment solutions. Raven Industries also excels in producing custom-engineered films for construction applications, including geomembranes, pond liners, and temporary enclosures. Their products are designed to meet stringent industry standards, ensuring durability and reliability in various environmental conditions.

-

Berry Global specializes in producing high-performance plastic films for the construction industry. Their product range includes advanced barrier technologies, roofing underlayment, specialty tapes, and vapor barriers. They also offer protective coverings, dust barriers, and concrete curing solutions. Their products are known for their characteristics, such as durability, flexibility, and ease of installation, making them a preferred choice for contractors and builders. The company also emphasizes sustainability, integrating recycled materials and eco-friendly practices in their manufacturing processes to reduce environmental impact.

Key Construction Films Companies:

The following are the leading companies in the construction films market. These companies collectively hold the largest market share and dictate industry trends.

- Raven Industries

- Berry Global, Inc.

- Saint-Gobain

- DuPont

- Eastman Chemical Company

- Polyplex

- RKW Group

- Coveris.

- Plastika Kritis S.A.

- Qenos Pty Ltd.

- KURARAY CO., LTD.

- Reinforced Plastics Industries

- CLIMAX SYNTHETIC PVT. LTD.

- Poly-America, L.P.

- Comp15

Recent Developments

-

In June 2024, Coveris announced a strategic partnership with Interzero aimed at advancing the circular economy. This collaboration will enhance plastics recycling by integrating Interzero's sorted materials into Coveris' innovative ReCover recycling process, producing high-quality recycled resins for packaging. Both companies emphasize waste elimination and sustainability, aiming to reduce CO2 emissions and comply with waste regulations. Coveris CEO Christian Kolarik and Interzero CEO Jan Kroker highlighted the partnership's potential to reduce waste and significantly promote a waste-free future.

-

In October 2023,Berry Global collaborated with Haver & Boecker to establish a closed-loop system for recycling NorDiVent film bags at their Steinfeld facility in Germany. This pilot project aimed at collecting and recycling empty bags, demonstrating the role of plastics in the circular economy. The initiative aligned with Berry's sustainability strategy, showcasing how recycled materials can meet performance standards. Both companies hope this project will inspire similar efforts across the industry, emphasizing the importance of collaboration in developing effective circular solutions.

Construction Films Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.6 billion

Revenue forecast in 2030

USD 25.3 billion

Growth Rate

CAGR of 5.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, resin type, application, function, end use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, South Korea, Australia, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Raven Industries; Berry Global, Inc.; Saint-Gobain; DuPont; Eastman Chemical Company; Polyplex; RKW Group; Coveris.; Plastika Kritis S.A.; Qenos Pty Ltd.; KURARAY CO., LTD.; Reinforced Plastics Industries; CLIMAX SYNTHETIC PVT. LTD.; Poly-America, L.P.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Construction Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global construction films market report based on product, resin type, application, function, end use, distribution channel, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Vapor Barrier Films

-

Gas Barrier Films

-

Window Films

-

Solar Films

-

Others

-

-

Resin Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyolefin Films

-

Polyester Films

-

Nylon Films

-

Ethylene Vinyl Alcohol Films

-

Polyvinyl Butyral Films

-

Fluoropolymer Films

-

Polyvinylidene Chloride Films

-

Polyimide Films

-

Bio-based Polymer Films

-

Polyvinyl Chloride Films

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flooring

-

Walls & Ceilings

-

Windows

-

Doors

-

Roofing

-

Building & Enveloping

-

Electrical

-

HVAC

-

Plumbing

-

Others

-

-

Function Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bonding

-

Protection

-

Insulation

-

Glazing

-

Soundproofing

-

Cable Management

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Direct

-

Third-party

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.