- Home

- »

- Medical Devices

- »

-

Contrast Enhanced Ultrasound Market Size Report, 2030GVR Report cover

![Contrast Enhanced Ultrasound Market Size, Share & Trends Report]()

Contrast Enhanced Ultrasound Market Size, Share & Trends Analysis Report By Product (Equipment, Contrast Agents), By Type (Non-targeted, Targeted), By End-use (Hospitals, Clinics, Ambulatory Diagnostic Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-141-1

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global contrast enhanced ultrasound market size was estimated at USD 2.04 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.70% from 2024 to 2030. The contrast-enhanced ultrasound (CEUS) market is witnessing significant growth due to various factors, such as the availability of affordable contrast agents, an increase in the number of ultrasound procedures performed, and the integration of contrast imaging modes into ultrasound systems. CEUS technology is also cost-effective, free from radiation, and more convenient for patients than other technologies, which is expected to drive market growth further. The integration of CEUS in Point-of-Care (PoC) diagnostics has been highlighted as a crucial aspect in combating the COVID-19 pandemic.

The increasing prevalence of chronic diseases such as cancer, cardiovascular diseases, liver diseases is contributing to the growth of the market. Cardiovascular disorder is the number one cause of death worldwide. Cardiovascular disorder is the number one cause of death worldwide. According to the WHO, around 17.9 million people die of cardiovascular disorders each year globally. Frequent monitoring of left ventricular volume (LV) and ejection fraction (LVEF) is vital in determining the timing & type of treatment offered to a patient with cardiovascular disorders because of increasing patient referrals for contrast-enhanced ultrasound procedures. Despite the advent of advanced ultrasound imaging techniques like harmonic imaging, the LV and LVEF values in patients are often underestimated due to their poor endocardial border delineation. Thus, the increasing demand for sensitive and accurate diagnostic tools in the quantitative assessment of ventricular volume in cardiac patients is expected to boost the contrast-enhanced ultrasound market growth.

In addition, the rising demand for minimally invasive diagnostic procedures is also driving the market growth. Contrast-enhanced ultrasound is a non-invasive diagnostic technique that does not require the use of radiation or contrast agents, which makes it a safer and more cost-effective alternative to other imaging modalities like CT scans and MRI. Furthermore, technological advancements in ultrasound imaging and the development of new contrast agents are also propelling the growth of this market. For instance, the development of microbubble contrast agents has improved the sensitivity and specificity of ultrasound imaging, leading to better diagnosis and treatment of various diseases.

Key players in the market are investing heavily in research and development of new products and technologies to gain a competitive edge. The increasing demand for sensitive and accurate diagnostic tools in the quantitative assessment of ventricular volume in cardiac patients is expected to boost the contrast-enhanced ultrasound market growth.

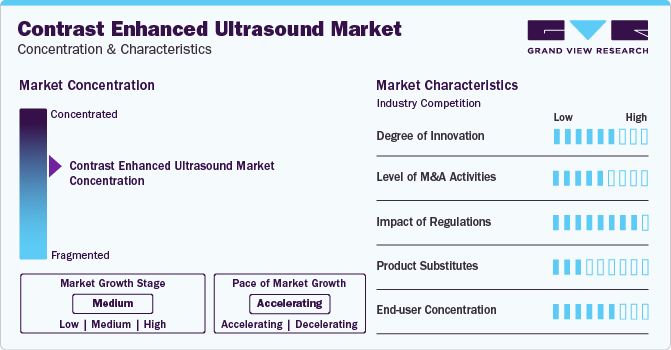

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The global market has witnessed a significant degree of innovation, marked by regulatory approvals and partnerships and collaborations. Key market players are facing increased competition for the R&D and approval of the new age contrast agents from regulatory bodies. For instance, In April 2023, Bracco Imaging S.p.A. has signed an agreement with SonoThera, Inc., in which Bracco Imaging has agreed to provide its gas-filled microbubbles technology platform to SonoThera for the development of its innovative nonviral gene therapy platform guided by ultrasound.

Collaboration between pharmaceutical companies, research institutions, and medical device manufacturers is crucial for the faster development and commercialization of advanced ultrasound contrast agents. Innovative research is required to explore new formulations and manufacturing techniques that can improve the stability and imaging capabilities of these agents. Despite the potential of this technology to provide precise diagnostic information, microbubbles still need to be utilized in various medical applications.

Product Insights

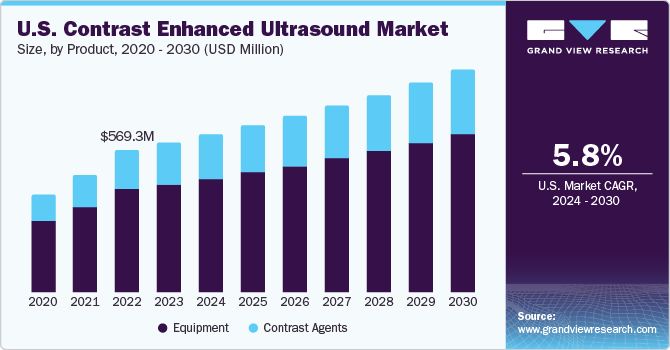

The equipment segment dominated the market and has captured the largest revenue share of 71.89% in 2023. The introduction of advanced ultrasound units with transducer technology and nonlinear imaging techniques has simplified the workflow of CEUS, thereby fueling market growth. The ultrasound scanner manufacturers are more inclined to provide comprehensive solutions for ultrasound imaging in a single system to increase product usability and improve the diagnostic experience.

The contrast agent segment is expected to witness a fastest CAGR during the forecast period. Contrast-enhanced ultrasound imaging is an emerging technology and has recently been approved for several new indications as it is being deployed in all upcoming ultrasound technologies. Contrast-enhanced ultrasound agents are typically used with ultrasound machines with specialized software and hardware designed to support their use. These machines may include advanced imaging capabilities, such as harmonic imaging, pulse inversion, and power Doppler modes, allowing for better blood flow and tissue perfusion visualization. Ultrasound contrast agents that are commercially available, such as Lumason and SonoVue by Bracco Diagnostics Inc., Definity by Lantheus Medical Imaging, Inc., and Optison & Sonazoid by GE Healthcare Inc. are the only contrast agents that have been approved by the FDA specifically for use in ultrasound imaging.

Type Insights

The non-targeted CEUS segment has captured the largest revenue share of over 80% of the global market in 2023. All the FDA-approved ultrasound contrast agents are of a non-targeted type. They are typically used to enhance diagnostic sensitivity, determination of the blood volume and flow in interest, and differentiate between malignant and benign liver tumors. The non-targeted CEUS agents are mainly used to detect and monitor tumor growth. By enhancing the contrast of blood vessels around tumors, CEUS allows for the detection of small or poorly vascularized tumors that may be missed by other imaging modalities. Additionally, CEUS can be used to assess the response of tumors to treatment, providing valuable information about the effectiveness of therapies. With continued research and development, the use of non-targeted CEUS agents is likely to expand, further improving the accuracy and sensitivity of medical imaging.

The targeted CEUS segment is anticipated to grow at a significant CAGR during the forecast period. Targeted CEUS uses microbubble-based contrast agents to enhance the ultrasound signals of specific tissue areas of interest. Targeted CEUS is mainly used for detecting and characterizing solid tumors. The microbubbles used in targeted CEUS can bind to specific markers on tumor cells, allowing for highly specific and sensitive imaging of these cells. The targeted CEUS is also used to monitor cancer treatment response. Targeted CEUS helps to assess how the ongoing treatment is working and whether any changes are required by targeting specific markers on cancer cells.

End-use Insights

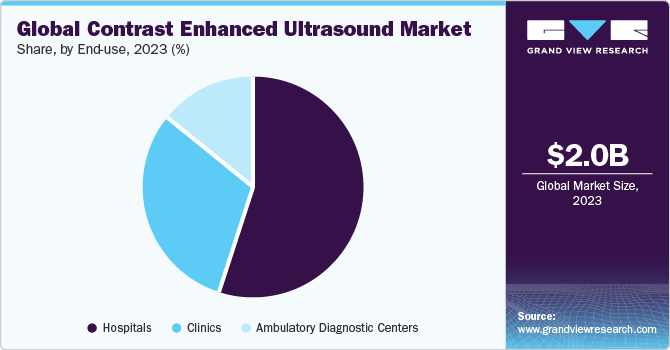

The hospital segment has captured the largest revenue share of over 54% of the global market in 2023. Contrast-enhanced ultrasound (CEUS) has gained popularity in hospital settings due to its effectiveness in providing a non-invasive, real-time assessment of blood flow. It is particularly useful for diagnosing liver and kidney diseases and identifying abnormalities in other organs. It is considered a safer alternative to other imaging methods like CT and MRI. Additionally, CEUS does not require exposure to ionizing radiation, making it a preferred choice for patients who require frequent imaging. As a result, there has been a growing demand for CEUS in hospitals, leading to increased use.

While CEUS is commonly used in hospital settings, it is also increasingly being utilized in ambulatory diagnostic centers and specialty clinics. One reason is that these settings often specialize in specific medical conditions, and CEUS can be particularly useful for diagnosing certain diseases and abnormalities. Additionally, ambulatory diagnostic centers and specialty clinics may have more advanced and specialized equipment better suited for CEUS imaging. Also, CEUS is a relatively quick and non-invasive procedure, making it more convenient for patients visiting these types of facilities for diagnostic tests and procedures.

Regional Insights

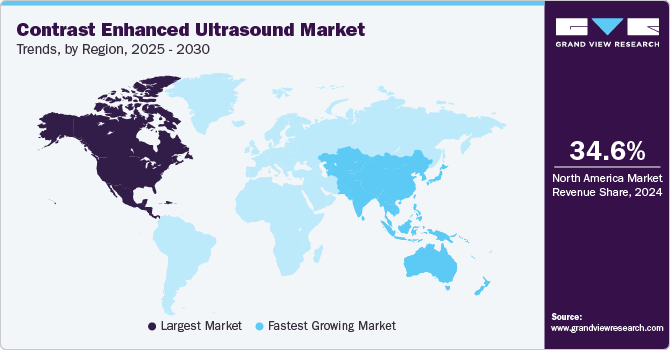

North America captured the largest market share of 34.62% in 2023. North America dominates the global market due to several reasons. Firstly, the region has a highly developed healthcare infrastructure supporting contrast enhanced ultrasound (CEUS) technology adoption. The presence of several key players in the region has contributed significantly to the growth of the market. Some of the leading companies in the North America contrast-enhanced ultrasound market include GE Healthcare, Bracco Imaging, and Lantheus Medical Imaging. These companies have adopted various strategies to maintain their market position. For instance, GE Healthcare has focused on product innovation, strategic partnerships, and mergers and acquisitions. On the other hand, Bracco Imaging has been expanding its product portfolio and increasing its geographic presence through partnerships and collaborations.

The U.S. has well-established medical codes, payment processes, and coverage policies for ultrasound services in hospitals, clinics, & ambulatory centers. In addition, reimbursements are provided for use of ultrasounds by general practitioners and family physicians at their offices. This has contributed to a rise in the number of ultrasound procedures in the U.S. Rising incidence of CVDs and Inflammatory Bowel Diseases (IBD) is expected to boost the demand for contrast-enhanced ultrasound market in the country.

Asia Pacific is anticipated to witness the fastest CAGR over the forecast period owing to the increasing healthcare expenditure, especially in countries, such as India and China. Moreover, the lack of well-organized reimbursement policies coupled with price-sensitive population in emerging economies is expected to boost the demand for cost-effective procedures, such as contrast-enhanced ultrasound imaging. A growing number of government initiatives to improve healthcare infrastructure in the region is also anticipated to augment the market growth.

Key Companies & Market Share Insights

Some of the key players operating in the global market include GE Healthcare, Bracco Diagnostic, Lantheus Medical Imaging, Inc.

-

GE Healthcare is a leading global medical technology and digital solutions provider. The company offers a wide range of products and services, including medical imaging, monitoring, diagnostics systems, and healthcare IT solutions

-

Bracco Diagnostics is a global leader in imaging solutions, focusing on diagnostic imaging agents and MRI, CT, and ultrasound solutions. With a presence in more than 100 countries, Bracco Diagnostics is dedicated to advancing diagnostic imaging and improving healthcare outcomes worldwide

-

Lantheus Medical Imaging, Inc. is a company that specializes in the development, manufacture, and commercialization of diagnostic medical imaging agents and products. Their products are used to diagnose a wide range of medical conditions, including cardiovascular disease, cancer, and neurological disorders

Canon Medical Systems Corporation and Shenzhen Mindray Bio-Medical Electronics Co., Ltd. are some of the emerging market participants in the contrast-enhanced ultrasound market.

-

Canon Medical Systems Corporation is a leading provider of medical equipment and solutions for the healthcare industry. The company specializes in the development, manufacturing, and distribution of diagnostic imaging systems, including ultrasound machines, CT scanners, and MRI systems

-

Shenzhen Mindray Bio-Medical Electronics Co. Ltd. was founded in 1991 and is a leading provider of medical devices and solutions globally. Mindray's product portfolio includes patient monitoring systems, in-vitro diagnostic products, ultrasound imaging systems, anesthesia machines, and more. The company strongly focuses on innovation and has invested heavily in research and development, resulting in numerous patents and awards

Key Contrast Enhanced Ultrasound Companies:

- Lantheus Medical Imaging, Inc.

- GE Healthcare

- Bracco Diagnostic

- GE HealthCare

- Siemens Healthcare GmbH

- Koninklijke Philips N.V.

- CANON MEDICAL SYSTEMS CORPORATION

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Recent Developments

-

In September 2023, GE HealthCare received a grant of USD 44 million by the Bill & Melinda Gates Foundation to create AI-assisted ultrasound technology. This funding will enable the development of state-of-the-art auto-assessment applications and tools for ultrasound imaging that utilize AI assistance. The newly developed technology will be focused on improving maternal and fetal health and respiratory diseases. The project will be led by Caption Health, which was recently acquired by GE HealthCare and will be designed to function on various ultrasound devices and probes, including more affordable handheld devices.

-

In March 2023, Bracco Imaging is expanding its product portfolio in the ultrasound & MRI contrast as it can see the growth in the area. Also, the company is partnering with scanner manufacturers to promote ultrasound contrast, especially in China, Japan, and Korea.

Contrast Enhanced Ultrasound Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.14 billion

Revenue forecast in 2030

USD 2.99 billion

Growth rate

CAGR of 5.70% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Norway; Sweden; India; Singapore; South Korea; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lantheus Medical Imaging, Inc.; GE Healthcare; Bracco Diagnostic; GE HealthCare; Siemens Healthcare GmbH; Koninklijke Philips N.V.; CANON MEDICAL SYSTEMS CORPORATION; and Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contrast Enhanced Ultrasound Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels as well as provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global contrast enhanced ultrasound market report based on product, type, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Contrast Agents

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-targeted

-

Targeted

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Diagnostic Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global contrast enhanced ultrasound market size was estimated at USD 2.04 billion in 2023 and is expected to reach USD 2.14 billion in 2024.

b. The global contrast enhanced ultrasound market is expected to grow at a compound annual growth rate of 5.70% from 2024 to 2030 to reach USD 2.99 billion by 2030.

b. North America dominated the contrast-enhanced ultrasound market with a share of 34.62% in 2023. This is attributable to the regulatory approval of ultrasound contrast agents for newer indications and the presence of aggressive training and educational programs related to contrast-enhanced ultrasound practice.

b. Some key players operating in the contrast enhanced ultrasound market include Lantheus Medical Imaging, Inc.; Bracco Diagnostic Inc., General Electric., Siemens Healthcare GmbH, nanoPET Pharma GmbH, ESAOTE SPA, and Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

b. Key factors that are driving the contrast enhanced ultrasound market growth include the Introduction of affordable contrast agents, increasing ultrasound procedural volume, and contrast imaging modes becoming an integral feature of ultrasound systems.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."