- Home

- »

- IT Services & Applications

- »

-

Content Management Software Market, Industry Report 2033GVR Report cover

![Content Management Software Market Size, Share & Trends Report]()

Content Management Software Market (2026 - 2033) Size, Share & Trends Analysis By Type (Solution, Service), By Deployment (Cloud-based, On-Premise), By Enterprise Size (Large Size Enterprise, Small and Medium-Sized Enterprise (SMEs)), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-146-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Content Management Software Market Summary

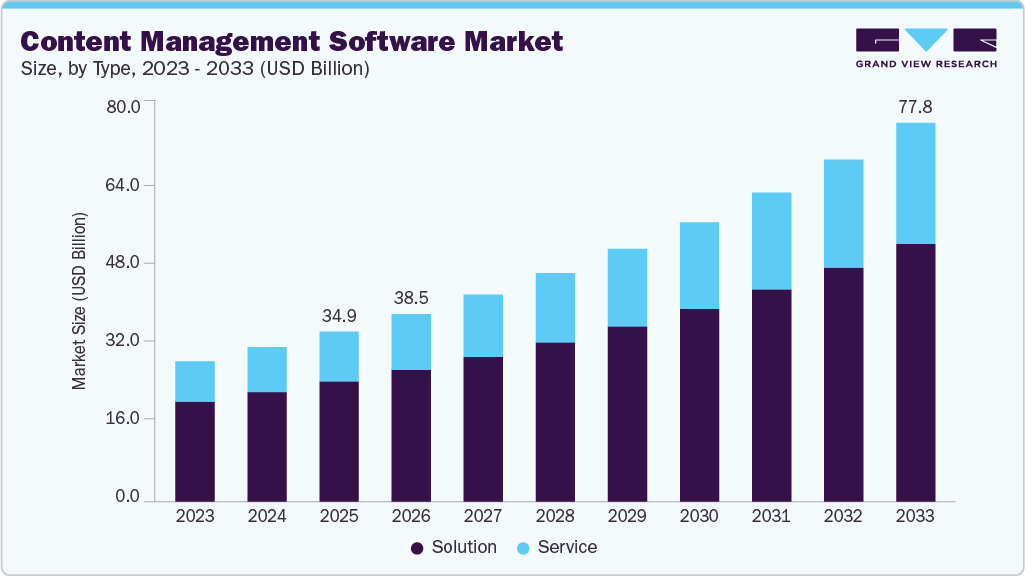

The global content management software market size was estimated at USD 34.94 billion in 2025 and is projected to reach USD 77.77 billion by 2033, growing at a CAGR of 10.6% from 2026 to 2033. The increasing demand for digital content across industries drives market growth.

Key Market Trends & Insights

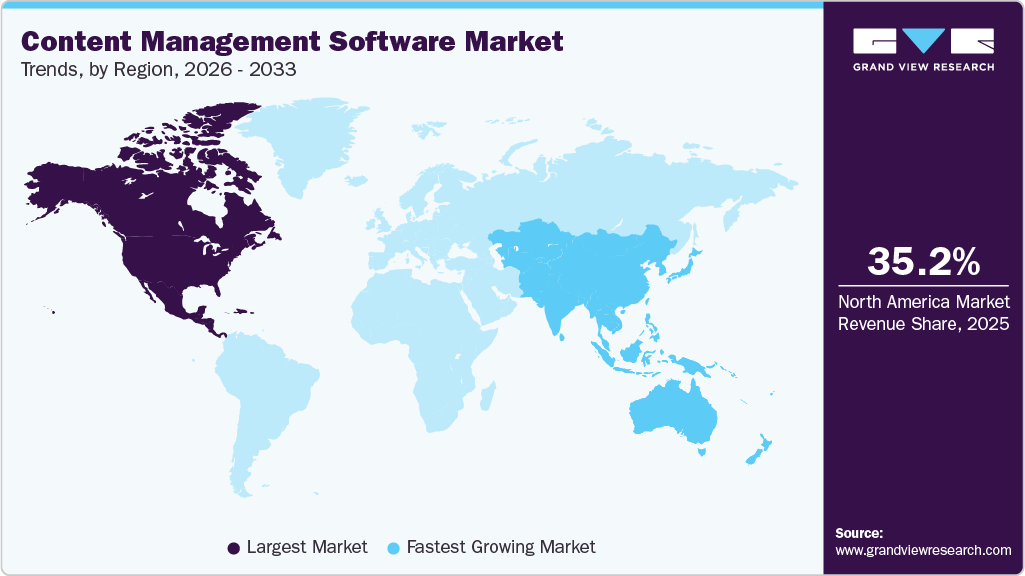

- North America held a 35.2% revenue share of the global content management software market in 2025.

- In the U.S., the market is driven by increasing digital transformation initiatives, growing adoption of cloud-based solutions, and the need for personalized, omnichannel customer experiences.

- By type, solution held the largest revenue share of 70.6% in 2025.

- By enterprise size, the large enterprise segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 34.94 Billion

- 2033 Projected Market Size: USD 77.77 Billion

- CAGR (2026-2033): 10.6%

- North America: Largest market in 2025

- Asia Pacific: Fastest-growing market

As companies generate more data and engage with consumers through various digital channels, the importance of organizing, storing, and delivering content in a streamlined way has become critical. A CMSincluding advanced content marketing management system solutions, helps businesses create, edit, and publish content on websites, intranets, and mobile platforms without needing deep technical expertise. This ability to manage content efficiently while maintaining brand consistency across multiple platforms is a major driver behind the adoption of CMS solutions. As a result, content management tools have become important for organizations for their digital strategy.

The expansion of e-commerce and online services has also significantly contributed to the rise of the CMS market. With more consumers shopping online and interacting with brands digitally, businesses are under pressure to update and manage their digital storefronts frequently. A robust CMS or content marketing management system enables them to do so efficiently, with features that allow real-time editing, content scheduling, and automated publishing. In addition, the ability of CMS tools to support multi-language content and localization helps companies cater to global audiences, which is especially critical for businesses expanding into new markets.

The increasing adoption of video media content in digital marketing strategies is another influential factor. Businesses across all sectors are increasingly leveraging video, infographics, podcasts, and interactive content to engage audiences more effectively. CMS platforms that support seamless multimedia content creation, storage, and delivery are gaining traction. For instance, in February 2025, Smint.io announced a strategic OEM partnership with Cloudinary, integrating Smint.io's content activation technology into Cloudinary Assets. This collaboration enhances content personalization and management. It will intensify competition and drive innovation in the digital asset and content management software industry. Overall, these developments highlight how modern CMS platforms are evolving to support scalable, cloud-native, and multimedia-rich digital experiences. Together, these trends are strengthening market growth, increasing competition, and accelerating innovation across the global content management software landscape.

Moreover, companies are increasingly forming key partnerships to integrate AI capabilities, improve cloud-based collaboration, and expand into new regions for better content creation and distribution. These collaborations often focus on combining established platforms with advanced technologies to support creators and enhance user experiences across digital channels, particularly within content marketing management system ecosystems. For instance, in November 2025, NAVER formed a strategic partnership with Japan’s content platform note, investing USD 12.7 million for a 7.9% stake. The collaboration focuses on integrating AI into large-scale content management, discovery, and distribution. This partnership is expected to accelerate AI-driven CMS adoption, strengthen creator ecosystems, and enhance competition in the Japanese and global markets.

Type Insights

The solution segment accounted for the largest revenue share of 70.6% in 2025. The increasing demand for integrated platforms that streamline the creation, management, and distribution of digital content is driving segment growth. Organizations across industries are facing mounting pressure to deliver consistent, engaging, and real-time content across a wide array of digital channels. CMS solutions provide the necessary infrastructure to centralize content workflows, enable role-based collaboration, and enhance content reuse, all of which result in improved operational efficiency and faster go-to-market strategies. This trend is further supported by growing investments in partnerships and platform integrations aimed at enhancing automation, monetization, and end-to-end content capabilities. For instance, in April 2025, AnyMind Group partnered with NDSoft and NextPaper to launch a fully automated advertising solution, integrating AnyManager's banner and video ad capabilities into NDSoft's CMS via API. This enables over 3,300 Korean media publishers to streamline ad delivery, tracking, and invoicing without dedicated teams. The initiative will intensify market competition by embedding advanced monetization features natively. Moreover, the ability of these solutions to unify marketing, sales, and customer service functions around a single content hub is optimal for enterprises to boost productivity and maintain brand consistency.

The service segment is expected to grow at the highest CAGR during the forecast period from 2026 to 2033. The rise in demand for managed and support services is driving segment growth. With many enterprises lacking in-house technical expertise or resources to maintain and update CMS platforms continuously, they are turning to managed service providers to handle routine operations, content migration, platform upgrades, and performance monitoring. This trend is particularly prevalent among small to medium-sized enterprises (SMEs), which benefit from outsourcing CMS management to reduce overhead costs and focus on core competencies. Additionally, ongoing support services ensure system stability and scalability, which is crucial for businesses experiencing rapid growth or operating across multiple regions.

Deployment Insights

The cloud-based segment accounted for the largest market share of 52.9% in 2025. The increasing demand for centralized content repositories across global enterprises is fueling cloud CMS adoption. Multinational organizations often struggle with siloed data and content stored across disparate systems and regional servers. Cloud-based CMS provides a unified platform for storing, organizing, and retrieving digital assets, ensuring that branding, messaging, and documentation remain consistent across geographies. For instance, in January 2024, Newgen Software released its cloud-validated Content Management Accelerator on the Guidewire Marketplace, enabling seamless integration with Guidewire ClaimCenter and PolicyCenter on Guidewire Cloud. This enhances document lifecycle management, secure collaboration, compliance, and productivity for insurers. The solution strengthens cloud-based enterprise content management software market adoption in the insurance sector. This integration will intensify competition and accelerate growth in the specialized market for insurance.

The on-premises segment is expected to experience significant growth during the forecast period from 2026 to 2033. The preference for one-time licensing models and cost predictability contributes to the segment’s growth. Some businesses favor capital expenditure (CapEx) over operational expenditure (OpEx), preferring to invest upfront in software that can be used over the long term without recurring subscription fees. This model offers predictable costs and can be more economical in the long run, especially for organizations with stable content management needs and limited requirements for scalability.

Enterprise Size Insights

The large-sized enterprise segment accounted for the largest market share of 56.7% in 2025. The high volume of data and digital content these organizations generate and manage daily is driving the adoption of CMS. Large enterprises often operate across multiple departments, locations, and time zones, leading to vast quantities of documents, multimedia files, customer data, and internal communications. Content management software helps these organizations streamline the storage, access, and retrieval of this data in a centralized and organized manner. This demand is further reinforced by continuous product innovation and the integration of advanced technologies such as artificial intelligence to address enterprise-scale complexity and performance requirements. For instance, in February 2025, Sitecore announced over 250 innovations for its composable digital experience platform and CMS, featuring advanced Sitecore Stream AI capabilities, including brand-aware AI, content copilots, and agentic workflows. These enhancements support multisite management, A/B testing, AI-driven personalization, and robust digital asset management tailored for large enterprises. This release will strengthen Sitecore's position and drive further AI adoption in the enterprise content management software market. Moreover, the ability to create secure repositories and implement role-based access ensures compliance with corporate governance policies and industry regulations, which is crucial for organizations handling sensitive information.

The small and medium-sized enterprise (SMEs) segment is expected to grow at the highest CAGR during the forecast period from 2026 to 2033. The increasing reliance on remote work and digital communication has made content accessibility and collaboration crucial for SMEs. CMS platforms allow teams to collaborate in real time, share documents securely, and maintain centralized access to content from any location. This is especially valuable for SMEs that rely on lean teams and flexible work environments. Features such as mobile access, cloud synchronization, and integration with productivity tools (like Google Workspace or Microsoft 365) enhance employee efficiency and support seamless remote collaboration. For instance, in January 2025, Impelsys and the Glide Publishing Platform announced a strategic partnership to deliver integrated headless CMS solutions for the media sector, targeting small enterprises. The collaboration combines Glide’s advanced CMS with Impelsys’ custom UX and app development, enabling seamless e-commerce, SSO, analytics, SEO, and digital marketing. This will empower small enterprises in the enterprise content management software market with affordable, scalable digital tools.

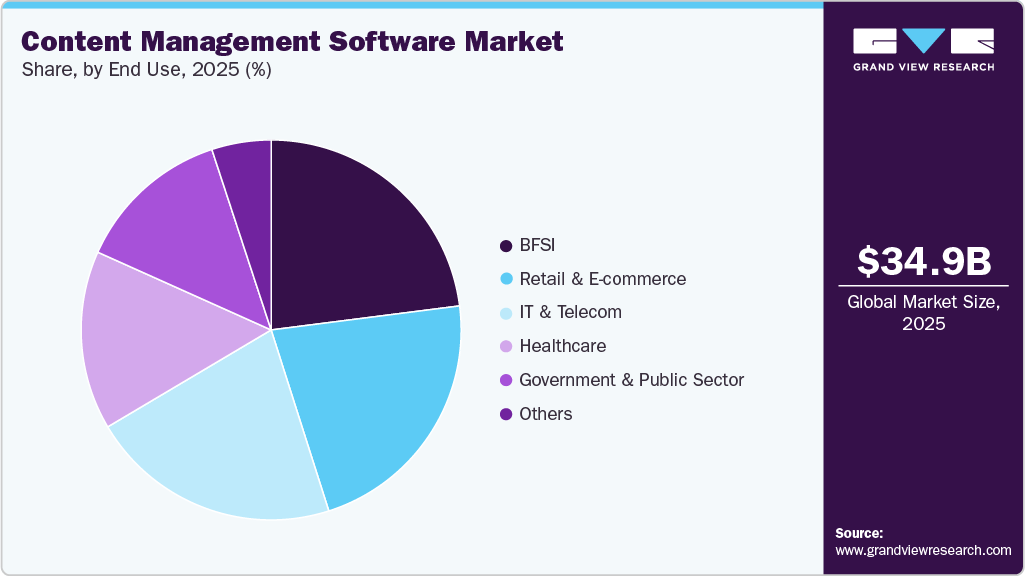

End Use Insights

The BFSI segment accounted for the largest market share of 28.9% in 2025. The shift toward remote work and digital banking has emphasized the need for real-time document access and collaboration tools. With employees and customers often operating in distributed environments, CMS platforms provide centralized and secure access to data, regardless of location. For instance, in September 2025, FintechOS, a leading AI-driven financial product engine, partnered with Tech Mahindra, a global technology consulting and digital solutions provider, to accelerate core modernization and deliver advanced digital experiences for financial institutions in the UK, Europe, North America, and Asia-Pacific. By integrating FintechOS's composable platform with Tech Mahindra's large-scale implementation expertise, the collaboration enables BFSI organizations to replace legacy systems, reduce costs, and launch personalized products faster across accounts, lending, insurance, and wealth management. This partnership will intensify market competition in the BFSI segment by promoting agile, AI-enhanced digital content and customer journey management, driving further innovation and market growth.

The government segment is expected to register significant growth during the forecast period in the global market. The need for improving citizen engagement and service delivery is another key driver in this sector. Many government organizations are transitioning to digital platforms to provide citizens with faster and more efficient services. Content management software supports this shift by enabling the digitization of forms, applications, and documents, making it easier for citizens to access public services online. For instance, in February 2025, the Ministry of Electronics and Information Technology (MeitY) launched the Digital Brand Identity Manual (DBIM) to standardize visual and verbal elements across Government and Public Sector of India websites, applications, and platforms, ensuring a uniform, citizen-centric user experience. This initiative includes a dedicated GOV. IN CMS platform for compliant content management. In the market's government segment, this standardization is expected to consolidate demand around the centralized GOV. IN CMS, it potentially reduces opportunities for diverse commercial vendors. Moreover, CMS tools allow government agencies to automate and streamline workflows, such as processing applications or issuing permits, reducing waiting time and increasing satisfaction among citizens. This is particularly important in today’s world, where the demand for seamless digital experiences is higher than ever.

Regional Insights

North America accounted for the largest market share of 35.2% in 2025 in the global content management software market. Businesses in North America are increasingly recognizing the need to provide exceptional client experiences. CMS solutions that offer personalized content distribution, targeted messaging, and seamless multichannel experiences are becoming more popular as businesses prioritize customer-centric initiatives. This growing focus on customer engagement is also encouraging technology providers to strengthen alliances and expand ecosystem partnerships across the region. For instance, in April 2023, Techcronus Inc., a California-based IT consulting and enterprise solutions provider, joined the International Association of Microsoft Channel Partners (IAMCP) in North America. This membership strengthens its long-standing Microsoft partnership, enhancing the delivery of solutions, including Dynamics 365, Power Platform, and Microsoft 365 for content collaboration and management. Overall, strong digital maturity, early adoption of advanced CMS capabilities, and a robust partner ecosystem continue to support North America’s market leadership. The region’s emphasis on personalization, cloud adoption, and integrated customer experiences is expected to sustain growth over the forecast period.

U.S. Content Management Software Market Trends

The content management software market in the U.S. accounted for the largest share in 2025. The rise of cloud computing is driving the growth of CMS solutions in the U.S. The cloud-based CMS market has seen a significant uptick as organizations look for flexible, scalable, and cost-effective solutions. Cloud-based CMS platforms offer several advantages, such as lower upfront costs, automatic updates, enhanced collaboration, and the ability to access content from anywhere. In a remote work environment, cloud CMS solutions have become even more critical as businesses require NLPe real-time access to content and collaboration across geographically dispersed teams. For instance, in November 2024, Box, the leading Intelligent Content Management platform, and Slalom, a global business and technology consulting firm from the U.S., announced a strategic partnership to deliver AI-powered solutions that modernize workflows, enhance collaboration, and unlock insights from enterprise content across industries like financial services, healthcare, retail, and the public sector. Overall, strong cloud adoption, a mature digital infrastructure, and increasing demand for AI-enabled content solutions are reinforcing the market’s leadership position. These factors are expected to continue driving innovation, enterprise adoption, and sustained market growth.

Europe Content Management Software Market Trends

The content management software market in Europe is anticipated to register significant growth from 2026 to 2033. The rise of automation and artificial intelligence (AI) is having a transformative effect on the market in Europe. Many organizations are looking to automate content-related tasks, such as categorization, tagging, and content recommendation, to improve operational efficiency and reduce human error. This trend is highlighted by recent innovations from key players in the industry. For instance, in October 2023, CoreMedia, a global leader in content management and digital experience platforms, launched CoreMedia Campaigns, a cloud-native SaaS application designed for efficient omnichannel campaign management. The intuitive solution enables marketing teams to plan, create, and deploy personalized content across channels, languages, and geographies with reduced administrative overhead and enhanced agility. Moreover, AI-powered CMS solutions are being used to automatically classify content, analyze user behavior, and optimize content delivery. These technologies help businesses manage large volumes of data more effectively and make smarter, data-driven decisions. AI also helps in improving content personalization and improving user experiences, making it a key factor in the growth of the CMS market in Europe.

The UK content management software market accounted for the largest share in 2025. The growing demand for multichannel content distribution is a key factor influencing the UK market. As businesses increasingly rely on a variety of digital platforms to engage their customers, the need for systems that can efficiently manage and distribute content across multiple channels has grown. UK businesses are leveraging CMS platforms to streamline the delivery of content across websites, social media, mobile apps, email newsletters, and more. The ability to manage content consistently across multiple channels is essential for maintaining brand coherence and optimizing user experiences. As multichannel marketing continues to rise in prominence, CMS solutions that enable centralized control over content distribution are becoming increasingly valuable to organizations in the UK.

The content management software market in France is poised for accelerated growth from 2026 to 2033, driven by strong demand for digital transformation across industries such as retail, luxury goods, and financial services. Businesses increasingly turn to modern CMS platforms to support omnichannel delivery, personalized customer experiences, and compliance with strict data privacy rules such as GDPR. Cloud-based and headless solutions gain traction, allowing companies to manage content efficiently across websites, mobile apps, and emerging channels while integrating AI for automation and better engagement. Strategic partnerships and collaborations are also playing a key role in accelerating innovation and expanding advanced content management capabilities in the market. For instance, in November 2025, Cognacq-Jay Image (CJI), a leading audiovisual services operator, and BeNarative, a cloud-based live video production and automated clipping platform, announced a strategic partnership to advance live-to-social and near-live workflows for broadcasters, OTT platforms, sports, events, and corporate sectors. This partnership bolsters innovation in video content management, enhancing competition and efficiency in France's growing market.

Asia Pacific Content Management Software Market Trends

The content management software market in the Asia Pacific is expected to register the fastest CAGR from 2026 to 2033. The growth is attributed to the rise of e-commerce, which has prompted the adoption of CMS end-uses that address the unique requirements of online businessesincluding content marketing management system capabilities. Content marketing features are being prioritized within CMS to assist product information management, content personalization, and efficient online sales strategies. Furthermore, cloud adoption is on the rise in the Asia Pacific region, with organizations leveraging cloud-based CMS solutions for scalability and flexibility. Cloud-native CMS end-uses allow businesses to scale their digital presence, accommodate traffic spikes, and manage content efficiently in a cost-effective manner. All these factors are expected to drive the market growth in the region. Collaborations and partnerships are further strengthening the adoption of advanced CMS solutions across the region. For instance, in May 2024, Newgen Software, a global provider of low-code digital transformation platforms with strong enterprise content management capabilities, formed a strategic partnership with ASEAN Business Partners (ABP) to expand in Southeast Asia, targeting Indonesia, Malaysia, the Philippines, Singapore, and Thailand. This collaboration will deliver advanced onboarding, lending, and trade finance solutions via the NewgenONE platform, enabling unified operations and scalable automation.

China's content management software market held a dominant share in 2025. The explosion of mobile and internet users in China is a significant driver for the CMS market. As one of the largest internet user bases globally, China has seen a rapid shift toward mobile-first consumption of digital content. This shift has created a demand for CMS platformsand content marketing management system solutions that can effectively manage content across multiple mobile channels, including apps, websites, and social media platforms. Mobile users expect a seamless experience when interacting with digital content, which has prompted businesses to adopt CMS solutions that ensure content is optimized for mobile delivery. With the mobile penetration rate constantly increasing, particularly in tier-2 and tier-3 cities, businesses in China are prioritizing CMS tools that can deliver responsive and adaptive content to cater to this growing mobile-first consumer base.

The content management software market in India is poised for rapid expansion from 2026 to 2033. The expansion of digital marketing and social media usage in India is another key factor propelling the demand for CMS solutions. Social media platforms such as Facebook, Instagram, Twitter, and YouTube are extensively used by businesses to engage with customers and promote products. Companies in India are increasingly leveraging these platforms for targeted advertising, influencer marketing, and direct customer engagement. To manage the growing volume of digital content and ensure consistent messaging across platforms, businesses are turning to CMS solutions and content marketing management system solutions. These tools help organizations streamline content creation, ensure timely updates, and optimize content for various social media channels. As digital marketing and social media play an increasingly central role in business strategies, CMS tools are becoming indispensable for Indian companies. In addition, Indian companies are increasingly partnering with technology providers to adopt innovative CMS solutions that enhance efficiency and scalability. For instance, in August 2025, Yotta Data Services launched Urja and Sudarshan - two cloud-native platforms tailored for the media and entertainment sector, focusing on content creation, CGI rendering, storage, distribution, and monetization with a pay-as-you-use model. These sovereign solutions ensure data privacy, low latency, and security, accelerating digital transformation for content platforms.

Key Content Management Software Company Insights

Key players operating in the bare metal cloud industry are Adobe, Broadcom, Inc., Microsoft Corporation, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In January 2025, PwC and Microsoft announced a strategic collaboration to deploy advanced AI agents, leveraging PwC's industry expertise and Microsoft's Copilot technologies to enhance operational efficiency, automate workflows, and drive innovation across sectors, including content management software. This partnership supports phased AI adoption for autonomous task execution and data-driven decision-making. This collaboration will accelerate AI integration in the market, enabling automated content creation, personalization, and hyper automation, thereby boosting market growth and competitive transformation.

-

In December 2024, PwC and Amazon Web Services (AWS) expanded their collaboration to accelerate generative AI adoption, combining PwC's industry expertise with Amazon Bedrock's advanced foundation models and Automated Reasoning safeguards. This partnership will develop tailored GenAI applications for regulated sectors, enhancing content validation, compliance, and efficiency in content management software solutions. This alliance is expected to drive innovation and market growth by enabling more reliable, industry-specific GenAI tools for automated content generation and governance.

-

In September 2024, Nomad Media announced a partnership with Mobius Labs to integrate cost-effective Generative AI into its platform, enhancing media library management through efficient content analysis, search, and creative insights. This collaboration makes advanced AI accessible for video content organizations, improving scalability and affordability. The integration is expected to drive the adoption of AI-powered content management solutions, boosting market growth.

Key Content Management Software Companies:

The following key companies have been profiled for this study on the content management software market.

- Adobe

- Box

- Broadcom

- Contentful

- Dribbble

- HubSpot, Inc.

- Hyland

- Kentico Software

- Lexmark International, Inc.

- Microsoft Corporation

- Open Text Corporation

- Oracle Corporation

- Sitecore A/S

- WordPress

- Xerox Corporation

Content Management Software Market Report Scope

Report Attribute

Details

Market size in 2026

USD 38.52 billion

Revenue forecast in 2033

USD 77.77 billion

Growth rate

CAGR of 10.6% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Adobe; Box; Broadcom; Contentful; Dribbble; HubSpot, Inc.; Hyland; Kentico Software; Lexmark International, Inc.; Microsoft Corporation; Open Text Corporation; Oracle Corporation; Sitecore A/S; WordPress; Xerox Corporation

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Enterprise size and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Content Management Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global content management software market report based on type, deployment, enterprise size, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Document management

-

Web content management

-

Collaboration Software

-

Digital rights management

-

Content Analytics

-

Others

-

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

Cloud-based

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Large Size Enterprise

-

Small and Medium-Sized Enterprise (SMEs)

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Government and Public Sector

-

Healthcare

-

IT & Telecom

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global content management software market size was estimated at USD 34.94 billion in 2025 and is expected to reach USD 38.52 billion in 2026.

b. The global content management software market is expected to grow at a compound annual growth rate of 10.6% from 2026 to 2033 to reach USD 77.77 billion by 2033.

b. The solution segment dominated the content management software market in 2025 driven by rising demand for integrated, cloud-based platforms that improve content management, compliance, collaboration, and digital transformation across enterprises.

b. Some key players operating in the market include Adobe; Box; Broadcom; Contentful; Dribbble; HubSpot, Inc.; Hyland; Kentico Software; Lexmark International, Inc.; Microsoft Corporation; Open Text Corporation; Oracle Corporation; Sitecore A/S; WordPress; Xerox Corporation.

b. Factors such as the growing demand for digital content creation and distribution across websites, mobile apps, and social platforms and rising adoption of cloud-based and SaaS solutions for scalability and cost efficiency play a key role in accelerating the content management software market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.