- Home

- »

- Pharmaceuticals

- »

-

Contraceptive Drugs And Devices Market Size Report, 2030GVR Report cover

![Contraceptive Drugs And Devices Market Size, Share & Trends Report]()

Contraceptive Drugs And Devices Market Size, Share & Trends Analysis Report By Product (Contraceptive Drugs (Contraceptive Pills, Patch, Injectable), Contraceptive Devices), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-032-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

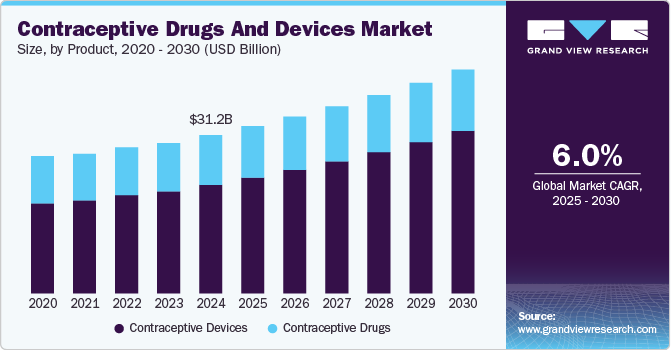

The global contraceptive drugs and devices market size was valued at USD 29.6 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030. The market growth can be attributed to an increase in the number of sexually transmitted diseases (STDs) and unintended pregnancies. A growing number of initiatives taken by the governments to spread awareness about contraception have resulted in market growth. Furthermore, government policies on controlling the population are expected to contribute to market growth.

The government is investing heavily in spreading awareness of STDs and abortion and how they are avoided with the help of contraceptive drugs or devices. The government is also spreading awareness about family planning, which will ultimately help the government in population management. Furthermore, key pharmaceutical companies are investing heavily in research and development to upgrade contraceptive drugs and devices as there is an increased demand for safe and effective contraceptive measures. Therefore, these factors have contributed to the growth of this market.

The increase in the population, especially in the middle and low-income regions, has resulted in market growth, as there is a rise in the popularity of contraceptive measures. With the rise in awareness regarding sexual health and family planning, there is an increased demand for effective contraceptive measures that can help in dealing with unwanted pregnancies. Furthermore, urbanization and changes in lifestyle, such as delaying pregnancy due to professional goals, are adding to the growth of the market.

Product Insights

The contraceptive devices segment dominated the market in 2023, with a share of 68.0% in 2023. The contraceptive devices segment is further divided into intrauterine devices (IUDs), condoms, vaginal rings, subdermal implants and diaphragms. The growth was attributed to the increased awareness regarding contraceptive devices as governments and public welfare groups have been active in spreading awareness regarding unwanted pregnancies. Contraceptive devices are effective against the spreading of STDs and preventing unwanted pregnancies. Furthermore, key market players are investing heavily in developing innovative contraceptive devices such as intrauterine devices (IUDs), condoms, vaginal rings, subdermal implants, and more. Therefore, these factors are responsible for the positive market growth of this segment.

Contraceptive drugs are anticipated to witness a CAGR of 3.5% over the forecast period owing to increased awareness regarding unwanted pregnancies and preventive measures such as pills, patches, and injectables. Increased accessibility and growing acceptance of contraceptive drugs among the urban population are driving the market growth of this segment, as the population is giving greater importance to sexual health and family planning.

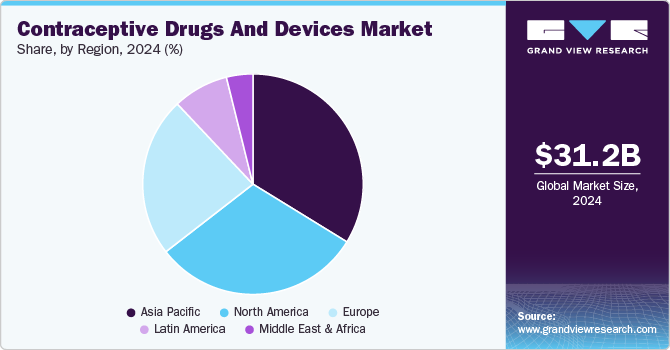

Regional Insights

North America held a market share of 30.9% in the global contraceptive drugs and devices market in 2023. This growth was attributed to the rising population and increased prevalence of STDs and unwanted pregnancies. Urban populations in the region have increased the use of contraceptive measures to mitigate problems such as unwanted pregnancies, abortion, and STDs. Furthermore, advanced healthcare infrastructure and government initiatives have resulted in positive market growth in this region.

U.S. Contraceptive Drugs And Devices Market Trends

The U.S. dominated the North America contraceptive drugs and devices market in 2023 with a revenue share of 84.3%. The factors responsible for the market growth in the country are widespread access to contraceptive measures and an increase in the awareness of STDs and unwanted pregnancies. Various options for contraceptive measures are available in healthcare, making contraceptive drugs and devices more accessible to the population. Furthermore, awareness spread by government and public welfare groups about STDs and abortions has resulted in market growth in this country.

Asia Pacific Contraceptive Drugs And Devices Market Trends

Asia Pacific dominated the contraceptive drugs and devices market with a market share of 33.2% in 2023. This market growth resulted from an increase in the initiatives taken by the government to spread awareness regarding STDs and unwanted pregnancies. The government has also been active in providing contraceptive measures in government funded medical institutes. Furthermore, the growing focus on family planning by the urban population due to the increase in unwanted population and STDs has resulted in the increased sale of contraceptive drugs and devices in the region.

China held a substantial market share in the contraceptive drugs and devices market due to the presence of key manufacturing companies and growing awareness about unwanted pregnancies and STDs. Major pharmaceutical companies can manufacture contraceptive products in huge numbers due to the presence of a developed manufacturing sector and cheap labor. The products are deployed quickly to the customers due to the country's strong distribution channel. Furthermore, the growth in population has resulted in the government putting more effort into educating the population about contraceptive measures. Therefore, these factors have resulted in positive market growth in this country.

Europe Contraceptive Drugs And Devices Market Trends

Europe contraceptive drugs and devices market was identified as a lucrative region in this industry pertaining to the presence of developed healthcare infrastructure and growing awareness regarding the use of contraceptive measures. The urban population in the region has increased the use of various contraceptive measures such as IUDs, condoms, and more as there is a growing emphasis on sexual health and family planning.

The UK contraceptive drugs and devices market is expected to proliferate due to the increased awareness and accessibility of contraceptive measures. The government has been active in spreading awareness regarding sexual health and STDs with the help of various campaigns and drives. Furthermore, the growing emphasis on family planning and maintaining sexual health has resulted in market growth in this country.

Key Contraceptive Drugs And Devices Company Insights

Some of the key companies operating in the contraceptive drugs and devices market are Abbvie, Inc., Afaxys, Inc., Agile Therapeutics, and Bayer AG, among others. Companies are focusing on investing in research and development for innovation in producing more effective and accessible contraceptive measures.

-

Abbvie, Inc is a biopharmaceutical company specializing in discovering, developing, manufacturing and commercializing drugs for treatment of diseases such as metabolic and rheumatological diseases, neurological diseases, skin diseases, STDs, and more.

-

Afaxys, Inc. is a pharmaceutical company that deals with contraceptive measures, medical supplies, instruments and diagnostics. The company deals with products such as oral contraceptives, emergency contraceptives, contraceptive patch, and more.

Key Contraceptive Drugs And Devices Companies:

The following are the leading companies in the contraceptive drugs and devices market. These companies collectively hold the largest market share and dictate industry trends.

- Abbvie, Inc.

- Afaxys, Inc.

- Agile Therapeutics

- Bayer AG

- China Resources (Holdings) Co., Ltd.

- Church & Dwight Co., Inc.

- Cupid Limited

- Helm AG

- Johnson & Johnson Services, Inc.

- Organon Group of Companies

- Pfizer Inc.

- Veru, Inc.

- Viatris Inc.

Recent Developments

-

In February 2023, Agile Therapeutics, a pharmaceutical and a women’s healthcare company announced clinical update on Twirla and status of pipeline evaluation. Twirla is a transdermal system, which is a once-weekly combined hormonal contraceptive (CHC) patch. The United States Food and Drug Administration (FDA) agreed to address the approval with help of electronic health records (EHR) and insurance claims from a large database from healthcare systems.

Contraceptive Drugs And Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 31.2 billion

Revenue forecast in 2030

USD 44.0 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbvie Inc.; Afaxys Inc.; Agile Therapeutics; Bayer AG; China Resources (Holdings) Co.; Ltd.; Church & Dwight Co. Inc.; Cupid Limited; Helm AG; Johnson & Johnson Services Inc.; Organon Group of Companies; Pfizer Inc.; Veru Inc.; Viatris Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contraceptive Drugs And Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global contraceptive drugs and devices market report based on product and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Contraceptive Drugs

-

Contraceptive Pills

-

Patch

-

Injectable

-

-

Contraceptive Devices

-

Condoms

-

Male Condoms

-

Female Condoms

-

-

Subdermal Implants

-

Intrauterine Devices (IUDs)

-

Copper IUDs

-

Hormonal IUDs

-

-

-

Vaginal Ring

-

Diaphragm

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."