- Home

- »

- Next Generation Technologies

- »

-

Global Consumer Drone Market Share Analysis Report, 2030GVR Report cover

![Consumer Drone Market Size, Share & Trends Report]()

Consumer Drone Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Multi-Rotor, Nano, Others), By Application (Prosumer, Toy/Hobbyist, Photogrammetry), By Region, And Segment Forecasts

- Report ID: 978-1-68038-831-2

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Consumer Drone Market Summary

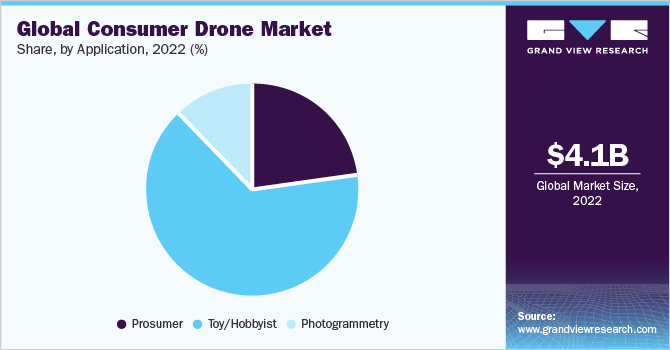

The global consumer drone market size was estimated at USD 4,120.8 million in 2022 and is projected to reach USD 11.56 billion by 2030, growing at a CAGR of 13.3% from 2023 to 2030. consumer drones are becoming increasingly popular among the population that wishes to create a gig, explore with aerial photography, or fly drones for fun, in addition to the traditional flight enthusiasts and hobbyists.

Key Market Trends & Insights

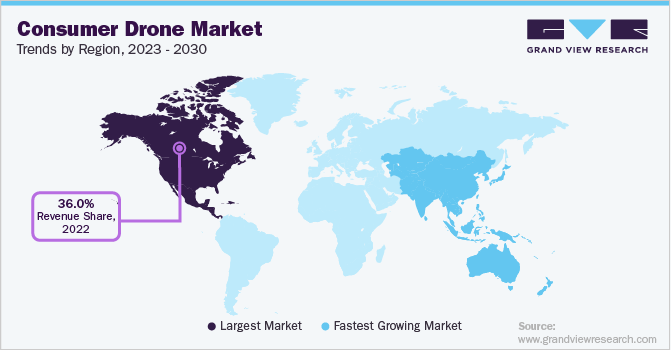

- North America dominated the global industry in 2022 accounting for over 36.0% of the market.

- The market in Asia Pacific is forecast to register a considerable CAGR of around 15.0% from 2023 to 2030.

- By product, multi-rotor consumer drones accounted for the largest market share of over 69% and are presumed to grow substantially in the forecast period.

- By application, the toy/hobbyist drone segment accounted for the highest market share of around 65% in 2022.

- By application, the prosumer segment is anticipated to grow with the highest CAGR of 14.6% over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 4,120.8 Million

- 2030 Projected Market Size: USD 11.56 Billion

- CAGR (2023-2030): 13.3%

- North America: Largest market in 2022

Customers are increasingly exploring the benefits of drones in enriching leisure activities and interests, resulting in a significant increase in global consumer drone sales. Furthermore, technological innovations in consumer drones are driving the market growth and this trend is expected to continue over the forecast period as well. For instance, in February 2022, Skyfish, a U.S. drone manufacturer, announced a technical collaboration with Sony Electronics to deliver drones with high-quality data gathering and photogrammetry capabilities

The integration with Sony Electronics’ mirrorless cameras enabled Skyfish drones to gather the data required to generate precise 3D models of large infrastructures among other applications. Similarly, DJI launched the Mini 3 Pro drone in May 2022, which weighs 249 grams and provides additional flight control capabilities along with a high-quality picture and video recording functionality. This product was specifically targeted toward the consumer/enthusiast category, with a special focus on portability and affordability.

Several organizations in different industries have started to invest in drones as a result of rapid growth in the market for drone services. Companies who invest in drones anticipate that the analysis of the data that drones collect will result in cost reductions, revenue growth, and better decision-making. Drones are being used by the media and entertainment industries for aerial photography, cinematography, and special effects. More changes will emerge as drones start collaborating with other technologies and drones. For instance, road and railroad operators can benefit from using drones and 3D modeling software during the design stage.

Additionally, the integration of artificial intelligence (AI) enables drone suppliers to gather and utilize visual and environmental data by using information from sensors attached to the drone. Computer vision is a crucial element of drones powered by AI. With this technology, drones can identify objects in the air and analyze and record data on the ground. Artificial Intelligence (AI), analyzing sensors, data processing, and drone network capabilities would help them collaborate with 3D printers, robots, and other technologies. For instance, in July 2022, Microsoft launched a simulator to train AI systems in drones. The simulator would help in software development and training, and also allow them to track how winds may affect the battery life and how the drones would fly in the rain. The advantages of employing drones are similar to adopting any new technology.

Consumer drone demand is expected to increase due to the growing popularity of steady aerial capturing, photography, and videography. The market for consumer drones has surged due to new manufacturing innovations for the product. The latest drone model technologies offer navigation systems linked to the user's device, high range, and control systems that are reliable, safe, efficient, and provide better speed. The consumer drone industry in North America is the leading region globally, driven by a high demand for drones in Canada and the U.S. Furthermore, the considerable investment in the market for drone technology across the region, is driving the growth further. For instance, in February 2022, Phystech Ventures, a U.S.-based venture capital firm, stated that there had been a USD 5 billion investment in drone technology in the past two years.

Product Insights

Multi-rotor consumer drones accounted for the largest market share of over 69% and are presumed to grow substantially in the forecast period. Multi-rotors are increasingly used in aerial photography and filming, and the devices leverage the advantage of vertical take-off and landing, which is unavailable in the other counterparts. The multi-rotor drone has a higher payload capacity, making it suitable for different end-uses. Furthermore, multi-rotor drones are significantly used in law enforcement in various regions. These have been viewed as a better alternative to inspection and payload carrier applications, which need higher precision maneuvering, and the capacity to fly over challenging terrain and operate for extended periods.

The others segment comprising fixed wing and hybrid type drones is projected at the highest CAGR of 16.2% by 2030. Small fixed-wing and rotary-wing aircraft are often employed for filming and still photography, with such types of drones coming in various sizes and configurations. The ability of drones to carry a variety of sensors and gadgets accounts for their popularity. The most effective mix of aerial platform and payload depends on the application's scope.

Application Insights

The toy/hobbyist drone segment accounted for the highest market share of around 65% in 2022. Drones are experiencing the most advancements of any contemporary technical development. Some toy drones now fly without operator guidance as autonomous flying technology becomes widespread. Nano drones are being increasingly used in toy/hobbyist applications by aviation enthusiasts across the world for recreational purposes. Additionally, a rise in the need for lightweight drones is anticipated to fuel the market's expansion for toy drones.

The prosumer segment is anticipated to grow with the highest CAGR of 14.6% over the forecast period. Steep growth in this segment can be attributed to the emergence of technology in electronics, which has attracted gaming enthusiasts to accept drones as their new source of recreation. Drone racing in the form of a recreational hobby is being promoted at a large scale in various geographies, boosting the adoption of drones for prosumer applications. Additionally, drones and unmanned aerial vehicles are quickly replacing regular inhabited aircraft to approach wildlife from the air for various applications. The use of prosumer drones can, however, disrupt wildlife to varying degrees while being less disruptive than the use of occupied aircraft.

Regional Insights

North America dominated the global industry in 2022 accounting for over 36.0% of the market share owing to increased technological adoption. The Federal Aviation Administration's (FAA) positive initiatives and rising government spending on the advancement of drones are likely to drive business growth in the region. The market for civilian drones used for both recreational and commercial purposes has steadily expanded in recent years as a result of the rapid emergence of consumer electronics, the shrinking cost of the server, bandwidth consumption, the emergence of cloud technologies, and an enhancing price-to-performance ratio of hardware components, as well as a sharp increase in demand for "bird's-eye" views of the earth. The expanding drone market in the U.S., stimulated by diverse applications across different sectors, is expected to provide profitable business opportunities in the coming years.

The market in Asia Pacific is forecast to register a considerable CAGR of around 15.0% from 2023 to 2030. This growth can be attributed to China’s thriving drone industry, the established consumer electronics market across Japan, and increasing demand for drones across developing countries such as India, and Southeast Asian countries. Additionally, the Chinese government has been offering various subsidy programs and other advantageous domestic policies for drone purchases to encourage the development of the sectors' technical capabilities. Their expanding application fields are driving drone demand in China. The region intends to establish a drone manufacturing base in order to capitalize on the expanding business.

Key Companies & Market Share Insights

The industry has a high risk of new entrants. New developers in start-up businesses have been able to enter the market due to minimal entry barriers and easy access to existing technology. New and innovative drone applications have yet to be commercially promoted, thus limiting the threats from existing competitors. The competition will eventually intensify during the projected period as new entrants establish consumer bases and gain their trust as core producers. Moreover, the presence of many global and regional players has increased the level of competitive rivalry. Some of the major players in the global consumer drone market. Some of the prominent players in the consumer drone market include:

-

3D Robotics, Inc. (Kitty Hawk)

-

SZ DJI Technology Co., Ltd.

-

Eachine

-

Guangdong Cheerson Hobby Technology Co., Ltd.

-

Guangdong Syma Model Aircraft Industrial Co., Ltd (Syma)

-

Guangzhou Walkera Technology Co., Ltd. (Walker)

-

Yuneec International Co., Ltd.

-

SkyTech Drone Sp. z o. o

-

Horizon Hobby, LLC

-

Parrot Drone SAS

-

Shantou Chenghai Weili Toys Industrial Co., Ltd. (WL Toys)

-

JIANJIAN TECHNOLOGY CO., LTD.

-

Hubsan

Consumer Drone Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4,833.6 million

Revenue forecast in 2030

USD 11.56 billion

Growth rate

CAGR of 13.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; Australia; Brazil

Key companies profiled

3D Robotics; Inc. (Kitty Hawk); SZ DJI Technology Co., Ltd.; Eachine; Guangdong Cheerson Hobby Technology Co., Ltd.; Guangdong Syma Model Aircraft Industrial Co., Ltd (Syma); Guangzhou Walkera Technology Co., Ltd. (Walker); Yuneec International Co., Ltd.; SkyTech Drone Sp. z o. o; Horizon Hobby, LLC; Parrot Drone SAS; Shantou Chenghai Weili Toys Industrial Co., Ltd;. (WL Toys); JIANJIAN TECHNOLOGY CO., LTD.; Hubsan

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

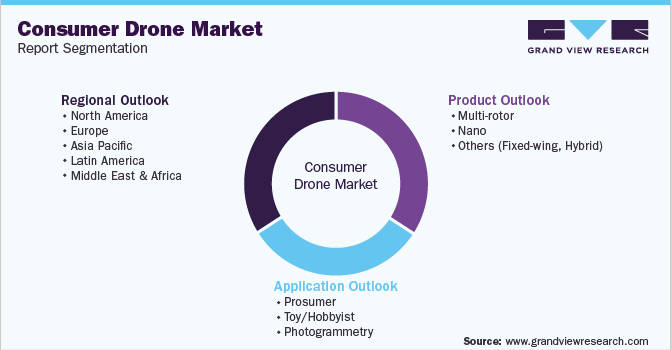

Global Consumer Drone Market Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels and analyzes the latest market trends in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global consumer drone market report based on product, application, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Multi-rotor

-

Nano

-

Others (Fixed-wing, Hybrid)

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Prosumer

-

Toy/Hobbyist

-

Photogrammetry

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global consumer drone market size was estimated at USD 4.12 billion in 2022 and is expected to reach USD 4.83 billion by 2023.

b. The global consumer drone market is expected to grow at a compound annual growth rate of 13.3% from 2023 to 2030 to reach USD 11.56 billion by 2030.

b. The multi-rotor segment dominated the consumer drone market with a share of 69.6% in 2022. This is attributed due to the increased use of multi-rotor drones in aerial photography and FPV racing application.

b. Some key players operating in the consumer drone market include DJI, Yuneec, Hubsan, Horizon Hobby LLC, and Parrot Drones SAS.

b. The consumer drone market's significant growth prospects can be attributed to the increasing prominence of drone flying as a hobby activity, such as UAV photography and racing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.