- Home

- »

- Next Generation Technologies

- »

-

Contract Cleaning Services Market Size, Share Report, 2030GVR Report cover

![Contract Cleaning Services Market Size, Share & Trends Report]()

Contract Cleaning Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service Type (Window Cleaning, Floor & Carpet Cleaning, Upholstery Cleaning, Construction Cleaning), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-146-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Contract Cleaning Services Market Summary

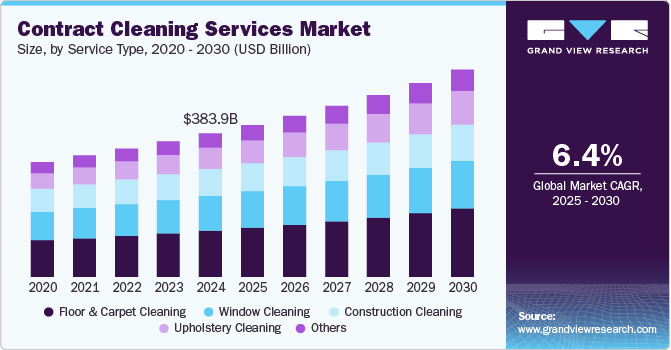

The global contract cleaning services market size was estimated at USD 383.99 billion in 2024 and is projected to reach USD 406.56 billion in 2025, growing at a CAGR of 6.4% from 2025 to 2030. The increasing awareness about hygiene in the workplace and the growing concerns about employee wellness and workplace sustainability drive the market for these services worldwide.

Key Market Trends & Insights

- North America led the contract cleaning services market, with the largest revenue share of 36.4% in 2024.

- By service type, the floor & carpet cleaning segment led the market, with the largest revenue share of 32.2% in 2024.

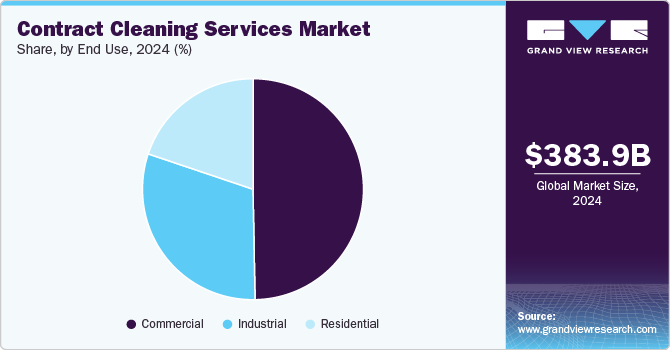

- By end use, the commercial segment led the market, with the largest revenue share of 49.7% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 383.99 Billion

- 2030 Projected Market Size: USD 406.56 Billion

- CAGR (2025-2030): 6.4%

- North America: Largest market in 2024

Cleaning services, which cover floor, carpet, upholstery, and window dusting, are primarily undertaken by commercial and industrial establishments to keep the premises clean and healthy.

Business organizations, especially large establishments, enter into contractual agreements with the service providers for these services. The service providers charge business organizations primarily based on two factors: the type of service availed and the frequency of desired services, which can be daily, once a week, semiannually, once a month, or annually. However, construction cleaning services are usually availed once and are charged based on the degree of cleansing required. Business organizations are investing considerable amounts in proper workplace maintenance to ensure a green and healthy working environment for their employees.

Service providers nowadays are shifting towards the concept of green cleaning, which essentially involves the use of natural products such as vinegar, baking soda, and lemons, among others, for cleansing the premises. The growing environmental concerns, as well as the negative implications of using products that have harmful chemicals, such as carcinogens and allergens, on human health, have paved the way for the adoption of these methods. The benefits associated with the use of green products for cleanup are expected to increase their adoption, shaping the service portfolios of providers in the coming years.

With the increase in the number of fatal diseases, individuals and businesses have become more conscious about the health of their employees and family members. This has resulted in increased spending on maintaining hygienic surroundings where people spend most of their time during work hours. Besides, the increasing disposable income is driving the trend of hiring professional cleaners for cleansing services among house owners. On the contrary, the introduction of automated cleaning robots that leverage Artificial Intelligence (AI) capabilities to perform dusting chores is expected to challenge the market growth to a certain extent.

COVID-19 Impact

The COVID-19 outbreak heightened worries about workplace hygiene and sanitation. The requirement for hygiene procedures to assure the safety of customers and staff rose with the easing of lockdown restrictions and the gradual reopening of the economy. To stop and contain future epidemics, business organizations are increasing the frequency of premise sanitization. The easing of lockdown restrictions and gradual re-opening of the economy has necessitated hygiene procedures to provide safety to employees and customers. Companies are increasing the frequency of premise sanitization to control and prevent potential outbreaks. Besides, several countries' governments have issued SOPs/guidelines that businesses must comply with to mitigate the risk of consecutive waves of the ongoing pandemic. Commercial and industrial establishments are mandated to abide by the guidelines laid not just to ensure the safety of their employees but also to deter any legal action.

Service Type Insights

Based on service type, the market is classified into window cleaning, floor & carpet cleaning, upholstery cleaning, construction cleaning, and others. The floor & carpet cleaning segment led the market with the largest revenue share of 32.2% in 2024. Floor & carpet cleansing is a very tedious and time-consuming task since the floor area is quite large in corporate office/manufacturing facilities. Therefore, the amount charged by the service contractors for this service is higher as compared to other services such as upholstery and window cleaning. On the other hand, the cost for these services does vary depending upon factors such as time, area, frequency, and complexity, among others. Moreover, floor cleansing is a pre-requisite for any commercial and industrial establishment and is, therefore, mostly outsourced to skilled contractors.

The upholstery cleaning segment is anticipated to grow at a considerable CAGR of 8.3% throughout the forecast period. The other cleaning services offered by the vendors include window, upholstery, and construction cleaning, among others. Among these, the upholstery cleaning services are anticipated to register at the fastest CAGR over the forecast period, primarily due to the current and long-lasting impact of the ongoing COVID-19. Upholstery, which includes sofas/couches and padded chairs, is one of those products exposed to direct human contact. Therefore, corporate offices are increasingly availing of these services to maintain the hygiene and safety of employees during and after post coronavirus outbreak.

End-use Insights

Based on end use, the market is classified into residential, industrial, and commercial. The commercial segment led the market with the largest revenue share of 49.7% in 2024. The commercial sector, which primarily includes office buildings, invests significantly in keeping the premises clean and sanitized. Furthermore, the revival of the construction and real estate sector after a brief period of lull during the first half of this decade and the resulting rise in the number of commercial buildings are the key factors for the high share of this segment. Other commercial establishments such as healthcare/medical facilities, educational institutions, hotels & restaurants, and retail outlets mostly prefer outsourcing the essential cleansing operations, thereby enabling employees and the management to focus primarily on the core business operations. Thus, the commercial sector is anticipated to offer immense growth opportunities for the service providers during and post-pandemic period.

The industrial segment is also projected to register at a strong and steady CAGR during the forecast period. Contractual service providers are appointed at such industrial manufacturing facilities to perform construction cleaning tasks, including oil spill cleaning & control and debris & dust cleaning, among others. Moreover, renovation activities undertaken by manufacturing facilities require cleanup at regular intervals. Furthermore, the increasing level of disposable income and the growing inclination of the young population towards outsourcing regular cleanup tasks is going to propel the market demand among residential end users.

Regional Insights

The North America contract cleaning services market held the largest revenue share of 36.4% in 2024. The region is characterized by a large number of service providers, especially in the U.S. In addition, most commercial establishments have contractual service agreements with the service providers to offer their employees a clean and sanitized working environment. For instance, Wegmans, which runs a chain of grocery stores under its name in the U.S., appointed Cleaning Services Group, Inc. to upkeep the construction sites, which eventually helped the company to keep the store environment free from debris, dust, and oil spills. Therefore, the trend towards outsourcing cleaning tasks is expected to continue, bolstering the regional market growth during the forecast period.

U.S. Contract Cleaning Services Market Trends

The contract cleaning services market in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. This growth is driven by increasing awareness of hygiene standards and stringent regulations in commercial and public spaces. The expansion of industries such as healthcare, retail, and hospitality further fuels the demand for specialized cleaning services. Technological advancements, such as automation and eco-friendly cleaning solutions, are enhancing operational efficiency and customer satisfaction. In addition, rising preferences for outsourcing cleaning tasks to professional service providers contribute to market growth. The adoption of sustainable practices and green certifications is also shaping consumer choices, bolstering the market's trajectory. Strong economic conditions and urbanization trends further reinforce the expansion of this sector in the U.S.

Asia Pacific Contract Cleaning Services Market Trends

The contract cleaning services market in Asia Pacific is anticipated to grow at a considerable CAGR of 7.5% throughout the forecast period. The growing number of under-construction units, which require regular clean-up for proper management of the site, is one of the key factors driving the growth of the regional market. Moreover, investments made by the government towards infrastructure development have led to a steep rise in the number of new commercial spaces in the region over the last few years. This, in turn, is expected to increase the adoption of cleaning services, including floor, window, and upholstery cleaning, among others. In addition, Asia Pacific is among the worst coronavirus-hit regions with high population density, which is having a positive impact on the adoption of cleaning services in the region.

The China contract cleaning services market is expected to grow at a significant CAGR from 2025 to 2030. Rapid urbanization and industrialization are key drivers of this growth, alongside the increasing adoption of professional cleaning services in commercial and residential sectors. Government policies promoting health and sanitation standards have heightened demand for these services across public facilities. The market is witnessing a shift towards environmentally friendly cleaning products and technologies, reflecting consumer and regulatory preferences. As e-commerce and retail spaces proliferate, the need for regular maintenance and cleaning services has surged. In addition, a growing middle class and their heightened focus on hygiene contribute significantly to market expansion. The competitive landscape is evolving, with local players adopting advanced practices to capture the growing demand.

The contract cleaning services market in Japan is expected to grow at a significant CAGR from 2025 to 2030. Japan’s aging population and a shrinking workforce are prompting a rise in demand for outsourced cleaning services. The emphasis on cleanliness and orderliness in Japanese culture enhances the importance of professional cleaning, especially in public spaces and offices. Technological advancements, including robotics and IoT-based cleaning solutions, are being increasingly adopted to address labor shortages and improve efficiency. The healthcare sector’s growth and heightened sanitation standards post-pandemic are also pivotal in driving demand. Furthermore, Japan’s focus on eco-friendly and sustainable solutions aligns with global trends, making it a key feature in service offerings. The market is also influenced by the strong presence of small and medium-sized enterprises adopting innovative practices to remain competitive.

The India contract cleaning services market is expected to grow at a significant CAGR from 2025 to 2030. This growth is propelled by rapid urbanization, increasing construction activities, and a burgeoning corporate sector. Government initiatives such as Swachh Bharat Abhiyan (Clean India Mission) have created widespread awareness about hygiene, boosting the demand for professional cleaning services. The rising disposable income of middle-class households is also contributing to the adoption of these services in residential spaces. Technological advancements and the availability of cost-effective services have made contract cleaning more accessible to businesses and consumers. In addition, the growth of industries such as healthcare, IT, and retail further amplifies the demand for cleaning and maintenance services. However, challenges such as workforce skill development and market fragmentation remain key concerns.

Middle East and Africa (MEA) Contract Cleaning Services Market Trends

The contract cleaning services market in the Middle East and Africa (MEA)is expected to grow at a significant CAGR from 2025 to 2030. Urbanization and economic diversification, particularly in Gulf Cooperation Council (GCC) countries, are driving demand for professional cleaning services in commercial and residential sectors. The growth of industries such as tourism, hospitality, and healthcare has heightened the need for specialized cleaning solutions. Moreover, governments in the region are investing in public infrastructure and sanitation, creating opportunities for market expansion. The adoption of innovative technologies, including automated cleaning equipment, is gradually gaining traction in the MEA market. A growing awareness of sustainable and eco-friendly practices is also shaping service offerings. However, market growth is uneven across the region, with infrastructure and economic challenges in some African nations posing hurdles.

The UAE contract cleaning services market is expected to grow at a significant CAGR from 2025 to 2030. This growth is driven by rapid urbanization, the expansion of the hospitality and tourism industries, and a strong focus on maintaining high hygiene standards in public and private spaces. The UAE’s increasing investments in infrastructure projects, including malls, airports, and luxury residential complexes, are further boosting the demand for professional cleaning services. Government regulations emphasizing cleanliness and sanitation, particularly in healthcare and food service industries, are also contributing to market growth. Technological advancements such as robotic cleaning solutions and eco-friendly products are being adopted to meet the expectations of environmentally conscious consumers. In addition, the outsourcing trend among businesses for cost efficiency and specialized cleaning expertise is further propelling the market forward. As the UAE continues to diversify its economy, the contract cleaning services sector is poised for sustained expansion.

Key Contract Cleaning Services Company Insights

The market is highly fragmented, with the presence of a large number of service providers. To gain significant revenue share and strengthen their position in the market. Market incumbents are undertaking various growth strategies, including strategic acquisitions and partnerships, to expand their reach by leveraging each other’s expertise. Further, owing to the ongoing COVID-19 pandemic, several service providers have altered their service delivery plans and packages, thereby enabling customers to choose the cleaning frequency as per their requirements and ease. Some prominent players in the contract cleaning services industry include ABM Industries Incorporated, Sodexo Group, ISS Facility Services, Inc., Jani-King International Inc., Mitie Group plc., and Pritchard Industries Inc.

-

Some of the key companies operating in the contract cleaning services industry include Jani-King International Inc., ISS Facility Services, Inc., and Sodexo Group, among others.

-

Jani-King International Inc. is renowned for its franchise-based model, which allows the company to maintain a widespread global presence while delivering localized services tailored to specific customer needs. This approach enables rapid scalability and adaptability in diverse markets, providing flexibility to meet varying regulatory and operational requirements. The company's focus on offering specialized cleaning services for industries such as healthcare, hospitality, and retail ensures it meets high hygiene standards, enhancing client satisfaction. By leveraging advanced cleaning technologies and eco-friendly practices, Jani-King positions itself as a forward-thinking service provider that aligns with evolving environmental and industry trends. The company also emphasizes robust training programs for its franchisees and staff, ensuring consistent service quality across regions. Its customer-centric approach, supported by comprehensive support systems for franchise owners, strengthens its ability to attract and retain clients. In addition, Jani-King's strong branding and decades of experience in the industry instill confidence among customers and franchisees, solidifying its position as a trusted partner for professional cleaning solutions.

-

ISS Facility Services, Inc. stands out as a comprehensive provider of integrated facility management solutions, combining contract cleaning services with other essential maintenance and operational support offerings. This integrated approach allows the company to deliver value-added services to its clients, improving efficiency and streamlining vendor management. With a strong emphasis on innovation, ISS leverages data-driven solutions and smart technologies, such as IoT-enabled devices and robotics, to optimize cleaning processes and reduce operational costs. The company is also committed to sustainability, incorporating green cleaning practices and eco-friendly products into its service portfolio, appealing to environmentally conscious organizations. Operating in over 30 countries, ISS benefits from a robust global infrastructure while retaining the flexibility to address local market dynamics. Its ability to cater to diverse industries, including healthcare, education, and corporate sectors, ensures a broad customer base. Furthermore, ISS’s focus on employee engagement and continuous skill development contributes to superior service quality and customer satisfaction, enhancing its industry reputation.

-

Sodexo Group excels by offering a diverse range of facilities management services alongside its contract cleaning operations, creating a one-stop solution for clients seeking comprehensive support for their operational needs. With a strong global footprint spanning over 50 countries, the company serves a wide array of industries, including corporate offices, schools, healthcare facilities, and government institutions. Sodexo’s commitment to sustainability is evident through its adoption of green cleaning practices and innovative technologies that reduce environmental impact while enhancing efficiency. The company’s emphasis on personalized services, supported by robust client relationship management systems, ensures tailored solutions that meet the unique requirements of each client. In addition, Sodexo invests significantly in employee training and engagement, fostering a motivated workforce capable of delivering high-quality services. Its diversified portfolio and expertise in delivering consistent performance across geographies enable Sodexo to address complex challenges faced by large-scale enterprises. By integrating cleaning services with other offerings, the company provides a seamless and cost-effective solution for its clients.

Vanguard Cleaning Systems Inc., and Stanley Steemer International Inc. are some of the emerging companies in the target market.

-

Vanguard Cleaning Systems Inc. differentiates itself through its innovative franchise model, which focuses on empowering local operators while maintaining high-quality standards. By offering comprehensive training programs and robust operational support, the company ensures its franchisees deliver consistent and reliable services tailored to client needs. Vanguard places a strong emphasis on using eco-friendly cleaning solutions and sustainable practices, aligning with the growing demand for environmentally responsible services. Its specialization in serving small to medium-sized businesses gives it an edge in addressing this segment’s unique requirements with cost-effective solutions. Vanguard’s focus on advanced cleaning technologies, such as touchless disinfection systems, positions it as a forward-thinking service provider. In addition, its customer-centric approach, supported by detailed service customization and regular client feedback mechanisms, helps build long-term relationships. This combination of localized service delivery, innovation, and sustainability allows Vanguard to effectively cater to diverse industry sectors, including offices, medical facilities, and educational institutions.

-

Stanley Steemer International Inc. stands out for its expertise in deep cleaning and restoration services, with a particular focus on carpets, upholstery, and hard surfaces. The company leverages proprietary cleaning technology and equipment to deliver superior results, ensuring a high level of customer satisfaction. Stanley Steemer’s direct-service model, which includes company-owned operations and certified technicians, allows it to maintain strict quality control across its service network. Its emphasis on using EPA-certified cleaning solutions and methods that meet health and safety standards resonates with health-conscious consumers and commercial clients alike. Stanley Steemer also provides specialized services, such as air duct cleaning and water damage restoration, enabling it to address a wider range of client needs. By offering transparent pricing and flexible scheduling, the company enhances accessibility and convenience for its customers. Its established reputation in residential markets, combined with its expanding presence in commercial cleaning, positions it to effectively compete in the broader global market.

Key Contract Cleaning Services Companies:

The following are the leading companies in the contract cleaning services market. These companies collectively hold the largest market share and dictate industry trends.

- ABM Industries Incorporated

- Jani-King International Inc.

- ISS Facility Services, Inc.

- Sodexo Group

- Mitie Group plc.

- Pritchard Industries Inc.

- Vanguard Cleaning Systems Inc.

- Stanley Steemer International Inc.

- Cleaning Services Group, Inc.

- The ServiceMaster Company, LLC

Recent Developments

-

In September 2024, OCS UK & I, a subsidiary of OCS Group Holdings Ltd., acquired Exclusive Services Group, a leading provider of contract cleaning services in the UK and Ireland. This acquisition will strengthen OCS's position in key sectors like education, data centers, leisure, media, and retail. Both companies share similar values and a focus on operational excellence, ensuring smooth integration. This move is a significant step towards OCS's goal of becoming a leading facilities service provider, with the company aiming to double its revenue in the UK and Ireland over the next five years.

-

In April 2022, KBS, a portfolio company of Cerberus Capital Management, acquired Kimco, a leading provider of commercial cleaning and facility maintenance services. This acquisition will strengthen KBS's position in the business and industrial sectors, allowing it to offer a wider range of services to its clients. By combining their expertise and technology, KBS and Kimco aim to enhance operational performance and set new industry standards.

Contract Cleaning Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 406.56 billion

Revenue forecast in 2030

USD 555.44 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa (MEA)

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; China; India; Japan; South Korea; Australia; Brazil; UAE; KSA; and South Africa

Key companies profiled

ABM Industries Incorporated; Jani-King International Inc.; ISS Facility Services, Inc.; Sodexo Group; Mitie Group plc.; Pritchard Industries Inc.; Vanguard Cleaning Systems Inc.; Stanley Steemer International Inc.; Cleaning Services Group, Inc.; The ServiceMaster Company, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contract Cleaning Services Market Report Segmentation

This report forecasts revenue growth at global, regional as well as at country levels and offers analysis of the latest qualitative as well as quantitative market trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global contract cleaning services market report based on service type, end-use, and region:

-

Service Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Window Cleaning

-

Floor & Carpet Cleaning

-

Upholstery Cleaning

-

Construction Cleaning

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Residential

-

Industrial

-

Commercial

-

Healthcare & Medical Facilities

-

Educational Institutions

-

Hotels & Restaurants

-

Retail Outlets

-

Corporate Offices

-

Financial Institutions

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the contract cleaning services market growth include increasing awareness about hygiene at the workplace and growing concerns about workplace sustainability and employee wellness.

b. The global contract cleaning services market size was estimated at USD 383.99 billion in 2024 and is expected to reach USD 406.56 billion in 2025.

b. The global contract cleaning services market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 555.44 billion by 2030.

b. North America dominated the contract cleaning services market with a share of 36.4% in 2024. This is attributable to the presence of a large number of service providers, especially in the U.S. In addition, most of the commercial establishments have contractual service agreements with the cleaning service providers to offer a clean and sanitized working environment to their employees.

b. Some key players operating in the contract cleaning services market include ABM Industries Incorporated, Jani-King International Inc., ISS Facility Services, Inc., Mitie Group Plc, and Pritchard Industries Inc., among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.