- Home

- »

- Network Security

- »

-

Container Security Market Size, Share & Trends Report, 2030GVR Report cover

![Container Security Market Size, Share & Trends Report]()

Container Security Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Deployment, By Enterprise Size, By Vertical (BFSI, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-092-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

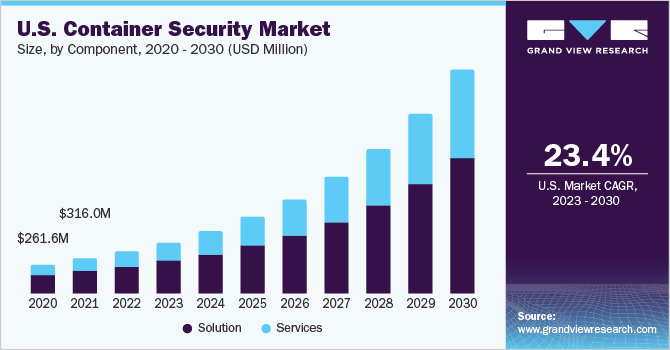

The global container security market size was valued at USD 1.53 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 26.5% from 2023 to 2030. The market growth can be attributed to the increasing adoption of container applications across all sizes of enterprises and production environments, the rise in cloud computing solutions across several industry verticals, and the growing adoption of serverless technologies. Organizations have begun to implement cutting-edge security solutions, such as a Customer Identity and Access Management (CIAM) structure, which aid in the protection of key company information and sensitive end-user data.

Modern cloud-based systems such as Zoom and Salesforce have become crucial in enabling knowledge workers to interact competently from their homes, whereas public cloud hosting providers such as AWS, Microsoft Azure, and Google Cloud have experienced tremendous success. These factors would further supplement the growth of the container security industry during the forecast period. Virtual machines and their Operating System (OS) dependencies have become important responsibilities for developers in the age of cloud computing and application development tools. Application portability between clouds is a crucial element in the adoption of containers and container-related technologies, such as Docker and Kubernetes, to expedite time-to-market by DevOps.

For instance, in May 2022, Docker, Inc., a cloud solution provider, announced the acquisition of Tilt, a toolkit for microservice development. The service incorporates Tilt technologies for Kubernetes development into the Docker platform to reduce the pain points for development teams. With this integration, Tilt helps developers build applications for Kubernetes, and provides features such as reproducible development environments and live updates. These strategic developments would further drive the container security industry during the forecast period.

Containerization is a crucial aspect of implementing the DevOps idea since it allows for the creation, testing, and delivery of consistent software in large-scale Internet of Things (IoT) systems. Containerization helps with this by providing sandboxed environments and agile design approaches. Containers, as opposed to virtual machines, which allow developers to run software in the simulator of a specific hardware system, offer portability and security throughout IoT development. Other advantages of containerization include flexibility, cost savings, efficiency, and the capacity to scale services for a faster time-to-market.

Furthermore, containers with easy-to-deploy, independent, and compact qualities allow programs to run as microservices in a variety of IoT devices and platforms. To extend their AI and machine learning capabilities, most cloud providers, such as Azure and AWS, supply container images as deployment models in edge devices. Previously, high-level computers were required to execute such advanced services. Microservices, on the other hand, address complexity issues by splitting down applications into a set of manageable services. This allows developers to use low-cost IoT devices to achieve the same results. These strategic developments would further drive the container security industry during the forecast period.

Organizations are moving away from conventional business models and transforming themselves into digital businesses in response to the rising proliferation of mobility services and social media coupled with the emergence of new cloud-based solutions and the Internet of Things (IoT). Continued digitalization is prompting organizations to deliver quality software at a faster rate in line with their changing business needs. Enterprises’ drive toward digitization has triggered the adoption of automation technologies, cloud-based solutions, and software development models that can ensure the agility necessary to deploy and tweak the applications in line with the changing business needs quicker than before. At this juncture, DevOps can allow enterprises to introduce agile/lean methodologies throughout the supply chain, including the development, building, testing, deployment, and monitoring of software. DevOps can integrate software development, quality assurance, and infrastructure operations into a single automated solution that can offer numerous benefits as compared to a standalone agile development. These factors would further drive the growth of the container security industry during the forecast period.

A variety of challenges are being faced by organizations adopting DevOps to improve their workflow and productivity. One of the most common challenges faced by organizations is standardization of tools and the lack of a standard definition of DevOps has created a lot of confusion across the industry. Implementation of DevOps for each enterprise is unique and requires a custom approach due to the lack of a standardized or simplified approach to the adoption of DevOps, which hinders market growth. Standardization challenges arise due to the availability of multiple tools with overlapping features, making it difficult to evaluate or do a proof of concept before selection. Automation of a specific process throughout an enterprise can result in silos automation and the use of manual ad hoc methods due to a lack of tool knowledge. There are no central DevOps teams to evaluate and recommend the right set of tools for any organization. Project teams set up their own desired tools and serve teams without clarity on infrastructure availability. DevOps implementation is unique for each organization and no standard approach to its adoption is expected to hinder the growth of the container security industry.

Component Insights

The solution segment accounted for the largest market share of 62.11% in 2022. Several organizations are engaged in adopting container security solutions, which have capabilities in detecting vulnerabilities that can initiate a potential attack. Container security solutions protect container image builds and runtime hosts, platforms, and application layers. Implementing such solutions will mitigate risks and reduce vulnerabilities across the ever-growing attack surface. These solutions offer a clear separation of responsibilities, allowing developers to focus on application development while IT operations teams focus on application deployment and management, such as the installation of specific software versions and configurations. Furthermore, they virtualize the operating system's Control Processing Unit (CPU), storage, network resources, and memory; providing developers with a view of the OS that is separate from other applications. These benefits provided by the solutions would further supplement the growth of the segment during the forecast period.

The services segment is anticipated to grow at a CAGR of 27.4% during the forecast period. The segment growth can be attributed to the increased adoption of professional services, increasing demand for IT security services to monitor and manage security solutions, and increasing demand for consultation services and maintenance aid upgradation services from organizations. As such, organizations offering software and IT services have transformed their legacy business processes. They are trying to engage with their customers via digital channels to record feedback, complaints, ratings, and suggestions on software releases. Organizations have already invested in big data and analytics solutions that can help better understand customer needs, preferences, and behaviors. Furthermore, the new processes can ensure a better service desk experience for customers. They have also incorporated agile development methodologies to accelerate the development cycle and to improve the time-to-market.

Deployment Insights

The cloud-based segment accounted for a market share of 54.52% in 2022. Even as cloud computing evolves, cloud-based platforms remain vulnerable to criminality and data breaches. Because of the high costs involved with on-premise solutions, more businesses are turning to cloud computing. They enable organizations to reach the same level of threat detection and prevention. Furthermore, Artificial Intelligence (AI) disrupts and improves the Software as a Service (SaaS) business in a variety of ways. The combination of SaaS with AI allows businesses to better use data, customize services, boost security, and supplement human capabilities. Furthermore, the significant cost reductions associated with the usage of cloud-based platforms are pushing commercial establishments and government agencies to transition to cloud storage and cloud-based platforms, which will boost demand for cloud-based container security solutions during the forecast period.

The on-premise segment is anticipated to grow at a CAGR of 24.6% during the forecast period. Several organizations prefer having complete ownership of solutions and upgrades as these contain crucial business databases. This enables organizations to maintain the highest level of data security. In addition, the on-premise deployment decreases reliance on third-party organizations by offering explicit monitoring and data security. Qualys container security, for example, enables users to track, discover, and constantly protect containers from build to runtime. It also gives comprehensive insight across on-premise container setups. Furthermore, Qualys' on-premise container security provides comprehensive coverage and high-accuracy vulnerability scanning of images, allowing security analysts to focus on remediation. This organizational preference for safeguarding the confidentiality of internal data is likely to enhance demand for on-premise implementation during the forecast period.

Enterprise Size Insights

The large enterprise segment accounted for the largest market share of 51.16% in 2022. Large enterprises run a variety of applications and services in distributed environments and require updates to meet their business demands. They offer multiple benefits to large-scale enterprises, such as improved security, increased productivity, and cost savings. Large organizations are aggressively investing in DevOps solutions to ensure error-free code, offer better quality software, and ensure continuous customer engagement. It enables organizations to improve business operations by providing better collaboration between development and operational teams to drive faster product releases. These factors would further supplement the demand for container security solutions for large enterprises during the forecast period.

The Small & Medium Enterprises (SMEs) segment is expected to grow at the highest CAGR of 27.3% during the forecast period. Small organizations are trying to find new innovative ways to increase delivery speed without introducing any new sources of errors or delays. Given that DevOps tools are supposed to combine software development, quality assurance, and infrastructure operations into a single automated framework; implementing DevOps can help resolve the complexities associated with the software delivery cycle and introduce automated standardized processes that can enhance delivery speeds. DevOps can remove all the bottlenecks in the software lifecycle, thereby helping small organizations to enhance their productivity and improve response time toward business needs. These factors would further supplement the growth of the segment during the forecast period.

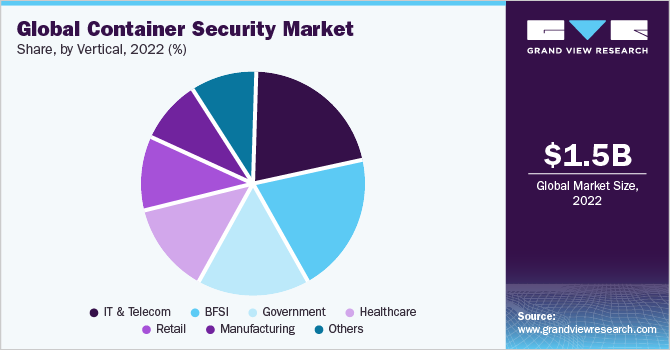

Vertical Insights

The IT & telecom segment accounted for the largest market share of 21.96% in 2022. With the outbreak of the COVID-19 pandemic, IT and telecom organizations had to quickly adopt cloud applications and services to allow their employees to work effectively and efficiently outside the office, and away from traditional network security tools. As such, IT & telecom companies started focusing on developing and implementing in-house cloud network security solutions. This, in turn, kept the market afloat during the pandemic while also contributing to segment growth. IT and telecom companies store the personal information of users, such as their names, addresses, and financial information, due to which they become a compelling target for cyber attackers. To protect sensitive data and avoid data losses, telecom companies are expected to increase their spending on such types of solutions. Furthermore, an increase in the complexity of the regulatory environment across the world is making it vital for telecom companies to stay ahead of the changing regulatory compliance-driven environment, thus accelerating segment growth.

The BFSI segment is anticipated to grow at a CAGR of 29.5% during the forecast period. For financial institutions, container technology is a critical component of the larger framework to stay ahead of fintech rivals. The technology offers various benefits from improving their application's portability to better operational resilience. As a result, several banks are restructuring the processes and technologies of their IT departments. It helps financial institutions achieve their goals in terms of security, scalability, and speed.

However, financial institutions have rigid IT systems, that can hardly meet the dynamic requirements of regulations, multifaceted customer requirements, and technological progress. To reduce this complexity in the banking software, containers provide the optimal package of microservices. With the help of microservices, banking IT systems can be modernized step by step. These factors and developments would further create the demand for container security solutions in the BFSI industry during the forecast period.

Regional Insights

North America held a major share of 31.67% of the container security market in 2022. The container security industry in North America is driven by the increasing adoption of advanced technologies by several Small & Medium Enterprises (SMEs), growing demand for microservices, and digital transformation among several enterprises. The growing preference for cloud solutions and services, especially among the SMEs in the region, to boost business. For instance, in June 2022, Docker, the U.S.-based software service provider, announced the acquisition of Atomist, a SaaS-based application platform. The acquisition aims to accelerate Docker’s secure software chain efforts. With this acquisition, client organizations would be able to gain visibility and control across their software supply chain, without disrupting their existing workflow and tools. These developments across the region would further drive the demand for container security solutions during the forecast period.

Asia Pacific is anticipated to grow at the fastest CAGR of 29.9%. The regional growth can be attributed to the rise in the volume of organizational data, surging in the number of SMEs, and growing use of vulnerability management applications by organizations to tackle cyber-attacks. According to a recent survey by Red Hat in 2022, enterprises in Asia Pacific are at the vanguard of open-source software deployment. Around two third of IT executives in the region employ open-source code for infrastructure upgrades, which is monitored by DevOps teams. Moreover, the regional IT leaders anticipate high-quality software, cutting-edge technologies, and the endorsements of software professionals. These factors would further create the demand for container security solutions across enterprises in the region during the forecast period.

Key Companies & Market Share Insights

The key players operating in the container security market include Microsoft Corporation; IBM; Amazon Web Services; VMware; Google LLC; Cisco Systems, Inc.; and Docker Inc. The companies aim to broaden their product offering and utilize a variety of inorganic growth tactics, such as regular mergers, acquisitions, and partnerships.

For instance, in October 2022, Microsoft Corporation announced new updates to its cloud platforms which include the addition of Kubernetes Fleet Manager and other security & service updates. Kubernetes Fleet manager allows the DevOps team in scaling the centralized management for easy orchestration of Kubernetes clusters. This permits policy networking and configuration on a single dashboard. This will allow client organizations to monitor Azure Kubernetes Service clusters across their entire organization. Some prominent players in the global container security market include:

-

Microsoft Corporation

-

Broadcom, Inc.

-

IBM

-

Amazon Web Services

-

VMware

-

Qualys

-

Docker Inc.

-

Check Point Software Technologies Ltd.

-

Zscaler

-

Aqua Security

-

Sophos

-

Anchore

-

Palo Alto Networks

-

HCL Technologies Limited

-

CROWDSTRIKE

Container Security Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.90 billion

Revenue forecast in 2030

USD 9.88 billion

Growth Rate

CAGR of 26.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Segments covered

Component, deployment, enterprise size, vertical, region

Key companies profiled

Microsoft Corporation; Broadcom, Inc.; IBM; Amazon Web Services; VMware; Qualys; Docker Inc.; Checkpoint Software Technologies Ltd.; Zscaler; Aqua Security; Sophos; Anchore; Palo Alto Networks; HCL Technologies Limited; CROWDSTRIKE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Container Securit Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global container security industry report based on component, deployment, enterprise size, vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small and medium-sized enterprises

-

Large enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecom

-

Retail

-

Healthcare

-

Manufacturing

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global container security market is expected to grow at a compound annual growth rate of 26.5% from 2023 to 2030 to reach USD 9.88 billion by 2030.

b. The solution segment accounted for the largest market share of 62.11% in 2022. Several organizations are engaged in adopting container security solutions, which have capabilities in detecting vulnerabilities that can initiate a potential attack. Container security solutions protect container image builds and runtime host, platforms, and application layers.

b. The key players operating in the container market include Microsoft Corporation, Broadcom, Inc., IBM, Amazon Web Services, VMware, Qualys, Docker Inc., Check Point Software Technologies Ltd., Zscaler, Aqua Security, Sophos, Anchore, Palo Alto Networks, HCL Technologies Limited, and CROWDSTRIKE

b. The container security market growth can be attributed to the increasing adoption of container applications across all sizes of enterprises and production environments, rise in cloud computing solutions across several industry verticals, and growing adoption of serverless technologies.

b. The global container market size was estimated at USD 1.53 billion in 2022 and is expected to reach USD 1.90 billion by 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.