- Home

- »

- Medical Devices

- »

-

Healthcare Contract Manufacturing Market Size Report, 2033GVR Report cover

![Healthcare Contract Manufacturing Market Size, Share & Trends Report]()

Healthcare Contract Manufacturing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Medical Devices, Pharmaceutical), By End Use (Medical Device Companies), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-128-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Healthcare Contract Manufacturing Market Summary

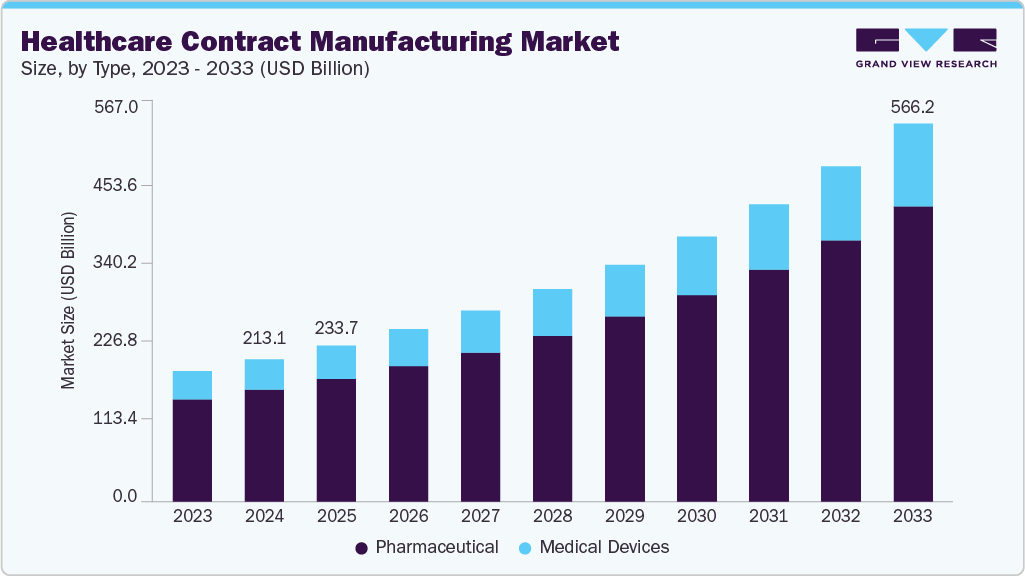

The global healthcare contract manufacturing market size was estimated at USD 213.06 billion in 2024 and is projected to reach USD 566.16 billion by 2033, growing at a CAGR of 11.7% from 2025 to 2033. The market is driven by the expanding biologics and biosimilars market, increasing regulatory complexity, and the commercial success of biologics for clinical use.

Key Market Trends & Insights

- Asia Pacific healthcare contract manufacturing market held the largest share of 38.68% of the global market in 2024.

- The healthcare contract manufacturing in the U.S. is expected to grow significantly over the forecast period.

- By type, the medical devices segment held the largest market share in 2024.

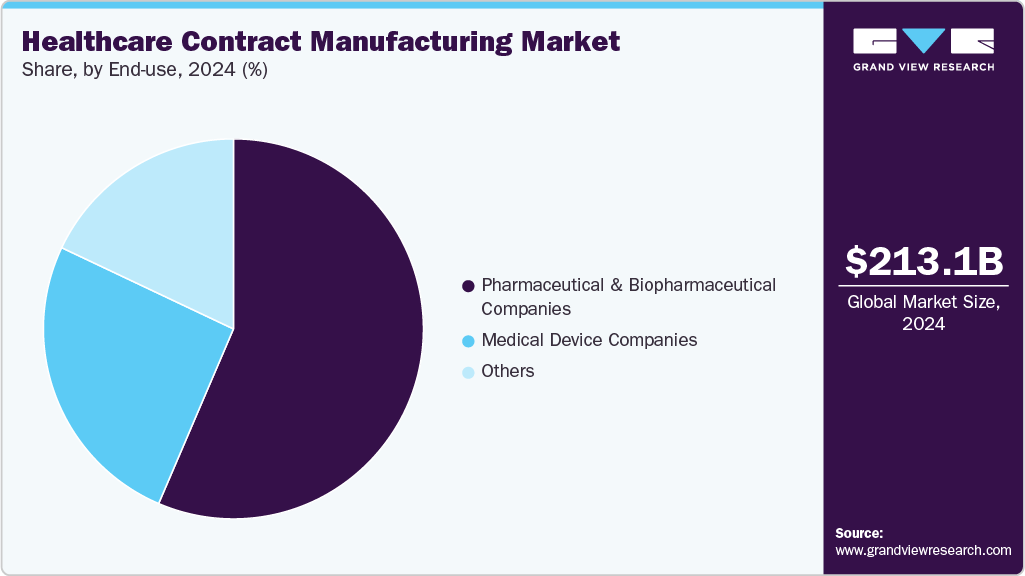

- By end use, the pharmaceutical & biotechnology companies segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 213.06 Billion

- 2033 Projected Market Size: USD 566.16 Billion

- CAGR (2025-2033): 11.7%

- Asia Pacific: Largest market in 2024

Contract manufacturers with established biologics platforms support pharmaceutical companies in scaling up complex biologic drug manufacturing, including monoclonal antibodies, vaccines, and cell and gene therapies. As patents expire for blockbuster biologics, biosimilars gain prominence, creating outsourcing opportunities for CMOs/CDMOs with flexible capacity. Their expertise in process development, large-scale production, and quality management positions them as critical partners in meeting rising global demand for biologics and biosimilars, significantly driving the healthcare contract manufacturing market’s growth.Furthermore, organizations such as the FDA, EMA, and WHO have strict and changing regulations for the global healthcare industry. A substantial investment in data integrity, quality assurance, and Good Manufacturing Practices (GMP) is necessary to meet manufacturing compliance. Many businesses, particularly new biopharma and medtech enterprises lack the internal infrastructure and knowledge necessary to meet these criteria. A dependable option is provided by contract manufacturers with proven compliance frameworks, regulatory approvals, and inspection histories. Businesses reduce risks, prevent expensive delays, and guarantee quicker market access through outsourcing. Global demand for contract manufacturing partnerships is significantly fueled by the growing complexity of regulations.

The need for pharmaceutical medications and medical equipment is being driven by the increasing frequency of noninvasive surgical operations. OEMs are progressively outsourcing non-core manufacturing tasks in order to handle this growth, which allows for lower labor costs, better capital utilization, increased productivity, and shorter lead times. For pharma companies of all sizes, outsourcing has become a cost-effective strategy, particularly as fixed costs for biologics manufacturing-representing nearly 60-70% of the Cost of Goods Sold (COGS)-remain unavoidable even during idle production periods. This makes outsourcing an economically viable option to balance efficiency, scalability, and cost management in a competitive healthcare landscape.

Furthermore, the adoption of multi-product facilities for biologics manufacturing has demonstrated both economic efficiency and safety, as risks of product carryover are negligible, thereby driving market growth. However, rapid supply chain adaptation is a difficulty for the heavily regulated medical device business. Although the FDA actively monitors and responds to shortages, U.S. manufacturers are not required to notify the agency of any actual or prospective shortages. Aluminum, integrated circuits, lithium-ion batteries, and specialty parts such as platinum, pneumatic fittings, and black body radiation sources are among the items in short supply. According to Medical Product Outsourcing, outsourcing should result in lower costs and a quicker time to market, which is expected to support the expansion of the healthcare CRO market.

Opportunity Analysis

The market for healthcare contract manufacturing has a lot of potential because of the growing need for affordable medication and device manufacturing, the growing number of OEMs outsourcing, and the requirement to streamline supply chains. Prospects are further enhanced by expanding pipelines for biologics and biosimilars as well as technological developments in manufacturing processes. The growing healthcare infrastructure and increasing patient demand in emerging markets present unrealized possibilities. In addition, opportunities for strategic alliances are being created by CDMOs' growing adoption of digital technologies, flexible capacity models, and regulatory expertise. These elements put the market in a position for long-term growth and international expansion.

Impact of U.S. Tariffs on the Global Healthcare Contract Manufacturing Market

The cost of raw materials and components, especially for APIs, medical devices, and specialized equipment, has increased due to U.S. tariffs, posing significant difficulties to the global healthcare contract manufacturing market. Due to the disruption of global supply chains caused by these tariffs, businesses are being forced to look into alternate sourcing methods and depend more on local suppliers. This stimulates the diversification of industrial bases and encourages investments in local production, even while it also increases operating costs and affects profitability. As a result, the tariffs cause temporary difficulties but may eventually promote supply chain stability and regional resilience.

Technological Advancements

Technological advancements are transforming the healthcare contract manufacturing market by driving efficiency, quality, and scalability. AI and ML optimize supply chains, process control, and medication development, automation and robotics reduce errors and increase efficiency. Continuous manufacturing allows for increased flexibility, decreased waste, and speedier production. In the meantime, 3D printing speeds up development processes and reduces costs by enabling quick prototyping and patient-specific medical devices. High-throughput instruments and single-use systems are examples of advanced bioprocessing technologies that improve the production of biologics by lowering the risk of contamination and facilitating scalable production. When taken as a whole, these developments improve responsiveness, lower expenses, and meet the rising need for sophisticated healthcare solutions.

Pricing Model Analysis

Diverse pricing strategies are used in the healthcare contract manufacturing sector to strike a balance between value delivery, cost control, and flexibility. By linking compensation to project phases, milestone-based pricing promotes accountability, openness, and risk sharing. worth-based pricing rewards quality and innovation by emphasizing results and tying expenses to clinical or economic worth. Pharmaceutical and medical device companies are drawn to fixed-fee models because they provide predictable costs and make budgeting easier. However, rigorous scope control is essential to prevent overruns. Through recurrent costs, subscription/retainer models offer continuous access to capacity and experience, making them appropriate for long-term projects and smaller businesses looking for consistent cooperation. Thus, these models strengthen partnerships, streamline operations, and improve financial predictability in a highly regulated, innovation-driven market.

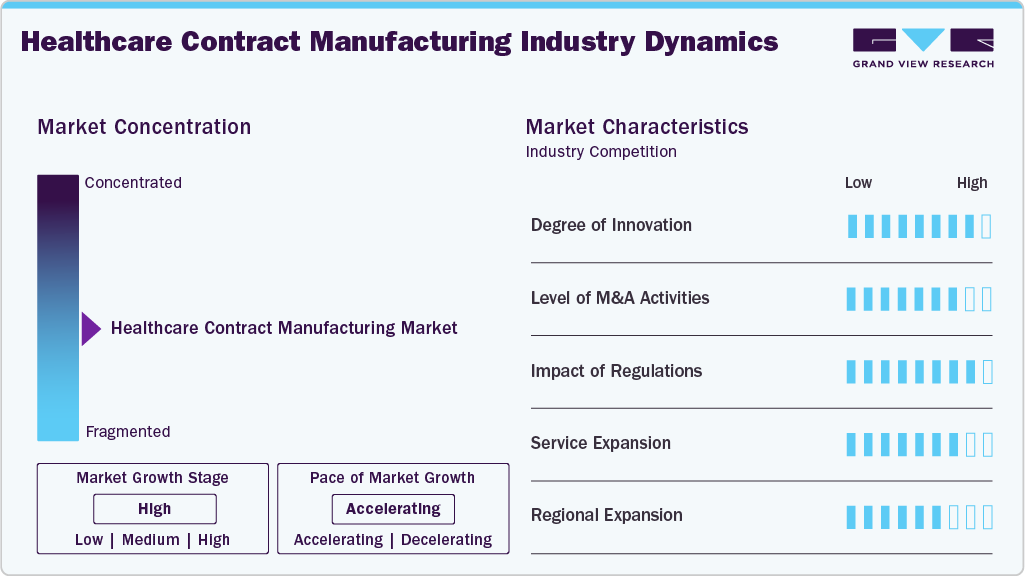

Market Concentration & Characteristics

The healthcare contract manufacturing market growth stage is high, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service expansion, and regional expansion.

Innovation in healthcare contract manufacturing is driven by advanced technologies such as continuous manufacturing, single-use systems, and digitalization. Companies increasingly adopt automation, AI-driven analytics, and flexible manufacturing platforms to enhance efficiency, product quality, and scalability. This constant innovation fosters competitive differentiation, accelerates drug development, and supports the growing demand for complex biologics and medical devices

Mergers and acquisitions are frequent in healthcare contract manufacturing, driven by the need to expand capabilities, geographic reach, and service offerings. Large CDMOs acquire niche firms specializing in biologics, medical devices, or emerging technologies to remain competitive. These activities consolidate market presence, improve efficiency, and provide end-to-end solutions, strengthening partnerships with pharmaceutical and medical device companies.

The highly regulated healthcare sector strongly influences contract manufacturing. Compliance with global standards from the FDA, EMA, and other authorities ensures quality and safety. Frequent regulatory updates push manufacturers to invest in upgraded facilities, digital quality systems, and GMP compliance. Regulations increase operational complexity and costs, they also build client trust and market credibility.

Healthcare contract manufacturers are diversifying their service offerings to include packaging, shipping, clinical trial supplies, and drug discovery support. Providing innovative solutions shortens turnaround times, increases value, and draws in customers looking for integrated services. By targeting biotech startups and mid-sized pharmaceutical companies, service diversification also enables manufacturers to enhance long-term alliances and income streams.

Global demand is pushing contract manufacturers to expand regionally, setting up facilities in high-growth markets such as Asia-Pacific, Latin America, and the Middle East. This expansion addresses localized demand, reduces supply chain risks, and improves cost efficiency. Regional presence also allows firms to tap into favorable tax incentives, regulatory support, and growing healthcare investments worldwide.

Type Insights

The pharmaceutical segment dominated the market with the largest revenue share of 78.32% in 2024. The market is witnessing significant driven by rising demand for generics, biologics, and complex formulations. Increasing R&D investments, patent expirations, and the surge in chronic and rare diseases are driving outsourcing to specialized partners. Pharmaceutical firms benefit from contract manufacturers' scalability, regulatory knowledge, and innovative technology, which lower costs and speed time to market. Outsourcing demands are further reinforced by the growth of customized medicine, biosimilars, and biologics. Furthermore, CDMOs and CMOs are essential due to the necessity for flexible, multi-product facilities and strict compliance standards.

The medical devices segment is the fastest growing segment over the forecast period, owing to rising demand for diagnostic equipment, surgical instruments, and wearable technologies. Increasing prevalence of chronic diseases and the shift toward minimally invasive procedures have fueled outsourcing needs for complex device production. OEMs partner with contract manufacturers to leverage advanced technologies, ensure regulatory compliance, and reduce production costs while maintaining high quality standards. Growing adoption of single-use and homecare devices further accelerates this trend. With cost pressures and global supply chain complexities, contract manufacturing offers efficiency, scalability, and speed, strengthening segmental growth potential in the near future.

End Use Insights

The pharmaceutical & biotechnology companies segment accounted for the largest share in 2024, owing to their reliance on outsourcing to enhance efficiency, reduce costs, and focus on core R&D. Increasing demand for complex biologics, biosimilars, and innovative drug formulations has intensified partnerships with CMOs and CDMOs offering advanced manufacturing and regulatory expertise. These companies outsource large portions of production to meet growing global demand, comply with stringent quality standards, and optimize supply chains.

The medical device companies segment is witnessing considerable growth during the forecast period, driven by rising demand for innovative and high-precision medical devices. The growing use of wearable health monitoring, diagnostic tools, and minimally invasive procedures is driving growth. Device manufacturers can lower capital costs, maximize production efficiency, and adhere to strict regulatory requirements by outsourcing manufacturing. Production capacities are further accelerated by technological developments such as automation, additive manufacturing, and smart device integration. CMOs are also investing in specialized facilities and collaborations to meet complicated, high-value medical device manufacturing needs as a result of growing patient awareness and healthcare infrastructure expansion in emerging nations.

Regional Insights

North America healthcare contract manufacturing marketis expected to grow at a significant CAGR over the forecast period. The market is attributed to rising demand for pharmaceuticals, biologics, and advanced medical devices. Outsourcingoperations andies to reduce costs, streamline operations, and access specialized expertise. Technological advancements such as automation, continuous manufacturing, and digital supply chain integration are enhancing efficiency and compliance with stringent FDA regulations. Key players, including Thermo Fisher Scientific, Catalent, Jabil, and Lonza, are strengthening capabilities through strategic partnerships and capacity expansions, positioning North America as a global leader in healthcare contract manufacturing.

U.S. Healthcare Contract Manufacturing Market Trends

The healthcare contract manufacturing market in the U.S. is accounted for the largest market share in the North America market, owing to aging population & chronic diseases and advanced manufacturing technologies. Pharmaceutical and medical device firms increasingly outsource to reduce costs, accelerate time-to-market, and ensure compliance with stringent FDA standards. For instance, in April 2025, Regeneron is expanding U.S. contract manufacturing unit through a USD 3 billion agreement with FUJIFILM Diosynth in North Carolina, nearly doubling capacity and reinforcing its role in advancing global biotech innovation.

Canada healthcare contract manufacturing market is growing steadily,supported by cost efficiency, regulatory compliance, and increasing outsourcing by pharmaceutical and biopharmaceutical companies to optimize production. Strong government support for healthcare innovation and investments in modern manufacturing facilities further strengthen the market. For instance, in May 2025, NeuroSense Therapeutics successfully scaled up commercial production of PrimeC, strengthening its CMC and supply chain with Canadian compliance, enabling a rapid, reliable pathway toward a potential Canadian market launch.

Europe Healthcare Contract Manufacturing Market Trends

Europe healthcare contract manufacturing market is expanding, due to cost optimization and collaborative R&D ecosystem. Advanced bioprocessing technologies, modular manufacturing facilities, and digitalized quality systems are improving flexibility, production efficiency, and regulatory compliance across Europe. Investments in sustainable and green manufacturing practices, including energy-efficient plants and circular supply chains, are gaining traction. In addition, Europe’s well-established life sciences clusters, robust public-private R&D partnerships, and specialized talent pool support innovation, enabling contract manufacturers to deliver high-quality, complex biologics, advanced therapies, and medical devices while meeting stringent EMA and national regulatory standards.

The healthcare contract manufacturing market in Germany held the highest share in 2024. This growth can be attributed to strong public-private R&D partnerships and a skilled workforce further support innovation. Key players, including Merck, Lonza, Catalent, and Recipharm, are expanding capacities and services, positioning Germany as a leading hub for healthcare contract. For instance, in May 2024, Merck launched the Mobius ADC Reactor, the first single-use system for antibody-drug conjugates, enhancing efficiency, safety, and scalability, enabling biopharmaceutical companies to accelerate production and deliver critical therapies globally.

The UK healthcare contract manufacturing market is expected to grow significantly over the forecast period. The country's growth is fueled by various technological advancements, strong biopharmaceutical clusters and several collaborations and partnerships. For instance, in January 2025, Plexāā partnered with Panasonic Manufacturing UK for contract manufacturing of the award-winning BLOOMmedical device, accelerating production and scaling to meet growing demand and support its upcoming U.S. market launch.

Asia Pacific Healthcare Contract Manufacturing Market Trends

Asia Pacific held the largest revenue share of 38.68% in 2024 and is amongst the fastest growing segment over the forecast period.The market is growing rapidly, driven by rising demand for favorable regulatory environment and government initiatives & incentives. Technological advancements, including automation, continuous manufacturing, and digitalized quality systems, enhance efficiency, scalability, and compliance with regulatory standards. Major players such as WuXi AppTec, Samsung Biologics, Lonza, and Thermo Fisher Scientific are investing in capacity expansion and innovative services, positioning the region as a global hub for healthcare contract manufacturing.

The healthcare contract manufacturing market in China is witnessing new growth opportunities driven by government incentives and strategic policies, along with cost-effective manufacturing and increasing outsourcing. Technological advancements, including automation, continuous manufacturing, and AI-powered diagnostics, enhance production efficiency and regulatory compliance. China’s 2025 policy for high-end medical devices accelerates innovation, streamlines approvals, and fosters strategic partnerships, creating a more dynamic ecosystem.

Japan healthcare contract manufacturing market is witnessing steady growth driven by innovations such as automation, continuous manufacturing, and digitalized quality systems enhance production efficiency and scalability. R&D and commercialization are accelerated by government incentives, a trained labor force, and industry-university partnership. To bolster Japan's contract manufacturing business, major companies like Boehringer Ingelheim, Lonza, Thermo Fisher Scientific, and Fuji Pharma are using modern technology and increasing their capacity.

India healthcare contract manufacturing market is experiencing rapid expansion, attributed to rising domestic healthcare demand and strategic export potential. Strategic investments such as SAVA Healthcare’s new Indore facility in March 2024, features modern infrastructure and EU/US FDA-compliant technologies, expand manufacturing capacity, create jobs, and strengthen India’s position as a global hub. Some of the players like Aragen, Jubilant Life Sciences, and Syngene further drive market growth.

Latin America Healthcare Contract Manufacturing Market Trends

Latin America healthcare contract manufacturing market is witnessing steady growth, fueled by rising demand for pharmaceuticals, biologics, and medical devices, alongside increasing outsourcing by domestic and global companies. Cost-effective production, supportive government policies, and expanding healthcare infrastructure drive the market to enhance efficiency and scalability. Strategic capacity expansions and partnerships by key players, including Lonza, Thermo Fisher Scientific, and WuXi Biologics, are positioning Latin America as a competitive and reliable hub for healthcare contract manufacturing in the global market.

Brazil healthcare contract manufacturing market is growing steadily, driven by innovations in continuous manufacturing, and digitalized quality platforms enhance efficiency and regulatory compliance. Strategic developments, such as, in March 2025, Benuvia Operations received ANVISA GMP certification positioned the company as a trusted partner for compliant local and international production. Supportive government policies, expanding healthcare infrastructure, and investments by key players further strengthen Brazil’s role as a competitive hub in healthcare contract manufacturing.

Middle East & Africa Healthcare Contract Manufacturing Market Trends

Middle East and Africa healthcare contract manufacturing market is expanding rapidly, fueled by regional healthcare investments, favorable regulatory reforms, and strategic location for exports. Some of the strategic investments such as in August 2025, MS Pharma’s SFDA-approved biologics facility in Saudi Arabia, specializing in monoclonal antibodies and complex peptides is boosting market growth. Initiatives by Thermo Fisher Scientific, Lonza, and Samsung Biologics, strengthen the region’s manufacturing capabilities and global competitiveness.

UAE healthcare contract manufacturing market is rapidly evolving, driven by the country’s ambitious transformation under the “We the UAE 2031” vision. Substantial government investment, regulatory reforms attracting global pharmaceutical companies, and focus on emerging technologies like AI and genomics are key drivers. World-class hospital networks, such as Cleveland Clinic Abu Dhabi and Healthpoint Hospital, demonstrate advanced capabilities, integrating robotic surgery and specialty programs. Private players like Burjeel Holdings and NMC Healthcare are expanding aggressively, while innovations in precision medicine and AI-driven healthcare position the UAE as a rising global hub for pharmaceutical manufacturing and medical services.

Key Healthcare Contract Manufacturing Company & Market Share Insights

Key companies in the global healthcare contract manufacturing market are leveraging strategic launches and partnerships to expand capabilities and market reach. Notably, in June 2025, ITOCHU Corporation launched a Comprehensive Support Service through its subsidiary A2 Healthcare and ITC Venture Partners, assisting overseas pharmaceutical companies in entering the Japanese market. This initiative addresses stringent regulations, complex clinical procedures, and pricing challenges, reducing “drug loss” and enabling global biopharmaceuticals to access Japan efficiently. Such moves highlight the role of major players in driving innovation, regulatory navigation, and enhanced market penetration in healthcare contract manufacturing.

Key Healthcare Contract Manufacturing Companies:

The following are the leading companies in the healthcare contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Nordson Corporation

- Integer Holdings Corporation

- Jabil Inc.

- Viant Technology LLC

- FLEX LTD.

- Celestica Inc.

- Sanmina Corporation

- Plexus Corp.

- Phillips-Medisize

- West Pharmaceutical Services, Inc.

- Synecco Ltd

- Catalent, Inc.

- Thermo Fisher Scientific Inc.

- Recipharm AB

- Boehringer Ingelheim International GmbH

- Lonza

- Samsung Biologics

- WuXi AppTec

- FUJIFILM Diosynth Biotechnologies

- Cambrex Corporation

Recent Developments

-

In July 2025, The UK government unveiled a six-point Life Sciences sector plan aiming to grow the industry to USD 55 bn by 2035, focusing on manufacturing and commercialization. While R&D excels, commercial adoption remains a challenge. This initiative seeks to position the UK as Europe’s leading life sciences hub, boosting global competitiveness

-

In June 2025, UCB announced a major investment in an innovative U.S. biologics manufacturing facility, creating 300 high-skilled jobs and over 500 construction roles. The expansion strengthens CMO partnerships, supports pipeline growth, and enhances a resilient supply chain while contributing USD 5 billion to the U.S. economy. This underscores UCB’s long-term commitment to innovation, sustainable healthcare, and patient access.

-

In September 2024, VERDOT expanded France, for a 45,000 sq.-ft. headquarters and manufacturing facility, consolidating two sites, creating 50-75 jobs, and expanding bioprocessing purification capacity by 150%. The facility will serve as a Center of Excellence for R&D and bioprocessing innovation. This strengthens VERDOT’s global manufacturing capabilities.

Healthcare Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 233.73 billion

Revenue forecast in 2033

USD 566.16 billion

Growth rate

CAGR of 11.7% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait; Qatar; Oman

Key companies profiled

Nordson Corporation;Integer Holdings Corporation; Jabil Inc.; Viant Technology LLC; FLEX LTD.; Celestica Inc.; Sanmina Corporation; Plexus Corp.; Phillips-Medisize; West Pharmaceutical Services, Inc.; Synecco Ltd; Catalent, Inc.; Thermo Fisher Scientific Inc.; Recipharm AB; Boehringer Ingelheim International GmbH; Lonza; Samsung Biologics; WuXi AppTec; FUJIFILM Diosynth Biotechnologies; Cambrex Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Healthcare Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global healthcare contract manufacturing market report based on type, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Devices

-

Service

-

Accessories manufacturing

-

Assembly manufacturing

-

Component manufacturing

-

Device manufacturing

-

-

Therapeutic Area

-

Oncology

-

Infectious Diseases

-

Neurological Disorders

-

Cardiovascular Disease

-

Metabolic Disorders

-

Autoimmune Diseases

-

Respiratory Diseases

-

Ophthalmology

-

Gastrointestinal Disorders

-

Hormonal Disorders

-

Hematological Disorders

-

Others

-

-

-

Pharmaceutical

-

API/Bulk Drugs

-

Advanced drug delivery formulations

-

Packaging

-

Finished dose formulations

-

Solid

-

Liquid

-

Semi-solid formulations

-

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Medical Device Companies

-

Pharmaceutical & Biopharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

Qatar

-

Oman

-

-

Frequently Asked Questions About This Report

b. The global healthcare contract manufacturing market size was estimated at USD 213.06 billion in 2024 and is expected to reach USD 233.73 billion in 2025.

b. The global healthcare contract manufacturing market is expected to grow at a compound annual growth rate of 11.69% from 2025 to 2033 to reach USD 566.16 billion by 2033.

b. Asia Pacific dominated the healthcare contract manufacturing market with a share of 38.68% in 2024. The regions market is driven due to the rising demand for favorable regulatory environment and government initiatives & incentives. Technological advancements, including automation, continuous manufacturing, and digitalized quality systems, enhance efficiency, scalability, and compliance with regulatory standards.

b. Some key players operating in the healthcare contract manufacturing market include Nordson Corporation; Integer Holdings Corporation; Jabil Inc.; Viant Technology LLC; FLEX LTD.; Celestica Inc.; Sanmina Corporation; Plexus Corp.; Phillips-Medisize; West Pharmaceutical Services, Inc.; Synecco; Catalent, Inc.; Thermo Fisher Scientific Inc.; Recipharm; Boehringer Ingelheim International GmbH; Lonza; Samsung Biologics; WuXi AppTec; FUJIFILM Diosynth Biotechnologies and Cambrex Corporation

b. Key factors are the rising prevalence of chronic disorders, increasing aging population, and increasing outsourcing of devices due to extensive use and complexity in manufacturing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.