- Home

- »

- Medical Devices

- »

-

Continuous Subcutaneous Insulin Infusion Market, 2030GVR Report cover

![Continuous Subcutaneous Insulin Infusion Market Size, Share & Trends Report]()

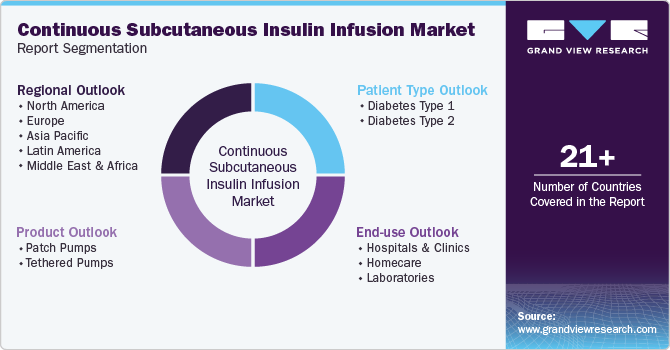

Continuous Subcutaneous Insulin Infusion Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Patch Pumps, Tethered Pumps), By Patient Type (Diabetes Type 1, Diabetes Type 2), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-482-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

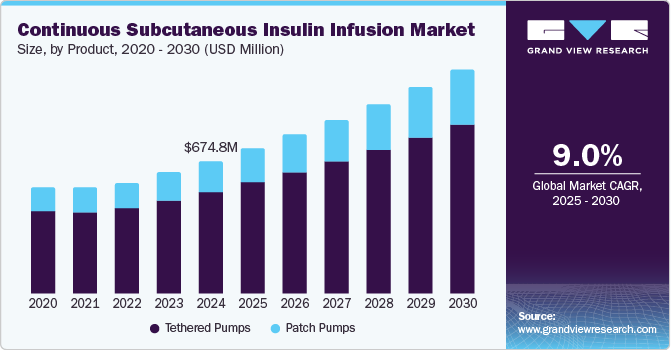

The global continuous subcutaneous insulin infusion market size was valued at USD 674.8 million in 2024 and is anticipated to grow at a CAGR of 9.0% from 2025 to 2030. The continuous subcutaneous insulin infusion (CSII) market is fueled by the rising prevalence of Type 1 and Type 2 diabetes and technological advancements such as AI-integrated insulin pumps, CGM systems, and smartphone connectivity-supportive government initiatives and campaigns by organizations such as WHO further promote adoption. In addition, the aging population, with higher susceptibility to diabetes, drives demand for advanced insulin delivery systems.

The market is driven by the increasing prevalence of Type 1 and Type 2 diabetes, leading to a higher demand for advanced diabetes management solutions. CSII offers precise insulin delivery, reducing complications and improving patient quality of life. According to the World Health Organization (WHO), diabetes affects approximately 830 million people globally, with most residing in low- and middle-income countries and over 50% lacking access to treatment. Type 2 diabetes, the most common form, has seen a rise across all income levels over the past three decades. The condition causes serious complications, making access to affordable insulin and treatments critical for survival.

The aging population, with higher susceptibility to Type 2 diabetes, contributes to the demand for advanced insulin delivery systems such as CSII. According to the Centers for Disease Control and Prevention (CDC), between August 2021 and August 2023, 15.8% of U.S. adults had diabetes, with 11.3% diagnosed and 4.5% undiagnosed. Men showed higher rates of total (18.0%) and diagnosed diabetes (12.9%) compared to women (13.7% and 9.7%, respectively). Diabetes prevalence rose significantly with age, reaching 27.3% of those 60 and older.

The market is fueled by technological advancements such as AI-integrated insulin pumps, CGM systems, and smartphone connectivity-supportive government initiatives and campaigns by organizations such as WHO further promote adoption. For instance, in May 2023, the U.S. Food and Drugs Administration cleared the Beta Bionics iLet Dosing Decision Software and iLet ACE Pump, forming the iLet Bionic Pancreas system for individuals aged six and older with type 1 diabetes. This system uses an adaptive algorithm that simplifies insulin management, eliminates manual adjustments, and introduces a meal announcement feature to estimate carbohydrate intake.

Product Insights

Tethered pumps accounted for the largest share of 77.5% in 2024. The increasing prevalence of diabetes drives segment growth, growing patient preference for more precise insulin delivery, advancements in pump technology offering improved comfort and ease of use, and the need for continuous blood sugar management. In addition, these pumps support better diabetes control by delivering basal and bolus insulin, enhancing patient adherence and quality of life.

The patch pump segment is expected to grow at the fastest CAGR of 10.2% over the forecast period, owing to the increasing demand for convenient, customizable insulin delivery solutions that cater to people with higher insulin requirements, such as those with Type 2 diabetes. For instance, in September 2024, Embecta Corp received FDA clearance for its disposable patch pump for insulin delivery. This pump, tailored for people with Type 2 diabetes (T2D), has a 300-unit insulin reservoir that allows it to meet the needs of individuals with higher insulin requirements. The patch pump provides adjustable insulin doses for up to three days and includes a Bluetooth-enabled controller with a user-friendly touchscreen interface.

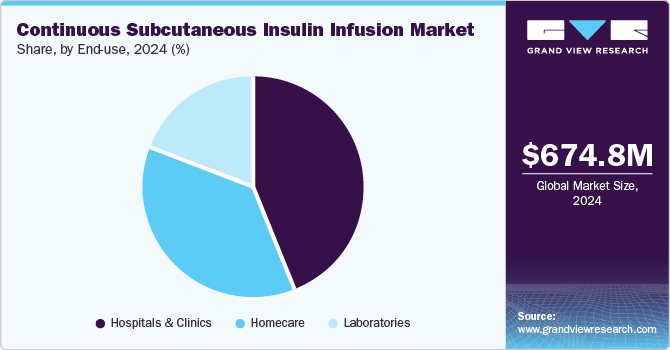

End-use Insights

The cardiology segment dominated the market with a share of 28.0% in 2024. This dominance can be attributed to the government initiatives and medical coverage programs for the diabetes related services. Medicare covers various diabetes-related services, including up to two yearly screenings at no cost, a lifetime diabetes prevention program at no charge if eligible, and diabetes self-management training with a 20% co-payment after the Part B deductible. It also covers diabetes equipment like glucose monitors and insulin pumps with a 20% co-payment and a maximum USD 35 insulin cost for traditional pumps. Part D covers certain supplies for insulin administration, with applicable coinsurance and deductibles.

The homecare segment is expected to grow at the fastest CAGR of 9.4% over the forecast period. The increasing preference for home-based diabetes management drives the demand for the segment, providing convenience and better control. Technological advancements, such as smaller and more user-friendly devices with enhanced connectivity, promote adoption. In addition, the cost-effectiveness of home care, aided by insurance coverage and reduced hospital visits, makes it an attractive option for patients.

Patient Type Insights

The diabetes type 1 segment held the largest market share of 82.1% in 2024, which can be attributed to the growing global prevalence of diabetes type 1, necessitating efficient and continuous insulin delivery solutions for better blood sugar management. According to the IDF Global Diabetes Atlas, type 1 diabetes is an autoimmune disease that damages the pancreas's insulin-producing cells, requiring individuals to take insulin to control blood sugar. It affects approximately 5-10% of people with diabetes globally. The number of cases per 1,000 people varies across countries, with the U.S. and India having the highest rates, at 175.9 and 171.3, respectively.

The diabetes type 2 segment is expected to grow at the fastest CAGR of 10.0% over the forecast period. This growth can be attributed to the increasing prevalence of the disease, the growing need for personalized insulin delivery solutions, and the demand for better blood sugar control to manage the condition more effectively. The convenience and improved quality of life offered by insulin pumps are also key motivators, as patients seek easier ways to manage insulin delivery and avoid complications associated with Type 2 diabetes.

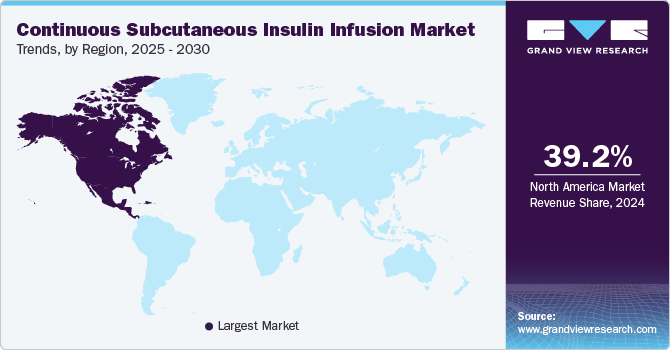

Regional Insights

North America continuous subcutaneous insulin infusion market held the largest share of 39.2% in 2024, which can be attributed to the approval of advanced insulin pumps that feature meal detection technology and automatic insulin corrections, enhancing blood sugar control and making diabetes management more convenient for patients. For instance, in April 2023, the U.S. FDA approved the Medtronic MiniMed 780G insulin pump, a device with meal-detection technology that provides automatic insulin corrections every five minutes. This system improves blood sugar control, helping users achieve up to 75% time range, and it is suitable for patients aged seven and above with type 1 diabetes.

U.S. Continuous Subcutaneous Insulin Infusion Market Trends

The U.S. continuous subcutaneous insulin infusion market dominated in 2024 due to the growing demand for advanced, personalized diabetes management solutions driven by innovations in wearable insulin delivery devices and integration with continuous glucose monitoring (CGM) systems. For instance, in June 2023, Medtronic acquired EOFlow, a manufacturer of the EOPatch insulin delivery device, a tubeless and disposable insulin patch. This acquisition expands Medtronic's capabilities in offering diverse diabetes management solutions, adding wearable insulin patches to its portfolio. The EOPatch system integrates with Medtronic's Meal Detection Technology and CGM systems, enhancing the company's ability to provide patients with more personalized insulin delivery options globally.

Europe Continuous Subcutaneous Insulin Infusion Market Trends

The Europe continuous subcutaneous insulin infusion market was identified as a lucrative region in 2024. The regional market is expanding due to the increasing prevalence of diabetes, particularly Type 1 diabetes, which drives demand for advanced insulin delivery systems. Technological advancements, such as artificial intelligence (AI) and Internet of Things (IoT) integration in insulin pumps, are enhancing the personalization and effectiveness of diabetes management. In addition, supportive government policies and rising patient awareness contribute to broader adoption, especially in hospital and home care settings.

Asia Pacific Continuous Subcutaneous Insulin Infusion Market Trends

The Asia Pacific continuous subcutaneous insulin infusion market is anticipated to grow at a CAGR of 9.7% over the forecast period. The rising prevalence of diabetes and undiagnosed cases, along with increasing instances of hyperglycemia during pregnancy and impaired glucose tolerance, are driving the market in the region. According to the International Diabetes Federation (IDF), in Southeast Asia (SEA), 90 million adults are living with diabetes, with 46 million of them undiagnosed. In addition, 1 in 4 live births are impacted by hyperglycemia during pregnancy, and 47 million adults have impaired glucose tolerance, half of whom are also undiagnosed.

The China continuous subcutaneous insulin infusion market held the largest market share in 2024. China's rapidly growing elderly population is increasing the demand for advanced diabetes management solutions, including continuous subcutaneous insulin infusion, to address age-related health challenges. For instance, by the end of 2022, China's elderly population aged 60 and above reached 280.04 million, representing 19.8% of the total population. The population aged 65 and above stood at 209.78 million, accounting for 14.9%, with a dependency ratio of 21.8%, reflecting the increasing proportion of older individuals in the country.

Japan continuous subcutaneous insulin infusion market is expected to grow significantly over the forecast period owing to technological advancements in insulin pumps, such as Bluetooth connectivity, remote monitoring, and improved accuracy. The well-developed healthcare infrastructure in the country facilitates the adoption of these innovative systems, which enable better diabetes management through advanced and user-friendly insulin delivery solutions.

Key Continuous Subcutaneous Insulin Infusion Company Insights

Some of the key companies in the continuous subcutaneous insulin infusion market include Medtronic, F. Hoffmann-La Roche Ltd, ZEALAND PHARMA, CeQur Simplicity, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Medtronic is a global medical technology company that designs, develops, and manufactures various medical devices for treating heart valve disorders, heart failure, vascular diseases, neurological disorders, and musculoskeletal issues. The company also provides biologic solutions for orthopedics and dental markets.

-

F. Hoffmann-La Roche Ltd is a biotechnology company specializing in developing drugs and diagnostics for major diseases, including cancer, autoimmune conditions, CNS disorders, and infectious diseases. It provides in vitro diagnostics, cancer diagnostics, and diabetes management solutions while advancing research in disease prevention, diagnosis, and treatment.

Key Continuous Subcutaneous Insulin Infusion Companies:

The following are the leading companies in the continuous subcutaneous insulin infusion market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- F. Hoffmann-La Roche Ltd

- ZEALAND PHARMA

- CeQur Simplicity

- Insulet Corporation

- YPSOMED

- B. Braun SE

- BD (Becton, Dickinson and Company)

Recent Developments

-

In August 2024, Abbott and Medtronic partnered to develop integrated diabetes management technology. Abbott was expected to create glucose sensors exclusively compatible with Medtronic's insulin pumps and automated insulin delivery systems, aiming to enhance real-time glucose control.

-

In July 2024, F. Hoffmann-La Roche Ltd received CE Mark certification for its Accu-Chek SmartGuide continuous glucose monitoring (CGM) system, intended for people with type 1 or type 2 diabetes undergoing flexible insulin therapy.

-

In September 2023, Medtronic received CE Mark approval for its Simplera Continuous Glucose Monitor (CGM), which features a disposable, all-in-one design for easier use and reduced environmental impact. Simplera integrates advanced technology for real-time glucose monitoring to improve diabetes management.

Continuous Subcutaneous Insulin Infusion Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 741.8 million

Revenue forecast in 2030

USD 1.14 billion

Growth rate

CAGR of 9.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, patient type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Medtronic; F. Hoffmann-La Roche Ltd; ZEALAND PHARMA; CeQur Simplicity; Insulet Corporation; YPSOMED; B. Braun SE; BD (Becton, Dickinson and Company)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Continuous Subcutaneous Insulin Infusion Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global continuous subcutaneous insulin infusion market report based on product, patient type, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Patch Pumps

-

Basal

-

Bolus

-

Basal and Bolus

-

-

Tethered Pumps

-

Insulin Reservoir or Cartridges

-

Insulin Set Insertion Devices

-

Battery

-

-

-

Patient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Diabetes Type 1

-

Diabetes Type 2

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Homecare

-

Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.